According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MT4

- ADSS trading platform

- SCA

- 2005

Our Evaluation of ADSS

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

ADSS is a reliable broker with the TU Overall Score of 7.14 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ADSS clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

ADS Securities is an STP broker for trading and investing with clients from the Middle East and North Africa. Services are provided for both retail and institutional clients.

Brief Look at ADSS

ADS Securities (ADSS, ADS) is one of the top brokers and has been providing services since 2010. The company offers trading in six asset classes such as currency pairs, CFDs on stock indices, commodities, bonds, cryptocurrencies, and stocks of companies from around the world. ADS Securities initially provided services on financial markets trading to clients from MENA (the Middle East and North Africa) countries. More than 20,000 active clients use the broker's services. The main office of the company is in Abu Dhabi.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Reliable regulation from the Securities and Commodities Authority (SCA, 1190047) in the UAE.

- Access to CFDs on shares of UAE, Saudi Arabia companies.

- Services are provided through the popular MetaTrader 4 terminal and proprietary ADSS trading platform.

- No commissions for trading.

- A wide range of deposit and withdrawal methods.

- High spreads on Classic accounts - from 1.2 pips for the EUR/USD pair.

TU Expert Advice

Financial expert and analyst at Traders Union

ADS Securities has been providing services for over 10 years and it is one of the leading brokers based in the Middle East.

The ADS Securities brokerage company offers three types of accounts: Classic, Elite and Swap-Free (an account for Muslims without swaps, but with increased spreads). There are no commissions, and the conditions of Classic accounts are worse than the market average because the spreads are floating, and because their size starts from 1.2 pips. The average (target) spread for EUR/USD is about 1.2 pips. ADSS offers up to 500:1 leverage on FX pairs and up to 333:1 on indices (leverage may vary depending on the jurisdiction in which the account is opened). Trades are executed within 200 milliseconds. The communication in the broker's system is carried out using patented technology.

For transparency purposes, more information on spreads, commissions, and other costs for many instruments is collected in the Markets Information Sheet. This document and additional terms for trade services can be obtained from technical support specialists. Online chat operators answer quickly, but to provide maximum information, you may be asked to give a phone number.

- You are an experienced trader seeking a diverse range of instruments. ADS Securities offers forex, indices, commodities, equities, and cryptocurrencies, providing a comprehensive selection to accommodate diverse trading preferences.

- You value access to global markets. ADS Securities operates in various regions, including the Middle East, North Africa, UK, Singapore, and Hong Kong, offering a broad reach in terms of market access.

- You prefer low spreads. High spreads on Classic accounts, starting from 1.2 pips for the EUR/USD pair, may not align with your preference for low spreads. If low spreads are a crucial factor in your trading strategy, you may need to consider other brokers with more competitive spread offerings.

ADSS Trading Conditions

Your capital is at risk. The information presented is not directed at residents of any particular country outside the United Arab Emirates and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

| 💻 Trading platform: | MT4 (Desktop. Mobile, Web), the ADSS trading platform |

|---|---|

| 📊 Accounts: | Demo, Classic, Elite, Pro, Swap-free |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | UAEPGS (for UAE accounts), Apple Pay, Samsung Pay, Visa and Mastercard, Bank Transfer, BipiPay, GSD Pay, Neteller, Skrill |

| 🚀 Minimum deposit: | From USD 100 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,10 pips |

| 🔧 Instruments: | Currency pairs (60), CFDs on stocks (more than 500), indices (15), metals (4), bonds (10), energy resources (4), cryptocurrencies (5) |

| 💹 Margin Call / Stop Out: | 80-100%. 50% |

| 🏛 Liquidity provider: | Large banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution |

| ⭐ Trading features: | There is no inactivity fee on this account |

| 🎁 Contests and bonuses: | Check with support services for the availability of current promotions |

ADSS offers its clients about 600 instruments for trading, supported by the classic MetaTrader4 and the ADSS trading platform, and the ability to trade from Classic, Elite and Pro accounts. Muslims can work on Islamic accounts (no swaps). Clients can open three accounts, but only one can be swap-free. Clients receive leverage up to 1:500, depending on the asset chosen for trading and the jurisdiction of the account. Potential clients can test the trading conditions on demo accounts.

ADSS Key Parameters Evaluation

Video Review of ADSS

Share your experience

- Best

- Last

- Oldest

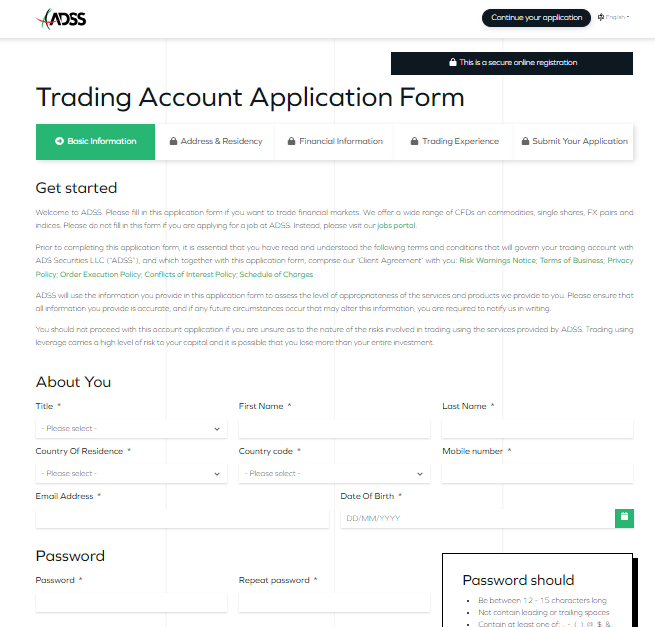

Trading Account Opening

To start trading with ADSS, you need to open a trading account. Local UAE residents can submit their applications in minutes using UAE Pass.

For others, a quick guide looks like this:

1) On the ADSS website, click Open Account. Please note that you can choose the country for opening an account where you select the language of the site (in the upper right corner). By default, the site is loaded in English, and accounts are opened in the local language.

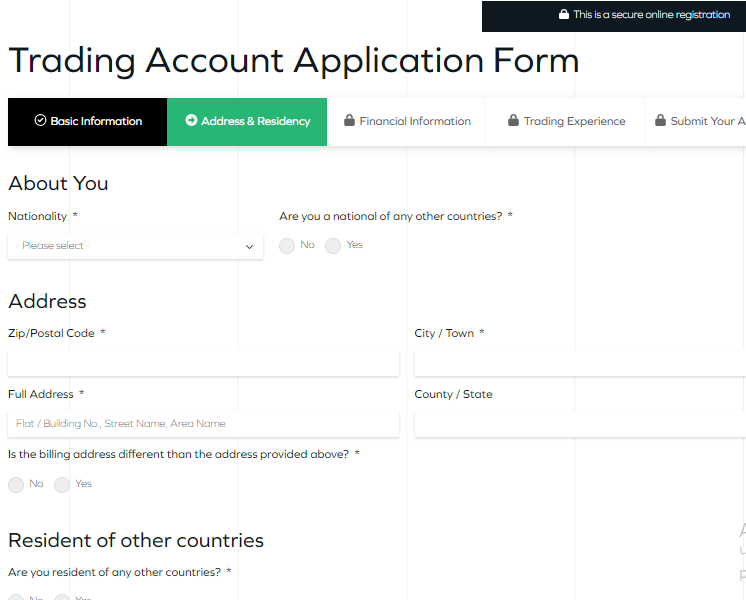

When opening an account, you need to go through 5 stages, providing basic information, information about address and citizenship, information about your income, savings, and experience in making trades in financial markets. At the confirmation stage, the system will require you to upload two documents.

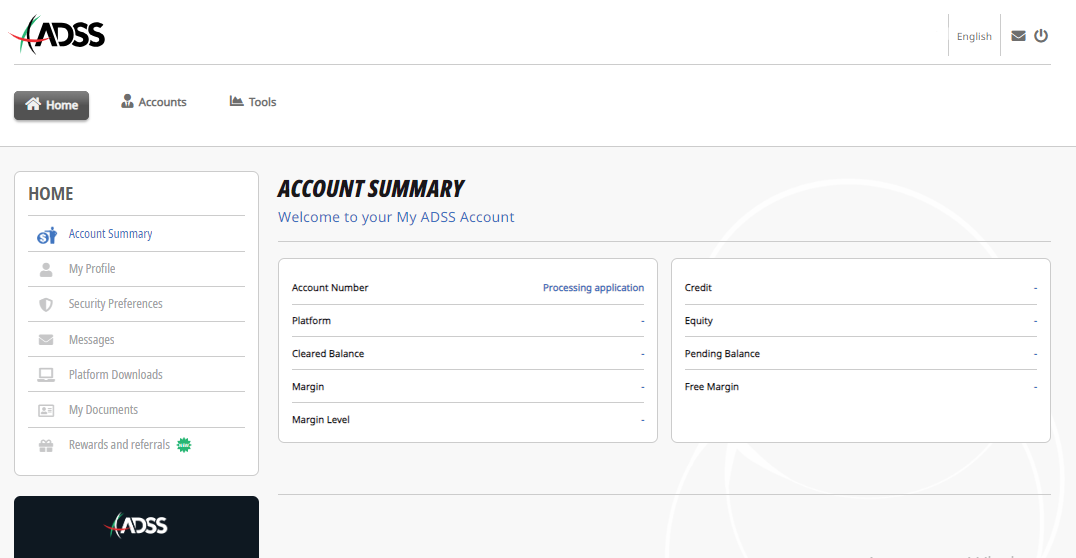

3) After completing the application and uploading documents, the system will open a personal account for the client.

Also in the personal account, the trader has access to:

-

Economic calendar.

-

Security settings - for example, receiving SMS notifications.

-

Downloading distributions of the MT4 platform.

-

Links to participate in the referral program.

Regulation and safety

ADSS has a safety score of 6.8/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 20 years

- Not tier-1 regulated

ADSS Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

| ESCA (UAE) | Emirates Securities and Commodities Authority | United Arab Emirates | Varies depending on the case, no fixed limit. | Tier-2 |

ADSS Security Factors

| Foundation date | 2005 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker ADSS have been analyzed and rated as High with a fees score of 4/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of ADSS with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, ADSS’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

ADSS Standard spreads

| ADSS | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,8 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,2 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,8 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

ADSS RAW/ECN spreads

| ADSS | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,00 | 3 | 3,5 |

| EUR/USD avg spread | 0,10 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,10 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with ADSS. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

ADSS Non-Trading Fees

| ADSS | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | |

| Withdrawal fee, % | 0 | 0 | |

| Withdrawal fee, USD | 15 | 0 | 0-15 |

| Inactivity fee ($, per month) | 1095 | 0 | 0 |

Account types

ADS Securities offers 3 types of main accounts as well as a Swap-free account.

Account types:

Demo accounts are available for all terminals.

ADS Securities is a broker targeting the Middle Eastern, North African, and Asian markets. In addition to standard services for trading on Forex and CFD contracts on popular instruments, the broker provides the opportunity to trade securities of the Persian Gulf companies.

Deposit and withdrawal

ADSS received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

ADSS offers limited payment options and accessibility, which may impact its competitiveness.

- Minimum deposit below industry average

- Bank wire transfers available

- Bank card deposits and withdrawals

- Low minimum withdrawal requirement

- USDT payments not accepted

- Wise not supported

- Deposit fee applies

What are ADSS deposit and withdrawal options?

ADSS offers a limited selection of deposit and withdrawal methods, including Bank Card, Bank Wire, Skrill, Neteller. This limitation may restrict flexibility for users, making ADSS less competitive for those seeking diverse payment options.

ADSS Deposit and Withdrawal Methods vs Competitors

| ADSS | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are ADSS base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. ADSS supports the following base account currencies:

What are ADSS's minimum deposit and withdrawal amounts?

The minimum deposit on ADSS is $100, while the minimum withdrawal amount is $15. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact ADSS’s support team.

Markets and tradable assets

ADSS offers a wider selection of trading assets than the market average, with over 2000 tradable assets available, including 60 currency pairs.

- Crypto trading

- 60 supported currency pairs

- Passive income with bonds

- Futures not available

- Copy trading not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by ADSS with its competitors, making it easier for you to find the perfect fit.

| ADSS | Plus500 | Pepperstone | |

| Currency pairs | 60 | 60 | 90 |

| Total tradable assets | 2000 | 2800 | 1200 |

| Stocks | No | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products ADSS offers for beginner traders and investors who prefer not to engage in active trading.

| ADSS | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Customer support

Support operators are available 24 hours a day, 5 days a week.

Advantages

- In the online chat, you can ask a question without being a client of the company

- Support available in Arabic, English, Urdu, Hindi and French

Disadvantages

- Too much time to answer questions - up to 15 minutes or more

- Support need a phone number for a more qualified specialist to advise

The broker provides the following communication channels:

-

phone fax;

-

email;

-

online chat on the website and in the personal account;

-

feedback form.

Both registered clients and unregistered individuals who do not have an active account can ask the support team questions.

Contacts

| Foundation date | 2005 |

|---|---|

| Registration address | 8th floor, CI Tower, Corniche Road, PO Box 93894, Abu Dhabi, United Arab Emirates |

| Regulation |

SCA

Licence number: 1190047 |

| Official site | https://www.adss.com/ |

| Contacts |

+971 2 652 9777; +44(0) 203 771 5453

|

Education

The ADSS website has a dedicated tutorial section. It contains information primarily for beginners, intermediates and experts.

The broker has cent accounts, where you can practice the knowledge gained without significant risk. Contact technical support if you need help on opening a cent account. ADS CFD broker offers trading facilities for a range of products, you can find out more by confirming on their website.

Comparison of ADSS with other Brokers

| ADSS | Eightcap | XM Group | RoboForex | Octa | InstaForex | |

| Trading platform |

MT4, ADSS trading platform | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader4, MetaTrader5, OctaTrader | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $100 | $100 | $5 | $10 | $25 | $1 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:40 to 1:1000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0.8 points | From 0 points | From 0.8 points | From 0 points | From 0.6 points | From 0 points |

| Level of margin call / stop out |

80% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 25% / 15% | 30% / 10% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | Yes |

Detailed Review of Trademax ADS Securities

ADSS is one of the leaders in the UAE brokerage market.

ADS Securities in figures:

-

The registered capital is $400 million.

-

More than 20,000 active clients.

-

Over 1.6 billion open positions.

ADSS is a broker for private traders and institutional investors

This broker supports ECN technology. To clarify the conditions for direct access to the market, clients can contact their manager. Classic, Elite, Islamic, and demo accounts are available to traders. The company's clients can trade currency pairs, as well as CFDs on stocks, indices, metals, energies, and cryptocurrencies.

Clients of ADS Securities trade through desktop and mobile terminals like MetaTrader 4 and the ADSS trading platform. Traders can trade in one click, and the use of automated advisors and scripts are allowed.

Useful investment services of ADSS:

-

Dow Jones news feed.

-

AutoChartist Trade Setups. Service for recognizing patterns of technical analysis.

-

Daily market reviews and email trading ideas.

Advantages:

There are six asset classes available for trading.

Regulated by the Securities and Commodities Authority (SCA) in the UAE.

The broker provides free analytics and online tools to improve the quality of trading.

All clients, regardless of the size of the deposit, can have access to Islamic accounts, but they must speak with Trading Services.

Latest ADSS News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i