According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MetaTrader4

- ASIC

- FSA

- VFSC

- CySEC

- 2013

Our Evaluation of OneRoyal

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

OneRoyal is a moderate-risk broker with the TU Overall Score of 6.23 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by OneRoyal clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Among CFD brokers, OneRoyal stands out in many ways. Few offer seven groups of CFDs, and almost no other market operates simultaneously under the control of four regulators. Leverage of 1:1000, minimum trade volume of 0.01 lot, and starting deposit from $50 are quite standard indicators. Spreads from 0 pips and fees of $0-$7 per lot look attractive and outperform many competing companies. Passive income options are additional advantages, as well as high-quality training and tools for technical and fundamental analyses. Unfortunately, this broker does not have a referral program, trading is available only through MT4, and technical support does not work on weekends.

Brief Look at OneRoyal

OneRoyal’s clients trade CFDs on currency pairs, cryptocurrencies, stocks, indices, precious metals, energies, and ETFs. In addition to a free demo account, there are four live account types, namely Classic, ECN, VIP, and ECN Elite. The deposit starts from $50, and spreads start from 0, 0.4, or 1.4 pips depending on the account type. Trading fees also depend on the account type and can be $0, $3.5, or $7 per full lot. This broker provides access to two copy trading services, which are HokoCloud and Myfxbook. Another possibility of passive income is joint MAM accounts. Trading is conducted through MetaTrader 4 (MT4) modified by this broker with 12 unique tools. There is full-fledged training, several specialized services, and technical and fundamental analysis tools. Technical support works 24/5.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- This broker gives the most individualized offers, which are four live account types differing in spreads and fees and various versions of MT4 that can be customized for each client;

- This broker does not set trading restrictions; thus, using advisors, trading news, scalping, and hedging are allowed. The minimum trade volume is 0.01 lot;

- There are hundreds of CFDs from seven groups in this broker's pool, which are more than enough to diversify risks and increase profit potential, especially considering the flexible leverage of up to 1:1000;

- The basic account currency can be USD, AUD, CAD, CHF, EUR, GBP, HKD, NZD, or SGD. There are 14 payment systems available and this broker covers all costs of its clients. Also, there is no fee for depositing and withdrawing funds;

- The company has existed since 2006 It is one of the oldest representatives of the segment, and it is regulated by four organizations, which ensures high security for traders;

- OneRoyal uses XCore-based high-speed connectivity in its LD4 and NY4 data centers. As a result, traders receive the minimum order execution time and an unsurpassed level of protection;

- Technical support is provided 24/5 by several call centers for different regions that include communication via email, live chat, and instant messengers.

- Traders can work only through MetaTrader 4, it is convenient and functional, but there are many other popular solutions that are not available here;

- This broker offers copy trading services and joint MAM accounts, but individuals do not have the opportunity to participate in the referral program and receive rewards for inviting new clients;

- The company has significant regional restrictions; thus, it does not provide its services to residents of Syria, North Korea, Iran, and some other countries.

TU Expert Advice

Author, Financial Expert at Traders Union

OneRoyal offers a range of services allowing its clients to trade CFDs on currency pairs, cryptocurrencies, stocks, indices, precious metals, energies, and ETFs. It provides four live account types starting with a $50 minimum deposit, alongside a free demo account. Leverage up to 1:1000, spreads starting from 0 pips, and low trading fees enhance the broker's attractiveness. Additionally, OneRoyal covers withdrawal costs and does not impose trading restrictions, supporting various strategies like scalping and hedging.

However, OneRoyal's exclusive use of MetaTrader 4 may limit platform choices for traders preferring MT5 or other proprietary platforms. The absence of a referral program and the broker's regional service restrictions may also be considered drawbacks. Overall, the broker's offerings are extensive, making it suitable for both beginners seeking to start trading with low fees and experienced traders looking for diverse CFD options.

OneRoyal Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | МetaТrader 4 |

|---|---|

| 📊 Accounts: | Demo, Classic, ECN, VIP, and ECN Elite |

| 💰 Account currency: | USD, EUR, AUD, CAD, CHF, GBP, HKD, NZD, and SGD |

| 💵 Deposit / Withdrawal: | Bank transfer, Visa, Mastercard, Neteller, Skrill, FasaPay, POLi Payments, GlobePay, NganLurong.vn, PayTrust, PayRetailers, Interac, Whish Money, and crypto wallets |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | CFDs on currency pairs, stocks, indices, cryptocurrencies, precious metals, energies, and ETFs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: |

Demo account is free; Four live account types; Low entry threshold; Many CFDs from seven groups; Copy trading services; Joint accounts; Tight spreads and low fees; Only one trading platform; Significant leverage. |

| 🎁 Contests and bonuses: | Welcome bonus |

If a broker offers several live account types and their conditions are different, the minimum deposit will almost always be different also. This is exactly the case with OneRoyal. To open Classic and ECN accounts, a minimum deposit of $50 is required, while for VIP and ECN Pro accounts, you need to deposit at least $10,000. You can deposit funds from a bank account, bank card, crypto wallet, or through an electronic payment system. In total, this broker supports 14 funding options. The maximum leverage on the accounts is the same. Traders choose their preferred leverage or trade without it. Technical support is client-oriented and works 24/5. It is possible to contact specialists by phone, email, live chat, and instant messaging.

OneRoyal Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

BD

BD 4

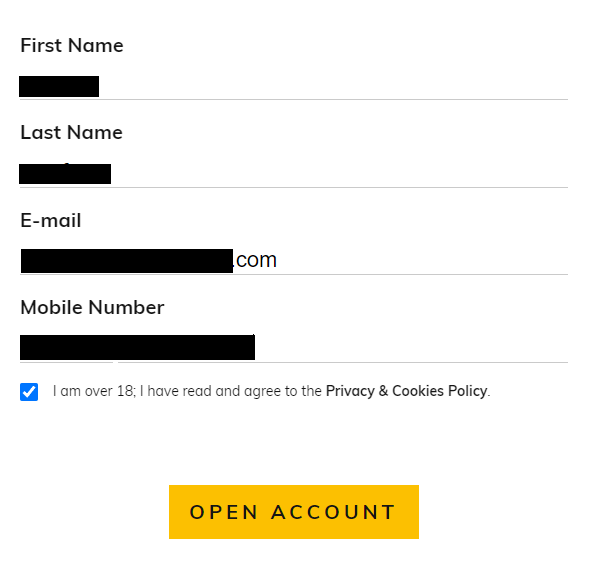

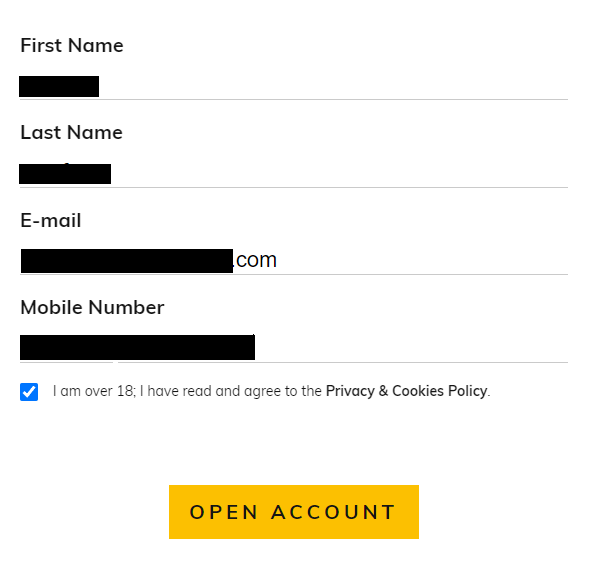

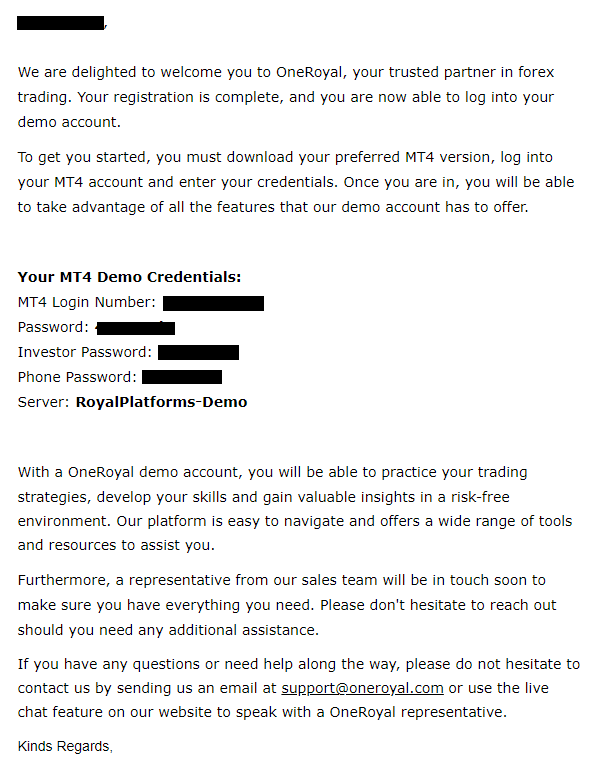

Trading Account Opening

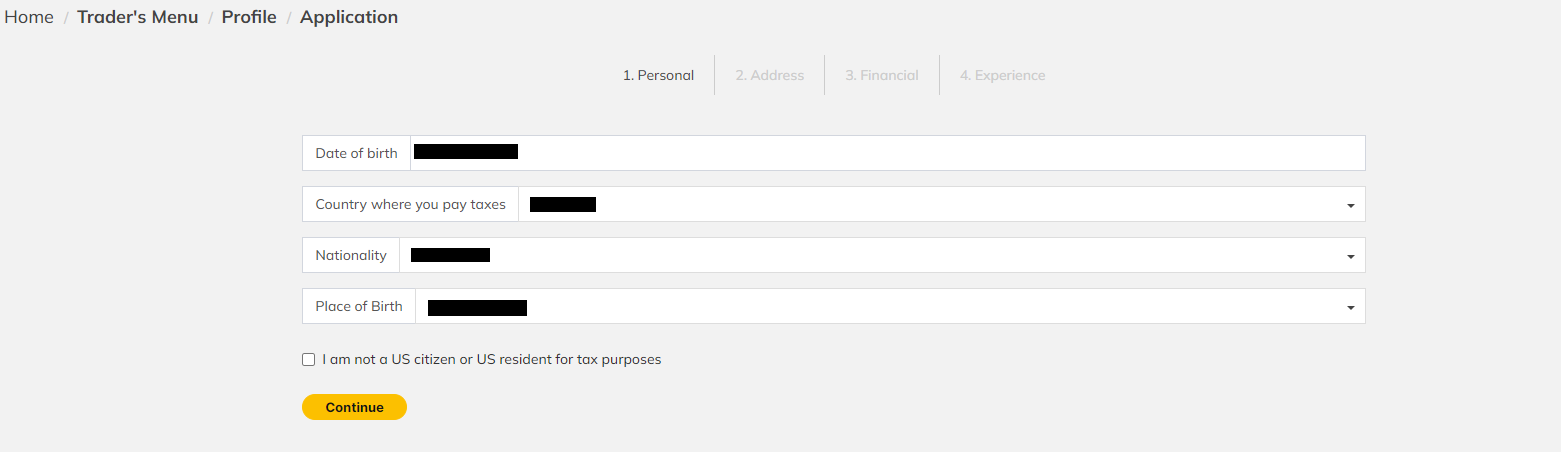

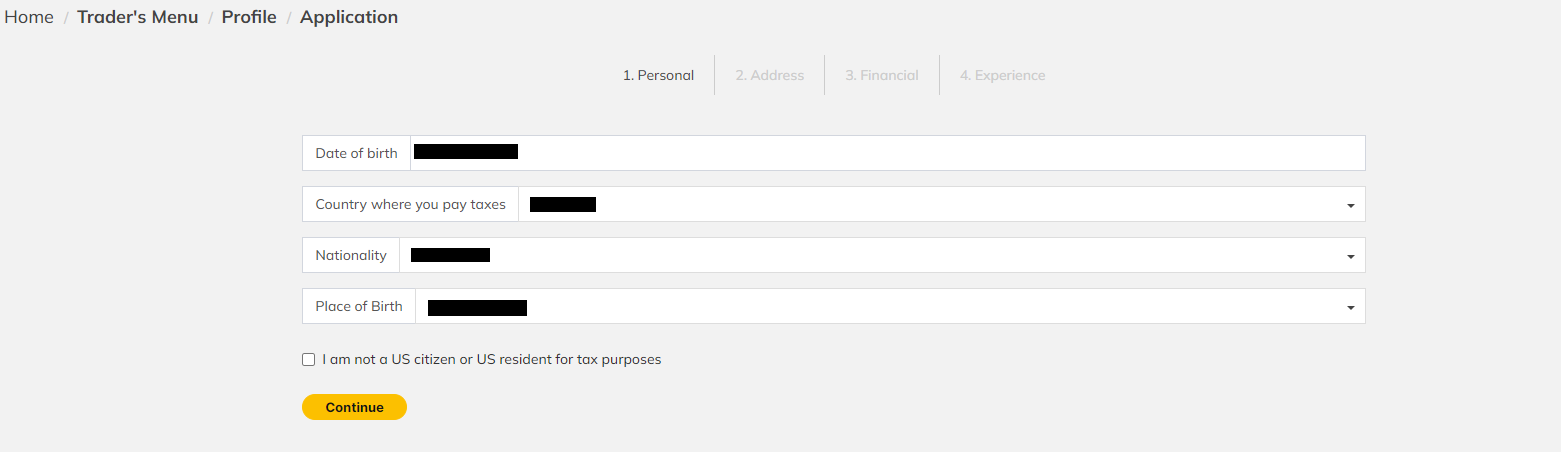

To start working with this broker, register on its website. Then go through verification, select the account type, make a deposit, and download the trading platform. After that, you can start trading. Sometimes new clients have questions about the registration process and what tools are available in the user account. So, TU experts have compiled a detailed guide on registration and features of the user account.

Go to broker website. In the upper right corner, select the interface language and click the “Sign Up” button.

Enter your first and last names, email address, and contact phone number. Tick the appropriate box to confirm that you are over 18, and click the “Open Account” button.

Two emails will be sent to the specified email address. The first one will contain registration data, including login and password, as well as a server for an automatically opened demo account. In the second letter you will find the login and password for the user account.

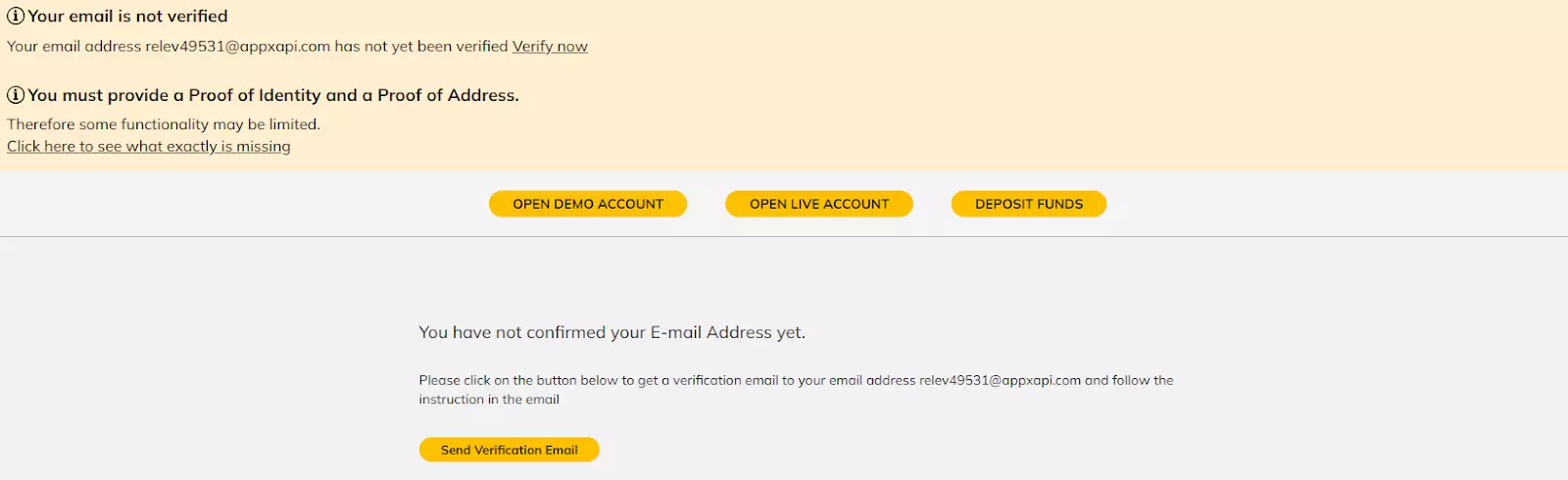

At the top of the user account on this broker's website (where you will automatically be redirected) there will be a notification to confirm your email. Click the “Verify now” link. After that, follow the link from another email.

Also, at the top of the page in your user account you will see a notification about the requirement to verify. Click the link in this notification. Enter your date of birth, nationality, and full address with zip code. Answer a few questions about your financial capacity and trading experience.

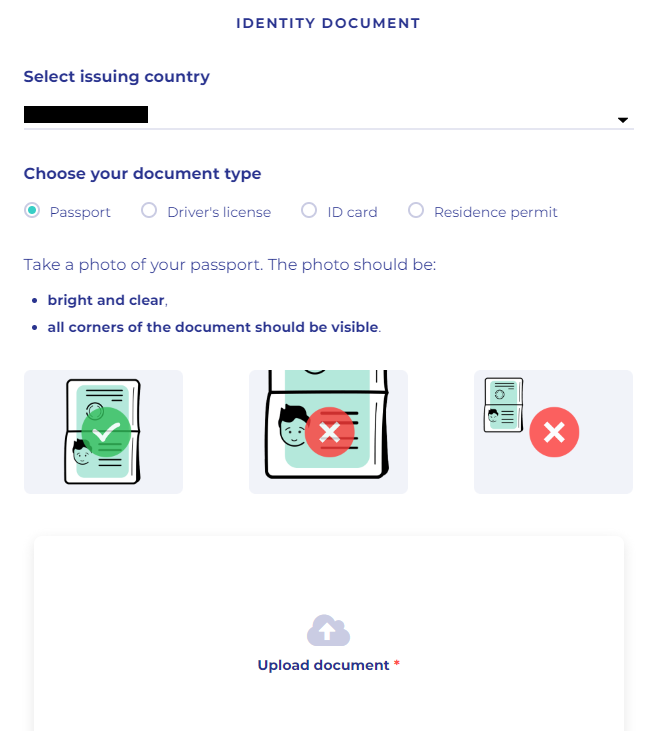

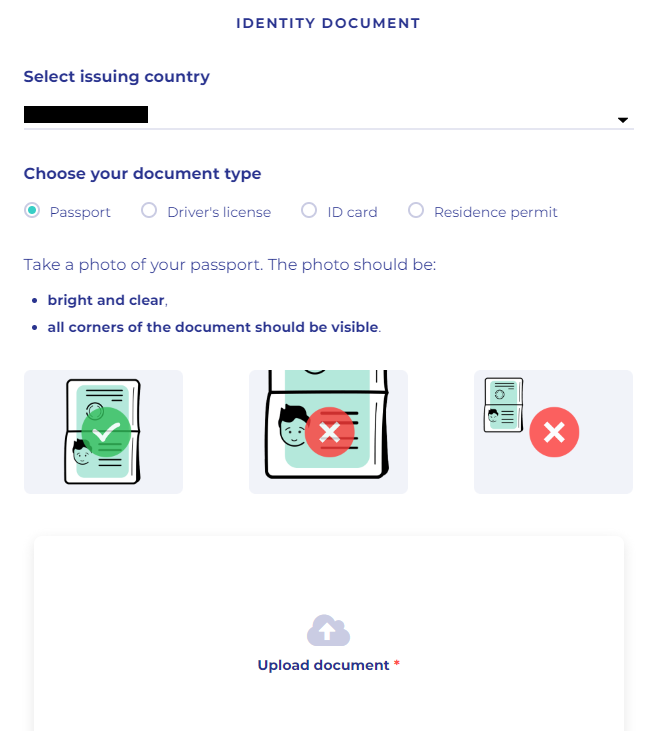

After completing all the blocks, you will be taken to the main verification page. Here select the type of document proving your identity and upload its photo/scan through a special form. Just follow the instructions on the screen.

Upon successful verification, click the “Open Live Account’ button at the top of the same block and follow the instructions on the screen. Select the account type, leverage, and basic currency. Then click the “Deposit Funds” button, select a deposit channel, and fund your account.

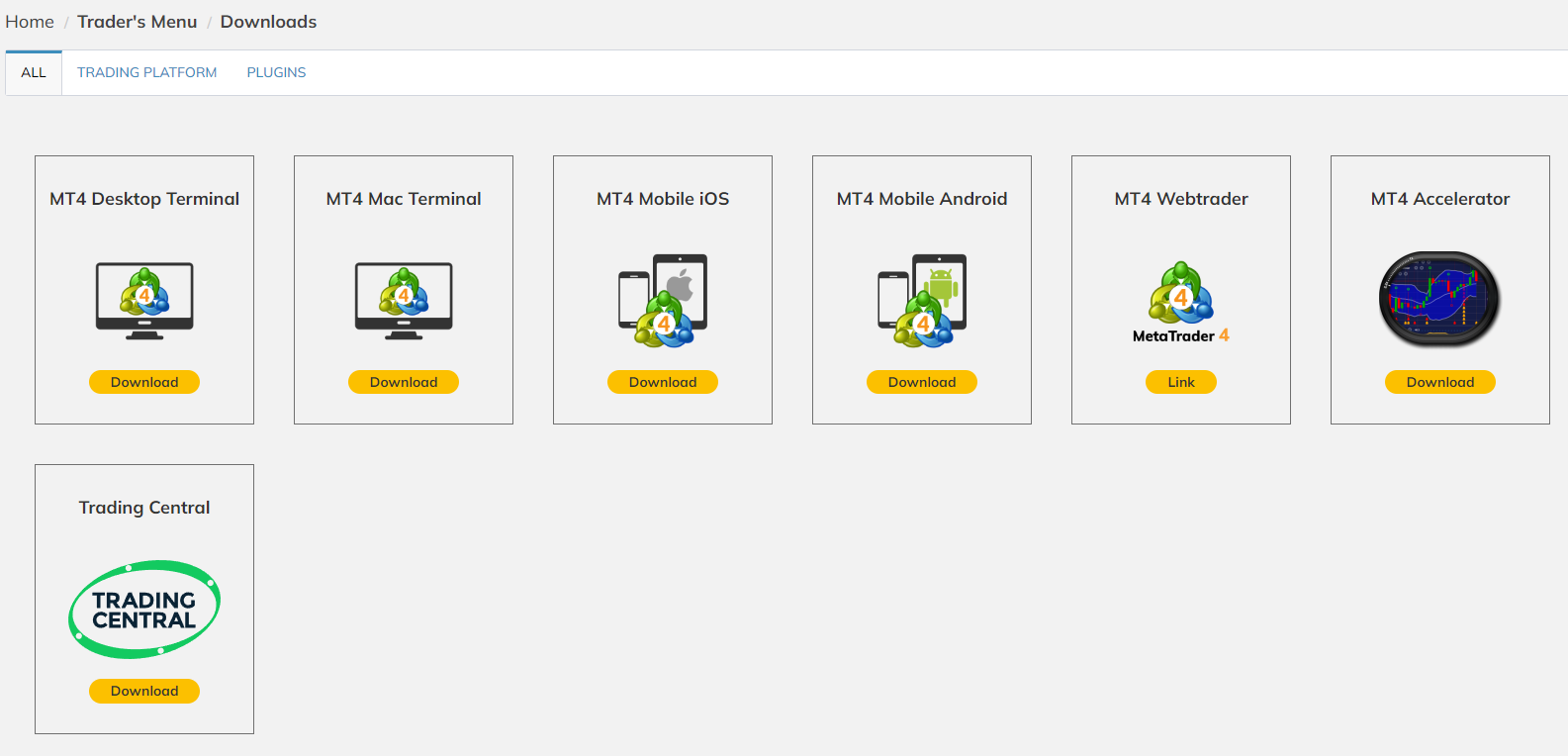

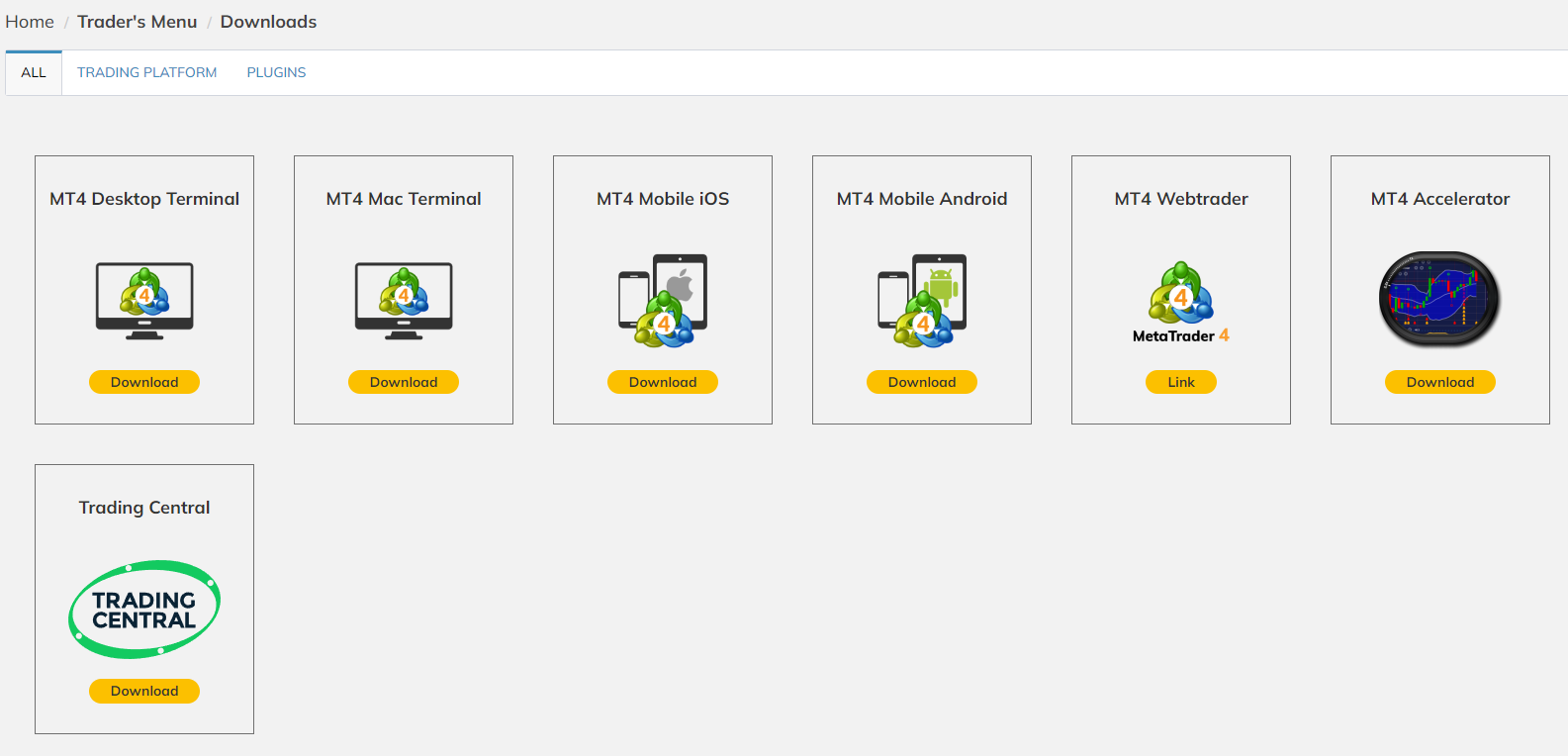

Go to the “Downloads” section. Choose the appropriate version of the trading platform, download its distribution kit, and install it on your device. Note that here you can also download such applications as Trading Central (provided by this broker) and MT4 Accelerator (from the trading platform). After installing the platform, launch it, enter the access data that you received in the first letter, and start trading.

Features of the user account:

Accounts. In this block, traders can open and close live and demo accounts;

Funds. This block provides for depositing money, submitting withdrawal requests, and viewing the transaction history;

Profile. Here, this broker's clients can edit their personal data, pass verification, and set security parameters;

Downloads. This block includes all versions of MT4 and additional applications;

Economic calendar. It contains a tool for fundamental analysis;

Trading Central. This block contains many other tools;

Also, here traders have the opportunity to contact technical support of this broker.

Regulation and safety

OneRoyal has a safety score of 9.9/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record over 12 years

- Strict requirements and extensive documentation to open an account

OneRoyal Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

VFSC VFSC |

Vanuatu Financial Services Commission | Vanuatu | No specific fund | Tier-3 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

SVG FSA SVG FSA |

Financial Services Authority of St. Vincent and the Grenadines | St. Vincent and the Grenadines | No specific fund | Tier-3 |

OneRoyal Security Factors

| Foundation date | 2013 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker OneRoyal have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of OneRoyal with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, OneRoyal’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

OneRoyal Standard spreads

| OneRoyal | Pepperstone | OANDA | |

| EUR/USD min, pips | 1,0 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,4 | 1,5 | 0,5 |

| GPB/USD min, pips | 1,0 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

OneRoyal RAW/ECN spreads

| OneRoyal | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,1 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with OneRoyal. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

OneRoyal Non-Trading Fees

| OneRoyal | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

The choice of a trading account is of paramount importance. Sometimes brokers have very different account conditions, but in the case of OneRoyal, each account is a little different. Live account types differ in minimum deposit, spread, and trading fees, other conditions are the same. According to this broker, Classic and ECN accounts are intended for novice traders and market participants who do not have large capital. VIP and ECN Elite accounts are more suitable for experienced players who have been trading for a long time and have the opportunity to invest significant amounts. For the first two accounts, $50 is enough to start trading, while professional accounts require at least $10,000. This broker provides for trading only through MetaTrader 4, and you can use its desktop or mobile versions for any operating system. OneRoyal offers an MT4 distribution kit with 12 proprietary plug-ins, which are beneficial solutions that are worth using in trading, plus special tools for analysis and forecasting, such as Trading Central, calculators, and an economic calendar.

Account types:

As a rule, if traders are working with this broker for the first time, they will initially open a demo account. The demo provides for learning all the features of this broker, and also gives him the opportunity to practice and try this or that strategy with real quotes. Further, in accordance with their experience, financial capabilities, and preferences, this broker's clients will later register live accounts, select the version of MetaTrader 4 suitable for them, and begin to fully trade.

Deposit and withdrawal

OneRoyal received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

OneRoyal provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- BTC available as a base account currency

- No deposit fee

- Bank wire transfers available

- Supports 5+ base account currencies

- Limited deposit and withdrawal flexibility, leading to higher costs

- PayPal not supported

- Wise not supported

What are OneRoyal deposit and withdrawal options?

OneRoyal provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT.

OneRoyal Deposit and Withdrawal Methods vs Competitors

| OneRoyal | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are OneRoyal base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. OneRoyal supports the following base account currencies:

What are OneRoyal's minimum deposit and withdrawal amounts?

The minimum deposit on OneRoyal is $50, while the minimum withdrawal amount is $50. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact OneRoyal’s support team.

Markets and tradable assets

OneRoyal offers a wider selection of trading assets than the market average, with over 2000 tradable assets available, including 180 currency pairs.

- Copy trading platform

- 2000 assets for trading

- 180 supported currency pairs

- Bonds not available

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by OneRoyal with its competitors, making it easier for you to find the perfect fit.

| OneRoyal | Plus500 | Pepperstone | |

| Currency pairs | 180 | 60 | 90 |

| Total tradable assets | 2000 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products OneRoyal offers for beginner traders and investors who prefer not to engage in active trading.

| OneRoyal | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

OneRoyal received a score of 7.15/10, reflecting an average offering in terms of trading platforms and tools. The broker covers essential functionality but may fall short in some advanced features or platform diversity compared to leading competitors.

- Strategy (EA) Builder is available

- API access for automated trading

- One-click trading

- MetaTrader is available

- No TradingView integration

- No access to cTrader and its advanced tools.

- No access to a proprietary platform

Supported trading platforms

OneRoyal supports the following trading platforms: MT4. This selection covers the basic needs of most retail traders. We also compared OneRoyal’s platform availability with that of top competitors to assess its relative market position.

| OneRoyal | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | No | Yes | Yes |

Key OneRoyal’s trading platform features

We also evaluated whether OneRoyal offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | No |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | No |

| Supported indicators | 68 |

| Tradable assets | 2000 |

Additional trading tools

OneRoyal offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

OneRoyal trading tools vs competitors

| OneRoyal | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | Yes | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | Yes | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

OneRoyal supports mobile trading, offering dedicated apps for both iOS and Android. OneRoyal received 2/10 in this section, which suggests limited user interest or weak performance of the apps.

- Android and iOS apps

- Indicators not supported

We compared OneRoyal with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| OneRoyal | Plus500 | Pepperstone | |

| Total downloads | No data | 10,000,000 | 100,000 |

| App Store score | No data | 4.7 | 4.0 |

| Google Play score | No data | 4.4 | 4.0 |

| Mob. 2FA | No | Yes | Yes |

| Mob. Indicators | No | Yes | Yes |

| Mob. Alerts | No | Yes | Yes |

Education

Traders, even with minimal experience, know perfectly well that practice alone is not enough to improve their skills. Thus, more theoretical training is needed. It is necessary to follow the market and use trendy solutions and life hacks, abandoning outdated methods that have lost their effectiveness. Typically, market participants read eBooks, communicate on specialized forums, and attend seminars. Some brokers organize comprehensive training courses for their clients, and OneRoyal is one of them. The knowledge hub provides basic information on the theory of trading in a convenient, structured, and visual form, available in video formats. A whole section is devoted to advanced video lessons, which are divided into thematic modules. This broker regularly holds webinars on trading and investing, conducted by experienced traders. In addition to a block with technical ideas and a collection of articles with analytics, this broker offers the Roy and Al Show, where two professional traders explain in simple terms the important aspects of trading various instruments.

Unlike most brokers, OneRoyal does not focus exclusively on novice traders. Indeed, this broker provides an impressive number of materials for those who are just starting their journey in trading. But the educational system also involves working with middle-level traders and experienced market participants. This applies to both advanced learning and webinars, as well as the Roy and Al Show, which covers a variety of topics. Thus, a trader who does not have any experience in trading can safely register on the OneRoyal website and learn from this broker, subsequently applying the acquired knowledge on a demo account, and then on a live account. Pro-level users will also find a lot of useful things here.

Customer support

Any broker needs technical support, regardless of how flawless the implementation of the platform is and how detailed everything is described in the FAQs and guides. After all, traders constantly face difficult and controversial issues, when their experience does not matter. These can be problems when depositing or withdrawing funds, atypical trading situations, etc. And it is important how quickly and efficiently users will receive help. If this broker's specialists respond promptly and competently, clients are satisfied. Otherwise, they may become disappointed with this broker and go to a competitor. OneRoyal offers advanced technical support, the benefits of which are hard to ignore. It is available through several call centers, email, live chat, and the company’s profiles in instant messengers. All communication channels are available 24/5. On weekends, traders, unfortunately, must wait until the next business day to have their issues addressed.

Advantages

- Many communication channels

- Non-clients of this broker can contact technical support

- Technical support is available round the clock on weekdays

Disadvantages

- Support is not available on weekends

Whether you are this broker’s client or just intend to become one, feel free to contact client services. It exists to explain trading-related concerns. Below are the current communication channels:

-

international call center;

-

email;

-

live chat on the website and in the user account;

-

tickets on personal account;

-

WhatsApp and Telegram (link is above).

Also, OneRoyal has official profiles on Facebook, Instagram, LinkedIn, Twitter, and YouTube. There you can also contact managers of the company. Subscribe to this broker's profile on one or more social networks to be aware of its latest developments.

Contacts

| Foundation date | 2013 |

|---|---|

| Registration address |

Level 7, 1 York Street, Sydney NSW 2000, Australia Berytus Parks Building Block A, 1st fl. Park Avenue, Mina El Hosn, Beirut Central District, Lebanon Govant Building, 1st Floor, Kumul Highway, Port Vila, BP1276, Vanuatu Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St. Vincent & the Grenadines 4300 N University Dr, Care Suite D206, Sunrise FL 33351, U.S.A. 9 building, 256 Street, Sarayat Al-Maadi, Cairo 109, Allen Avenue, Ikeja, Lagos State, Nigeria |

| Regulation |

ASIC, FSA, VFSC, CySEC

Licence number: 312/16, 420268, 700284 |

| Official site | https://oneroyal.com/ |

| Contacts |

+61282845100, +9611975275, +18887059006, +18448853159, +23409035755510

|

Comparison of OneRoyal with other Brokers

| OneRoyal | Bybit | Eightcap | XM Group | Exness | Octa | |

| Trading platform |

MetaTrader4 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5, OctaTrader |

| Min deposit | $50 | No | $100 | $5 | $10 | $25 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:40 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.6 points |

| Level of margin call / stop out |

No | No / 50% | 80% / 50% | 100% / 50% | 60% / No | 25% / 15% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | Yes | No |

Detailed review of OneRoyal

The company uses an advanced technology stack and modern financial technology (Fintech), which is expressed in the use of XCore connections, virtual dedicated servers, and SSL security protocols. For this reason, the operation of this broker is exceptionally stable. It has been active for 17 years, and there have been neither critical failures; nor has it been hacked. All this proves that user funds and information are completely safe. Moreover, this broker works with tier-1 liquidity providers, which ensures favorable spreads and fast order execution. Any account type can be reclassified into an Islamic swap-free account upon request. In general, this broker cares about its clients and constantly improves the working infrastructure to provide the most comfortable working conditions.

OneRoyal by the numbers:

-

4 live accounts plus a demo account;

-

7 groups of CFDs on hundreds of assets;

-

Minimum spread is 0 pips (on the ECN account);

-

2 copy trading services;

-

4 regulators (ASIC, CySEC, VFSC, and FSA).

OneRoyal is a CFD broker for novice and experienced traders

There are many brokers offering only CFDs. But there are only a few among them that provide access to hundreds of trading instruments from seven different groups, such as currency pairs, cryptocurrencies, stocks, indices, precious metals, energies, and ETFs. Why is a large choice of different asset types in this broker's pool important? It makes traders’ opportunities for risk diversification more flexible. Another aspect is the strategic potential. When traders are not limited to choosing two or three groups, they can implement an almost endless range of solutions. OneRoyal’s clients work through MetaTrader 4, which many consider to be an ageless classic. MT4 is really good as it's easy to learn, it has an intuitive interface, and it offers many major localization languages. But its main advantage is the possibility of customization through hundreds of practical and useful plug-ins. OneRoyal offers a distribution with twelve custom plug-ins.

Useful services offered by OneRoyal:

-

MAM accounts. The joint account service allows traders to register as managers or investors. Managers trade with their own funds and funds on sub-accounts. They benefit not only from personal profit, but they also receive fees from investors. Investors, in their turn, earn passively with reduced risk;

-

Copy trading. This service allows experienced traders to become signal providers (everyone can copy their trades) and receive additional profit from investors’ fees. In their turn, investors earn without trading in person, and get a unique experience by watching the actions of a professional;

-

Trading Central. This comprehensive analytical service studies newsfeeds and generates forecasts for certain assets based on it. In Trading Central, traders are provided with expert opinions, expected trend changes, and even signals for a successful trade entry.

Advantages:

This broker has a low entry threshold. It offers a free demo account and standard account types with a minimum deposit of only $50;

This broker’s clients can trade an impressive pool of assets that includes hundreds of CFDs on assets from seven different groups. They trade without limits using trading leverage up to 1:1000;

The fee policy of this broker is objectively profitable. Spreads are tight, starting at 0 pips, fees are market average or lower, and there are no withdrawal fees;

The company operates 100% transparently. Conditions for all transactions are known in advance. You can find substantial information about trading with this broker on its website;

Technical support is available 24/5 via several major channels, including phone, email, live chat, and popular instant messengers.

Latest OneRoyal News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i