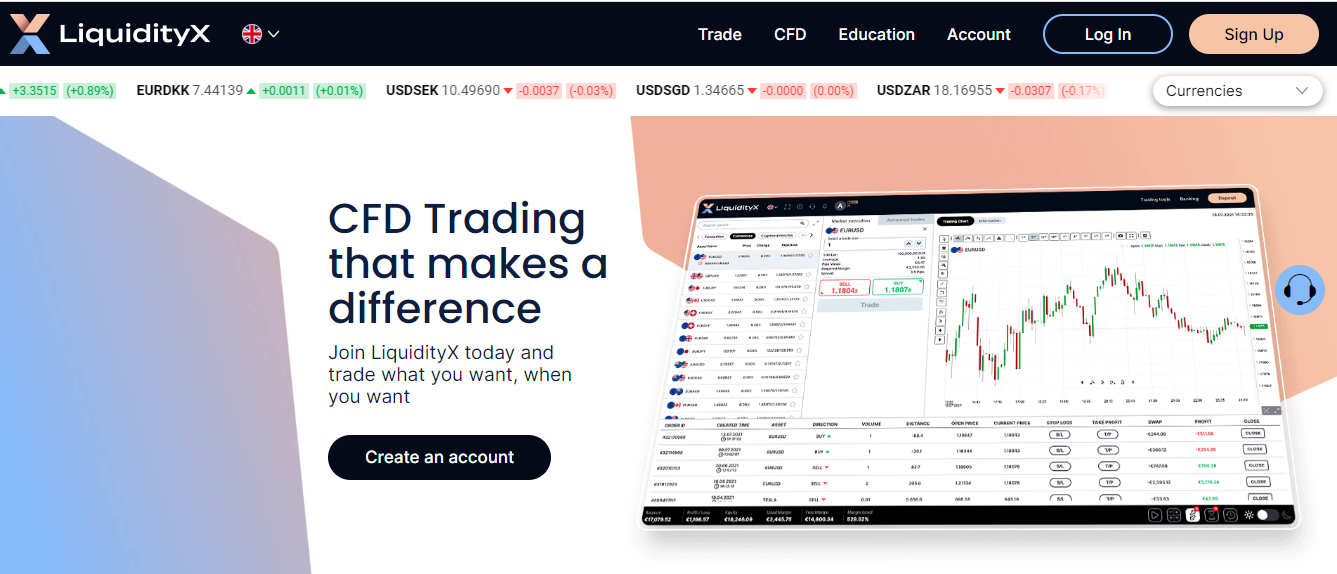

LiquidityX Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €250

- MT4

- Proprietary platform

- 2022

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €250

- MT4

- Proprietary platform

- 2022

Our Evaluation of LiquidityX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

LiquidityX is a high-risk broker with the TU Overall Score of 2.77 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by LiquidityX clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. LiquidityX ranks 334 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

LiquidityX is a broker for professionals and retail traders. It offers standard options for active trading but also welcomes passive investors who prefer automated trading.

Brief Look at LiquidityX

LiquidityX is a regulated Forex and CFD broker headquartered in Athens, Greece. It offers all the necessary tools for active trading and does not prohibit the use of third-party services to receive passive income. Trading is available on the broker’s proprietary trading platform and MetaTrader 4 (MT4). The company's clients have access to negative balance protection, advanced analytics, and free training on trading financial instruments.

- The broker complies with the requirements of the European Financial Supervision Commission;

- Availability of four account types for retail traders and individual conditions for professionals;

- Mobile, desktop, and WebTrader versions of MetaTrader 4, plus demo trading platforms are available;

- Negative balance protection for all account types;

- Large choice of currency pairs and CFDs;

- Free fundamental data and forecasts made using technical analysis.

- The minimum deposit amount is higher than that of many Forex brokers;

- High spreads and limited leverage for non-professional traders;

- Withdrawal fees are charged.

TU Expert Advice

Financial expert and analyst at Traders Union

LiquidityX is a subsidiary of the Greek investment holding firm Capital Securities S.A. The broker provides access to the Forex market, as well as to trading CFDs on stocks, indices, commodities, and cryptocurrencies. LiquidityX offers STP (Straight-Through Process) accounts with only spreads and swaps for transferring positions overnight. The broker does not withhold fees per lot or other trading fees.

LiquidityX operates in accordance with the requirements of not only the Hellenic Capital Market Commission (HCMC) but also the European Securities and Markets Authority (ESMA). This means that every client of LiquidityX is either retail or professional. Since 2018, ESMA has introduced special measures for retail traders.

LiquidityX Summary

| 💻 Trading platform: | MT4 (desktop, Android app, iOS app, and WebTrader) and the broker’s own (proprietary) web trading platform |

|---|---|

| 📊 Accounts: | Demo, Basic, Gold, Platinum, and VIP |

| 💰 Account currency: | EUR |

| 💵 Replenishment / Withdrawal: | Bank cards, electronic payment systems, and wire transfer |

| 🚀 Minimum deposit: | €250 |

| ⚖️ Leverage: | Up to 1:30 for retail clients;Up to 1:400 for professionals |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 1.6 pips |

| 🔧 Instruments: | Forex, stocks, indices, commodities, ETFs, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | The broker’s own liquidity provider |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market and instant executions |

| ⭐ Trading features: | EAs and copy trading on MetaTrader are available |

| 🎁 Contests and bonuses: | No |

Retail traders can start working with LiquidityX by making a €250 deposit. They also can get access to a wide range of currency pairs and CFDs with leverage up to 1:30. You can place both market and pending orders, including stop loss and take profit. The broker offers market and instant execution. Professionals (traders with relevant experience and an investment portfolio starting from €500,000) have access to leverage up to 1:400, analytics from Trading Central, and a personal account manager.

LiquidityX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

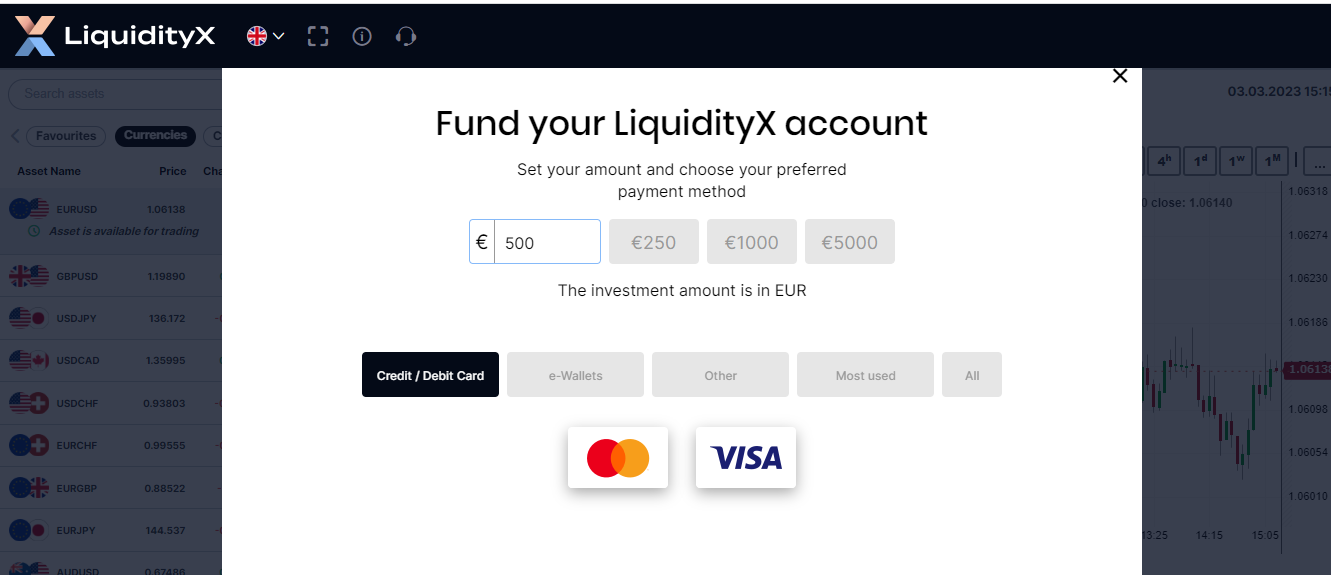

Trading Account Opening

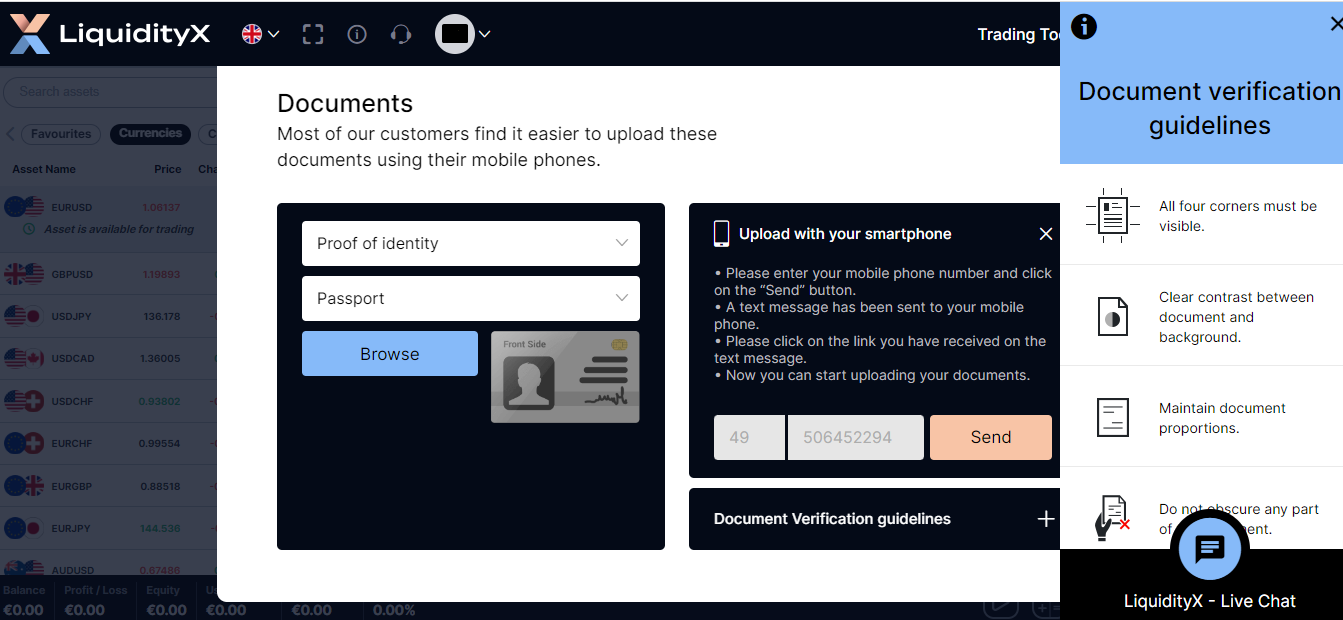

To become a client of LiquidityX, registration of a user account on the company's website is necessary. Below are instructions on how to register:

Start registration. You can use the “Sign Up” button at the top of the screen or the “Create an Account” button on the main page of the website.

Fill out the form to open an account. Enter your name, phone number, and email address. You will also have to answer a number of questions about CFD trading. After that, a letter with a system-generated password will be sent to the specified email address. Use it to enter your user account. The password can be changed in the settings of the user account.

What is available in LiquidityX’s user account:

Additional services available in the user account:

Switching between live and demo accounts;

TipRanks, Autochartist, and economic calendar;

Submission of withdrawal requests;

History of deposits and withdrawals;

Trading hours;

Creation and reviewing of the selected assets shortlist.

Regulation and safety

The LiquidityX brand is managed by Capital Securities S.A., which is regulated by the Hellenic Capital Market Commission, license number 2/11/24.5.1994.

LiquidityX is a member of the Investor Compensation Fund. Each retail client can receive insurance coverage in the amount of up to €20,000 in case of suspension of the broker's activities. The company uses the most up-to-date technologies, such as 128-bit SSL encryption from Thawte, to protect the personal information and funds of its clients.

Advantages

- Negative balance protection

- Segregated bank accounts are used to keep clients’ funds

- Insurance coverage for retail clients in case of suspension of the broker’s activity

Disadvantages

- When registering an account, you must confirm your skills and ability to trade CFDs by answering some questions

- HCMC significantly limits leverage for retail traders and prohibits deposits/withdrawals in cryptocurrencies

- The broker requires details of the bank card (number and CVV code) and its photo

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Basic | From $30 | Yes |

| Gold | From $27 | Yes |

| Platinum | From $21 | Yes |

| VIP | From $16 | No |

Additional trading fees include swaps. They are withheld on all positions transferred overnight. An objective assessment of the broker's fees is impossible without comparing them with the conditions of other companies. Below is a table showing the average fees of LiquidityX and its closest competitors.

| Broker | Average commission | Level |

|---|---|---|

|

$23.5 | |

|

$1 | |

|

$8.5 |

Account types

To trade with LiquidityX, traders must open a live account. Four account types are provided with different fee amounts and deposit requirements. They also differ in the number of available free withdrawals.

Account types:

A demo account can be opened both in MT4 and on the broker’s proprietary trading platform. LiquidityX offers a wide range of trading account types with different deposit requirements, which also differ in spreads and withdrawal conditions.

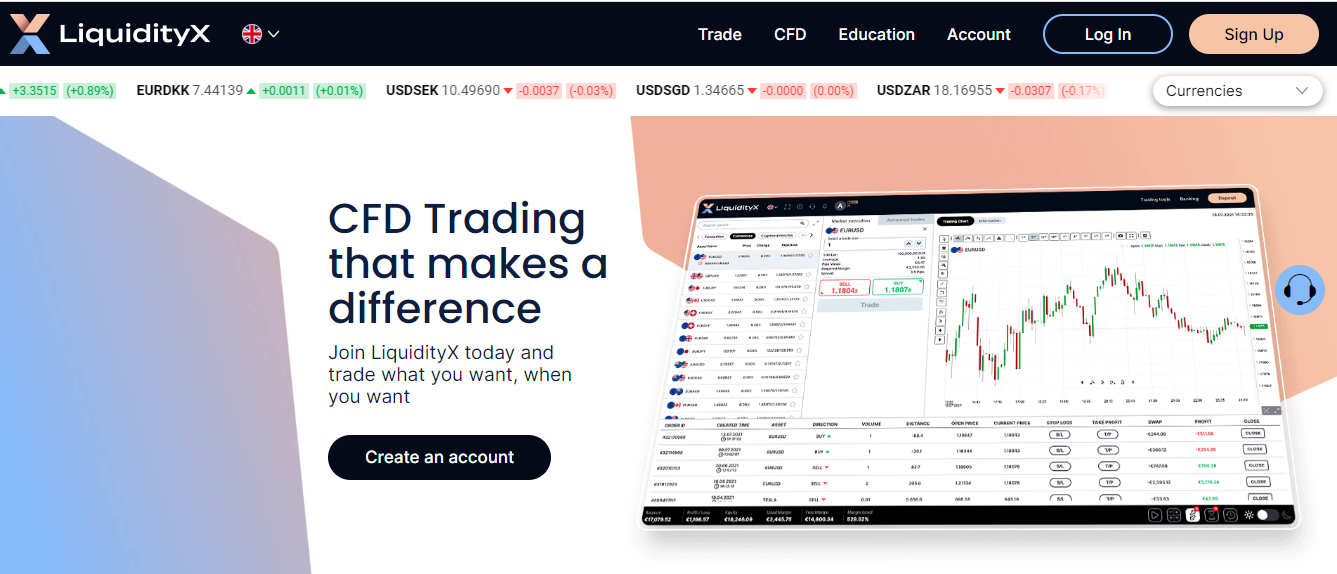

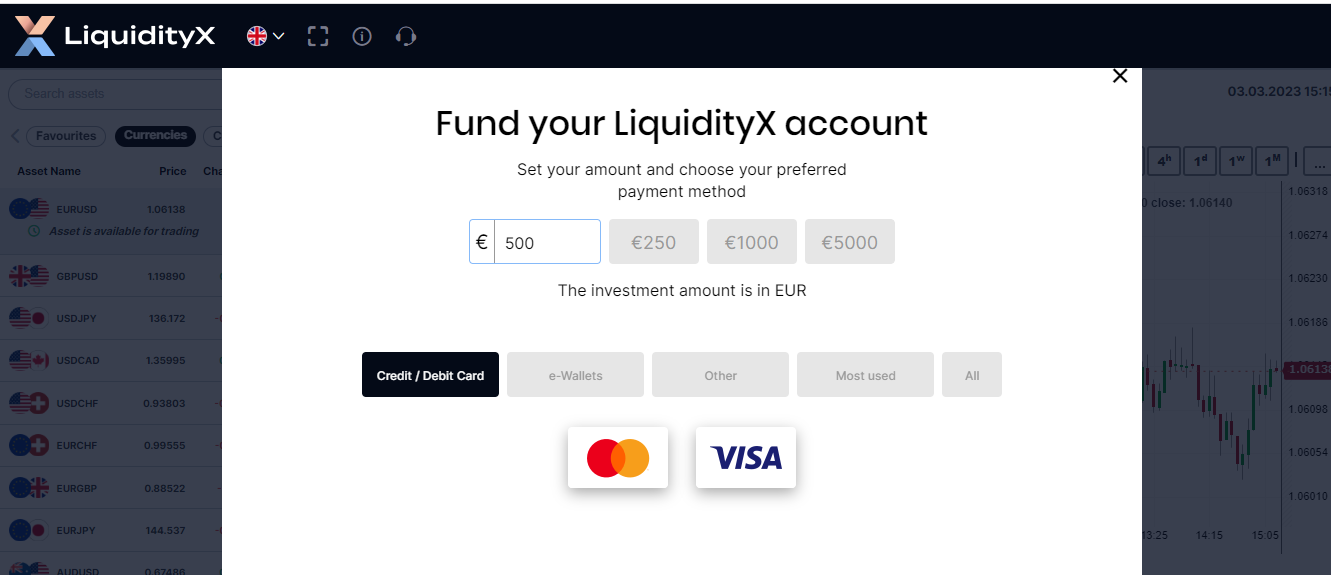

Deposit and Withdrawal

-

The amount equal to the made deposit can be withdrawn by the method used to replenish the account. The company transfers profits only to the client's bank account or e-wallet. The received profit cannot be withdrawn to credit cards;

-

Withdrawal requests are processed within 24 hours. The terms for crediting funds vary depending on the payment method and can be up to 5 business days;

-

VIP clients do not pay withdrawal fees. Holders of other account types also have the opportunity to withdraw profits free of charge, but they are subject to restrictions on the number of zero-fee withdrawals;

-

The minimum withdrawal amount for wire transfers is $120, €100, or £80. There are no such requirements for bank cards, Skrill, and Neteller;

-

Each bank transfer will cost $30/€30/£30. The fee for withdrawal to cards and e-wallets is calculated as a percentage of the transaction amount and is 1.7%-3.5%. The highest fee is for withdrawals to bank cards.

Investment Options

These are reduced leverage, special margin closing rules, and restrictions on trading benefits. Professional traders can trade with high leverage and on individual terms, but they are not protected by the Investor Compensation Fund (ICF). Retail clients have access to ICF insurance coverage of up to €20,000 in case of financial insolvency of the broker. Negative balance protection is an option for all LiquidityX’s clients who trade CFDs and currencies.

LiquidityX is focused on active trading and does not offer any investment solutions. However, its clients can receive passive income using services that are available to users of the MetaTrader trading platform. LiquidityX does not have a partnership program, so traders cannot earn money by attracting new clients. Investments in PAMM or MAM accounts are not available from this broker.

Passive income with LiquidityX

LiquidityX does not have services for making a profit other than active trading, but the broker allows the usage of some strategies to earn passive income. These include:

Algorithmic trading. Each LiquidityX client who works on MT4 can use Expert Advisors (EAs). Expert Advisors in MetaQuotes Language 4 (MQL4) are either paid or free, and semi or fully automatic. The broker does not prohibit using any of them;

Copy trading. MetaTrader users can duplicate the strategies of hundreds of successful traders worldwide. You can subscribe to an unlimited number of profiles and earn on automatic copying trades, giving these traders a part of your profits.

LiquidityX does not make recommendations on the choice of signal providers or advisors. In the case of using third-party services, the broker acts as an intermediary that offers access to the trading platform and executes trades. Its fee for passive investment is the standard spread, no additional fees are charged.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program from LiquidityX

LiquidityX does not have a partnership program.

Customer support

LiquidityX client support is available 24/7.

Advantages

- Live chat operators are available 24/7

- You can get support in English, German, and Spanish

Disadvantages

- Live chat operators answer only general questions

- Not all questions sent by email are answered

To get an answer to your question or solve a problem, contact technical support via:

-

live chat;

-

email;

-

telephone.

The live chat button is available both on the website and in the trader's user account.

Contacts

| Foundation date | 2022 |

|---|---|

| Registration address | Capital Securities S.A., 58, Metropoleos Street, 105 63, Athens, Greece |

| Official site | https://www.liquidityx.com/ |

| Contacts |

+30 21 1199 5046

|

Education

The “Education” section on the LiquidityX website contains training materials in various formats. Moreover, useful information for novice traders is available in the “Trading & Investing” and the “General” blocks of the FAQs section, as well as in the “CFD” menu of the website.

Novice traders can use demo accounts with virtual deposits to learn how to trade currencies and CFDs.

Comparison of LiquidityX with other Brokers

| LiquidityX | RoboForex | Pocket Option | Exness | FxPro | FreshForex | |

| Trading platform |

MT4, Proprietary platform | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MT4, MobileTrading |

| Min deposit | $250 | $10 | $5 | $10 | $100 | No |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.6 point | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 25% / 20% | 40% / 20% |

| Execution of orders | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | $30 |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of LiquidityX

LiquidityX is a brokerage company registered in Greece and regulated by the local financial authority HCMC. It provides services within the European Economic Area plus Switzerland but excluding Belgium. The euro is the main currency of mutual settlements with clients. Deposits and withdrawals in cryptocurrencies are not allowed. The choice of electronic payment providers is limited by HCMC and ESMA.

LiquidityX by the numbers:

-

The parent company was founded over 29 years ago;

-

4 trading account types for retail clients;

-

2 major trading platforms.

LiquidityX is a broker with conditions subject to the requirements of the European Securities and Markets Authority

LiquidityX offers trading with more than 35 currency pairs and with a maximum leverage of 1:20-1:30. Twenty cryptocurrency pairs are traded with leverage of 1:2 and 28 indices are traded with trading leverage of 1:5-1:20. Leverage up to 1:10-1:20 is available for 30 commodities, including metals, energies, and agricultural products. More than 70 stocks, which are securities of companies from the EU, the U.S., and Asia, are represented. These assets are traded in the CFD format, that is, traders do not buy or sell real stocks, but only make deals with virtual CFDs. All CFDs on stock are traded with leverage no higher than 1:5.

Traders who prefer web trading can choose between WebTrader MT4 and LiquidityX’s proprietary platform. MetaTrader 4 apps are available for mobile trading on iOS and Android devices. Also, MT4 can be installed on a PC or laptop for trading on the desktop version.

Useful services offered by LiquidityX:

-

Online calculator. This is a tool to calculate the fee for a position. It shows the spread and swap sizes. Traders must specify the account type and currency, asset, position size, duration, and action (buy or sell). The calculation is available to both retail and professional clients.

-

TipRanks. This is a tool for tracking stock prices, the latest stock market news, and asset buy/sell recommendations from professional financial advisors. Clients of LiquidityX receive TipRanks data for free.

-

Autochartist. This program automatically analyzes data on the charts and then gives a possible forecast of changes in the asset price. LiquidityX’s clients have access to market trend tracking for currency pairs, commodities, and indices.

-

Economic calendar. Traders get access to this tool upon registration on the LiquidityX website. The calendar displays important financial data that may affect the value of assets.

Advantages:

Large choice of currency pairs, including currency, plus cryptocurrency pairs.

The range of available assets includes CFDs on stocks from Europe, the U.S., and Asia.

24/7 client support.

Opportunity to combine active trading with automated trading using special applications.

Simple and easy-to-use proprietary software for trading through the browser of a mobile or stationary device.

All clients have access to Market Buzz, analyst opinions, daily market analysis, and Web TV.

User Satisfaction