CFDs carry many risks and the market is highly volatile. While returns are possible, they're proportionate to the risk of loss and both should be presented in equal measure.

Plus500 Withdrawal Guide

Plus500 is a CFD broker that offers its clients the ability to trade on various markets, including forex, indices, commodities, stocks, and cryptocurrencies. One thing that makes Plus500 stand out from other brokers is that it offers a very user-friendly platform, making it ideal for those new to online trading.

This review will discuss the Plus500 withdrawal guide and process. We will highlight the key steps involved in withdrawing funds from your account, as well as any fees that may be applicable. Overall, we will provide a detailed overview of the Plus500 withdrawal process so that you can make an informed decision about whether this broker is right for you.

Plus500 Withdrawal Methods

Plus500 offers several withdrawal methods to choose from, so you can choose the one that best suits your needs. The broker does not charge any withdrawal fees, so anything you incur will only be from your bank of choice or payment issuer. When it comes to withdrawal limitations, all methods do have a minimum amount threshold. The broker also recommends using the same deposit and withdrawal methods. Here is a rundown of their withdrawal methods:

Credit/Debit Card: Plus500 allows users to withdraw funds from their accounts using a credit or debit card. Funds are typically transferred within 1-3 business days after withdrawal authorization. However, this will highly depend on your bank’s processing time.

Bank Transfer: Plus500 also offers withdrawals by bank transfer. Bank transfer withdrawals typically take 5-7 business days to process from when the withdrawal is authorized. Withdrawals to your bank may be delayed depending on your bank of choice and country of residence.

E-Wallets: Plus500 offers withdrawals to various e-wallets, including PayPal and Skrill. Payments take anywhere from 3 to 7 business days from the day your withdrawal is approved.

PayNow: Plus500 offers the PayNow withdrawal method for Singapore customers. With PayNow, you can withdraw funds from your Plus500 account using your mobile phone number.

POLi: Plus500 also offers the POLi withdrawal method for Australian and New Zealand customers. With POLi, you can withdraw funds from your Plus500 account using your internet banking account.

| Method | Speed | Fee | |

|---|---|---|---|

| Bank cards | Yes | By next billing date | $0 |

| Wire transfer | Yes | 5 to 7 business days | $0 |

| Payment services | Skrill and PayPal | 3 to 5 business days | $0 |

| Crypto | No |

How to Withdraw Money From Plus500

To understand more about how to withdraw from Plus500, simply follow these steps:

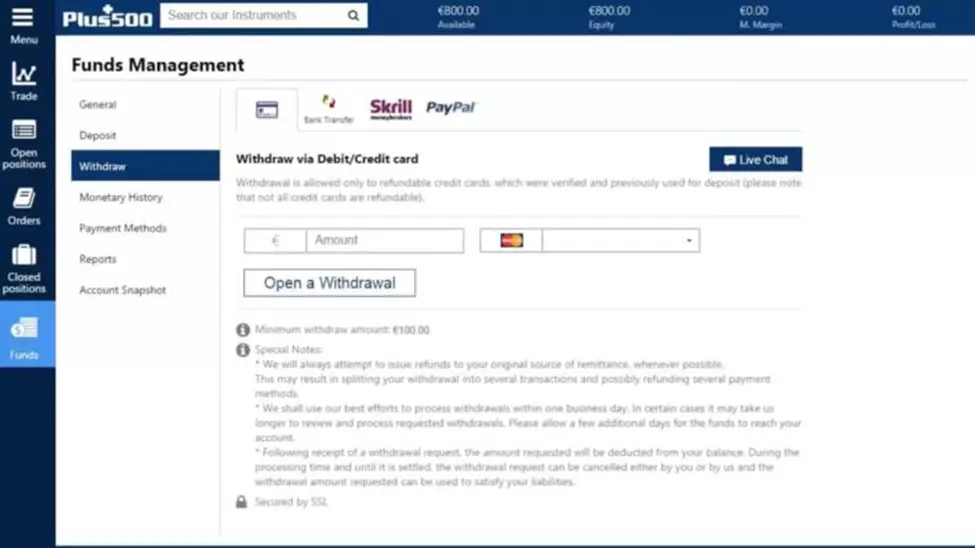

Plus500

Log into your account and click on the menu icon in the upper left corner.

Choose the “Funds Management” option from the drop-down menu.

Select “Withdraw” and then choose your preferred withdrawal method.

Fill out all of the required details and then click on “Open a Withdrawal.”

Plus500

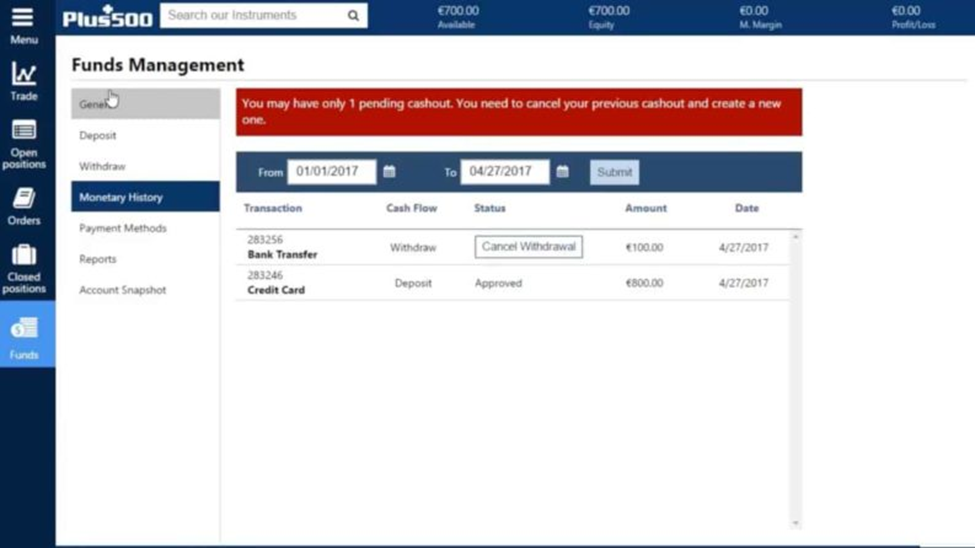

Your withdrawal request will go through several stages, including:

Requested: This is when the broker receives your withdrawal request and is awaiting processing

Approved (In Progress): This is when the broker has authorized your request

Approved (Sent): This is when the broker sends your funds to your withdrawal method of choice

Approved (Settled): At this point, the withdrawal is complete

Once your withdrawal process is complete, you may see some clearing delays. To see this process, check the” Monetary History” section.

Plus500

What Is the Plus500 Minimum Withdrawal Amount?

Now that you know how to withdraw profit from Plus500, what’s the minimum withdrawal? When you make a withdrawal from your Plus500 account, there is a minimum amount that you must adhere to for the transaction to be processed. For e-wallets, the minimum amount is USD 50. The minimum amount for credit or debit card withdrawals is USD 100. For bank transfers, the minimum amount is also USD 100.

What Are Plus500 Withdrawal Currencies?

IWhen you make a Plus500 withdrawal, you will be able to choose from a variety of currencies. The most popular choices are USD, GBP, EUR, and CHF, but you can also withdraw in AUD, JPY, PLN, HUF, CZK, CAD, TRY, SEK, NOK, and SGD. Plus500 offers competitive rates for all of these currencies. When withdrawing, simply select the currency you wish to receive and enter the amount you would like to withdraw.

FAQs

How do I withdraw money from Plus500?

To withdraw money from your Plus500 account, simply log in and click on the “Menu” tab. From there, you can select the “Funds Management” tab and then on “Withdrawal.” Enter the amount you wish to withdraw and choose your preferred withdrawal method. The money will then be transferred to your chosen account.

How long does it take for my withdrawal to be processed?

Withdrawals are typically processed within 3 to 7 business days. The length of time will highly depend on your withdrawal method of choice. Bank transfers take the longest, though.

What is the minimum amount I can withdraw?

The minimum amount you can withdraw from your Plus500 account is %50 for e-wallets and $100 for other methods.

What are the costs associated with withdrawing money?

There are no costs associated with withdrawing money from your Plus500 account. However, please note that some banks and other payment issuers may charge you.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.