According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €1,000

- MetaTrader4

- MetaTrader5

- ActivTrades

- TradingView

- FCA

- Amtsgericht München

- CSSF

- 2022

Our Evaluation of Qtrade-de

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Qtrade-de is a moderate-risk broker with the TU Overall Score of 6.09 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Qtrade-de clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

QTrade is a regulated broker that offers a wide range of assets for both professional and retail clients. Also, a high initial deposit doesn’t allow novice traders with small free capital to test the broker’s conditions.

Brief Look at Qtrade-de

QTrade was incorporated in 2009 and has its head office in Munich. It is supervised by BaFin (The Federal Financial Supervisory Authority) and participates in the German compensation scheme for investors. QTrade partners with ActivTrades, an international broker regulated by FCA (Financial Conduct Authority | UK), SCB (Securities Commission of the Bahamas), and ESMA (European Securities and Markets Authority). Their accounts are integrated, which allows QTrade clients to use ActivTrader, the ActivTrades proprietary platform, along with MetaTrader 4, MetaTrader 5, and TradingView. QTrade focuses on active trading CFDs and Forex. Also, it offers leverage up to 1:30 (1:400 outside Germany) and proprietary signals. The broker provides its services to residents/citizens of Germany above age 18 and to residents of 70 more countries.

- BaFin ensures security and reliability;

- Account types for retail and professional trading;

- Negative balance protection;

- Over 1,000 CFDs on different assets, including currency pairs;

- Trading micro and mini lots;

- Technical and telephone support are available in German;

- Wide choice of trading platforms.

- To start retail trading CFDs, a minimum deposit of €1,000 is required;

- The broker’s website doesn’t contain educational materials for novice traders or information for developing the trading skills of more experienced traders;

- No live chat with technical support.

TU Expert Advice

Author, Financial Expert at Traders Union

QTrade offers a range of CFD and Forex trading options, featuring MetaTrader 4, MetaTrader 5, ActivTrader, and TradingView platforms. It provides diverse account types for both retail and professional traders, with EUR, USD, GBP, and CHF as base currencies. Benefits include the absence of fees for account maintenance and order processing, tight spreads, and leverage up to 1:30 for European clients and up to 1:400 outside Germany. Its regulation by BaFin and participation in German compensation schemes contribute to secure trading conditions.

However, the high minimum deposit of €1,000 may limit accessibility for traders with lesser capital, and there is no cryptocurrency trading offered directly. Additionally, QTrade lacks live chat for client support and provides limited educational resources for beginners. Thus, it may be more suitable for experienced traders who prioritize low trading fees and value a broad choice of CFDs and Forex pairs over educational support or expanded asset classes.

Qtrade-de Trading Conditions

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, ActivTrader, and TradingView |

|---|---|

| 📊 Accounts: | Demo and Live (Premiumkonto and Professionalkonto) |

| 💰 Account currency: | EUR, USD, GBP, and CHF |

| 💵 Deposit / Withdrawal: | Bank transfers, bank cards, Neteller, Skrill, PayPal, and Sofort |

| 🚀 Minimum deposit: | €1,000 |

| ⚖️ Leverage: | Up to 1:30 /1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,05 pips |

| 🔧 Instruments: | Forex (major, minor, and exotic currencies), futures contracts, and CFDs on indices, commodities, stocks, ETFs, and bonds |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | 10+ major banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market |

| ⭐ Trading features: | EAs, scalping, and trading on news events are allowed |

| 🎁 Contests and bonuses: | Occasionally |

QTrade offers trading mini, micro, and standard lots. Trades can be executed on trading platforms or by phone without fees for the use of a dealing table. In addition to the main order types, traders can work with extended orders such as trailing stop, OCO (One Cancels Other), and OTO (One Triggers Other). Traders from Germany can’t use trading leverage over 1:30, however, traders from other jurisdictions can work with leverage up to 1:400.

Qtrade-de Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

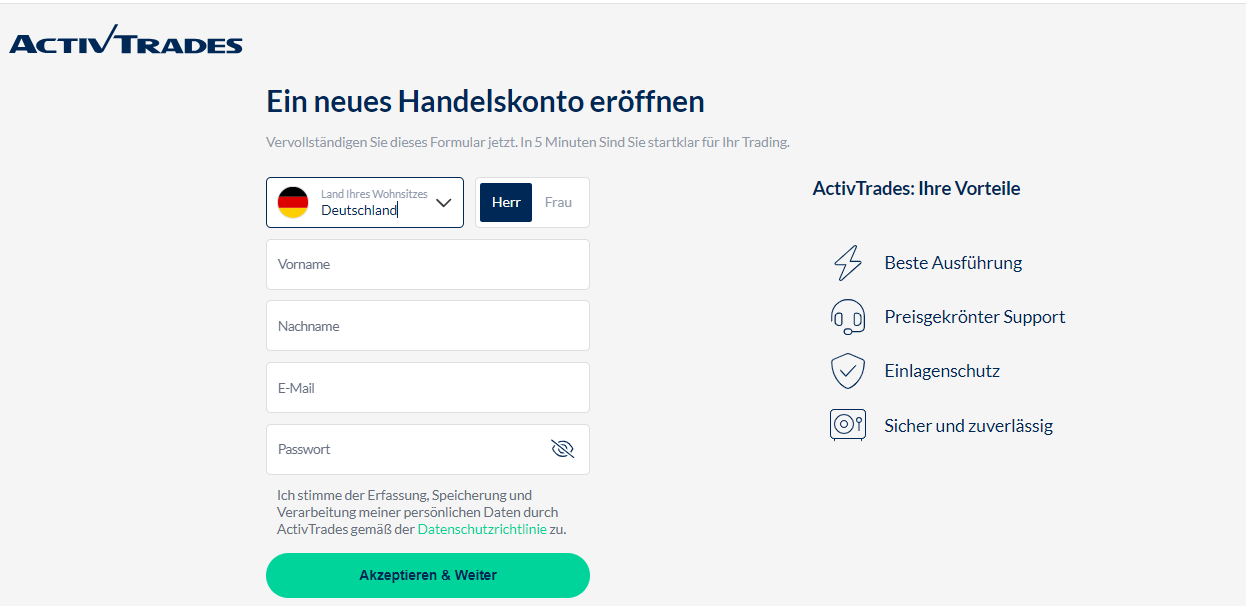

Trading Account Opening

Creating a user account involves opening a trading account with the broker. Follow the brief instructions below.

Click the “Livekonto” button on the QTrade website. This launches the process to open a live account.

Next, the system redirects you to the website of ActivTrades, which is the broker’s partner. In the on-screen form, choose your country, and enter your first and last names, and email. Also, make a reliable password.

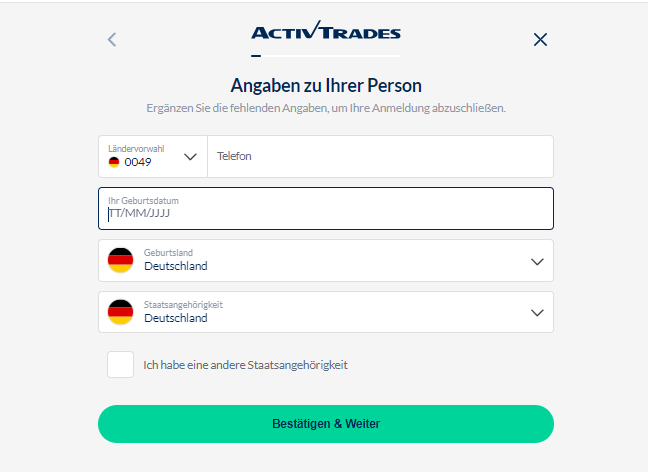

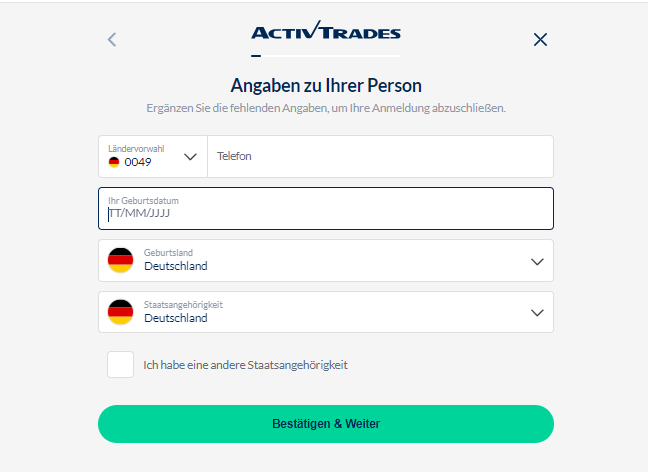

Next, choose your country of citizenship and residence, and provide your date of birth and phone number.

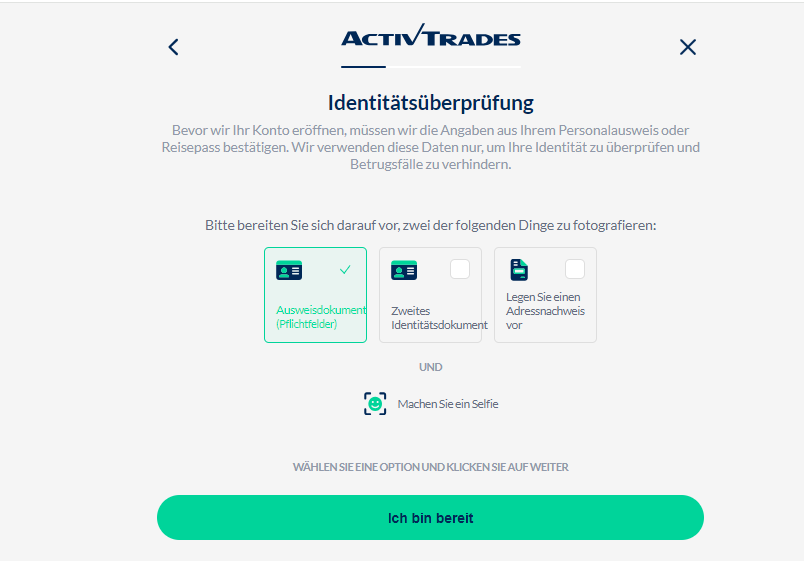

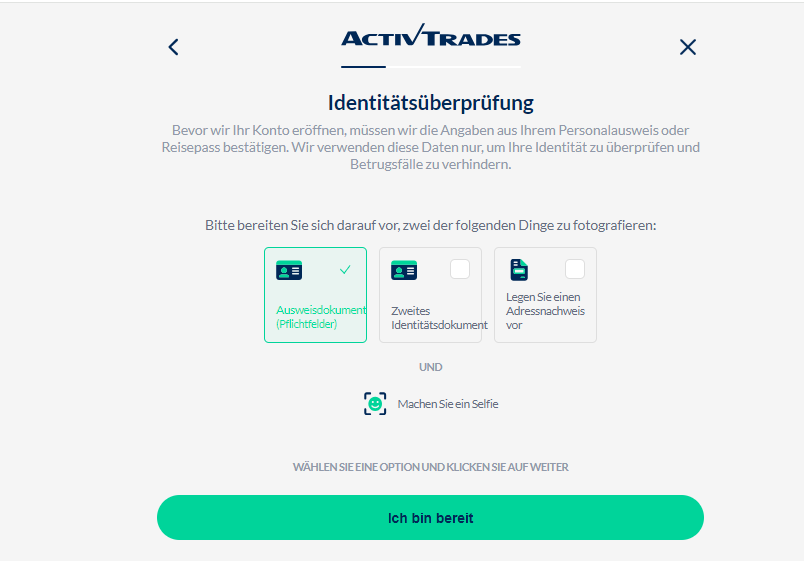

The last stage of registration is uploading documents to verify your identity and place of residence.

Regulation and safety

Qtrade-de has a safety score of 8/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record of less than 8 years

Qtrade-de Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

Qtrade-de Security Factors

| Foundation date | 2022 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Qtrade-de have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Qtrade-de with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Qtrade-de’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Qtrade-de Standard spreads

| Qtrade-de | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,1 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,4 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,2 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,7 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Qtrade-de RAW/ECN spreads

| Qtrade-de | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,50 | 3 | 3,5 |

| EUR/USD avg spread | 0,05 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,10 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Qtrade-de. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Qtrade-de Non-Trading Fees

| Qtrade-de | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

QTrade is integrated with ActivTrades, therefore when traders open accounts with QTrade, they automatically open accounts with ActivTrades. According to ESMA requirements, traders from Germany are divided into retail and professional. Each status triggers its respective trading conditions and available protection tools. Potential clients can open an Einzelkonto (Individual account), Gemeinschaftskonto (Joint account), or Gesellschaftskonto (Company account) accounts.

Account types:

Traders can open a demo account with a virtual deposit of €50,000 and use it within 30 days. After traders open live accounts, they can request a demo account with unlimited validity.

QTrade offers a clear pricing model, as well as modern and innovative platforms that provide a comfortable trading experience.

Deposit and withdrawal

Qtrade-de received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Qtrade-de provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Bank wire transfers available

- No withdrawal fee

- Low minimum withdrawal requirement

- PayPal supported

- Wise not supported

- BTC not available as a base account currency

- Only major base currencies available

What are Qtrade-de deposit and withdrawal options?

Qtrade-de provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, PayPal, Skrill, Neteller.

Qtrade-de Deposit and Withdrawal Methods vs Competitors

| Qtrade-de | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | Yes | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Qtrade-de base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Qtrade-de supports the following base account currencies:

What are Qtrade-de's minimum deposit and withdrawal amounts?

The minimum deposit on Qtrade-de is $1000, while the minimum withdrawal amount is $0. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Qtrade-de’s support team.

Markets and tradable assets

Qtrade-de offers a limited selection of trading assets compared to the market average. The platform supports 0 assets in total, including 100 Forex pairs.

- Copy trading platform

- ETFs investing

- Passive income with bonds

- Limited asset selection

- Crypto trading not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Qtrade-de with its competitors, making it easier for you to find the perfect fit.

| Qtrade-de | Plus500 | Pepperstone | |

| Currency pairs | 100 | 60 | 90 |

| Total tradable assets | 2800 | 1200 | |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Qtrade-de offers for beginner traders and investors who prefer not to engage in active trading.

| Qtrade-de | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

For assistance, visit the Kontakt & Hilfe section of the broker’s website. It contains all available communication channels and a ready-made form to request help by email or phone. The company works from 9:00 to 17:00 (GMT+1) Monday through Friday.

Advantages

- Multiple communication channels

- Support managers are available during business hours on weekdays without breaks (24/5)

Disadvantages

- No live chat on the broker’s website

- Support isn’t available on weekends

To get assistance from QTrade, traders can use:

Telephone;

Fax;

Email;

Feedback form;

The company’s postal address;

TeamViewer to solve technical issues;

Facebook and X.

To receive more prompt assistance by email or phone, select the topic of the request in the feedback form.

Contacts

| Foundation date | 2022 |

|---|---|

| Registration address | QTrade GmbH, Landsberger Straße 155, 80687 München, Deutschland |

| Regulation | FCA, Amtsgericht München, CSSF |

| Official site | https://qtrade.de/ |

| Contacts |

Education

QTrade holds educational webinars with professional traders and provides free materials to acquire necessary trading skills.

A demo account is suitable for exploring trading on financial markets. This account type is free and a virtual deposit is used for trading; therefore, there is no risk of losing real money.

Comparison of Qtrade-de with other Brokers

| Qtrade-de | Eightcap | XM Group | RoboForex | TeleTrade | Markets4you | |

| Trading platform |

ActivTrades, MetaTrader4, MetaTrader5, TradingView | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | MT4, MobileTrading, MT5 |

| Min deposit | $1000 | $100 | $5 | $10 | $10 | No |

| Leverage |

From 1:1 to 1:30 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:10 to 1:4000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | 1.00% | No |

| Spread | From 0.5 points | From 0 points | From 0.8 points | From 0 points | From 0.2 points | From 0.1 points |

| Level of margin call / stop out |

No | 80% / 50% | 100% / 50% | 60% / 40% | 70% / 20% | 100% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | Yes |

Detailed review of Qtrade

QTrade proactively introduces new technologies and innovations to improve trading. It has an extensive client base that consists of traders worldwide. The broker offers competitive trading conditions with floating spreads and no fees for order processing and account maintenance. QTrade provides access to a wide range of financial instruments and supports trading on such popular platforms as MetaTrader 4 and MetaTrader 5.

QTrade by the numbers:

14+ years of brokerage services;

Over 1,000 CFDs including CFDs on 80 currency pairs;

Quotes from 10 major liquidity providers;

100+ educational articles for novice and professional traders.

QTrade is a broker with a wide choice of CFDs and currency pairs

Major currency pairs are traded with spreads from 0.5-2.8 pips for EUR/USD and GBP/CAD, and leverage up to 1:30. Spreads for minor pairs start at 0.8-5 pips and leverage is up to 1:20. Exotics are traded with spreads from 5.9-1,000 pips and leverage up to 1:20. Leverage for gold and indices is up to 1:20; for silver and commodities, it is up to 1:10; and for bonds, stocks, and ETFs, it is up to 1:5. The broker doesn’t offer cryptocurrency trading.

QTrade provides access to 24 stock markets. There are over 300 CFDs with leverage up to 1:5. Fees for providing real-time prices for CFDs on stocks are as follows. For European markets, it is €0 and for other markets, it is €1 a month. Margin requirements differ for deposits over and less than €25,000. The broker allows its clients to simultaneously open long and short positions, scalp, and trade on news events.

Useful services offered by QTrade:

Professional newsfeeds provided by Dow Jones and Newswires;

Real-time quotes without delays on a live account;

Free demo accounts on various platforms;

Educational and analytic webinars;

A blog with useful articles for traders of different levels.

Advantages:

Fast and simple account opening within 24 hours;

Ultra-fast execution without requotes;

No regional limitations — the broker provides its services worldwide;

Efficient technical support that helps to solve any technical problems through remote access as well;

Educational resources, analytics, and useful tools that help to gain and improve trading skills.

QTrade provides different deposit and withdrawal methods, ensures deposit protection, and complies with EU standards of limiting losses.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i