Saxo Bank - Pros and Cons for Beginners

Saxo Bank is a premium multi-asset broker banking service with outstanding research, a user-friendly trading platform, and a fantastic assortment of over 60,000 transferable instruments.

But is Saxo Bank an ideal online trading platform for beginners? All beginner-friendly platforms must have low fees, excellent customer service, great educational tools, low minimum initial deposit, excellently designed mobile and web trading platforms, and an accessible account opening process.

Without concluding any straightforward yes or no, we have a detailed review of Saxo bank fees, Saxo Bank account, etc., to help you know its feasibility for beginners. Let’s scroll down to the details for “Is Saxo bank Safe” until the end to clarify the conclusion.

Saxo Bank - pros and cons for beginners

Midas, the original name of the SaxoBank trading firm, was created in 1992. The Danish Financial Supervisory Authority, or FSA, approved the broker in 2001. Following that, the corporation name was changed to SaxoBank. Our experts have thoroughly reviewed Saxo bank's pros and cons to help you clarify whether it is an ideal broker for beginners.

👍 Pros:

•Beginners have options from over 35,000 tradeable instruments and can invest in any of these classes according to their interests.

•Beginner traders are also allowed to connect with the provided third-party platforms to access custom tools and have no extra cost.

• Saxo Bank also has futures, CFDs, and Forex trading options for short-term clients.

• Beginners with no experience in mutual fund investing can also participate in mutual fund investing from Saxo Bank.

• Saxo bank never asks for withdrawal or deposit fees from their new or existing traders.

• Saxo Bank has an easy interface for its mobile application, making it easier for beginners to explore the platform.

👎 Cons:

• Beginners need to deposit an initial amount of £500 to start trading with the platform.

• A live chat facility is not provided to assist with trades or any other queries.

Saxo Bank for beginners - review

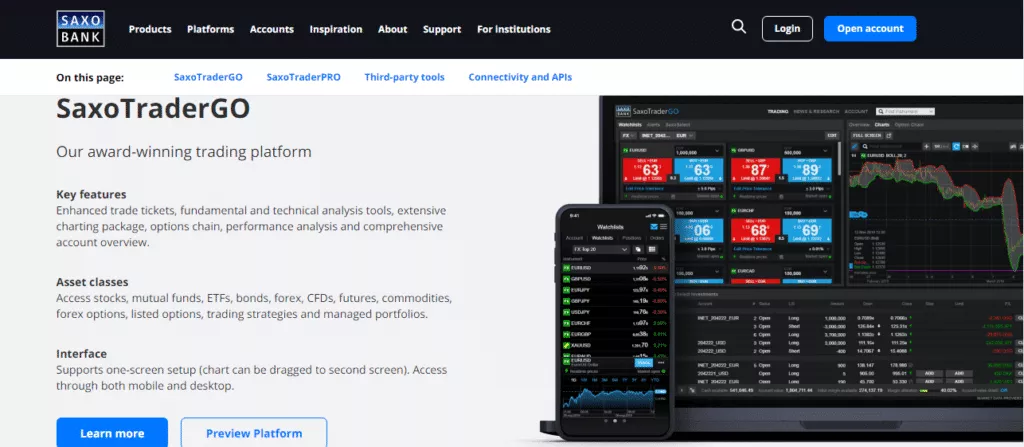

SaxoTraderGo

Saxo Bank minimum deposit

The minimum deposit of the Saxo bank is $500-$2000, which a new investor might not be willing to invest in a new platform.

Saxo Bank fees

Fees are among the most significant components of trading, and Saxo Bank excels in some areas: Low currency and Fund fees.

Saxo bank account has low fees for trading FX and mutual funds but high fees for trading bonds, options, futures, and average fees for trading stocks and ETFs. Non-trading costs like custody and inactivity fees make Saxo bank extremely expensive to buy and keep investors. Saxo Bank offers free deposits and withdrawals.

Saxo bank investment programs

Saxo Bank is a multi-asset broker that offers over 60,000 trading symbols to clients and traders. FX options, Spot FX, Contracts for Difference (CFDs), non-deliverable forwards (NDFs), stocks, stock options, Exchange Traded Notes (ETNs), Exchange Traded Funds (ETFs), futures, and 33,000 bonds are all available at Saxo Bank (accessible only by phone).

Exchange-traded securities (ETS): In addition to CFD shares, Saxo Bank provides ISA/SIPP accounts for share trading.

Cryptocurrency trading is enabled via derivatives but not directly trading the actual property (e.g., buying Bitcoin).

Saxo Bank account opening

Saxo bank offers an accessible account opening process. Investors or traders need to supply the following details initially- full name, country of residence, and email address and need to secure their account with a strong password. In the next process, the bank will also ask for financial status details to confirm whether an investor is suitable for platform investment conditions.

As a trading platform

Saxo Bank is a good forex trading option since it offers various currency pairs, competitive spreads, and full access to the worldwide FX market.

Saxo Bank is an ECN or Direct Market Entry brokerage that connects traders to key liquidity providers and a global liquidity pool, offering a safe and low-cost forex trading option and sufficient liquidity.

Trading stocks at Saxo is quite costly. Alternative equity brokers allow you to purchase and sell stocks for less money while maintaining the same level of security. Saxo bank will levy an annual custody fee if you keep supplies, ETFs, or bonds in your account.

Currency conversion fees may apply if you exchange assets denominated in a currency apart from your account currency.

Saxo Bank's fundamental and technical research tools are well-developed, and their online trading system is one of the best on the market.

Education

The educational tools provided by Saxo Bank are an excellent place to begin. Account for testing purposes. Tutorial about trading platforms. This elevates the content of Saxo Bank.

To assist traders, there is a "Training" area. The materials for both novice and experienced traders are in English.

The procedure to open accounts and the basics of trading in financial products is covered. The trading platform's functionality is described in this guide. Exchange rate influences on a global scale Bonds, stocks, and CFDs have specific nomenclature. English practical video tutorials are also available.

Customer support

Saxo bank offers customer assistance in an astounding variety of languages. You can also use a chatbot, which functions similarly to an intelligent FAQ area. It provides pertinent answers to fundamental questions. Relevant solutions are provided over the phone. However, it takes some time to reach a customer service representative. Email responses are received within one day.

In Saxo's 16 offices worldwide, phone customer assistance is only accessible from Monday to Friday between 9:00 a.m. and 5:30 p.m. local time.

Conclusion

Saxo Bank excels at integrating its various platforms like the desktop, web, and mobile platforms. Saxo Bank was named Best in Class in nine categories for 2022, including Platform & Tools, Investment Offering, and Research.

Saxo Bank is a globally recognized brand that provides nearly everything traders want. The client experience is flawless, with modern technologies and thorough market research. But, the initial deposit and average customer service aspects make it difficult for beginners to understand the platform or begin trading, thereby making it not an ideal broker for beginners.

FAQ

Is Saxo Bank safe to use?

According to the reviews and details, Saxo bank is a safe platform to begin trading with, as they have top-tier security to safeguard your funds.

How does Saxo Bank safeguard my investments?

Saxo Bank works on a global scale through many organizations. This is significant since the regulator and the level of investment protection available to you vary depending on the organization.

Is using Saxo Bank inexpensive or expensive?

Saxo has low fees for trading FX and mutual funds but high fees for trading bonds, options, futures, and average fees for trading stocks and ETFs. Non-trading costs like custody and inactivity fees make Saxo prohibitively expensive for buy-and-hold investors.

Is Saxo bank licensed?

Yes, Saxo bank is licensed, and the Swiss Financial Market Supervisory Authority regulates the platform.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.