Our Evaluation of Exness

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Exness is one of the top brokers in the financial market with the TU Overall Score of 8.7 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Exness clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the broker’s clients are fully satisfied with the company.

Exness broker is a trusted broker partner that is compliant with all relevant terms. Exness complies with all payment obligations and pays money earned.

Brief Look at Exness

Exness is one of the world’s largest brokers, known for its competitive trading conditions, high security, and wide selection of assets. The company serves over 1 million active clients and processes a monthly volume exceeding $4 trillion.

While specializing in currency pairs, Exness also offers CFDs on stocks, commodities, indices, and cryptocurrencies. The broker caters to all experience levels with various account types – from cent accounts and social trading for beginners to high leverage and Expert Advisor support for seasoned professionals.

Exness holds multiple international licenses, including the stringent FCA and CySEC, ensuring trader funds are protected.

With features like 24/7 support, fast withdrawals, and analytics tools, Exness strives to provide an optimal trading experience.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Availability of 8 licenses and a membership in the Financial Commission providing up to EUR 20,000 insurance coverage per client in the event of a force majeure;

- Wide choice of account types — Standard, Standard Cent, Pro, Zero and Raw Spread;

- Wide range of CFDs, including over 100 currency pairs;

- Zero deposit and withdrawal fees (Depends on the payment system);

- Proprietary platforms for active and social trading, as well as all versions of classic MT4 and MT5.

- The broker’s website offers almost no educational materials;

- 24/7 support isn’t available in all languages.

Exness Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Exness Ltd and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MetaTrader 4/5 (desktop, web, and mobile), Exness Terminal (web), and Exness Trade App (mobile) |

|---|---|

| 📊 Accounts: |

Standard type: Cent, Standard, and Plus Professional type: Pro, Zero, and Raw Spread |

| 💰 Account currency: |

EUR, USD, GBP, CAD, AUD, and CHF for all account types; 38 more currencies for non-cent account types |

| 💵 Deposit / Withdrawal: | Bank Wire, Bank Cards, Neteller, Skrill |

| 🚀 Minimum deposit: | $10 (Depends on the payment system and account type) |

| ⚖️ Leverage: | 1:unlimited for retail clients (Terms and Conditions apply) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | CFDs on: forex, cryptos, commodities, indices, and stocks |

| 💹 Margin Call / Stop Out: |

Standard: 60%/0% Professional: 30%/0% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: |

Cryptocurrencies — market; Other assets — instant/market (Pro), market (Zero, Raw Spread, and standard account types) |

| ⭐ Trading features: |

Floating spreads; Fixed fee per lot on professional account types. |

| 🎁 Contests and bonuses: | No |

Due to an expanded range of trading accounts, Exness is suitable for both professionals and novice traders with little or no experience. The former trade on Pro accounts, and the latter trade on standard and cent accounts. Occasionally, Exness pays bonuses to its new and existing clients.

Not every broker can compete with the range of trading instruments offered by Exness. The company provides 5 classes of CFDs. Commodities can be split into two more groups — metals and energies. The choice of currency pairs is one of the widest on the market. There are over 100 pairs, including majors, minors, and exotics. Leverage is up to 1:2,000 on all account types. Further, active traders can use unlimited leverage subject to requirements for the number of traded lots. The requirements for standard and professional account types are 5 lots, for the cent account, it is 500 lots. The swap-free option is available for all account types.

Market execution is available for trades with currency pairs, indices, stocks, and commodities. Trades on the Pro account are executed instantly. This rule doesn’t apply to cryptocurrencies. Only market execution is available when trading those. Trading conditions on one account type on different platforms are similar. That is, swaps and spreads for Standard account types on MT4, MT5, or Exness in-house platforms are the same.

TU Expert Advice

Financial expert and analyst at Traders Union

Exness has been providing its services since 2008. Over this period, the company has opened its representative offices worldwide, obtained licenses from many regulatory authorities, and provided in-house platforms for active and passive trading. Its client investments are protected by the Compensation Fund of the Financial Commission. Additional security measures, such as holding client funds in segregated accounts, ensure their safety and blocking from unauthorized use.

Today, Exness is one of the biggest European and global brokers with a monthly trading volume of $4.44 trillion. This data is provided on the company’s website in the public domain. Also, there are reports of independent audits regularly held by Deloitte, a highly reputable auditor.

Exness wants to be a universal broker for traders with any capital, experience, and strategy. Moreover, its partnership programs with favorable conditions allow the broker to expand its already extensive client base.

- You need low deposits. Minimum deposit requirements depend on a selected payment method.

- You want to trade actively. For active traders, the broker offers some of the lowest spreads for currency pairs that start from 0.1 pips, an opportunity to trade without fees (Terms and Conditions apply), and top liquidity level.

- You prefer trading with EAs. Exness offers some of the best conditions for trading with third-party Expert Advisors. These include low fees, the market’s highest liquidity, and servers located in the main Forex centers.

- You need free VPS without any conditions. Like other top brokers, Exness offers a virtual dedicated server. To get it for free, a trader needs to have at least $1,000 on the account or a 30-day trading volume of not less than $500,000 (excluding copy trading).

We checked the office of the Exness brokerage company in Cyprus, which is located at the following address according to the information on the company’s website:

1, Siafi Street, Porto Bello, Office 401, CY-3042 Limassol

-

The company is located at the stated address

-

We were able to speak to a company representative

-

We were able to visit the office as clients

-

-

Video of the company’s office and an interview with Exness

-

Exness Key Parameters Evaluation

Video Review of Exness

Share your experience

- Best

- Last

- Oldest

NA Windhoek

NA Windhoek the team is always available 24/7

i did not experience any weaknesses up to date

FR Paris

FR Paris Everything is perfect.

There are no drawbacks.

KE Nairobi

KE Nairobi A recent experience I had with Exness that really impressed me. I was trading when I got a glitch in the terminal. No matter what, I just couldn't execute my trades. Frustrated, I took to Twitter to vent about the issue, hoping to find a solution or at least some sympathy from fellow traders. To my surprise, Exness was quick to notice my tweet and respond to me directly. Their customer support team reached out to me within minutes, asking for more details about the problem I was experiencing. They were genuinely concerned and eager to help resolve the issue as quickly as possible. So, I just wanted to take a moment to thank Exness for their exceptional customer service!

Nothing

LV Riga

LV Riga High rating!

There is no weaknesses

NG Lagos

NG Lagos Fast Customer Support Response. Technical Trading Support. Crisis Management. Professional Service.

Adding more automated risk management tools could enhance Exness' already strong trading platform

PK

PK reliable

Didn’t find any

PK

PK I personally use it and recommend

No issue at over all

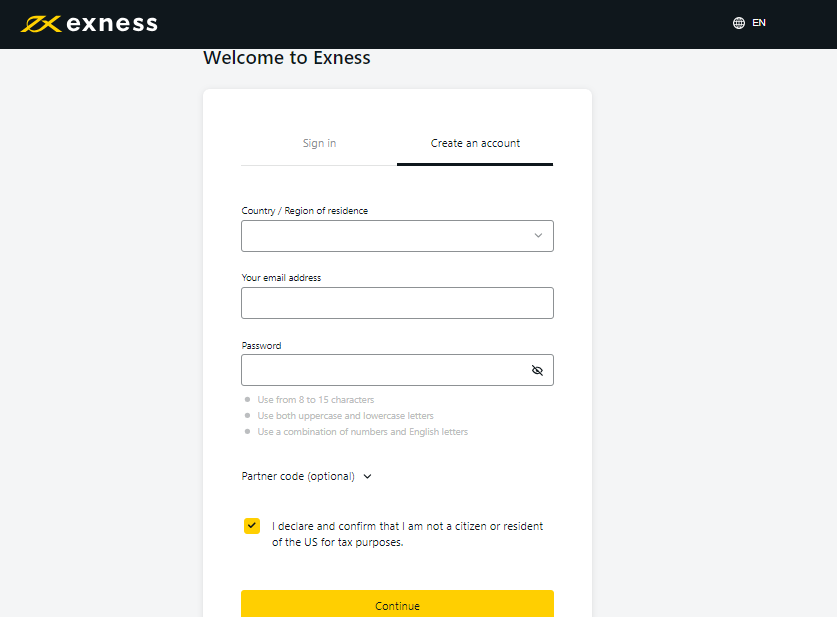

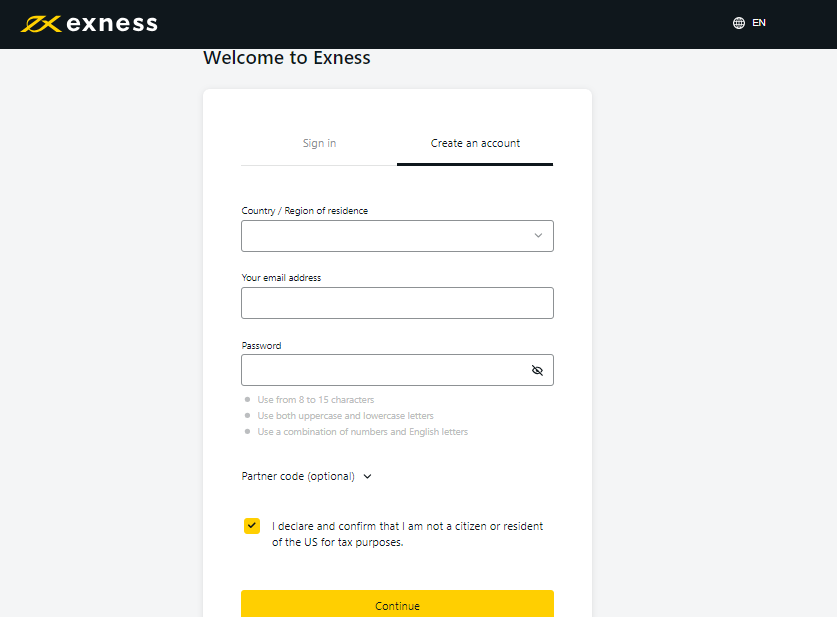

Trading Account Opening

To reduce spreads on each trade, use a TU referral code when opening an account with Exness. Before that, register on the Traders Union website.

How to open, deposit and verify a trading account | Firsthand experience of Traders Union

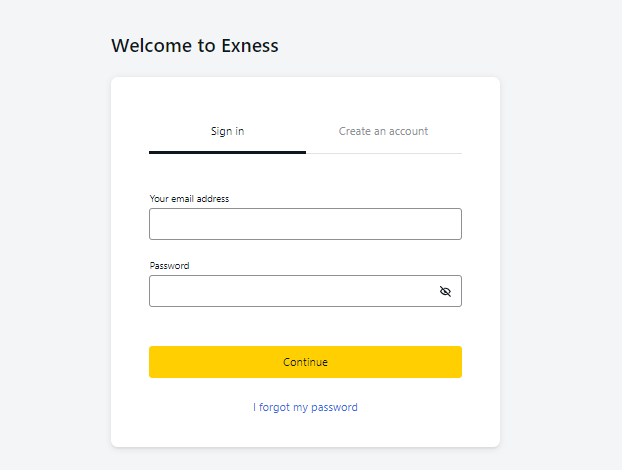

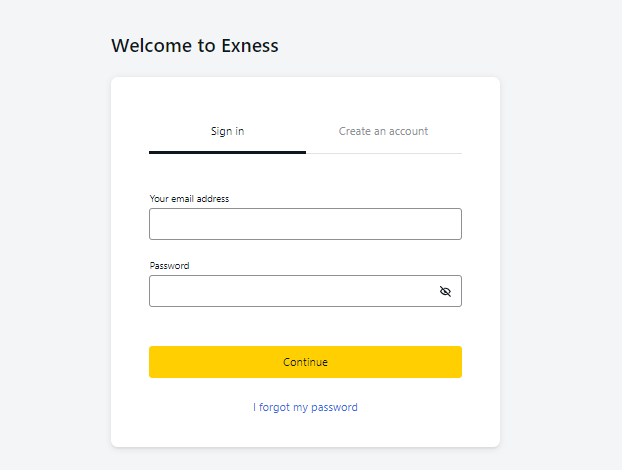

First step to open a trading account is to register a user account on the broker’s website.

Fill in the application with your data and generate a reliable password.

Upon confirmation of your email, you can sign in to your user account.

Features of the user account: open live accounts and create demo accounts, deposit funds and make internal transfers.

Additional features of Exness’ user account:

-

Productivity statistics;

-

Submit withdrawal requests;

-

Registration of a strategy provider account.

Regulation and safety

Exness has a safety score of 10/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 17 years

- Strict requirements and extensive documentation to open an account

Exness Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

BVI FSC BVI FSC |

British Virgin Islands Financial Services Commission | British Virgin Islands | No specific fund | Tier-2 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

FSCA SA FSCA SA |

Financial Sector Conduct Authority of South Africa | South Africa | No specific fund | Tier-2 |

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

| CMA (Kenya) | The Capital Markets Authority | Kenya | KES 50,000 | Tier-2 |

| JSC (Jordan) | Jordan Securities Commission | Jordan | JOD 10,000 | Tier-2 |

Exness Security Factors

| Foundation date | 2008 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Exness have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Exness with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Exness’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Exness Standard spreads

| Exness | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,6 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,8 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,2 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Exness RAW/ECN spreads

| Exness | Pepperstone | OANDA | |

| Commission ($ per lot) | 3 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,3 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Exness. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Exness Non-Trading Fees

| Exness | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

To execute your first trade with Exness, open a live account with this broker. Upon user account registration, choose an appropriate account type, set its base currency and leverage, and make a deposit.

Initial deposit is $10,

Spreads are from 0.2 pips.

This account type is only available on MT4.

Spreads are variable from 0.3 pips.

Initial deposit is $10.

Spreads are floating from 0.8 pips.

Initial deposit is $10.

Spreads start at 0 pips, but $0.4 fee per full lot is charged.

Spreads start at 0.1 pips, no fees.

A demo mode is available for all account types. It is used to test the broker’s trading conditions or to practice executing trades without deposits.

Exness can be called a universal broker since it offers profitable trading conditions for both professionals and novice traders.

Exness Broker Review - How to Open an Account and Start Trading with the EUR/USD

Deposit and withdrawal

Exness received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Exness provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- USDT (Tether) supported

- Bank card deposits and withdrawals

- Minimum deposit below industry average

- No withdrawal fee

- Wise not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

- PayPal not supported

What are Exness deposit and withdrawal options?

Exness provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT.

Exness Deposit and Withdrawal Methods vs Competitors

| Exness | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Exness base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Exness supports the following base account currencies:

What are Exness's minimum deposit and withdrawal amounts?

The minimum deposit on Exness is $10, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Exness’s support team.

Markets and tradable assets

Exness offers a limited selection of trading assets compared to the market average. The platform supports 200 assets in total, including 100 Forex pairs.

- Crypto trading

- Copy trading platform

- Indices trading

- Futures not available

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Exness with its competitors, making it easier for you to find the perfect fit.

| Exness | Plus500 | Pepperstone | |

| Currency pairs | 100 | 60 | 90 |

| Total tradable assets | 200 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Exness offers for beginner traders and investors who prefer not to engage in active trading.

| Exness | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

Exness received a score of 8/10, indicating a strong offering in terms of trading platforms and tools. The broker provides broad access to popular platforms and supports a variety of features designed to enhance both manual and automated trading.

- API access for automated trading

- One-click trading

- Free VPS for uninterrupted trading

- MetaTrader is available

- No access to a proprietary platform

- Strategy (EA) Builder is not available

- No access to cTrader and its advanced tools.

Supported trading platforms

Exness supports the following trading platforms: MT4, MT5, WebTrader. This selection covers the basic needs of most retail traders. We also compared Exness’s platform availability with that of top competitors to assess its relative market position.

| Exness | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | Yes | Yes | Yes |

Key Exness’s trading platform features

We also evaluated whether Exness offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 80 |

| Tradable assets | 200 |

Additional trading tools

Exness offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

Exness trading tools vs competitors

| Exness | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | Yes | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

Exness supports mobile trading, offering dedicated apps for both iOS and Android. Exness received 8/10 in this section, reflecting strong user engagement and well-developed functionality. High ratings, solid download numbers, and the presence of advanced mobile features contributed to the high score.

- Strong Android user ratings, currently at 4.6/5

- Supports mobile 2FA

- Solid iOS user feedback, with a rating of 4.5/5

- Limited features vs desktop

We compared Exness with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| Exness | Plus500 | Pepperstone | |

| Total downloads | 10,000,000 | 10,000,000 | 100,000 |

| App Store score | 4.5 | 4.7 | 4.0 |

| Google Play score | 4.6 | 4.4 | 4.0 |

| Mob. 2FA | Yes | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

Currently, Exness doesn’t provide training for novice traders. If you want to learn basic Forex and CFD concepts, go to the Help section of the website. To develop practical trading skills, open a demo account. The company provides extensive information on the basics of trading, helping each client understand how orders are executed, what influences asset prices, and the fundamentals of technical analysis, including identifying critical chart patterns.

Customer support

24/7 support is available to traders who speak English, Chinese, Vietnamese, Thai, or Swahili. Working hours of client service in other languages are available in the Contact us section of the broker’s website.

Advantages

- Support is available in 16 languages

- 24/7 live chat

Disadvantages

- No

Exness managers are available by:

-

email;

-

phone number provided in the Contact us section;

-

live chat on the website or in the user account.

Contacts

| Foundation date | 2008 |

|---|---|

| Registration address | Headquarters: Limassol, Cyprus |

| Regulation | FCA, CySEC, FSA (Seychelles), FSCA, BVI FSC, CBCS, CMA |

| Official site | www.exness.com |

| Contacts |

+35725008105

|

Comparison of Exness with other Brokers

| Exness | Eightcap | XM Group | RoboForex | Octa | Kama Capital | |

| Trading platform |

Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader4, MetaTrader5, OctaTrader | MetaTrader5 |

| Min deposit | $10 | $100 | $5 | $10 | $25 | No |

| Leverage |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:40 to 1:1000 |

From 1:1 to 1:400 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.6 points | From 0 points |

| Level of margin call / stop out |

60% / No | 80% / 50% | 100% / 50% | 60% / 40% | 25% / 15% | 20% / No |

| Order Execution | Market Execution, Instant Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | Yes | No | No | Yes | No | Yes |

Detailed Review of Exness

Eight international regulators. This ensures a high-security level. Financial reports on main indicators, such as trading volume, active clients, withdrawal amounts, and partner rewards, are updated monthly on the broker’s website. Every six months, Deloitte, which is one of the Big Four global accounting firms, conducts audits of Exness. The broker also offers a fairly extensive list of CFDs on stocks, such as: Nvidia stock, Apple stock, Google stock, Tesla stock etc.

Exness performance as of September 2023:

-

650,000+ active clients;

-

Over $1.7 billion of withdrawn funds;

-

Over $140 million of paid partner rewards.

Exness is a universal Forex broker for traders with varied trading experience

Due to a wide choice of trading instruments and platforms, Exness is suitable for traders with any background. Experienced market participants can trade with unlimited leverage and keep any number of open positions. For this, they use desktop MetaTrader 5 with advanced technical analysis tools.

Less experienced traders can use Standard account types, all versions of Exness MT4, and Exness proprietary platforms with easier-to-use functions than those of MT5. Any trader can first open a demo account to practice, and later open a cent account. Exness provides different types of analytics that help traders make informed trading decisions.

Tools to improve trading efficiency:

-

Forex calculators. These tools are used to calculate margin, spreads, the value of 1 pip, fees, and swaps (short and long);

-

Free VPS. It is provided for account types with a balance over $1,000 or with a monthly trading volume of $500,000 subject to the account balance of $500-$999.

Advantages:

Spreads from 0.2 pips on standard and 0 pips on professional account types;

Competitive fees per lot on accounts for experienced traders;

Free analytical tools and access to the WebTV newsfeed;

High partner rewards for attracting new clients;

Participation in international compensation funds that return investors’ money in case of the broker’s bankruptcy;

24/7 technical support is available in 5 languages, including English.

Exness adheres to a client-oriented approach in its payment processing policy. Therefore, instant deposits and withdrawals with no broker’s fees are available.

Latest Exness News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i