Exness Withdrawal Review

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

To withdraw funds from Exness, follow these simple steps:

Using online trading platforms can sometimes be overwhelming, especially when it's time to reap the fruits of your investment. One of the major players in this arena, Exness, offers a structured and user-friendly process for fund withdrawal.

Many people ask: Is Exness legit? Exness, a renowned global online trading platform, has always been about user accessibility and transparency. This Exness review provides a comprehensive guide, elucidating every step and aspect of the Exness withdrawal process. By the end of this article, you'll understand the steps to follow, the time it takes, and the withdrawal options available to you, making the process clear and straightforward. Let’s understand how to withdraw from Exness, Exness withdrawal time, and more, so you can confidently manage your funds.

How to withdraw money from Exness

Withdrawing your profits is a core part of trading and Exness makes it smooth and intuitive. Whether you're trying to withdraw money from Exness for the first time or just need a refresher, follow these easy steps below. We’ll also explain how to withdraw from Exness via different payment channels.

Log in to your personal area

The process starts by accessing your Personal Area at Exness. This is where your trading dashboard, wallet details, and account settings are managed. You’ll need to login using your email and password. This step is mandatory for anyone looking to understand how to withdraw money from an Exness account securely.

Open the “Withdrawal” tab

After logging in, find and click the “Withdrawal” section. It lists all available payment systems in your region. This is where most users start when asking how to withdraw funds from Exness using local or global payment systems.

Choose a withdrawal channel

Exness offers multiple channels to withdraw your funds, and each has its own rules:

Bank card

To withdraw from Exness using a bank card, you must use the same card you used to make your deposit. You can only withdraw up to the total amount deposited via that card; any profits must be withdrawn using a different method (e.g., e-wallet or bank transfer). This method is secure and commonly used for its reliability.

Bank transfer

Bank transfers allow you to withdraw both deposited funds and trading profits directly to your bank account. You will need to provide valid banking details. This method is suitable for withdrawing larger amounts and typically has higher limits. Processing times may vary depending on your country and bank, but are usually within 24 hours to a few business days.

E-Wallets (Skrill, Neteller, etc.)

For speed and simplicity, many traders prefer e-wallets. These usually support instant transfers and have no withdrawal fees. Ideal for traders wondering how to withdraw money from Exness quickly without dealing with banks.

Mobile app

If you're using the Exness Trade mobile app, you can complete the full withdrawal process directly on your phone. Simply go to Wallet → Withdrawal, and follow the instructions. Perfect for those trading on the go and asking how to withdraw from Exness using a smartphone.

Exness terminal (Web Platform)

Withdrawals can also be initiated through the Exness web terminal. While the trading interface is the focus, you’ll be redirected to the secure Personal Area to complete the transaction. This is practical for those managing trades directly from their desktop.

Enter the transaction details

Fill in the amount you wish to withdraw and check your destination account. Be careful. One small mistake can delay your withdrawal. Accuracy here is critical for anyone learning how to withdraw money from Exness without errors.

Verify your withdrawal

To protect your funds, Exness requires verification. You'll receive a confirmation code via email or SMS, depending on your security settings. This step confirms that the person requesting the withdrawal is authorized which is essential for withdrawing money from an Exness account safely.

Wait for processing

Once you complete the steps, Exness processes the request automatically.

Bank cards: 24 hours up to 7–10 business days.

Bank transfers / e-wallets: usually up to 30 minutes.

App withdrawals: same speed as desktop.

Regardless of method, this is the final step to withdraw money from Exness successfully. Looking for details about payouts? Information on limits, processing time, and supported withdrawal channels is available in this guide: Does Exness pay out profits?

Note: Always use the same channel for withdrawal that you used for deposit; Exness enforces this to prevent fraud. And while Exness doesn’t charge withdrawal fees, your payment provider might.

Key features and customization options

The Exness Web Terminal is designed for traders who value speed, accessibility, and control without the need to download any external platform. With a clean interface and cloud-based infrastructure, it’s suitable for both beginners and experienced users. Here are the key features and personalization tools that make this trading platform stand out.

Lightning-fast access and cross-device sync

Exness users can trade instantly via browser on any device, without installation delays. All sessions and preferences are synced automatically, making the Exness web terminal app one of the most convenient ways to stay connected to your trading account. The browser-based Exness web terminal app ensures secure access to your portfolio from anywhere in the world.

Interface customization and layout control

Traders can personalize chart types, layout panels, and even font sizes to fit their workflow. Whether you’re scalping or swing trading, a customizable interface helps you focus on what matters.

Theme switching: light and dark modes

If you’re working in different lighting conditions or just prefer a particular aesthetic, you’ll love the theme options available. You can easily switch between light and dark mode if you're wondering how to change Exness web terminal theme — just head to “Settings” and choose your preferred display. Many users also ask how to change the theme in Exness web terminal, and the answer is simple: it's available in one click under the interface customization menu.

Smart charting tools

The terminal includes dozens of technical indicators, drawing tools, and timeframes, all available without extra plugins. You can save chart templates and use them across different devices instantly.

Real-time data and no latency

Market quotes update in real time, with no lags or delays, a critical factor for short-term traders. Integrated order execution ensures minimal slippage during high-volatility periods.

Exness withdrawal time

Timing is a significant aspect of financial transactions. With Exness, the withdrawal time largely hinges on the chosen payment method. Users can expect the process to be completed within 24 hours for cards. However, there are times, especially during heavy transactional periods, when this can extend to 7-10 business days. It's also essential to remember that location and currency can influence these times. Always refer to Exness' specific guidelines for each payment method to avoid surprises.

Additionally, users frequently ask how long it takes to withdraw from Exness, particularly when comparing payment systems or switching to a new method for the first time. While average speeds are listed, actual performance can depend on both technical and regional factors.

Understanding how long it takes to withdraw from Exness is especially important when trading across time zones or during high-volatility events that may delay processing queues.

The officially stated Exness withdrawal time is just part of the picture — real-world experiences often vary based on intermediary banks, local holidays, or system load.

Some traders also want to know how much time Exness takes to withdraw during peak hours or end-of-week processing; in these cases, delays are usually external and not from Exness itself.

It’s also worth noting that while Exness processes requests 24/7, users wondering if I can withdraw from Exness on weekends should check whether their payment provider or bank operates on those days, as many suspend processing outside standard business hours.

Minimum and maximum withdrawal limits

The flexibility of Exness' withdrawal system is one of its core strengths, particularly in terms of limits tailored to different user needs. For bank transfers, users can initiate transactions starting from just $1, offering accessible conditions for small-scale traders.

This means the Exness minimum threshold to withdraw funds is extremely low, making it suitable even for micro-accounts or testing withdrawal methods.

For those asking what is the minimum amount to withdraw from Exness, it usually starts at $1 for most payment systems, but can vary depending on the provider and currency used. In practice, the minimum amount to withdraw from Exness may differ by country or method, so it's essential to review the requirements listed in your Personal Area.

On the upper end, users often ask how much can you withdraw from Exness, especially when withdrawing larger profits or capital. Depending on the channel, the platform allows limits ranging from $2,000 to $50,000 per transaction, ensuring flexibility for both retail and professional traders.

If you’re wondering how much money can I withdraw from Exness in a single request, the answer depends on your selected payment system, account verification status, and regional restrictions.

To help evaluate Exness against other brokers with similar withdrawal conditions, check out our detailed comparison of Exness vs Kot4x.

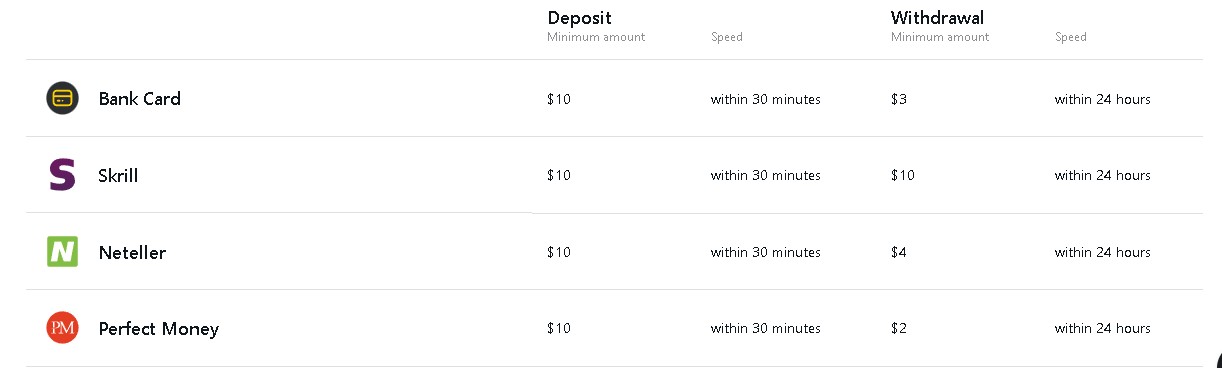

Exness withdrawal methods, speed and fees

Exness offers a wide range of options for clients to manage their funds, with fast execution times and zero internal fees across most services. The platform supports multiple Exness withdrawal methods, including bank cards, bank transfers, electronic payment systems, and cryptocurrency wallets, all tailored to suit global users.

For crypto traders, it’s helpful to know how to withdraw from Exness to Binance, which typically involves linking a USDT-compatible address for seamless transfers. Those using stablecoins often ask how to withdraw USDT from Exness, and this can be done by selecting the appropriate crypto wallet in the withdrawal section.

If you plan to withdraw from Exness to Binance, make sure your Binance wallet address matches the network supported by Exness (e.g., TRC20 or ERC20).

Fiat users may also be searching how to withdraw from Exness to bank card, a standard method that supports both deposits and withdrawals for verified cards. Each method comes with specific processing times and conditions. Understanding them in advance helps avoid delays and ensures smooth transactions.

| Method (Yes, no or list available options) | Speed | Fee | |

|---|---|---|---|

| Bank cards | Yes | 24 hours, (Whole process may take up to 7-10 days) | 0 |

| Wire transfer | Yes | 30 minutes | 0 |

| Payment services (list available, if any) | Yes | 30 minutes | 0 |

| Crypto (list available, if any) | No |

Exness withdrawal issues and troubleshooting

While Exness provides a smooth and efficient withdrawal system, users may occasionally encounter issues that prevent transactions from going through. Understanding the reasons behind these interruptions can help resolve them quickly and avoid future delays.

One of the most common problems is receiving a system message stating "you are currently not eligible to withdraw with this method Exness", which usually means the method wasn’t previously used for deposit or isn’t available in your region.

Another frequent concern is when users report that they can’t withdraw from Exness, often due to pending verification, unmatched payment methods, or technical downtime. In such cases, double-checking your account status, ensuring the deposit–withdrawal method match, and verifying your identity usually resolves the problem.

New traders may also wonder why can't I withdraw from Exness, especially if they’ve just completed their first few trades or bonuses are involved. Keep in mind that Exness may restrict withdrawals until certain trade volume conditions are met, or if funds are tied to promotional credits.

If you’re facing any of these issues, it’s best to visit the “Transaction History” section, check for error messages, and contact Exness Support for method-specific guidance.

Exness withdrawals by country

Withdrawal processes on Exness vary slightly depending on the country, mostly due to local financial systems and supported payment providers. Below is an overview of how withdrawals work in key regions like India and Nigeria, including common user questions.

Exness withdrawals in India

Exness supports several localized withdrawal options in India, including UPI, local bank transfers, and internet banking. These methods are visible only to users located in India and with verified accounts.

Traders often ask how to withdraw money from Exness in India, and the answer is simple: log in, go to the Withdrawal section, and select a locally supported method like UPI or bank transfer.

A common concern is can I withdraw money from Exness in India, especially given Indian forex regulations. Yes, withdrawals are available, but only via methods previously used for deposit.

For users looking for specifics, how to withdraw from Exness to a bank account in India involves selecting "Online Bank Transfer" from your Personal Area and providing correct account details.

There’s also the broader question: can we withdraw money from Exness in India? Yes — provided that the account is verified, the user’s identity matches the bank details, and the chosen method complies with local laws.

Note: Some Indian banks may block or delay forex-related transactions. It’s advised to use payment methods known for successful forex processing.

Exness withdrawals in Nigeria

In Nigeria, Exness supports withdrawals via local bank cards, internet banking, and select e-wallets such as Skrill and Neteller.

For those searching how to withdraw from Exness in Nigeria, the best route is to use the same method that was used for the initial deposit. This ensures fast processing and compliance with Exness policies.

Withdrawal times in Nigeria are generally fast. Bank transfers may take up to 24 hours, while e-wallets are often instant.

Tip for all countries

Log in to your Personal Area to see the exact list of available withdrawal methods for your country. Exness filters them based on your geolocation and account history, ensuring that only eligible options are displayed.

Transaction status tracking

For those anxious moments when you're wondering where your money is, Exness provides a transparent solution. Simply head over to the “Transaction History” section, and voila! Every detail about your withdrawal, from initiation to processing, can be tracked in real time.

Exness withdrawal currencies

Exness offers a global platform, and its currency offerings reflect that. While USD remains a primary withdrawal currency, the platform is not restricted to it. Other currencies come into play depending on the payment method and geographical location. For instance, a trader from the UK has the added convenience of withdrawing profits in EUR or GBP. Such flexibility ensures that Exness caters to a broad spectrum of users across the globe.

Always double-check your withdrawal details

The withdrawal process with Exness is among the most transparent and user-friendly in the online trading industry. The broker offers a wide range of payment systems, near-instant processing times, and minimal restrictions — all of which are essential for traders who rely on fast access to capital, especially those using high-frequency or short-term strategies.

One of the standout features is Exness’ strict policy of using the same method for deposits and withdrawals. This not only helps prevent fraud but also adds an extra layer of security. The ability to withdraw as little as $1 is a clear sign of how accessible and flexible the platform is for both beginners and professionals.

Personally, I’ve tested multiple channels — from bank cards to Skrill — and in all cases, the funds were received within the expected timeframes. Another big plus is that Exness doesn’t charge any internal withdrawal fees, which is rare in today’s market.

My advice to traders: always double-check your withdrawal details and be mindful of possible delays caused by external payment providers, especially during peak hours. Overall, Exness delivers a smooth, reliable, and transparent withdrawal experience — a strong competitive edge that sets it apart from many other brokers.

Conclusion

Withdrawing funds from Exness is a simple and user-friendly process, providing multiple options for traders across the globe. Whether you’re withdrawing to a bank account, e-wallet, or using the Exness Trade app, the platform offers fast, reliable, and commission-free withdrawal methods. It's essential to ensure that your withdrawal method matches your deposit method and that your account is fully verified. Always be aware of your region’s specific withdrawal options, such as those for India or Nigeria, and keep in mind that processing times may vary during peak periods or weekends. Understanding the withdrawal limits, fees, and supported methods will help ensure smooth and efficient transactions.

For traders asking how to withdraw money from Exness, the key is preparation and following the correct steps, including choosing the right payment method and verifying your account. By doing so, you can enjoy quick and secure access to your funds. With Exness withdrawal options as low as $1, the platform prioritizes accessibility and flexibility for users worldwide.

FAQs

Can I withdraw from Exness to my bank account?

Yes, you can withdraw money from Exness to a bank account securely. The process ensures financial safety and is available through various payment methods.

How do I withdraw money from my Exness account?

To withdraw funds from Exness, access your Personal Area, select the "Withdrawal" tab, choose your preferred payment method, and follow the necessary steps. This is how you can withdraw money from Exness easily.

Why can't I withdraw from Exness?

A potential reason could be that your withdrawal amount surpasses the deposited amount, or there might be insufficient funds in your account. If you’re unsure how to withdraw money from Exness, make sure your account balance is in order.

Can you withdraw all your money from Exness?

The withdrawal ceiling is determined by your trading account's free margin, visible in your Personal Area. It will help you determine how much you can withdraw from Exness.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).