deposit:

- $500

Trading platform:

- MetaTrader5

- 0%

SmartFX Review 2024

deposit:

- $500

Trading platform:

- MetaTrader5

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of SmartFX Trading Company

SmartFX is a high-risk broker with the TU Overall Score of 2.56 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by SmartFX clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. SmartFX ranks 359 among 414 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

SmartFX is a broker that focuses on working with experienced traders that prefer to use the Straight-through Processing (STP) mechanism of trading.

SmartFX is an STP broker that was established in 2018. The company holds the brokerage license of the Vanuatu Financial Services Commission (VFSC). The broker offers a single Standard account for trading currency pairs, stock indices, precious metals and energies. Smart FX allows all trading strategies, including hedging, algorithmic trading, Expert Advisors and copy trading.

| 💰 Account currency: | USD, EUR, GBP, JPY |

|---|---|

| 🚀 Minimum deposit: | USD 500 |

| ⚖️ Leverage: | Up to 1:400 |

| 💱 Spread: | from 1.2 pips |

| 🔧 Instruments: | 130 currency pairs, futures, CFDs on stocks, indices, commodities, metals, energies |

| 💹 Margin Call / Stop Out: | 100%/50% |

👍 Advantages of trading with SmartFX:

- Regulated by an international financial commission.

- Wide selection of trading assets of various classes.

- Spreads at the same level as competitors and not only for majors.

- The broker does not charge non-trading fees for deposit and withdrawal of funds.

- Universal MT5 trading platform (desktop and mobile versions).

- Possibility of trading with leverage.

- Access to passive income options available on MetaTrader: copy trading, script trading and EAs.

👎 Disadvantages of SmartFX:

- The minimum deposit amount is too high for a novice trader.

- No referral program for retail traders.

- No bonuses, cent accounts and quality education.

Evaluation of the most influential parameters of SmartFX

Trade with this broker, if:

- You want access to passive income options available on MetaTrader, including copy trading, script trading, and Expert Advisors (EAs).

- You are looking for a broker that offers a wide variety of trading goods, ranging from indices to forex currency pairings. A diverse range of tradable assets can provide you with multiple options for building a diversified portfolio.

Do not trade with this broker, if:

- If regulatory oversight from a well-known regulatory body is a top priority for you. This broker is not regulated by such an authority, and hence, it may not meet your criteria.

- Low minimum deposit is essential for you. With a minimum deposit requirement of USD 500, this broker isn’t one with a lower entry barrier, and hence, this minimum deposit may be considered relatively high for your preferences.

Geographic Distribution of SmartFX Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of SmartFX

SmartFX cannot be considered a newcomer in online trading, as it has been providing services for over 4 years. The company’s management sees no need in developing a proprietary interface for trading, preferring classic trading platforms instead, specifically MetaTrader 5. The broker also does not offer original investment programs, but its clients can use the entire variety of them offered by MT5.

Smart FX does not use the ECN technology. For trading, traders can use standard STP accounts with floating spreads. The choice of assets is not limited to major currency pairs and CFDs on popular stocks, indices and commodities. The broker offers secondary (crosses) and exotic currency pairs, stocks of more than 1,600 American and 20 European companies and also 20 futures contracts.

SmartFX is a regulated broker you can use to trade with leverage and deposit and withdraw funds in a convenient way. The company does not charge a deposit/withdrawal fee. The conditions for performing transactions are standard for financial markets: payments from third parties are not accepted, and the funds can be withdrawn in the same way the deposit was made.

Dynamics of SmartFX’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

SmartFX does not offer original investment solutions. However, traders can earn passive income using the built-in features of the MetaTrader platform. Investing equity in PAMM and MAM trust accounts is not available. As for earning additional income on partnership programs, the broker does not offer such an opportunity to retailer traders.

Investment solutions available for MT5 users

MetaTrader 5 is a universal platform in terms of functionality, as you can earn by trading independently, as well as earn a passive income using:

Expert Advisors (ЕА);

Algorithmic trading using scripts;

Copy trading (copying trades of other traders).

The trading platform features detailed guides for working with all of the above instruments. On the marketplace of the MQL5.community website, you can find free EAs and software for algorithmic trading. They can be tested on a demo account. An investor pays a monthly fee for copying trades of the chosen trader. The minimum fee is USD 30.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

SmartFX partnership program:

IB is an offer for those who want to become an introducing broker of SmartFX. The reward for IB is the percentage of the trading fee paid by the invited clients.

White Label is a program for companies planning to provide brokerage services. SmartFX provides an optimized website, CRM system, client portal, access to MT5 and the best liquidity for its partners.

Franchise is a program for launching a brokerage company under the SmartFX brand in your region. By buying franchises, the company becomes a partner of a ready-made business.

At the moment, SmartFX does not offer a referral program for retailer traders.

Trading Conditions for SmartFX Users

SmartFX offers its clients more than 2,000 financial instruments that can be traded from standard accounts. The leverage depends on the class of assets. The highest leverage (1:400) is available for currency pairs. The maximum leverage for CFDs is 1:100. You can use debit/credit cards, bank transfers and electronic wallets for deposits and withdrawals.

$500

Minimum

deposit

1:400

Leverage

24/5

Support

| 💻 Trading platform: | MetaTrader 5 |

|---|---|

| 📊 Accounts: | Demo Account, Smart Account |

| 💰 Account currency: | USD, EUR, GBP, JPY |

| 💵 Replenishment / Withdrawal: | Bank Wire Transfers, Credit/Debit Cards, Skrill, Neteller, Sticpay |

| 🚀 Minimum deposit: | USD 500 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 1.2 pips |

| 🔧 Instruments: | 130 currency pairs, futures, CFDs on stocks, indices, commodities, metals, energies |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | N/A |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution |

| ⭐ Trading features: | All strategies are allowed: active and passive |

| 🎁 Contests and bonuses: | No |

Comparison of SmartFX with other Brokers

| SmartFX | RoboForex | Pocket Option | Exness | TeleTrade | FxPro | |

| Trading platform |

MetaTrader5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MobileTrading, MT5, cTrader, FxPro Edge |

| Min deposit | $500 | $10 | $5 | $10 | $1 | $100 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:10 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.2 point | From 0 points | From 1.2 point | From 1 point | From 0.8 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 70% / 20% | 25% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| SmartFX | RoboForex | Pocket Option | Exness | TeleTrade | FxPro | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | Yes | No |

| Options | No | No | No | No | No | No |

SmartFX Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Smart Account | from 12$ | Yes, charged by banks and payment systems |

Commission per lot is not charged, as the broker does not offer ECN accounts.

In order to find out how competitive the spreads of Smart FX are, Traders Union analysts compared them with the spreads of two popular brokerage companies RoboForex and Forex4you. The table below shows the results of the analysis.

| Broker | Average commission | Level |

| SmartFX | $12 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed Review of SmartFX

SmartFX is an STP broker offering a wide choice of assets, competitive spread and a popular trading platform MetaTrader 5. The broker’s clients have access to leverage and margin trading from a single account. Analysts of the brokerage company publish market analysis daily to help traders achieve success in trading currency pairs, futures and CFDs. SmartFX offers various channels of communication with customer support service. The company has profiles on Facebook, Instagram, Twitter, LinkedIn and YouTube.

SmartFX in figures:

-

Over 4 years of stable operation.

-

Over 2,000 financial instruments.

-

Over 130 currency pairs.

-

5 payment systems for deposit and withdrawal.

-

Verification of documents within 24 hours.

SmartFX is a broker with no restrictions for trading styles

Every Smart FX client has a choice between active strategies and passive investing. Traders can trade Forex pairs, indices, stocks, gas, oil and commodities as CFDs. The broker provides an opportunity to trade futures with a margin for more experienced market players and professional traders. If a trader is interested in passive income on the Forex market, he/she can copy trades, use EAs and special scripts. It is also possible to trade in a semi-automatic mode using Smart FX signals provided in the daily market reviews.

SmartFX trading platforms are desktop and mobile versions of MT5. They support 21 timeframes and 6 types of pending orders. Hedging, netting, algorithmic and automatic trading are allowed. The broker does not offer the web version of MetaTrader.

Useful services by SmartFX:

-

Market calendar. It features the trading session hours of different markets: Forex, metals, energies, indices, stocks and futures. Also, weekends and holidays are specified.

-

Daily market analysis. It is performed by SmartFX analysts using the strategy based on support and resistance levels. In addition to Support and Resistance values, the daily analysis also specifies Trading Range, Take Profit and Stop Loss values.

-

Economic calendar. It shows important events for a Forex trader and is an effective instrument of fundamental analysis.

Advantages:

Simple registration and quick verification of documents provided by a potential client as a part of KYC.

A single account for all trading instruments.

The operation of the company is regulated, the license for working with securities was issued by the VFSC.

Availability of demo accounts that can be opened on the mobile or desktop MT5.

Zero deposit and withdrawal fee.

24-h support on weekdays by phone, live chat, email and popular instant messengers.

All clients of the broker can participate in free webinars held by financial experts in the area of online trading, who are members of the SmartFX team.

How to Start Making Profits — Guide for Traders

SmartFX offers only one type of real account. However, a client can open up to 3 trading accounts in different currencies.

Account type:

You can open a demo account on MT5. A demo account with a virtual deposit of USD 100,000 does not have an expiry date.

SmartFX is an STP broker offering classic accounts with floating spreads and zero commission per lot.

Investment Education Online

There is an Education section on the SmartFX website, but there is no educational information in it. It consists of two blocks: Webinars (you can submit an application for participation in the future online seminars), and Blog with articles on trading. A novice trader can find more useful information in the FAQ.

A demo account is an effective learning instrument. You can use it to practice training without investing real money.

Security (Protection for Investors)

SmartFX is a brand of Smart Securities and Commodities Limited. It is registered in the territory of Vanuatu and operates in compliance with the law of this country.

The operation of SmartFX is regulated by the Vanuatu Financial Services Commission (VFSC). The broker’s registration number is 40491. The VFSC makes sure that SmartFX complies with anti-money laundering and anti-terrorist financing regulations and services the clients without violating the laws of Vanuatu.

👍 Advantages

- A trader may lodge a complaint with the regulator if the broker violates the agreement

- The VFSC allows its licensees to provide high leverage

- The Vanuatu regulator does not prohibit depositing and withdrawing funds using electronic payment systems

👎 Disadvantages

- The VFSC does not have a compensation fund

- The broker services its clients in compliance with the laws of a small island state

- Identity verification is mandatory to start trading with SmartFX

Withdrawal Options and Fees

-

A withdrawal request is processed within 1-3 hours during the operating hours of the company: from 10am till 7:00pm (GMT+4) Sunday through Friday.

-

Transactions via Skrill, Neteller, Sticpay are instant. The money is credited to the bank account within 2-3 working days.

-

SmartFX does not charge a withdrawal fee, but banks and payment systems may charge their fees.

-

You can use a bank transfer to withdraw only US dollars and euro, Skrill and Neteller — USD, EUR, GBP. Also JPY can be transferred to debit/credit cards.

-

If a client requests a withdrawal after trading inactivity, the company may charge a fee equivalent to the bank fee or 3% of the withdrawal amount.

Customer Support Service

Customer support is available 24/5.

👍 Advantages

- High response speed of live chat operators

- Support is available in English

👎 Disadvantages

- On Saturdays and Sundays, chat operators are not available

- Responses by email come within 24-48 hours

There are several ways to contact customer support:

-

Live Chat;

-

Phone;

-

Email;

-

Facebook and WhatsApp instant messengers.

The company has two physical offices: in Dubai (UAE) and Port Vila (Vanuatu). They are open for clients from Monday to Saturday (inclusive) from 10am to 7pm local time.

Contacts

| Foundation date | 2004 |

| Registration address | Smart Securities and Commodities Limited, 1st Floor Govant Building, Kumul Highway, Port Vila, Vanuatu |

| Official site | https://smartfx.com/ |

| Contacts |

Email:

support@smartfx.com,

Phone: +97144319003 |

Review of the Personal Cabinet of SmartFX

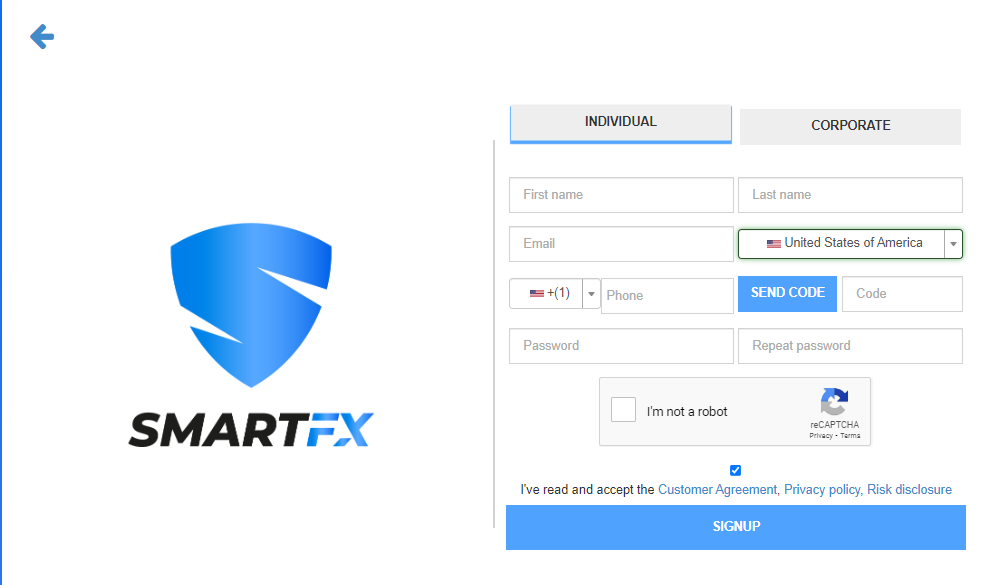

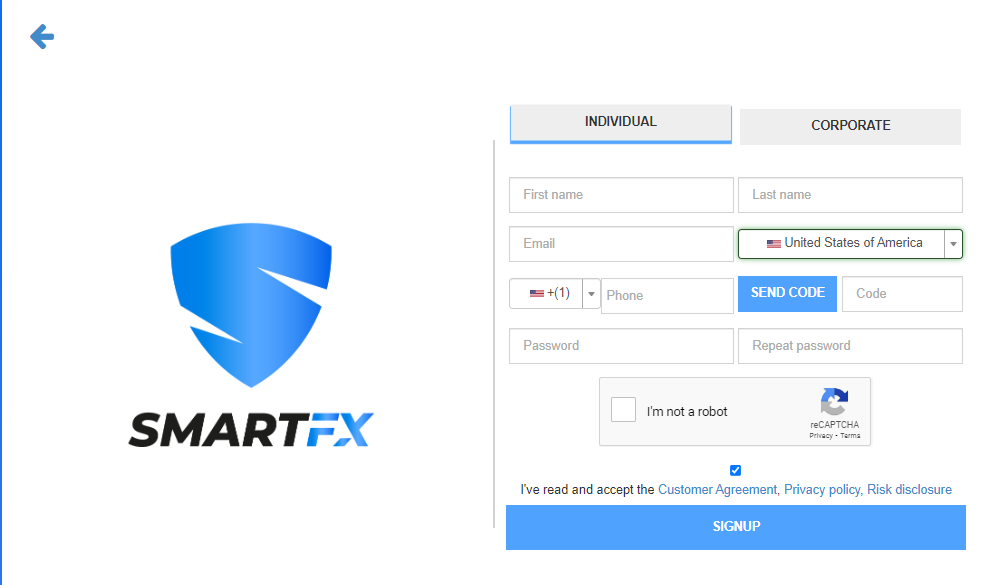

You need a Personal Account for opening a trading account, passing verification and managing funds. In order to create a personal account on SmartFX, you need to register. Take the following steps:

Click on one of the buttons on the screenshot below if you are on the homepage of SmartFX website. You can use the Open Live Account button, which is available on every page of the website.

Once you start registration, a form will open. You need to choose an Individual account – it is for retail traders. Then, fill out your First Name and Last Name (as specified in your ID), Phone and Country of Residence. Click Send Code. A six-digit code will be sent to your phone. Enter it in the Code box to confirm your phone number. Come up with a reliable password that you will use to log into your Personal Account.

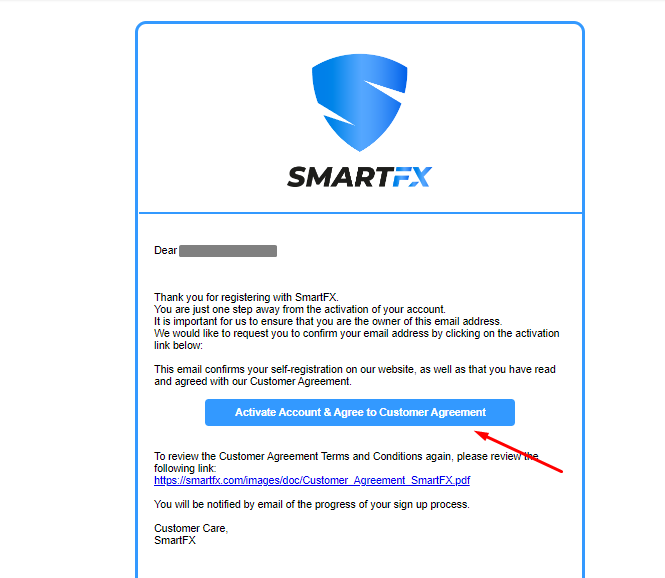

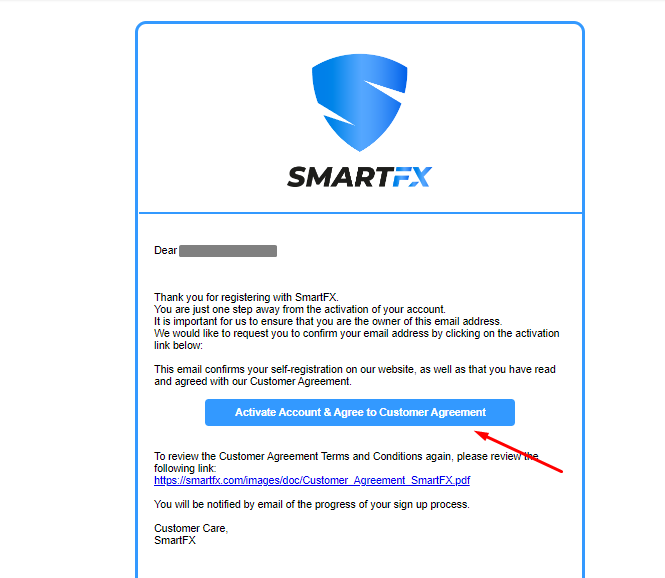

Next, check your email. Find a letter from SmartFX with the email confirmation link. The letter may be in your Spam folder.

Now, you can log into your Persona Account. Just enter your email and password.

The following features are available in your SmartFX Personal Account:

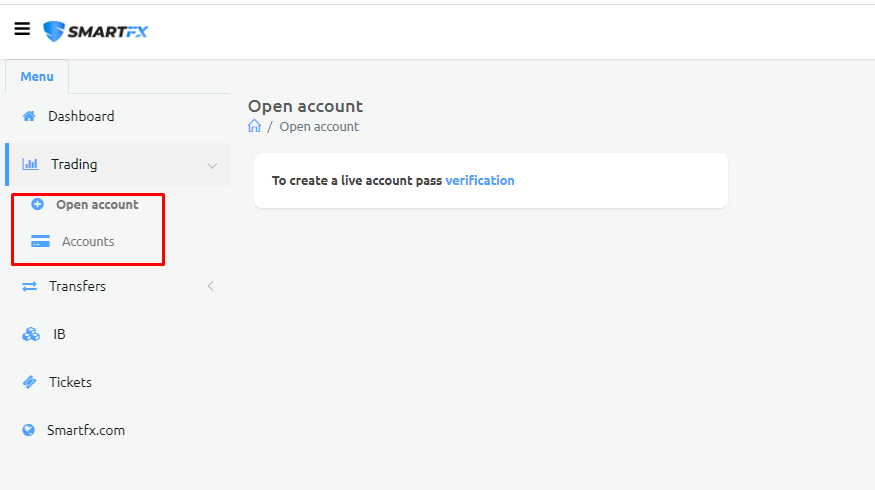

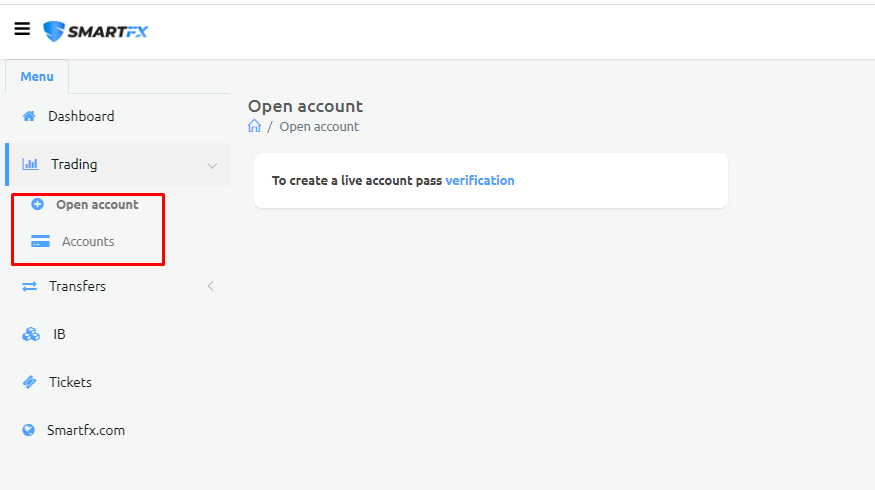

1. Opening a new trading account:

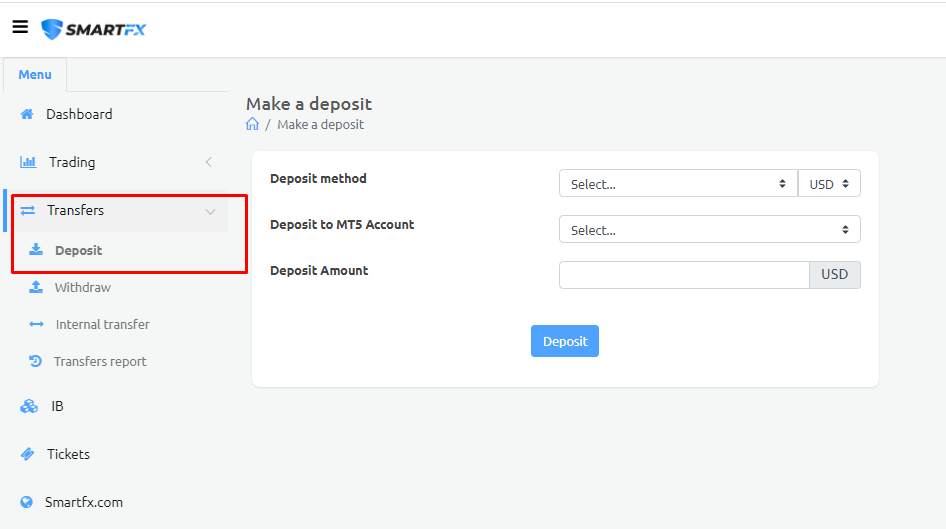

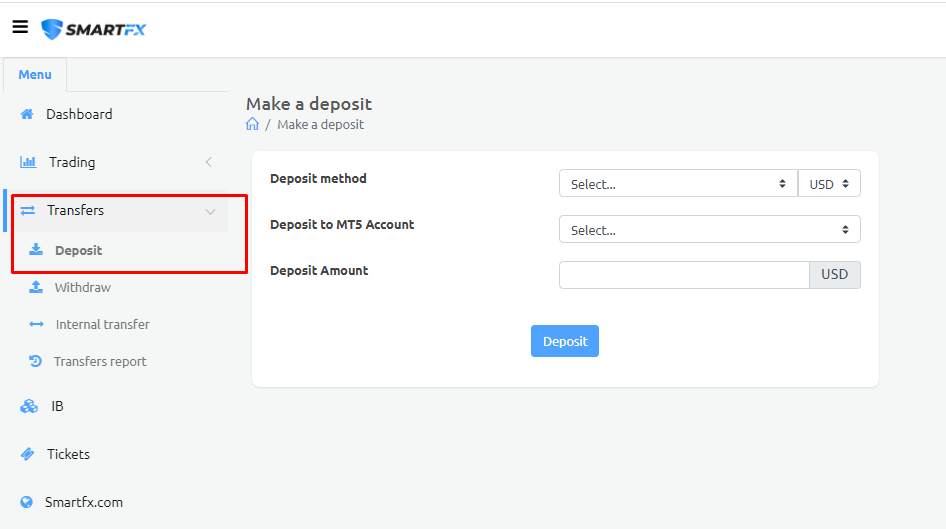

2. Depositing money to your trading account:

1. Opening a new trading account:

2. Depositing money to your trading account:

In the Personal Account, the traders can also:

-

Pass verification;

-

Download the desktop version of MT5;

-

Submit a withdrawal request;

-

Transfer money between accounts;

-

Register a ticket for customer support;

-

Set up their personal account and link their personal bank account.

Articles that may help you

FAQs

Do reviews by traders influence the SmartFX rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about SmartFX you need to go to the broker's profile.

How to leave a review about SmartFX on the Traders Union website?

To leave a review about SmartFX, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about SmartFX on a non-Traders Union client?

Anyone can leave feedback about SmartFX on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.