How to Use Tickmill Copy Trading

Step-by-step guide how to use Tickmill copy trading:

-

Step 1: Open a live account

-

Step 2: Access the client area

-

Step 3: Register for social trading

-

Step 4: Browse and select a strategy provider

-

Step 5: Start copying trades

-

Step 6: Monitor and manage your copy trading

Copy trading has changed how many people invest in the financial markets. By letting traders follow the moves of skilled professionals, Tickmill makes it possible for beginners to earn money without needing to understand complex market details. This article will show you how to use Tickmill's copy trading service so you can use its benefits fully.

How to use Tickmill copy trading

Tickmill Copy Trading, also known as Tickmill Social Trading, allows you to follow and copy the trades of seasoned traders. The platform provides an integrated solution where trades from strategy providers are automatically replicated in your account. This service offers unique features such as performance-based fees, the ability to follow multiple traders, and support for both MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

www.tickmill.com

Step-by-step guide how to use Tickmill copy trading

Step 1: Open a live account. To start, you need to open a live trading account with Tickmill. The registration process is straightforward and requires you to provide basic personal information and verification documents.

www.tickmill.com

Step 2: Access the client area. After opening your live account, log in to the Tickmill Client Area using your credentials. This is your central hub for managing your trading activities, including copy trading.

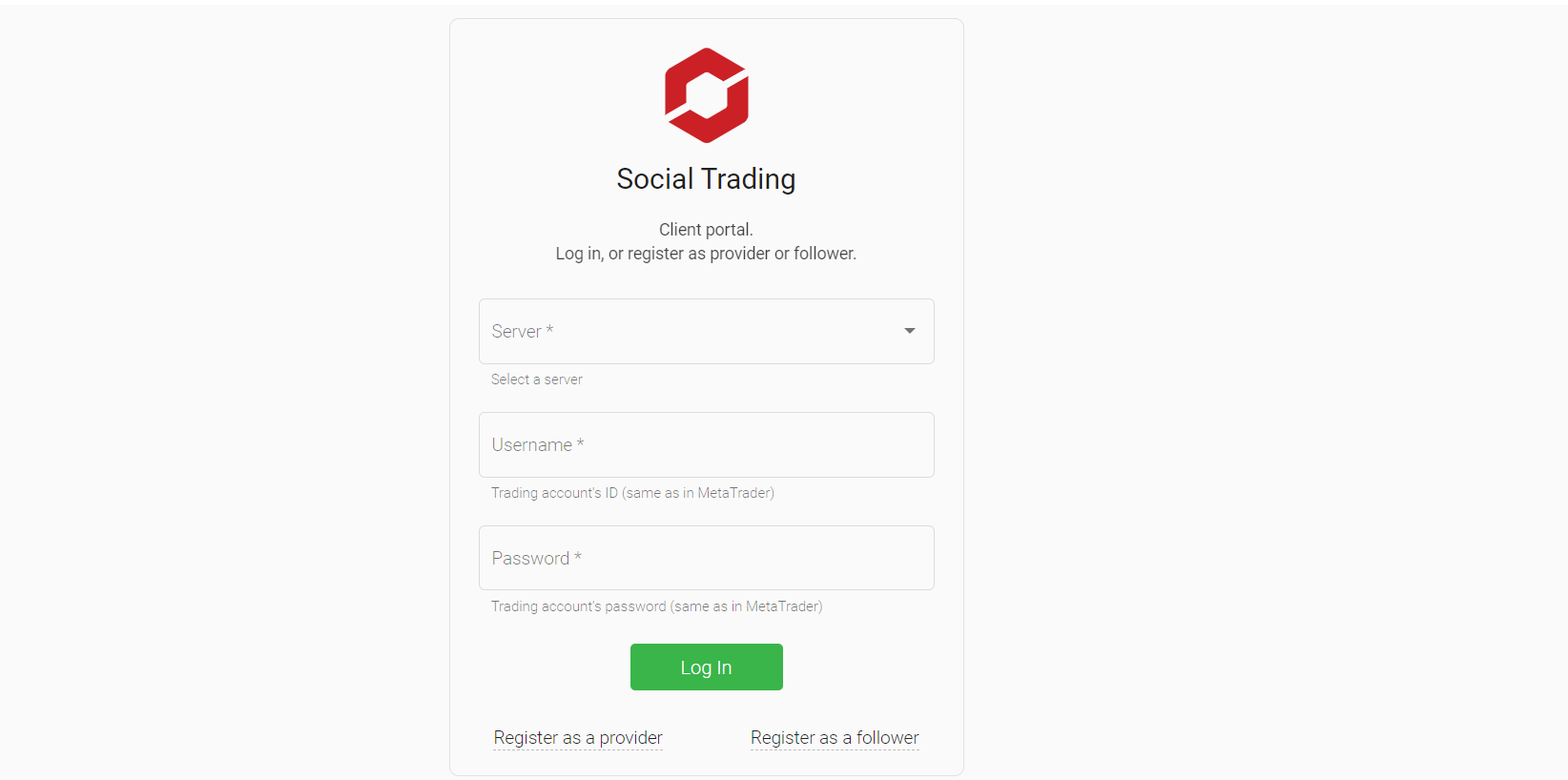

Step 3: Register for social trading. Within the Client Area, navigate to the Social Trading section. Here, you can register as either a Follower or a Strategy Provider. As a Follower, you will be copying trades from other experienced traders. Follow the on-screen instructions to complete your registration for social trading.

www.tickmill.com

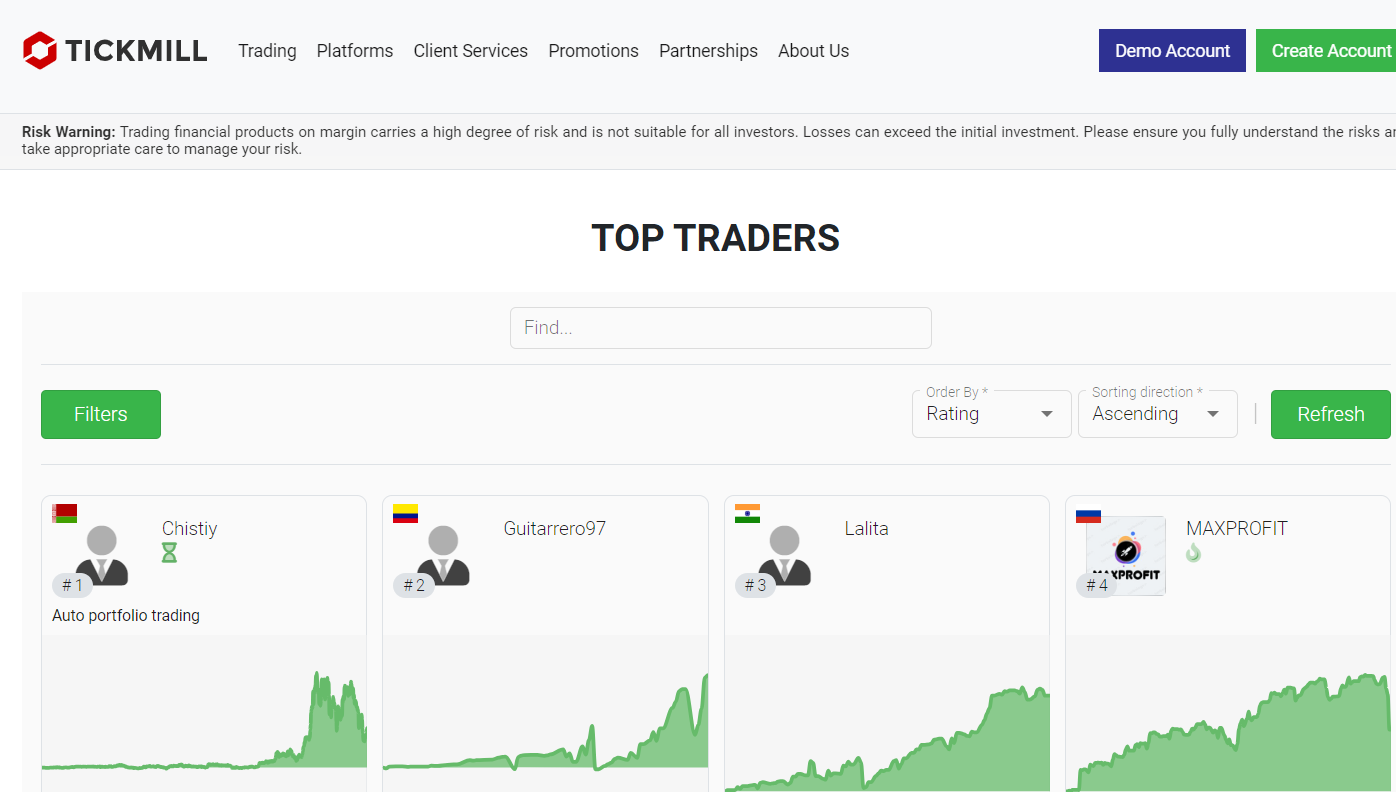

Step 4: Browse and select a strategy provider. Once registered for social trading, you can browse through a list of available Strategy Providers. Tickmill provides detailed statistics and performance metrics for each provider, helping you make an informed decision. Look for providers with a consistent track record, low drawdowns, and strategies that align with your trading goals.

Apply key filters:

-

Drawdown: This metric measures the peak-to-trough decline in value and indicates the potential risk involved. Look for providers with a low drawdown, ideally below 20%, to minimize risk exposure.

-

Profitability: Examine the overall profit generated by the strategy provider over a significant period. A high profitability metric with consistent positive returns is ideal, as it indicates successful and sustainable trading strategies.

-

Trading frequency: This metric shows how often trades are executed. The ideal trading frequency can vary based on your preferred trading style. High-frequency trading might indicate an active strategy, which can be more volatile, while lower frequency may suggest a more conservative approach.

-

Consistency: Look at the regularity of the provider's performance. High consistency with steady returns and low volatility is preferable, as it suggests a stable and reliable trading approach.

-

Risk management: Assess the provider's risk management strategies. Effective use of stop-loss and take-profit orders is crucial for protecting capital. Providers with strong risk management practices are generally more reliable.

Step 5: Start copying trades. After selecting a Strategy Provider, you can start copying their trades. The process is automated, meaning that any trade executed by the provider will be mirrored in your account. Ensure that your account has sufficient funds to copy trades effectively. Tickmill’s platform allows you to adjust the amount you want to allocate to each provider, giving you control over your risk exposure.

www.tickmill.com

Step 6: Monitor and manage trades. Use the MetaTrader platform to monitor your copied trades. Regularly check the performance and make adjustments if necessary. You can close trades manually if you see fit.

Tips for traders

For beginners, it’s crucial to start with a small investment and gradually increase it as you become more comfortable with the platform. Understand the minimum deposit requirements and familiarize yourself with basic risk management strategies. Selecting reliable strategy providers is key to minimizing risk.

This table outlines various risk management techniques, explaining each method's purpose and how it can help traders mitigate risk while using Tickmill's copy trading service.

Risk management

| Risk management technique | Description |

|---|---|

Diversification |

Spread your investments across multiple assets or strategy providers to reduce risk. |

Stop-loss orders |

Automatically sell a security when it reaches a certain price to limit losses. |

Take-Profit orders |

Automatically sell a security when it reaches a certain price to lock in profits. |

Risk-reward ratio |

Compare potential rewards of a trade to the risk involved to ensure favorable trade setups. |

Position sizing |

Determine the appropriate amount of capital to invest in a single trade based on risk tolerance. |

Regular monitoring |

Continuously monitor your investments and market conditions to make informed decisions. |

Advanced traders using Tickmill's copy trading platform can benefit from a more strategic and data-driven approach. Here are some key considerations to enhance your trading experience:

Consider sharing your strategy

If you have a successful trading strategy and a solid track record, think about becoming a strategy provider yourself. This allows you to earn fees by sharing your strategy with other traders. To attract followers, make sure your strategy is well-documented, consistently profitable, and shows strong risk management.

Connect with other traders

Engage with the trading community to share insights, strategies, and experiences. Joining forums, attending webinars, and participating in social trading networks can provide useful perspectives and improve your trading knowledge. Networking with other advanced traders can also open up opportunities for collaboration and strategy improvement.

Make use of MetaTrader features

Tickmill supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, each offering a range of advanced features. Use tools such as automated trading scripts, custom indicators, and advanced charting tools to improve your trading. These features can help you adjust your trades and respond quickly to market changes.

Important factors to consider

When engaging in Tickmill copy trading, several key factors should be considered to ensure a well-informed and strategic approach. Here’s a detailed look at what you need to evaluate:

1. Understanding and evaluating performance metrics is crucial in selecting a reliable strategy provider. Key metrics include:

-

Drawdown. This measures the decline from a peak to a trough in the value of your investment. A lower drawdown indicates a safer investment.

-

Profitability. Look at the overall profit generated by the strategy provider over a significant period.

-

Trading frequency. Understand how often trades are executed. Higher frequency might indicate a more active trading strategy, which could be riskier.

2. Costs associated with Copy Trading

-

Performance fees. These are fees paid to the strategy provider based on the profits they generate for you. It’s essential to know the percentage charged and how it affects your overall returns.

-

Hidden costs. Be aware of any additional costs that might not be immediately apparent, such as spreads, overnight fees, or withdrawal fees.

3. Legal and regulatory considerations. Ensure that the trading platform and strategy providers you choose comply with all relevant legal and regulatory requirements. This includes understanding the regulatory environment of the jurisdiction where the broker operates.

Comparing long-term and short-term strategies

| Factor | Long-term strategies | Short-term strategies |

|---|---|---|

Drawdown |

Typically lower |

Can be higher due to frequent trades |

Profitability |

Steady, potentially lower but more stable |

Higher potential profits but with increased risk |

Trading Frequency |

Lower, with fewer trades |

Higher, with multiple trades executed daily |

Performance Fees |

May vary, typically lower due to fewer transactions |

Can be higher due to more frequent trading |

Hidden Costs |

Generally lower, less affected by frequent trading fees |

Higher, as frequent trades incur more costs |

Regulatory Compliance |

Easier to manage, fewer trades to monitor for compliance |

Requires more vigilance due to high volume of trades |

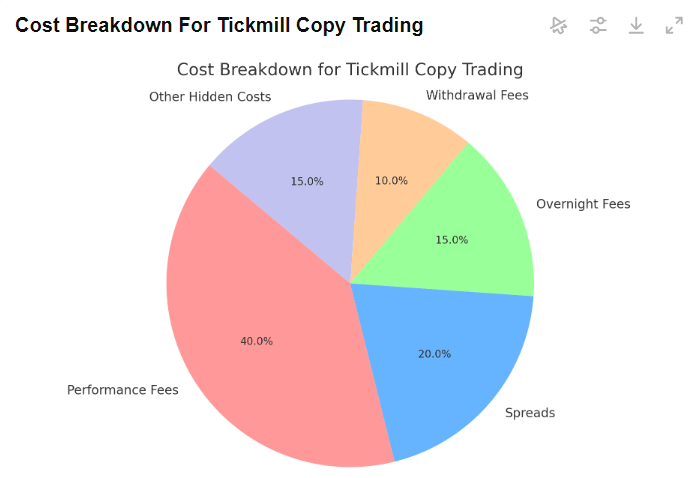

Cost breakdown chart

-

Performance fees. Percentage of profits paid to strategy providers.

-

Spreads. Difference between buy and sell prices on trades.

-

Overnight fees. Costs for holding positions overnight.

-

Withdrawal fees. Charges for withdrawing funds from the account.

-

Other hidden costs. Any additional costs that may arise from the trading process.

Cost Breakdown Chart

Copy trading involves significant risk, including the potential for substantial losses. It is important to conduct thorough due diligence and understand the specific risks associated with Tickmill. Regulatory warnings and legal considerations should also be taken into account to protect your investment.

Pros and cons of Tickmill copy trading

This table provides a clear and concise comparison of the advantages and disadvantages of using Tickmill's copy trading service.

Pros and cons of Tickmill copy trading

| Pros | Cons |

|---|---|

|

Regulated broker ensuring fund safety |

High minimum deposit for copy trading |

|

No fees for accessing copy trading service |

Complex setup process for beginners |

|

Comprehensive information |

Copy trading with Tickmill can be a valuable tool

As a professional trader with many years of experience, I emphasize the importance of thoroughly understanding copy trading before starting. While the idea of quick profits can be tempting, it's important to remember that all trading involves risk, including copy trading.

Always take the time to carefully evaluate any strategy provider you consider. Look beyond their short-term results and focus on their long-term performance, how they manage risk, and their trading approach. A provider with consistent performance over several years is usually more dependable than one with sudden recent success.

Stay involved and informed. Even though copy trading automates many aspects, it's crucial to stay engaged. Regularly check how the strategy providers you follow are performing, and be ready to make changes if their performance declines or their trading behavior changes.

Copy trading with Tickmill can be a valuable tool, but it requires the same careful approach as any other investment. By being diligent and strategic, you'll be in a better position to succeed.

Conclusion

Using Tickmill's copy trading can be a game-changer, especially if you're new to trading or don't have the time to analyze the markets deeply. This service allows you to benefit from the expertise of experienced traders by copying their trades directly into your account.

Keep in mind the importance of evaluating performance metrics, understanding the costs involved, and being aware of the risks and regulatory considerations. While Tickmill offers numerous advantages, such as being a regulated broker and providing comprehensive information, it also requires a significant initial investment and has a complex setup process.

FAQs

Can I stop copying trades at any time?

Yes, you can stop copying trades at any time. You simply need to unlink your account from the strategy provider in the client area.

What happens if the strategy provider I’m copying stops trading?

If a strategy provider stops trading, your account will not automatically follow any new trades. You will need to select a new strategy provider to continue copy trading.

How do I monitor the performance of the trades I’m copying?

You can monitor the performance of the copied trades through the MetaTrader platform. Regularly review your dashboard for detailed performance metrics.

Can I copy multiple strategy providers at the same time?

Yes, Tickmill allows you to copy multiple strategy providers simultaneously. This can help diversify your trading and spread risk.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).