How to Open a Tickmill Account

If you're looking for a reliable and user-friendly online broker, Tickmill is definitely worth considering. In this article, we'll explain how to open a Tickmill account and take advantage of all the features and benefits this broker offers. We'll also provide an overview of the documents you'll need to provide to open an account. So if you're ready to start trading with Tickmill, read on.

Tickmill Account Requirements and Documents

To open a Tickmill account, you need to be at least 18 years and located in a country where Tickmill accounts can be opened. When it comes to documents, you'll need to provide some personal information and proof of identity. Traders will need to submit a passport, national ID, driver's license or other government-issued ID.

In addition, you'll need to provide proof of address in the form of a bank statement, utility bill, mortgage statement, or credit card statement. Once you've gathered all the required documents, you can begin the account opening process. Here are countries where Tickmill is available:

Australia

China

Germany

India

Hong Kong

Ireland

Malaysia

Singapore

South Africa

UAE

UK

The account opening process is straightforward and can be completed entirely online. You'll simply need to fill out an online form and provide the required documents. Once the registration is complete, you'll need to deposit a minimum amount of $100 from your bank account.

Tickmill Bonus - How to Get No Deposit Bonus $30Tickmill Account Types

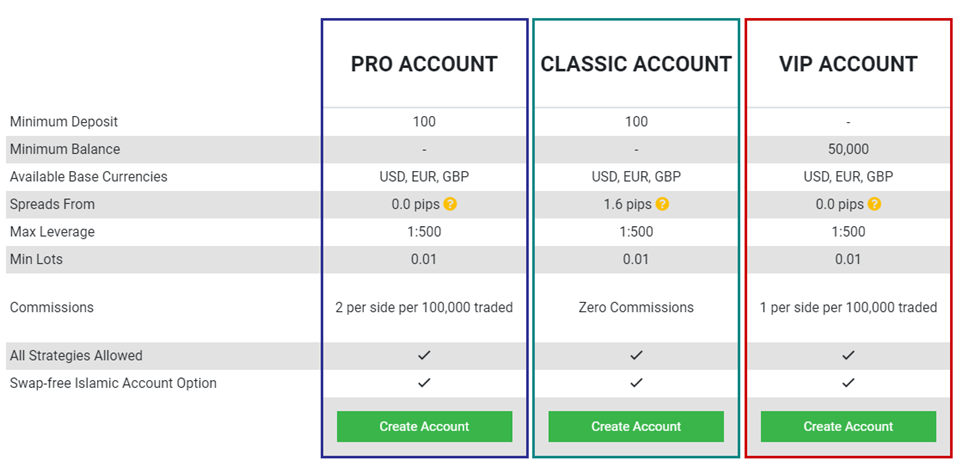

Tickmill offers three main live account types, which are Classic, Pro and VIP. All accounts are different from each other, so we'll examine each one in detail to help you make an informed decision. Apart from these three main accounts, there’s a Tickmill demo account, Islamic account, and Swap-Free account.

The Classic Account

The Tickmill Classic Account is a great choice for investors who are looking to get started with a small deposit. You only need to deposit $100 to open an account, and you'll receive 1.6 pips. There's no commission charged on this account type, so you can maximize your earnings. You'll also have access to all 80+ assets, which can go a long way toward diversifying your portfolio.

The minimum trade size is 0.01 lots, and the base currencies include USD, EUR, GBP, and PLN, which will highly depend on your country of registration. With the Tickmill Classic Account, you can get started with forex trading without breaking the bank.

The Pro Account

The Pro account is ideal for experienced traders who are looking for low spreads and commissions. To open this account, you'll need to deposit a minimum of $100, but you'll enjoy spreads starting at 0 pips on 62 currency pairs in total. You'll also pay just $2 in commission per side on each lot traded, which is very competitive depending on what you're getting, and if you trade larger sizes, you can get even better rates.

Tickmill also offers access to all 80+ assets across their platform, so you'll never be short on choice, and with a minimum trade size of just 0.01 lots, the Pro account is also great for those who like to trade smaller sizes. Base currencies on this account include USD, EUR, GBP, and PLN, but you might need to check with the broker with PLN is available to you, depending on your location.

Tickmill Spread and Fees ExplainedThe VIP Account

The Tickmill VIP account is designed for serious traders who are looking for competitive spreads and commissions. This account requires a minimum deposit of $100 and offers 62 currency pairs with spreads as low as 0 pips, making it perfect for any trader looking to get the most out of their trading experience. In addition, the VIP account comes with a $1 commission per side on each lot traded.

For those who are looking to trade a large volume of assets, the VIP account also provides access to all 80+ assets available on the Tickmill platform. Finally, this account has a minimum trade size of 0.01 lots, but there's also a minimum balance requirement of $50,000. The Tickmill VIP account is an ideal choice for traders looking for a comprehensive trading solution.

Types of Tickmill Trading AccountsTickmill Account Opening Guide

Opening a Tickmill live account is easy and only takes a few minutes. Here is a step-by-step guide.

Choose Your Ideal Account

First, you need to decide which account type is right for you. The Classic account is best for beginners, while the Pro account is designed for more experienced traders. The VIP account is reserved for the most elite clients on the platform. Once you've chosen your account, proceed to the next step.

Choose Your Ideal Account

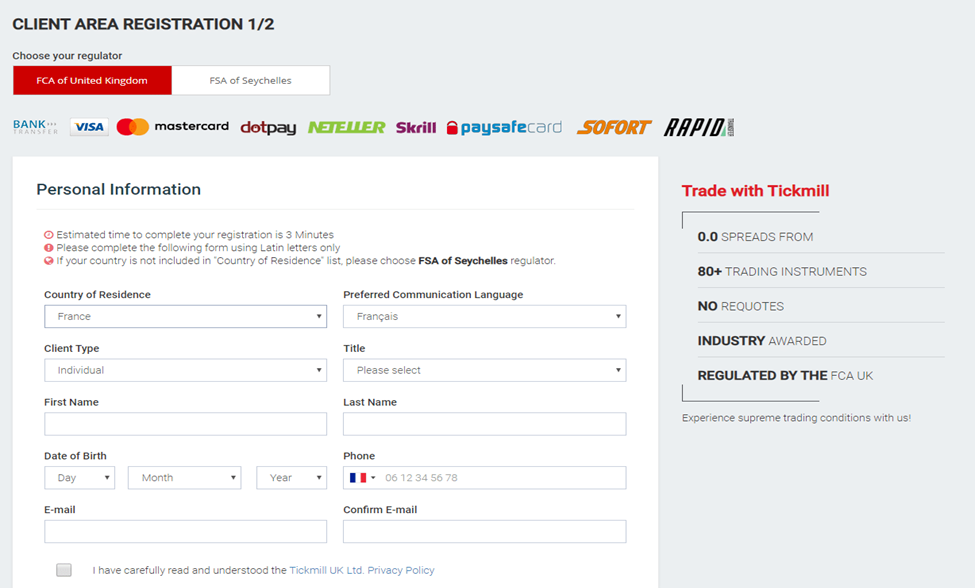

Fill Out Your Personal Information

To get started, you'll need to provide some basic personal information, including your name, address, nationality, TIN, date of birth, phone number, and preferred language.You’ll have to agree to some terms and conditions at this point.The platform will send a verification email, which will send you to the financial info and experience section.

Fill Out Your Personal Information

Identify Yourself

The next step is to add your identity. You'll need to provide some personal information and upload a copy of your passport or other government-issued ID. This is necessary to comply with anti-money laundering regulations. Once you've completed this step, you can move on to funding your account.

Fill Out Financial Information and Trading Experience

The platform requires that you fill out your financial information, including your employment status, how much you make, and how much you intend to spend. There will also be questions about your trading experience that you need to fill out.

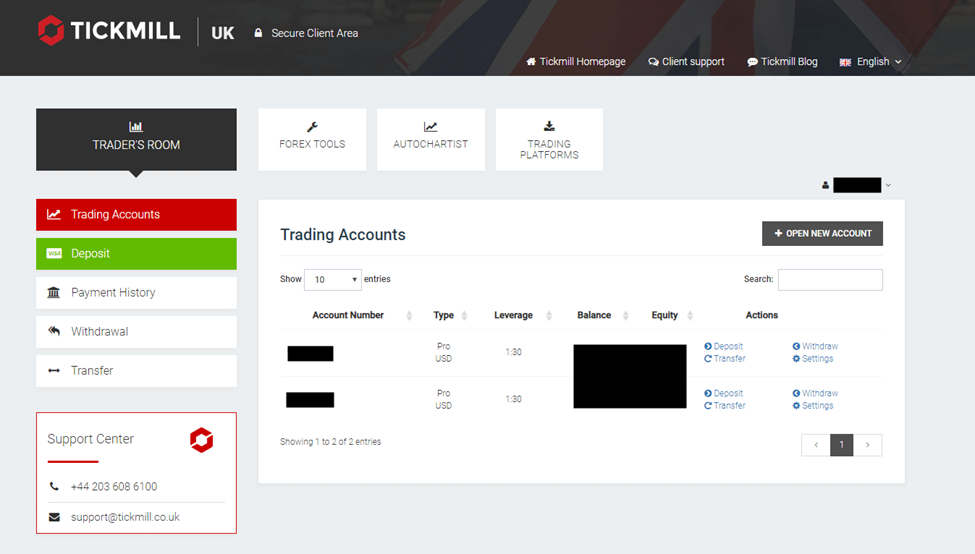

Fund Your Account

Once you've set up your account, you'll need to fund it to start trading. You can do this by making a deposit via bank transfer, credit/debit card, crypto, or e-wallet. The process is simple and straightforward, and once your funds have cleared, you'll be ready to start trading. When making a deposit, be sure to take advantage of any promotional offers that may be available - these can give you a great head start on your trading journey.

Funding Your Account

How to Close a Tickmill Account

If you're thinking about closing your Tickmill live account, there are a few things you'll need to do first. First, you'll need to withdraw any remaining funds from your account. To do this, log in to your account and go to the withdrawal page. Once you've withdrawn your funds, you'll need to close any open positions. Finally, once you've completed these steps, you can contact Tickmill's customer support team to request that your account be closed. Once your account has been closed, you will no longer be able to log in or trade on the platform.

FAQ

How do I open a Tickmill live account?

To open a live account with Tickmill, you need to go through the account opening process on our website and deposit the required minimum amount.

What documents do I need to provide to open an account?

To open a live account with Tickmill, you will need to provide your ID and proof of address. Please note that the broker requires original documents or certified copies.

How long does it take to open an account?

The account opening process usually takes less than 5 minutes. However, in some cases, it may take up to 24 hours for your documents to be processed by the compliance department.

Is there a minimum deposit requirement?

Yes, the minimum deposit for a live account is $100.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.