Withdrawals from Tickmill

Tickmill commissions

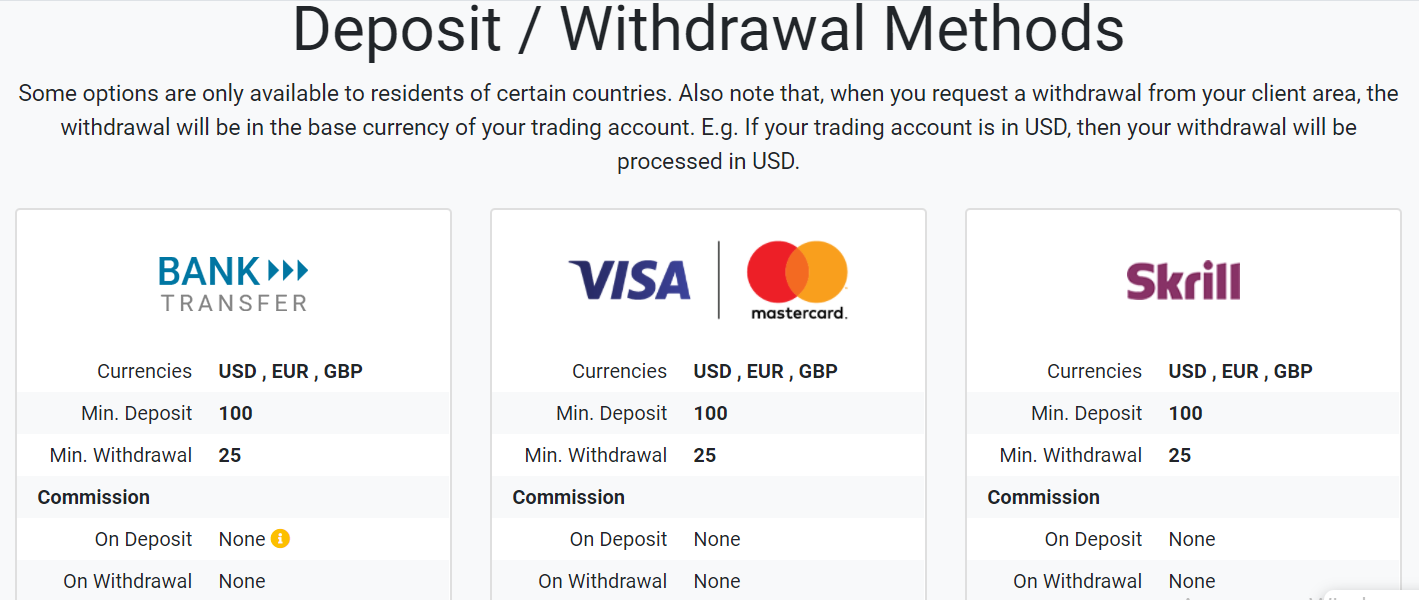

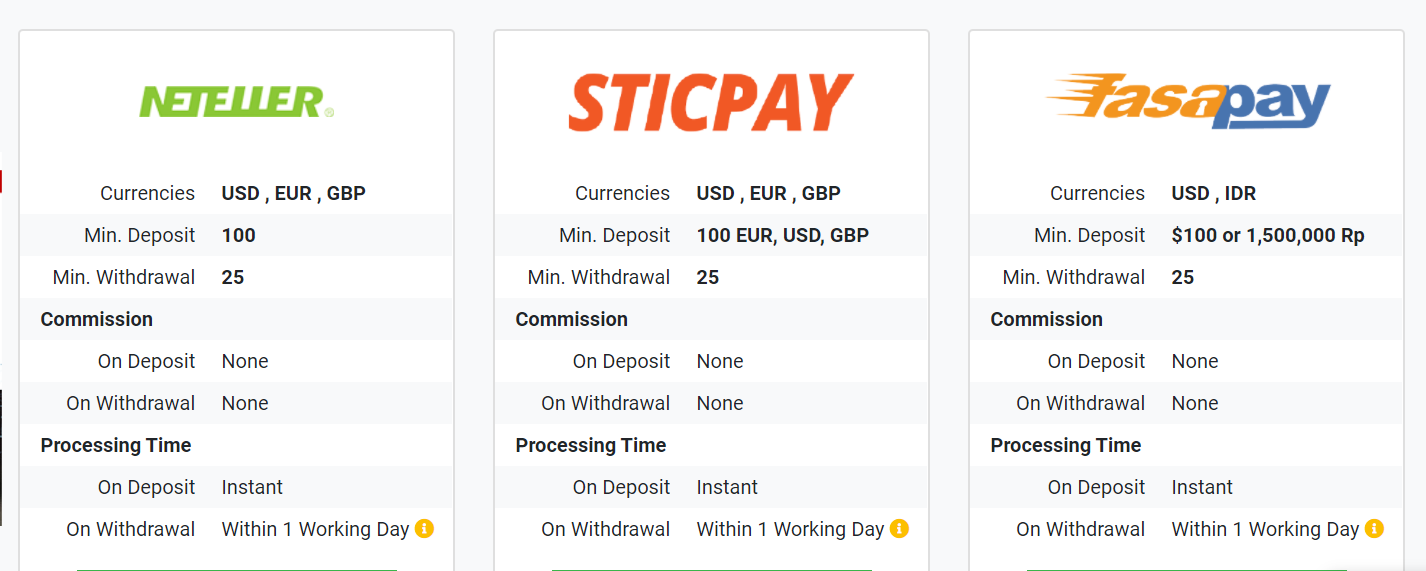

The Tickmill broker doesn’t charge fees for withdrawing funds from trading accounts. Nor is there a commission charged when making a deposit. This advantage makes the broker one of the most popular among traders. However, there is a $25 withdrawal minimum which is imposed to discourage repetitious withdrawals for small amounts due to its commission-free policy.

We compared Tickmill with other brokers from the Top 3 of the Traders Union Forex brokers rating. See the results below.

| Withdrawal method | Tickmill | XM.com | Admiral Markets |

| Bank transfer | From 0% | 2.8% | 2 free payments every month, then 7.5 AUD / 5 GBP / 5 EUR / 6 CHF / 350 RUB / 25 USD per transaction |

| E-wallet | From 0% |

Neteller – 2%; Webmoney - 0.8%; Skrill - 2.5%; Perfect Money - 0.5% |

Skrill - 1% (min. 1 AUD/USD /EUR/SGD); 2 free payments every month; Neteller -1% (min. 1 AUD/ USD/EUR/ GBP/JPY/ SGD / 3 BRL / 16 MXN); 2 free payments every month; PayPal - 1% (min. 1 EUR/ USD/GBP/ CHF/PLN/HUF /CZK/SEK /AUD/SGD) |

| Visa and Mastercard cards | From 0% | Unavailable | Only initial payment amount is commission-free |

Withdrawal methods from Tickmill

You can withdraw money from Tickmill by:

-

● Bank transfer:

Swift

Sepa

-

● E-wallets:

Webmoney

Skrill

Neteller

Sticpay

AdvCash

Perfect Money

ecoPayz

-

● Bank transfer to Visa/MasterCard cards:

VISA

Mastercard

A wide range of withdrawal methods in Tickmill allows you to choose the most convenient option based on the payment systems you use. It is amazing that the broker does not charge fees regardless of the withdrawal method used.

Commission expenses arise on the side of the financial intermediary — a bank, a card issuer, an e-payment system though, so the client will never get 100% of the amount declared for withdrawal to the account. Another advantage of the broker is the efficiency of the application process. The withdrawal of funds is carried out within one business day using any selected method. But don’t forget about the UTC timezone offset of the broker and the recipient's bank.

| Withdrawal method | Tickmill | XM Group | Admiral Markets |

| Bank transfer | Yes | Yes | Yes |

| E-wallet | Yes | Yes | Yes |

| Visa, MasterCard cards | No | Yes | Yes |

- ● Log in to the broker's website.

- ● Select the trading account to withdraw money from.

- ● Enter your payment details.

- ● Confirm the application.

Contact the broker's technical support service for assistance to find out more about withdrawing funds from your Tickmill account.

Withdrawal processing speed

The first step to withdraw funds from the broker's account is to submit an application. You can do it via your online account in a few clicks. Application processing and payment shall be carried out within one business day.

In terms of the withdrawal methods, Tickmill ranks up there with the more well-known brokers from the Traders Union top-rated brokers such as Admiral Markets and XM.com. Moreover, even though the company doesn’t charge commissions for financial transactions, it nevertheless processes applications as quickly as possible.

| Withdrawal method | Tickmill | XM Group | Admiral Markets |

| Bank transfer | During 1 business day | 3-5 banking days | 1-3 business days |

| E-wallet | During 1 business day | 30 minutes | Instant |

| Visa or MasterCard cards | During 1 business day | Unavailable | 1-3 business days |

The currency being withdrawn doesn’t affect the transaction speed. However, have regard to deductions due to monetary conversions. The broker’s commission for withdrawal of funds is 0%, but the commissions of banks, e-payment systems, etc., selected by the trader, can exceed 5%.

Know more than others,

earn more than others!

Register with the IAFT to be able to receive additional payments from us when working with Tickmill and to keep abreast of all the news of the Forex market.

How to withdraw money from Tickmill

You can withdraw any amount from the Tickmill account. The minimum amount is $25. The withdrawal is only possible after account verification. Verification can be made in a few steps:

-

1

Log in to the broker's website.

Funds Withdrawal in Tickmill - Log in

-

2

Apply for a withdrawal and enter the payment details of the selected bank or e-payment system.

Funds Withdrawal in Tickmill - Account menu

-

3

Check the receipt of funds into the account according to the regulations.

Funds Withdrawal in Tickmill - Select the method

Reviews on withdrawal from Tickmill

There were no problems when replenishing or withdrawing funds. Everything is very easy. You choose the appropriate method, click on the button, and get to the page. Then just complete the details and apply. I’ve already withdrawn money from Tickmill three times. Usually, everything happens in one and a half to two days.

The responsibility of a partner is one of the most important qualities in business. Do as you say. Tickmill says that the withdrawal of funds is completed within one business day. The maximum delay I had was up to 3 days. It is ok though because at some brokers you have to wait 5 days. Moreover, the site clearly states that there may be delays due to the difference in time zones.

I have no complaints. Everything is similar to other brokers. However, there is an important advantage, transactions are commission-free here. Sure, this is possible, especially when you withdraw funds to a WebMoney wallet. Therefore, the commission-free policy does not provide any significant savings. And yet it is very pleasant to experience such loyalty. I have withdrawn money only once so far. There weren’t any problems or delays.

I am very distrustful and skeptical when choosing a broker until I make sure that everything is reliable. I’ve been working with Tickmill for several years. I am very satisfied: the terms are good, and there are no delays when withdrawing funds. The absence of commissions from the broker for financial transactions is another nice bonus.

I trade using advisors. I program them myself, so I am more than satisfied with the results. I focused on the possibility of using scripts for automated trading when choosing a broker. In this matter, many companies are at a high level. However, I opted for Tickmill because there are very favorable payment terms with its standard service.

Do you want to evaluate the Tickmill services quality? Then follow the link to the broker's official website

FAQs on withdrawing money from Tickmill

What is the minimum deposit for Tickmill?

The minimum deposit at Tickhill is $100 for Classic and Pro accounts. And the minimum deposit for a Premium account is $50,000.

What is the fee for deposits and withdrawals at Tickmill?

The broker’s commission is 0%. At the same time, there are other costs associated with withdrawing money. They are due to the commissions of the beneficiary banks or e-payment systems.

What is the maximum leverage of Tickmill?

Tickmill offers maximum leverage of 1:500.

What trading instruments does Tickmill allow traders to use?

The broker's range of trading instruments is quite wide: currency pairs, cryptocurrencies, stocks, CFDs, futures, etc.

Does Tickmill work with digital currency because it is convenient?

Yes. Tickmill provides traders with the chance to withdraw money to all popular e-payment systems: WebMoney, Skrill, Neteller, and Sticpay.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).