deposit:

- $10

Trading platform:

- MT4

- MT5

- WebTrader

- CySEC

- FCA

- FSCA

- FSC

- 0%

TRADE.com Review 2024

deposit:

- $10

Trading platform:

- MT4

- MT5

- WebTrader

- CySEC

- FCA

- FSCA

- FSC

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of TRADE.com Trading Company

TRADE.com is a broker with higher-than-average risk and the TU Overall Score of 3.41 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TRADE.com clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. TRADE.com ranks 274 among 414 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

TRADE.com is a broker with a wide choice of trading instruments and various account types for active traders.

TRADE.com offers trading currency pairs, indices, bonds, commodities, stocks, cryptocurrencies, and ETFs. It is regulated by the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority of South Africa (FSCA), the Financial Conduct Authority of the UK (FCA), and the Financial Services Commission of the Republic of Mauritius (FSC).

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $10 |

| ⚖️ Leverage: | Up to 1:290, subject to the asset |

| 💱 Spread: | Subject to account and asset types: EUR/USD, USD/JPY, and GBP/USD — from 0.1 pips; gold — from 0.14 pips |

| 🔧 Instruments: | Currency pairs and CFDs on stocks, indices, bonds, commodities, ETFs, energies, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | Margin call: 50% |

👍 Advantages of trading with TRADE.com:

- Over 2,100 financial assets are available;

- Four account types with different conditions for professional and novice traders, as well as a demo account to trade virtual currency;

- The broker is supervised by four regulators which increases client confidence;

- No deposit and withdrawal fees;

- Detailed information on spreads and fees is available.

👎 Disadvantages of TRADE.com:

- No PAMM or MAM accounts for passive income;

- No partnership programs with rewards for attracted clients;

- No cent accounts for trading with minimum amounts.

Evaluation of the most influential parameters of TRADE.com

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of TRADE.com

TRADE.com is trustworthy since it is supervised by regulators of four countries: the UK, Special Administrative Regions (SARs), Cyprus, and Mauritius. Also, the broker’s website provides all legal documents, as well as information on fees and spreads. The broker is aimed at long-term prospects and improves its service constantly. Account types with different spreads, fees, and minimum deposits are available. Spreads differ significantly on various account types. For example, spreads on the Mini account for popular currency pairs start at 1.4 pips, while on ECN, they start at 0.1 pips.

The company offers desktop and mobile MT4, MT5, and WebTrader. Also, there are many useful tools, including an economic calendar, and technical and fundamental analyses. Newsfeeds, reviews, analytics, and FAQs on crucial information about working with the website and trading platforms are available.

The broker has many communication channels to contact technical support operators, who are prompt and competent. Also, traders are assigned personal managers, who support and help them.

Dynamics of TRADE.com’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

TRADE.com focuses on active trading; thus, it doesn’t offer PAMM or MAM accounts. The only passive income option here is social trading platforms. To make passive income, choose successful traders and subscribe to their signals. All open and closed positions are copied onto the trading platform. However, find out whether the broker allows social trading before using this service.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

The broker doesn’t offer any partnership programs either. Therefore, only two options to make income are available: independent trading and copy trading via a subscription to signals of experienced market participants.

Trading Conditions for TRADE.com Users

TRADE.com offers over 2,100 financial instruments, MetaTrader 4/5, and WebTrader. Four account types with different minimum deposit requirements are available. Leverage ranges from 1:1 to 1:290 subject to the asset. Novice traders can improve their trading skills on a demo account, while professionals can use it to test the broker’s conditions and exercise Forex strategies.

$10

Minimum

deposit

1:290

Leverage

24/5

Support

| 💻 Trading platform: | MT4, MT5, and WebTrader |

|---|---|

| 📊 Accounts: | Demo, Mini, Plus, Pro, and ECN Pro |

| 💰 Account currency: | USD |

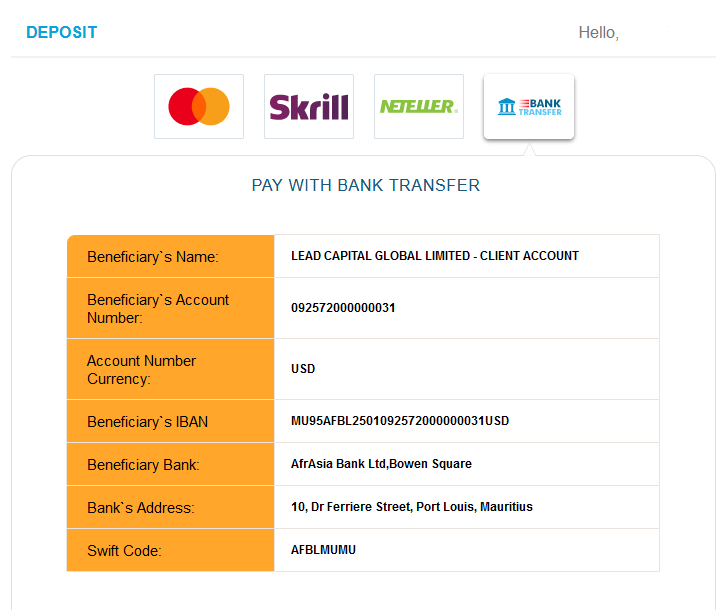

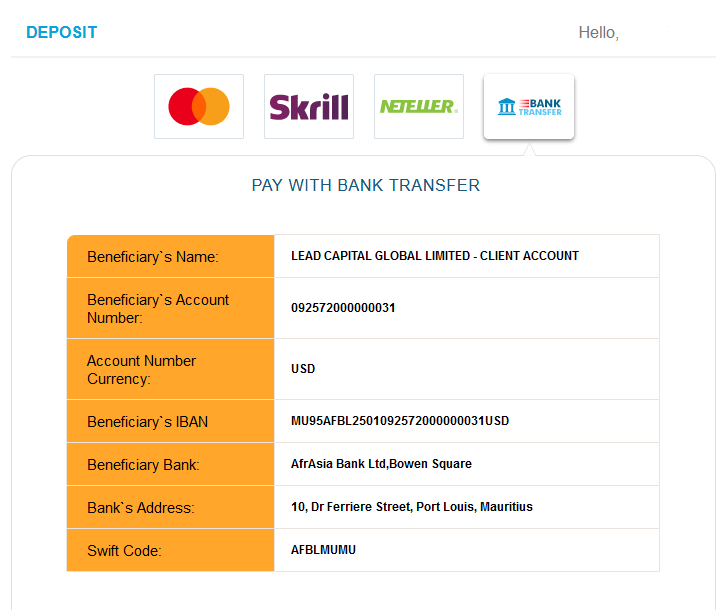

| 💵 Replenishment / Withdrawal: | Visa, Mastercard, bank transfers, Neteller, and Skrill |

| 🚀 Minimum deposit: | $10 |

| ⚖️ Leverage: | Up to 1:290, subject to the asset |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Subject to account and asset types: EUR/USD, USD/JPY, and GBP/USD — from 0.1 pips; gold — from 0.14 pips |

| 🔧 Instruments: | Currency pairs and CFDs on stocks, indices, bonds, commodities, ETFs, energies, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | Margin call: 50% |

| 🏛 Liquidity provider: | Own providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Limit and market execution |

| ⭐ Trading features: | Fee for an inactive account over 90 days is $25 |

| 🎁 Contests and bonuses: | Yes |

Comparison of TRADE.com with other Brokers

| TRADE.com | RoboForex | Pocket Option | Exness | Forex4you | Libertex | |

| Trading platform |

MT4, MT5, WebTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5 | Libertex, MT5, MT4 |

| Min deposit | $10 | $10 | $5 | $10 | No | 100 |

| Leverage |

From 1:1 to 1:290 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:10 to 1:1000 |

From 1:1 to 1:30 for retail clients |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.1 points | From 0 points | From 1.2 point | From 1 point | From 0.1 points | From 0.1 points |

| Level of margin call / stop out |

50% / No | 60% / 40% | 30% / 50% | No / 60% | 100% / 20% | 50% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | Yes | No |

Broker comparison table of trading instruments

| TRADE.com | RoboForex | Pocket Option | Exness | Forex4you | Libertex | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Crypto | Yes | No | Yes | Yes | No | Yes (as CFDs) |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes (tradable CFDs or Stocks for investment) |

| ETF | Yes | Yes | No | No | No | Yes (as CFDs) |

| Options | No | No | No | No | No | Yes (as CFDs) |

TRADE.com Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Mini | $14 | No |

| Plus | $10 | No |

| Pro | $8 | No |

| ECN Pro | $1 | No |

There are swap fees for transferring positions overnight.

The comparative table below shows the average fees for TRADE.com and two other Forex brokers. Since spreads differ for each instrument, the popular EUR/USD, USD/JPY, and GBP/USD pairs were used for analysis.

| Broker | Average commission | Level |

| TRADE.com | $8.25 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed review of TRADE.com

TRADE.com offers a wide range of financial instruments and advanced trading platforms with customized charts and options. The broker is focused on long-term profitable partnerships with traders, therefore it provides transparent trading conditions, useful tools, and professional analytics. Also, TRADE.com offers personal manager assistance with the opportunity to study techniques and principles of trading on financial markets.

TRADE.com by the numbers:

-

4 regulatory licenses;

-

2,100 trading instruments;

-

Minimum deposit is $10.

TRADE.com is a broker for active trading and passive income

The broker offers three standard account types and the ECN type that allows its clients to trade directly with liquidity providers. Such account types always have the lowest spreads and the fastest order execution. Copy trading is available for passive income. Trading assets range from currencies and cryptocurrencies to stocks of major companies, metals, oil, and gas. Upon registration, traders are provided with a multifunctional user account with an integrated WebTrader platform.

TRADE.com allows the use of automated advisors, scripts, and most trading strategies. It provides all the necessary software to trade on computers, and portable and mobile devices running on Windows, macOS, iOS, and Android.

Useful services offered by TRADE.com:

-

Economic calendar. It provides a schedule of important global events that can affect the market situation;

-

TradingView. It is the trading community with access to various useful information and over 100 charts;

-

Trading Central. This tool provides access to newsfeeds, analytics, interactive support, and research connected to financial markets;

-

History of trading operations. This is information on your profits, losses, and open and closed positions.

Advantages:

Minimum deposit is $10;

Tight spreads on professional account types;

Personal client managers;

Daily analytics;

Welcome bonus for new clients;

Real-time quotes for popular instruments.

All TRADE.com clients can make deposits and trade without verification.

Guide on how traders can start earning profits:

TRADE.com offers four account types, MetaTrader 4/5, and WebTrader. Maximum leverage is 1:290. Minimum leverage is 1:1 for ETFs and 1:2 for cryptocurrencies. All account types have separate and distinct minimum deposit requirements.

Account types:

Traders can open a demo account on any platform available with the broker.

TRADE.com offers various trading conditions suitable for both novice and professional traders.

Bonuses from TRADE.com

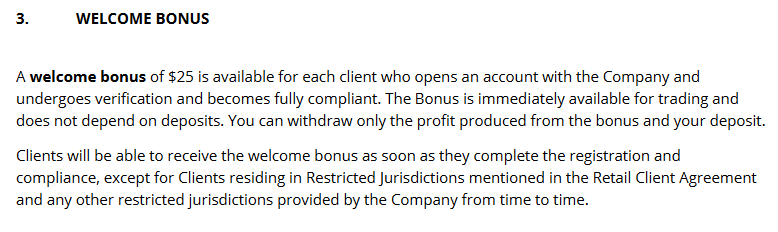

Welcome Bonus

New clients receive a $25 welcome bonus upon registration. Traders can withdraw only the money earned using the bonus.

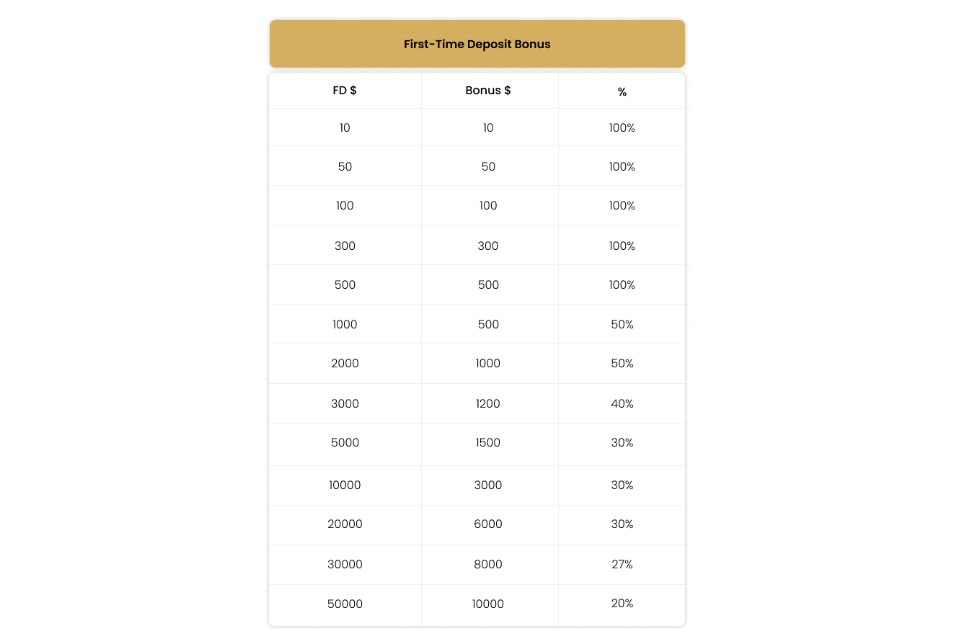

First-time deposit bonus

When making their first deposits, traders can receive bonuses that are subject to the deposited amount. Bonus funds are available only after traders spend their own money. To withdraw profits made using the bonus, a trading volume of $20,000 for each received $1 is required. The trading period is 30 days from the receipt of the bonus. Available bonuses are provided in the table below.

Bonus program conditions can change, so TU recommends that you first ask technical support about current bonuses.

Investment Education Online

The TRADE.com website doesn’t contain any educational materials, but there is brief information on the main concepts and guides on working with trading orders. Upon registration, traders get access to technical and fundamental analyses in their user accounts.

The broker doesn’t offer cent accounts, so novice traders are recommended to consolidate theory on a demo account and then switch to a live one.

Security (Protection for Investors)

Trade Capital Markets (TCM) that manages TRADE.com is licensed by CySEC under number 227/14, FSCA under number FSP 47857, FCA under number 73538, and FSC under number C119023948.

👍 Advantages

- Client funds are held in segregated accounts with tier-1 banks

- The company is supervised by four regulators

- In case of any problems, traders can file complaints with regulators

👎 Disadvantages

- To open an account, detailed information on occupation and income is required

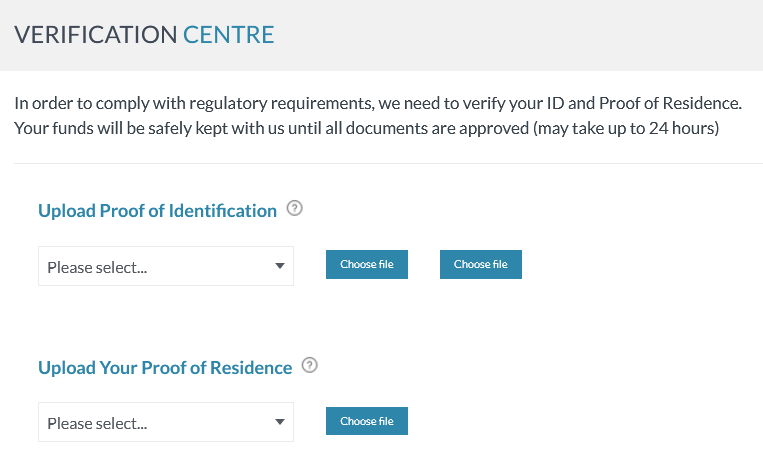

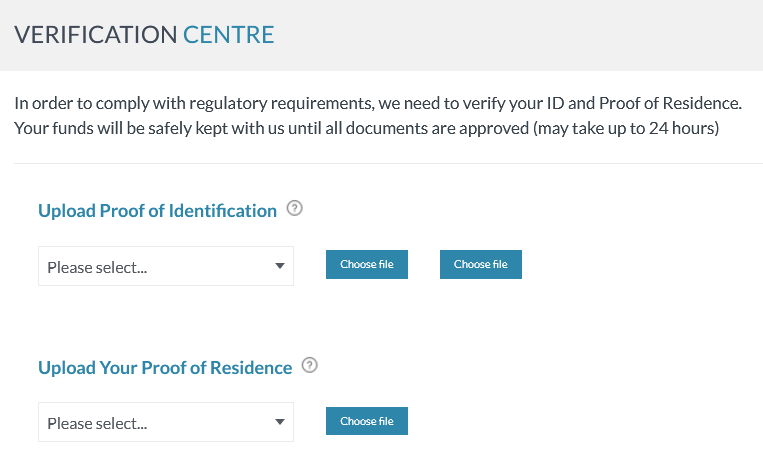

- To withdraw profits, verification is necessary

- No two-factor authentication for advanced user account protection

Withdrawal Options and Fees

-

Withdrawals are available upon verification;

-

Four withdrawal methods are available: bank transfers, bank cards, Skrill, and Neteller;

-

The broker doesn’t charge withdrawal fees;

-

If the account currency differs from the currency in a wallet, bank account, or bank card, the broker charges a conversion fee.

Customer Support

TRADE.com’s technical support is available 24/5.

👍 Advantages

- Non-clients of the broker can contact support

- Live chat and WhatsApp are available to promptly solve any issues

👎 Disadvantages

- Support is available only on business days

- No call-back option

Technical support is available through the following communication channels:

-

telephone;

-

feedback form;

-

email;

-

live chat;

-

WhatsApp.

Email communication is available in many languages.

Contacts

| Registration address | Lead Capital Services Ltd, 121 Prodromou Avenue, 1st Floor, Hadjikyriakion Bldg. 1, Strovolos, Nicosia, 2064, Cyprus |

| Regulation |

CySEC, FCA, FSCA, FSC |

| Official site | https://www.trade.com/en/global/ |

| Contacts |

Email:

support@trade.com,

|

Review of the Personal Cabinet of TRADE.com

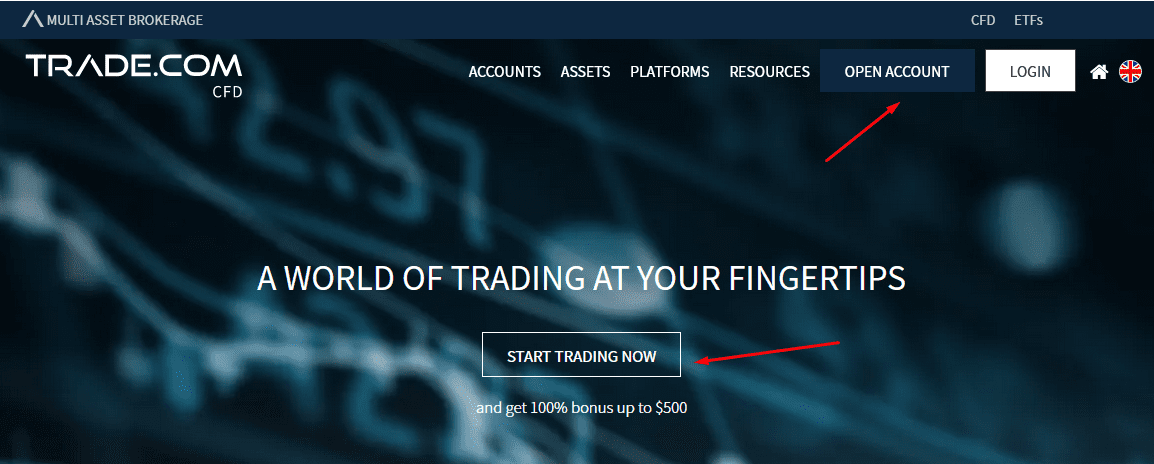

To start working with TRADE.com, register with the broker and open a trading account, following the instructions below:

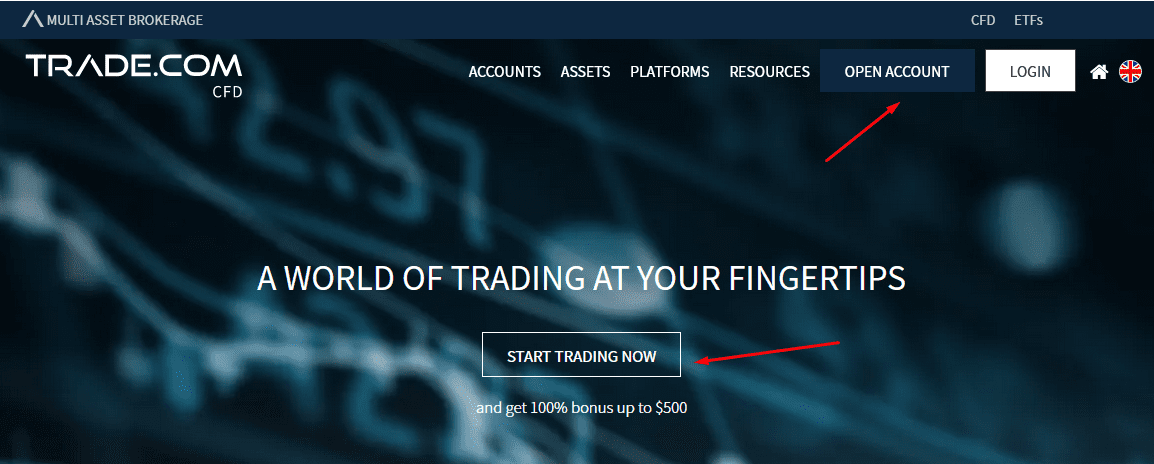

Click the “Start Trading Now” or the “Open Account” button on the broker’s website.

Fill in the registration form with your first and last names, country, address, phone number, and email. Further, indicate your tax code or reasons for not having it, and choose your occupation, position, income, and expected deposit. Also, specify your tax residency. Upon registration, confirm your email, by following the link in the message sent by the company.

Features of the user account that allow you to:

Additional features of TRADE.com’s user account allow you to:

-

Apply technical and fundamental analyses;

-

View trading on a web platform;

-

Review the settings for time zone and language;

-

Use Trading Central’s newsfeeds, reviews, and market analytics;

-

Review your trading accounts, information on open/closed orders, and profit/loss;

-

Quickly switch between live and demo accounts.

Disclaimer:

Your capital is at risk. Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. TRADE.com and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

Articles that may help you

FAQs

Do reviews by traders influence the TRADE.com rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about TRADE.com you need to go to the broker's profile.

How to leave a review about TRADE.com on the Traders Union website?

To leave a review about TRADE.com, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about TRADE.com on a non-Traders Union client?

Anyone can leave feedback about TRADE.com on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.