deposit:

- $250

Trading platform:

- MT4

TradeFW Review 2024

Attention!

This brokerage company is on the Blacklist. Working with companies on the Blacklist carries high risks of losing your money. We continuously monitor the Internet in order to identify new scams aimed at defrauding traders, and categorically do not recommend working with companies on the Blacklist.

We advise traders to choose reliable and trustworthy licensed companies from among top brokers of our rating:

Summary of TradeFW Trading Company

TradeFW is a classic broker for active traders of any level of trading experience.The company undergoes an annual independent audit, which confirms the absence of any irregularities and responsible executing of its obligations to the traders. The broker's membership in the ICF (Investor Compensation Fund) means that traders' deposits are insured in a case of force majeure.

👍 Advantages of trading with TradeFW:

- Availability of an insurance fund.

- Protection against negative balance for every trader.

- Extended set of trading assets — ETFs are added to standard instruments.

- No trading restrictions. Allows hedging, scalping, and application of trading advisers on MT4.

- Lightning-fast withdrawals.

👎 Disadvantages of TradeFW:

- High spreads — from 1.7 pips. This may indicate that the broker has liquidity problems or works with individual providers with a high markup on the STP model.

- Low leverage —only up to 1:30.

- Absence of any obvious competitive advantages — proprietary tools, developments, applications, etc.

Geographic Distribution of TradeFW Traders

Popularity in

Video Review of TradeFW i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Investment Programs, Available Markets and Products of the Broker

At the moment, the TradeFW broker does not offer investment programs and is not developing the direction of active trading services. For those who are not ready to spend time trading or do not have enough expertise, but want to earn, there is an alternative option in the form of the MetaQuotes signal copying service. It has a built-in MT4 platform and allows copying signals of any trader in the MQL5 community. Each TradeFW client can also become a signal provider for TradeFW investors or other brokers after having registered on the MQL5 website.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

TradeFW’s affiliate program

For now, TradeFW does not use affiliate programs to promote its brand, but instead, relies on quality, responsibility, and reliability. Perhaps affiliate programs are coming soon.

Trading Conditions for TradeFW Users

The arsenal of TradeFW trading instruments contains more than 250 assets, including shares of structured ETF funds. Trading conditions are strict: maximum leverage is only up to 1:30 with a minimum deposit of $250. Spreads start from 1.7 pips depending on the type of account you are using.

$250

Minimum

deposit

1:30

Leverage

24/5

Support

| 💻 Trading platform: | MT4 for any type of device and iOS |

|---|---|

| 📊 Accounts: | Standard, Gold, VIP, and Professional |

| 💰 Account currency: | USD, EUR, and GBP |

| 💵 Replenishment / Withdrawal: | Visa, Mastercard, Neteller, Skrill, Sofort, Trustly, SEPA (Cyprus bank), wire transfer |

| 🚀 Minimum deposit: | From $250 |

| ⚖️ Leverage: | Up to 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 1.7 pips |

| 🔧 Instruments: | Over 250 assets: CFDs on currency pairs, stocks, indices, and commodity assets |

| 💹 Margin Call / Stop Out: | No data /50% |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Instant execution, Market execution |

| ⭐ Trading features: | It is possible to invest in ETF stocks here |

| 🎁 Contests and bonuses: | No |

TradeFW Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | From $27 | No |

| Gold | From $20 | No |

| VIP | From $17 | No |

| Professional | From $17 | No |

For the transfer of an open position to the next day there is a swap commission. Also, the Traders Union analysts made a comparative analysis of TradeFW's commissions with the similar tariff policies of its competitors. The average spread for the EUR/USD pair was taken as the basis, the amount is specified in money terms for one full standard lot.

| Broker | Average commission | Level |

| TradeFW | $20.2 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed Review of TradeFW

TradeFW is a classic mid-tier broker that has staked on the stock market. In addition to the traditional CFD assets, TradeFW offers investments in stocks and ETFs of European companies. And if for currency pairs the broker's spread can be called overpriced, the trading conditions for share trading are relatively competitive.

TradeFW broker by the numbers:

-

More than 250 trading assets.

-

4 awards in the categories "Best CFD Broker in Europe", "Best Platform", etc. were received in 2020.

TradeFW is a broker for active trading and passive investing

TradeFW is an STP broker that works directly with liquidity providers. Providers, according to the partnership agreements, put quotations and satisfy traders' requests. The broker then sets its commission on the spread. This explains a relatively high spread: from 1.7 to 2.7 pips. Liquidity providers are European investment banks.

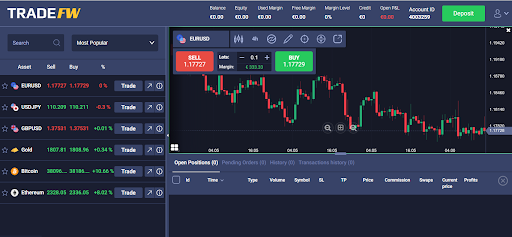

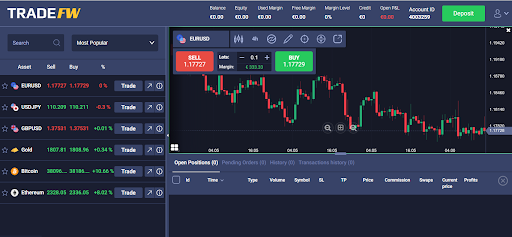

In addition to the standard MT4 platform, the broker offers its proprietary TradeFW platform. Access to the platform appears only after registration and entering brief information about oneself. Its functionality is inferior to the desktop version of MT4, but its mobile versions are more functional than the mobile versions of MetaTrader. The TradeFW platform resembles the browser terminals of binary brokers by design and interface because there are minimal technical analysis, instruments, one-click trading, simplified chart variants, and no built-in testers. Therefore, it is a great option for beginners.

Additional services and TradeFW applications are still under development.

Advantages:

Transparency of trading conditions.

Access to international stock markets.

Protection against negative balance for all traders.

More than 200 trading assets.

There is a demo account for testing opportunities and trading platforms, which can also be used on mobile devices.

How to Start Making Profits — Guide for Traders

TradeFW offers four account types, the main difference between them is the minimum transaction volume and spread. There is almost no difference in commission between them. Leverage is up to 1:30, on the VIP account, it is up to 1:500. Deposits require from $250.

Account types:

For more detailed information on each account, please, contact the support team.

Bonuses Paid by the Broker

Presently, TradeFW does not offer any bonus programs. But in the future, the company's policy may change.

Investment Education Online

On the TradeFW website training information is presented in a separate Education block. But it is more of a theoretical nature as it introduces traders to the specifications of the contracts.

There is a demo account without the necessity of verification to get acquainted with the broker's possibilities.

Security (Protection for Investors)

TradeFW is licensed by CySEC and complies with the MiFID II European Directive. The broker guarantees the security of data transmission (via SSL encryption), protection of personal information, and non-disclosure. A compensation fund was created from brokerage fees in case of a force majeure. Client account segregation is confirmed by an annual independent audit.

👍 Advantages

- Account segregation

- Availability of a compensation fund

- Broker compliance with European regulatory requirements

👎 Disadvantages

- The complexity of documenting a claim for a private investor

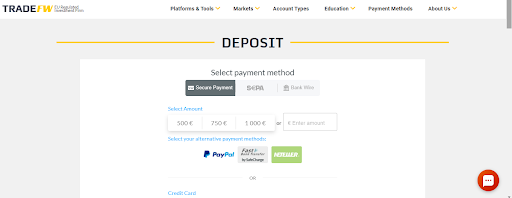

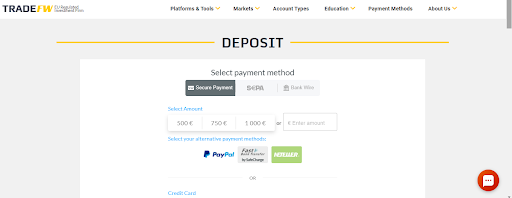

Withdrawal Options and Fees

-

TradeFW allows withdrawing funds at any time without any limitations on the number of requests or total amount.

-

The account currencies are EUR and USD. Depositing in GBP is possible in some cases.

-

Withdrawal requests are processed within 24 hours. Bank wire transfers take up to 5-7 days.

-

The minimum withdrawal amount is $100/EUR/GBP.

-

Deposits and withdrawals: Visa, Mastercard, Neteller, Skrill, Sofort, Trustly, SEPA (Bank of Cyprus), wire transfer.

-

There are no withdrawal fees. The trader pays the commissions of payment systems himself. There is a commission for trusted withdrawal and an expedited application process.

Customer Support Service

Support is available 24 hours a day, 5 days a week. It does not work on weekends.

👍 Advantages

- Instantaneous response, crystal clear, and question-related

👎 Disadvantages

- No

This broker provides the following communication channels for its clients:

-

Online Chat.

-

Feedback form.

-

Email.

-

Phone numbers of offices in UK, Italy, Germany, Cyprus.

Registration is not necessary to contact support.

Contacts

| Foundation date | 2016 |

| Registration address | Isiodou, Andrea Laskaratou & Emanouel Roides Street 10-12, 2. Floor, Ayia Zoni, 3031 Limassol, Cyprus |

| Official site | https://www.tradefw.com/ |

| Contacts |

Email:

support@tradefw.com,

|

Review of the Personal Cabinet of TradeFW

Would you like to save on spreads? Then open a TradeFW account using an affiliate link. You can find it in the broker's review after you register on the Traders Union website. It is free of charge.

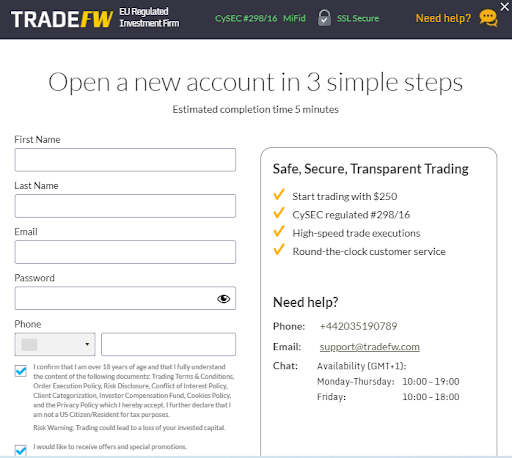

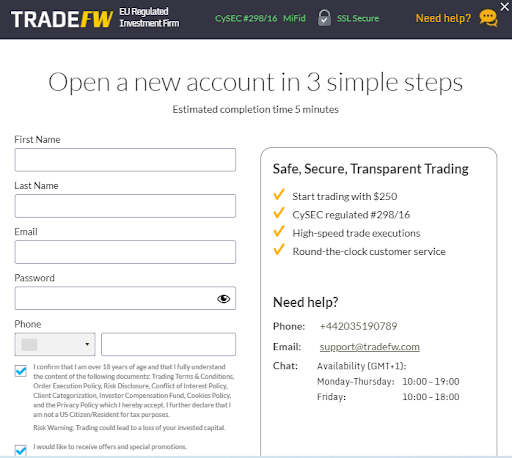

How to open an account with a TradeFW broker:

On the broker's home page, click "Open Your Account." Fill out the registration form. It has three steps and takes only 5-7 minutes to complete.

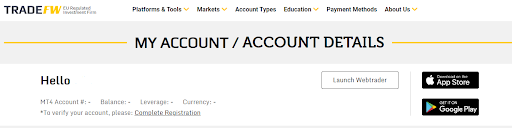

You will get access to your personal cabinet after the first registration step. You need to be verified to trade.

Functions of the TradeFW personal account:

1. Account balance management:

2. Access to the browser version of the TradeFW platform:

1. Account balance management:

2. Access to the browser version of the TradeFW platform:

Other features of the personal account:

-

Access to news and setting alerts.

-

History of transactions on open accounts.

-

Statistics on trades and open accounts management.

-

Personal information management: verification, change of password, change of personal data.

We constantly monitor the Internet for the emergence of new fraudulent schemes to deceive traders. We have been collecting data about scam brokers for more than 10 years and we think we know every dishonest company in the market. Below we have collected for you the information about the scammers from the List of SCAM Brokers.

Articles that may help you

FAQs

Why has TradeFW been placed on the Forex Broker Blacklist?

Possible reasons:

• multiple complaints have been filed against TradeFW by traders claiming the broker failed to fulfil its obligations, including process withdrawals;

• the website of TradeFW is down, not updated or operates with clear errors and some features are not available;

• TradeFW has been blacklisted by the regulatory authority, and a warning has been published on the regulator’s website.

What should I do if TradeFW got blacklisted and I still have money in my account?

Don’t panic right away. First, try to find out the reason why TradeFW got blacklisted. The situation may be temporary. Contact Traders Union client service for details. If the situation is critical, try to withdraw money. The best way to do it in parts, so that the broker does not suspect that you want to withdraw your entire balance and close the account.

What should I do if I cannot withdraw my money from TradeFW?

If your broker refuses to process withdrawals under various pretexts, your algorithm of actions is as follows:

• Get a clear response from the broker’s Support Service with reference to the clauses of the Terms of Use (User Agreement). Save your correspondence and download the transaction history from your account.

• With a full package of documents, appeal to the following organizations: the broker’s regulator or corresponding law enforcement agencies. If you make your deposit with a bank transfer, try to initiate a chargeback request.

• Share your situation on traders’ forums, add the broker to blacklists of various websites, as it will help others avoid the mistake.

Is there any chance to recover my money if TradeFW is a scam?

On rare occasions, yes, for example, if the broker was a member of a compensation fund, or upon a court’s ruling.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.