deposit:

- $100

Trading platform:

- MT5 Desktop

- ParagonEx (Web)

- UFX Trader

- CySEC

- VFSC

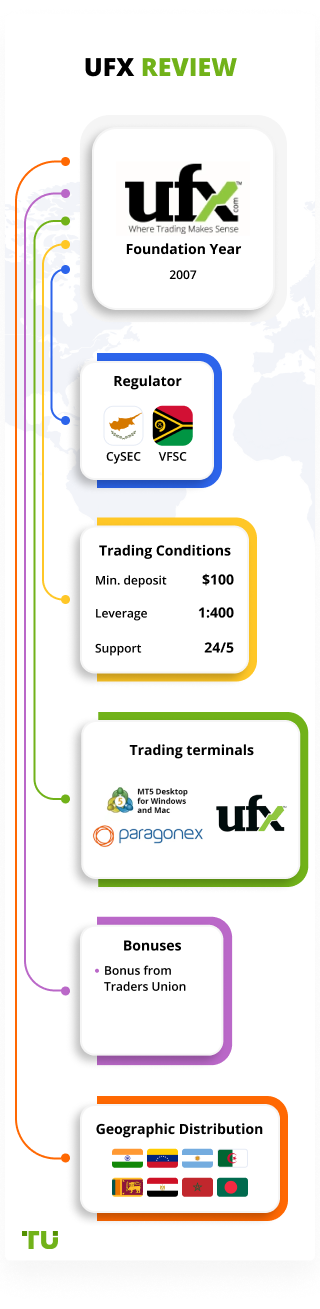

UFX Review 2024

Attention!

This brokerage company is on the Blacklist. Working with companies on the Blacklist carries high risks of losing your money. We continuously monitor the Internet in order to identify new scams aimed at defrauding traders, and categorically do not recommend working with companies on the Blacklist.

We advise traders to choose reliable and trustworthy licensed companies from among top brokers of our rating:

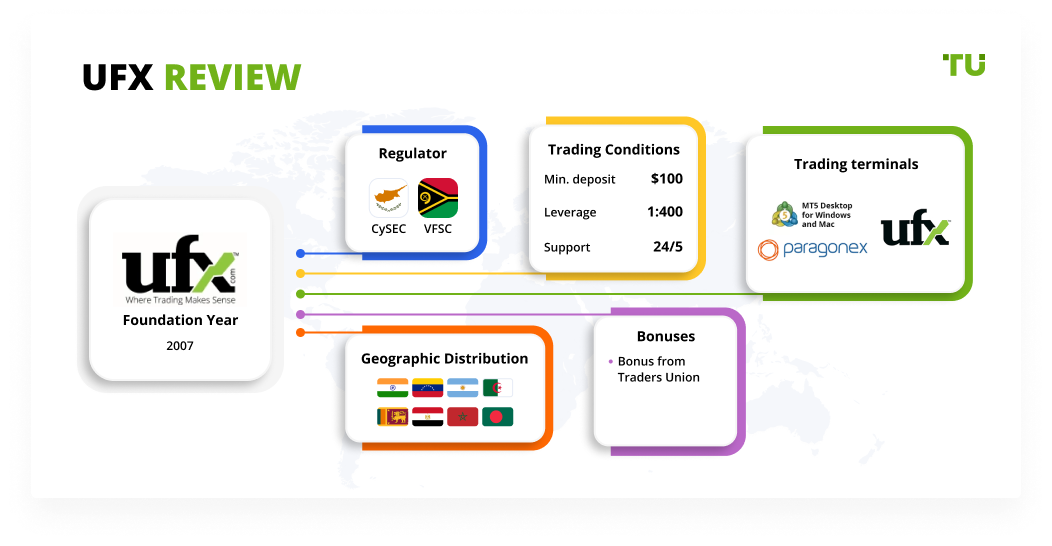

Summary of UFX Trading Company

The UFX Forex broker is for trading currency pairs, CFDs, and ETFs. It has offices all over the world and has been providing top-notch brokerage services since 2007. It has also received more than 20 international awards while being regulated by two commissions — CySEC (Cyprus) and VFSC (Vanuatu). The broker is focused on active traders who prefer to trade with fixed spreads and high leverage, but it allows its clients to use passive strategies as well. Traders can copy trades of successful market participants and connect expert advisors for automated trading.

👍 Advantages of trading with UFX:

- Availability of licenses from two international regulators — VFSC and CySEC.

- The extensive list of trading assets such as currency pairs, CFDs, and ETFs.

- A vast array of payment systems for deposits and withdrawals.

- High affiliate payments for the connection of new clients.

- Access to trade on cent, standard, and professional accounts with high leverage.

- Possibility to open an Islamic account, the conditions of which allow you to refuse a charge for transferring the position to the following trading day (swap).

- Participation of traders domiciled in CySEC jurisdiction in the Investor Compensation Fund with maximum coverage up to €20,000 per person.

👎 Disadvantages of UFX:

- The company keeps high fixed spreads — from 2 pips (on major currency pairs).

- The broker does not accept traders residing in the US or the UK.

- At the moment, only Bitcoin is available from cryptocurrencies.

Geographic Distribution of UFX Traders

Popularity in

Video Review of UFX i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Investment Programs, Available Markets and Products of the Broker

The UFX specializes in providing services to active traders. However, the broker does not prohibit the use of passive strategies, so its clients can copy deals of successful market participants and connect robot advisors. At the moment, the company does not offer PAMM or MAM accounts and does not allow investing in ready-made portfolios of assets.

How to receive passive profits through UFX

Representatives of UFX emphasize that the investment solutions are available only to those customers who use MetaTrader 5 for trading. It is this terminal that supports algorithmic trading and makes it possible to connect to the copy trading platform. If a trader has opened an account with UFX, he or she can make passive profits by depositing $5,000 and by:

-

Copying the trades of other market participants. The website MetaTrader 5 has a special trading signals showcase. It presents statistics of the most successful traders at the site. The investor must register on the website, choose a signal provider and deposit the amount of money specified by the signal provider. There is nothing else to do: When a trader trades, his transactions are automatically copied to the subscriber's account. If a successful transaction is closed, the signal provider receives a pre-determined percentage of the profit, while the rest of the profit is transferred to the investor's account.

-

Automated Expert Advisors. Traders who do not want to analyze the market or make transactions themselves can entrust Expert Advisors (EAs) with these activities. Advisors work according to the algorithm prescribed by the developer that allows for full automation of the trading processes. The UFX allows its clients to use robots but at the same time is not responsible for them.

At the moment, the author's web platform does not support the work of advisors and does not allow connecting to the copy trading platforms. For this reason, investment solutions are available only to clients with Gold and Platinum accounts, and who have made a deposit of $5000-10,000.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

UFX’s affiliate program:

-

Refer-a-Friend referral program. According to its conditions, a referral receives $100 if the referral has made an initial deposit from $500 to $1,000. If the amount of the first deposit of the connected trader is $1,000 - $10,000, the referral receives remuneration equal to 10% of the referral's deposit.

The company's website has a section mentioning the different types of partnership, which includes Introducing Broker, White Label, Franchise, and Affiliate program. However, all these programs are currently inactive.

Trading Conditions for UFX Users

Traders who choose UFX as their Forex broker can trade over 400 financial instruments. Leverage size varies depending on the asset class and country of residence. The broker offers STP accounts like cent, standard, premium, and Islamic. It is possible to open a demo account. The minimum time during which a trader can close an open trade is 1 minute.

$100

Minimum

deposit

1:400

Leverage

24/5

Support

| 💻 Trading platform: | ParagonEx (WebTrader), UFX Trader mobile, MetaTrader 5 (desktop) |

|---|---|

| 📊 Accounts: | Demo, Micro, Mini, Standard, Gold, Platinum, Islamic |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Credit cards (MasterCard, Visa, Visa Electron, Maestro, Diners Club), bank transfers, Skrill, Neteller, SOFORT, ELV (Elektronisches Lastschriftverfahren), Giropay, iDEAL, Neosurf, China UnionPay (CUP), CashU, Qiwi, WebMoney, POLi, paysafecard |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Fixed, from 2 pips |

| 🔧 Instruments: | Currency pairs (49), Bitcoin, CFD on metals (2), energy stocks (2), indices (8), stocks (300+), ETFs (40) |

| 💹 Margin Call / Stop Out: | 50%/25% |

| 🏛 Liquidity provider: | ЕU banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | The broker keeps fixed spreads on all account types, traders from the EU countries are protected by the CySEC Compensation Fund |

| 🎁 Contests and bonuses: | Yes |

UFX Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Micro | From $0.4 | No |

| Mini | From $40 | No |

| Standard | From $30 | No |

| Gold | From $20 | No |

| Platinum | From $20 | No |

| Islamic | From $40 | No |

The broker charges a swap fee for transferring a position to the next day. Islamic traders can open an Islamic account and refuse to receive interest.

The average fee is an important indicator that allows finding out how favorable the trading conditions are. The experts at the Traders Union calculated the average spread of UFX and then compared it to the trading commissions of the brokers RoboForex and FxPro. The results of the average spread comparison are shown in the table below.

| Broker | Average commission | Level |

| UFX | $25 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed Review of UFX

The UFX is a full Straight Through Processing (STP) broker which uses ECN (electronic communication networks) to transmit traders' orders to the execution venue with the best price. Thus, there is no conflict of interest between the company and its clients. It is regulated by the CySEC and the VFSC and offers a wide range of assets and trading accounts. Its clients have access to analytics from Trading Central, 24-hour support, and several convenient ways to deposit and withdraw funds.

About UFX broker by the numbers:

-

Has provided brokerage services for over 14 years.

-

Has two licenses from international financial markets regulators.

-

Received more than 20 prestigious awards in the sphere of online trading.

-

Offers more than 400 instruments for trading.

-

Provides 6 types of real accounts.

-

Allows trading with up to 1:400 leverage.

UFX is a broker for currency and CFD trading with leverage

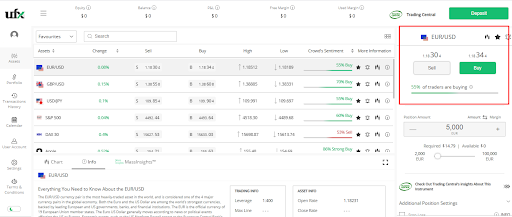

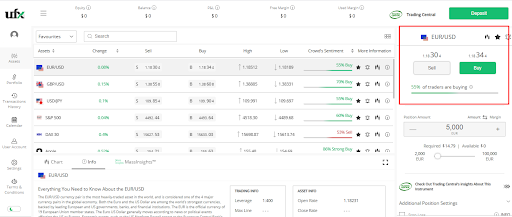

The broker allows its clients to invest in currency pairs, CFDs, and ETFs as well as gold, silver, crude oil, and gas. Also through UFX, you can make transactions in the most popular stock indices, such as Dow Jones, Nasdaq 100, and the S&P 500. The broker provides up to 1:400 leverage, but the maximum leverage ratio differs from country to country. Thus, EU traders receive leverage up to 1:30 on major currency pairs; up to 1:20 on minor currencies, gold CFDs, and major indices; up to 1:10 on commodities (except gold) and non-core stocks; and up to 1:5 on CFDs on the most popular stocks.

The company provides the MetaTrader 5 terminal for desktop trading, as well as the UFX Trader Mobile and Web Trader mobile applications. Only those clients who opened Gold and Platinum accounts and deposited $5,000 or $10,000 respectively have access to the MT5 terminal.

Useful Services of UFX:

-

Trading Central analysis. Clients with a total balance exceeding $1,000 can use technical analysis, general recommendations, and market studies from the leading financial data provider.

-

Alliance Signals. Gold and Platinum account holders can subscribe to receive trading signals via SMS or email to predict more profitable trades.

-

MassInsights Stream Elements. This tool is integrated into the trading terminals that broadcast market data, latest news, reports, financial calendar events, and actual asset behavior.

-

Economic Calendar. It allows traders to receive up-to-date information on forthcoming events in the financial sector. The calendar has several filters: by country, industry, and by date.

Advantages:

The company completely separates client funds from its capital and uses segregated bank accounts for this purpose.

UFX proprietary terminals have a simple interface and are not overloaded with complicated indicators, so they can be mastered even by a Forex novice.

The broker returns to loyal clients a part of the funds withheld as a trading commission (spread).

The company regularly updates bonus programs and holds competitions with money prizes among registered traders.

UFX does not have any hidden trading or maintenance fees.

Clients trading through MT5 can earn passive income through copy trading and automated robot advisors.

The broker provides educational articles, quality real-time support, and regular market reviews.

For the convenience of its users, the company's website is translated into 24 languages. The web trading terminal interface is available in 25 languages.

How to Start Making Profits — Guide for Traders

The UFX offers six types of trading accounts with fixed spreads. The maximum leverage is 1:400. The accounts differ in spread level, minimum deposit, presence/absence of access to the MT5 platform, and additional features.

Types of accounts:

Traders can open demo accounts in all available terminals.

UFX is an STP broker for traders whose trading strategies are more profitable with fixed spreads.

Bonuses Paid by the Broker

From time to time, the UFX broker offers its clients bonuses for the first and subsequent deposits, discounts on spreads, and real money for trading on demo accounts. However, at the moment only rebate bonuses are available to traders who trade through UFX. Under its terms, the client receives a portion of the funds withheld by the broker as a spread. The amount of bonus for each asset is displayed in the terminal. The money can be withdrawn conveniently or used to open new trades. A rebate bonus is not available for all trading instruments. The list of countries whose residents can receive the bonus is also limited.

Investment Education Online

The UFX website does not have a separate block of training materials. The basics of trading can be found in the Contact Us section. There are several trading and risk management guides as well as answers to frequently asked trading questions (FAQs).

Trading with virtual money on a demo account will help you practice using your new knowledge and psychologically prepare you for trading on the real Forex market.

Security (Protection for Investors)

UFX is a part of UFX Global Markets Inc. It is licensed by two regulators — Cyprus Securities and Exchange Commission and Vanuatu Financial Services Commission. The CySEC license number is 127/10 and the VFSC license number is 14581.

EU customers are served by a CySEC regulated unit and are therefore protected by the Investor Compensation Fund (ICF). Under its terms, each trader may receive up to €20,000 in the event of a financial collapse of UFX.

👍 Advantages

- VFSC and CySEC regularly monitor the financial activity of licensees

- Client funds are kept in segregated accounts with worldwide banks and are separated from the broker's capital

- Regulators allow deposits and withdrawals via electronic wallets

👎 Disadvantages

- ICF compensation is not available for traders residing outside the EU

- ICF coverage is only available to retail clients without Professional status

- No deposits or withdrawals can be made without verification

Withdrawal Options and Fees

-

The preferred method to withdraw funds is the same system by which the deposit was made. However, funds exceeding the original deposit amount are withdrawn only by bank transfer.

-

Withdrawal currency is US dollars only.

-

The minimum amount for withdrawal is $25.

-

Withdrawals by bank transfer and to cards are carried out within 3-10 working days. The money will be sent to your wallet within 5 business days after confirmation of the withdrawal request.

-

The company does not charge any withdrawal fees. However, payment processing fees can be charged by banks and payment systems.

Customer Support Service

Support’s schedule is 24 hours a day (Monday through Friday).

👍 Advantages

- The operators of the online chat answer the questions of unregistered users

- The response time via live chat is 1-3 minutes.

- On trading days support is available 24 hours a day

👎 Disadvantages

- It is impossible to contact the company's representatives on Saturday and Sunday

- The site has no form to order a callback

- Long waiting time for the answer to the question sent to email through the ready form on the website

This broker provides the following communication channels for its clients:

-

via online chat;

-

by telephone from the Contact Us section (12 international numbers are available);

-

via email feedback form;

-

through Facebook and Twitter.

Online chat is available not only on the broker's website but also in the personal account of the client.

Contacts

| Foundation date | 2007 |

| Registration address | UFX Global Markets Inc | The Govant Building | Kumul Highway | P.O.Box 1276 | Port Vila, Vanuatu. |

| Regulation |

CySEC, VFSC |

| Official site | https://www.ufx.com/ |

| Contacts |

Phone:

+44 20 8150 0778

|

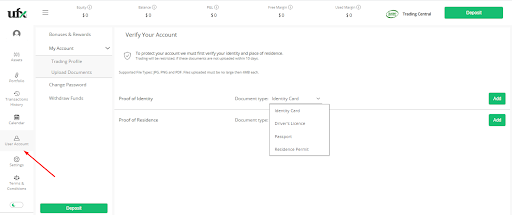

Review of the Personal Cabinet of UFX

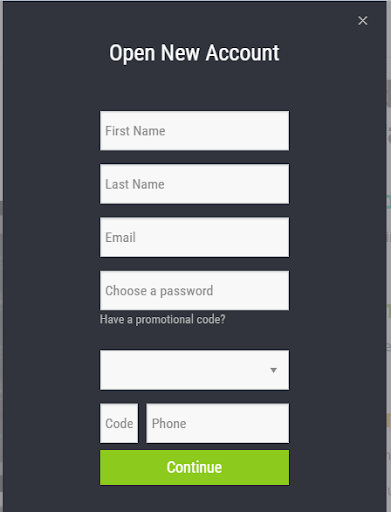

A trader needs a personal account to open a trading account and to manage payment and trading operations. To create a personal account on the UFX website follow these steps:

Click Sign Up at the top of any page of the official website.

In the registration form that opens, enter your first name, last name, email, and phone number. At this stage, you also need to think up a password that will be used to log in to your personal account in the future.

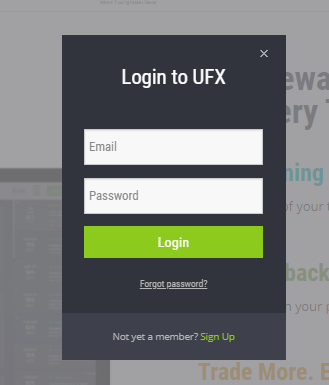

To log in to a personal account, click the Login button on any page of the UFX.com website. Enter the email address and password you provided earlier.

To start trading with UFX, follow the steps below in your personal cabinet:

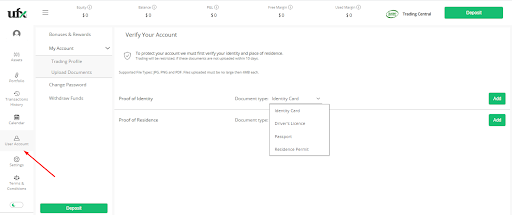

1. Complete the verification process:

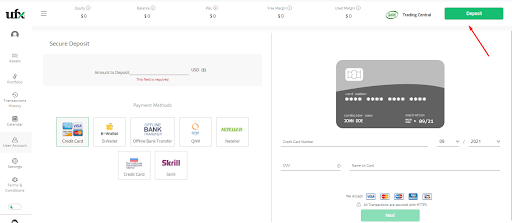

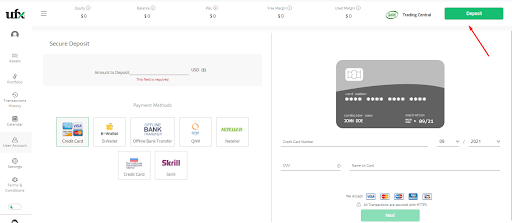

2. Make a deposit:

3. Choose your assets to trade:

1. Complete the verification process:

2. Make a deposit:

3. Choose your assets to trade:

Auxiliary add-ons to your personal account:

-

Portfolio — list of orders placed.

-

Transactions history — history of transactions and closed orders completed within 1, 7, 30 days or for the full history.

-

Economic Calendar — dates of the most significant market events in real-time.

-

User account — menu for managing the account and filing withdrawal requests.

-

Settings — block for changing the interface language and switching to demo.

-

Terms & Conditions — detailed description of trading conditions and cooperation with the company.

-

Support - button for fast communication with the technical support representative.

We constantly monitor the Internet for the emergence of new fraudulent schemes to deceive traders. We have been collecting data about scam brokers for more than 10 years and we think we know every dishonest company in the market. Below we have collected for you the information about the scammers from the List of SCAM Brokers.

Articles that may help you

FAQs

Why has UFX been placed on the Forex Broker Blacklist?

Possible reasons:

• multiple complaints have been filed against UFX by traders claiming the broker failed to fulfil its obligations, including process withdrawals;

• the website of UFX is down, not updated or operates with clear errors and some features are not available;

• UFX has been blacklisted by the regulatory authority, and a warning has been published on the regulator’s website.

What should I do if UFX got blacklisted and I still have money in my account?

Don’t panic right away. First, try to find out the reason why UFX got blacklisted. The situation may be temporary. Contact Traders Union client service for details. If the situation is critical, try to withdraw money. The best way to do it in parts, so that the broker does not suspect that you want to withdraw your entire balance and close the account.

What should I do if I cannot withdraw my money from UFX?

If your broker refuses to process withdrawals under various pretexts, your algorithm of actions is as follows:

• Get a clear response from the broker’s Support Service with reference to the clauses of the Terms of Use (User Agreement). Save your correspondence and download the transaction history from your account.

• With a full package of documents, appeal to the following organizations: the broker’s regulator or corresponding law enforcement agencies. If you make your deposit with a bank transfer, try to initiate a chargeback request.

• Share your situation on traders’ forums, add the broker to blacklists of various websites, as it will help others avoid the mistake.

Is there any chance to recover my money if UFX is a scam?

On rare occasions, yes, for example, if the broker was a member of a compensation fund, or upon a court’s ruling.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.