According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $137

- Ninja Trader

- R Trader

- Rithmic

- TradingView

- Tradovate

- The challenge lasts 7 days and takes place on a real account, with 8 plans to choose from, The first 25 thousand dollars of profit the trader keeps, then the distribution is 90%/10%, 4 Five trading platforms are available,There are newsfeeds and excellent training courses

- Determined by the broker

Our Evaluation of Apex Trader Funding

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Apex Trader Funding is a prop trading firm with higher-than-average risk and the TU Overall Score of 3.42 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Apex Trader Funding clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable partner with better conditions, as, according to reviews, many clients of this firm are not satisfied with the company’s work.

Apex Trader Funding offers numerous advantages over its competitors. It provides flexible plans with various options, reasonable subscription fees, a straightforward and quick live account challenge, and a lucrative referral program. The 90% profit payout is among the highest in the industry (with an unprecedented 100% for the first $25,000 in profits). Additionally, traders can choose their trading platform and benefit from quality education. However, there are some drawbacks, including the absence of scaling options in the plans and the limitation to trading only futures contracts. The company does not operate in all countries.

Brief Look at Apex Trader Funding

Apex Trader Funding is a proprietary trading firm that offers 8 different trading plans. Clients can receive funding ranging from $25,000 to $300,000 by successfully completing a challenge. The qualification process is a single stage and lasts only 7 days. There is no initial deposit required, and the monthly subscription fee starts at $137. The company does not set the daily drawdown, there is only the general one, and its value depends on the plan. There are no trading restrictions. Traders can news trade, trade on holidays, scalp, and hedge. The company provides access to four trading platforms: rTrader, NinjaTrader, Rithmic, and Tradovate. Access to NinjaTrader is free of charge, even though a single-user license typically costs $75. Traders receive 100% of the profits for the first $25,000 and then 90% on all plans. Payouts are made twice a month upon request, with no restrictions. The website features a news section, and free educational webinars are available. There is also a referral program that allows partners to earn 15% of the profits generated by traders they refer.

- The 7-day challenge is conducted on a live account, and traders keep all the profits.

- With 8 different plans, traders can choose their optimal capital size, up to $300,000.

- Profit distribution is highly favorable as traders receive 100% up to $25,000 and 90% on all plans.

- The tradable assets pool includes currency futures, stocks, interest rates, agricultural products, energies, metals, and cryptocurrencies.

- Traders can practice with reduced risk by trading micro-futures.

- Users have access to four trading platforms, and the company does not restrict trading strategies or methods.

- The client support is available 24/7 via phone and live chat on the website.

- While the firm provides access to a wide range of trading instruments, they are all futures contracts.

- Plans do not assume scaling, which means, having chosen 25k, a trader can increase the capital only by trading.

- Cooperation with the company is not possible for Iran, Iraq, Indonesia, South Africa residents, and many other countries.

TU Expert Advice

Financial expert and analyst at Traders Union

Apex Trader Funding is a proprietary trading company, that was founded in 2008 and is considered one of the veterans in this field. The company is American-based and holds all the necessary licenses. It has not been involved in fraudulent schemes and fulfills its stated commitments entirely. Currently, according to Apex Trader Funding's statement, it operates in over 150 countries and collaborates with 30,000 traders. While there is no confirmation of these figures, given the profitability of the partnership, these numbers seem quite realistic.

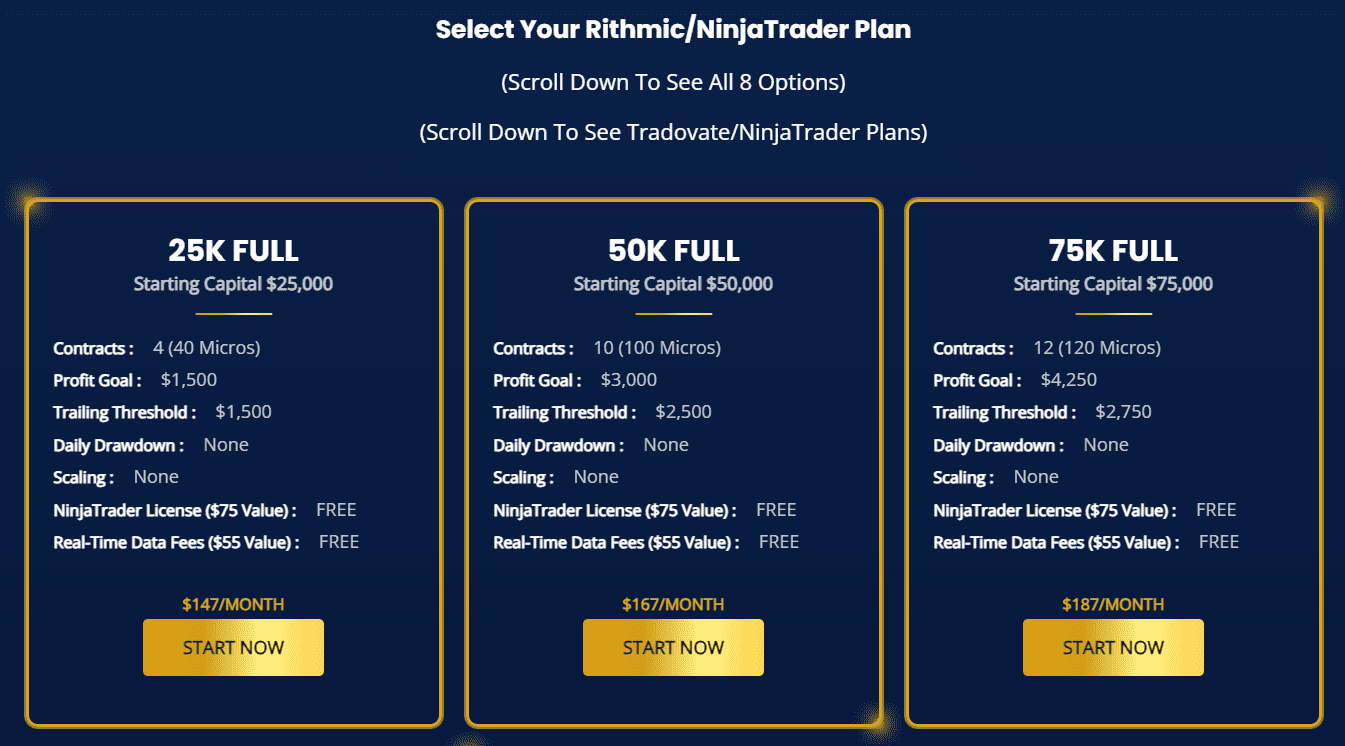

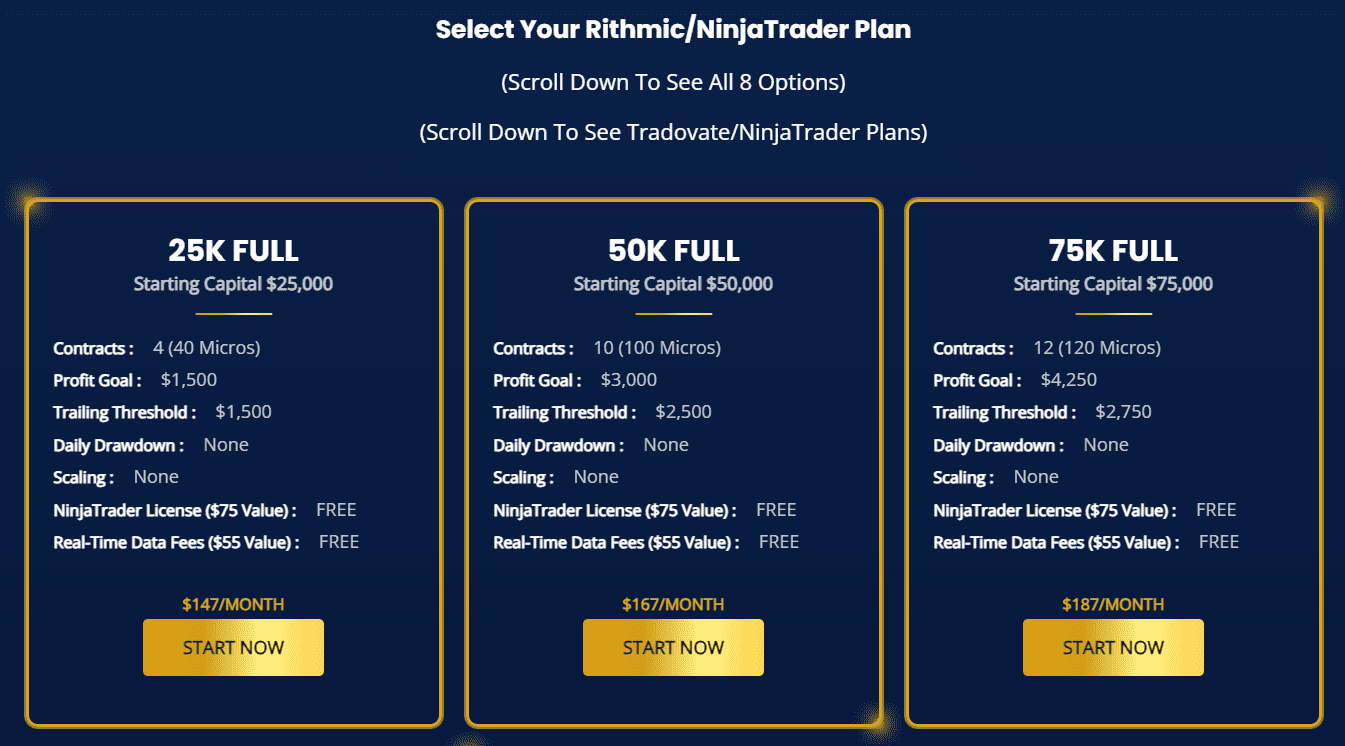

The key point is that Apex Trader Funding offers 8 different funding plans, ranging from $25,000 to $300,000. The monthly subscription fees range from $147 to $657 accordingly. There is no initial deposit, and traders receive a challenge account for free. What's interesting is that the qualification account is real, not a demo, so users keep all the profits they earn. The challenge lasts only 7 days, not 1-2 months like most prop firms.

Apex Trader Funding does not restrict its clients in trading strategies and methods. You can news trade, trade on holidays, and swap. The only limitation is the drawdown, with no daily drawdown requirements. The drawdown limits depend on the chosen plan. For instance, on the 25k plan, you cannot lose more than $1,500. If a trader exceeds this limit, their account is closed. However, it can be reopened at any time for $80, and there is no limit on the number of reopenings. This is sometimes referred to as resetting the account.

An important note is that Apex Trader Funding only provides access to futures markets, including currencies, stocks, interest rates, agricultural products, energies, metals, and cryptocurrencies. Micro-futures are also available. Technically, this is equivalent to a micro-account as any broker would offer. It is designed for exploring trading opportunities and refining strategies. The prop firm also offers news analysis and high-quality educational webinars for beginners. Registration in advance for the nearest session is mandatory.

As for the drawbacks, traders note two points. First, scaling is not available. Regardless of the chosen plan, users can only increase their capital through trading. Second, there are regional restrictions, with several dozen countries being blacklisted. Overall, aside from these points, there are no major issues with the prop firm, and it can be recommended for consideration.

- You have a consistent and profitable trading strategy, as Apex seeks traders who can demonstrate a reliable ability to generate returns. While extensive experience isn't necessary, you should have a well-defined strategy with a track record of profitability.

- You have at least 6 months of trading experience. While Apex doesn't mandate years of experience, they prefer traders who have spent at least six months actively trading. This timeframe allows traders to develop a solid understanding of the markets and refine their skills through practical experience.

- You're a beginner with no experience, as Apex expects applicants to have a foundational understanding of trading concepts and a certain level of proficiency in executing trades.

- You lack a profitable track record. While the experience requirement is still modest, Apex strictly requires a history of profitability.

Apex Trader Funding Summary

| 💻 Trading platform: | rTrader, NinjaTrader, Rithmic, Tradovate, TradingView |

|---|---|

| 📊 Accounts: | 25K FULL, 50K FULL, 75K FULL, 100K FULL, 150K FULL, 250K FULL, 300K FULL, 100K STATIC, EVALUATION RESETS |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfers, bank cards, electronic payment systems |

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | Determined by the broker |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | Determined by the broker |

| 🔧 Instruments: | Futures on currencies, stocks, interest rates, agricultural products, energies, metals, cryptocurrencies |

| 💹 Margin Call / Stop Out: | Determined by the broker |

| 🏛 Liquidity provider: | Determined by the broker |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

The challenge lasts 7 days and takes place on a real account, with 8 plans to choose from, The first 25 thousand dollars of profit the trader keeps, then the distribution is 90%/10%, 4 Five trading platforms are available, There are newsfeeds and excellent training courses |

| 🎁 Contests and bonuses: | Yes |

Apex Trader Funding does not require an initial deposit, but there is a monthly subscription fee for each plan. The fee varies based on the amount provided within the chosen plan. For example, if a trader selects the “25k” plan, they will pay $147. For the “100k” plan, the fee is $207; and for the “300k” plan, it's $657. There are no other costs for the trader. Of course, there are trading fees, but those are determined by the broker. The broker also sets the leverage level. Technical support is available 24/7. It has a multi-channel call center and live chat on its website.

Apex Trader Funding Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Challenge rules and pricing

Apex Trader Funding provides access to funding up to $2 500 000, with challenges requiring at a minimum of 7 trading days. The entry-level plan starts at $137, min but the fee is non-refundable.

- High funding potential — up to $2 500 000

- Multiple scaling options

- Flexible trading rules and conditions

- No free evaluation option

- No instant funding options

Apex Trader Funding Challenge fees and plans

We compared Apex Trader Funding’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | Daily loss,% | Max. loss, % |

| Rithmic |

|

|

|

|

|

| Tradovate |

|

|

|

|

|

| Tradovate Static |

|

|

|

|

|

| Rithmic Static |

|

|

|

|

|

What’s the minimum trading period for Apex Trader Funding’s challenge?

A minimum of 7 trading days is required, regardless of how quickly you reach the profit target.

Does Apex Trader Funding offer a free evaluation?

No, Apex Trader Funding does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at Apex Trader Funding?

No, Apex Trader Funding does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

Apex Trader Funding outlines the main rules for funded accounts, including a max. loss of 0,625% and a daily loss limit of 0%. The firm also restricts certain trading strategies, which are detailed below.

- News trading allowed

- Scalping allowed

- Flexible leverage up to 1:100

- Copy trading not allowed

- Strict max loss

Apex Trader Funding trading conditions

We compared Apex Trader Funding’s leverage and trading conditions with competitors to help you better understand how it measures up.

| Apex Trader Funding | Hola Prime | SabioTrade | |

| Max. loss, % | 0,625 | 5 | 6 |

| Max. leverage | 1:100 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | Yes | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | No | No | No |

Deposit and withdrawal

Apex Trader Funding earned a Low score based on how smoothly and conveniently traders can deposit and withdraw funds.

Apex Trader Funding's limited selection of payment methods and supported currencies may reduce its convenience and global accessibility.

- Weekly payouts

- Bank сard deposits and withdrawals

- USDT payments not supported

- Limited deposit and withdrawal options

Deposit and withdrawal options

To help you evaluate how Apex Trader Funding performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

Apex Trader Funding Payment options vs Competitors

| Apex Trader Funding | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | No | No | No |

| Crypto | No | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared Apex Trader Funding with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| Apex Trader Funding | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | Yes | Yes | No |

| Biweekly | No | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

Apex Trader Funding offers the following base account currencies:

Trading Account Opening

To start collaborating with this prop trading company, you need to register on its official website and choose one of the plans. Then, make the first month’s payment, and you can begin the challenge. The experts at TU have prepared the below step-by-step guide to address any questions. It also highlights the main features of the user account.

Go to the prop trading company's website. In the upper right corner, select your preferred interface language. Click on “Sign up”.

Choose the plan that suits you best. Click on “Start now”.

Read the terms of collaboration.

Specify the payment type. Enter your first and last names. Provide your email address. Create a username and password.

Enter your registered address with the postal code. Specify your phone number. If you have a discount code, enter it in the corresponding field.

Read the documents regarding the terms of collaboration with the prop trading company. Agree to each term by checking the box. Then click “Next”.

You will receive an email from the prop trading company at the specified email address. Click on the link in the email to confirm your email.

Enter the card details with which you will pay the plan. In the future, if necessary, you can choose another payment channel (in some regions, other channels are available immediately). Click “Subscribe and Pay” and follow the on-screen instructions.

Now you can download the platform that suits you. To do this, follow the link on the proprietary trading company's website. Install the platform on your device and start the challenge.

Your Apex Trader Funding’s user account also allows you to:

-

Monitor your account’s status, open and close accounts, and reset them (reopen).

-

Transact and trade available archives, obtain details, and generate reports from them.

-

Join and interact with the referral program, and communicate via the help center and live chat.

-

Update your personal information, and review payment details and security settings.

Regulation and safety

For a prop trading company, official registration is sufficient because it does not execute traders' transactions on the global market, as that's the broker's role. Apex Trader Funding is registered in Austin, Texas, and operates under U.S. law. There are no confirmed instances of the company failing to meet its obligations to clients, and it has no conflicts with tax or other authorities. In potential terms, traders have nothing to fear, and the partner is reliable.

Pros

- The company has been in the market for a long time and is well established

- Officially registered in the U.S.

- It has its own legal department

Cons

- There is no information on its partner broker or its regulator

Markets and tradable assets

Apex Trader Funding has a score of 3.5/10, which corresponds to a Low assessment of its market and asset offering.

- Futures available

- No Forex trading

Tradable markets

We compared the range of tradable instruments offered by Apex Trader Funding with two leading competitors to highlight the differences in market access.

| Apex Trader Funding | Hola Prime | SabioTrade | |

| Futures | Yes | No | No |

| CFDs | No | Yes | Yes |

| Forex | No | Yes | Yes |

| Options | No | No | No |

| Stocks | No | No | No |

| Crypto | No | Yes | Yes |

| Indices | No | Yes | Yes |

Investment Options

Some proprietary trading firms offer additional sources of income for their traders. In the case of Apex Trader Funding, it's about a referral program with high bonus payouts.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Referral program

The concept is simple. The trader receives a referral link from the prop firm, which they can freely share on the internet, send via email, and use in messaging apps. Anyone who clicks on this link and visits the company's website becomes the user's referee. The bonus from a referral consists of 15% of their monthly subscription fee and reset fee. This bonus is paid out as long as the referee is trading using Apex Trader Funding's funds. There are no limits on the number of referrals or the maximum income from them. Payouts are made automatically on the 15th of each month if the earnings from the previous month are $100 or more.

Customer support

Are Visa card payments accepted? Is there a conversion fee? Can I trade U.S. index futures? Traders often have questions, and the company's technical support must be up to the task. Because if support is unresponsive or lacks competence, a trader may never start a partnership or become disappointed and switch to a competitor. After all, there are quite a few prop trading companies out there. Apex Trader Funding strives to avoid such scenarios, which is why it provides high-quality 24/7 technical support that’s available through three channels: phone, live chat, and tickets.

Pros

- A trader can ask for help 24/7

- This prop company's technical support team also works 24/7

- Three communication channels ensure convenient access to support

Cons

- During rush hour, delays in receiving responses from specialists are common.

Current contact channels for Apex Trader Funding client service:

Call center.

Support portal tickets.

Live chat on the website and in the user account.

Apex Trader Funding has official profiles on the following social media platforms: YouTube, Facebook, and Instagram. You can also contact technical support through them. It is recommended to subscribe to any of the company's accounts to stay up to date with its latest events.

Contacts

| Foundation date | 2020 |

|---|---|

| Registration address | 2028 E. Ben White Blvd | Ste 240 -9873 | Austin, TX 78741 |

| Official site | https://apextraderfunding.com/ |

| Contacts |

1-855-273-9873

|

Education

Many traders want to work with prop trading companies but are not confident in their skills and experience. Therefore, if there is an opportunity for intensive training, they will gladly take it. Moreover, continuous learning is beneficial for everyone, so intermediate players and even professionals often enroll in specialized programs to learn something new and improve their skills. Apex Trader Funding offers an excellent opportunity to learn. Its study course comprises comprehensive educational courses where market experts teach users everything from the basics of trading to life hacks and the latest trading methods. Participation is free, but you must be an existing client of the company and apply in advance. This is because the number of students in the course is limited, and the courses run in strictly defined time periods.

Professional players are unlikely to find anything useful if they enroll in Apex Trader Funding's training courses. However, for beginners and intermediate-level traders, this opportunity is simply invaluable because it allows them to explore modern markets in all their nuances.

Comparison of Apex Trader Funding to other prop firms

| Apex Trader Funding | FundedNext | Hola Prime | SabioTrade | OANDA Prop Trader | Lark Funding | |

| Trading platform |

Ninja Trader, Rithmic, RTrader, TradingView, Tradovate | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | MetaTrader5, MT5 Webtrader | cTrader, DXTrade |

| Min deposit | $137 | $32 | $48 | $119 | $35 | $60 |

| Leverage | No |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:50 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | No | 110% / 100% |

| Order Execution | Market Execution | N/a | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of Apex Trader Funding

Apex Trader Funding rightfully holds one of the top positions in its market segment because it offers objectively attractive conditions. A wide selection of plans, an optimal subscription fee, a profit split of 90%/10%, and the absence of additional costs are indeed excellent features. Equally important is the provision of favorable trading conditions, at which Apex Trader Funding also excels. With four trading platforms and broker partner fees lower than the market average, this prop trader provides robust support. The prop trading company places a strong emphasis on client service, and its specialists are ready to assist at any time. The Apex Trader Funding website includes a detailed FAQs section, ensuring transparency and clarity for traders.

Apex Trader Funding by the numbers:

The company is present in over 150 countries.

There are 30,000 clients.

No initial deposit is required.

There are 8 plans available for traders.

Referral payouts are 15%.

Apex Trader Funding is a proprietary trading company for futures trading

Futures contracts have their unique characteristics, and many traders prefer to work with this category of financial instruments. Apex Trader Funding offers contracts for currencies, stocks, interest rates, agricultural products, energies, metals, and cryptocurrencies. This includes micro-futures contracts as well. It's a diverse and varied pool that allows traders to employ nearly any trading style or method. Furthermore, the variety of assets enables traders to create a diversified portfolio, thereby reducing trading risks.

Apex Trader Funding’s analytical services:

The challenge lasts only 7 days, as opposed to the 1-2 months at most other prop trading companies. Given the low complexity of the challenge, even traders with minimal experience can successfully complete it.

If a user exceeds the overall drawdown or fails to reach the required profit level, they can always reopen their account for a fee of $80, with no restrictions.

The referral program enables users to earn 15% of the monthly fee of their referred clients, as well as 15% of each account reopening by those referrals. There's no limit to the number of referrals, and any means can be used to attract them.

Advantages:

The first $25,000 in profits are retained in full by the trader, without any payments to the prop company. Afterward, the trader’s share amounts to 90%.

There is no initial deposit or additional expenses. There is only a subscription fee, the amount of which depends on the chosen plan.

The prop company's pool includes a variety of futures from different groups, expanding the trader's strategic possibilities and allowing them to reduce risks through a high-quality, diversified portfolio.

Apex Trader Funding does not restrict its clients, as they can engage in scalping, hedging, news trading, and other methods.

Technical support is available 24/7. You can reach out to the managers by phone or through live chat on the website.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i