According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $57

- MetaTrader5

- TradeLocker

- Match Trader

- Weekend trading is allowed, EAs are allowed, and stop losses are optional.

- Up to 1:100

Our Evaluation of AquaFunded

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

AquaFunded is a high-risk prop trading company with the TU Overall Score of 2.85 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by AquaFunded clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this company, as, according to reviews, most clients are not satisfied with the firm.

AquaFunded is geared toward experienced traders, offering favorable trading conditions, flexible funding models, and fast payouts. However, less experienced traders should be aware of certain limitations.

Brief Look at AquaFunded

AquaFunded, a Dubai-based proprietary trading firm, offers funding up to $400,000, scalable to $2 million. Payout rates are 90% for evaluation phase programs, 95% for instant funding, and 100% for an optional additional fee. AquaFunded provides one-, two-, and three-phase evaluation challenges, with funded amounts ranging from $5,000 to $200,000. Instant funding programs (Standard and Pro) are also available, with funding from $2,500 to $100,000. While AquaFunded works with traders globally, including those in the EU and the U.S., its services are unavailable in certain countries, such as Japan, Bulgaria, Vietnam, Thailand, Albania, and Brazil.

- Variety of funding models.

- High profit share.

- Wide range of trading instruments.

- There is no time limit for evaluation.

- No educational materials for beginner traders on the website.

- Traders must complete a minimum number of trading days with a small profit to receive payouts.

TU Expert Advice

Financial expert and analyst at Traders Union

AquaFunded offers several noteworthy features. News trading is permitted; however, on funded accounts, opening or closing trades within five minutes before or after major news releases is prohibited. Profits generated during this period will be voided, though the account will remain active. Trading during FOMC (Federal Open Market Committee) statements is strictly prohibited, and any resulting profits will be forfeited.

AquaFunded requires a minimum number of trading days, depending on the account type. Single- and two-phase evaluations require a minimum of three trading days, with at least 0.5% profit achieved each day. Instant funding models require a minimum of five trading days with the same profit requirement. These days need not be consecutive; any day with sufficient trading activity qualifies.

AquaFunded prohibits arbitrage, high-frequency trading, and strategies exploiting data latency, considering them unfair practices. Changing the company-provided password is also prohibited. Furthermore, “all-or-nothing” strategies, where more than 80% of the margin is deployed in a single trade, are forbidden due to their incompatibility with sound risk management.

AquaFunded Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 5 (МТ5), Match-Trader, TradeLocker |

|---|---|

| 📊 Accounts: | Instant Standard, Instant Pro, 1-Step, 2-Step Standard, 2-Step Pro, 3-Step |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: |

Deposit: Visa, Mastercard, Maestro, American Express, Apple Pay, cryptocurrencies Withdrawal: bank transfer and cryptocurrencies via Riseworks |

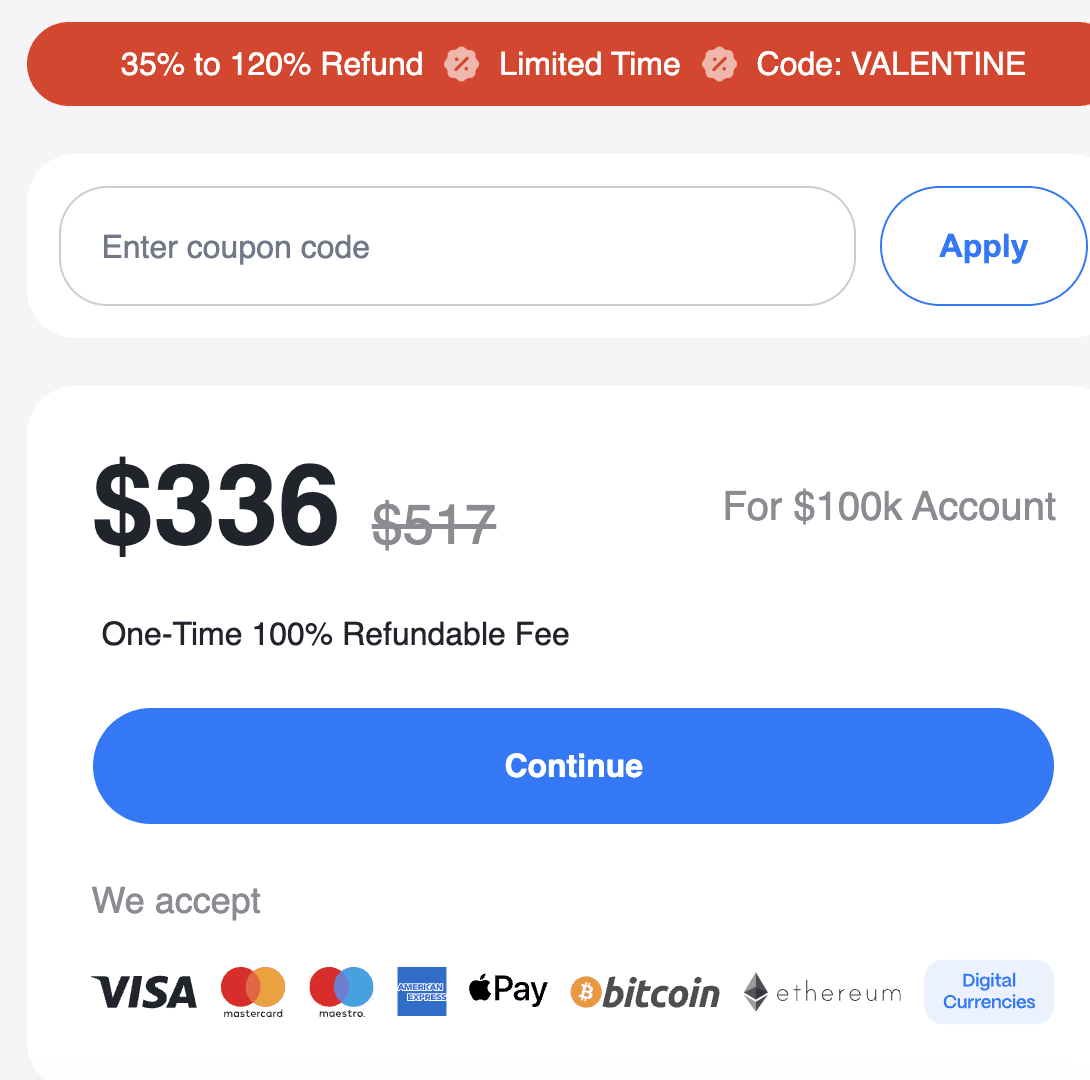

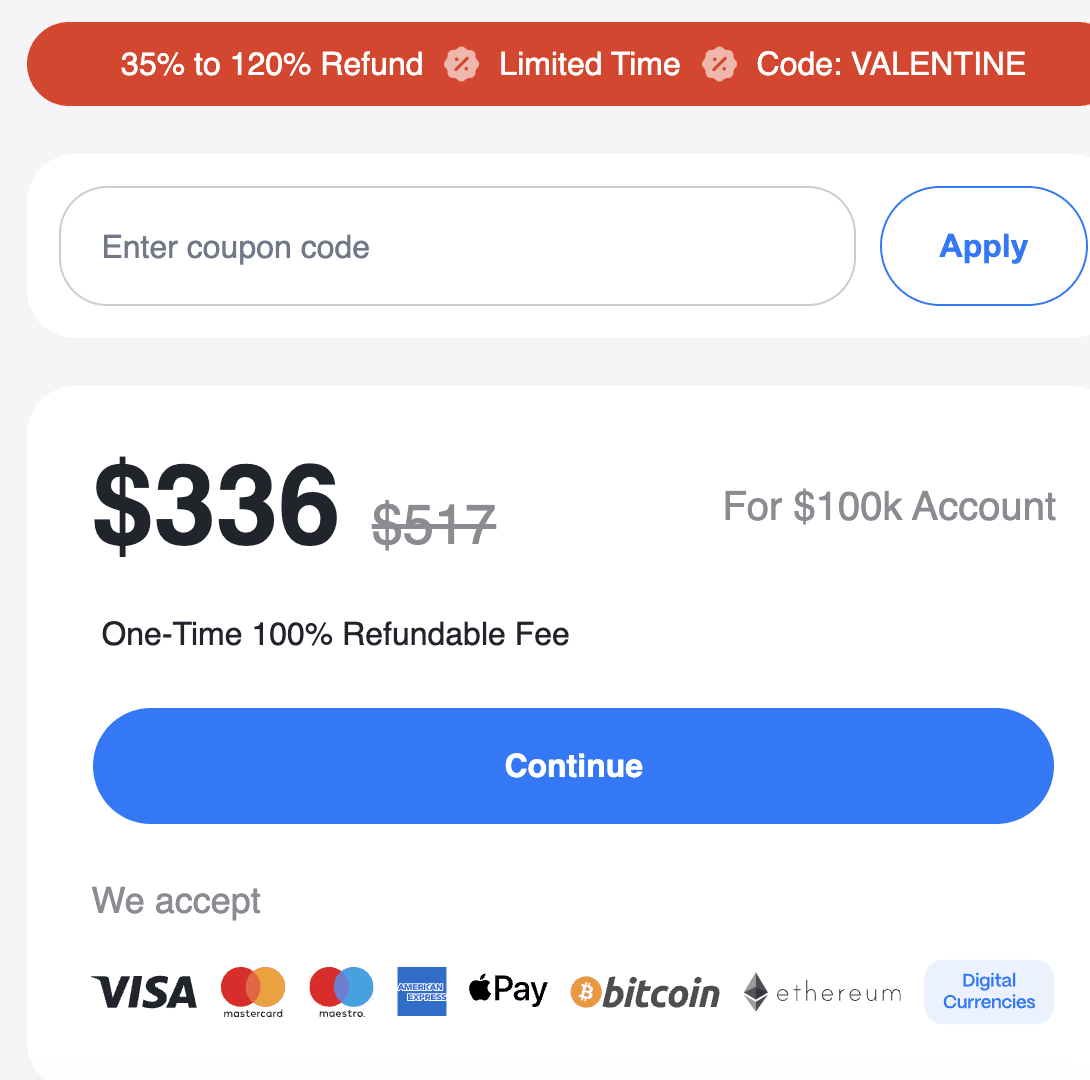

| 🚀 Minimum deposit: | $57 (discounted to $37) |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | Floating from 0.0 pips |

| 🔧 Instruments: | Forex, indices, commodities, cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market, Limit |

| ⭐ Trading features: | Weekend trading is allowed, EAs are allowed, and stop losses are optional. |

| 🎁 Contests and bonuses: | Yes |

The maximum leverage for evaluation accounts is as follows: Forex – 1:100, indices and commodities – 1:20, crypto – 1:2. The maximum leverage after funding is: Forex – 1:50, indices and commodities – 1:10, crypto – 1:2. AquaFunded does not impose restrictions on holding positions overnight or over the weekend. Cryptocurrency trading on weekends is also allowed. There are no limitations on the maximum lot size. U.S. residents and citizens cannot use the MT5 platform.

AquaFunded Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

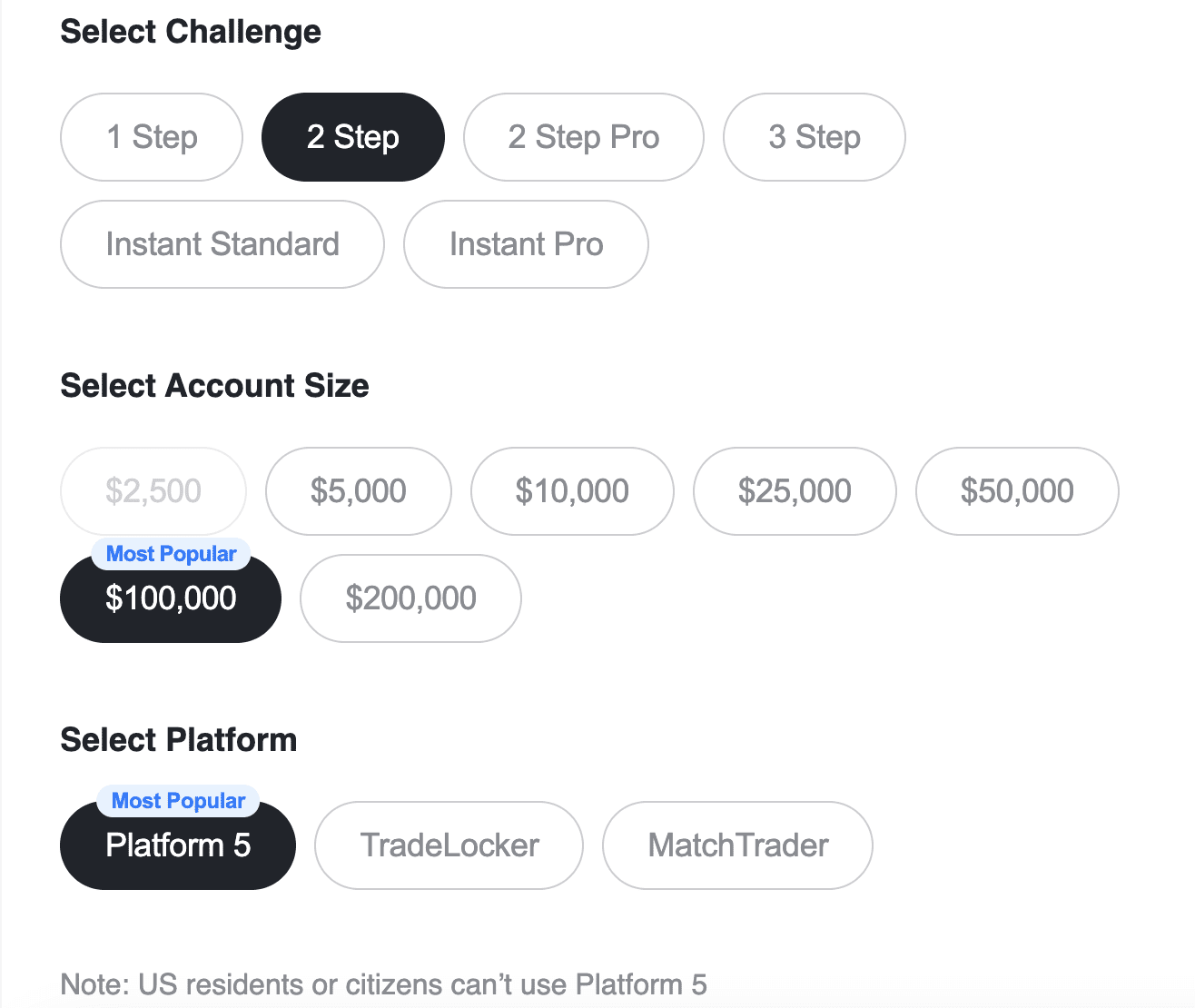

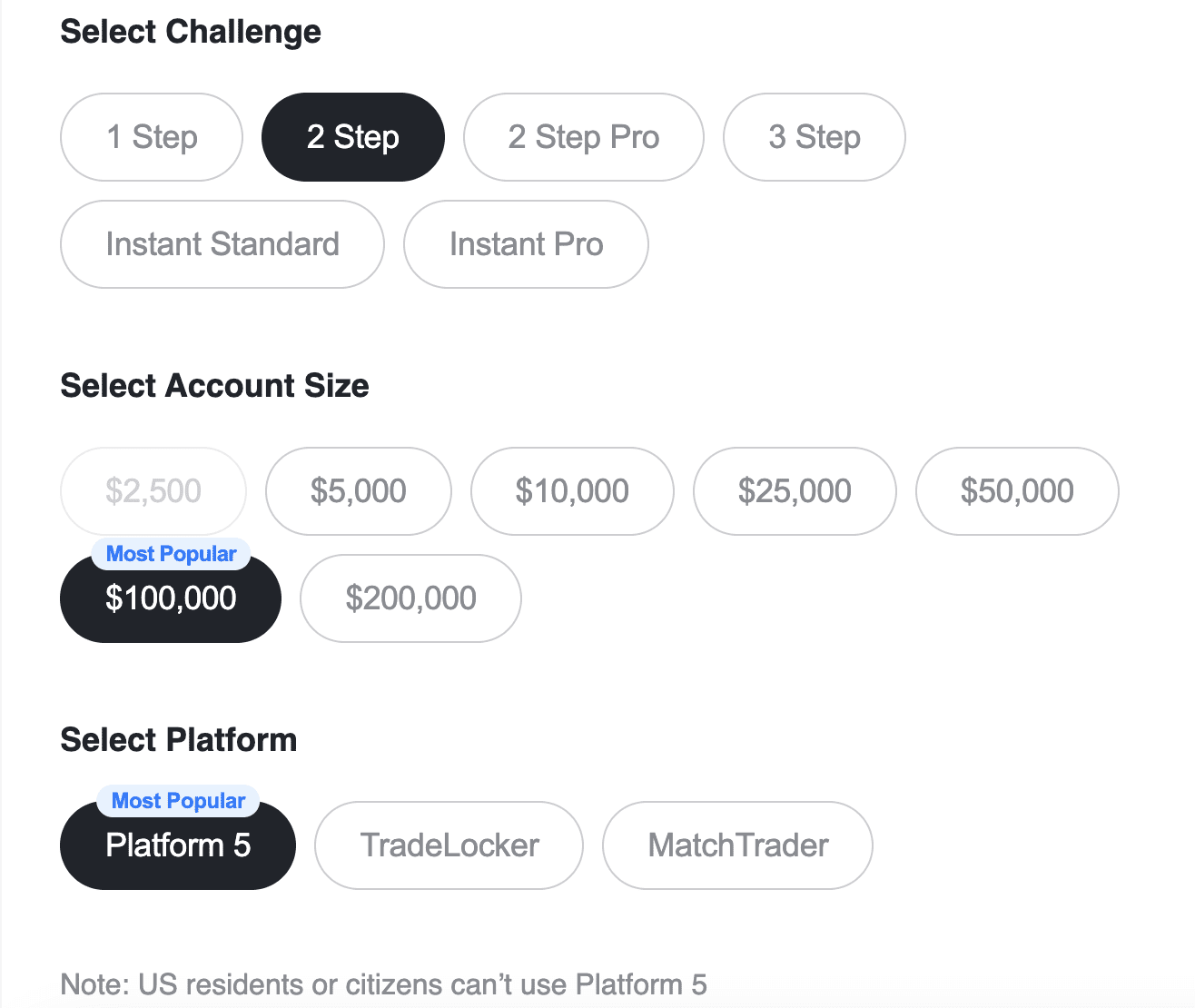

Challenge rules and pricing

AquaFunded provides access to funding up to $2 000 000, with challenges requiring at minimum of 3 trading days. The entry-level plan starts at $42, and the fee is refundable if the challenge is successfully completed.

- Low entry cost — from $42

- Instant funding available

- High funding potential — up to $2 000 000

- No demo account provided

- No free evaluation option

AquaFunded Challenge fees and plans

We compared AquaFunded’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | Daily loss,% | Max. loss, % |

| 1 Step |

|

|

|

|

|

| 2 Step Standard |

|

|

|

|

|

| 2 Step Pro |

|

|

|

|

|

| 3 Step |

|

|

|

|

|

| Instant Standard |

|

|

|

|

|

| Instant Pro |

|

|

|

|

|

What’s the minimum trading period for AquaFunded’s challenge?

A minimum of 3 trading days is required, regardless of how quickly you reach the profit target.

Does AquaFunded offer a free evaluation?

No, AquaFunded does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at AquaFunded?

Yes, AquaFunded offers instant funding. Details may vary by plan, so we recommend checking the latest terms on the company’s official website.

Trading rules

AquaFunded outlines the main rules for funded accounts, including a max. loss of 5% and a daily loss limit of 3%. The firm also restricts certain trading strategies, which are detailed below.

- Copy trading allowed

- News trading allowed

- Scalping allowed

- Strict max loss

AquaFunded trading conditions

We compared AquaFunded’s leverage and trading conditions with competitors to help you better understand how it measures up.

| AquaFunded | Hola Prime | SabioTrade | |

| Max. loss, % | 5 | 5 | 6 |

| Max. leverage | 1:100 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | Yes | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | Yes | No | No |

Deposit and withdrawal

AquaFunded earned a Low score based on how smoothly and conveniently traders can deposit and withdraw funds.

AquaFunded's limited selection of payment methods and supported currencies may reduce its convenience and global accessibility.

- Bank сard deposits and withdrawals

- Bitcoin (BTC) supported

- USDT (Tether) supported

- No on-demand withdrawals

- Limited deposit and withdrawal options

Deposit and withdrawal options

To help you evaluate how AquaFunded performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

AquaFunded Payment options vs Competitors

| AquaFunded | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | No | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared AquaFunded with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| AquaFunded | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | No | Yes | No |

| Biweekly | Yes | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

AquaFunded offers the following base account currencies:

Trading Account Opening

New clients must register and make a payment to access their user account on the AquaFunded website. Step-by-step instructions are as follows:

Click "Get Funded."

Select a program, funding amount, and trading platform.

Choose additional features.

Enter a discount coupon and complete the challenge purchase payment.

The final step is filling out the registration form. Provide your email address, first name, last name, address, and phone number.

Regulation and safety

AquaFunded (legal entity – Aqua Funded FZCO) is registered in Dubai, United Arab Emirates. It is not a broker and does not accept client deposits. The company's activities are limited to simulated prop trading, which does not require regulatory authorization.

Advantages

- Cryptocurrency deposits and withdrawals are available

- Trading with leverage up to 1:100 is allowed.

Disadvantages

- Traders cannot complain to regulators

- Payouts can be canceled without prior notice

Markets and tradable assets

AquaFunded has a score of 3.5/10, which corresponds to a Low assessment of its market and asset offering.

- Indices available

- Crypto trading available

- Forex trading supported

- CFDs not offered

- Stock trading not allowed

Tradable markets

We compared the range of tradable instruments offered by AquaFunded with two leading competitors to highlight the differences in market access.

| AquaFunded | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | No | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | No | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

AquaFunded allows the use of Expert Advisors (EAs), enabling traders to implement automated strategies. However, there are restrictions on trade copying: traders can only duplicate positions across their own accounts - evaluation, funded, or external accounts. Copying trades from other traders is strictly prohibited.

AquaFunded’s affiliate program

AquaFunded’s referral program allows registered clients to earn by recommending the platform to other traders. Participants receive rewards for each referred client who makes a purchase, along with additional bonuses for achieving certain milestones.

Referral program conditions:

-

Standard commission is 15% of the referral’s purchase amount.

-

$50 bonus for 10 referrals, in addition to commissions

-

Increased commission to 20% for 50 referrals

-

Official partnership with the company for 100 referrals, with personalized conditions.

This program is ideal for those looking to monetize their audience or introduce prop trading opportunities to colleagues. The minimum payout amount is $100.

Customer support

AquaFunded provides 24/7 client support.

Advantages

- 24/7 access to support

- Chat is available on the website

Disadvantages

- The company does not serve traders over the phone

Contact methods are:

-

Online chat on the website.

-

Discord.

-

Email.

-

Contact form in the support section.

Additionally, the company can be reached via Telegram, X (Twitter), and Instagram. AquaFunded also has a YouTube channel.

Contacts

| Official site | https://www.aquafunded.com/ |

|---|---|

| Contacts |

Education

The company's official website does not provide educational materials for beginners or traders with minimal experience. The FAQs section briefly outlines the funding conditions, trading rules, and strategy requirements.

New traders must rely on external sources to obtain the necessary educational information.

Comparison of AquaFunded to other prop firms

| AquaFunded | FundedNext | Hola Prime | SabioTrade | The Trading Pit | E8 Markets | |

| Trading platform |

MetaTrader5, TradeLocker, Match Trader | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | MetaTrader4, MetaTrader5, BOOKMAP, R Trader, QUANTOWER | MT5, Match Trader |

| Min deposit | $57 | $32 | $48 | $119 | $99 | $33 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:30 |

From 1:1 to 1:50 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | No | No |

| Order Execution | Market Execution | N/a | Market Execution | Market Execution | No | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed AquaFunded review

AquaFunded introduced Wave Stop, a risk management system designed to protect traders from excessive losses. If open positions on a funded account reach a loss of 2% of the account balance, the system automatically closes all open trades. After that, the trader can immediately resume trading. However, repeated Wave Stop activations may result in a reduced profit share or account closure. When purchasing an account with AquaFunded, traders can choose additional options: 100% profit instead of the standard 90-95% split or receiving their first payout in 7 days instead of 14. Activating these options increases the challenge cost by 15% for each add-on or by 25% for both benefits.

AquaFunded by the numbers:

-

Total payouts exceed $2.5 million.

-

More than 28,000 traders have purchased a challenge.

-

Up to 120% refund on the initial deposit.

-

90-100% profit share for traders.

-

Guaranteed withdrawals within 48 hours.

AquaFunded is a prop company with unlimited valuation time and capital appreciation options

AquaFunded offers unlimited time for evaluation and an opportunity to scale capital. Traders can hold multiple evaluation accounts simultaneously. Funded accounts can be merged up to a $400,000 limit, but this rule does not apply to instant funding accounts. The scaling plan allows traders to increase their account balance up to $2 million. To qualify, a trader must achieve 12% profit within 3 months, after which the account balance increases by 25% of the initial deposit.

Since there is no time limit for evaluation, retries are not provided. However, traders must remain active by placing at least one trade every 30 days. AquaFunded allows hedging and the Martingale strategy and does not require mandatory stop-loss usage.

AquaFunded’s analytical services:

-

Payout guarantee: If a withdrawal is not processed within 48 hours, the trader receives $500.

-

Refund up to 120% of the initial deposit after completing the evaluation phase and receiving four profit withdrawals.

-

Promo codes for discounts and increased refund percentages on challenge fees.

-

24/7 professional support through multiple communication channels.

Advantages:

Fast withdrawals every two weeks, with the first possible after 7 days.

Floating ECN spreads starting from 0.0 pips.

No hidden rules, lot size restrictions, or mandatory stop-losses.

Funding is available without an evaluation phase.

Unique risk management system to prevent major losses.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i