According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $187

- MT4

- Only one type of account

- Four balance options

- Initial fee is refundable subject to successful completion of the challenge

- Profit split is 85%

- Scaling is available

- All trading strategies, advisers, bots, and copy trading are available

- Trading through MT4 only

- Up to 1:100

Our Evaluation of Blue Guardian Capital

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Blue Guardian Capital is one of the best proprietary trading firms in the financial market with the TU Overall Score of 9.43 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Blue Guardian Capital clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the firm’s clients are fully satisfied with the company.

Blue Guardian Capital offers standard proprietary trading mechanisms on favorable conditions. Traders are provided with only one type of account with balances that vary up to $200,000, plus the possibility of scaling. Partners trade through a reliable and trusted broker with ECN spreads, five groups of financial instruments, and leverage of up to 1:100. Traders need to be active at least 5 days a month and monitor the drawdown, no other restrictions are imposed. They can trade during the weekends, trade news, or use advisors and services for copy trading. The firm offers a partnership program, and there are also regular promotions and bonuses.

Brief Look at Blue Guardian Capital

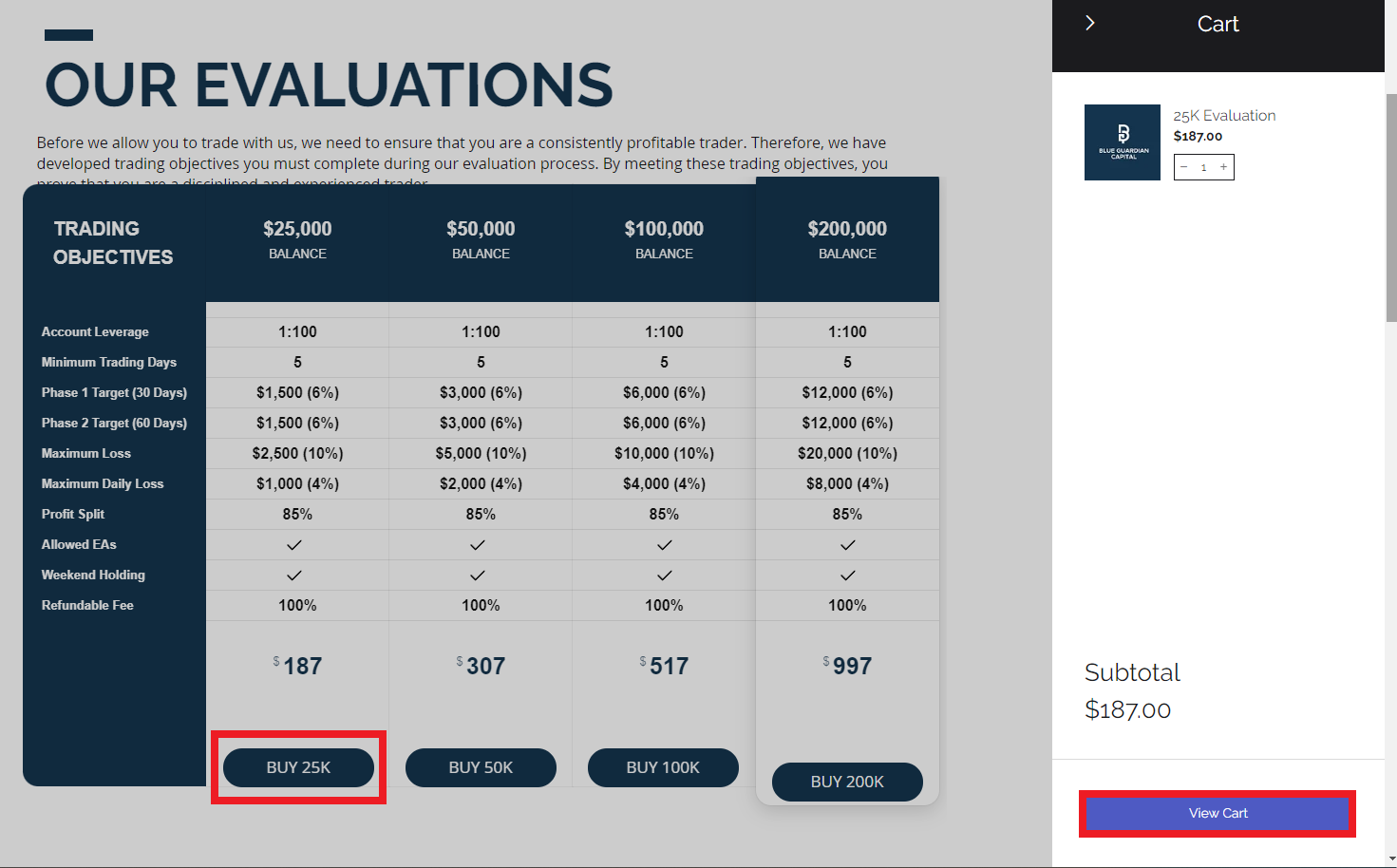

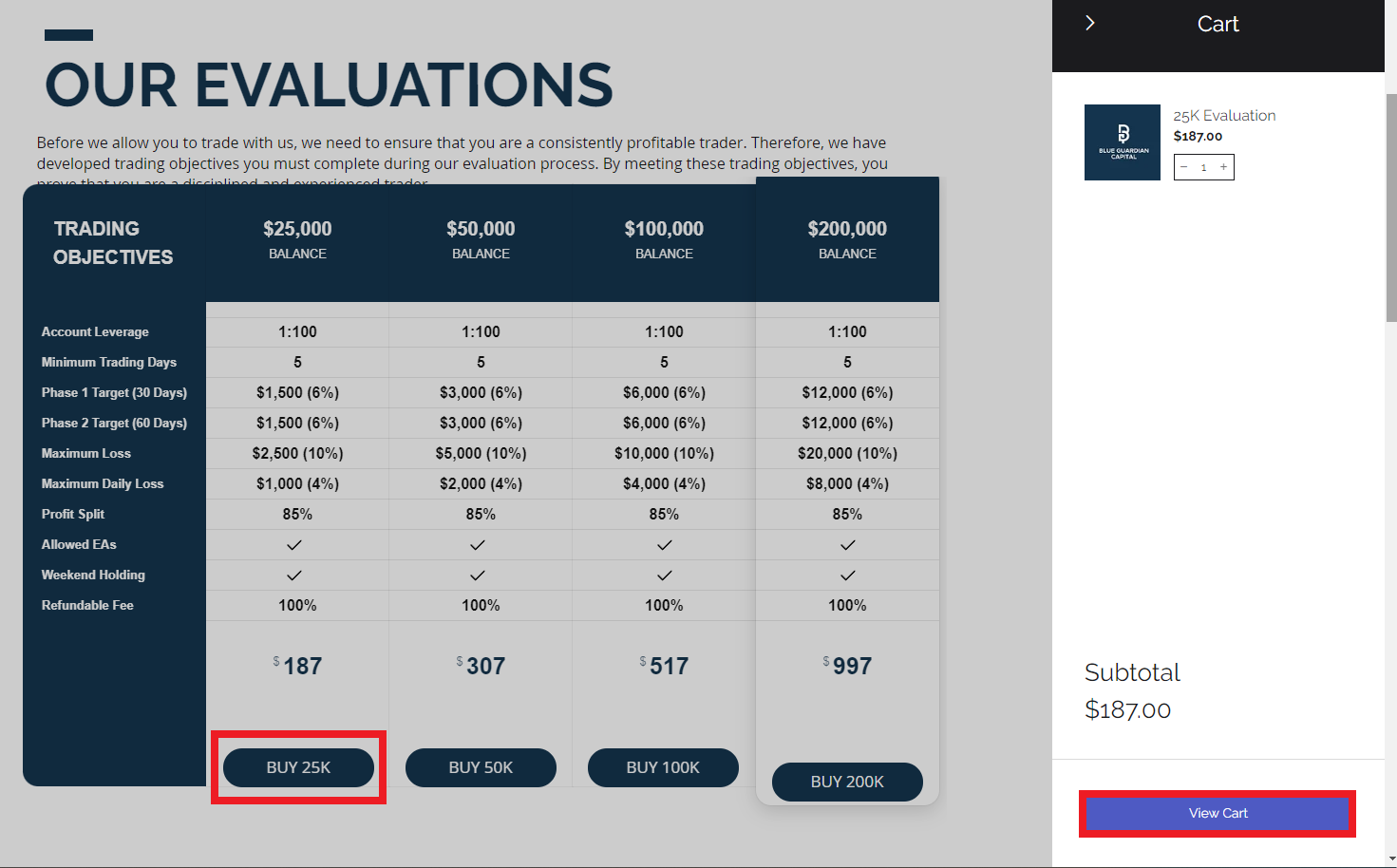

The proprietary (prop) firm Blue Guardian Capital is registered in the UK and is partnered with the broker Purple Trading Seychelles. The platform provides traders with funding ranging from $25,000 to $200,000, with the ability to scale up to $1,800,000. Traders need to pay an initial fee of $187 to $997 depending on the funded balance, and complete the two-phase challenge on demo accounts, earning the profit target. After that, they get live accounts. Partners’ profit split is 85% from the first day of trading. They can trade currencies, cryptocurrencies, indices, commodities, and gold. Leverage is determined by the asset with a maximum of 1:100. Blue Guardian Capital offers ECN (Electronic Communication Network) spreads, providing its partners with the most favorable trading conditions. There is no fee for withdrawing funds, you can use bank cards, e-wallets, or crypto wallets. Withdrawals are available every 14 days with a positive balance of 4%. Traders work without restrictions, using any style or strategy.

- One type of account and four balance options. Traders can receive up to $200,000 immediately upon completing the challenge;

- Partners of the prop firm get the opportunity to scale by trading for 4 months with a positive balance of 4% or more. The amount on the account will increase by 30% each time, and so on up to $1,800,000;

- Hundreds of assets from different groups are available for trading, namely currencies, cryptocurrencies, indices, commodities, and gold;

- Partners are not limited in their choice of strategy. They can scalp, hedge, trade news, or use advisors;

- Copy trading, usage of bots, and other software tools are permitted;

- The profit split is 85% from the first day of trading on a live account;

- The MetaTrader 4 (MT4) platform has many plugins.

- The prop firm provides prompt technical support, which operates 24/7, but there is no call center;

- MetaTrader 4 is convenient and reliable, but many traders are used to other solutions that are not available here;

- Funds can be withdrawn no more than once every 2 weeks.

TU Expert Advice

Financial expert and analyst at Traders Union

Blue Guardian Capital was incorporated in 2019. Its founders are Sean Bainton and Eric Gairns, professional traders with many years of experience. Gairns is a mathematician and has been involved in statistics all of his life. The unique background allowed the founders of the prop firm to clearly define the needs of the target audience. Therefore, since its incorporation, Blue Guardian Capital has had only one type of account with a moderate balance step ranging from $25,000 to $200,000 and the ability to scale up to $1,800,000.

According to Bainton, from the very beginning, they sought to limit their partners as little as possible. If you look at the current trading conditions of the platform, you will understand that everything worked out. Traders can really use many strategic solutions. They can transfer positions, trade during the weekends, trade news, use advisors and bots, or copy trades. You just need to be active for at least 5 days a month and monitor the drawdown. By the way, the drawdown requirements are very loyal. It is up to 10% for the total drawdown and up to 4% for the daily drawdown.

Very few prop trading firms offer similar conditions. Traders Union also wants to draw attention to its loyal fee policy. The initial fee of $187 is fully refundable upon successful completion of the challenge. Further, the prop firm’s profit split is 15%, which is more profitable in comparison with most of its competitors. The firm charges a universal fee of $3.50, there are no other fees. Since the firm works with Purple Trading Seychelles, there is no question of security and trust.

In conclusion, TU notes that Blue Guardian Capital has no constructive disadvantages. In some reviews, the absence of other platforms, except for MT4, is indicated as a minus. Others are unhappy that there is no call center. However, the 24/7 live chat is ideal for client support issues. This prop firm offers bonuses and regular promotions that lower the entry threshold and make trading even more profitable. Blue Guardian Capital can be recommended for review by traders of all levels.

Blue Guardian Capital Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | Standard |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank cards, e-wallets, and crypto wallets |

| 🚀 Minimum deposit: | $187 |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | No |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, indices, commodities, and gold |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: |

Only one type of account; Four balance options; Initial fee is refundable subject to successful completion of the challenge; Profit split is 85%; Scaling is available; All trading strategies, advisers, bots, and copy trading are available; Trading through MT4 only |

| 🎁 Contests and bonuses: | Yes |

Initial fees of all prop trading firms depend on the type of account and the balance. Sometimes, instead of a one-time fee, a platform charges a monthly subscription fee. Blue Guardian Capital offers standard conditions. There is a fixed initial fee, with no additional costs for traders. Moreover, the fee is refundable subject to successful completion of the challenge. As for leverage, it is naturally determined by the group of assets with which traders work. For example, leverage of 1:100 is available for currencies; for cryptocurrencies, it is 1:2; indices are traded with leverage up to 1:50; and for commodities and gold the indicator is 1:25. Finally, technical support is an important issue that Blue Guardian Capital solved very simply. It offers 24/7 communication via email and live chat, tickets are also available.

Blue Guardian Capital Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Challenge rules and pricing

Blue Guardian Capital provides access to funding up to $2 000 000, with challenges requiring at minimum of No time limits trading days. The entry-level plan starts at $50, and the fee is refundable if the challenge is successfully completed.

- High funding potential — up to $2 000 000

- Low entry cost — from $50

- No free evaluation option

- No demo account provided

Blue Guardian Capital Challenge fees and plans

We compared Blue Guardian Capital’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | 2 - Profit target, $ | Daily loss,% | Max. loss, % |

| Unlimited |

|

|

|

|

|

|

| Rapid |

|

|

|

|

|

|

| 3 Step |

|

|

|

|

|

|

What’s the minimum trading period for Blue Guardian Capital’s challenge?

No minimum trading days. You can complete the challenge as soon as you reach the profit target.

Does Blue Guardian Capital offer a free evaluation?

No, Blue Guardian Capital does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at Blue Guardian Capital?

No, Blue Guardian Capital does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

Blue Guardian Capital outlines the main rules for funded accounts, including a max. loss of 6% and a daily loss limit of 4%. The firm also restricts certain trading strategies, which are detailed below.

- Scalping allowed

- Trading bots (EAs) allowed

- News trading allowed

- Multiple trading restrictions may apply

Blue Guardian Capital trading conditions

We compared Blue Guardian Capital’s leverage and trading conditions with competitors to help you better understand how it measures up.

| Blue Guardian Capital | Hola Prime | SabioTrade | |

| Max. loss, % | 6 | 5 | 6 |

| Max. leverage | 1:100 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | Yes | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | Yes | No | No |

Deposit and withdrawal

Blue Guardian Capital earned a Medium score based on how smoothly and conveniently traders can deposit and withdraw funds.

The deposit and withdrawal options at Blue Guardian Capital meet most standard requirements and are in line with what many prop firms provide.

- Weekly payouts

- USDT (Tether) supported

- Bank сard deposits and withdrawals

- Bitcoin (BTC) supported

- Payoneer not supported

- Limited deposit and withdrawal options

- No on-demand withdrawals

Deposit and withdrawal options

To help you evaluate how Blue Guardian Capital performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

Blue Guardian Capital Payment options vs Competitors

| Blue Guardian Capital | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | No | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared Blue Guardian Capital with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| Blue Guardian Capital | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | Yes | Yes | No |

| Biweekly | Yes | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

Blue Guardian Capital offers the following base account currencies:

Trading Account Opening

To start trading with this prop firm, register on its website and pay for the challenge. Traders Union has prepared this step-by-step guide for your convenience.

Go to the main page of the Blue Guardian Capital website and click the "Get Started" button in the main block.

Learn about the balance options and trading conditions. Choose the balance that suits you. A cart menu with the initial fee for the selected balance will appear on the right. Click the "View Cart" button.

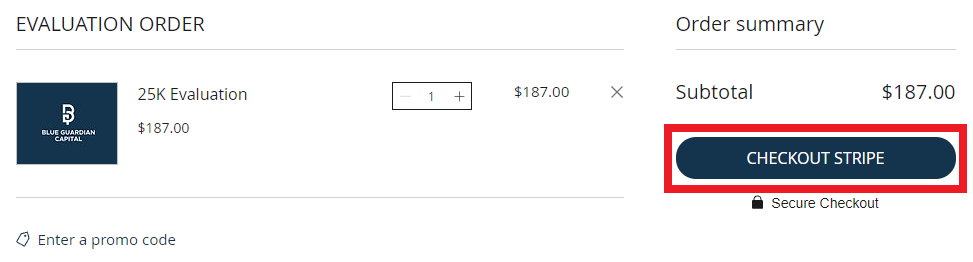

Check the payment amount and click the "Checkout Stripe" button.

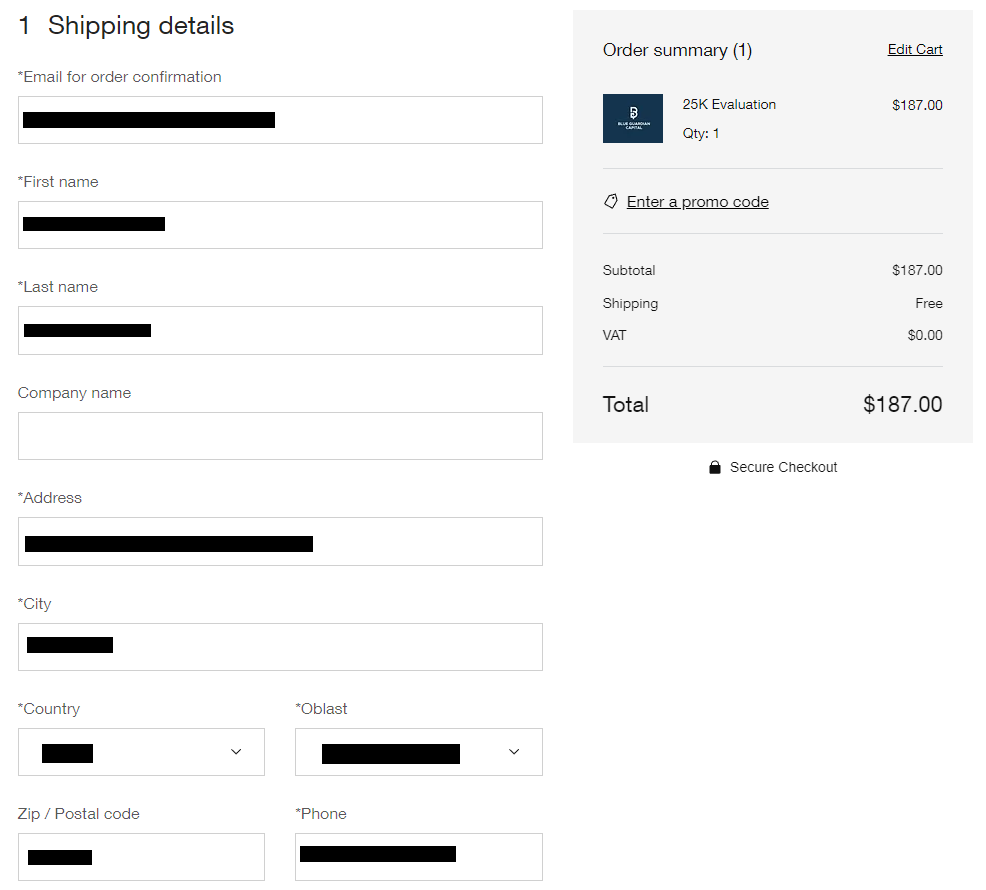

Enter your email, first and last names, and registration address with its postal code. Also enter your mobile phone number. After that, select a payment option and follow the instructions on the screen. As soon as the payment is credited to the account of the prop firm, you will get access to your user account.

Features of Blue Guardian Capital’s user account:

-

The dashboard displays current information about the account with the ability to detail trading achievements;

-

The trader sees information about all transactions, including the payment of fees and withdrawal of funds with the current status;

-

Partners of the prop firm can view the history of their transactions and open positions;

-

In the user account, it is possible to change registration and contact details, as well as set security parameters.

Regulation and safety

Blue Guardian Capital is officially registered in the UK and operates within the framework of regional financial legislation. Such platforms do not need international regulation, because they do not bring transactions of their partners to the interbank markets. This is done by its broker, Purple Trading Seychelles. The broker is regulated, the relevant documents are presented on its official website. Therefore, partners of Blue Guardian Capital can have no doubt that their transactions are brought to the interbank market and are executed on general terms.

Advantages

- Traders can contact the prop firm’s technical support

- It is possible to contact the broker’s lawyers

Disadvantages

- It is impossible to get help from regional financial institutions, if you don’t reside in Great Britain

Markets and tradable assets

Blue Guardian Capital has a score of 7/10, reflecting a strong variety of markets and assets available for trading.

- CFDs offered

- Forex trading supported

- Crypto trading available

- Stock trading not allowed

- Futures not available

Tradable markets

We compared the range of tradable instruments offered by Blue Guardian Capital with two leading competitors to highlight the differences in market access.

| Blue Guardian Capital | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | No | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

Prop trading firms usually do not offer investment solutions. Their partners cannot, for example, trade dividend stocks or invest in cryptocurrency staking. Prop platforms provide experienced traders with capital for trading, and everything focuses on this. Partnership (referral) programs are sometimes considered an option for passive income. In fact, such earnings are only relatively passive, because in order to receive significant income, you need to communicate a lot on the internet or have a popular blog.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Referral program form Blue Guardian Capital:

Each partner of the prop firm receives a personal link and can freely place it on the internet or send it via instant messengers and by email. Users who go to the platform through this link become the referee of its owner. If they pay the initial fee within 30 days, the owner of the link receives 20% of the amount. You can have any number of referrals. Bonus funds are not automatically transferred to the main account, but they are displayed in the user account. A trader can submit a request by email and receive bonus funds at the beginning of the next month.

Customer support

Technical support is needed for traders to receive professional help in situations that they cannot handle on their own. Regardless of the intuitiveness of the website and the details of the FAQs, partners of the firm always have questions. That is why Blue Guardian Capital offers 24/7 technical support available through the main communication channels, namely email, live chat, and tickets.

Advantages

- Non-partners can contact tech support

- All communication channels are available 24/7

Disadvantages

- Call center is not available

To contact the Blue Guardian Capital client support team, use one of the following communication channels:

-

email;

-

live chat on the website and in the user account of a trader;

-

tickets;

The firm has an official Twitter channel and an Instagram profile, where traders can learn the latest news and promotions.

Contacts

| Foundation date | 2018 |

|---|---|

| Registration address | 2 Highlands Court, Cranmore Avenue, Solihull, West Midlands, United Kingdom, B90 4LE |

| Official site | https://www.blueguardiancapital.com/ |

| Contacts |

Education

Prop firms are interested in their partners trading professionally and successfully because the higher the partner's profit is, the more income the platform receives. In this regard, some of them develop their own training systems. They offer detailed guides and hold webinars with experienced market participants to improve the skills of their traders. But Blue Guardian Capital takes a different approach.

Blue Guardian Capital assumes that its partners are experienced traders who do not need basic or advanced training. And this is logical, because in order to complete the two-phase challenge, you need to have fundamental knowledge and experience in trading.

Comparison of Blue Guardian Capital to other prop firms

| Blue Guardian Capital | FundedNext | Hola Prime | SabioTrade | Leeloo Trading | Lark Funding | |

| Trading platform |

MT4 | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | R Trader Pro, Ninja Trader | cTrader, DXTrade |

| Min deposit | $187 | $32 | $48 | $119 | $26 | $60 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

No |

From 1:1 to 1:50 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | No | 110% / 100% |

| Order Execution | No | N/a | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of Blue Guardian Capital

For a firm incorporated only 4 years ago, Blue Guardian Capital has a lot of achievements that allow it to stand out from its competitors. For example, the firm is partnered with a well-known Seychelles broker offering hundreds of highly leveraged trading instruments. At the same time, the platform has very favorable conditions for spreads and fees, which attracts partners worldwide. Another important point is that the firm practically does not limit its traders at the funding stage. They need to monitor the total and daily drawdowns and trade for at least 5 days within a 30-day cycle. There are no other conditions. News trading, transfer of positions, copy trading, and advisors are available. Few prop trading firms give their partners this freedom of action. The platform has a convenient user account with an intuitive dashboard. Integration with MT4 is quick and technically simple.

Blue Guardian Capital by the numbers:

-

Minimum deposit is $187;

-

Immediate balance is up to $200,000;

-

The partners’ profit split is 85%;

-

Maximum drawdown is 10%;

-

Leverage is up to 1:100.

Blue Guardian Capital is a prop trading firm for comfortable trading of many instruments

Some firms that provide their capital to traders focus on a specific group of assets, and most often these are currency pairs. Sometimes stocks and indices, as well as cryptocurrencies, are added. Blue Guardian Capital offers several hundreds of the most sought-after instruments from the Purple Trading Seychelles pool. These are currency pairs, cryptocurrencies, indices, commodities, and gold. Other precious metals are not available. Why is a wide choice an advantage? It is because traders do not want to limit themselves; they desire to work with the instruments that are comfortable for them. In addition, the more assets you use in trading, the more successfully the main risks are diversified. And you definitely want to lower them when trading with leverage of up to 1:100.

Useful features of Blue Guardian Capital:

-

Traders can choose one of four balance options, namely $25,000, $50,000, $100,000, or $200,000;

-

The two phases of the challenge last a total of 90 days. Profit target for both phases is only 6% of the balance;

-

The traders’ profit split is 85% from the first day of trading at the funding stage;

-

Withdrawal of funds is available once every 14 days. The application is processed within a few hours;

-

Technical support is active 24/7, the most efficient way of communication is via live chat.

Advantages:

The challenge is quite simple, traders do not need to have exceptional experience and unique skills to successfully complete it;

There is no mandatory profit target at the funding stage, traders trade at their own pace. The main thing is to be active for at least 5 days within the month;

Partners of the prop trading firm can trade during the weekends, trade news, and use standard advisors, bots, or other software solutions;

The initial fee is refundable. In the future, the firm’s profit split of 15% and a universal fee of $3.50 are the only expenses of the partner of the prop firm;

Withdrawal of funds is not subject to any fees. Profit can be withdrawn once every 14 days to bank cards, e-wallets, or crypto wallets without limits.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i