According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $49

- MetaTrader4

- MetaTrader5

- No time limits for passing the challenge

- The profit target is 10% in Phase 1 and 5% in Phase 2

- The daily drawdown is 5% and the total drawdown is 10%

- 6 evaluations

- Scaling up to $500,000.

- Up to 1:50

Our Evaluation of IC Funded

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

IC Funded is a prop trading firm with higher-than-average risk and the TU Overall Score of 4.67 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by IC Funded clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable partner with better conditions, as, according to reviews, many clients of this firm are not satisfied with the company’s work.

IC Funded offers attractive trading conditions with a challenge not limited to time and several scalable evaluation plans. The prop firm also offers high leverage and does not restrict any strategies. However, the absence of passive income options and the limited choice of assets can be a disadvantage for some traders.

Brief Look at IC Funded

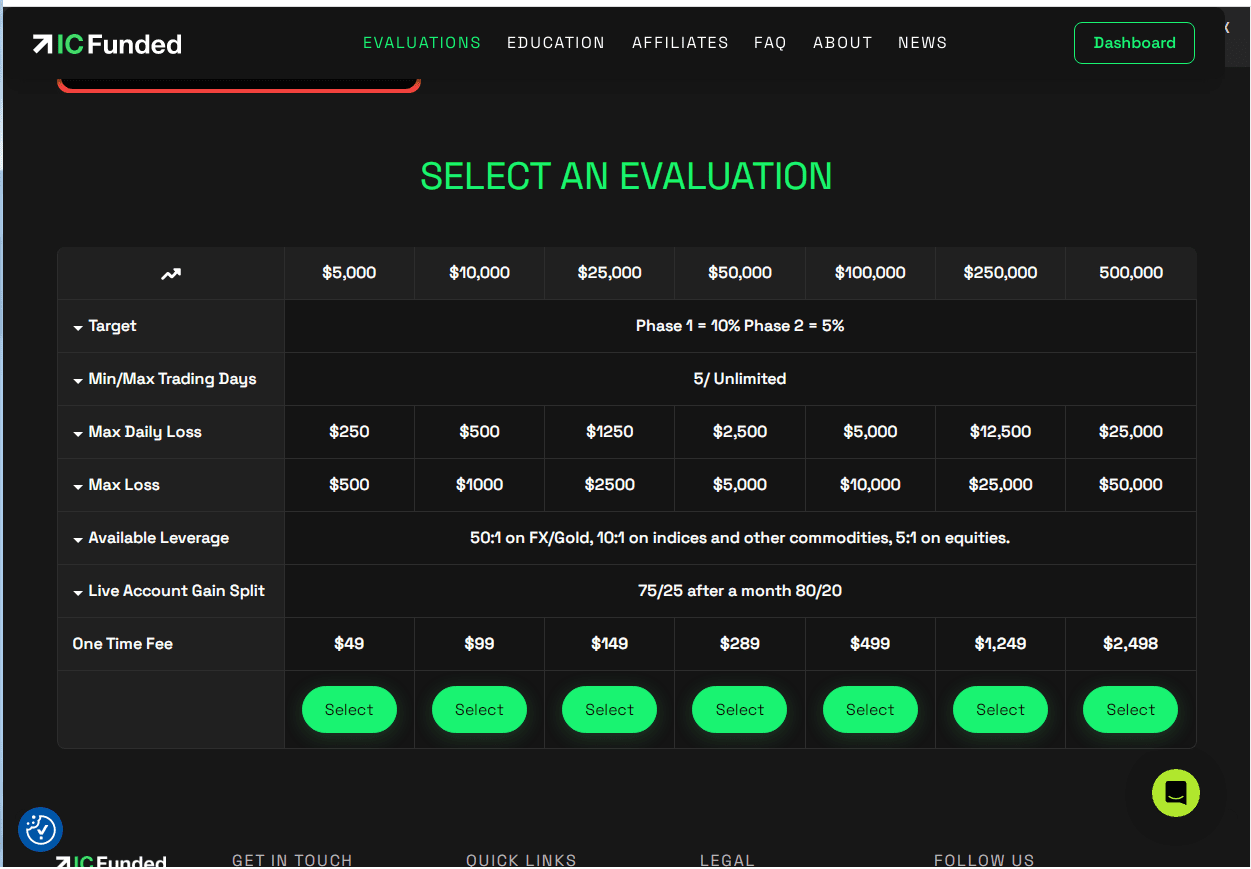

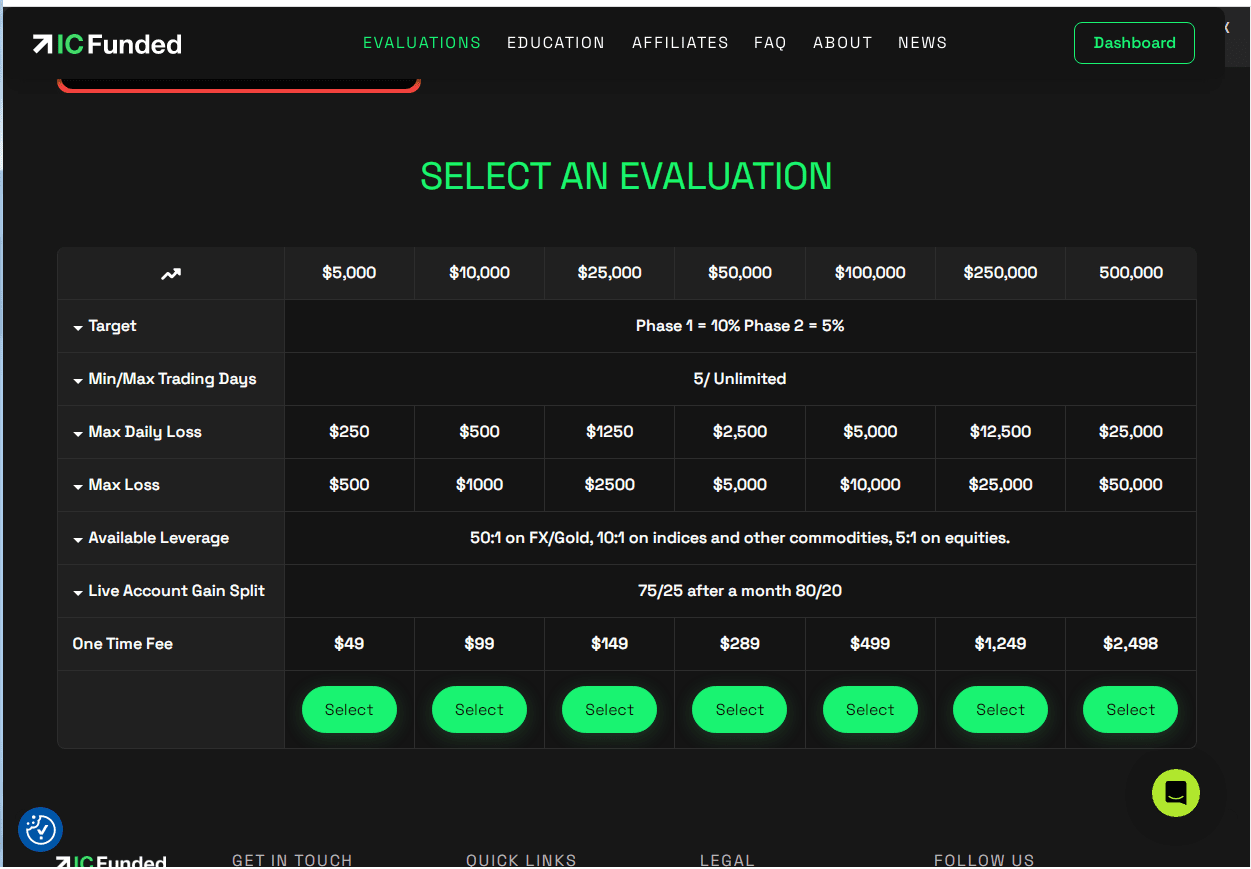

IC Funded is a company offering several levels of financing ranging from $5,000 to $250,000. The maximum account size is $500,000. The minimum initial participation fee is $49. To qualify for the required funding, merchants must complete a two-step challenge. Each phase requires a 10% and 5% profit target, respectively, with a maximum daily drawdown of 5% and a total drawdown of 10%. There are no time limits for the challenge. The leverage is up to 1:50. The initial profit split is 75/25, but successful traders can reach 80% within a month. MetaTrader 4 and MetaTrader 5 trading platforms are available.

- Multiple rating plans up to $250,000 with the option to increase the amount;

- No time limit to meet the challenge;

- Various trading strategies are allowed, including automated ones;

- MT4 and MT5 platforms provide convenient trading conditions;

- Sufficient leverage;

- Trader's profit share is up to 80%.

- No passive income opportunities;

- Limited choice of assets;

- Non-refundable initial fee.

TU Expert Advice

Author, Financial Expert at Traders Union

IC Funded is a proprietary trading firm that provides several evaluation plans ranging from $5,000 to $250,000, with the potential to scale up to $500,000. It utilizes MetaTrader 4 and MetaTrader 5 platforms, offering selection of over 150 instruments, including Forex, cryptocurrencies, and indices. Trading conditions include a profit split starting at 75%, scalable up to 80%, and leverage up to 1:50. There are no time limits on trading challenges, and a variety of trading strategies are permitted, enhancing flexibility.

However, IC Funded does have certain drawbacks, such as a non-refundable initial fee and a limited selection of assets for trading. Both passive income options and some popular trading instruments like options and futures are not available. These conditions may not suit traders who prioritize asset diversity or require refundable upfront fees. Overall, IC Funded may be suitable for experienced traders looking for scalable funding opportunities and flexible trading strategies.

IC Funded Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4 and MetaTrader 5 |

|---|---|

| 📊 Accounts: | 6 evaluations plans with funding from $5,000 to $250,000 |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfers, bank cards, and online payment systems |

| 🚀 Minimum deposit: | $49 |

| ⚖️ Leverage: | Up to 1:50 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | From 0 pips |

| 🔧 Instruments: | Currencies, cryptocurrencies, oil, indices, and precious metals |

| 💹 Margin Call / Stop Out: | 50%/30% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

No time limits for passing the challenge; The profit target is 10% in Phase 1 and 5% in Phase 2; The daily drawdown is 5% and the total drawdown is 10%; 6 evaluations; Scaling up to $500,000. |

| 🎁 Contests and bonuses: | Yes |

IC Funded offers several plans with initial fees ranging from $49 to $2,498. There are no additional service fees. Maximum leverage depends on the specific asset you choose to trade. Technical support is available 24/5 via various communication channels including email and live chat.

IC Funded Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

DE Falkenstein

DE Falkenstein Challenge rules and pricing

IC Funded provides access to funding up to $500 000, with challenges requiring at minimum of 5 trading days. The entry-level plan starts at $49, and the fee is refundable if the challenge is successfully completed.

- High funding potential — up to $500 000

- Low entry cost — from $49

- No instant funding options

- No free evaluation option

IC Funded Challenge fees and plans

We compared IC Funded’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | 2 - Profit target, $ | Daily loss,% | Max. loss, % |

| Trading Plan 1 |

|

|

|

|

|

|

| Trading Plan 2 |

|

|

|

|

|

|

| Trading Plan 3 |

|

|

|

|

|

|

| Trading Plan 4 |

|

|

|

|

|

|

| Trading Plan 5 |

|

|

|

|

|

|

| Trading Plan 6 |

|

|

|

|

|

|

| Trading Plan 7 |

|

|

|

|

|

|

What’s the minimum trading period for IC Funded’s challenge?

A minimum of 5 trading days is required, regardless of how quickly you reach the profit target.

Does IC Funded offer a free evaluation?

No, IC Funded does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at IC Funded?

No, IC Funded does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

IC Funded outlines the main rules for funded accounts, including a max. loss of 10% and a daily loss limit of 5%. The firm also restricts certain trading strategies, which are detailed below.

- Flexible max loss limit

- Flexible leverage up to 1:50

- Scalping allowed

- Copy trading not allowed

IC Funded trading conditions

We compared IC Funded’s leverage and trading conditions with competitors to help you better understand how it measures up.

| IC Funded | Hola Prime | SabioTrade | |

| Max. loss, % | 10 | 5 | 6 |

| Max. leverage | 1:50 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | Yes | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | No | No | No |

Deposit and withdrawal

IC Funded earned a Medium score based on how smoothly and conveniently traders can deposit and withdraw funds.

The deposit and withdrawal options at IC Funded meet most standard requirements and are in line with what many prop firms provide.

- Bank сard deposits and withdrawals

- Bitcoin (BTC) supported

- USDT (Tether) supported

- Supports bank wire transfers

- Payoneer not supported

- Wise not supported

- No on-demand withdrawals

Deposit and withdrawal options

To help you evaluate how IC Funded performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

IC Funded Payment options vs Competitors

| IC Funded | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | Yes | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared IC Funded with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| IC Funded | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | No | Yes | No |

| Biweekly | Yes | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

IC Funded offers the following base account currencies:

Trading Account Opening

To start working with IC Funded, register on its official website. Choose the evaluation, pay the initial fee, and start the challenge. Upon its successful completion, trading with a chosen plan becomes available. To eliminate any questions, TU experts prepared a step-by-step guide on the registration process and described the main features of the user account.

Go to the prop firms’ website.

Go to the Evaluations page and scroll down to the evaluation list. Choose the plan that best suits you and click the “Select” button.

Register by providing your email and creating a password.

Fill in your first and last names, country of residence, address with a postal code, phone number, and email.

Choose a deposit method and enter the required information. Agree to the terms and conditions by checking the box and clicking the “Submit” button.

Once your payment is confirmed, log into your user account. Download MetaTrader 4 or MetaTrader 5 to start the challenge.

Additional features of IC Funded’s user account allow traders to:

-

Open and close accounts with different evaluation plans, and view information about their active accounts;

-

Pay initial fees for new accounts and submit withdrawal requests;

-

Edit their personal information and security settings;

-

Contact technical support.

Regulation and safety

Since prop firms do not require regulation, registration as an investment platform is enough. IC Funded is an officially registered firm. It is managed by Finocom Services LTD, registered in Hong Kong. The main task of IC Funded is to provide traders with funding. It uses MT4 and MT5 platforms with a user-friendly interface and advanced functionality. The prop firm partners with various brokers providing reliable trading conditions for its clients.

Advantages

- Official registration

- Access to professional trading platforms

Disadvantages

- Lack of regional protection outside Hong Kong

Markets and tradable assets

IC Funded has a score of 8/10, reflecting a strong variety of markets and assets available for trading.

- Stock trading allowed

- Crypto trading available

- CFDs offered

- Futures not available

- Options not supported

Tradable markets

We compared the range of tradable instruments offered by IC Funded with two leading competitors to highlight the differences in market access.

| IC Funded | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

Unlike some prop firms, IC Funded does not offer investment solutions or copy trading services. Instead, it focuses on providing active traders with access to funding, competitive trading conditions, and valuable educational and assessment resources. However, keep in mind that the initial fee is non-refundable.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Customer support

Encountering various difficult or unclear situations, traders contact technical support. If its responses are prompt and competent, they continue trading with a prop firm. IC Funded knows this and offers 24/5 technical support available via email and live chat.

Advantages

- Two communication channels

- Unregistered users can contact support

- Managers are available round the clock on weekdays

Disadvantages

- Support is limited on weekends

Both registered users and non-clients of the prop firm can contact technical support.

Available communication channels are:

-

Email;

-

24/7 live chat.

IC Funded has its profiles on Facebook, X (Twitter), and other social media, where traders can also contact technical support. For news updates, subscribe to any of the available profiles.

Contacts

| Registration address | Finocom Services Ltd, Room 10, 8/F Sun House, 90 Connaught Road Central, Hong Kong |

|---|---|

| Official site | https://www.icfunded.com/ |

| Contacts |

Education

IC Funded offers an extensive choice of educational materials, including articles, videos, webinars, and training courses to help traders better understand trading conditions and rules. The basic information on technical and fundamental analyses, risk management, psychology of trading, and market insights is available on the firm’s website.

Comparison of IC Funded to other prop firms

| IC Funded | FundedNext | Hola Prime | SabioTrade | GoatFundedTrader | OANDA Prop Trader | |

| Trading platform |

MetaTrader4, MetaTrader5 | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | MetaTrader5, Match Trader, TradeLocker | MetaTrader5, MT5 Webtrader |

| Min deposit | $49 | $32 | $48 | $119 | $30 | $35 |

| Leverage |

From 1:1 to 1:50 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

50% / 30% | No | No | 100% / 50% | No | No |

| Order Execution | Market Execution | N/a | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of IC Funded

IC Funded is an advanced prop firm with a positive reputation among traders. This is partly due to its support for MetaTrader 4 and MetaTrader 5 trading platforms, both known for their user-friendly interface and extensive features that facilitate profitable trading. Client reviews also reflect this positive sentiment.

Traders Union experts found no evidence of IC Funded failing to fulfill its obligations. The prop firm focuses solely on providing funding and creating a comfortable trading environment. This allows it to compete with industry leaders and attract a large client base.

Maximum daily and total drawdowns are set at 5% and 10%, respectively. Leverage is variable, reaching a maximum of 1:50 for currencies and gold, 1:10 for indices and commodities, and 1:5 for equities. Traders can scale their accounts by 50% of the initial amount and potentially gain additional funds based on specific conditions. The maximum scaling reaches $500,000. Bonus programs are also available. The initial fee ranges from $49 to $2,498 depending on the chosen funding tier.

IC Funded by the numbers:

-

The minimum initial fee is $49;

-

The maximum scaling limit is $500,000;

-

Target profit is 10% for phase 1 and 5% for phase 2;

-

150+ trading instruments;

-

Additional fees are $0.

IC Funded is a prop firm for comfortable trading

A wide choice of assets provides a wide range of trading possibilities. IC Funded’s pool consists of various assets, including currency pairs, cryptocurrencies, oil, precious metals, and indices. This variety and available leverage allow traders to use almost any strategy and build diversified portfolios to reduce risks. The profit split increases as the balance grows. Initially, the trader’s profit share is 75%, but it can increase up to 80% within a month of successful trading. Complete transparency, understanding of working conditions, and the absence of trading restrictions allow traders to work with maximum comfort.

Useful services offered by IC Funded:

-

To get funded, traders choose among several plans and pass the challenge;

-

Traders can open multiple accounts and close them at any time;

-

A total 10% drawdown and daily 5% drawdown protect traders from excessive risk;

-

The number of lots depends on leverage and the account balance. For example, with a balance of $100,000 and leverage of 1:50, traders can hold up to 50 open lots at once;

-

There is no minimum activity required, just one trade per month suffices.

Advantages:

Official registration and support for MT4 and MT5;

150+ financial instruments from different groups;

Traders pay non-refundable initial fees without any additional service fees;

All evaluation plans are scalable up to $500,000. Once the profit target is achieved, the account balance increases;

Technical support is available.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i