Instant Funding Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $79

- cTrader

- MetaTrader5

- Match Trader

- DX Trade

- No time limit for achieving the target profit. Algo trading.

- Up to 1:100

Our Evaluation of Instant Funding

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Instant Funding is one of the best proprietary trading firms in the financial market with the TU Overall Score of 9.75 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Instant Funding clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the firm’s clients are fully satisfied with the company.

Instant Funding’s variety of programs allows traders to choose the most suitable funding model based on their experience and preferences. All of the firm's tools and services are designed to support traders in achieving effective and successful trading in financial markets.

Brief Look at Instant Funding

Instant Funding is a proprietary trading company based in the United Kingdom that has been operating since 2021. It serves traders in more than 180 countries, including the United States. Trading instruments available include major and minor currency pairs, metals, commodities, indices and cryptocurrencies. Instant Funding offers One-Phase and Two-Phase assessment programs to obtain funded accounts ranging from $10,000 to $200,000, as well as instant funding from $1,250 to $80,000. The maximum allocation per operator after scaling can reach $2.5 million for One-Phase and Two-Phase challenges and $3.84 million for instant funded accounts.

- Single and two-phase challenges, as well as an instant funding program.

- Possibility to choose between a Raw Spread account or a commission-free account.

- High profit participation rate: 80% (base) or 90% (scalable accounts).

- Leverage up to 1:100 for major currency pairs.

- Algorithmic trading is not allowed.

- Higher one-time fee of between $79 and $89, depending on the challenge, compared to competitors.

TU Expert Advice

Author, Financial Expert at Traders Union

Instant Funding is a proprietary trading firm based in the UK, offering access to trading over 180 countries, including the U.S. It provides a range of funded accounts including One-Phase and Two-Phase Challenges, with account sizes ranging from $10,000 to $200,000, and Instant Funding from $1,250 to $80,000. The company supports various trading platforms, including MetaTrader 5, DXTrade, cTrader, and Match-Trader, and offers leverage of up to 1:100. Traders can engage in Forex, indices, metals, and cryptocurrencies, benefiting from either Raw Spread or commission-free accounts.

Despite the advantages, Instant Funding has several drawbacks. Algorithmic trading is not permitted, and a one-time fee ranging from $79 to $89 is higher compared to competitors. Additionally, news trading and scalping are restricted. These restrictions may not suit traders who rely on automated strategies or trade frequently during news events. While the company provides a flexible approach for manual traders who seek high funding potential, it may not be suitable for those who depend on automation and broader strategic freedom.

Instant Funding Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | cTrader, DXTrade, Match-Trader, Platform5 and MetaTrader 5 (МТ5) |

|---|---|

| 📊 Accounts: | One-Phase Challenge, Two-Phase Challenge, and Instant Funding with access to Commission-free accounts and RAW spreads |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: |

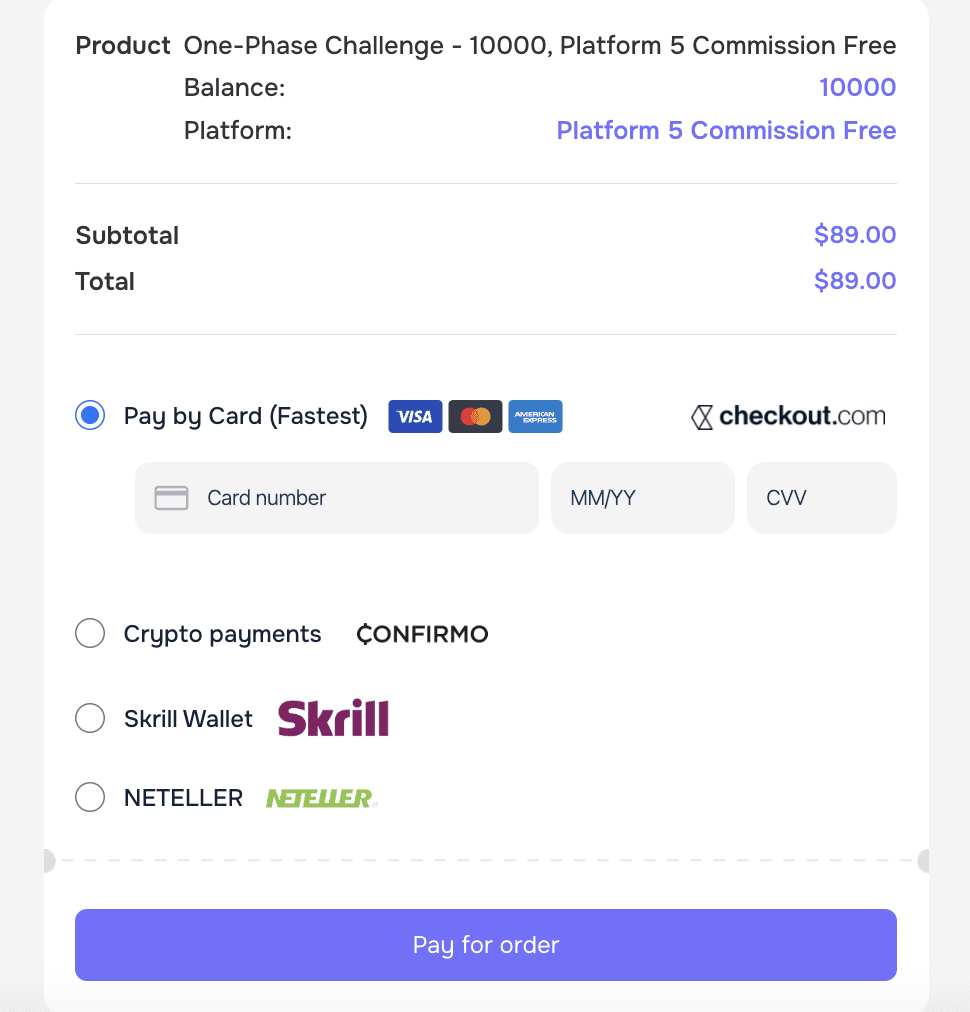

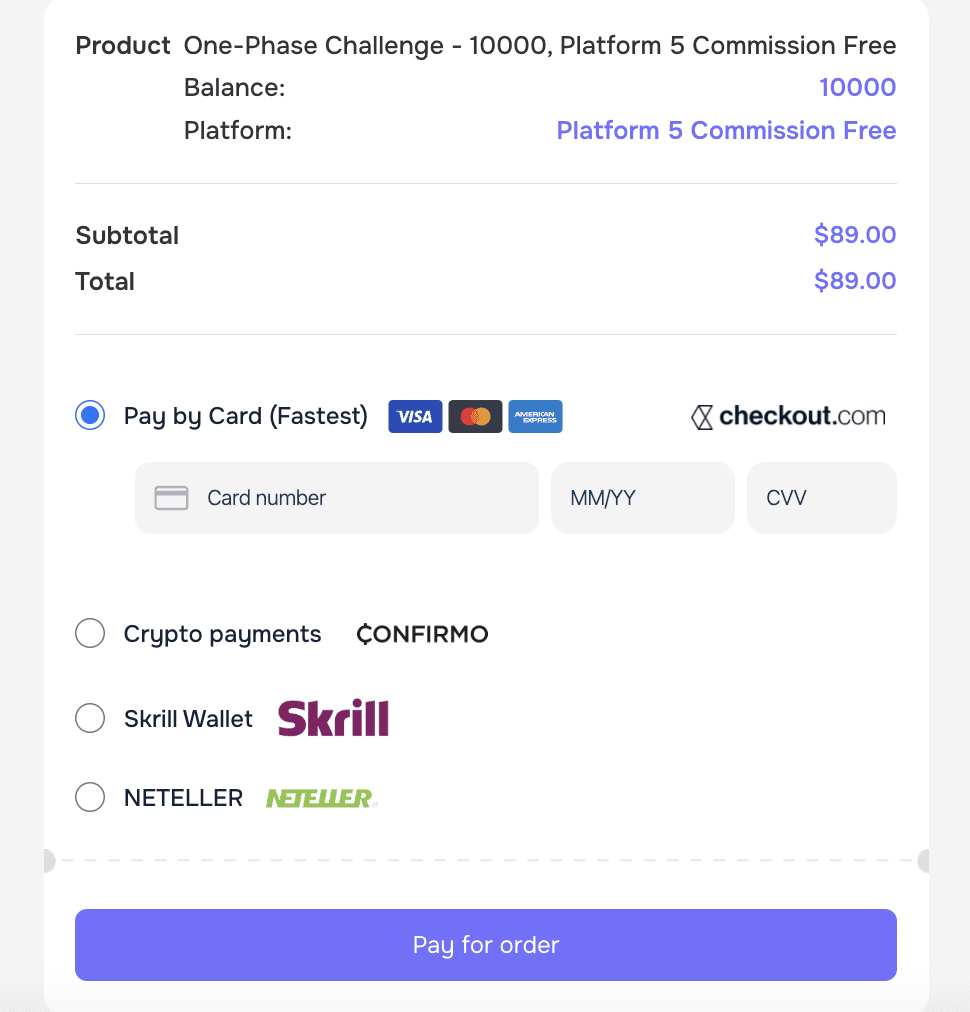

Deposit: Skrill, Neteller, Visa, Mastercard, and American Express, cryptocurrencies via Confirmo Withdrawal: wire transfer and cryptocurrencies via Rise, direct cryptocurrency payments |

| 🚀 Minimum deposit: | $79 |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | Floating |

| 🔧 Instruments: | Forex, indices, cryptocurrencies, metals, energies (oil, gas) |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Regulated liquidity providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market, Limit |

| ⭐ Trading features: | No time limit for achieving the target profit. Algo trading. |

| 🎁 Contests and bonuses: | Yes |

Instant Funding has set maximum lot sizes for different account types and asset classes to maintain a fair and stable trading environment. The maximum leverage for currencies is 1:100, commodities and indices are 1:20, and cryptocurrencies are 1:2. Martingale trading is not allowed. Traders from the United States can only trade using the DXTrade platform.

Instant Funding Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

PK Rawalpindi

PK Rawalpindi I chose Raw Spread account for myself, as I prefer to see real market spreads and pay a small commission for my trades.

none

Challenge rules and pricing

Instant Funding provides access to funding up to $2 500 000, with challenges requiring at a minimum of 3 trading days. The entry-level plan starts at $44, min but the fee is non-refundable.

- Low entry cost — from $44

- High funding potential — up to $2 500 000

- Instant funding available

- No demo account provided

- Minimum trading period required

Instant Funding Challenge fees and plans

We compared Instant Funding’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | Daily loss,% | Max. loss, % |

| One Phase |

|

|

|

|

|

| Two Phase |

|

|

|

|

|

| Instant |

|

|

|

|

|

What’s the minimum trading period for Instant Funding’s challenge?

A minimum of 3 trading days is required, regardless of how quickly you reach the profit target.

Does Instant Funding offer a free evaluation?

No, Instant Funding does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at Instant Funding?

Yes, Instant Funding offers instant funding. Details may vary by plan, so we recommend checking the latest terms on the company’s official website.

Trading rules

Instant Funding outlines the main rules for funded accounts, including a max. loss of 8% and a daily loss limit of 0%. The firm also restricts certain trading strategies, which are detailed below.

- No weekend close rule

- Flexible leverage up to 1:100

- News trading not allowed

- Trading bots (EAs) not allowed

Instant Funding trading conditions

We compared Instant Funding’s leverage and trading conditions with competitors to help you better understand how it measures up.

| Instant Funding | Hola Prime | SabioTrade | |

| Max. loss, % | 8 | 5 | 6 |

| Max. leverage | 1:100 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | No | Yes | Yes |

| News trading | No | Yes | Yes |

| Scalping | No | No | Yes |

| Copy trading | No | No | No |

Deposit and withdrawal

Instant Funding earned a Medium score based on how smoothly and conveniently traders can deposit and withdraw funds.

The deposit and withdrawal options at Instant Funding meet most standard requirements and are in line with what many prop firms provide.

- Weekly payouts

- Bank сard deposits and withdrawals

- BTC payments not supported

- No on-demand withdrawals

Deposit and withdrawal options

To help you evaluate how Instant Funding performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

Instant Funding Payment options vs Competitors

| Instant Funding | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | No | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | Yes | No | No |

| Neteller | Yes | No | No |

Profit withdrawal frequency

We compared Instant Funding with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| Instant Funding | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | Yes | Yes | No |

| Biweekly | No | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

Instant Funding offers the following base account currencies:

Trading Account Opening

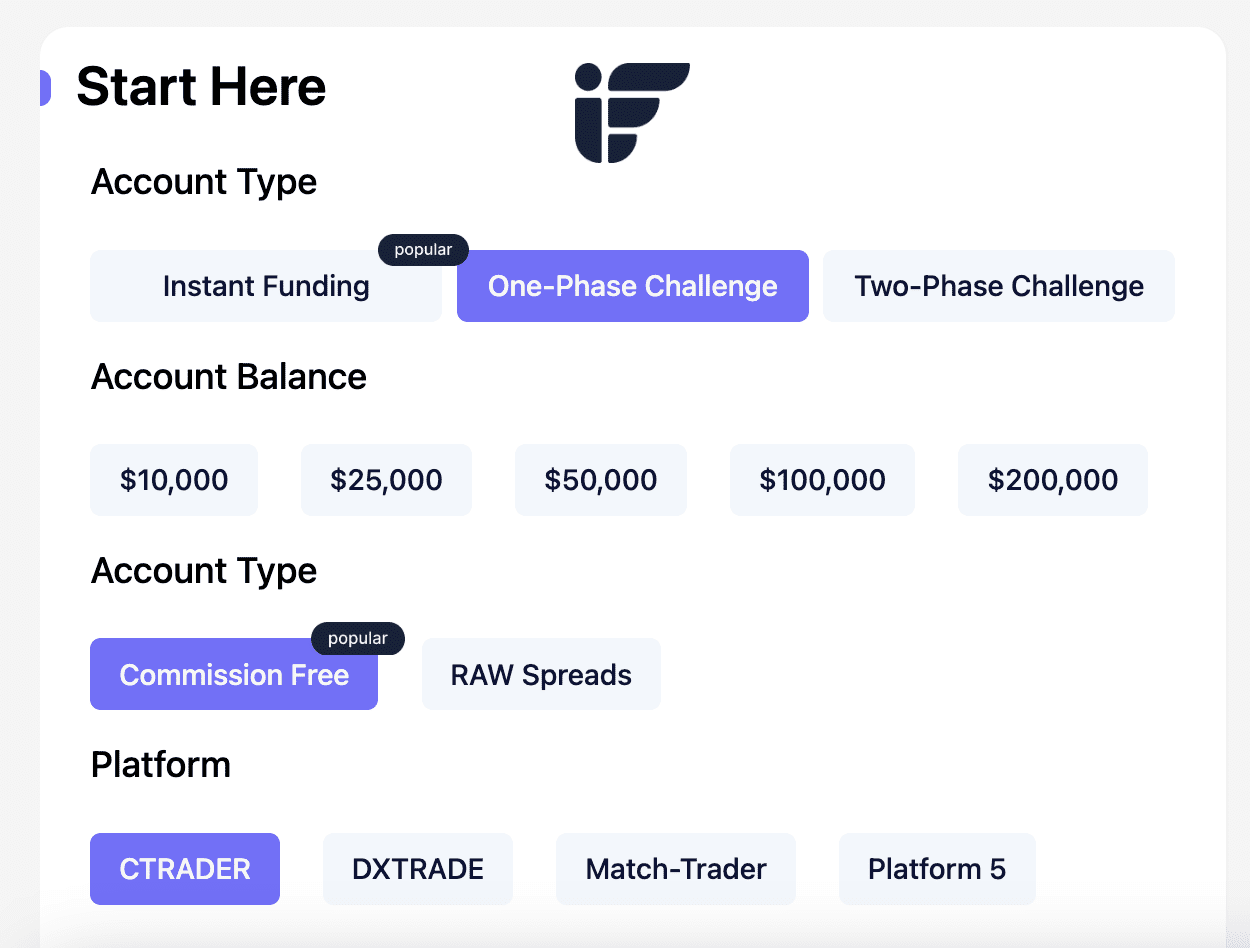

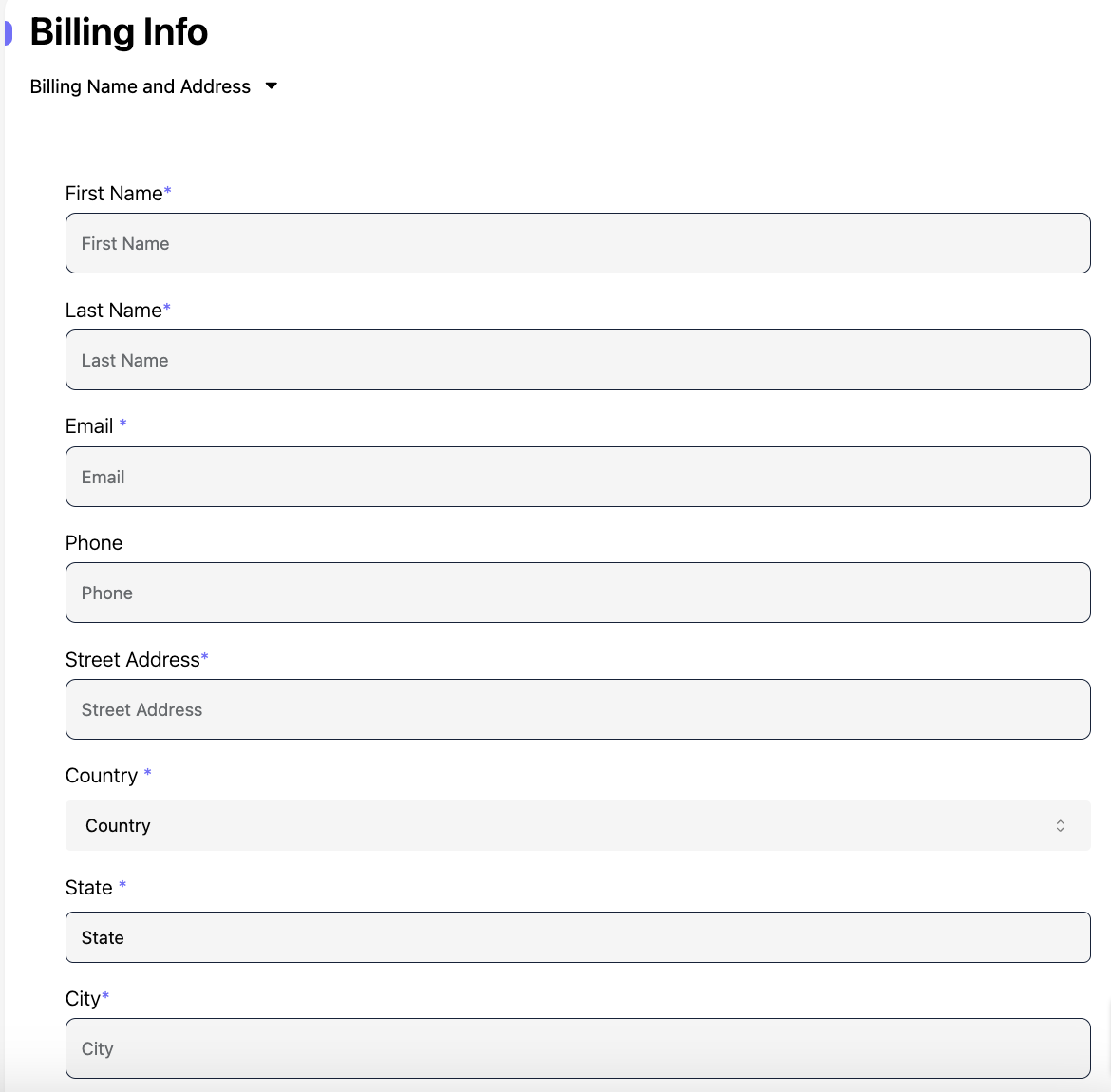

To start using a virtual account, follow these steps:

Select a funding plan. Choose the account balance, account type, and trading platform.

Fill out a short registration form.

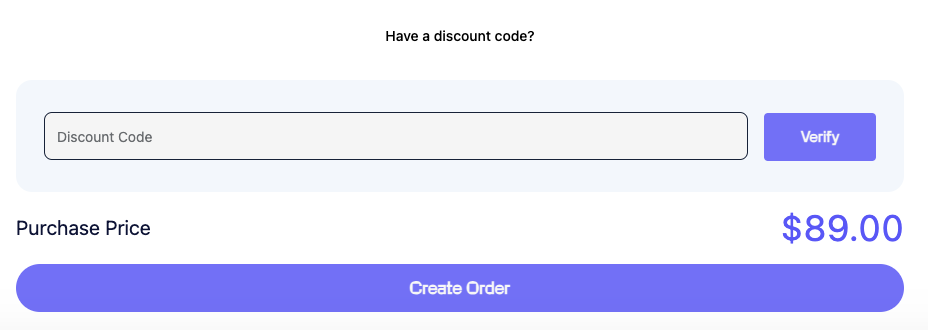

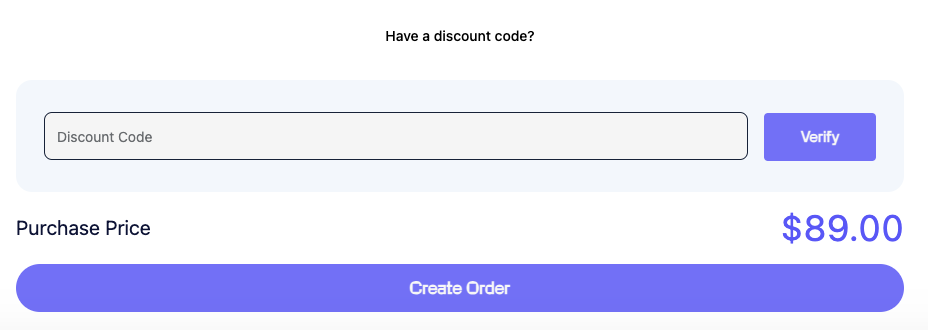

Enter a promo code (if applicable) to receive a discount and generate a payment order.

Make the payment using one of the available payment methods.

Once the payment is completed, you will gain access to your user account. To log in, use your email and password that is sent to your email upon registration.

Regulation and safety

Instant Funding is a trading name of Acello Ltd, a company registered with the UK Information Commissioner's Office (ICO) under registration number 12696083. The ICO is a government body responsible for regulating data protection and ensuring compliance with privacy laws such as the UK GDPR and the Data Protection Act 2018.

This does not mean the company is regulated by the Financial Conduct Authority (FCA) or holds a brokerage license. The ICO deals solely with matters related to personal data protection.

Advantages

- Protection of clients' personal information under UK legislation

- Partnership with regulated brokers and liquidity providers

Disadvantages

- Disputes are resolved internally without the involvement of a disinterested third party

Markets and tradable assets

Instant Funding has a score of 7/10, reflecting a strong variety of markets and assets available for trading.

- Indices available

- CFDs offered

- Forex trading supported

- Options not supported

- Stock trading not allowed

Tradable markets

We compared the range of tradable instruments offered by Instant Funding with two leading competitors to highlight the differences in market access.

| Instant Funding | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | No | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

Automated trading opportunities for passive income are limited. Traders may copy trades from their accounts at other proprietary trading firms, retail brokers, or any external and internal sources to their Instant Funding accounts. However, copying trades between accounts owned by different individuals, including relatives and friends, is strictly prohibited. All accounts using the same strategy must belong to a single trader; any collaboration between different traders is not allowed.

Instant Funding prohibits the use of publicly available, third-party Expert Advisors (EAs), algorithms, or bots. Proprietary or private automated trading systems may be permitted, provided they comply with company rules and do not violate restrictions on certain trading practices.

Instant Funding’s affiliate program

The Instant Funding affiliate program offers multiple rewards for actively referring new clients.

Referral program conditions:

-

Commission rewards. The program offers 15% of a referral’s first purchase for standard partners and 17.5% for strategic partners, those who have referred at least 30 traders.

-

Welcome bonuses. Ranging from $100 to $1,000, depending on the number of referrals. A minimum of 10 traders must be referred to qualify for bonuses.

-

Additional bonuses. 5% commission on a referral’s subsequent purchases and $100 for each recruited partner who generates $500 in revenue or $150 for strategic partners.

Instant Funding provides partners with a 10% discount code for their audience, access to an analytics dashboard with payouts every two weeks, a minimum payout threshold is $50, and the opportunity to participate in quarterly tournaments with prizes.

Customer support

Instant Funding provides remote assistance through multiple communication channels.

Advantages

- 24/7 chat support

- Solving any problems online

Disadvantages

- There is no phone support

Support can be contacted via:

-

Live chat on the website.

-

Email support.

-

Telegram.

-

X (Twitter).

-

LinkedIn.

-

Facebook.

-

Discord.

Instant Funding also has active TikTok, Instagram, and YouTube pages, where clients can find additional support and updates.

Contacts

| Registration address | 30 Old Bailey, London, England, EC4M 7AU |

|---|---|

| Official site | https://instantfunding.io/ |

| Contacts |

Education

The Instant Funding website features educational materials in a blog that publishes articles on various aspects of trading, such as strategies and market analysis, designed to enhance traders' knowledge and skills.

Additionally, the company offers webinars conducted by professional traders and educators.

Comparison of Instant Funding to other prop firms

| Instant Funding | FundedNext | Hola Prime | SabioTrade | Hyrotrader | OneUp Trader | |

| Trading platform |

cTrader, DX Trade, MetaTrader5, Match Trader | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | Bybit’s web platform and mobile apps | Ninja Trader, RTrader, iTrader, Photon, QScalp |

| Min deposit | $79 | $32 | $48 | $119 | $89 | $125 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:1 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | No | No |

| Order Execution | Market Execution | N/a | Market Execution | Market Execution | Market Execution | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed Instant Funding review

Traders who choose Instant Funding for prop trading gain access to a wide range of instruments, including 30+ currency pairs, gold, silver, oil, and major global indices. Cryptocurrency trading is also available, featuring assets like Bitcoin, Ethereum, Solana, and more.

Clients can enable the unique Major News Trading option, which allows trading during major news events and holding positions over the weekend. Additionally, Instant Funding permits weekend position holding during the evaluation phases, Phase One and Phase Two, of challenges. If a trader fails the assessment, Instant Funding offers the opportunity to retake it at a discounted price.

Instant Funding by the numbers:

-

Operating since 2021.

-

Over 25,000 traders served.

-

Available in 180+ countries.

-

Discord community with 46,000+ members.

Instant Funding is a prop firm with growth potential and a flexible trading approach

Instant Funding imposes no time limits for completing its evaluation phases. However, traders must place at least one trade every 60 days to maintain an active account. News trading is permitted on evaluation accounts, but on funded accounts, opening trades within four minutes before and after major news events is prohibited. Exceptions are possible only with special permission.

Instant Funding offers account growth opportunities through its scaling program. To qualify, traders must achieve at least a 10% gain within 90 days, after which the initial account balance increases by 25%. This process can be repeated every 90 days until the balance doubles the starting amount.

Instant Funding’s analytical services:

-

Instant funding program with immediate access to trading capital, and no evaluation required.

-

An educational blog featuring beginner-friendly tutorials, market analysis, and trading ideas.

-

Overnight position holding is allowed, along with different leverage levels depending on the selected instrument.

-

Trading competitions with cash prizes and free challenge entries.

Advantages:

Access to 50+ trading instruments.

Support for multiple trading platforms.

Opportunity to manage larger capital upon reaching specific profit milestones.

Educational articles and webinars to help traders improve their skills and knowledge.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i