According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $14

- MetaTrader4

- 23 funding programs to choose from

- one- or two-step challenge, relatively easy for experienced traders

- profit sharing ranging from 60%/40% to 90%/10% as it depends on the successful trading duration

- 1:100

Our Evaluation of Next Step Funded

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Next Step Funded is a prop trading firm with higher-than-average risk and the TU Overall Score of 3.21 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Next Step Funded clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable partner with better conditions, as, according to reviews, many clients of this firm are not satisfied with the company’s work.

Next Step Funded offers an enticing program for traders of all experience levels seeking to leverage significant capital. Beginners can start with Flash Evaluations for just $14, using a virtual $15,000 account. Professionals can access a live $200,000 account for $150. As you progress to live trading, you'll earn a share of the profits, starting at 60% and increasing to 70%, or even 80% or 90%.

Brief Look at Next Step Funded

Next Step Funded clients are offered 23 funding programs across five types, including Flash Evaluations, Standard One-Step, Standard Two-Step, HFT One-Step, and HFT Two-Step. These programs differ in deposit amount, provided capital, profit target, maximum daily and overall drawdown, and other parameters. During the challenge phase, clients trade on a demo account, and upon success, a live account is opened by the company, with profit sharing ranging from 60%/40% to 90%/10% in favor of the trader. Eightcap is the broker's partner offers in its pool CFDs on currency pairs, stocks, indices, metals, and energies, totaling over 500 assets. Trades are executed through the MetaTrader 4 trading platform with leverage up to 1:100.

- A vast number of programs with individual parameters and relatively easy requirements.

- The ratio of one-time payment to trading balance is quite reasonable, and there's no need to pay a monthly subscription.

- There are minimal restrictions on methods and strategies, with favorable profit sharing.

- Partnership with Eightcap ensures spreads from 0 pips and low trading commissions.

- There is an affiliate program that can bring up to 12.5% of Next Step Funded's revenue from referrals' payments.

- 24/7 technical support via email, with the option to submit requests through a ticket system.

- Several deposit and withdrawal methods without company fees.

- Not all programs provide a deposit refund after completing the challenge.

- The first withdrawal of funds can only be requested a month after starting live trading, and then no more than once every two weeks.

- There are additional conditions that can lead to challenge failure

TU Expert Advice

Author, Financial Expert at Traders Union

Next Step Funded provides a variety of trading instruments across 23 funding programs, including Flash Evaluations and Standard One-Step challenges. The firm offers access to CFDs on currency pairs, stocks, indices, metals, and energies through the MetaTrader 4 platform with leverage up to 1:100. Account types range from $14 deposits for a $15,000 trading account, with potential capital allocation up to $200,000. Notable advantages include favorable profit-sharing schemes starting at 60/40 and increasing to 90/10, no monthly fees, and 24/7 email support.

However, Next Step Funded has drawbacks like limited withdrawal frequency and the lack of regional regulatory protection outside the U.S. The absence of phone support and limited educational resources may also deter some traders. Nonetheless, with its diverse program options and flexible trading conditions, Next Step Funded may suit both novice and experienced CFD traders looking to utilize significant capital.

Next Step Funded Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4 |

|---|---|

| 📊 Accounts: | Flash Evaluations, Standard One-Step, Standard Two-Step, HFT One-Step, and HFT Two-Step |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Visa and MasterCard cards, crypto wallets |

| 🚀 Minimum deposit: | $14 |

| ⚖️ Leverage: | 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | From 0 pips |

| 🔧 Instruments: | CFDs on currency pairs, stocks, indices, metals, energies |

| 💹 Margin Call / Stop Out: | 80%/50% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: | 23 funding programs to choose from; one- or two-step challenge, relatively easy for experienced traders; profit sharing ranging from 60%/40% to 90%/10% as it depends on the successful trading duration |

| 🎁 Contests and bonuses: | Yes |

The deposit amount depends on the funding program type and the required trading capital. The minimum deposit is only $14 for completing the Flash Evaluations, which provides access to $15,000. The maximum fee is $2,150 for the HFT program with a one-step challenge, which, if successfully completed, will result in $300,000 being added to the real balance. The leverage depends on the asset type, with the highest leverage of 1:100 available for currency pairs. Of course, traders can adjust the leverage within the available range. Client support is available 24/7. Inquiries are handled via email and through the ticket system on the company’s website.

Next Step Funded Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Challenge rules and pricing

Next Step Funded provides access to funding up to $200 000, with challenges requiring at minimum of No time limits trading days. The entry-level plan starts at $28, and the fee is refundable if the challenge is successfully completed.

- Low entry cost — from $28

- Multiple scaling options

- Flexible trading rules and conditions

- Minimum trading period required

- Limited funding — up to $200 000

Next Step Funded Challenge fees and plans

We compared Next Step Funded’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | Daily loss,% | Max. loss, % |

| Standard - 1 Step |

|

|

|

|

|

| Standard - 2 Step |

|

|

|

|

|

| HFT |

|

|

|

|

|

| Flash |

|

|

|

|

|

| Pro+ |

|

|

|

|

|

What’s the minimum trading period for Next Step Funded’s challenge?

No minimum trading days. You can complete the challenge as soon as you reach the profit target.

Does Next Step Funded offer a free evaluation?

No, Next Step Funded does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at Next Step Funded?

No, Next Step Funded does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

Next Step Funded outlines the main rules for funded accounts, including a max. loss of 8% and a daily loss limit of 4%. The firm also restricts certain trading strategies, which are detailed below.

- Trading bots (EAs) allowed

- Flexible leverage up to 1:100

- Scalping allowed

- News trading not allowed

- Copy trading not allowed

Next Step Funded trading conditions

We compared Next Step Funded’s leverage and trading conditions with competitors to help you better understand how it measures up.

| Next Step Funded | Hola Prime | SabioTrade | |

| Max. loss, % | 8 | 5 | 6 |

| Max. leverage | 1:100 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | Allowed (Not Allowed for Pro+) | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | No | No | No |

Deposit and withdrawal

Next Step Funded earned a Low score based on how smoothly and conveniently traders can deposit and withdraw funds.

Next Step Funded's limited selection of payment methods and supported currencies may reduce its convenience and global accessibility.

- Supports bank wire transfers

- Bitcoin (BTC) supported

- Bank сard deposits and withdrawals

- USDT (Tether) supported

- No on-demand withdrawals

- Payoneer not supported

- Wise not supported

Deposit and withdrawal options

To help you evaluate how Next Step Funded performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

Next Step Funded Payment options vs Competitors

| Next Step Funded | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared Next Step Funded with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| Next Step Funded | Hola Prime | SabioTrade | |

| On demand | No data | No | Yes |

| Weekly | No data | Yes | No |

| Biweekly | No data | Yes | No |

| Monthly | No data | Yes | No |

What base account currencies are available?

Next Step Funded offers the following base account currencies:

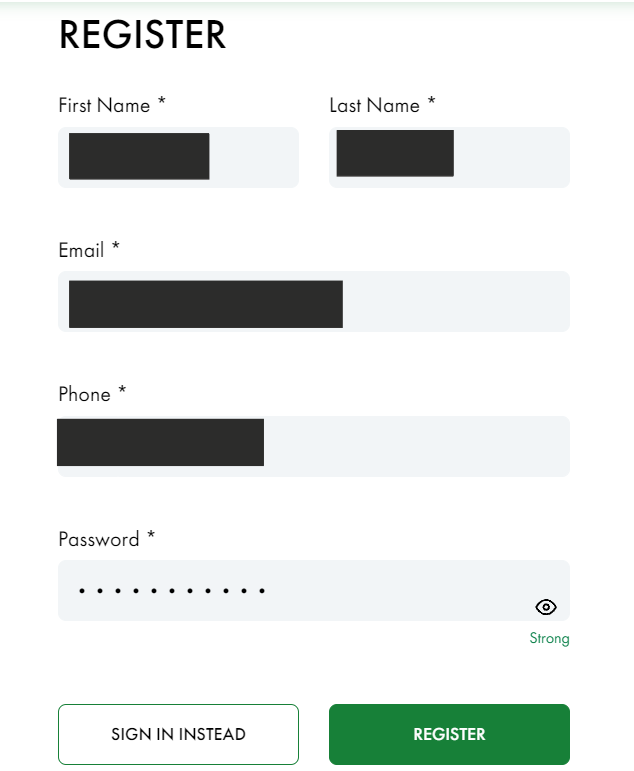

Trading Account Opening

To start working with the prop-trading company, register, enter your personal details, and make the initial deposit. The process is straightforward, yet Traders Union experts have prepared a brief guide to eliminate any questions that can arise.

Visit the prop-trading company's website. In the top right corner, select your language and click "Sign Up."

Enter your first and last name, email address, and phone number. Create a password. Click "Register."

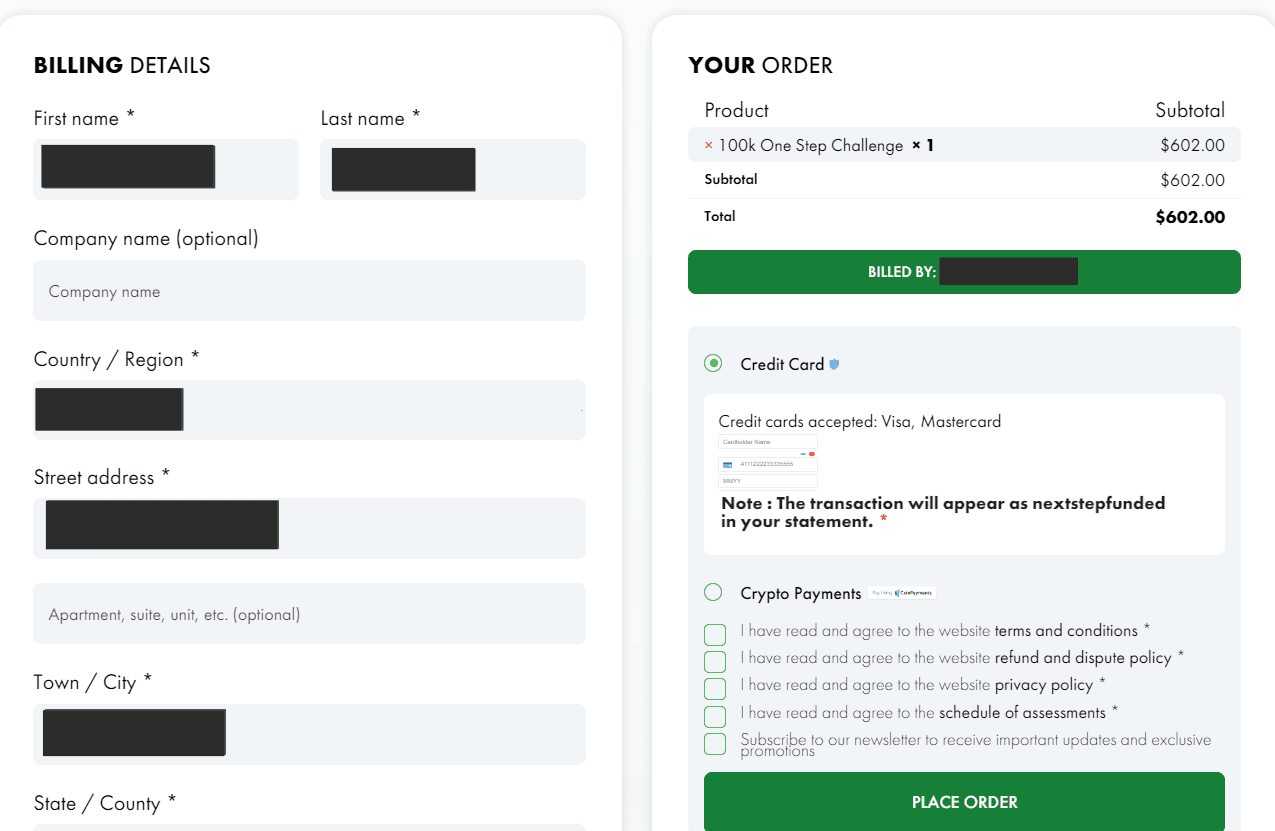

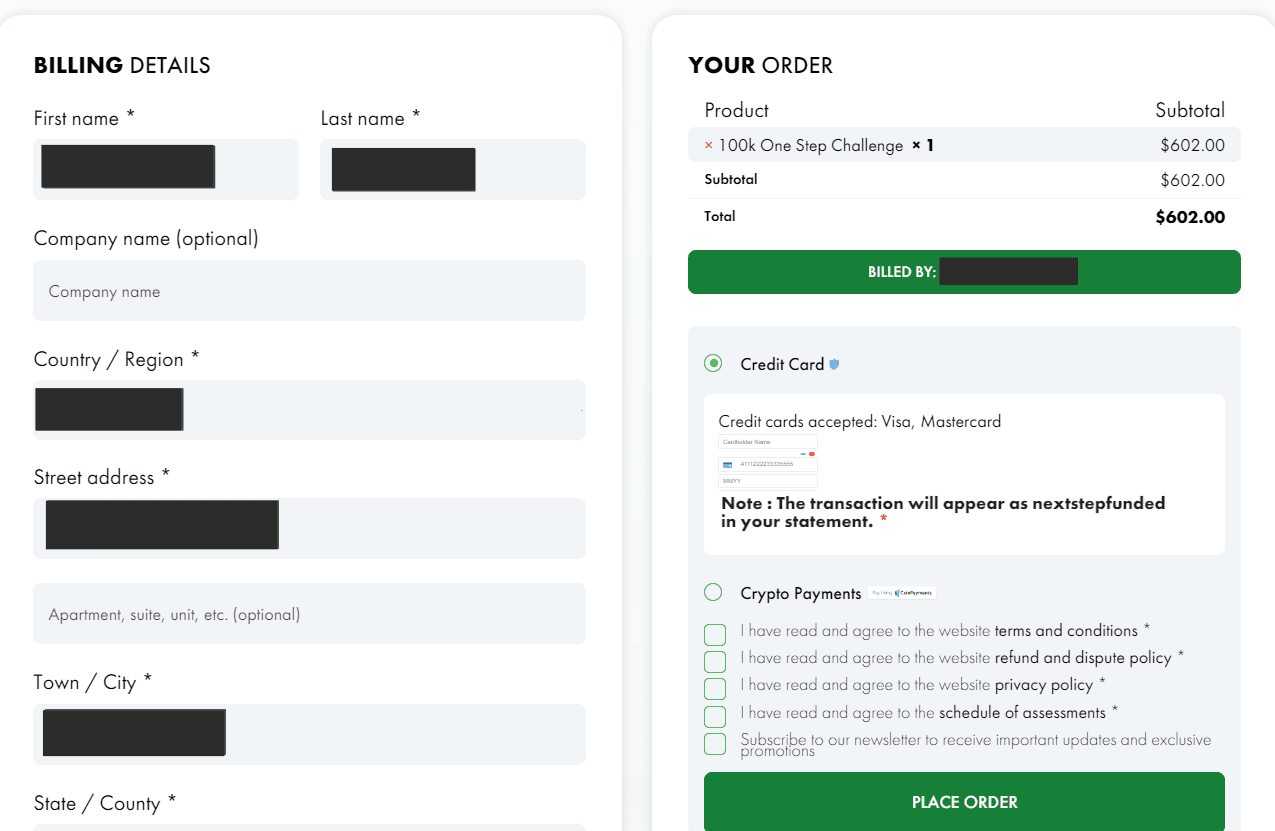

Choose a suitable funding type. This can be done on the main page of the website or in the corresponding sections. Provide missing details such as your residential address, postal code, etc. Choose a payment method: Visa, MasterCard, or cryptocurrency wallet, and enter the required details. Agree to the terms and conditions by checking the respective boxes. Click "Place Order."

Next, download the MetaTrader 4 trading platform from the MT4 website or from the Eightcap broker's website. Then you can take the challenge.

Additional features of Next Step Funded’s user account allow traders to:

-

View recent orders, update account information, and change passwords.

-

Register in the affiliate program, and track the number of referrals, their purchases, and earned rewards.

-

View detailed statistics on all funding programs, whether in the challenge phase or actual trading.

-

Navigate to the page where clients can buy a tariff.

-

Complete KYC (Know Your Client) verification. Before live trading begins, this process requires submitting scans or photos of all requested documents for verification

Regulation and safety

Prop trading firms require registration, but regulation is not necessary. Their task is to provide traders with funds, while the execution of trades on the international market is handled by the broker who acts as their partner. Next Step Funded is registered in the U.S. Eightcap is based in Australia and holds several authoritative regulations from AFSL (Australian Financial Services Licence), CySEC (The Cyprus Securities and Exchange Commission), and SCB (The Securities Commission of The Bahamas).

Advantages

- The company is officially registered

- Works with a verified, licensed broker

- Has a positive reputation

Disadvantages

- The company's clients cannot obtain regional protection outside the United States

Markets and tradable assets

Next Step Funded has a score of 8/10, reflecting a strong variety of markets and assets available for trading.

- Stock trading allowed

- Indices available

- Forex trading supported

- Options not supported

- Futures not available

Tradable markets

We compared the range of tradable instruments offered by Next Step Funded with two leading competitors to highlight the differences in market access.

| Next Step Funded | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

Prop firms do not offer PAMM accounts or copy trading services, as their sole task is to provide capital to traders who successfully pass their challenges, allowing them to trade on global financial markets. However, affiliate programs are quite common. Next Step Funded offers one as well. While it may not provide passive income like the aforementioned options, it can still be a good source of income, especially if you have a website, blog, or a popular social media account.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Next Step Funded’s Affiliate Program

You don’t need to be an active client to participate. A trader submits an application, which will be reviewed within 24 hours. It is essential to specify how you will attract referrals. If the application is approved, you receive an individual referral link. Clients who come via this link and purchase a program will earn the partner 5% of the amount. Note, that only one purchase per client counts. Eventually, you can earn up to 12.5% by referring a large number of clients. All clicks, registrations, and conversions can be easily tracked on the monitoring page. Income can be withdrawn on the 1st and 15th of each month, with a minimum withdrawal amount of $100. Requests are submitted via email to support@nextstepfunded.com. Withdrawals are made in USDT, so you will need a cryptocurrency wallet that supports this stablecoin.

Customer support

Efficient and professional client support is crucial for building trader loyalty. A prompt, comprehensive, and knowledgeable response fosters trust, while delays or inexperienced responses can erode it. Next Step Funded boasts 24/7 support via email and a ticketing system.

Advantages

- It is not necessary to be an active client to contact the support

- Applications are processed quite quickly

- High level of service

Disadvantages

- No phone numbers

The available contact methods include:

-

Email;

-

Ticket system.

Additionally, traders can join the Discord channel using the provided link and leave their messages there.

Contacts

| Official site | https://nextstepfunded.com/ |

|---|---|

| Contacts |

Education

Rarely prop trading firms emphasize on educational aspects. This is the case for Next Step Funded, whose management logically assumes that if a trader registers with them and applies for funding, they already have at least basic knowledge and experience. Otherwise, failure in the challenge is almost inevitable.

For beginners, it's recommended to use external resources to study and prepare before starting. Next Step Funded offers the Flash Evaluations program as a cost-effective entry point, requiring a $14 deposit to access $15,000 in capital.

Comparison of Next Step Funded to other prop firms

| Next Step Funded | FundedNext | Hola Prime | SabioTrade | Earn2Trade | The Trading Pit | |

| Trading platform |

MetaTrader4 | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | NinjaTrader, R Trader Pro, Finamark, Overcharts | MetaTrader4, MetaTrader5, BOOKMAP, R Trader, QUANTOWER |

| Min deposit | $14 | $32 | $48 | $119 | $150 | $99 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:1 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

80% / 50% | No | No | 100% / 50% | 10% / 10% | No |

| Order Execution | Market Execution | N/a | Market Execution | Market Execution | Market Execution | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of Next Step Funded

Next Step Funded was founded just over a year ago. It attracts traders with a wide range of funding programs and a well-thought-out offering. The evaluation phase is straightforward but cannot be passed without attention to several important details. Trading must not only be successful but also disciplined and well-planned as this is the primary requirement. This makes sense, as the company is risking its own money. Therefore, they provide real capital from $15,000 to $300,000 only to clients who have an effective long-term strategy and can prove their trading competence. Partnering with the broker Eightcap is a smart choice. Eightcap has no significant weaknesses, while its advantages are undeniable: a small minimum deposit, reasonable trading fees, a variety of assets, and optimal leverage are some of its strengths.

Next Step Funded by the numbers:

-

The minimum deposit is $14.

-

10% is the required profit rate in one-step challenges.

-

5% is the maximum daily drawdown, and 10-12% is the overall one.

-

Funding of up to $300,000 (up to $600,000 for multiple funding programs).

-

90% is the maximum trader profit share.

Next Step Funded is a prop trading firm for comfortable and diverse trading

Any company providing its capital to traders is interested in offering access to a wide range of financial instruments. This allows traders to create a deeply diversified portfolio and apply their preferred strategies. In partnership with Eightcap, Next Step Funded offers over 500 assets, including CFDs on currency pairs, stocks, indices, metals, and energies. Trading is conducted through the reliable MetaTrader 4 trading platform. Flexible, optimal leverage up to 1:100 enhances profit potential.

Next Step Funded’s analytical services:

-

Flash Evaluations. Ideal for experienced traders seeking a fast track to live trading, this program allows you to complete the challenge in just one day with a small deposit. For example, a $22 deposit unlocks $25,000 in capital or $75 for $100,000.

-

Deposit refund. Available in Standard One-Step and Standard Two-Step programs. Upon successful challenge completion, the deposit is credited to the Eightcap broker account and becomes available for trading.

-

Free second attempt. This applies to all programs except Flash Evaluations. To pass, you must not violate any rules and reach the time limit, even if your score isn't high enough to qualify.

Advantages:

Variety of funding programs allows clients to choose the best option for themselves.

Relatively simple challenges can be completed even without exceptional experience and skills.

Eightcap is a reputable and regulated broker, with efficient trading mechanisms and low fees.

Highly favorable profit sharing of up to 80%/20% or even 90%/10% in favor of the trader.

Profit withdrawals can be made to Visa/MasterCard and cryptocurrency wallets; and support is responsive and competent.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i