According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $35

- MetaTrader5

- MT5 Webtrader

- Profit target is 8% and 5%

- Daily and total drawdowns are 5% and 10%.

- Up to 1:100

Our Evaluation of OANDA Prop Trader

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

OANDA Prop Trader is one of the best proprietary trading firms in the financial market with the TU Overall Score of 9.51 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by OANDA Prop Trader clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the firm’s clients are fully satisfied with the company.

OANDA Prop Trader offers unique opportunities for professional growth and substantial profits. Transparent conditions, unlimited time for challenges, and high leverage make it attractive to experienced traders. Strict regulation and reliability allow traders to be confident of their transaction security. However, high initial fees can be an obstacle for novice traders, while the lack of passive income options can limit opportunities for generating profits.

Brief Look at OANDA Prop Trader

OANDA Prop Trader is a proprietary trading firm offering funding from $5,000 to $500,000. Traders can select from various two-phase challenges with initial fees ranging from $35 to $2,400. Challenges require achieving a profit target of 8% in the first phase and 5% in the second, while maintaining daily and total drawdowns of 5% and 10%, respectively. The initial profit split is 80/20, with the possibility of increasing the trader's share up to 90%. Leverage of up to 1:100 is available for improved risk management.

- Wide choice of challenges for traders with different strategies and experience;

- Competitive profit split;

- Wide range of trading assets for portfolio diversification, including currencies, commodities, metals, and indices.

- High challenge fees;

- No passive income options.

TU Expert Advice

Author, Financial Expert at Traders Union

OANDA Prop Trader offers a range of challenges with funding from $5,000 to $500,000. Traders can choose from various account types with fees starting at $35. The platform supports MetaTrader 5, offering leverage up to 1:100 and a competitive profit split that starts at 80/20. A wide array of trading assets, including Forex, commodities, and indices, are available, allowing for portfolio diversification. The firm provides reliable oversight via its association with the OANDA Group and 24/5 client support through email and live chat.

However, OANDA Prop Trader's high initial challenge fees and the lack of passive income options may deter novice traders who may not have the capital to start. Restrictions on specific trading strategies such as news and copy trading also exist. Therefore, while the firm offers robust trading conditions favorable for experienced traders seeking growth, beginners may find its entry barriers challenging.

OANDA Prop Trader Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT5 and MT5 WebTrader |

|---|---|

| 📊 Accounts: | From $5,000 to $500,000 |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank cards and bank transfers |

| 🚀 Minimum deposit: | $35 |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.1 |

| 💱 EUR/USD spread: | Floating |

| 🔧 Instruments: | Currency pairs, metals, indices, and commodities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

Profit target is 8% and 5%; Daily and total drawdowns are 5% and 10%. |

| 🎁 Contests and bonuses: | No |

OANDA Prop Trader offers several challenges differing in initial fees and available funding. Leverage of up to 1:100 allows traders to place larger positions with lower capital. Technical support is available 24/5 via email and live chat.

OANDA Prop Trader Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Challenge rules and pricing

OANDA Prop Trader provides access to funding up to $500 000, with challenges requiring at minimum of No time limits trading days. The entry-level plan starts at $35, and the fee is refundable if the challenge is successfully completed.

- Low entry cost — from $35

- Free demo account available

- High funding potential — up to $500 000

- No instant funding options

- No free evaluation option

OANDA Prop Trader Challenge fees and plans

We compared OANDA Prop Trader’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | 2 - Profit target, $ | Daily loss,% | Max. loss, % |

| 5К |

|

|

|

|

|

|

| 10К |

|

|

|

|

|

|

| Titanium |

|

|

|

|

|

|

| Titanium X |

|

|

|

|

|

|

| Silver |

|

|

|

|

|

|

| Gold |

|

|

|

|

|

|

| Lucky 888 Challenge |

|

|

|

|

|

|

| Platinum Challenge |

|

|

|

|

|

|

| Black Challenge |

|

|

|

|

|

|

What’s the minimum trading period for OANDA Prop Trader’s challenge?

No minimum trading days. You can complete the challenge as soon as you reach the profit target.

Does OANDA Prop Trader offer a free evaluation?

No, OANDA Prop Trader does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at OANDA Prop Trader?

No, OANDA Prop Trader does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

OANDA Prop Trader outlines the main rules for funded accounts, including a max. loss of 10% and a daily loss limit of 5%. The firm also restricts certain trading strategies, which are detailed below.

- Flexible leverage up to 1:100

- No weekend close rule

- Trading bots (EAs) allowed

- News trading not allowed

- Copy trading not allowed

OANDA Prop Trader trading conditions

We compared OANDA Prop Trader’s leverage and trading conditions with competitors to help you better understand how it measures up.

| OANDA Prop Trader | Hola Prime | SabioTrade | |

| Max. loss, % | 10 | 5 | 6 |

| Max. leverage | 1:100 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | No | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | No | No | No |

Deposit and withdrawal

OANDA Prop Trader earned a Medium score based on how smoothly and conveniently traders can deposit and withdraw funds.

The deposit and withdrawal options at OANDA Prop Trader meet most standard requirements and are in line with what many prop firms provide.

- Supports bank wire transfers

- Bank сard deposits and withdrawals

- USDT payments not supported

- PayPal not supported

Deposit and withdrawal options

To help you evaluate how OANDA Prop Trader performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

OANDA Prop Trader Payment options vs Competitors

| OANDA Prop Trader | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | Yes | No | No |

| Crypto | No | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared OANDA Prop Trader with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| OANDA Prop Trader | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | No | Yes | No |

| Biweekly | Yes | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

OANDA Prop Trader offers the following base account currencies:

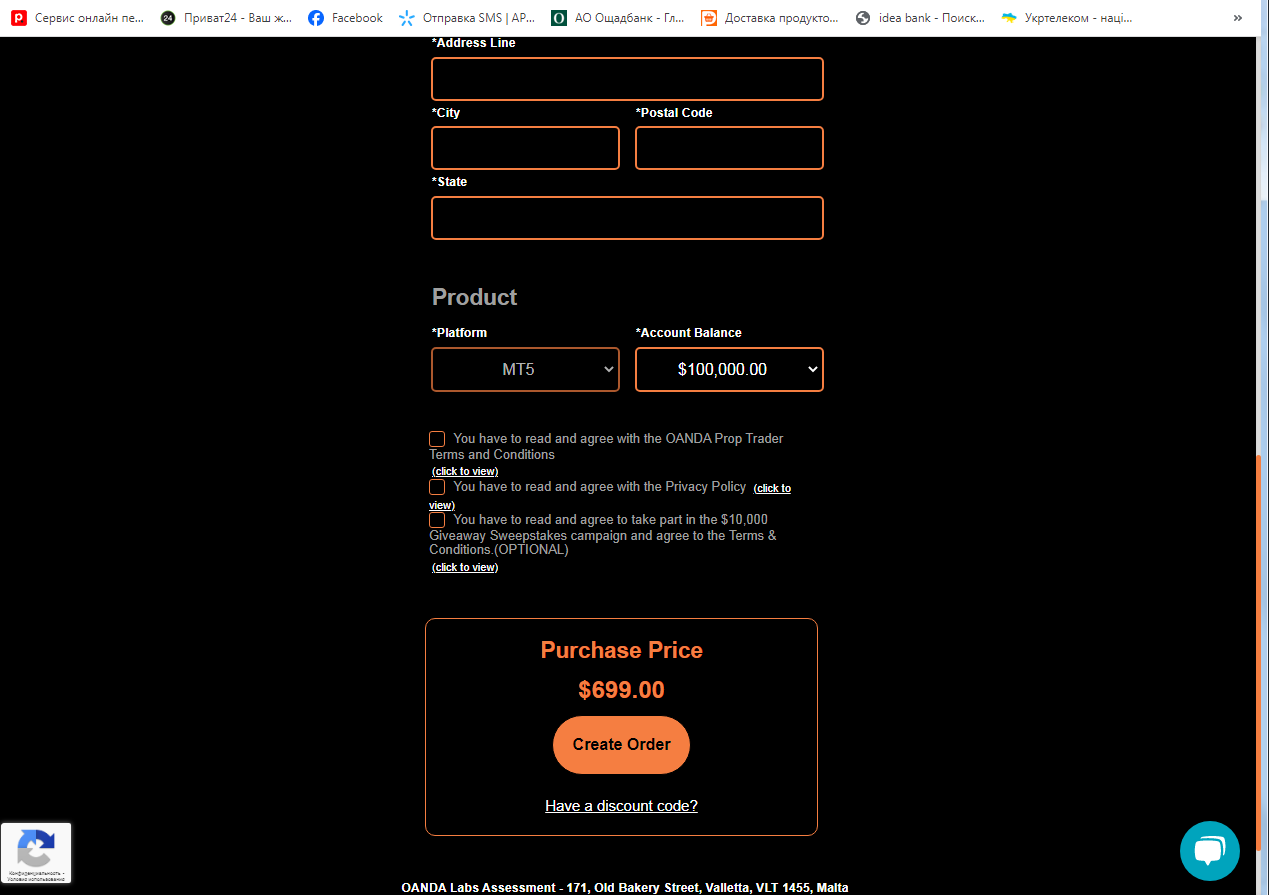

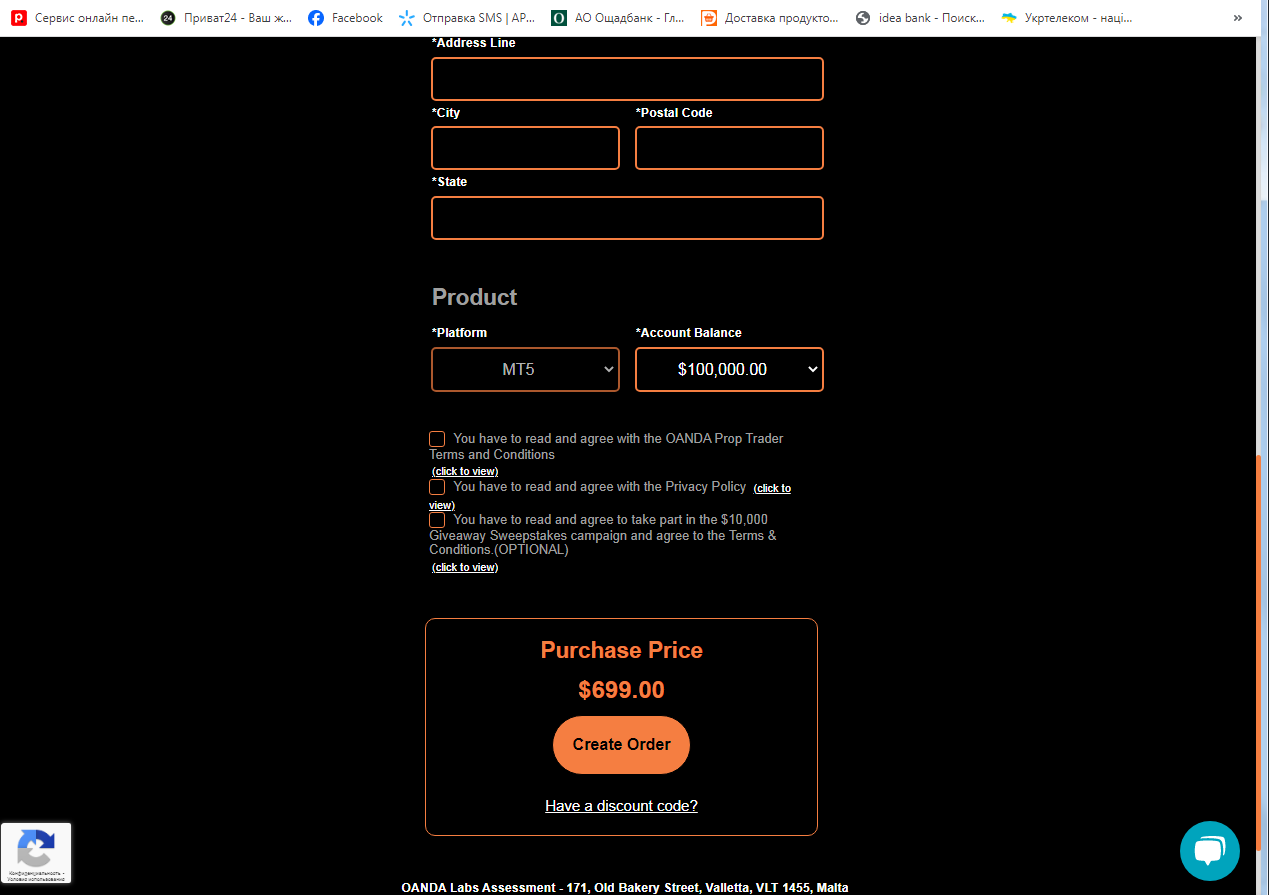

Trading Account Opening

To start working with OANDA Prop Trader, register on its official website, select the challenge, and pay the initial fee. Upon successful completion of the challenge, start trading on a live trading account. TU experts prepared a step-by-step guide on registration and described features of the firm’s user account.

Go to the OANDA Prop Trader website and click “Take the Challenge”.

Choose the desired challenge and click “Buy now”.

Carefully review the challenge conditions before proceeding.

Fill in the registration form with your first and last names, date of birth, country of residence, phone number, email, and residence address.

Choose the desired balance, agree to the terms and conditions by checking the box, and click “Create Order”. Choose the payment method and enter your payment details.

After successful payment, get access to your user account.

Download the trading platform to start the challenge.

Additional features of OANDA Prop Trader’s user account allow traders to:

-

Manage active challenges and monitor their progress.

-

Pay initial fees for new challenges and submit withdrawal requests.

-

Update personal information and security settings.

-

Download the trading platform.

-

Contact technical support.

Regulation and safety

OANDA Prop Trader is regulated by multiple authorities, including the UK FCA and ASIC, ensuring a high level of trader trust and security. While prop firms are not required to be regulated, partnering with a licensed broker offers additional protection and peace of mind, ensuring a reliable trading platform and fulfillment of all obligations.

Advantages

- Official registration and regulation

- Partnership with a licensed broker

- No reported conflicts with clients

Disadvantages

- Regional client protection outside OANDA’s jurisdiction may not be available

Markets and tradable assets

OANDA Prop Trader has a score of 6/10, indicating an Average offering of markets and tradable assets.

- Indices available

- CFDs offered

- Forex trading supported

- Options not supported

- Futures not available

Tradable markets

We compared the range of tradable instruments offered by OANDA Prop Trader with two leading competitors to highlight the differences in market access.

| OANDA Prop Trader | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | No | No | No |

| Crypto | No | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

OANDA Prop Trader focuses on providing traders with a unique opportunity to trade with real capital and competitive trading conditions. Since it caters primarily to active traders seeking profit opportunities, investors looking for passive income options might consider other intermediaries.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Customer support

When having questions about working with OANDA Prop Trader, traders can contact 24/5 technical support via email and live chat on the website.

Advantages

- Several communication channels

- Unregistered clients can contact support

Disadvantages

- Support is not available on weekends

Whether you are the firm’s client or just intend to become one, do not hesitate to contact technical support with any questions.

Available communication channels are:

-

Email;

-

Live chat in the Support section.

OANDA has its profiles on Facebook, X (Twitter), and Instagram, where traders can view news updates and contact support.

Contacts

| Registration address | OANDA Europe Limited 50-52 Cannon Street, London, EC4N 6JJ, United Kingdom |

|---|---|

| Regulation | FCA, ASIC |

| Official site | https://proptrader.oanda.com/en/ |

| Contacts |

Education

OANDA Prop Trader offers access to educational materials through the OANDA Labs platform, featuring various articles and recommendations on market analysis, along with reviews of major currency pairs and economic indicators. However, the platform's content primarily caters to experienced traders and may not be suitable for beginners.

The FAQs section provides answers to basic questions on challenges and trading conditions. Comprehensive information on companies is available on other website pages.

OANDA Prop Trader offers limited educational resources designed for experienced traders. Useful materials and analytics are provided in the blog, however, for a detailed market study, it is recommended to use additional resources.

Comparison of OANDA Prop Trader to other prop firms

| OANDA Prop Trader | FundedNext | Hola Prime | SabioTrade | Instant Funding | Blue Guardian Capital | |

| Trading platform |

MetaTrader5, MT5 Webtrader | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | cTrader, DX Trade, MetaTrader5, Match Trader | MT4 |

| Min deposit | $35 | $32 | $48 | $119 | $79 | $187 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | No | No |

| Order Execution | Market Execution | N/a | Market Execution | Market Execution | Market Execution | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of OANDA Prop Trader

OANDA Prop Trader, a young prop firm, has gained the trust of traders through its transparent conditions and a reliable partnership with OANDA, one of the world's leading brokers. The firm offers funding up to $500,000 with a maximum leverage of 1:100 for improved risk management. The challenge features achievable profit targets of 8% for phase 1 and 5% for phase 2. Initial fees are refundable upon successful completion.

OANDA Prop Trader by the numbers:

-

The minimum initial fee is $35;

-

Maximum funding is $500,000;

-

Profit target is 8% and 5%;

-

100+ available trading instruments;

-

The maximum trader’s profit share is 90%.

OANDA Prop Trader is a prop firm offering a comfortable trading environment

OANDA Prop Trader offers a diversity of trading assets, including currency pairs, commodities, metals, and indices, which allows traders to implement various strategies and diversify their portfolios with minimum risks. Leverage up to 1:100 provides for placing larger positions with smaller capital. Transparent conditions like refundable initial fees and fair profit split make the firm attractive for traders seeking professional and financial growth. Technical support is available 24/5.

Useful services offered by OANDA Prop Trader:

-

Traders can choose between several challenges and receive the initial fee refund once successful.

-

Clients are allowed to open multiple accounts and close them at any time.

-

10% total drawdown and 5% daily drawdown provide for risk management and protect against impulsive decisions.

-

Leverage of up to 1:100 allows traders to efficiently use their capital and open positions at minimum costs.

-

No minimum trading activity is required.

Advantages:

Regulation in 8 jurisdictions ensures reliability and client protection;

100+ trading instruments are available;

No subscription or hidden fees;

Accounts are scalable up to $500,000;

24/5 technical support is available via email and live chat.

Latest OANDA Prop Trader News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i