According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $65

- MetaTrader4

- MetaTrader5

- KCM WebTrader

- Automated trading strategies are allowed

- All open positions must be closed before the weekend.

- Up to 1:100

Our Evaluation of SiegPath

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

SiegPath is a high-risk prop trading company with the TU Overall Score of 2.86 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by SiegPath clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this company, as, according to reviews, most clients are not satisfied with the firm.

SiegPath (SiegFund) ensures user accounts and client data security by implementing advanced encryption methods and adhering to KYC (Know Your Client) and AML (Anti-Money Laundering) regulations. The firm offers a wide range of account types and allows its clients to use leverage and various trading strategies.

Brief Look at SiegPath

SiegPath (SiegFund), founded in 2016 in Australia, is a prop firm that provides funding up to $400,000 to experienced traders with proven strategies. There are 1-step and 2-step challenges. The firm’s asset pool includes currency pairs, CFDs on stocks, stock indices, metals, and other financial instruments. SiegPath serves clients worldwide, excluding OFAC (the Office of Foreign Asset Control) sanctioned countries.

- Lifetime referral rewards;

- Initial payment refund upon successful assessment;

- Transparent monitoring system through a SiegPath user account;

- Continued trading after minor violations.

- No additional bonuses;

- Strict daily profit target requirements.

TU Expert Advice

Financial expert and analyst at Traders Union

SiegPath (SiegFund) offers trading CFDs on a range of instruments, including major and minor currency pairs, energies, indices, precious metals, and U.S. stocks. The available leverage varies depending on the instrument and challenge type. For example, most currency pairs are traded with maximum leverage of 1:30 for 1-step challenges and 1:100 for 2-step challenges.

The prop firm classifies all challenge rule violations into two types: soft and hard breaches. Soft breaches lead to closing of all non-compliant trades but do not terminate trading. Hard breaches, such as exceeding daily loss limits or maximum drawdown, lead to challenge failure or account termination. Once traders pay the initial fee, they gain access to a dedicated dashboard where they can monitor their assessment and live accounts. The platform updates metrics every minute.

The challenge requires a minimum 5-day trading period to ensure consistent results. To succeed, traders must achieve net profit of 1% of the initial balance on three separate days. If the overall profit target is achieved, but daily profit requirements are not met, traders can get a new account to restart the challenge.

SiegPath Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4 (MT4), MetaTrader 5 (MT5), and KCM WebTrader |

|---|---|

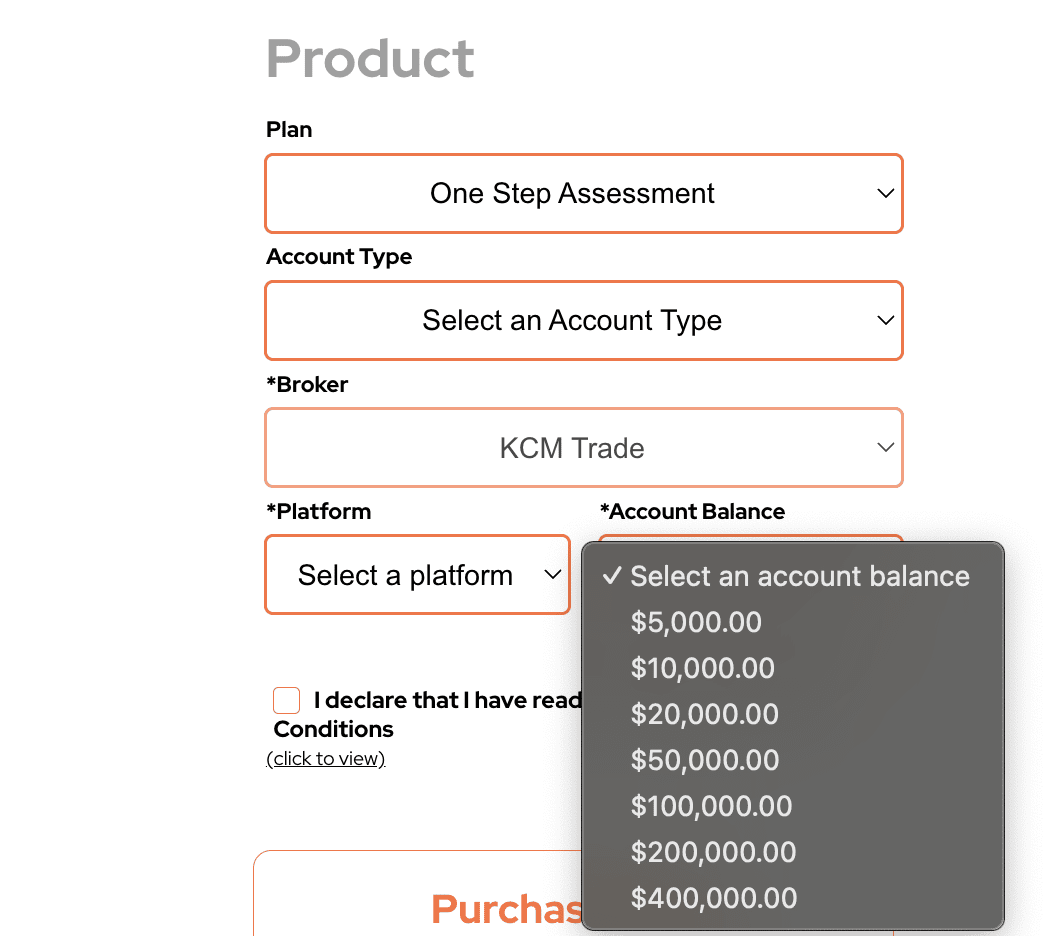

| 📊 Accounts: | Assessment and live accounts with $5,000, $10,000, $20,000, $50,000, $100,000, $200,000, and $400,000 balances |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | PayPal, Skrill, cryptocurrencies, and bank transfers |

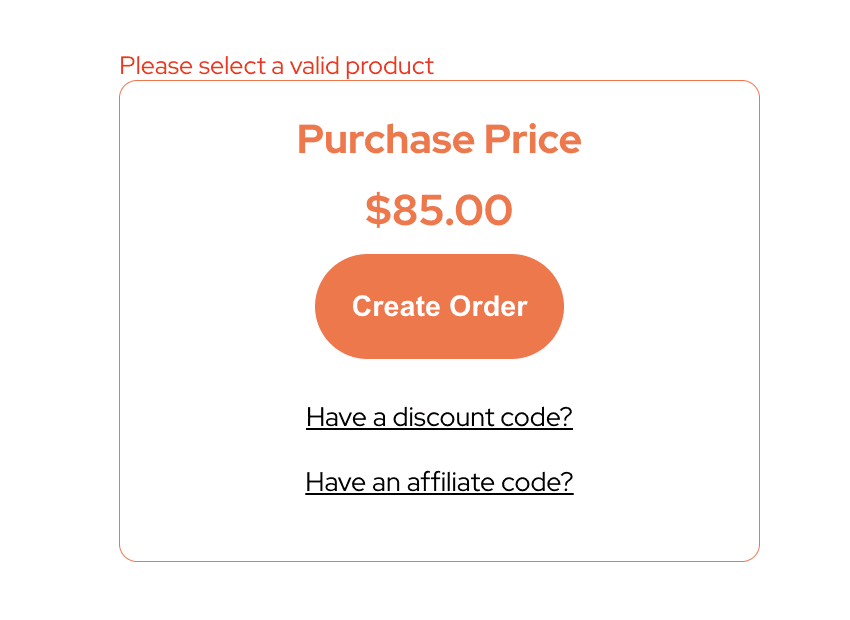

| 🚀 Minimum deposit: | $65 for 2-step challenge and $85 for 1-step challenge |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | From 1.6 pips for EUR/USD |

| 🔧 Instruments: | CFDs, currency pairs, precious metals, indices, stocks, and energies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

Automated trading strategies are allowed; All open positions must be closed before the weekend. |

| 🎁 Contests and bonuses: | Yes |

SiegPath (SiegFund) is a PE firm, an authorized prop firm that filters qualified traders. This means that once traders reach the funded stage, they trade with real capital in live markets, rather than on a virtual account. This approach is designed to maximize the benefit between company and traders, and comprehend the nature of prop trading. SiegPath offers lower pricing, 3 types of evaluations, and free trading conditions that support EA, news trading, and flexible trading strategies. SiegPath permits scalping strategies and trading during news events. However, all open positions must be closed by 15:45 EST on Friday. Additionally, the firm requires stop-loss orders for every trade. Inactive accounts are closed after 14 days.

SiegPath Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Challenge rules and pricing

SiegPath provides access to funding up to $400 000, with challenges requiring at minimum of 3 trading days. The entry-level plan starts at $65, and the fee is refundable if the challenge is successfully completed.

- High funding potential — up to $400 000

- Multiple scaling options

- Flexible trading rules and conditions

- No instant funding options

- Minimum trading period required

SiegPath Challenge fees and plans

We compared SiegPath’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | Daily loss,% | Max. loss, % |

| 1 Step - Beginner |

|

|

|

|

|

| 2 Step - Experienced |

|

|

|

|

|

| 2 Step - Elite |

|

|

|

|

|

| 1 Step - Experienced |

|

|

|

|

|

| 1 Step - Elite |

|

|

|

|

|

| 2 Step - Beginner |

|

|

|

|

|

What’s the minimum trading period for SiegPath’s challenge?

A minimum of 3 trading days is required, regardless of how quickly you reach the profit target.

Does SiegPath offer a free evaluation?

No, SiegPath does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at SiegPath?

No, SiegPath does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

SiegPath outlines the main rules for funded accounts, including a max. loss of 6% and a daily loss limit of 3%. The firm also restricts certain trading strategies, which are detailed below.

- Trading bots (EAs) allowed

- Copy trading allowed

- News trading allowed

- Weekend close required

SiegPath trading conditions

We compared SiegPath’s leverage and trading conditions with competitors to help you better understand how it measures up.

| SiegFund | Hola Prime | SabioTrade | |

| Max. loss, % | 6 | 5 | 6 |

| Max. leverage | 1:100 | 1:100 | 1:30 |

| Weekend close rule | Yes | No | No |

| Mandatory Stop Loss | Yes | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | Yes | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | Yes | No | No |

Deposit and withdrawal

SiegPath earned a Medium score based on how smoothly and conveniently traders can deposit and withdraw funds.

The deposit and withdrawal options at SiegPath meet most standard requirements and are in line with what many prop firms provide.

- USDT (Tether) supported

- Bitcoin (BTC) supported

- PayPal supported

- Supports bank wire transfers

- No on-demand withdrawals

- No bank сard option

- Limited deposit and withdrawal options

Deposit and withdrawal options

To help you evaluate how SiegPath performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

SiegPath Payment options vs Competitors

| SiegPath | Hola Prime | SabioTrade | |

| Bank Card | No | Yes | Yes |

| Bank Wire | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | Yes | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | Yes | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared SiegPath with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| SiegPath | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | No | Yes | No |

| Biweekly | Yes | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

SiegPath offers the following base account currencies:

Trading Account Opening

To start the challenge with SiegPath, go to the firm’s official website and register following the below instructions.

At the top of any page, click “Sign Up”.

Provide your personal data in the registration form.

Choose a challenge, trading platform, and funding amount.

Pay for the chosen challenge.

Features of SiegFund’s user account allow traders to:

-

Upload verification documents;

-

Use the economic calendar;

-

View the newsfeed;

-

Request withdrawals;

-

Apply for trading contests.

Regulation and safety

As a prop firm, SiegPath (SiegFund) does not hold client funds or offer investment accounts, which exempts it from licensing. SiegPath partners with KCM Trade, a broker regulated by the Financial Services Commission (FSC) of Mauritius.

Advantages

- Registration in Hong Kong

- Regulated partnering broker

- Advanced security measures

Disadvantages

- Accounts may be closed for rule violations without profit payout

- SiegPath (SiegFund) is not responsible for KCM Trade’s reliability

- FSC of Mauritius is known for its lenient licensing process

Markets and tradable assets

SiegPath has a score of 8/10, reflecting a strong variety of markets and assets available for trading.

- Stock trading allowed

- CFDs offered

- Forex trading supported

- Futures not available

- Options not supported

Tradable markets

We compared the range of tradable instruments offered by SiegPath with two leading competitors to highlight the differences in market access.

| SiegPath | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

While SiegPath (SiegFund) forbids the use of managed accounts for passive income, it allows its clients to automate their trading with expert advisors and use TheCopyTrades platform for copy trading.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program from SiegPath (SiegFund)

SiegPath referral program offers four levels based on the number of referred clients:

-

Bronze. This level is awarded for up to 49 referrals and offers a 12% reward of the referral’s initial payment.

-

Silver. To receive a 15% reward, it is required to attract 49-199 referrals.

-

Gold. With 199-499 referrals, partners earn 18% rewards.

-

Platinum. Partners with over 500 referrals receive 21% rewards.

SiegPath (SiegFund) offers lifetime referral rewards.

Customer support

SiegPath (SiegFund) only offers online client support. Phone communication is not available.

Advantages

- Prompt communication via a live chat

- Replies are highly informative

Disadvantages

- Limited communication channels

- No callback option

Available communication channels:

-

Live chat on the website;

-

Email;

-

Telegram channel.

The Contact section features a feedback form to send an email to the firm.

Contacts

| Registration address | SIEG Corporation Limited, Units 1902-5, 19/F, Dah Sing Financial Centre, 248 Queen's Road East, Wan Chai, Hong Kong SAR |

|---|---|

| Official site | https://www.siegpath.com/ |

| Contacts |

Education

SiegPath (SiegFund) offers numerous educational materials in the form of eBooks and courses for traders of all levels. The Academy section provides useful articles for both novice and experienced traders.

Trading videos and tutorials can be accessed upon user account registration.

Comparison of SiegPath to other prop firms

| SiegPath | FundedNext | Hola Prime | SabioTrade | Blue Guardian Capital | Hyrotrader | |

| Trading platform |

MetaTrader5, MetaTrader4, KCM WebTrader | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | MT4 | Bybit’s web platform and mobile apps |

| Min deposit | $65 | $32 | $48 | $119 | $187 | $89 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.6 point | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | No | No |

| Order Execution | Market Execution | N/a | Market Execution | Market Execution | No | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed SiegPath (SiegFund) review

SiegPath (SiegFund) was founded in 2016 as an online trading education platform. In 2021, backed by a private investment company, it transitioned into a prop trading firm. Today, it partners with over 10 brokers and major investment holdings. SiegPath (SiegFund) is registered in Hong Kong under number 65938113 and maintains a representative office in Melbourne, Australia.

SiegPath (SiegFund) by the numbers:

-

8+ years of experience;

-

7 challenge programs;

-

2 assessment types;

-

Funding ranges from $5,000 to $400,000;

-

Profit split is 80%-90%.

SiegPath (SiegFund) is a prop firm offering a variety of account types and straightforward challenge conditions

The 1-step challenge requires the profit target of 8%, with daily and total drawdowns of 3% and 6%, respectively. The 2-step challenge implies achieving the profit target of 10% during the first step and 5% during the second step. Daily and total drawdowns are limited to 5% and 10%. Both programs must be completed within 180 days.

The use of SiegPath services for any illegal activities, including market manipulation, prohibited trading strategies, or exploitation of errors, is strictly prohibited. Hard breaches may result in user account termination.

Useful services offered by SiegPath:

-

Initial payment refund upon success in the challenge;

-

Lifetime referral rewards;

-

Dedicated user account for account management and withdrawals;

-

Availability of economic calendar, technical and fundamental analyses, and currency heat map;

-

Flexible challenge completion options.

Advantages:

Lifetime referral program;

Fast metrics update;

Strict anti-manipulation rules;

Flexible challenge conditions with a minimum trading period of 5 days;

Support for various trading strategies;

Possibility to restart the challenge after soft breaches.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i