Proptradr (T4TCapital) Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- cTrader

- Seven balance options

- 80% profit split

- Trading during weekends is permitted.

- 1:100

Our Evaluation of Proptradr

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Proptradr is a moderate-risk prop trading firm with the TU Overall Score of 5.47 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Proptradr clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this firm as not all clients are satisfied with the company, according to reviews.

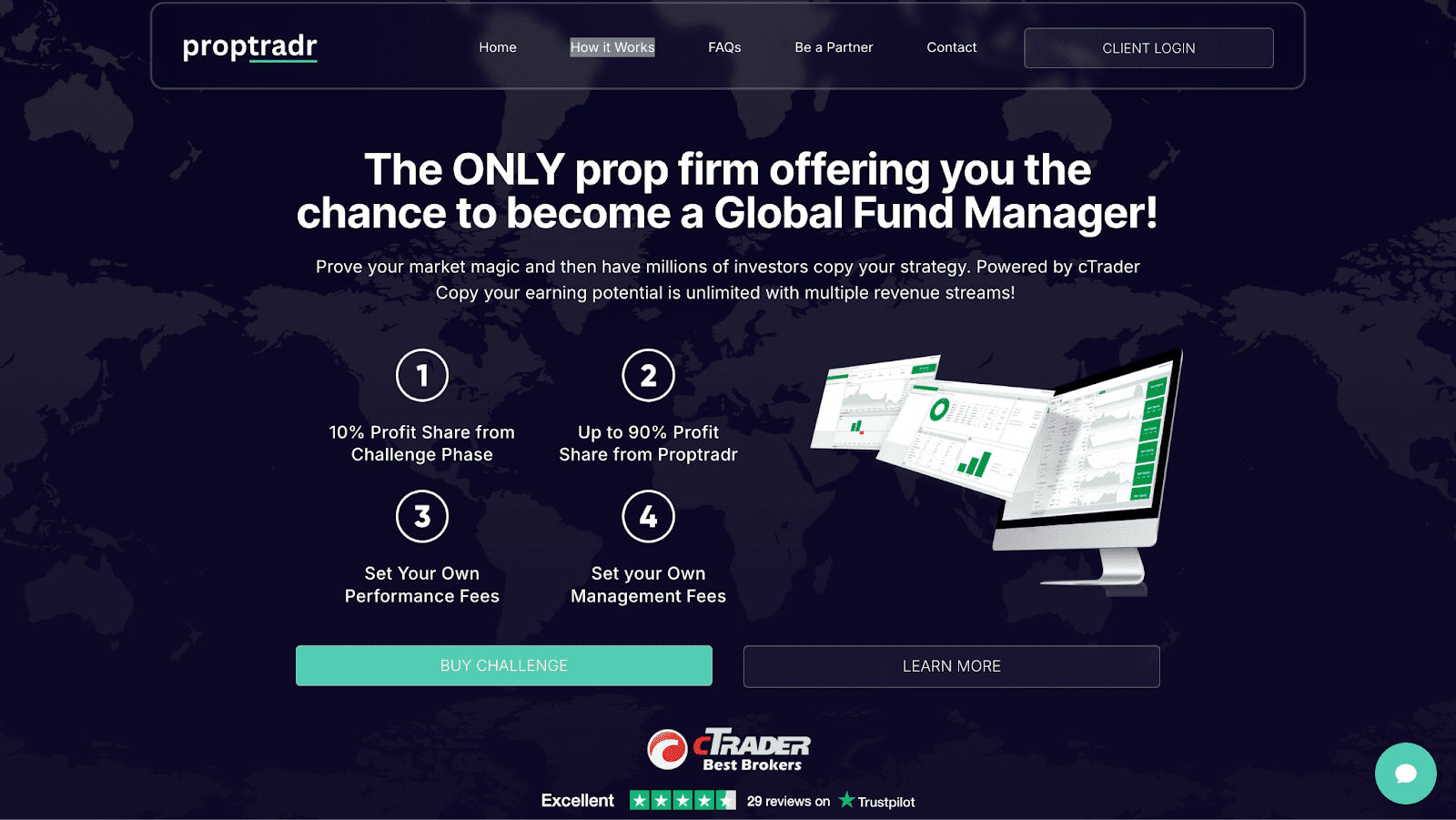

Proptradr hasn't introduced anything new, but it has improved the standard mechanisms. It has a lot of assets in the pool, appropriate leverage, and fairly loyal trading conditions with minimal restrictions. The single-phase challenge takes place on a demo account without any time limits. Traders keep 80% of their income. One trading platform (cTrader) with mobile version available. The referral program allows you to earn 15% of initial fees paid by an unlimited number of invited users. Also, there are unique rebates from Traders Union.

Brief Look at Proptradr

The proprietary (prop) Proptradr Funds Management firm is registered in Australia. It is partnered with several brokers and works directly with first-tier liquidity providers. The platform offers traders funding in the amount of $5,000, $10,000, $25,000, $50,000, $100,000, $200,000 or $1000,000 with the ability to scale up to $4,000,000. Only the initial fee is charged, there is no subscription fee. A mandatory profit target is not set, it is relevant only for scaling. Profit split is 80%. There is no withdrawal fee. Proptradr allows scalping and hedging. Daily drawdown limit is 5%. Partners of the prop firm trade currency pairs, cryptocurrencies, stocks, commodities, and metals. The maximum leverage is 1:100. The firm offers a partnership program with payouts of 15% of the amount deposited by a referral.

- 7 balance options;

- Large choice of instruments, moderate trading leverage, and usage of any strategy are available;

- 1:100 trading leverage;

- Trade through cTrader;

- Opportunity to become a Global Fund Manager through cTrader’s cTrader Copy Program;

- Partners of this prop firm can trade during weekends;

- 7 balance options: $5K, $10K, $25K, $50K, $100K, $200K, $1M.

- Availability of only one trading platform (cTrader).

TU Expert Advice

Financial expert and analyst at Traders Union

Most successful prop firms were established by professional traders. In the case of Proptradr (T4tCapital), everything is different. The firm was incorporated by Brad Gilbert a risk manager with 30 years of experience. He took the whole team from his previous job and started Proptradr. The firm has demonstrated an exceptional client-oriented approach and service adaptability since its incorporation.

Among the actual trading conditions of the prop firm, there are several points that stand out. First, the platform offers only one type of account, and there is no instant funding. The challenge is universal, without time limits. A profit target of 8% usually does not cause problems, although a win rate requirement is added to it. It is from 45% of the winning trades. Novice traders will have to work hard, but everything is achievable.

The initial fee is below the market average. For example, $50 is paid for the balance of $5,000. However, the fee is non-refundable. When completing the challenge, trading is carried out on a demo account, that is, traders do not earn anything. Profit split is 80%.

An important point about the withdrawal of funds is that it can be requested only once a month. The payment will come on the first day of the following month. Partners can work with currencies, cryptocurrencies, stocks, commodities, and metals. The maximum leverage is 1:100. The restrictions are typical for the segment. You can hedge and scalp. Testing the platform did not reveal any weaknesses, problem areas, or inconsistencies between live and demo trading conditions.

In conclusion, TU notes that the prop firm works with a number of brokers, and its partners are first-tier liquidity providers. The list consists of organizations and banks. This allows the firm to provide more favorable trading conditions for traders. Thus, according to the sum of factors, Proptradr can be recommended for review.

Proptradr Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | cTrader |

|---|---|

| 📊 Accounts: | Only one Standard account (with three balance options) |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank cards, e-wallets, and crypto wallets |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | No |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, stocks, commodities, and gold |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: |

Seven balance options; 80% profit split; Trading during weekends is permitted. |

| 🎁 Contests and bonuses: | No, except for the bonuses in the form of rebates from Traders Union |

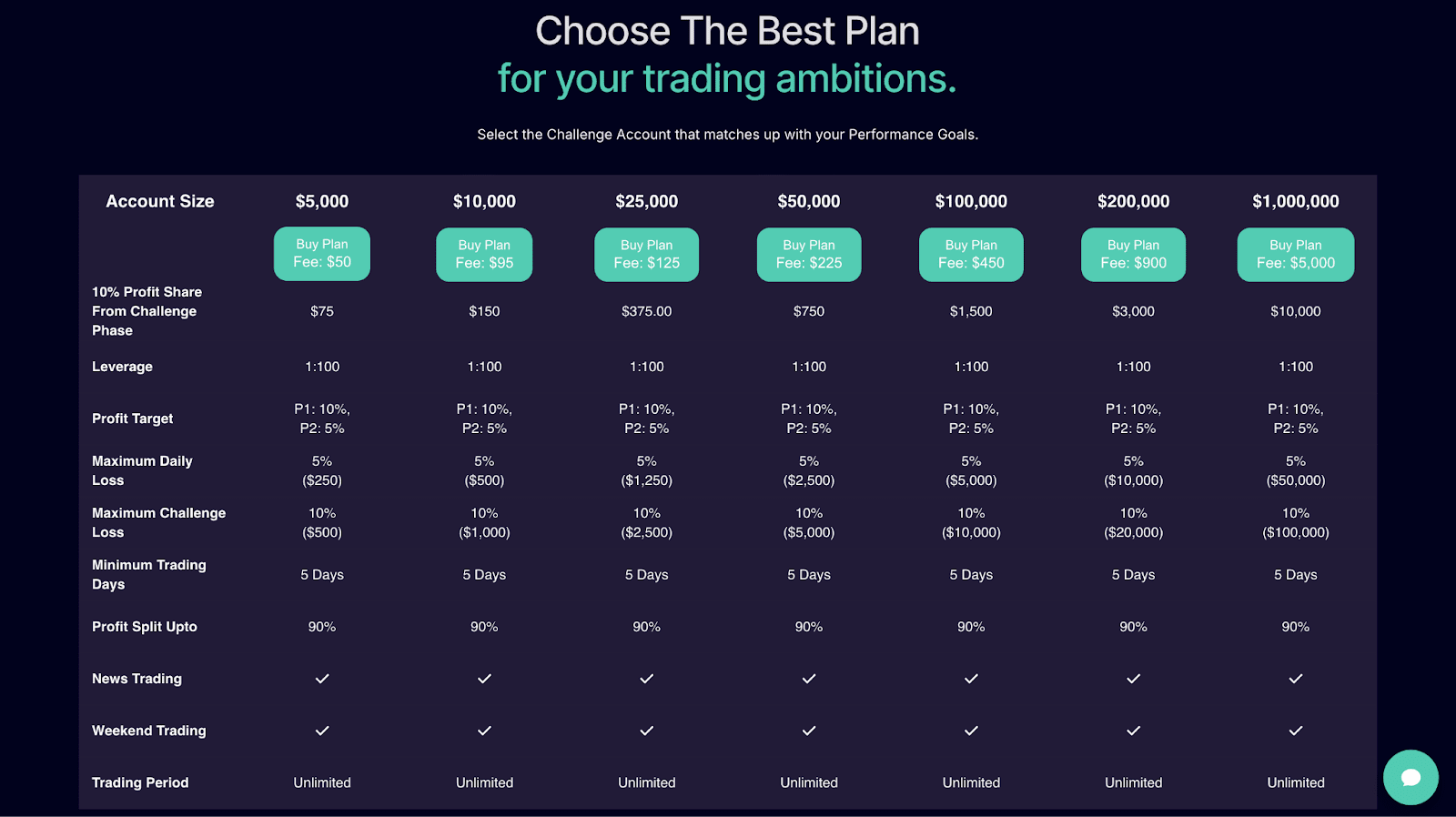

The initial fee depends on the type of account and the balance funded, as it is with all prop firms. Since Proptradr (T4tCapital) offers only one standard account, the fee is determined by the amount of funds that traders receive upon successful completion of the challenge. For the balance of $5,000, the initial fee is $50; for the balance of $10,000, it is $95; and for the balance of $25,000, it is $125. Trading conditions do not depend on the initial fee or the balance. For example, the leverage for all partners of the prop firm is 1:100. Profit split is 80%. Trading during weekends is allowed. As for technical support, it is represented by live chat on the firm's website. Live chat works on weekdays during certain hours. Questions left during non-working hours will be answered by managers as soon as they are in touch.

Proptradr Key Parameters Evaluation

Share your experience

No entries yet.

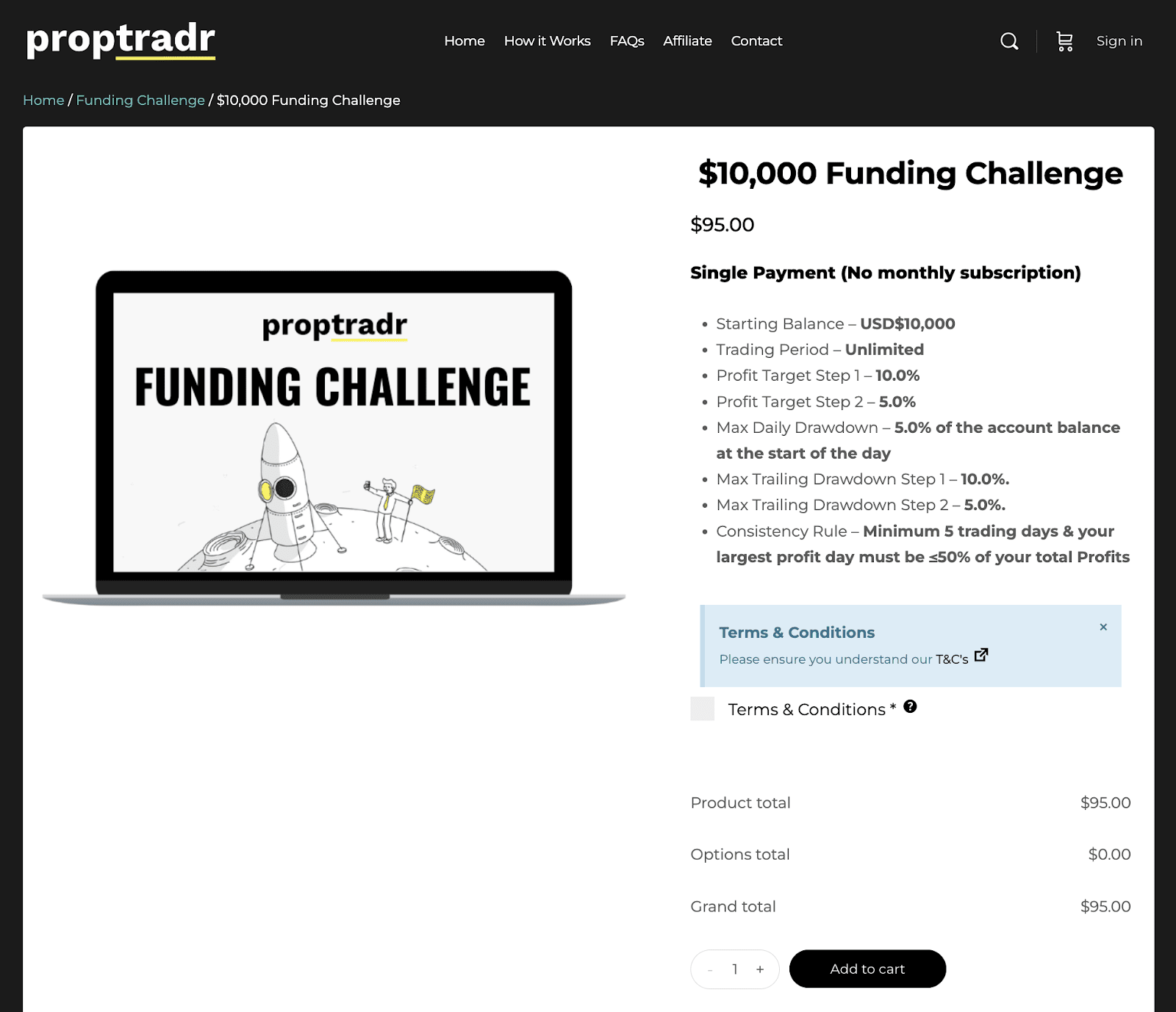

Challenge rules and pricing

Proptradr provides access to funding up to $1 000 000, with challenges requiring at minimum of 5 trading days. The entry-level plan starts at $100, and the fee is refundable if the challenge is successfully completed.

- High funding potential — up to $1 000 000

- Multiple scaling options

- Flexible trading rules and conditions

- Minimum trading period required

- Above-average entry cost — from $100

Proptradr Challenge fees and plans

We compared Proptradr’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | Daily loss,% | Max. loss, % |

| 1 Phase |

|

|

|

|

|

| 2 Phase |

|

|

|

|

|

What’s the minimum trading period for Proptradr’s challenge?

A minimum of 5 trading days is required, regardless of how quickly you reach the profit target.

Does Proptradr offer a free evaluation?

No, Proptradr does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at Proptradr?

No, Proptradr does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

Proptradr outlines the main rules for funded accounts, including a max. loss of 6% and a daily loss limit of 3%. The firm also restricts certain trading strategies, which are detailed below.

- Flexible leverage up to 1:10

- No weekend close rule

- Scalping allowed

- Copy trading not allowed

Proptradr trading conditions

We compared Proptradr’s leverage and trading conditions with competitors to help you better understand how it measures up.

| T4TCapital | Hola Prime | SabioTrade | |

| Max. loss, % | 6 | 5 | 6 |

| Max. leverage | 1:10 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | Yes | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | Yes | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | No | No | No |

Deposit and withdrawal

Proptradr earned a Low score based on how smoothly and conveniently traders can deposit and withdraw funds.

Proptradr's limited selection of payment methods and supported currencies may reduce its convenience and global accessibility.

- Bitcoin (BTC) supported

- Supports bank wire transfers

- USDT (Tether) supported

- Payoneer not supported

- No on-demand withdrawals

Deposit and withdrawal options

To help you evaluate how Proptradr performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

Proptradr Payment options vs Competitors

| Proptradr | Hola Prime | SabioTrade | |

| Bank Card | No | Yes | Yes |

| Bank Wire | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared Proptradr with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| Proptradr | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | No | Yes | No |

| Biweekly | No | Yes | No |

| Monthly | Yes | Yes | No |

What base account currencies are available?

Proptradr offers the following base account currencies:

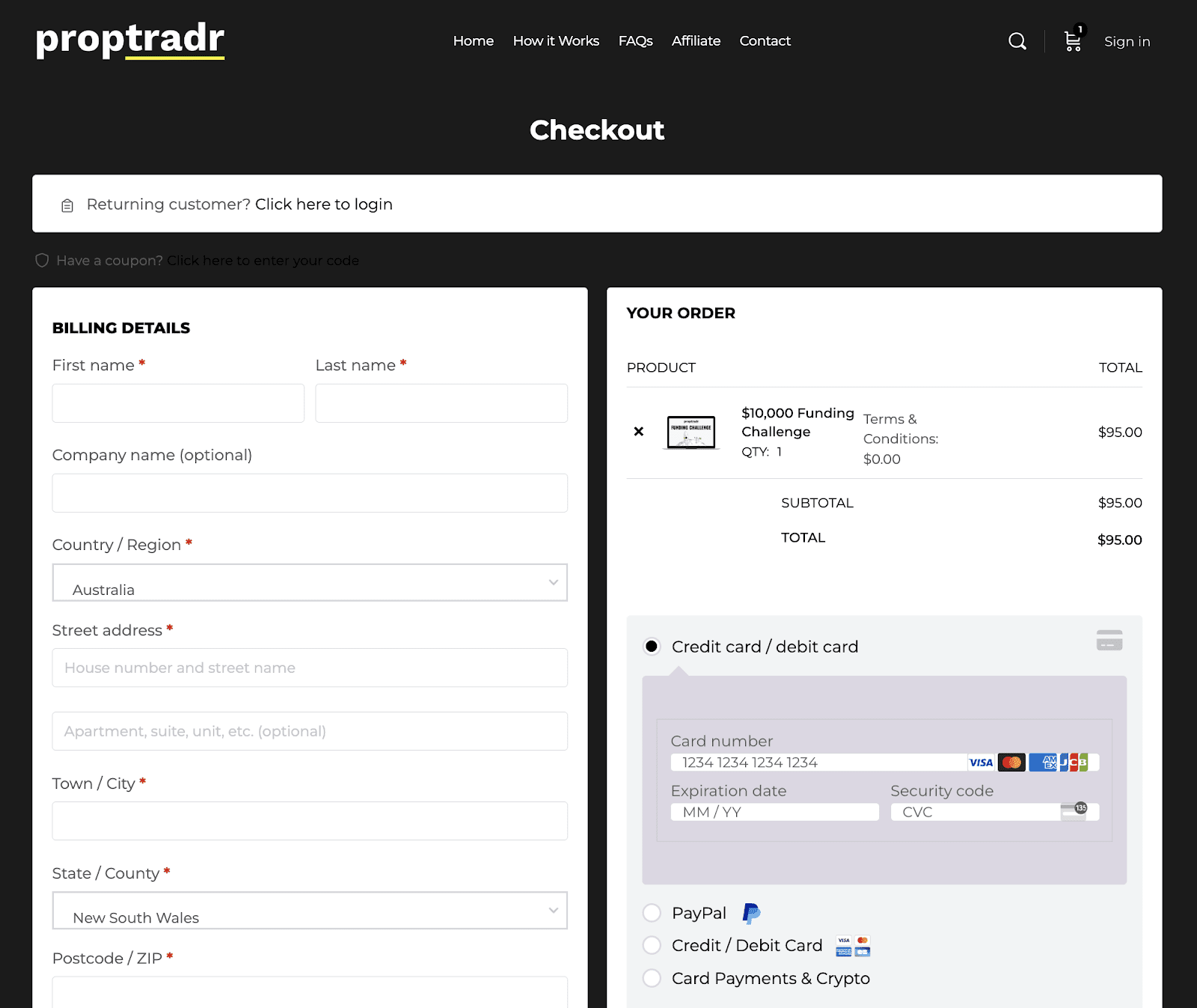

Trading Account Opening

Getting started with Proptradr is quite simple. Just follow the steps outlined below and you’ll be ready before you know it:

Visit Proptradr’s website. Head over to their site by clicking here

Initiate account registration. Click on the ‘Buy Challenge’ to initiate the registration process.

Pick your plan. Choose an account plan based on your trading goals (plans range from $5,000 to $1,000,000) and purchase the plan.

Fill out the form. After selecting your plan, simply make the payment and fill out the registration details.

Start the challenge and try to clear it. Once you've signed up, start trading for the challenge while keeping an eye on the rules and limits.

Start real trading. After completing the challenge and verification phase, you'll be ready to trade with real money. You’ll start working with live funds, and as you hit a 5% profit target, you'll not only earn your challenge profit bonus but also unlock exciting opportunities.

Grow into a fund manager. If you continue your success, you’ll have the chance to become a global fund manager through the cTrader strategy provider program. This means you can increase your profits by attracting investors and managing larger accounts, giving you more control over your growth.

Boost your earnings. As a fund manager, you'll have the opportunity to scale your account even more, allowing you to keep a larger portion of your profits—up to 90%. This is a huge chance to grow your financial success and take on more investment opportunities as a strategy provider with PROPTRADR.

Take out your earnings: After successfully meeting the requirements, you can withdraw your earnings or keep growing your account.

Key terms and conditions to keep in mind when creating an account

-

Age restriction. Must be 18+ to use the service.

-

Unauthorised access. Unauthorized access or hacking attempts are criminal offenses.

-

Trading platform. Offers simulated trading, not real live trading; no real funds are involved in the Challenge accounts.

-

Risk management. Strict limits on daily loss (5%) and maximum loss (10%) for Challenge accounts.

-

Challenge account fee. Non-refundable once a trade is placed.

-

Account inactivity. Accounts inactive for 30 days will be closed.

-

Prohibited trading strategies. No use of AI trading bots, high-frequency trading, or unfair strategies like Martingale.

-

Withdrawal rules. First payout available after 14 days; monthly thereafter; requires 5% profit on the live account.

-

Scaling plan. Traders can double account size after 3 months of 10% profit, with an increased profit share.

-

Refund policy. Fees are non-refundable after trading begins. Cancellations are only available within 14 days if no trades are placed.

-

Account termination. Breaching rules can lead to account termination with no refund.

-

Legal disputes. Disputes must go through mediation or arbitration.

Regulation and safety

Proptradr (T4tCapital) is a prop trading firm registered in the UK and subject to local laws. It is not a broker and does not bring its partners' transactions to the interbank market, so it does not need specialized regulation. Liquidity providers for Proptradr are first-tier organizations, such as banks. Traders can review the list of these organizations through technical support.

Advantages

- It is possible to contact the prop firm’s lawyers

Disadvantages

- It is impossible to get help from a regulator

- Assistance from a regional financial institution is not available, if you don’t reside in Great Britain

Markets and tradable assets

Proptradr has a score of 7/10, reflecting a strong variety of markets and assets available for trading.

- Crypto trading available

- Forex trading supported

- CFDs offered

- Options not supported

- Futures not available

Tradable markets

We compared the range of tradable instruments offered by Proptradr with two leading competitors to highlight the differences in market access.

| Proptradr | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | No | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

Prop trading firms do not offer typical investment solutions like cryptocurrency staking or dividend stocks. They provide traders with their capital for trading on the interbank market, and all their mechanisms are designed for this task. Nevertheless, sometimes referral (partnership) programs are considered as an option for passive income. However, you need to understand that this is not truly passive income. Indeed, in order to receive significant bonuses from referrals, you must actively communicate on the internet or have a popular blog.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program from Proptradr:

There is a section of the referral program with a personal link in the trader's user account. Traders can place the link on any website, and send it via instant messengers, or email. Any user who follows the link and registers on the website of the prop firm will become a partner (referee) of the link owner. As soon as the referee pays the initial fee, the link owner will receive 15% of the amount. The maximum amount is $52.50 if the referee pays for the account with the $100,000 balance. The number of referrals is not limited. The funds accumulated in this way are automatically transferred to the trader's external wallet at the beginning of each month, there is no need to submit a separate application.

Customer support

Technical support is needed if partners of the prop firm face an issue that they cannot solve on their own. Such situations happen frequently, regardless of the transparency of the platform and the details of the FAQs section. That is why it is so important that client support works promptly. Unfortunately, the Proptradr support is not active 24/7. It can be contacted only on weekdays from 09:00 to 17:00 GMT.

Advantages

- Managers answer promptly in live chat during working hours

- Users rate the quality of the support team as exceptionally high

Disadvantages

- Only live chat is available, there is no call center or email communication

- Technical support is not active on weekends. It works specific hours on weekdays

If you need expert help, you can write use live chat; it is available on the website and in the user account.

The prop firm has official Twitter and YouTube profiles. It is recommended to subscribe to them to learn Proptradr latest news.

Contacts

| Foundation date | 2020 |

|---|---|

| Registration address | Sky View, Argosy Road, East Midlands Airport, Derby, Derbyshire, United Kingdom, DE74 2SA |

| Official site | https://proptradr.com/ |

| Contacts |

Education

A prop firm is interested in its partners trading more successfully. After all, the higher their profit is, the higher the profit of the firm is. That is why many platforms provide their traders with educational materials, hold regular webinars, and pay attention to useful blog articles. Proptradr is one of those prop firms. Its website contains a lot of useful ideas. Also the firm’s experts provide online training.

In general, Proptradr (T4tCapital) education materials cover most of the practical issues. The firm's blog includes collections of articles on a variety of topics that are useful to most traders. Forex webinars are of particular interest to novice traders, although experienced players can also find something new for themselves.

Comparison of Proptradr to other prop firms

| Proptradr | FundedNext | Hola Prime | SabioTrade | Instant Funding | Gerchik&Co | |

| Trading platform |

cTrader | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | cTrader, DX Trade, MetaTrader5, Match Trader | MetaTrader5, Match Trader, cTrader |

| Min deposit | $50 | $32 | $48 | $119 | $79 | $29 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | No | No |

| Order Execution | No | N/a | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of Proptradr

Not many young prop firms manage to win the trust of tens of thousands of partners around the world within a couple of years. Proptradr initially offered the most simple and transparent conditions, such as one account, seven balance options, and a one-phase challenge without time limits. From the first day of the platform’s operation, currencies, cryptocurrencies, stocks, commodities, and precious metals have been represented on live accounts. Leverage is still 1:100. Definitely, there are many firms with leverage of up to 1:50 and above, but in most cases, professional traders do not trade with such leverage, because the risk is too high. The prop firm generally has favorable conditions, but it must protect its own capital and reinsure itself. Working with it is equally convenient for traders with any trading experience.

Proptradr by the numbers:

-

Minimum deposit is $50;

-

Up to $1000,000 of initial funding;

-

Balance scaling is up to $1,000,000;

-

Profit split is 80%.

Proptradr is a prop trading firm for comfortable trading in currencies, cryptocurrencies, stocks, commodities, and metals

Some platforms focus on a specific group of financial instruments, such as Forex. Often, several dozen assets from other popular groups are added, including stocks, indices, and cryptocurrencies. From the very beginning, Proptradr (T4tCapital) offered its partners a choice of hundreds of instruments, such as currencies, cryptocurrencies, stocks, commodities, and precious metals. And the list is constantly expanding. This is an advantage because traders do not have to trade assets that are of little interest to them and adapt to inconvenient restrictions. They work on their own conditions. The second plus is risk diversification. When traders trade with leverage, it is in their interest to do everything possible to reduce the negative consequences of unprofitable decisions. The division of capital between different assets helps a lot with risk diversification.

Useful features of Proptradr:

-

Traders do not need to puzzle over the choice of the type of account that will be the best for them. The prop firm offers one standard account with favorable trading conditions;

-

The challenge takes place on a demo account, so there aren’t any risks. However, market indicators are real. Traders are not limited in time, so they just need to achieve the profit target;

Advantages:

The challenge is one-phase, you need to achieve a profit of 8% and a win rate of at least 45% of trades;

Traders can trade through cTrader;

It is possible to hedge, scalp, and transfer positions;

The prop firm’s only fees are the initial fee and the profit split;

At any moment, a trader can reset the account and start again. This service is paid;

Scaling is available for all accounts with the balance starting from $100,000.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i