According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €99

- MetaTrader4

- MetaTrader5

- Hundreds of futures and Forex assets, 9 trading platforms, financial analysis tools, and integration with external services

- 1:30

Our Evaluation of The Trading Pit

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

The Trading Pit is one of the best proprietary trading firms in the financial market with the TU Overall Score of 9.59 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by The Trading Pit clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the firm’s clients are fully satisfied with the company.

Thetradingpit.com was launched only recently, but it is already possible to speak about its merits. It is convenient, multifeatured, and easy to master. The firm has a low entry threshold and favorable cooperation conditions. For example, after passing the challenge, traders receive up to 80% of profits. This prop firm has some drawbacks; however, they don’t look significant compared to the obvious advantages. The Trading Pit is one of the best options for those who want to move to the major league of futures and Forex.

Brief Look at The Trading Pit

The Trading Pit is a young proprietary (prop) trading firm with favorable conditions of cooperation. It is notable for its patented trading infrastructure, availability of 9 platforms (including МetaТrader 4 and МetaТrader 5), intuitive interface, and absence of supplemental charges. The Trading Pit currently offers over 500 CFDs [contract for (price) differences], and the variety of trading instruments is constantly expanding. The company provides its clients with educational content and mentors, allowing them to quickly hone their skills all the way to the professional level. Traders can connect their accounts at The Trading Pit to their Volume Trader accounts. Enrollment fees are from €99 to €999.

- Reasonable prices for trading both Forex and futures.

- The Trading Pit supports 9 of the most popular platforms, including MetaTrader 4 and MetaTrader 5.

- The firm presently offers futures, Forex, and over 500 CFDs. Cryptocurrencies and stocks will soon become available.

- Direct access to the markets, plus Live Squawk Box tools and integration with Volume Trader.

- Numerous financial solutions from an economic calendar to expert analytics.

- Live webinars, guides, individual mentorship, and other qualification improvement methods.

- A powerful affiliate program with favorable conditions for trading business representatives.

- No demo version or free plans. The minimum plan cost is €99.

- High qualification requirements in challenges for professional traders.

TU Expert Advice

Author, Financial Expert at Traders Union

The Trading Pit offers an array of trading instruments, including futures, Forex, and over 500 CFDs, and is planning to introduce cryptocurrencies and stocks soon. It supports nine trading platforms, including MetaTrader 4 and MetaTrader 5, providing traders versatility in their tool choices. A notable feature is the firm’s mentorship and educational support, which aims to enhance traders’ skills. The entry costs start at €99, with leverage up to 1:30, and the platform allows traders to retain up to 80% of their earnings.

However, The Trading Pit has some drawbacks, including high qualification requirements for trading challenges. Traders may find it less suitable if they prioritize diverse regulatory oversight, as it lacks international regulatory support beyond Liechtenstein. Consequently, The Trading Pit may appeal to experienced traders confident in managing potential risks and focusing on futures and Forex markets, while beginners or those requiring extensive educational resources may need to explore other options.

- You're looking for a substantial amount at a slow deposit. The Trading Pit's prop account, Lite, has a balance of $10,000. To open it, you need to deposit $100 and complete a 1-stage challenge.

- You're aiming for the highest possible account balance. Each client at The Trading Pit has account scaling available, with a maximum amount of $5 million. Traders retain 80% of their profits.

- You value freedom in actions. The prop-trading company allows scalping, hedging, and the use of advisors. The only requirement is trading for at least 3 days a month, achieving the required metrics.

- You're seeking comprehensive education. The educational section on the website offers minimal materials, and most of it might not be useful for traders with even minimal experience.

The Trading Pit Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, ATAS, QUANTOWER, R/TRADER, BOOKMAP |

|---|---|

| 📊 Accounts: | Lite, Standard, Executive, VIP |

| 💰 Account currency: | USD, EUR |

| 💵 Deposit / Withdrawal: | Visa/ Mastercard, Wire Transfer, Crypto, Google Pay, China UnionPay and various local payments available globally (wallets, local bank transfers) |

| 🚀 Minimum deposit: | €99 |

| ⚖️ Leverage: | 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | No |

| 🔧 Instruments: | Real Futures & Forex CFDs, including CFD Commodities, Indices, Crypto & Stocks. |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | Hundreds of futures and Forex assets, 9 trading platforms, financial analysis tools, and integration with external services |

| 🎁 Contests and bonuses: | No |

Enrollment fees depend on asset types and levels at which clients want to trade. There are 3 futures levels with enrollment fees of €99, €349, and €499, as well as 2 Forex levels, with enrollment fees of €399 and €999. If a trader proves his trading skills, he is refunded the fee along with the profit earned during the challenge. If a trader fails the challenge, he does not get any profit or refund. Trading leverage is determined individually after passing the challenge. Tech support responds in many major languages, and its call center and email are available 24/7.

The Trading Pit Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Challenge rules and pricing

The Trading Pit provides access to funding up to $5 000 000, with challenges requiring at minimum of 5 trading days. The entry-level plan starts at $99, and the fee is refundable if the challenge is successfully completed.

- High funding potential — up to $5 000 000

- Multiple scaling options

- Flexible trading rules and conditions

- Above-average entry cost — from $99

- No free evaluation option

The Trading Pit Challenge fees and plans

We compared The Trading Pit’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | Daily loss,% | Max. loss, % |

| CFD |

|

|

|

|

|

| Futures |

|

|

|

|

|

What’s the minimum trading period for The Trading Pit’s challenge?

A minimum of 5 trading days is required, regardless of how quickly you reach the profit target.

Does The Trading Pit offer a free evaluation?

No, The Trading Pit does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at The Trading Pit?

No, The Trading Pit does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

The Trading Pit outlines the main rules for funded accounts, including a max. loss of 2% and a daily loss limit of 1%. The firm also restricts certain trading strategies, which are detailed below.

- No weekend close rule

- Flexible leverage up to 1:30

- Scalping not allowed

- Strict max loss

The Trading Pit trading conditions

We compared The Trading Pit’s leverage and trading conditions with competitors to help you better understand how it measures up.

| The Trading Pit | Hola Prime | SabioTrade | |

| Max. loss, % | 2 | 5 | 6 |

| Max. leverage | 1:30 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | |

| News trading | No | Yes | Yes |

| Scalping | No | No | Yes |

| Copy trading | No | No | No |

Deposit and withdrawal

The Trading Pit earned a Medium score based on how smoothly and conveniently traders can deposit and withdraw funds.

The deposit and withdrawal options at The Trading Pit meet most standard requirements and are in line with what many prop firms provide.

- On-demand withdrawals

- USDT (Tether) supported

- Bitcoin (BTC) supported

- Bank сard deposits and withdrawals

- Wise not supported

- Limited deposit and withdrawal options

- Payoneer not supported

Deposit and withdrawal options

To help you evaluate how The Trading Pit performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

The Trading Pit Payment options vs Competitors

| The Trading Pit | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | No | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared The Trading Pit with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| The Trading Pit | Hola Prime | SabioTrade | |

| On demand | Yes | No | Yes |

| Weekly | No | Yes | No |

| Biweekly | No | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

The Trading Pit offers the following base account currencies:

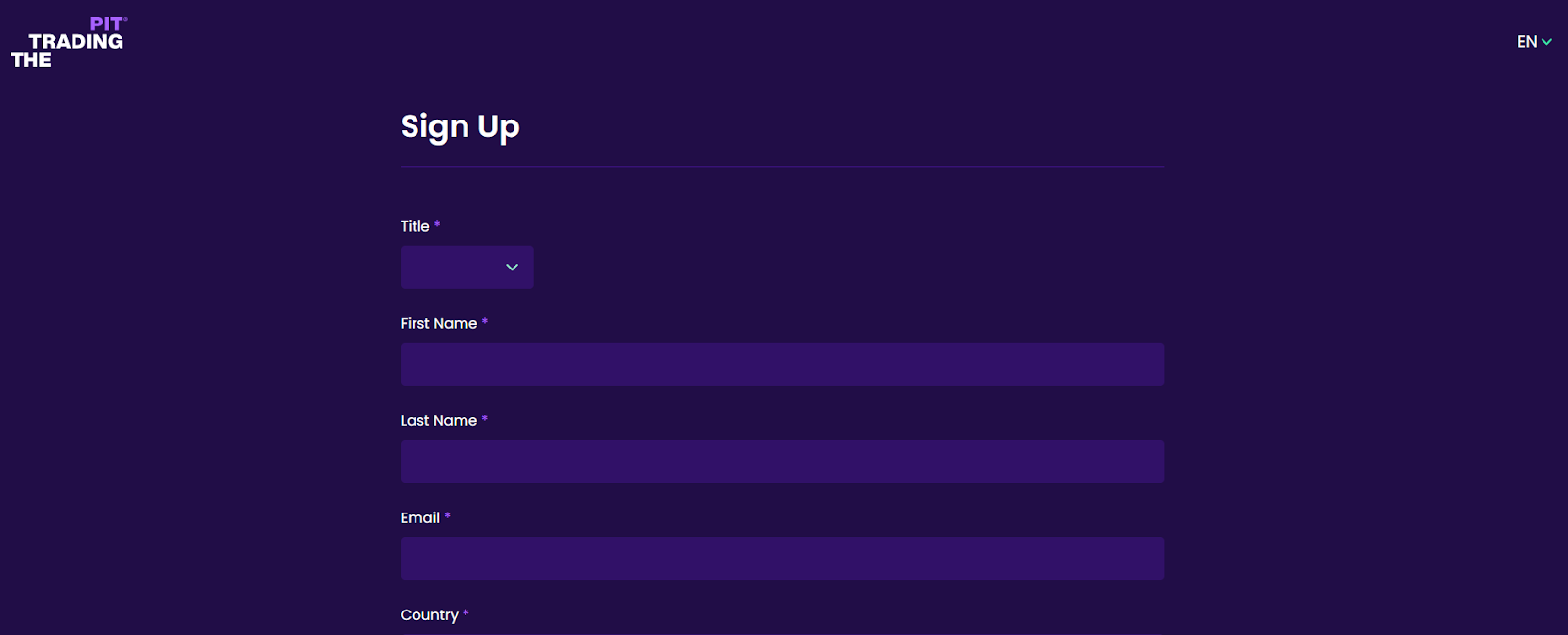

Trading Account Opening

To cooperate with this prop trading firm, you need to register on thetradingpit.com and get a user account. Below, TU considers the registration process in detail and describes The Trading Pit’s user account features.

Go to the company’s website and click “Sign Up” in the top right corner of the screen. If you need a different language, use the button right above “Sign Up”.

Include your title and enter your first and last names, country, email, and phone number. Only use real data, otherwise, you will not be verified. After filling in the fields, accept the terms of service by ticking the box. You can review the terms by following the links. If you don’t accept the terms, you won’t be able to trade with the company. Click “Create Account”.

Wait till you receive a message at the email address you included. It usually takes a few seconds, but sometimes you need to wait a few hours. If you don’t receive the message, contact tech support via chat. The message includes your login (email address) and password. The password can be changed in account settings. Click “Log in” in the message and enter the required information.

Select a challenge in the “My client area” of your user account. Follow the on-screen instructions to pay the enrollment fee and start trading. You can select several challenges.

You can monitor your progress in “Challenges overview”, where active challenges and trading results are displayed.

“Transaction history” displays incoming and outgoing transfers on all your accounts (you may have several).

Click on your name in the top right corner and choose “My profile”. Include your place of residence. This is necessary to verify your user account.

Click the “Dashboard” button and enter your login and password. In this section, you can see all your activity at The Trading Pit.

In your user account, you can deposit and withdraw funds, monitor your trades, and start conversations with tech support by clicking the button in the bottom right corner of the screen. To install the mobile app, follow the guide in the corresponding section of the website. Also, in the “Resources” section, you can learn how to set up trading platforms and other services.

Regulation and safety

The Trading Pit is officially registered in Liechtenstein and complies with the financial laws of that country. The company is licensed and has all the proper documents that can be reviewed on the official website. However, The Trading Pit is not controlled by any international regulator.

Advantages

- Traders can contact the prop firm’s lawyers

- Traders can file a complaint about the prop firm with the Financial Market Authority of Liechtenstein

Disadvantages

- Traders are not supported by financial bodies of their countries

- Traders cannot refer to international regulators for help

Markets and tradable assets

The Trading Pit has a score of 10/10, reflecting a strong variety of markets and assets available for trading.

- Indices available

- Forex trading supported

- Stock trading allowed

- Options not supported

Tradable markets

We compared the range of tradable instruments offered by The Trading Pit with two leading competitors to highlight the differences in market access.

| The Trading Pit | Hola Prime | SabioTrade | |

| Futures | Yes | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

This prop firm does not offer investment tools. It only provides novice and professional traders with funds for trading. After a client pays an enrollment fee and proves his qualifications via the challenge, he receives a certain amount of the firm’s funds and starts trading without the risk of losing his own money. He keeps a major part of the profit, has access to numerous trading instruments, and can constantly progress thanks to an integrated trading skills development system. Consequently, The Trading Pit does not offer passive earning options.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

The Trading Pit’s affiliate program

Partnership with the firm consists in attracting clients by using a referral link. Every new client who starts trading with the firm via the referrer’s link brings his referrer 5% of his profit (this percentage is subtracted from the company’s profit, not the referee’s). Depending on which assets the client trades, there are 10 to 15 earnings levels. The higher the level, the higher the referee’s payout percentage. Therefore, attracting experienced traders to The Trading Pit is favorable for affiliates.

Customer support

The Trading Pit’s technical support service works 24/7 and can be contacted by both clients and unregistered users. TU’s experts have analyzed reviews of the prop firm’s support, and they are mostly positive. Clients compliment the promptness and competency of the specialists.

Advantages

- Three contact methods: phone, email, and online chat

- Support can be contacted anytime

Disadvantages

- Support is only available in a few languages. English is the primary one

How to contact The Trading Pit’s client support:

-

multi-channel call center;

-

email;

-

live chat via a link on the website or in the app.

This prop firm has profiles (the links are in the footer) on all popular social media, including Facebook, Instagram, Twitter, YouTube, Reddit, and even TikTok. They are useful in that they keep you updated on the company’s news. Also, in its profiles, the firm promptly posts analytics and educational content.

Contacts

| Foundation date | 2018 |

|---|---|

| Registration address | Landstrasse, 63 9490 Vaduz, Liechtenstein |

| Official site | thetradingpit.com |

| Contacts |

+4986774014100

|

Education

Many prop firms offer their clients training that improves their trading skills. This is logical because firms want to cooperate with experts who bring them the highest profits. The Trading Pit is not an exception. Besides providing access to important tools, such as a financial calendar and heatmap, the company actively teaches traders using specialized materials.

Note that the newsfeed, market analytics, and expert advice and commentaries are available in Squawkbox, an integrated software with numerous customizable features. It can be installed on a smartphone.

Comparison of The Trading Pit to other prop firms

| The Trading Pit | FundedNext | Hola Prime | SabioTrade | GoatFundedTrader | Leeloo Trading | |

| Trading platform |

MetaTrader4, MetaTrader5, BOOKMAP, R Trader, QUANTOWER | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | MetaTrader5, Match Trader, TradeLocker | R Trader Pro, Ninja Trader |

| Min deposit | $99 | $32 | $48 | $119 | $30 | $26 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

No |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | No | No |

| Order Execution | No | N/a | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of The Trading Pit

The Trading Pit enables traders to earn in the futures and Forex markets using the firm’s capital. Stocks and cryptocurrencies will shortly become available for trading. Generally, this is a traditional proprietary trading firm, however, in terms of programs, it surpasses many of its competitors. The Trading Pit’s website is perfectly optimized and has a mobile version. The firm supports several major trading platforms and special solutions for prop trading. Qualification requirements are minimal, and traders that pass the challenge get unlimited access to honing their skills and earning profit.

The Trading Pit by the numbers:

-

€99 minimum enrollment fee;

-

100% of the enrollment fee is reimbursed if the challenge is completed successfully;

-

up to 80% of profit goes to the trader;

-

500 CFDs are available for trading;

-

affiliate profit from 5%.

The Trading Pit | Prop firm for trading Forex and futures

The firm offers many benefits, but keep in mind that, presently, users can only trade two categories of assets: futures and Forex. Cryptocurrencies and securities will be added soon. Considering the number of available assets, entry threshold, and profit potential, The Trading Pit does not have many competitors. Very few firms leave up to 80% of profits to traders. These are the conditions offered by The Trading Pit to everyone who wants to trade futures contracts and currencies without risking their own funds.

The Trading Pit’s useful features:

-

User accounts on thetradingpit.com can be connected to Volume Trader accounts, which gives traders unique opportunities to monitor their assets and analyze daily markets.

-

Clients can use the economic calendar, calculators, and other tools that are extremely useful for those who rely on fundamental analysis.

-

Educational articles, guides, and webinars are placed in a special section. This unique content is available to all users, even to unregistered visitors.

Advantages:

The challenges are objectively reasonable. For example, earning $500 on Forex in 60 days using a balance of $150,000 is an achievable target even for novice traders.

Low entry threshold and favorable cooperation conditions. As soon as a trader passes the challenge, he is refunded the enrollment fee and keeps up to 80% of his profit.

The firm does not impose considerable restrictions on traders. The most significant ones are that you need to trade at least 7 days and cannot exceed the daily drawdown limit.

Monthly fees depend on the market data a trader receives. His profit is determined, among other things, by leverage and available capital. These parameters are set individually after the challenge.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i