deposit:

- $75

Trading platform:

- MT4

Traderseed Review 2024

deposit:

- $75

Trading platform:

- MT4

- Instead of a share of the profit, a trader receives fixed payments for completing challenge levels

- Up to 1:100

Summary of Traderseed Trading Company

Traderseed is a prop trading firm with higher-than-average risk and the TU Overall Score of 4.19 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Traderseed clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable partner with better conditions, as, according to reviews, many clients of this firm are not satisfied with the company’s work. Traderseed ranks 39 among 41 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The Traderseed prop firm differs from its competitors. And many traders would rather get a fixed payment for passing a challenge than think about making enough money to cover a monthly fee. Traderseed’s challenges are objectively not hard, and you don’t have to be a high-class professional to pass them. Users can pay initial fees and get payouts through all primary channels, including bank cards and cryptocurrency wallets. Traderseed cooperates with the well-known Axi broker, which provides hundreds of assets and leverages up to 1:100.

Traderseed is not a typical prop (proprietary trading) firm and presents itself as the opposite of such platforms. The reason is that although a client trades with the firm’s capital, it does not get a percentage of what the client earns. The whole profit goes to the company, and the trader gets fixed payouts as he reaches certain profit levels. Traderseed currently offers three programs (challenges), which differ in the number of levels (4-5), profit targets, acceptable drawdown, initial fees, and size of payouts. For example, in the 30х Quest, the minimum initial fee is $75, and the trader gets a total of $2,250 after five levels. After completing the fifth level, he can start the challenge again, but without an initial fee this time. Clients trade on the MT4 platform. The available instruments include currency pairs, cryptocurrencies, commodities, and exchange indices.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $75 |

| ⚖️ Leverage: | Up to 1:100 |

| 💱 Spread: | No |

| 🔧 Instruments: | Currencies, cryptocurrencies, indices, agricultural commodities |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Traderseed:

- no monthly or trading fees, only an initial fee of $75-$250;

- traders get payouts at every level, as soon as they make the required profits;

- three programs with different plans allow every user to select the best option;

- no limits on trading styles or strategies. Traders only have to take the drawdown into account;

- a number of specialized solutions, including a proprietary copy trading service;

- traders use the popular MetaTrader 4 platform without limits on assets;

- clients can start trading with leverage up to 1:100 right away. No additional checks.

👎 Disadvantages of Traderseed:

- traders do not get a percentage of profits as they do with other prop trading firms. The company takes all their earnings;

- every level is strictly limited in time: you have to make a required profit in 30 days;

- if a trader exceeds a specified drawdown, he has to pay the initial fee again to restart the challenge.

Evaluation of the most influential parameters of Traderseed

Geographic Distribution of Traderseed Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Traderseed

The Traderseed prop firm provides its partners with its (the firm’s) own funds for the trading of currencies, cryptocurrencies, stocks, and agricultural commodities. Trades are routed to the market by Axi broker, a well-established reliable company with international regulation. Traderseed is special in that, in its programs, profit is not shared between a trader and the prop firm, whereas most of its competitors usually give traders 50%-80% of the profit. With Traderseed, a partner can count on a fixed payout, which the company guarantees to provide, as soon as he achieves a profit objective at a given level. Traderseed offers three programs, with 2-3 plans in each. Consider the 30x Quest with an initial fee of $150, for example. At level one, a trader gets a balance of $100,000 and a profit target of 7%. After hitting it, he moves to level two, where he is provided with $200,000, and the required profit target rises to 8%. For the completion of the second level task, the partner receives $350. The company pays out $650 for the third level, $1,100 for the fourth, and $2,400 for the fifth (each level has its own target profit). As a result, the partner earns a total of $4,500, while the initial fee was just $150.

In other programs, the total profit can be greater or lesser, depending on trading conditions. If the balance is positive, but the drawdown was exceeded, it is possible to restart the level. After completing the final level, a trader goes back to level one and starts all over again without an initial fee. The firm gives you 30 days for each level (you can finish sooner). The conditions are, on the whole, attractive, and for many traders (especially novices), this approach is convenient.

The trading is performed on MetaTrader 4 (including the mobile version). Other platforms are unavailable. You can hold positions open overnight, as well as use hedging and advisors. Traderseed has a proprietary copy trading service that enables partners to trade successfully without restrictions. Considering that the company has been in business for several years and has been tested by TU experts, it is worth checking out. However, this is a completely different prop trading experience. It’s optimal for aggressive and ambitious traders who aim to achieve their goals by all means.

Dynamics of Traderseed’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Other prop trading firms do not offer traditional investment programs, such as cryptocurrency staking or dividend stocks. However, many firms have affiliate programs, where traders can invite new users through referral links and earn bonuses. The bonus is usually a percentage of a monthly fee (if it applies) or a fixed amount. Traderseed offers partnerships as well. Its conditions are described below.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Traderseed’s affiliate program:

Each partner of this prop firm gets a personal link (after filling out a form in the corresponding section of the website), which he can post on any online platforms or send in messengers. A user who follows the link, registers, and pays an initial fee will become a referral of the link’s owner and bring him 20% of his fee. The number of referrals is unlimited. This way, socially active traders can earn a good income as an addition to the primary payouts.

Trading Conditions for Traderseed Users

The initial fee depends on the program and plan. The minimum fee is $75, the maximum is $250. The higher the fee, the larger the payout for every challenge level. The plan does not influence the balance, maximum drawdown, or profit target. Leverage depends on the program and assets traded and, in most cases, it’s from 1:10 to 1:30. Note that Traderseed’s tech support only responds by email. There is no call center, tickets, or live chat. On the plus side, managers answer questions around the clock, seven days a week.

$75

Minimum

deposit

1:100

Leverage

24/7

Support

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | 20x Challenge, Aggressive 20x Challenge, 30x Quest |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfers, bank cards, cryptocurrency wallets |

| 🚀 Minimum deposit: | $75 |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: | No |

| 🔧 Instruments: | Currencies, cryptocurrencies, indices, agricultural commodities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Instead of a share of the profit, a trader receives fixed payments for completing challenge levels |

| 🎁 Contests and bonuses: | No |

Comparison of Traderseed to other prop firms

| Traderseed | Topstep | FTMO | Funded Trading Plus | Elite Trader Funding | TopTier Trader | |

| Trading platform |

MT4 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | NinjaTrader, Rithmic, TradingView, Tradovate | MetaTrader4 |

| Min deposit | $75 | $1 | $155 | $119 | $80 | $225 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

No |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | No | No |

| Execution of orders | No | ECN | Instant Execution | Market Execution | No | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| Traderseed | Topstep | FTMO | Funded Trading Plus | Elite Trader Funding | TopTier Trader | |

| Forex | Yes | No | Yes | Yes | Yes | Yes |

| Metalls | No | Yes | Yes | Yes | Yes | No |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | No | No | Yes | Yes | No | Yes |

| Indexes | Yes | No | Yes | Yes | No | Yes |

| Stock | No | Yes | Yes | No | Yes | No |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | Yes |

Traderseed Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| 20x | Set by broker | No |

| 20x Aggressive | Set by broker | No |

| 30x | Set by broker | No |

Traderseed does not collect any charges from its partners and the company’s policy is entirely transparent. A trader only has to control the daily and general drawdown, as well as remember that each stage lasts for not more than 30 days. Exceeding a limit does not involve a penalty, but a trader has to start again. A positive balance allows you to repass the stage. But if the balance is negative, you will have to pay the initial fee again to restart the challenge. As far as spreads and trading fees go, Traderseed works with Axi broker.

Detailed review of Traderseed

With its unique concept of profit, Traderseed attracts thousands of traders worldwide. The company does not set any regional restrictions, i.e., your location does not matter. The well-known Axi broker intermediates in the trading. Partners of the platform get access to a large number of assets from various groups: from currencies to exchange indices. Also, spreads/fees are lower if you trade through Traderseed than if you trade directly with the broker. What difference does the rate of the trading fee make if the whole profit goes to the prop firm? In fact, the fee rate is very important because it impacts the profitability of trades. The sooner a trader hits the profit target and completes the challenge, the quicker he will get his payout.

Traderseed by the numbers:

-

minimum initial fee: $75;

-

additional commissions and fees: $0;

-

minimum balance: $100,000;

-

maximum leverage: 100х;

-

maximum payout: $7,500.

Traderseed is a prop trading firm for the trading of currencies, cryptocurrencies, indices, and agricultural commodities.

Not all prop firms offer several groups of financial instruments at once. Many focus on a particular group, such as Forex, stocks, or futures. Traderseed is one of those companies that do not limit their partners in this respect. The benefit of the firm’s approach is obvious. First, a partner trades what he knows how to trade and what best fits his strategic preferences. Second, the variety of instruments allows partners to diversify risks effectively. Diversification is definitely important for Traderseed’s partners because they trade with high leverage. A leverage of 1:10, 1:20, 1:30, and especially 1:100 may boost your potential profit significantly, but at the same time, it increases the risk and is somewhat dangerous even for experienced traders.

Key features of Traderseed:

-

Traders do not need to worry about covering monthly fees with profit. Hitting a profit target is enough to receive a payout.

-

The progress is 100% transparent. Each level has to be passed in not more than 30 days and all the stages have clear trading parameters.

-

The higher the initial fee, the larger the payout. Such an approach enables traders to choose comfortable conditions.

-

High leverage helps make the required profit in the shortest time, although it increases the trading risks.

-

Traders do not have to choose assets from a limited list. They have access to hundreds of instruments from various groups.

Advantages:

The company offers three programs with 2-3 plans in each to provide the most individualized conditions to different categories of partners.

A referral system with uniquely high payouts of 20% makes it possible for socially active traders to earn considerable bonuses.

The only things a partner must take into account are the drawdown and time limit. Any trading styles and strategies can be used without restrictions.

You can keep positions open overnight, as well as use hedging and advisors. Traderseed even provides its own copy trading service to make your trading easier.

The minimum initial fee is just $75. It allows traders to earn $2,250 of net profit for completing all challenge levels.

Guide on how traders can start earning profits

Traderseed offers three programs. The 20х Challenge is an all-in-one program, suitable for traders with little and average experience. The Aggressive 20х Challenge, intended for more active trading, is a more logical choice for experienced players. The 30х Quest involves the greatest risk due to higher leverage, but the potential income is the largest as well. The 30х Quest is geared towards professionals. However, high ambitions, observance of money management rules, and knowledge of trading psychology sometimes do real wonders. That is why a trader should always be clear-eyed about his abilities.

Account types:

Note that initial fees are not refunded. If a trader successfully passes all levels of a challenge, he can get back to level one and start again without paying the fee again. The cycle can be repeated any number of times.

Investment Education Online

Prop trading firms earn on the successful trading of their partners. A trader pays an initial or monthly fee and leaves a share of his profit to the firm. The profit share is the firm’s main source of income and, therefore, it’s in the firm’s interests that its partners trade better. That is why many prop firms organize various seminars and provide free learning courses, books, and other content. Traderseed is not an exception, although this platform does not have specialized guides.

Unfortunately, Traderseed does not offer its partners a single system of learning and qualification improvement. Apart from the basic guides, most information is in the company’s blog, where a lot of articles on various topics are constantly published.

Security (Protection for Investors)

Prop firms do not need regulation because they do not route trades to the market. In the case of such companies, it is important that the broker be regulated. Traderseed cooperates with Axi, which is officially registered in the United Kingdom, Australia, and UAE. Axi is a tried and tested company that has been providing brokerage services in the international market.

👍 Advantages

- Traders can submit consultation requests

- Traders can contact Axi broker directly and get help from its legal department

👎 Disadvantages

- In most regions, there is no local mechanism for the protection of traders’ rights.

Withdrawal Options and Fees

-

In accordance with a selected program and plan, a trader receives the first payout after completing the first or second-level challenge.

-

As a trader passes each subsequent level, he gets larger payouts.

-

Having received the final payout, a trader can go back to the beginning of the challenge and start the cycle again without paying the initial fee.

-

Withdrawal requests are processed individually after completing at least one challenge level.

-

A trader can withdraw funds to a bank account, bank card, cryptocurrency wallet, or use other withdrawal options.

Customer Support Service

In the case of Traderseed, support is only available by email. The address is included in the correspondence section of the website.

👍 Advantages

- Tech support can be contacted even by unregistered users

- Support works 24/7

👎 Disadvantages

- Support does not respond quickly

To contact the technical support team of Traderseed, use this email address.

The company’s news can be followed on YouTube, Twitter, and Facebook. The links to Traderseed’s official accounts are in the website footer.

Contacts

| Foundation date | 2019 |

| Registration address | The company does not have a physical address. |

| Official site | https://traderseed.io/ |

| Contacts |

Email:

kieran@traderseed.io,

|

Review of the Personal Cabinet of Traderseed

Go to the Traderseed official website and click “My Account” in the top right corner.

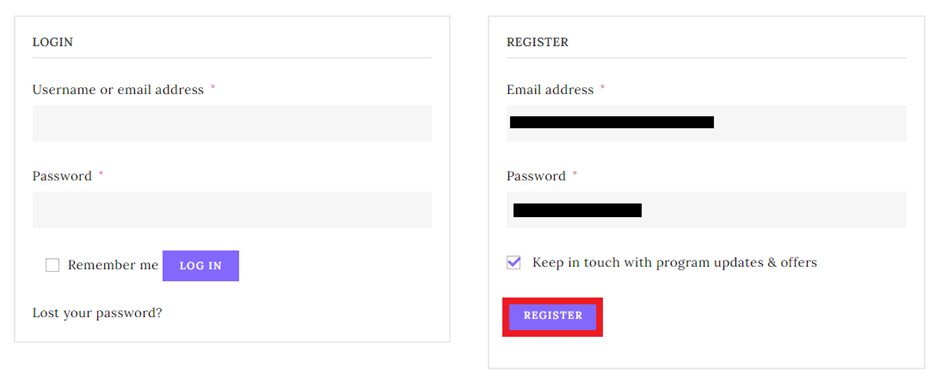

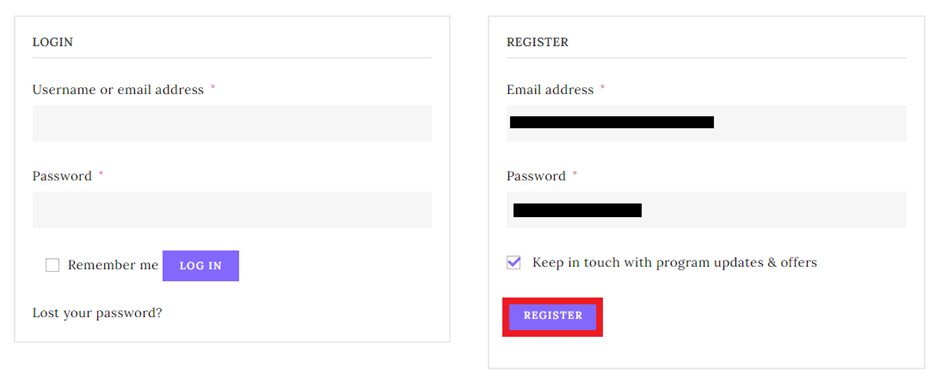

If you already have an account, sign in. To register, enter your email address in the right-hand window, create a password, and click “Register”.

At this point, you will get access to your user account, but the main features of the platform will be unavailable until you confirm your email by following the link that will arrive the email address you provided.

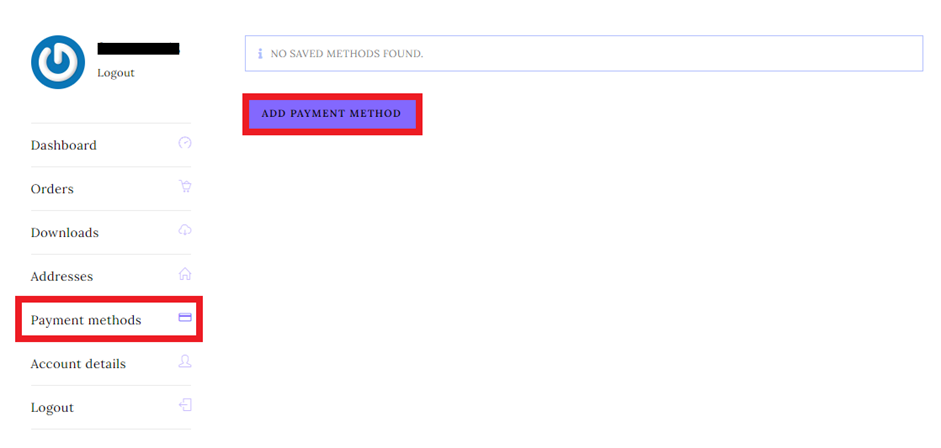

In the left menu, select “Payment methods”, click the “Add payment method” button, and follow the on-screen instructions. Contact tech support if necessary.

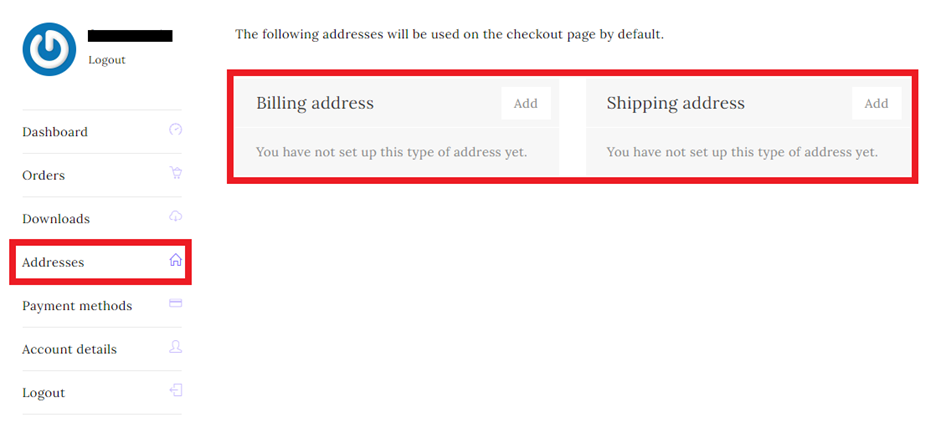

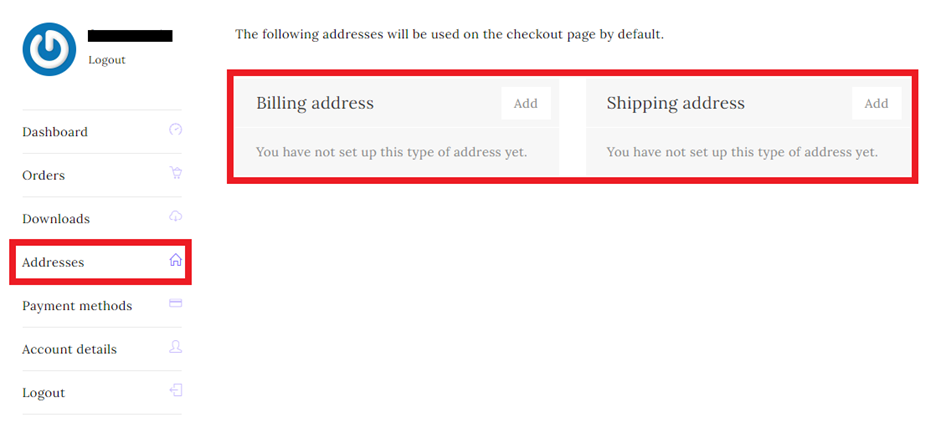

Next, go to “Addresses”. Include a billing address and a shipping address. Without including this information, you will not be able to withdraw funds.

Note that when you submit a withdrawal request, the company will require you to provide a scan/photo of your passport or driver’s license. It is necessary to ensure the safety of your funds.

Traderseed user account features:

-

Dashboard. Aggregate data on your trading account.

-

Orders. Active challenges and payment status.

-

Downloads. A list of completed and active challenges with current progress.

-

Addresses. Here you include your billing address and shipping address.

-

Payment methods. In this section, you need to include channels through which you will receive payouts.

-

Account details. Detailed account settings, including personal information and security parameters.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

How do client reviews impact Traderseed rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about Traderseed you need to go to the company's profile.

How can I leave a review about Traderseed on the Traders Union website?

To leave a review about Traderseed , you need to register on the Traders Union website.

Can I leave a comment about Traderseed if I am not a Traders Union client?

Anyone can post a comment about Traderseed in any review about the company.

Traders Union Recommends: Choose the Best!