Arthur Hayes' Crypto Investments: An Overview

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

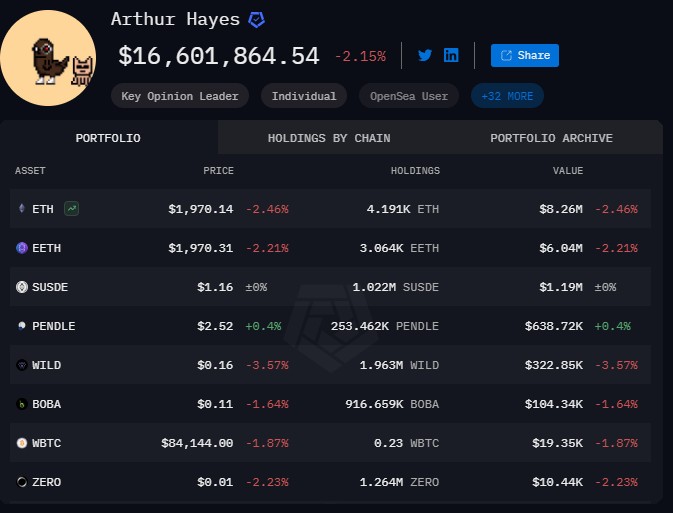

Arthur Hayes’ crypto portfolio includes Ethereum (ETH), Ethereum Name Service (ENS), LooksRare (LOOKS), GMX (GMX), Boba Network (BOBA), and PEPE. His portfolio is valued at approximately $16.6 million. He focuses on DeFi, Layer 2 scaling, and high-potential altcoins. His investments influence market trends, with a mix of strategic and speculative assets.

Arthur Hayes, the co-founder and former CEO of BitMEX, is a well-known name in crypto. With a sharp eye for crypto and how markets move, he puts money into a mix of coins and crypto startups. His portfolio shows he thinks things through — backing some lesser-known tokens along with big names like ETH. Even now, his calls still influence what people in crypto pay attention to.

Breakdown of Arthur Hayes’ cryptocurrency holdings

Arthur Hayes, co-founder and former CEO of BitMEX, has invested in a mix of major cryptocurrencies, stablecoins, and emerging altcoins. As of now, his portfolio is valued at approximately $16.6 million.

Ethereum (ETH). Hayes holds 4.19K ETH, valued at $8.26 million. He remains a strong supporter of Ethereum and believes in its long-term dominance as a smart contract platform.

Ethereum Name Service (EETH). His portfolio includes 3.06K EETH, worth $6.04 million, showing his interest in decentralized domain names.

sUSD (SUSDE). Hayes holds 1.02 million SUSDE, valued at $1.19 million, reflecting his exposure to stablecoins.

Pendle (PENDLE). He has 253.46K PENDLE, worth $638.72K, backing its role in tokenizing future yield on DeFi assets.

Wild (WILD). His investment in 1.96 million WILD, valued at $322.85K, suggests interest in the metaverse or NFT-related projects.

Boba Network (BOBA). Hayes holds 916.66K BOBA, worth $104.34K, aligning with his focus on Ethereum Layer 2 scaling solutions.

Wrapped Bitcoin (WBTC). He owns 0.23 WBTC, valued at $19.35K, indicating minor exposure to Bitcoin via Ethereum-based assets.

Zero (ZERO). His holdings include 1.26 million ZERO, valued at $10.44K, though its role in his portfolio is unclear.

These holdings show Hayes’ strategic approach — balancing Ethereum-based infrastructure, DeFi protocols, and speculative plays. His portfolio isn’t just about diversification but reflects conviction in key sectors of the crypto economy.

Financial impact and market reactions

Arthur Hayes isn't just a trader — he's a market-moving force. When he publicly backs a project, liquidity shifts almost instantly. In early 2023, after Hayes revealed his GMX investment, the decentralized perpetuals platform saw a 15% surge in open interest within 24 hours, with whales front-running retail traders.

His blog posts, often laced with macroeconomic analysis, act as a signal for deep-pocketed investors, leading to sudden spikes in volume. Unlike influencers who pump coins for engagement, Hayes plays the long game — his entries and exits aren’t driven by short-term hype but by structural shifts in crypto markets.

His strategic allocations also expose weak narratives. When Hayes went heavy on Ethereum Layer 2s like Boba, rival projects without strong fundamentals saw capital outflows, losing over $50 million in total value locked (TVL) within a week. His impact isn’t just about price movements — it’s about capital rotation. He doesn’t just pick winners; he indirectly signals which sectors will bleed liquidity. This ability to shift market dynamics makes his wallet activity one of the most closely tracked in crypto, influencing hedge funds and DeFi whales alike.

Arthur Hayes cryptocurrency strategy

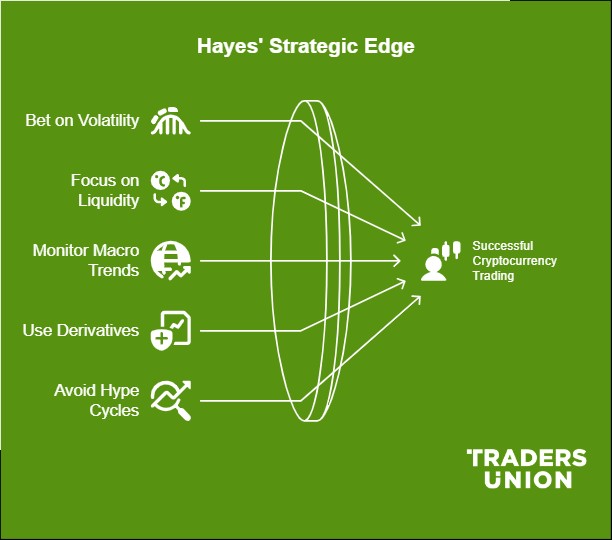

Arthur Hayes doesn’t just trade crypto — he builds narratives and bets on where the market will shift before the crowd catches on. Here’s what beginners can learn from his approach.

Bet on volatility, not direction. Hayes doesn’t just pick winners — he trades around market swings. Understanding how to profit from both up and down moves is key to long-term survival.

Go heavy on liquidity plays. He focuses on assets with deep liquidity, making sure he can enter and exit without major slippage. Beginners often overlook this and get trapped in low-volume tokens.

Follow macro, not just crypto. Hayes doesn’t trade crypto in isolation — he watches global markets, interest rates, and liquidity flows. If you’re not tracking macro trends, you’re missing half the game.

Use derivatives for risk control. Instead of just holding coins, he hedges risk using futures and options. Learning how to protect your downside is just as important as chasing upside.

Don’t buy into every hype cycle. Hayes is known for calling out overhyped projects. If something is already the “next big thing,” it’s probably too late to make real money on it.

Based on Arthur Hayes’ strategic approach to crypto investing, we’ve selected a list of beginner-friendly crypto exchanges to help new traders start their journey with the right tools and confidence.

| Foundation year | Min. Deposit, $ | Spot Taker fee, % | Spot Maker Fee, % | Deposit fee | Withdrawal fee | Demo account | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2017 | 10 | 0,1 | 0,08 | No | 0,0004 BTC 2,6 USDT | Yes | No | 8.9 | Open an account Your capital is at risk. |

|

| 2011 | 10 | 0,4 | 0,25 | No | 0,0005 BTC | No | No | 8.48 | Open an account Your capital is at risk. |

|

| 2016 | 1 | 0,5 | 0,25 | No | 0,0005 BTC | No | Malta Financial Services Authority | 8.36 | Open an account Your capital is at risk. |

|

| 2018 | 1 | 0,2 | 0,1 | No | 0-0,1% | Yes | No | 7.41 | Open an account Your capital is at risk. |

|

| 2004 | No | 0 | 0 | No | No | No | No | 7.3 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Risks and warnings

Arthur Hayes isn’t just watching the crypto space — he’s shaping its next big moves with bold ideas, new projects, and sharp market insights.

Doubling down on DeFi. Hayes is shifting toward decentralized finance, backing projects that remove middlemen and put power in users' hands.

Betting on real-world assets. He sees the next wave of crypto tied to tokenizing real-world assets like stocks, real estate, and commodities.

Pushing for permissionless trading. Expect Hayes to promote trading platforms that remove KYC barriers while staying legally sound.

Building the next-generation derivatives market. He’s exploring new crypto derivatives that go beyond futures and options, possibly linked to AI-driven market predictions.

Expanding into Asia’s crypto markets. With regulations tightening in the West, Hayes is eyeing Asia as the next big hub for crypto trading and innovation.

Arthur Hayes balances liquidity, risk, and market timing in his crypto portfolio

Arthur Hayes doesn’t just hold crypto — he structures his portfolio to react to the market while controlling risk. Unlike most investors who only focus on price, Hayes treats his holdings like a strategy, not just a collection of coins. His investments in Ethereum (ETH), sUSD (SUSDE), and GMX (GMX) aren’t just sit-and-hold investments — they’re set up to capitalize on market moves, inefficiencies, and leverage. If you’re new to crypto, don’t just copy his holdings. Instead, look at how he mixes stable assets with liquid ones so he can act fast when opportunities arise.

Another key lesson? Hayes doesn’t over-diversify. While most beginners spread themselves across too many coins, he sticks to a tight selection of tokens he knows inside out. His plays on Layer 2 solutions like Boba Network (BOBA) and DeFi yield protocols like Pendle (PENDLE) show he invests in narratives he truly understands, not the hottest trends. If you’re starting out, the takeaway isn’t “buy what Hayes buys.” It’s to stick to a plan — fewer but smarter investments that give you flexibility when the market moves.

Conclusion

Arthur Hayes remains a key influencer in the cryptocurrency industry, with his portfolio offering insights into the latest market trends and investment opportunities. By diversifying across Ethereum, DeFi protocols, and speculative assets, he demonstrates a balanced yet bold approach to crypto investing. However, traders should remain cautious, conduct independent research, and adopt risk management strategies to navigate the evolving crypto landscape successfully.

FAQs

What trading strategies can beginners learn from Arthur Hayes' portfolio?

Beginners can learn how to build a balanced portfolio by observing how Hayes blends high-liquidity assets with more speculative plays. His risk-managed approach shows the importance of timing, diversification, and market awareness.

Does Arthur Hayes invest in tokens outside the Ethereum ecosystem?

While his known holdings center on Ethereum and its Layer 2s, it’s unclear whether Hayes holds assets on chains like Solana, Avalanche, or Polkadot. However, his macro perspective suggests openness to ecosystems with long-term potential.

Has Arthur Hayes publicly backed any crypto launchpads or incubators?

Hayes hasn’t been directly tied to launchpads, but his strategic interest in early-stage tokens and DeFi platforms implies he may be involved behind the scenes in supporting blockchain innovation hubs.

What role does stablecoin exposure play in Hayes’ strategy?

Hayes' position in sUSD shows that he values stability during volatile cycles. This hints at a broader strategy of using stablecoins to manage liquidity and rotate capital efficiently.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.