Chainalysis Review In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Chainalysis is a leading blockchain analytics company that provides data, software, and services to organizations worldwide. Recognized for its innovative tools, Chainalysis enables compliance, investigation, and monitoring of blockchain transactions, ensuring transparency and security across the cryptocurrency ecosystem.

This article provides an in-depth review of Chainalysis, one of the leading blockchain analytics firms. We explore its history, market valuation, core services, and global impact on cryptocurrency regulation and compliance. Additionally, we highlight its key products, including Chainalysis Reactor and KYT, its role in preventing fraud, and its partnerships with governments and financial institutions. Finally, we analyze recent developments, interesting facts, and investment insights related to the company.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

Chainalysis overview

Chainalysis specializes in blockchain analytics and data-driven software solutions. The company focuses on tracking and analyzing cryptocurrency transactions, aiding governments, financial institutions, and businesses in combating fraud, money laundering, and other illicit activities in the blockchain space. Their services include:

Transaction monitoring. Real-time analysis of cryptocurrency transactions to detect suspicious activities.

Investigation tools. Software that assists in tracing the flow of funds on the blockchain.

Compliance solutions. Tools designed to help businesses adhere to regulatory requirements related to cryptocurrency transactions.

Region of operation

Chainalysis operates globally, serving clients across North America, Europe, Asia, and Latin America. The company maintains offices in key financial and technological hubs, including New York, London, Copenhagen, and Singapore. This global presence allows Chainalysis to cater to diverse markets and regulatory environments.

Chainalysis market capitalization

As of March 2025, Chainalysis is estimated to be valued at approximately $2.13 billion. This valuation reflects a significant decrease from its May 2022 valuation of $8.6 billion, likely due to market dynamics and evolving industry conditions.

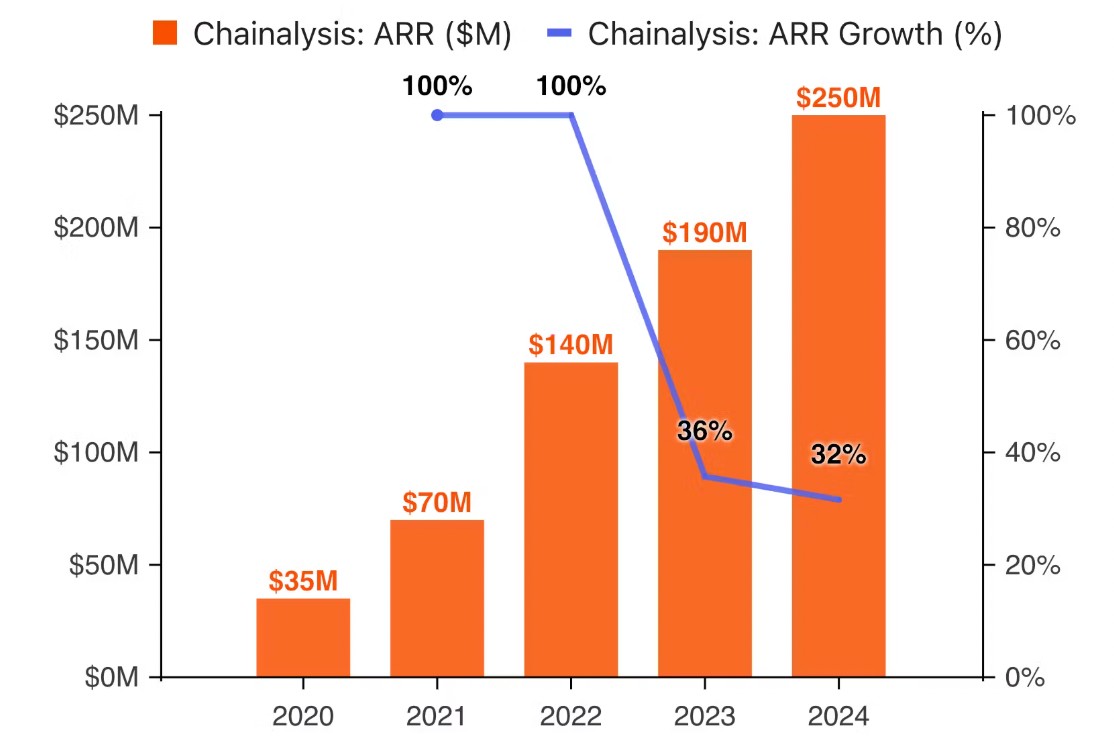

Chainalysis achieved an annual recurring revenue (ARR) of $190 million in 2023, marking a 35% increase from approximately $140 million in 2022. The company had previously doubled its revenues in both 2021 and 2022. Looking ahead, Chainalysis projects its ARR to reach $250 million by the end of 2024, representing an anticipated year-over-year growth of about 30%.

Chainalysis main products

Chainalysis offers a suite of products designed to enhance transparency and trust within the cryptocurrency ecosystem.

Chainalysis Reactor. Investigation software for tracking and analyzing blockchain transactions. It helps users visualize and understand the flow of funds on the blockchain.

Chainalysis KYT (Know Your Transaction). A real-time transaction monitoring tool for compliance. It enables businesses to monitor large volumes of cryptocurrency transactions and identify high-risk activities.

Chainalysis Kryptos. A directory of cryptocurrency profiles for businesses and regulators. It provides insights into cryptocurrency entities to facilitate informed decision-making.

Chainalysis founders

Chainalysis was co-founded by.

Michael Gronager. A blockchain technology expert with a background in quantum mechanics. Before founding Chainalysis, he co-founded the cryptocurrency exchange Kraken.

Jonathan Levin. An economist and data analyst instrumental in developing the company's data-driven approach to blockchain analysis.

Jan Møller. A developer and early adopter of Bitcoin technology who contributed significant technical expertise to the founding team.

Chainalysis history

Main phases of development:

2014. Chainalysis was established, focusing on developing blockchain investigation tools.

2015. Launched its initial product, gaining attention from law enforcement agencies.

2018. Expanded services to financial institutions with the release of KYT.

2020. Raised $100 million in Series C funding, increasing its valuation to over $1 billion.

2023. Expanded its global footprint, launching new offices in Singapore and Brazil.

2024. Celebrated its 10th anniversary by introducing new solutions for crypto investigations, risk assessment, and Web3 compliance.

2025. Acquired an AI-powered fraud detection solution to enhance proactive fraud prevention capabilities.

Interesting facts

Collaborations with governments. Chainalysis has partnered with over 70 law enforcement agencies worldwide, aiding in investigations of cryptocurrency-related crimes.

Key role in crypto regulation. The company has played a pivotal role in shaping cryptocurrency regulations by providing insights and data to policymakers.

Investment leadership. Backed by prominent investors, Chainalysis has consistently attracted significant funding.

Founder’s vision. Michael Gronager has emphasized the importance of building trust in blockchains by providing actionable data and insights to organizations worldwide.

Recent acquisition. In January 2025, Chainalysis acquired an AI-powered fraud detection solution to enhance its proactive fraud prevention capabilities.

Integration with Ethereum layer 2. In March 2025, Chainalysis announced support for an Ethereum layer 2 project to improve compliance and investigative workflows.

Quote: “Our mission is to build trust in blockchains by providing actionable data and insights to organizations worldwide.” – Michael Gronager, Co-founder and CEO.

To protect yourself, always check the origin of incoming transactions

Most beginners assume that blockchain transactions are anonymous and untraceable, but that’s a dangerous misconception. Chainalysis uses advanced clustering algorithms to link wallet addresses to real-world entities, even if they are spread across multiple chains. If you’re using cryptocurrency for legitimate purposes, it’s crucial to understand how data leaks can expose your identity.

One key tip is to avoid reusing addresses, as transaction patterns can make it easier to identify your holdings. Also, mixing funds from different sources within the same wallet can increase the risk of being flagged as high-risk, even if you’ve done nothing wrong.

A little-known fact is that Chainalysis provides risk scores on addresses that many exchanges and financial institutions rely on. If you receive funds from a flagged address — even indirectly — your wallet could be blacklisted without warning. Many users unknowingly interact with high-risk addresses when using decentralized exchanges or peer-to-peer platforms.

To protect yourself, always check the origin of incoming transactions using tools like Chainalysis Market Intel or KYT (Know Your Transaction). Additionally, maintaining separate wallets for different purposes (trading, staking, and long-term holding) can prevent cross-contamination of funds and lower the likelihood of account restrictions.

Conclusion

Chainalysis remains a dominant force in blockchain analytics, providing critical tools for tracking cryptocurrency transactions, preventing fraud, and ensuring compliance with global regulations. Its innovative solutions help businesses, financial institutions, and government agencies navigate the complexities of digital assets while maintaining security and transparency.

As cryptocurrency adoption expands and regulations tighten, Chainalysis is poised to lead the industry with cutting-edge technology and data-driven insights. Whether you're an exchange seeking compliance solutions or an investor looking to understand blockchain risks, Chainalysis offers the tools needed to stay ahead in the evolving digital economy.

FAQs

What makes Chainalysis unique?

Chainalysis’ comprehensive suite of blockchain analytics tools, coupled with its global reach and partnerships with law enforcement agencies, make it a standout in the industry.

Where is Chainalysis located?

Chainalysis has offices in New York, London, Copenhagen, Singapore, and other key global hubs.

Can I use Chainalysis for my business?

Yes, Chainalysis provides solutions for businesses, including cryptocurrency exchanges, financial institutions, and fintech companies, to ensure compliance and monitor transactions.

Is Chainalysis involved in cryptocurrency regulation?

Yes, Chainalysis plays a significant role in advising policymakers and shaping regulations to ensure the safe and transparent use of blockchain technology.

Related Articles

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.