Note!

This article was created for informational purposes only. Please consult a professional for more detailed information regarding your individual case.

Note!

This article was created for informational purposes only. Please consult a professional for more detailed information regarding your individual case.

Being still quite new, there isn’t a singular and overarching directive with regards to paying crypto taxes. As such, every country - or maybe continent - has been implementing a different regulation, depending on what they feel is right or how it affects their economy.

If you’re a crypto trader, who enters into transactions in various places, knowing how each one operates is essential. Not only to avoid breaking any existing laws, but also to maximize profit.

In today’s article, we’ll be shining the spotlight on the Great White North, and how Canadians are obligated to pay their crypto taxes. Since it may be different from Europe or the United States, familiarizing yourself with every detail will be helpful. Don’t worry, though, as we will go through each one from top to bottom.

Start trading cryptocurrencies right now with Binance!Like in other countries, crypto taxes in Canada are computed based on either annual income or capital gain. Knowing which category you fall under will depend whether your transaction is categorized as earnings from business, or through an investment.

This might seem complicated - because it is - so let’s set it aside for now. We’ll discuss it further in the succeeding sections.

Just one final point before we move on. The Canadian Revenue Agency’s rulings on crypto taxes are ever-evolving, which what holds true now may not be the case in a year. Therefore, it’s imperative to keep yourself updated to avoid any potential fines.

Unlike in the United States where it’s based on short-term or long-term investments, Canada’s crypto tax laws are a bit different. Here’s a quick rundown of all the important details.

Crypto is Taxable

First off, let me start by saying that yes, cryptocurrency investments are taxable.

They are considered an income-generating activity, and thus, must be properly reported to the government. Furthermore, digital currency (although its name suggests otherwise) is treated more as a capital asset than actual currency.

Business Income vs. Capital Gain

Before we jump into the step-by-step process, you’ll need to first determine whether your investments are classified as business income or capital gain. Because there’s a very different way of computing taxes on crypto for each.

Now, how do we differentiate the two?

Business Income is defined as any earnings gained from an entity’s daily operations. That means that if you are trading under a company, registered as an investment firm, and you promote it, then it’s considered this.

Other indicators that may be considered are how repetitive your transactions are, and whether or not your intention is to make a profit.

On the other hand, Capital Gain is simply earning a profit when assets increase in value upon selling, trading, as payment for goods and services, or sending it to someone as a gift. Normally, if you don’t trade on a regular basis, and enter into any transaction as an individual, then it can be deemed as capital gain.

At this point, there seems to be a very fine line separating the two. Unfortunately for us, guidelines from the Canada Revenue Service won’t get any more specific. All they say is differentiating the two is done on a case-to-case basis. So if you need further clarifications, we recommend consulting with an experienced tax lawyer.

Income Tax Fees

Let’s assume that your activities as a crypto trader falls under the business classification. Simply deduct any company expenses (including allowances, payments for computer hardware, rent, etc.) from your gross revenue, and you’ll get your taxable income.

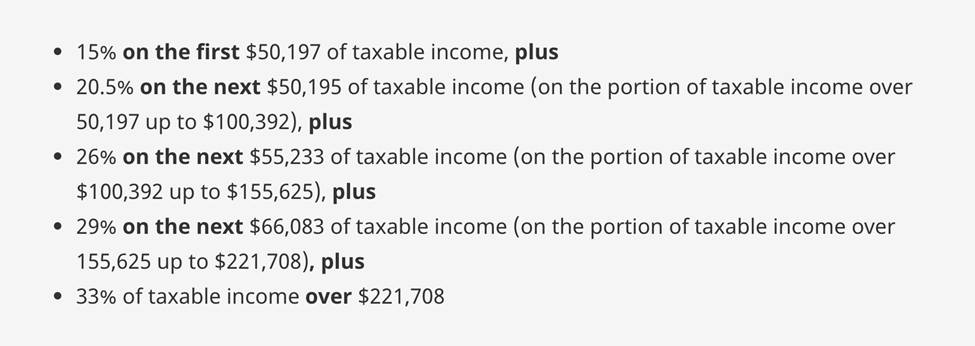

The next step will be to identify what bracket you fall under. Based on the CRS website, here are the Federal Tax Rates for 2023.

Federal Tax Rates for 2023

Remember, this is based on all your earnings for an entire year, not just from crypto.

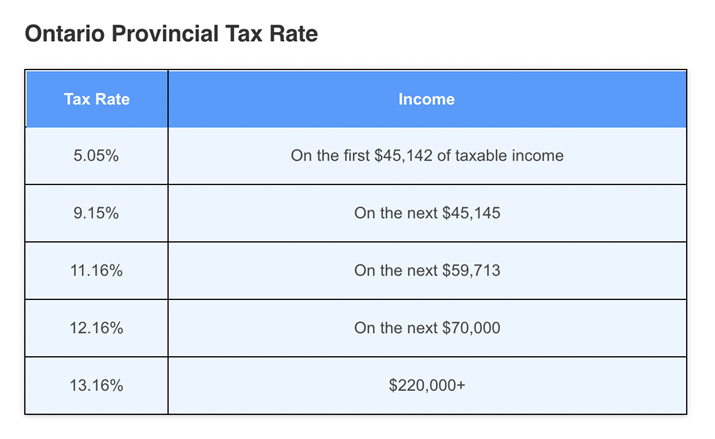

Besides that, you also need to account for the Provincial Tax Rate, which varies depending on your area of residence.

Provincial Tax Rate

This is on top of the Federal Tax percentage you owe. That being the case, adding these two will now determine your total income tax responsibility.

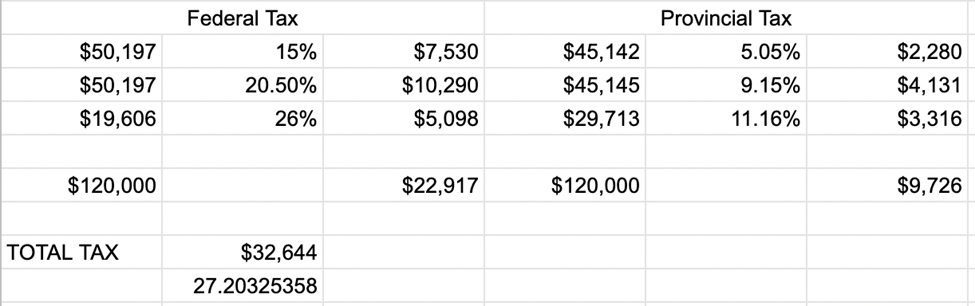

To clarify things further, let’s use Allan’s case as an example. For his occupation, he is a financial investor, residing in Ontario, who reports $120,000 in income every year. Falling under the third category, your federal tax rate for this year is 15% on the first $50,197, 20.5% on the succeeding $50,197, and 26% on the remaining amount.

For the provincial rates, it follows the same computation. You will be taxed 5.05% on the first $45,142 of earnings, 9.15% on the succeeding $45,145, and 11.16% on the remaining amount.

taxes example

Therefore, after considering all those factors, Allan will be required to pay $32,644 in crypto taxes, or equivalent to 27.20% of his total annual earnings.

Capital Gain Tax

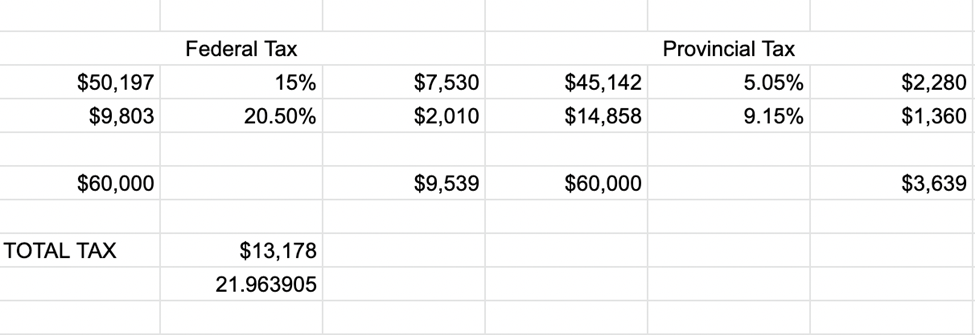

Computing for this follows the same format, except that only half of your capital gain is taxable.

But before that, remember that capital gain is the difference between an asset’s value now, from when you initially acquired it. The total increase is considered your capital gain, with half of it being the taxable amount.

To further explain this, let’s use our previous case as an example, this time assuming that $120,000 was his capital gain for all existing investments.

taxes example

So as you can see, only $60,000 becomes taxable. For federal tax, he pays 15% of $50,197 and 20.5% for the remaining amount. Then for the provincial income tax, he will be charged 5.05% of $45,142, and 9.15% for the last $14,858. The result is a capital gain tax of $13,178, or 21.96% of your initial investments.

According to multiple sources, the Canadian Revenue Service has been coordinating with various crypto exchanges to access customer information. This includes their personal and contact details, list of transactions, and their subsequent earnings.

Although it has yet to be confirmed that the CRS has full access, they have begun conducting investigations to ensure that crypto traders are filing, reporting, and paying for the correct amount of taxes.

Rather than run the risk of getting into more trouble, it would probably be best to ensure that all earnings are tabulated correctly. Otherwise, charges or tax evasion or money laundering might be filed against you or your company.

For corporations or investment entities, the easiest way to reduce crypto tax in Canada is by declaring all possible expenses. This includes the cost of maintaining equipment, rent, utilities, and other payables that are incurred on a regular basis.

Moreover, the Canadian government allows you to declare a maximum personal allowance of $13,808. Donations to reputable charities are considered non-taxable, too, and thus, will be deducted from your total tax bill.

As a result of this practice, your total taxable income lessens. There’s also a chance you fall to a lower tax bracket, which means smaller rates, and more savings on your end.

Not even miners are exempt from paying crypto taxes. Actually, in most cases, this venture is considered as a business transaction, and will be charged a higher percentage.

Earning from crypto mining can be reported in two ways. First is if you are working for a larger company and getting paid for your service, then this is a salary. Simply declare all your wages for an entire year, which then becomes your taxable income.

However, if the digital assets go directly to you, then it instead comes from a primary income stream. At which point, you must state all cryptocurrency obtained at its fair market value, or price at the time of mining.

Besides crypto mining, other affairs that must be declared as part of your annual income are rendering any other acts of service that gets you paid in virtual currency, referral bonuses, commissions or incentives, and stake rewards.

As mentioned earlier, income tax and capital gain tax are both very similar concepts. So closely relative, even, that they are often misconstrued or interchanged with one another. Even the Canadian Revenue Service has difficulty explaining these ideas, saying that they will categorize applications for the two, on a case-to-case basis.

However, let’s do a quick run-through of what we know so far.

Income tax is an influx of cash brought about by a business venture. Although there’s no one all-encompassing indicator, some signs are present to provide more clarity on this matter.

An investment can be considered an income tax if:

Work under a registered entity under this industry

Trade on a repetitive or regular basis

Your primary objective is to earn a profit

There is a volume of cryptocurrency involved

Activity is done for commercial purposes

Paid as a salary, commission, or incentive

On the contrary, capital gain is profit earned from the appreciation of a capital asset, upon being sold, traded, or given away. Activities under this category aren’t usually done on a daily basis and entered into by individuals. The main difference between this and income tax, at least from an accounting perspective, is that only half of your total capital gain over one year is taxable.

Knowing where each transaction falls under is important so you can pay the correct amount of taxes. Also, it will help strike the balance between your civic duty and responsibility in the household. You see, these rates are based upon a person or entity’s financial capacity, project expenses, and even expected profit.

It’s only objective is to create a win-win situation between traders and the government.

Under the current Canadian tax law, there is no distinction between short-term and long-term investment with regards to the amount of taxes paid. They both follow the same computation, regardless of how long it is held.

Initially, this may feel a bit restrictive, but it’s actually not. You are no longer forced to trade assets towards year-end so it won’t be taxed higher. Instead, individuals can take a wait-and-see approach, selling only when its value is at the peak.

Don’t get us wrong, thorough; active trading is still a viable option. You just won’t be bound by any deadlines, anymore.

Like we mentioned earlier, capital gain is the difference in value of assets now versus when you initially bought. That increase, under Canadian law, is liable to be taxes, and must be reported precisely on an yearly basis.

Once you have that number already, and deduct all possible expenses, you will come up with a final taxable amount. Search for the federal tax brackets of the existing year, check your provincial tax categories, add them together, then do a quick computation.

Once you do, you’ll have an estimate of how much taxes you need to pay the CRS.

Unfortunately, the reality is not everyone will make money through crypto trading. It’s still ultimately a risk of breaking even, or worse, losing your initial investment.

What makes things more complicated is in Canada, there is no non-taxable maximum, which is a threshold for those individuals earning less than a particular amount. As its name suggests, you won’t be liable to pay taxes if your annual earnings fall under that bracket.

The only consideration the CRS extends is through personal tax allowance amounting to $13,808. You still have to report that income and prove its validity, but if done so, won’t be taxable. This option is available for both income and capital gain tax.

A tax break is defined as any entries in a financial statement that results in a reduction of taxes. Thankfully, the Canadian tax law has a couple of these that traders can use to their advantage.

First, only half or your capital gains are taxable. This means that if your crypto portfolio increases by $10,000, the CRS will only remit a percentage from $5,000. Just remember that this is only applicable for capital gain tax, and not for business income. The reason for this is based on context, this isn’t your main source of income, and thus, should not be taxed heavily.

Each time an individual donates to a registered charity or non-profit organization, the amount (or a portion of that) can be written off from your taxes. In a way, this serves as fulfillment of your social responsibility to the country.

Anytime you enter into a profit-earning business, you’ll be asked to pay taxes. Not even cryptocurrency is exempted from this rule.

Like what we discussed earlier, income tax is our legal obligation to the CRS after collecting payment from a particular business transaction. Anything from crypto mining, receiving remittance after delivering a service or product, and bonuses fall under this category.

Now, knowing how much you need to pay will depend on your current tax bracket, both nationally and in your province. One you add the two together and do a simple mathematical computation, you should know how much income tax is expected from your venture.

If you’re thinking about beginning your trading career, consider signing up for crypto exchanges. These platforms provide a legitimate space to buy and sell digital assets. And because they are regulated by government organizations, you can be sure they strictly adhere to all existing laws and regulations. If you choose a crypto exchange with low fees, your trades will be more profitable.

Of course, not all crypto exchanges are perfect. Each one has their own set of strengths and weaknesses. At this point, we’d like to evaluate two of the most popular options available to help you decide which among them best fits your current needs.

This platform is better suited for beginners, because of its basic interface and user-friendly commands. As a result, navigating through the website is fairly easy. They also handle a wide range of assets, which is most appealing, because it opens doors to a lot of opportunities.

Unfortunately, this comes at quite an expense - literally - since their transaction fees are quite high. Coinbase’s customer service leaves a lot to be desired. Several clients have complained how difficult it is to seek assistance.

Nevertheless, it provides a lot of value, should you find this setup suitable.

Like its US counterpart, Binance in Canada faces a lot of issues, too. They have pulled out in several regions, and are currently regrouping to keep up with the ever-changing regulations of the CRS.

In general, their services seem to be sub-par and riddled with issues. It’s only silver lining is the affordable trading fees, which is one of the lowest around. At least whenever you earn more income, deductions are so much less.

Binance vs Coinbase - Which Crypto Exchange Is Better 2024?If you’ll notice, how one pays crypto taxes in Canada and the United States is quite different. This just shows that it’s really important to know every single detail, to avoid incurring unnecessary penalties.

For here, at least, we put more weight with where the earnings came from when determining how much tax should be paid. Knowing if its business income versus capital gain is the first, and arguably most crucial step, to know what your financial responsibility is.

Should you have any further questions, feel free to reach out through our website at.

Unfortunately, the Canadian tax law sees no difference between these two types of transactions. They are treated the same way, which gives traders more freedom to select when to buy or sell virtual currencies.

This is a local tax that varies per region, which is added onto any federal tax that individuals are required to pay for.

In most cases, since mining is considered a business transaction, it falls under the category of income tax. However, sometimes, hobby miners have been known to classify their activity under capital gain, especially if it’s not done regularly.

Yes, and no. The answer to this question is on a case-to-case basis. For further clarification, we recommend consulting with a tax lawyer or accountant.

Dwight specializes in risk, corporate finance, alternatives, fintech, general business trends, and financial markets, and he has broad experience managing complex projects. Dwight is an author for the Traders Union website.

Dwight was a financial columnist for The Wall Street Journal and The New York Times during the Great Financial Crisis. He has served as Editor-in-Chief of Worth, a personal finance magazine for the wealthy, and as Editor of Risk, the premiere global publication about derivatives, risk management, and quantitative finance, based in London.

He has also served as Managing Editor at The Economist Group and ran the Americas operations of two British trade publications.

For the last 12 years, Dwight has worked as a freelance writer and editorial project manager, serving clients in the financial technology, banking, broker/dealer, consulting, asset management, and corporate sectors. This has given him considerable experience in idea generation and project management, working collaboratively to help clients meet their goals with little or no supervision.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.