Central Bank Digital Currencies (CBDCs) vs Crypto In Simple Language

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

CBDCs are an attempt by the Central Banks to create the most controlled version of the money imaginable. Full fledged CBDC coin is counterfeit-proof, can be traced down, frozen in the wallet if stolen, and used as a payment method all around the world. If CBDCs are to be adopted — you’re going to find a new class of DeFi tools — Hybrid Liquidity Pools.

So, Central Banks want to make their own crypto and you are confused as to what it even means, but analytics project the whole market is going to have $7.1B in transactional volume by 2031. We dissected the buzzwords to help you understand what Central Bank Digital Currencies (CBDCs) are, how they function and why the banking system needs them.

Understanding the foundations of CBDCs in a nutshell

To understand CBDCs you first need to understand underlying ideas: crypto, blockchains, money printing by central banks and the malevolent nature of the human.

Crypto is decentralized by design — it has no single owner, no shareholders, no board of directors, nobody out there can single-handedly decide the fate of a single coin, otherwise it is not decentralized. Every action is recorded and can be reviewed by independent peers — like you and me — and those peers can judge for themselves if the transaction they’re looking at is a scam or not. On top of that — the identity of every participant of the network is protected by the system itself.

In crypto, people who keep the software running are the custodians of the network. The Bitcoin P2P network, for instance, has a set of rules to ensure that every block produced by every participant of the network is legit: the block number has to start with a really long series of zeroes, which is ensured by the way computations are executed and underlying hashing algorithms.

The blockchain is the backbone of crypto — it keeps records of every transaction ever made, forever, and those records cannot be modified once set. In a way, you can think of every blockchain record to be set in stone — immutable, unchangeable, as permanent as it gets. Replace stone with any medium that can carry information and you start to understand why Bitcoin made waves in 2009 — it can exist in any medium. Digital records are the easiest to keep, encrypt and oversee by other participants of the network, but essentially, you can store the entirety of the Bitcoin blockchain in a chain of books and keep them in a library.

How CBDCs change the way banking works and the risks they solve

Every Central Bank can print infinite amounts of national currency and it may be exploited for personal gain. For instance, the USA Government can lend itself a debt that has to be paid in national currency and then, print more currency to cover the debt. Exploitation potential of this flaw is endless, and it results in the inherent flaw of any monetary system with endless supply — unending inflation.

What makes cash worse is that it is hard to trace. Not only can you endlessly print cash, but you can’t trace it. Say, someone stole your cash stash, and starts to spend it somewhere — there is really no way to prevent that, unless you recorded every serial number of every banknote. Another case is when a politician takes a huge bribe in cash and goes on with his power trading business — the judgement system can’t really tell if those banknotes are taken as a bribe payment.

Same goes with every other time the cash is used for dirty causes, like slave trade, drugs, trafficing, ransom, extortion and so on. Moreover, you can make counterfeit currency and it’s really easy — you just need to replicate the exact way the Federal Reserve prints that banknote. Counterfeit is the oldest crime out there — even in Babylon 5000 BC people tried to do this.

How CBDCs work on the inside: core logic and principles

Let’s clear one thing out of the way — CBDCs are real, they aren’t a tech mambo-jambo: people are already using them, for years already. Market is only starting to pick up on the topic, as first pilots are nearing the completion stages and sharing the news.

Definition of CBDCs

CBDCs are central bank issued crypto with a single owner, centralized ledger of records and full control over every coin in existence from a single place.

They are traceable and controllable versions of the cash. The core idea of the CBDC runs like this:

The bank has sole control over the ledger which contains records about every transaction with CBDC ever made;

Every CBDC coin has a serial number, can be either in ACTIVE or INACTIVE state, has a track record of where and whom used it along with explanations for what;

Every transaction ever made by using CBDC is forever recorded inside a blockchain controlled by Monetary Institution of the country in question;

Once a person steals your CBDCs — the central bank can effectively freeze those coins inside the thief’s pocket, but so they can do to you;

Every CBDC coin represents national currency at 1 to 1 ratio and has a built-in mechanism to prevent attempts to counterfeit it;

In order to make a counterfeit CBDC you would need to somehow access the Federal Reserve servers which contain a CBDC blockchain and then make the whole network — which has many validators at once — accept your changes without raising an eyebrow.

What you need to understand is that CBDCs are inevitable: they are literally cheaper to operate than cash, have less fees built in, easier to control and can be used as a power tool — if the government doesn’t like you, they just freeze your CBDCs that very instant until further notice. That feature alone — the control — made China so happy it went on to test its e-CNY live ahead of the official launch.

3 ways banks can make and operate CBDC

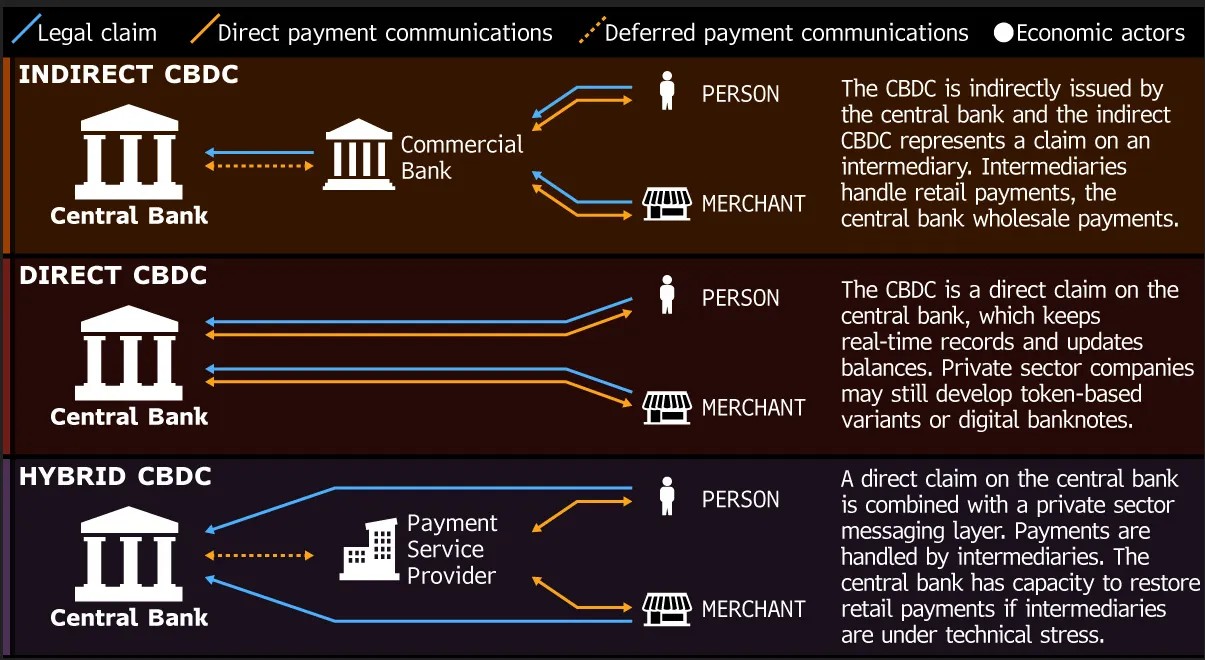

Indirect CBDC — Central Bank allows Commercial Banks to handle payments, open and close accounts, but CBDCs are minted by Federal Reserve and it has the top authority over the legal questions;

Direct CBDC — Federal Reserve mints CBDCs, Central Bank issues them to people, operates accounts, handles Person-to-Merchant communication and so on;

Hybrid CBDC — there is a service provider, they handle all the money movement, but the Central Bank owns the whole thing from A to Z.

Hybrid route puts the least amount of strain onto the central banks, and naturally, they should follow this path. Direct CBDC approach can wreak havoc on the markets, as it can kill any commercial banks in question real fast real quick. Indirect CBDC issuance requires the infrastructure which commercial banks don’t have. What would happen if the Hybrid CBDC route is taken? Chance is that commercial banks would adapt and transform into Payment Processors and Merchants won’t even notice the difference.

What do people think of CBDCs?

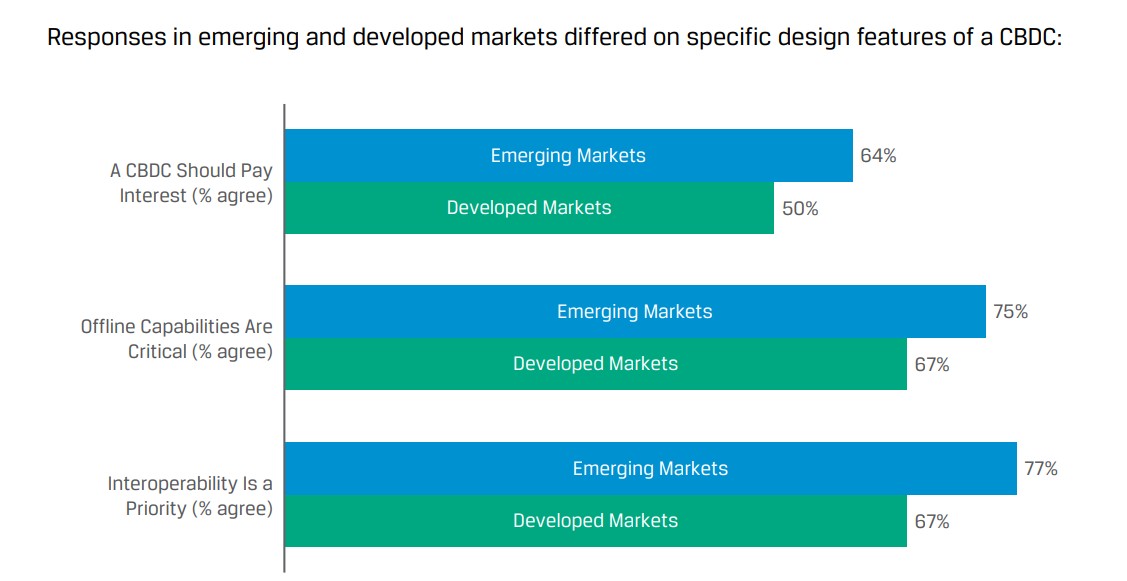

Here’s an excerpt from CFA Institute Global Survey on Central Bank Digital Currencies with 90k respondents:

A global plurality of 42% of respondents believe that central banks should launch CBDCs, while 34% disagreed and nearly one in four (24%) expressed no opinion. Only 13% said they had a strong understanding of CBDCs.

Globally, a majority believes that CBDCs can coexist with private cryptocurrencies. This points to some dichotomy in results. While a large majority agrees that public trust in fiat money is suffering because of monetary policy, a solid majority also believes that private money will always be inferior to government money.

How big is the CBDC market as of 2025

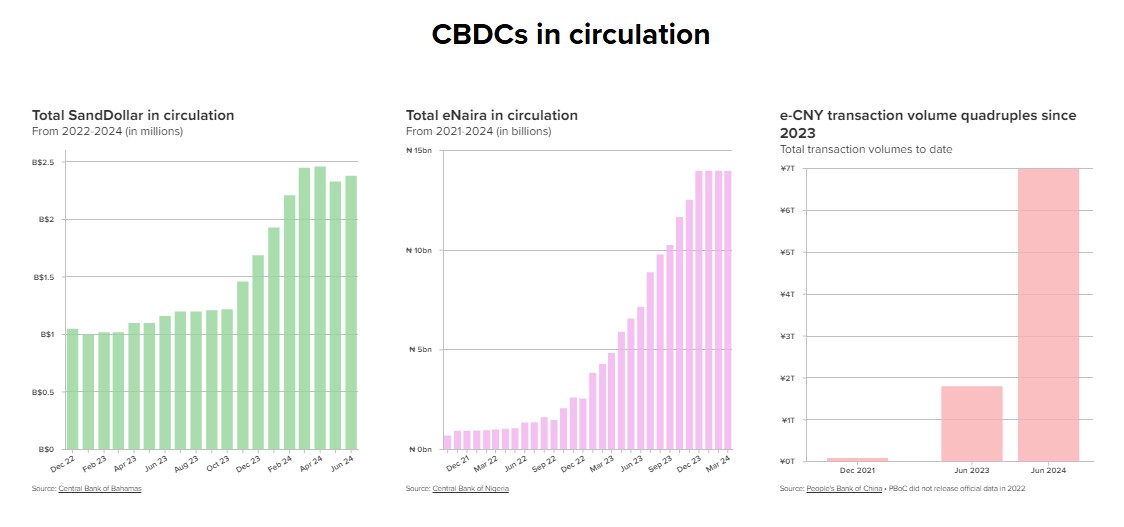

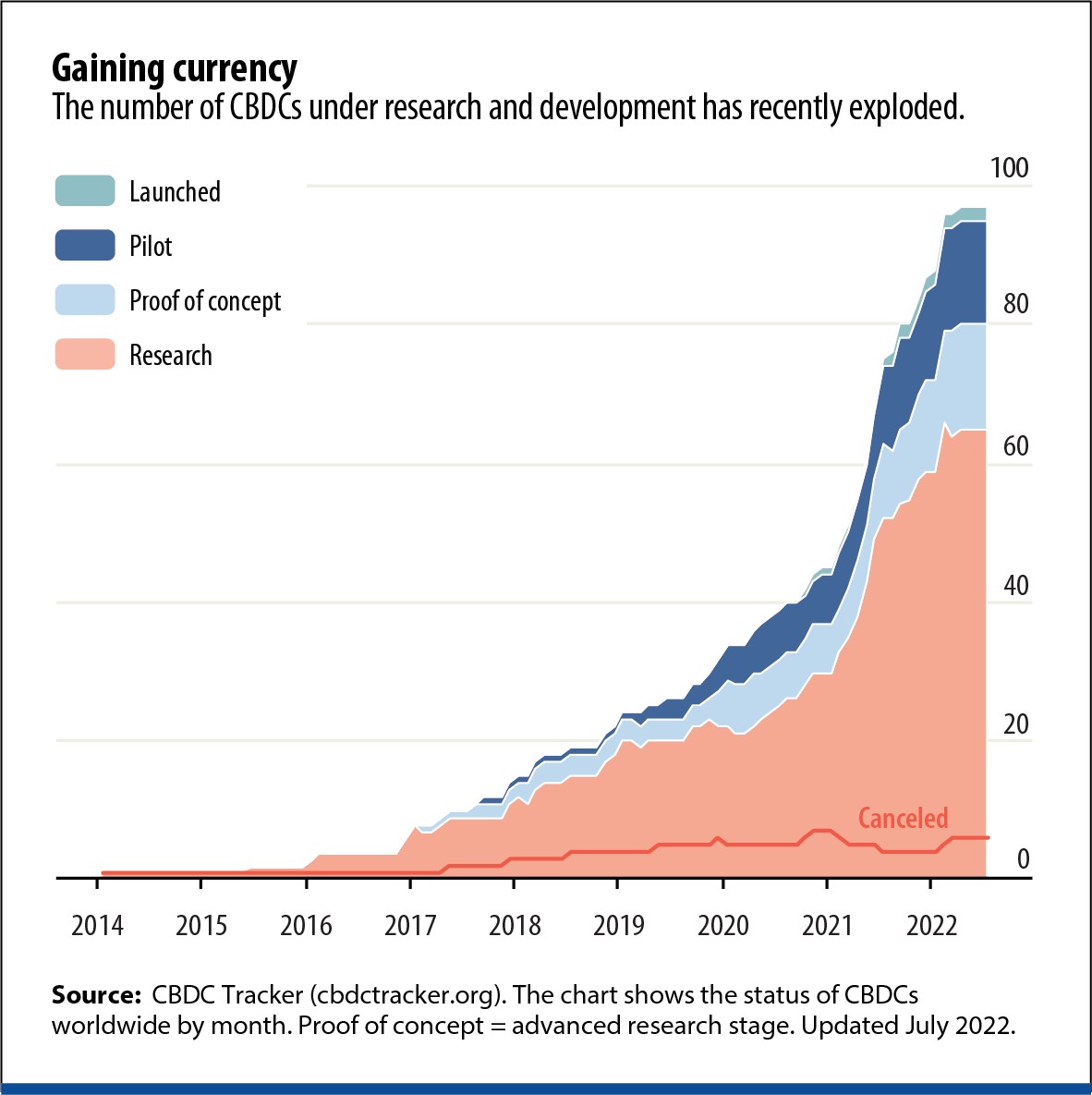

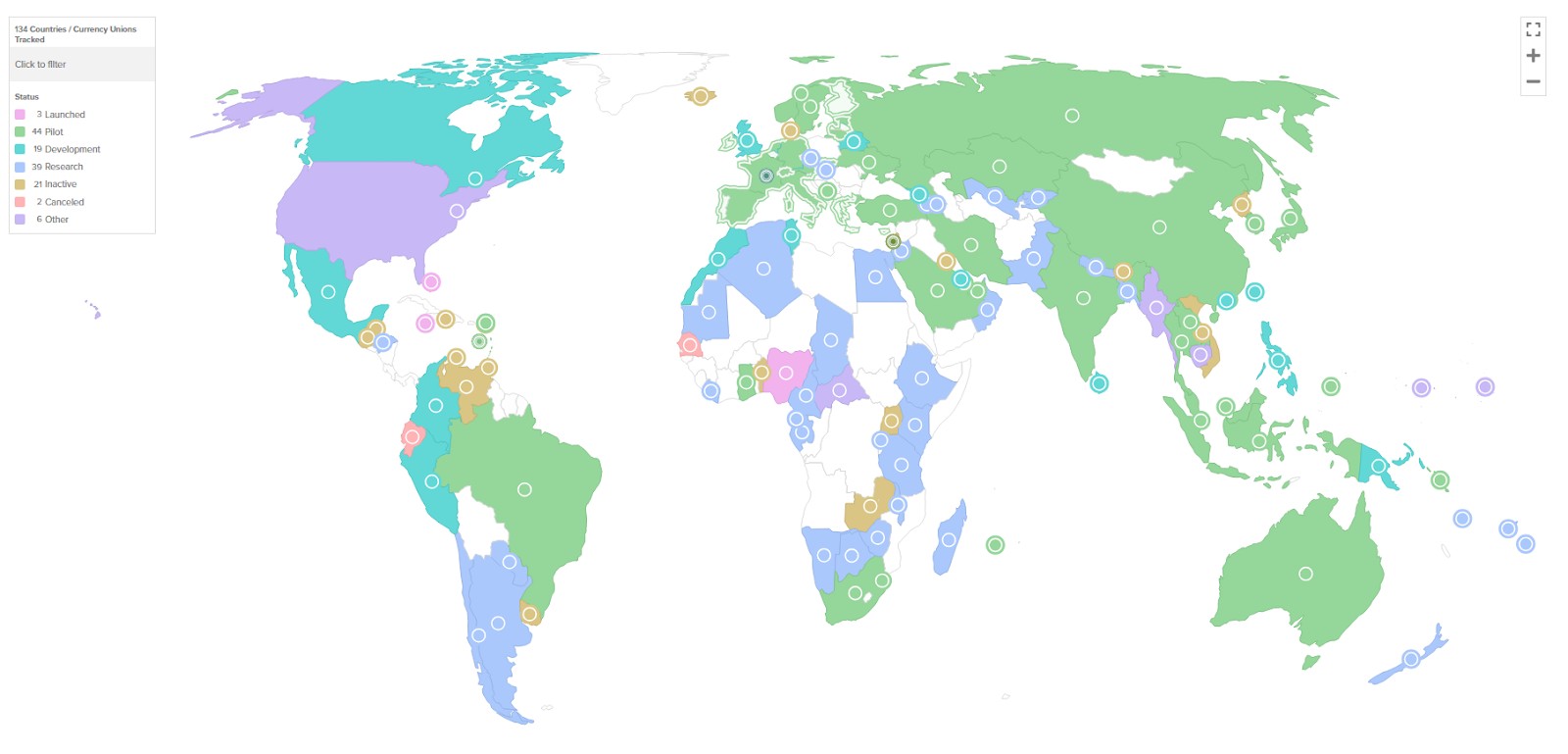

131 countries are tackling the problem — from the USA, South Korea and Japan to Nigeria and Namibia. Know how many cancelled their plans? Only 2 — Senegal and Ecuador, every other government is grinding for that CBDC launch like their survival depends on it. So far 3 have fully fledged launches — Nigeria with e-Naira, Bahamas with Sand Dollar, and Jamaica.

44 countries are grinding pilot versions of the CBDCs. The one people overlook is China who amassed ¥7T in CBDC transactions since 2023 — in fact, that number quadrupled over the course of 2 years. There’s no real way to put it aside from «the world is lagging behind on CBDCs and they are your new money, like it or not». Mind that pilot versions of CBDCs can be used as real money.

Here are some CBDC numbers for you:

129 countries are tackling the CBDCs like their survival depends on it, with only 2 canceling their plans;

Analytics project that by 2031 CBDCs will be responsible for $7.1B in transactional volume and save at least $45B in fees for people;

Out of 90443 people surveyed by CFA in 2023 more than half agreed CBDC has to be launched.

How CBDCs will affect crypto

There’s a high chance of CBDCs getting married with crypto. Liquidity Pools are a big thing in DeFi, what you need to understand is that they require two assets to function properly at once — Coin A (the support) and Coin B (the supported).

For the majority of time people used stablecoins as Coin A in order to provide support for the second asset. You see, people crave CBDCs because they use stablecoins which essentially serve the same purpose — to transfer the fiat value into crypto. Thing is — with stablecoins you have to pass the Fiat-to-Stablecoin step, no matter how hard you try, and CBDC can change that.

Because CBDCs are made after crypto, they can (and will be) used as a Coin A in the Liquidity Pools which would be called Hybrid Liquidity Pools, as they would be the first ones ever to utilize both Fiat and Crypto at the same time. This is like going from horse-powered carriage to a maglev in just 5 years.

With CBDC taking the place of stablecoins, the latter would have to adapt. Stablecoin providers would either transform into some kind of payment processor, or would continue to peg their coins 1 to 1 with CBDCs. In a natural market fashion, Providers can merge with Payment Service Providers in Hybrid approach and essentially act as distribution infrastructure for the CBDC.

But yes, CBDCs won’t obliterate the stablecoin market, because the likes of Tether Foundation already act like Payment Service Providers, they just have to take extra steps to peg Tether to real world assets. What is likely going to happen is that Tether Foundation becomes a major Payment Service Provider and helps to distribute, manage and operate the CBDC by using the existing infrastructure they’ve built for more than 8 years — it would be highly unwise not to utilise that on the Federal Reserve side. Counterwise, it would take more time and effort to build the fully fledged CBDC infrastructure than to use the 66% of the market share the Tether Foundation managed to amass — $200B, connections in both crypto and fiat networks and worldwide coverage.

CBDCs control money; crypto fights to stay free

Most people new to this space think CBDCs are just government-run versions of Bitcoin — but that’s not how they work. Unlike crypto, CBDCs can be programmed. That means central banks could limit how you use your money — like making sure stimulus cash only works at certain stores, or even giving it an expiration date. If you're used to Bitcoin’s freedom, this is a whole different world. Want a reality check? Watch what’s already happening in China or Nigeria — those pilots tell you more than any press release.

Another thing beginners miss: just because crypto is decentralized today doesn’t mean it’s immune to changes tomorrow. As CBDCs become more common, expect regulators to quietly push for new rules that affect even the decentralized stuff — like making DeFi apps follow identity checks. If you’re trading or building in this space, pay attention to what central banks say about “risk” or “stability.” It’s often code for changes that could hit your wallet before you see them coming.

Conclusion

Unlike decentralized cryptocurrencies like Bitcoin, CBDCs are fully controlled digital currencies managed by central banks, offering traceability, programmability, and the power to freeze funds. They aim to fix the flaws of physical cash — like counterfeiting and anonymity in crime — but at the cost of personal financial freedom. With CBDCs, money becomes programmable, potentially limited in how, where, or when it can be used. Crypto was born to resist control; CBDCs are built for it. As both systems evolve side by side, they will reshape the future of money — blending stability with surveillance, and freedom with regulation.

FAQs

Would CBDC replace my national currency?

CBDC, if launched properly, is a national currency and by design does not substitute cash payments.

Is CBDC the real money or a fake rumour launched by the internet?

No, they are real, and they are coming to your country soon or later.

Can CBDC hurt my savings in cash?

No, they are designed to represent real cash in 1 to 1 ratio.

Are CBDCs a good thing or a bad thing to the economy?

Good from the standpoint of more control over the currency flows, less fees, quicker transactions, more security and less space for counterfeit, but really questionable from the standpoint of the government locking your money down.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.