Trading The EGP: Currency Guide For 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Egypt's official currency is the Egyptian Pound (EGP), commonly symbolized as E£ or ج.م. Introduced in 1834, the EGP is issued and regulated by the Central Bank of Egypt. The Egyptian Pound operates under a managed float system and is partially convertible, with capital controls imposed on large cross-border transactions to stabilize the currency and manage foreign reserves.

Egypt, a major North African economy with close ties to the Middle East and Europe, is going through significant economic changes. For Forex traders and emerging market investors, the Egyptian Pound (EGP) is known for its sharp price swings, which can bring both opportunities and challenges. In this guide, we break down the EGP, its management, and what traders should watch for before taking positions on the EGP in 2025.

What currency does Egypt use?

Egypt uses the Egyptian Pound, represented by the symbol E£ or ج.م, with the ISO code EGP. It is the only legal tender in Egypt and is used in everything from everyday purchases to large-scale transactions.

Introduced in 1834, the Egyptian Pound is managed by the Central Bank of Egypt (CBE), overseeing monetary policy, inflation trends, and currency circulation under Law No. 194 of 2020.

For traders, the EGP offers an interesting example: it isn’t globally dominant but still draws attention because of Egypt’s IMF-supported reforms, inflation shifts, and periodic devaluations.

Currency overview:

Currency name. The Egyptian Pound (EGP) is the official currency of Egypt, divided into 100 piastres.

Currency type. It is a fiat currency regulated by the Central Bank of Egypt (CBE).

Exchange rate system. Egypt operates a managed float exchange rate system, allowing the currency's value to fluctuate within a controlled range.

Convertibility. The Egyptian Pound is partially convertible. While current account transactions like remittances and trade payments are generally permitted under standard banking controls, capital account transactions, including certain foreign investments and profit repatriation, are subject to restrictions.

Exchange rates and inflation: Key trading metrics

The Egyptian Pound is divided into 100 piastres (قرش). It is available in both coin and banknote form, although due to inflation, low-denomination coins are rarely used in practice.

Banknotes in circulation (as of 2025):

E£10, E£20, E£50, E£100, E£200

In recent years, the Central Bank of Egypt has transitioned to polymer banknotes for certain denominations. The E£10 polymer note was introduced in July 2022, followed by the E£20 polymer note in June 2023. These notes include enhanced security features and improved durability.

Coins (infrequently used):

25 piastres, 50 piastres, E£1

While still legal tender, these coins are typically not used for high-volume transactions due to the declining real value of small denominations.

Currency convertibility and controls

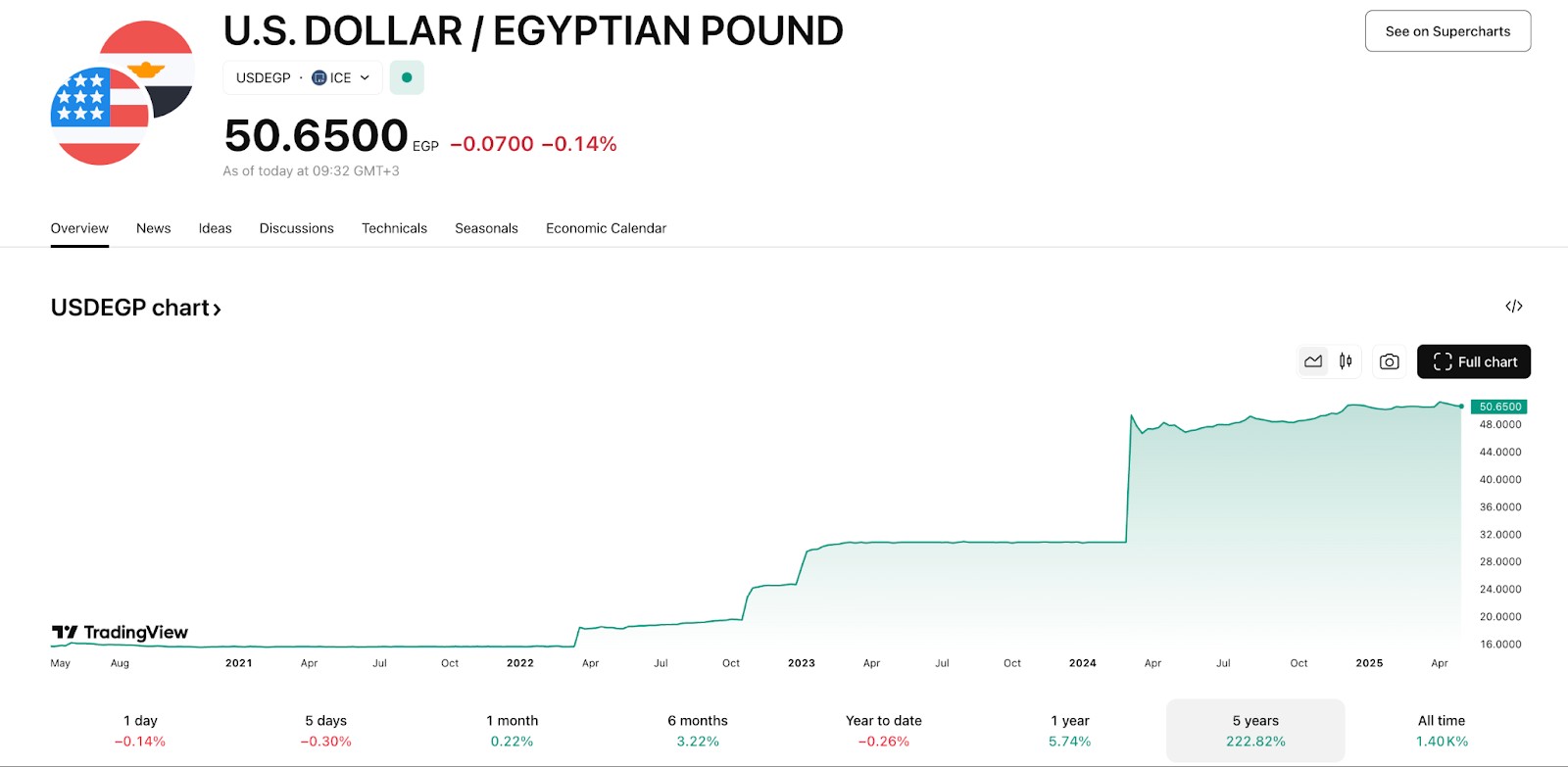

In recent years, Egypt's approach to currency convertibility has been marked by significant shifts aimed at stabilizing its economy. A pivotal moment occurred in March 2024 when the Central Bank of Egypt (CBE) decided to float the Egyptian pound, leading to a sharp depreciation of over 60% against the U.S. dollar.

This move was a response to severe foreign currency shortages and was a key condition for securing an expanded $8 billion loan from the International Monetary Fund (IMF). The flotation aimed to unify the exchange rate and eliminate the black market for foreign currency, which had been thriving due to the previous fixed exchange rate regime. The CBE also raised interest rates by 600 basis points to curb inflation and attract foreign investment.

Despite these measures, the Egyptian pound remains non-convertible for physical export; individuals are prohibited from taking the currency out of the country. While Law No. 38 of 1994 allows for the free transfer of foreign currency into and out of Egypt, the physical export of the Egyptian pound is still restricted. This policy reflects the government's cautious approach to currency controls, balancing the need for economic liberalization with concerns about capital flight and financial stability.

Digital payments and financial inclusion

Egypt’s digital finance sector continues to expand, driven by mobile wallets and fintech platforms. Key developments include:

Egypt’s digital finance sector continues to expand. This growth is driven by the increasing adoption of mobile wallets and fintech platforms, enhancing financial accessibility across the country.

Mobile wallet users (2025). Approximately 58 million users are active in Egypt, marking a steep rise in adoption as digital payment options become more mainstream.

Transactions (2025). Mobile wallet transactions are estimated to reach 3.3 billion annually, with a total value of around $36.2 billion.

Financial inclusion rate (2024). About 74.8% of Egypt’s adult population — roughly 52 million people — had access to formal financial services by the end of 2024.

Digital wallets in urban areas. Services like Vodafone Cash, Meeza, and Etisalat Cash are widely used in cities, playing a vital role in promoting cashless payments.

Progress on a digital pound. As of April 2025, the Central Bank of Egypt has not launched a digital pound, though exploratory work on a central bank digital currency (CBDC) is ongoing.

Trading the Egyptian Pound (EGP) in 2025

The EGP is considered an emerging market currency and is not widely traded outside the MENA region. However, it is still available for trading through select brokers, especially via exotic currency pairs. The majorly traded Egyptian Pound (EGP) pairs are:

USD/EGP. The most liquid and widely traded EGP pair, reflecting Egypt's strong trade and financial ties with the United States.

EUR/EGP. Actively traded due to significant economic relations between Egypt and the European Union.

GBP/EGP. Traded based on historical and ongoing financial connections between Egypt and the United Kingdom.

These pairs are considered exotic in the Forex market, often exhibiting wider spreads and higher volatility compared to major currency pairs. Traders should be aware of factors such as Egypt's monetary policy, inflation rates, and geopolitical developments, which can significantly influence the EGP's performance.

If you’re interested in trading the Egyptian Pound (EGP) on the Forex market, you’ll need to open an account with a broker that offers EGP currency pairs. Below, we’ve highlighted some of the leading Forex brokers that support Egyptian Pound trading. You can explore their features and offerings to find the one that best suits your trading needs.

| EGP | Currency pairs | Min. deposit, $ | Max. leverage | Deposit fee, % | Withdrawal fee, % | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | 40 | 100 | 1:500 | No | No | ASIC, SCB, CySEC, FCA | 9.1 | Open an account Your capital is at risk. |

|

| Yes | 57 | 5 | 1:1000 | No | No | CySEC, FSC (Belize), DFSA, FSCA, FSA (Seychelles), FSC (Mauritius) | 9 | Open an account Your capital is at risk. |

|

| Yes | 61 | No | 1:500 | No | No | VARA, AFSA, NBG, MiCAR | 9.2 | Open an account Your capital is at risk. |

|

| Yes | 40 | 10 | 1:2000 | No | 0-4 | FSC | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 55 | 100 | 1:500 | No | 1-3 | ASIC, FSCA, FSC Mauritius | 8.69 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Key considerations for traders

Get ahead of currency resets. Egypt often lets the EGP drop suddenly, then keeps it steady for months. Spotting the early signs of a reset can be a game-changer.

Keep an eye on outside support. The pound is tied closely to money from the IMF or Gulf countries. If funds stall or get delayed, expect the market to react fast.

Use tourism patterns to your advantage. Tourist seasons (like December–March) often bring more dollars into Egypt, which can give the pound a short lift and is great for short-term trades.

Track the black market rate. Unofficial exchange rates usually shift before the official ones do. Watch this to spot early warning signs that the EGP might move.

Forex instruments may include EGP exposure via non-deliverable forwards (NDFs) and synthetic instruments, which are common for currencies with capital controls.

Risks of holding or trading EGP

If you're thinking about holding or trading the EGP in 2025, these under-the-radar risks could blindside you if you're not watching closely.

Liquidity dries up fast. Even slight political tension or economic news can make it nearly impossible to exit EGP positions without a heavy premium.

Dual exchange rate traps. The gap between official and parallel rates can widen suddenly, wrecking profits if you’re stuck on the wrong side of the spread.

Central bank surprises. Egypt’s central bank tends to act without warning; rate hikes, capital controls, or devaluation announcements can hit after hours.

Import dependency risk. Since Egypt imports most essentials, global supply shocks can crush the EGP quickly, especially if foreign reserves are already tight.

Sector recommendations for traders in Egypt

Certain sectors within Egypt’s economy are more exposed to currency fluctuations and may signal market stress or opportunity:

Banking and financial services

Highly sensitive to CBE rate policy.

Traders should monitor central bank liquidity operations and loan/deposit ratio shifts.

Capital inflows or withdrawals often reflect in banking stock movement and currency momentum.

Import-dependent industries (FMCG, Automotive, Pharmaceuticals)

Depreciation leads to increased cost pressures for these sectors.

Watch import licensing rules, FX reserve coverage, and customs policy changes.

Tourism and hospitality

Benefits from a weaker pound due to increased foreign arrivals.

Seasonal patterns and global sentiment (e.g., visa policy, airline connectivity) can influence EGP indirectly.

Commodities and energy

Egypt imports most of its fuel and grains. Oil price shocks can directly pressure the balance of payments and, in turn, the EGP.

Track Brent crude prices and energy subsidy reforms.

Pros and cons of the Egyptian Pound

- Pros

- Cons

Central to all domestic financial activity in Egypt.

Regulated by a central monetary authority (CBE).

New polymer notes improve security and durability.

Expanding digital infrastructure supports mobile payments.

High inflation and frequent devaluation risks.

Capital controls limit international convertibility.

Not widely accepted outside Egypt.

Exchange rate volatility may impact predictability.

Timing EGP transfers with subsidy cycles and black market signals

If you're planning to use Egyptian Pounds (EGP), whether for a trip, sending money home, or doing business, keep an eye on Egypt’s government subsidy changes. These adjustments, especially around fuel or food prices, often hint at upcoming shifts in the EGP's value. When there’s pressure to cut subsidies, it usually signals trouble for the pound. The Central Bank may loosen its controls or let the EGP slide. If you notice these signs early, you can time your currency transfers before things shift.

Also, don’t ignore Egypt’s parallel currency market. While it’s technically unofficial, it’s often a better reflection of how people really value the EGP. When the gap between the official and black market rate widens, it’s usually a sign that the pound is about to lose value. If you're a business owner or sending remittances, tracking this gap can help you decide when to convert your money, or when to hold off a little longer.

Conclusion

Egypt uses the Egyptian Pound (EGP) as its official and only legal currency. As of 2025, the pound is undergoing significant transformation driven by monetary policy reforms, digital adoption, and inflationary pressure. While the EGP is critical for conducting business and daily life within Egypt, it presents notable risks and challenges for international investors and Forex traders.

Careful analysis, consistent monitoring of the economic landscape, and a clear understanding of the Central Bank’s policy direction are essential for anyone engaging with the currency of Egypt.

FAQs

Is the Egyptian Pound pegged to another currency?

No, the EGP operates under a managed floating exchange rate, not a fixed peg.

Can you trade EGP on all Forex platforms?

No, EGP is considered an exotic currency and is only available through select brokers.

Does Egypt offer currency forward contracts for hedging?

Yes, non-deliverable forwards (NDFs) are commonly used to hedge EGP exposure in global markets.

How does the IMF influence Egypt’s currency policy?

Egypt’s exchange rate and monetary reforms are often guided by IMF loan conditions and performance benchmarks.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).