Forex Trading Scams on WhatsApp in 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Plus500 - Best Forex broker for 2025 (United States)

Forex scams on WhatsApp include promises of high income, offers of account management and training for a fee. You can avoid them by not trusting suspicious offers, checking the reputation and license of brokers, and not providing personal details and financial information. Someone who has fallen victim to a scam should immediately report it on WhatsApp, block the contact and contact law enforcement or financial institutions for assistance and protection.

Modern Forex scammers often use social networks and messengers. Scammers find potential victims in groups where Forex traders communicate, share information and experience. Traders Union experts analyzed how scammers work in the popular messenger WhatsApp, what schemes are the most common among them, how to avoid them and how to act if you have to face them.

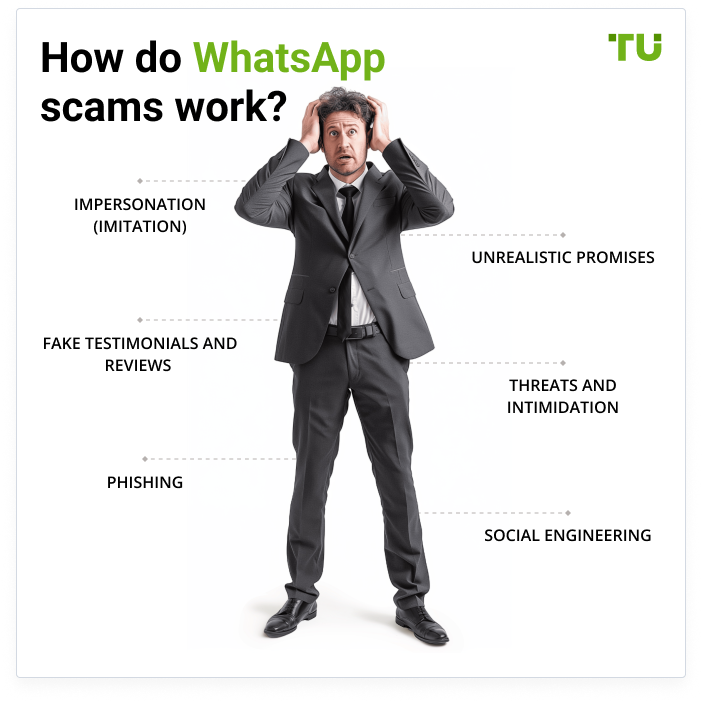

How do WhatsApp scams work?

Scammers on WhatsApp most often use these schemes of influence:

Impersonation (Imitation)

Scammers create groups or accounts mimicking official or trusted organizations such as banks, investment companies, or even friends and family of WhatsApp users. Through the use of fake profiles, they can convince users to provide their personal information or even transfer money.Unrealistic promises

Scammers often promise high returns or lucrative investment opportunities that are actually false. Scammers willingly “guarantee” quick profits or implausibly high rates of return to attract potential victims.Fake testimonials and reviews

Attackers write fake reviews or testimonials from supposed customers or members of their groups to convince new users that they are trustworthy. These reviews are actively circulated within trader groups on WhatsApp and other messengers.Threats and intimidation

Some scammers prefer to work rough and immediately apply intimidation techniques to make their victims act according to their wishes. These types of scammers threaten to reveal personal information, legal consequences or even physical violence to get the victim to transfer money or give access to bank accounts.Phishing

Phishing is the sending of malicious messages or links purporting to be from official sources (banks, brokers, large companies) in order to obtain sensitive information such as passwords, credit card numbers or bank details. Phishing can be realized by creating fake websites or applications that look like official ones but are actually fake. And when a duped customer enters his sensitive data there, the fraudsters debit his account.Social engineering

A way of manipulating victims’ emotions. A scammer may try to induce sympathy or stress in a potential victim in order to get them to take the actions the scammer wants - transferring money or giving access to confidential information.

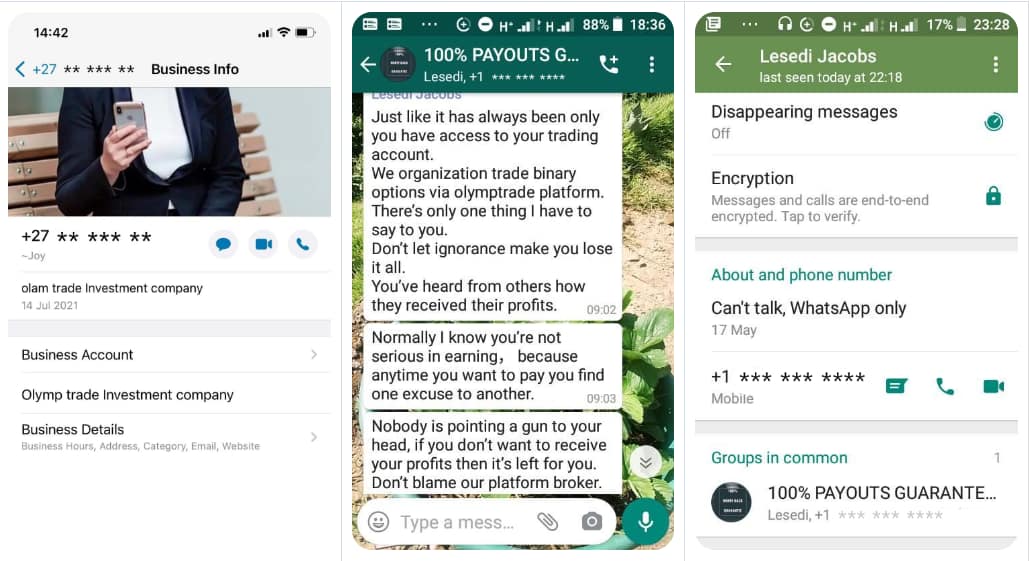

Examples of Whatsapp scam

There are so many ways of scamming. A common scheme involves contacting a user who introduces himself as a manager of a broker. He offers some “secret” way of earning money that no one knows about and offers to buy this information. This is a classic Whatsapp scam designed to tempt the trader to make a quick buck and pay.

Scam on WhatsApp

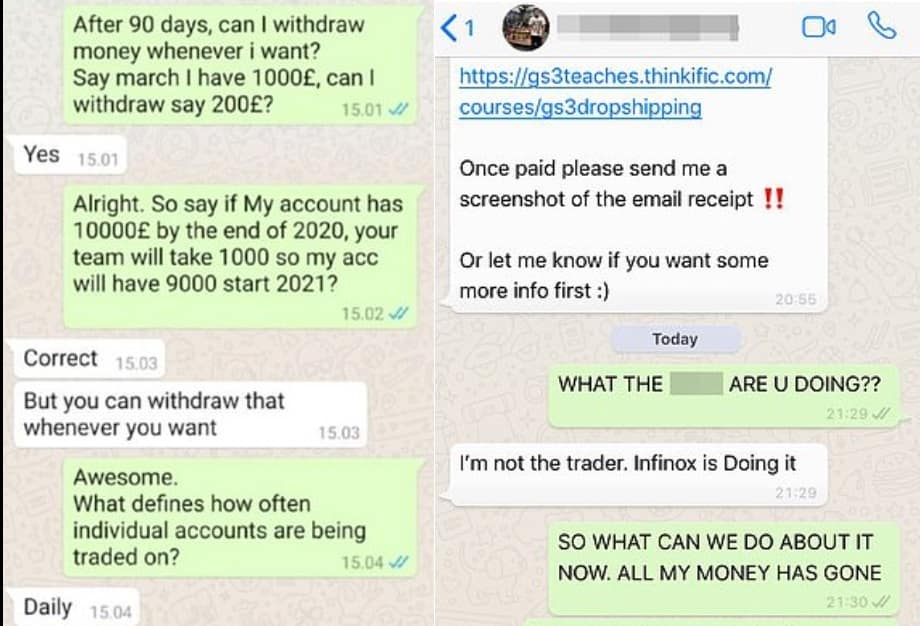

Scam on WhatsAppAnother method of scamming is the promise of high profits supposedly for managing a trading account. The scammer offers to send money for further management. At the same time, he sends a link to an unknown resource. The trader transfers the money and then remains without funds.

Scam on WhatsApp

Scam on WhatsAppWhat WhatsApp scams should you be aware of?

According to Traders Union research, fraudsters mostly offer fake signal providers or Forex broker account management services on WhatsApp. It is also common practice to offer fake training, after which a trader is supposedly guaranteed to become successful and immediately start earning high profits.

The Signal Provider Scam

In this scheme, scammers offer their services in providing trading signals for Forex, cryptocurrencies and other financial markets. They claim that these signals work without fail and will bring profit with a probability of 100%, which, of course, cannot be the case.

Signs of this scheme can be unrealistic promises of profitability, a lack of proven success stories or the refusal of scammers to provide detailed information about their trading strategies.

If you encounter such a scheme, it is best to avoid cooperation and do not contact the offered services in any way. It is strongly recommended to use signals only from verified providers.

The Account Management Scam

In this scheme, scammers offer a trader the management of his investment account or funds on the financial markets. They may promise guaranteed income or a high percentage of profit without warning about possible risks. Such unrealistic promises are a reason to be wary, because no one can ever guarantee 100% profit on Forex.

What should a trader do? Be cautious, ask if such a “manager” has a proper license or official documents about his place of work.

If the activity of this person seems even a little suspicious, it is better to be reinsured and not to make any payments or investments, to report the scam and block the contact.

Forex Training Scam

Scammers of this kind offer Forex trading training for a fee, claiming that after their course or training, the income will skyrocket and the trader is guaranteed to build a successful career in Forex. The victim pays money but does not receive training, or the training materials are of poor quality or stolen.

A trader should be wary of training offers, especially if they promise instant success without proper labor and training. One should always check the reputation and qualifications of trainers, as well as their history of success. Promises of quick riches should not be trusted - when they are made, they are almost guaranteed scams.

How to avoid Forex scams on WhatsApp?

Traders Union experts have given tips on how to avoid Forex scams on WhatsApp.

Before choosing a Forex broker, coach or account manager, you should carefully check their license and reputation.

Promises of quick and easy ways to make money should not be believed. Forex trading always takes time, patience and training.

It is dangerous to give access to personal information and financial accounts to unknown or unverified people.

Forex information should be obtained from reliable and trusted sources such as official broker websites or financial news portals.

Forex environment is extremely dynamic, so it is important to update your knowledge of financial markets - read literature, study strategies, analyze the market. It is much more difficult for an informed trader to become a victim of fraud than a beginner.

Trust intuition and common sense. If something seems too good to be true, it probably is.

Report suspicious activity to the appropriate services or organizations.

How to report a scammer on WhatsApp

To complain about a scammer on WhatsApp you can take the following steps:

Block and Report Spam : WhatsApp provides the option to block a contact and send a spam complaint. To do this, you need to open a chat with the scammer, tap on the name of that contact at the top of the screen, then scroll down and select “block and report spam”.

Report a scam through the official WhatsApp website : To do this, you need to log in to the WhatsApp page on the website and find the “Contact Us” section. Then select “WhatsApp Web” and then “Report Fraud”.

Filing a complaint on the right holder's website : Some websites and services also offer the option of filing a complaint against a scammer through their own mechanisms. For example, if a scammer is trying to sell fake Forex services, the user can contact the support team of the relevant broker or financial regulator.

Necessarily preserving screenshots and other evidence : Before blocking a scammer and sending a complaint, you should save screenshots of all suspicious messages or evidence of his fraud. This will come in handy for further investigation or notifying other users.

Expert opinion

Avoiding falling into the trap of Forex scammers operating via WhatsApp is possible, but it requires special caution and awareness. First of all, you should not trust promises of high returns or guaranteed investment profits offered via WhatsApp - it is almost always a trap.

It is also important to check the credentials and reputation of any brokers or Forex coaches who post on WhatsApp. It is highly discouraged to trust offers of training or account management without a proper license or registration. Before partnering with anyone or handing over your finances to them, it is important to do your own research regarding the reliability and transparency of whoever has offered the services.

Traders should be especially cautious about clicking on links or opening attachments that come through WhatsApp. This could be an attempt by scammers to use phishing techniques to gain access to credentials or infect the device with malware.

It is also important to pay attention to the unusual behavior of contacts on WhatsApp. If you receive messages with offers of Forex services from unknown or suspicious contacts, you should be very careful not to make hasty decisions. If the questionable offer or request comes from friends, relatives or other people in your WhatsApp contact list, it is better to call them back by phone or meet them in person to make sure that the contact has not been hacked by scammers.

Conclusion

Forex fraudsters often choose messengers, in particular WhatsApp, to find victims because of their wide availability, the ability to quickly disseminate information and relative anonymity - this creates a convenient environment for attackers to implement criminal schemes. The most common types of Forex trader scams on WhatsApp are fake signal providers, false training and education and offers to manage an account with a Forex broker. To avoid scams on WhatsApp, you should always check the documentation, certificates and reputation of the one who offers the services.

If a scammer is detected, Traders Union experts recommend immediately blocking the contact, reporting the spam on WhatsApp, and if the scammers have already stolen money, urgently contacting law enforcement authorities.

FAQs

What are the typical fraud schemes on the Forex market?

Most often scammers use account management offers, fake trainings and trading signals, but they can also impersonate other persons (for example, famous traders or bloggers).

How do Forex fraud schemes work?

Scammers usually contact potential victims via messengers, offering them quick and easy ways to make money on the Forex market. They use false promises of high returns, fake testimonials and fake documents to convince victims that they are trustworthy.

Can I get my money back after being scammed?

The ability to recover money after being caught up in a fraudulent scheme depends on many factors, including the victim's country of residence, the method of payment and the nature of the fraud. In some cases, it may be possible to contact law enforcement or specialized legal services.

If I become a victim of fraud, what actions should I take?

If you have been a victim of Forex fraud via WhatsApp or other messengers, contact your bank or payment system as soon as possible and contact the law enforcement authorities in your country. It is important to keep all evidence and documentation related to the fraudulent scheme for further proceedings.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

A Forex trading scam refers to any fraudulent or deceptive activity in the foreign exchange (Forex) market, where individuals or entities engage in unethical practices to defraud traders or investors.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Forex indicators are tools used by traders to analyze market data, often based on technical and/or fundamental factors, to make informed trading decisions.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.