Moneyfarm UK Review 2025: Is This Digital Wealth Manager Right for You?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Moneyfarm offers a personalized approach to digital wealth management. With a minimum investment of £500, it tailors portfolios based on your risk tolerance and goals. Moneyfarm’s standout feature is its human touch — users get access to investment consultants for guidance, a rarity among robo-advisors.

If you look around, robo-advisors are increasingly preferred by those interested in automating their portfolio management. Moneyfarm, a UK-based digital wealth manager, offers a simple, affordable, and flexible service through its personalized investment options. But how does it compare to other options, and is it the right choice for you? Let’s look into the details to see if it's the right fit, covering everything from key features to fees, performance, and customer experience.

What is Moneyfarm UK?

Moneyfarm is an FCA-regulated digital wealth manager that blends human expertise with automated portfolio management. Founded in Italy in 2012 and launched in the UK in 2016, Moneyfarm primarily invests in ETFs (Exchange-Traded Funds), making it an affordable alternative to traditional wealth managers. The platform offers a variety of accounts, including Stocks and Shares ISAs, Junior ISAs, General Investment Accounts (GIAs), and Personal Pensions (SIPPs), providing a comprehensive suite of investment options.

How does Moneyfarm work?

The platform’s sign-up process is simple yet detailed. It starts with an investor profile questionnaire designed to understand your risk tolerance, investment goals, and financial knowledge. Based on your answers, Moneyfarm generates a customized portfolio tailored to your needs, managed using a combination of algorithms and human oversight.

Step 1: Sign up

Visit the Moneyfarm website.

Click on “Get Started” at the top right of the homepage.

You’ll be asked to provide your personal details, such as your name, email, and phone number, to create an account.

You will need to verify your email and follow the registration process.

Step 2: Complete the investor profile

Moneyfarm requires you to complete a short questionnaire to assess your financial goals, risk tolerance, and investment time horizon.

Based on your answers, they will recommend one of their seven risk-based portfolios, ranging from low to high risk.

This helps them tailor a portfolio specifically to your investment needs.

Step 3: Select an investment type

Moneyfarm offers several investment options, and you’ll need to select the one that best matches your goals:

Active management: This is for hands-on investors looking to optimize growth. Active management fees start at 0.75%.

Fixed allocation: This is ideal for passive investors seeking low-cost, long-term growth. The fee starts at 0.45%.

Liquidity+: Suitable for short-term, low-risk cash management. This portfolio has a flat 0.3% fee.

Share investing: If you prefer picking your own stocks, ETFs, or mutual funds, Moneyfarm charges £3.95 per trade.

Step 4: Deposit funds

Once your account is set up, you’ll need to deposit a minimum of £500 to get started.

Deposits can be made via bank transfer or direct debit. You can set up regular contributions or make one-off payments.

For SIPP and ISA accounts, you can also transfer existing funds from other platforms into Moneyfarm.

Step 5: Portfolio management

After funding your account, your Moneyfarm portfolio is constructed using ETFs based on your risk profile.

The platform rebalances your portfolio periodically to keep it aligned with your investment goals.

If you chose Active Management, Moneyfarm’s team will monitor and adjust your portfolio to optimize growth.

Fixed Allocation portfolios are passively managed, so there’s less frequent rebalancing.

Step 6: Track your investments

You can monitor your portfolio through the Moneyfarm dashboard on their website or mobile app.

The platform provides real-time updates on your portfolio's performance, showing your returns and asset allocation.

If you have any questions or want to make adjustments, you can reach out to their customer service team, which offers advice and guidance.

Step 7: Withdraw or transfer funds

You can withdraw funds at any time by logging into your account and requesting a withdrawal.

Withdrawals usually take up to seven business days, depending on the type of assets you hold.

If you want to transfer your investments to another platform, you can do so without penalties.

Products offered by Moneyfarm UK

Moneyfarm provides a range of investment products to meet different financial needs:

Stocks and shares ISA: Tax-free growth on your investments with flexible contributions and withdrawals.

Junior ISA: A long-term, tax-efficient savings vehicle for children, with the same flexibility and portfolio options as the adult ISA.

General Investment Account (GIA): Similar to the ISA but without the tax benefits.

Personal Pension (SIPP): Retirement savings that allow for tax relief on contributions, with the added bonus of employer contributions.

Moneyfarm UK fees and charges

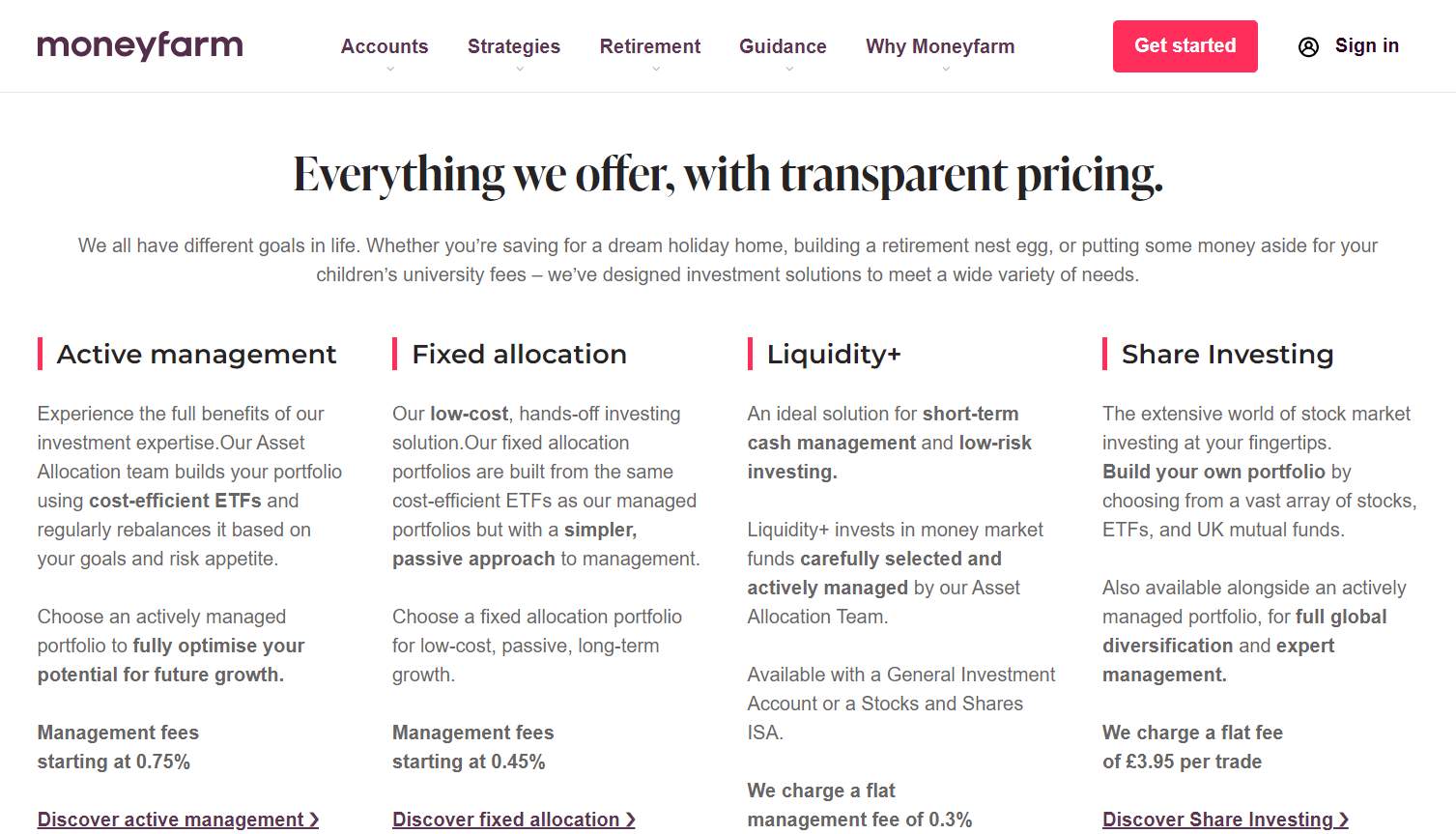

Active management

Moneyfarm's active management solution provides a hands-on approach where their expert Asset Allocation team actively builds and rebalances your portfolio using cost-efficient ETFs. This option optimizes your potential for future growth based on your financial goals and risk tolerance. With active management, you benefit from professional oversight, ensuring your investments are continually adjusted to align with market conditions and your personal objectives.

Management Fees: Start at 0.75% annually.

Fixed allocation

For those seeking a more hands-off, passive investment approach, fixed allocation portfolios offer low-cost long-term growth. These portfolios are constructed using the same cost-efficient ETFs as the actively managed portfolios but with a simpler, passive strategy. Ideal for those who want to invest for the long term without regular portfolio adjustments, fixed allocation provides a straightforward and low-cost solution.

Management Fees: Start at 0.45% annually.

Liquidity+

If you're looking for a low-risk, short-term investment solution, Liquidity+ is designed to manage cash efficiently while still offering growth potential. This product invests in money market funds selected and actively managed by Moneyfarm’s Asset Allocation team. It’s available through a General Investment Account or a Stocks and Shares ISA, making it ideal for managing cash reserves or minimizing risk.

Management Fees: A flat fee of 0.3% annually.

Share investing

For those who prefer to build their own portfolio, Moneyfarm offers Share Investing, providing access to a wide array of stocks, ETFs, and UK mutual funds. This service allows you to diversify globally while having control over your investments. You can also use this alongside an actively managed portfolio for maximum diversification and expert guidance.

Trading Fees: £3.95 per trade.

Pros and cons of Moneyfarm UK

- Pros

- Cons

- User-friendly platform: Both the app and web interface are easy to navigate, making it accessible for beginner investors.

- FCA-regulated: Moneyfarm is fully regulated by the Financial Conduct Authority, ensuring your investments are protected.

- Low fees: The tiered fee structure and use of low-cost ETFs make Moneyfarm an affordable choice.

- High minimum investment: A £500 minimum investment may be steep for some beginners.

- Limited to UK and Italy: Moneyfarm is currently only available to residents of the UK and Italy, limiting its accessibility.

How much can you earn with Moneyfarm UK?

The returns on your Moneyfarm investments depend heavily on your portfolio’s risk level and market performance. Over the past few years, average portfolio returns have been comparable to other robo-advisors, with a typical medium-risk portfolio returning around 28% since the platform’s UK launch.

However, it’s important to remember that investing always carries risks, and past performance does not guarantee future returns.

Risks and warnings

Market risks

As with any investment, Moneyfarm’s portfolios are subject to market risks. ETFs, while diversified, can still experience significant losses during periods of market volatility.

Custodial risks

While Moneyfarm is regulated by the FCA, which provides some protection, investors should still be aware of the risks related to the platform itself. In the unlikely event that Moneyfarm were to go out of business, your funds are covered up to £85,000 by the Financial Services Compensation Scheme (FSCS).

Customer reviews and experience

Moneyfarm boasts a strong reputation among its users. Customers have praised the platform’s ease of use, responsive customer service, and consistent portfolio performance. However, some users have complained about withdrawal delays and the lack of direct stock trading options.

Moneyfarm removes much of that pressure

One of the biggest mistakes I’ve seen new investors make is trying to time the market. Trust me, even for seasoned professionals, predicting market movements is incredibly difficult. The beauty of a service like Moneyfarm is that it removes much of that pressure, allowing your portfolio to grow over time without the stress of constant monitoring. Their diversified portfolios and rebalancing strategies help mitigate risk, but remember, risk is always part of the equation.

Take the time to understand your risk tolerance before you begin. Moneyfarm offers different portfolios based on how much risk you’re willing to take, so choose wisely based on your long-term goals. And while their advisors are there to help, it’s always a good idea to educate yourself about basic investing principles. The more you know, the better equipped you’ll be to make informed decisions when it matters most.

Conclusion

Moneyfarm is an excellent option for those seeking a simple, affordable, and regulated investment platform. Its wide range of products, including ISAs, pensions, and GIAs, coupled with a strong focus on ethical investing, makes it a versatile choice for long-term investors. However, its high minimum investment and lack of availability in countries outside the UK and Italy may be drawbacks for some.

If you’re looking for an easy-to-use platform with low fees and solid performance, Moneyfarm is definitely worth considering. But as with any investment, be sure to carefully assess your financial goals and risk tolerance before diving in.

FAQs

Is there a penalty if I withdraw my money from Moneyfarm before a certain period?

No, Moneyfarm doesn’t charge penalties for withdrawals. You can withdraw your funds anytime; however, it may take up to seven business days depending on your portfolio’s assets.

Can I transfer an existing ISA from another provider to Moneyfarm?

Yes, you can transfer an existing Stocks and Shares ISA or Junior ISA to Moneyfarm without losing your tax benefits. The Moneyfarm team can guide you through the transfer process.

Does Moneyfarm offer a mobile app for managing my portfolio?

Yes, Moneyfarm provides a mobile app for both iOS and Android, allowing you to monitor your portfolio, make deposits, and access customer support from your phone.

How does Moneyfarm handle dividend payments from ETFs in my portfolio?

Dividends from the ETFs in your portfolio are automatically reinvested, helping your portfolio grow over time without you needing to take action.

Can I open multiple Moneyfarm accounts for different investment goals?

Yes, you can open multiple accounts on Moneyfarm for different goals, such as a Stocks and Shares ISA for general savings and a SIPP for retirement planning.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).