How To Track Insider Trading Activity

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How to track insider trading activity:

Solution 1. Understanding SEC forms

Solution 2. Using the EDGAR database

Solution 3. Monitoring third-party tools

Solution 4. Analyzing insider trading data

Solution 5. Using stock analysis tools.

Insider trading involves the buying or selling of a company's securities by someone who has access to non-public, material information about the company. While illegal insider trading is a crime that can lead to hefty fines and jail time, legal insider trading occurs when insiders — such as company executives or major shareholders — buy or sell stock based on information that is eventually disclosed to the public. In this article, we'll discuss insider trading, exploring how you can legally track insider activities to make more informed investment decisions.

How to track insider trading activity

Tracking insider trading can provide investors with valuable insights. Insiders, by virtue of their positions, have a better understanding of the company's prospects than the average investor. Tracking insider trading activity involves monitoring SEC filings, public databases, and specialized tools. The U.S. Securities and Exchange Commission (SEC) requires insiders to disclose their trades through specific forms, which are publicly accessible. Beyond SEC filings, several third-party platforms aggregate and analyze this data, making it easier for investors to interpret insider activities. Let’s take a look at the top ways to track insider trading:

Understanding SEC forms

The SEC requires insiders to file three key forms:

Form 3: Filed when an individual becomes an insider, detailing their initial ownership of company securities.

Form 4: Filed whenever there is a change in an insider's ownership, such as buying or selling shares.

Form 5: Filed annually to report any changes not disclosed on Form 4 or that qualify for deferred reporting.

These forms provide the raw data you need to track insider trading.

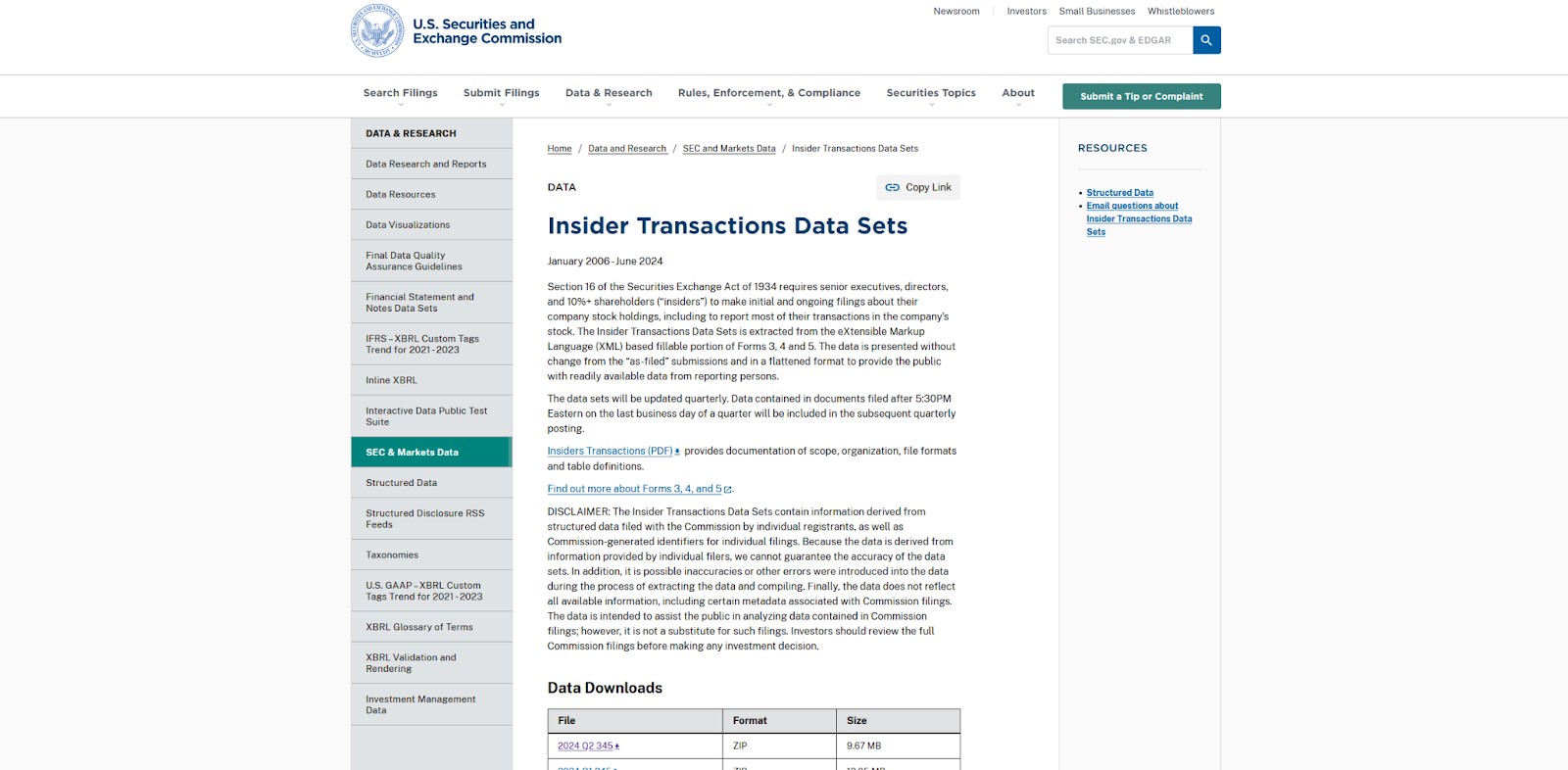

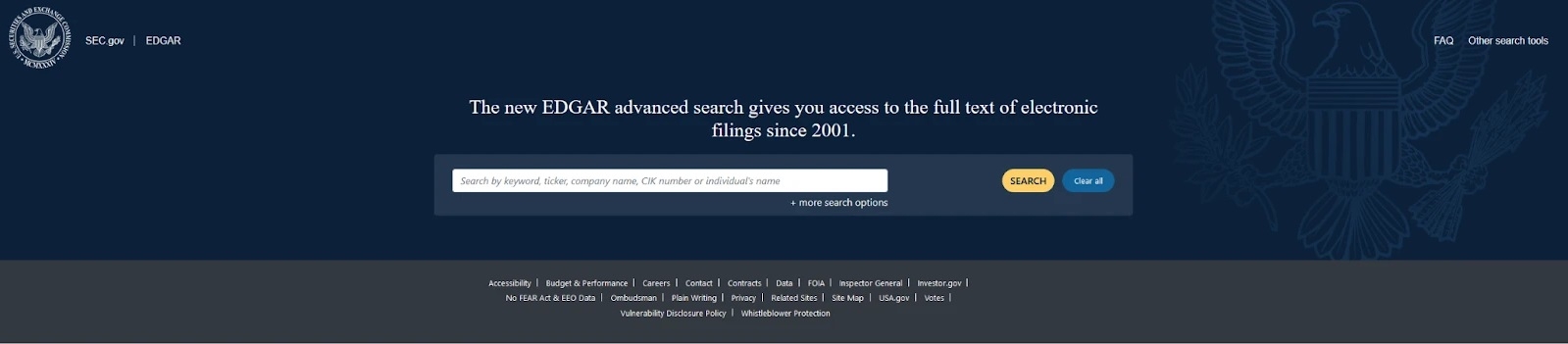

Using the EDGAR database

The SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system is a treasure trove of insider trading data. You can search for specific companies or insiders and view their recent transactions. While the interface may seem complex at first, EDGAR can turn out to be an insightful tool for serious investors.

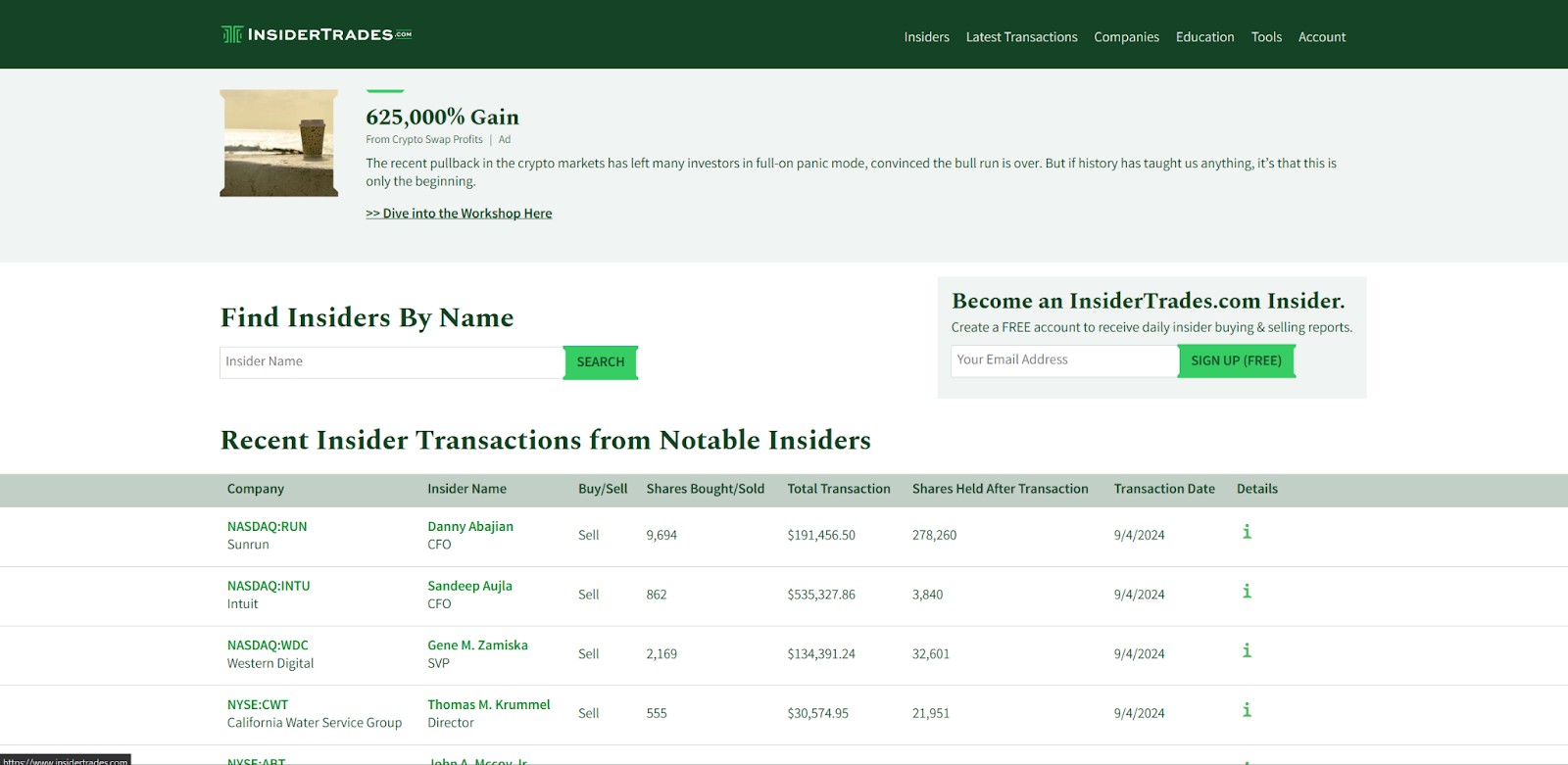

Monitoring third-party tools

Platforms like InsiderTrades.com, TipRanks, and MarketBeat simplify the process of tracking insider trading. These tools aggregate data from multiple sources, offering user-friendly dashboards and real-time alerts. Many of these platforms also offer advanced features like insider rankings and trade volume analysis, helping you make sense of the data.

Analyzing insider trading data

Interpreting insider trading data involves looking at both the timing and context of trades. For instance, consistent buying by multiple insiders could indicate confidence in the company’s future. On the other hand, insider selling isn’t always a bad sign — sometimes it’s just a matter of diversifying assets or covering personal expenses. The key is to look for patterns and corroborate insider activity with other forms of analysis.

Using brokerage analysis tools

Many analysis and brokerage platforms provide built-in tools to track insider trading. Some platforms offer alerts for significant insider activity, helping you stay updated.

| Demo | Min. deposit, $ | Max. leverage | Signals | Investor protection | Open an account | |

|---|---|---|---|---|---|---|

| Yes | 100 | 1:300 | Yes | €20,000 £85,000 SGD 75,000 | Open an account Your capital is at risk. |

|

| Yes | No | 1:500 | Yes | £85,000 €20,000 €100,000 (DE) | Open an account Your capital is at risk.

|

|

| Yes | No | 1:200 | Yes | £85,000 SGD 75,000 $500,000 | Open an account Your capital is at risk. |

|

| Yes | 100 | 1:50 | Yes | £85,000 | Study review | |

| Yes | No | 1:30 | Yes | $500,000 £85,000 | Open an account Your capital is at risk. |

Key tips for traders

Check legal filings. Go directly to SEC filings such as Form 4 or Form 5. These documents give you a firsthand look at insider transactions, providing more precise details than news reports.

Track insider trends, not events. Focus on the long-term patterns of insider buying or selling during market dips or peaks. This can give you insights into their confidence in the company's future prospects.

Understand the roles. Take note of which company insiders are trading. Actions by C-level executives or directors can be more telling about the company's direction than those by less senior staff.

Use sentiment analysis tools. Apply advanced software to assess how often and in what sentiment insiders are trading across the market. This helps you understand the broader market mood.

Compare with institutional movements. Look at how insider trading aligns with institutional investor activities. A matching trend between these can signal a strong market move.

Integrate insider data into models. Mix insider trading data into your math-based models that also consider earnings forecasts and economic indicators. This integrated approach can sharpen your investment decisions.

Risks and warnings

Chasing anomalies. Watch out for jumping to conclusions when you see unusual trading patterns. Sometimes, what looks like insider trading might just be the usual rebalancing by institutional investors or market adjustments.

Legal boundaries. It's important to stay within the law. Taking guesses about insider information can easily slip into illegal territory if you're not careful about the source and nature of the data you use.

Misleading signals. Company execs might buy or sell shares for personal reasons, like estate planning or diversifying their investments, which doesn't necessarily reflect their view on the company's future.

Timing discrepancies. Insider trading reports might not be up to date. Relying solely on SEC filings could lead you to make decisions based on stale information.

Volume vs. intent. Don't read too much into the volume of shares being traded by insiders. These moves could be part of automatic trading plans set up long before and may not signal any significant company developments.

Don’t take insider trading data at face value

If you're diving into tracking insider trading, start with Form 4 filings from the SEC. Focus not just on how many shares are bought or sold but also on when these transactions happen, especially around big company announcements. The real insight lies in spotting whether insiders buy more right before good news hits or sell off stocks just before a drop. You can use third party tools to alert you to insider moves at companies you’re watching and help you see these actions in context with other important events.

Also try looking at insider trading in smaller, less-covered companies too. Moves here can be more telling and less noticed by the big news networks, so they could be very profitable if you spot them early. Connect with other investors who are into these types of stocks through online communities. Discussing what insider actions might mean with others can deepen your understanding and lead to smarter investment choices. Paying attention to the little details in these lesser-watched areas can really pay off. And remember to do all of this while not breaking the law barrier.

Summary

Tracking insider trading activity involves monitoring the buying and selling of a company’s stock by its executives, directors, and key employees. These actions can provide valuable insights into the company’s future performance, as insiders are assumed to have more information about the company's prospects than the average investor. To effectively track this activity, investors can use resources such as the SEC’s EDGAR database or specialized platforms. However, interpreting this data requires context, such as the insider’s role within the company and the relative size of their transactions.

FAQs

Why is tracking insider trading activity important for investors?

Tracking insider trading is important because it provides insights into how those closest to the company perceive its future prospects. Insider purchases may indicate confidence, while sales might raise concerns, although not always for negative reasons.

What are the best tools to track insider trading?

Some of the best tools for tracking insider trading include the SEC’s EDGAR database, OpenInsider, and Finviz. These platforms offer detailed information on insider transactions and allow users to filter and analyze the data effectively.

How should investors interpret insider buying and selling?

Investors should consider the context of the trade, including the insider's role in the company and the size of the transaction relative to their existing holdings. Large purchases by C-level executives often carry more weight than smaller transactions by lower-level employees.

Can insider trading activity be used as a standalone investment strategy?

While insider trading activity can provide valuable insights, it should not be used as a standalone investment strategy. It’s best used in conjunction with other analyses and due diligence, as insiders may buy or sell for reasons unrelated to the company's financial health.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.