Is Day Trading Haram Or Halal?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Day trading, also known as intraday trading, means buying and selling assets within the same trading day. Its acceptability under Islamic law continues to spark discussion. While some scholars believe it may be halal if certain rules are followed, others view it as haram because of its ties to speculation (maysir), interest (riba), and uncertainty (gharar).

In this article, we take a closer look at how intraday trading fits into the framework of Islam and Shariah laws. They explore the perspectives of different scholars, emphasizing the need to comply with principles such as asset ownership, transparency, and the prohibition of riba. Factors like avoiding interest-based accounts and assessing the ethical impact of speculative behavior (maysir) are central to this analysis. The article also highlights alternative, Shariah-compliant investment paths. By the end of it, you will have a clear answer to your question: Is intraday trading allowed in Islam?

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Is day trading halal in Forex, crypto, and stocks?

Day trading across multiple asset classes can be halal in Islam, but only when certain requirements are met. Unlike long-term investing, intraday trading in Islam involves faster execution and shorter holding periods. This brings up key concerns in Islamic finance related to risk, ownership, and the trader's intention.

Most scholars agree that day trading is halal in Islam when the trader:

Takes full ownership of the asset before selling it (avoid short selling).

Avoids margin trading or interest-based financing.

Trades only in halal instruments such as Shariah-compliant cryptocurrencies, Forex, or approved stocks.

Avoids speculation and gambling-like behavior.

Forex trading

Forex day trading is halal in Islam when trades are settled immediately, without delay or rollover fees, and if conducted through spot contracts without interest. Following guidance from AAOIFI and the Islamic Fiqh Council, trades must be executed hand-to-hand (yadan bi yadin).

In 2024, nearly 63% of brokers offering Islamic accounts supported intraday trading with real-time settlement and no interest.

Guidelines for halal Forex trading:

Trade only spot contracts, not forward or futures.

Avoid unstable or exotic currency pairs.

Work with regulated brokers offering formal Islamic accounts.

Check for any hidden charges that resemble interest.

Avoid gambling-like forms of trading, like binary options.

“Allah has permitted trade and forbidden riba.” – Surah Al-Baqarah 2:275

Cryptocurrency trading

The reason why intraday trading is haram, particularly in cryptocurrency, is due to its speculative nature. However, many scholars now classify crypto day trading as conditionally halal based on the Shariah status of the token and the structure of the trade. Tokens must not be tied to haram industries, and leverage or margin-based speculation must be avoided.

Prominent scholars such as Mufti Faraz Adam and organizations like the Shariah Review Bureau have declared tokens like Bitcoin, Ethereum, and Cardano halal when used for utility or payment.

In 2023, CoinMetrika released a list of 47 cryptocurrencies approved through Islamic legal checks. Over 30 percent of young Muslim traders in the GCC and Southeast Asia reported using these tokens for short-term trades.

Halal requirements for crypto day trading:

Avoid futures and margin-based trades.

Use wallets or licensed exchanges to maintain actual ownership.

Trade coins with clear use cases, not hype-driven or risky tokens.

Stay updated on new fatwas regarding each token.

“Do not sell what you do not own.” – Sunan an-Nasa’i 4611

Stock and ETF day trading

Halal day trading in stocks and ETFs is defined as trading the assets in the stock market that are Shariah-compliant and ownership is established immediately.

The Shariah Review Bureau clarified in 2023 that ETFs avoiding prohibited sectors and using physical replication are permissible for short-term trading, provided transactions are settled in cash and not through synthetic contracts.

"O you who have believed, do not consume one another’s wealth unjustly but only [in lawful] business by mutual consent." – Surah An-Nisa, 4:29

Why is day trading haram according to some scholars?

Is day trading halal or haram in Islam? Scholars are divided. Those who classify it as haram point to speculative behavior, psychological harm, and the absence of real economic contribution. Margin, interest exposure, and the lack of full ownership are also recurring concerns. Key concerns include:

It often involves interest through margin or overnight fees. Even if you don’t keep trades overnight, your brokerage account might generate or be exposed to interest internally.

Excessive speculation resembles gambling. When trades are placed rapidly without real ownership intent, the behavior starts to mirror chance-based betting more than investment.

No actual transfer of ownership happens. Some day trades don’t involve full settlement, which violates the Islamic principle that you should own what you sell.

It creates psychological addiction and greed. Constant trading feeds a mindset of chasing quick wins, which scholars say weakens self-control and spiritual discipline.

It disconnects value from real economic activity. Scholars argue that rapid-fire trading doesn’t build anything tangible, making profit from it feel detached from ethical contribution.

Many platforms bundle haram assets. Even if you choose halal stocks, the platform itself may earn from or facilitate interest, which scholars say taints the transaction.

These concerns explain why day trading is haram according to some schools or in certain conditions. For instance, Hanafi jurists approve only if ownership and risk are established, while Shia scholars stress ethical intention and clarity of contract.

Fatwa bodies like the Islamic Fiqh Council and Muslim World League (18th Session, 2006) permit spot transactions but warn against leveraged models with deferred interest.

Islamic Fatwa and consensus

Islamic scholars remain divided on whether day trading is halal or haram in Islam, with opinions often shaped by how the trades are carried out. Based on a 2024 review of Islamic finance perspectives from Southeast Asia and the UK, more than 70% of scholars now support intraday trading as halal when it follows core Shariah principles like clear ownership, full transparency, and no involvement with interest.

Fatwa councils and regulatory bodies that have addressed this issue include:

The Islamic Fiqh Academy (MWL, 2006), which permits spot transactions but warns against leverage and deferred settlement.

The Majlis Ugama Islam Singapura (MUIS), which issued a guidance stating: “Trading activities may be permissible if they avoid gharar and riba and adhere to ethical screening.”

The Shariah Advisory Council (SAC) of Malaysia, which allows short-term trading when swaps and interest are not involved and the trades are done via Shariah-compliant platforms.

Is day trading halal according to Hanafi scholars? Most Hanafi jurists approve it if the trader genuinely owns the asset and avoids margin trading or speculation. They stress the idea of holding ownership along with the risk of gain or loss, which confirms the trade's validity.

What about Shia scholars’ view on halal day trading? They tend to take a more cautious view but generally permit it as long as the trades involve real assets, clear terms, and no hidden risk.

Islamic fatwa for intraday trading now commonly includes guidelines such as:

No margin accounts that involve interest.

Only halal assets such as Shariah-screened stocks, approved crypto, or commodities.

Swap-free accounts, especially for Forex trading.

Complete clarity on how trades are executed, owned, and settled.

Derivatives like options may only be used for hedging / non-speculative trading activities.

"And Allah has permitted trade and forbidden riba." – Surah Al-Baqarah, 2:275

What Islamic authorities say about Intraday trading?

In the Islamic community, scholars hold varying views on whether intraday trading aligns with Shariah law.

Spreads, swaps, and exchange commissions have been formally discussed by the Islamic Consulate on Fiqh of the Muslim World League, which reviewed the matter of margin trading during its 18th session held in Makkah (10–14/3/1427 AH or 8.04–12.04.2006).

Islam defines riba as both the act and consequence of charging interest on capital. The Quran says, "For what you give in growth, so that it may increase in the wealth of people, is not increased in the eyes of Allah" (Surah Ar-Rum, Ayah 39).

Modern scholars typically differentiate between:

Riba al-Nasi'ah. Profit from delayed payment.

Riba Fadl. Unjustified markup on goods.

Swaps are classified as a form of hard riba since they act as additions to a loan. Even when brokers remove swap fees from trading accounts, the structure of margin-based trades can still conflict with Shariah.

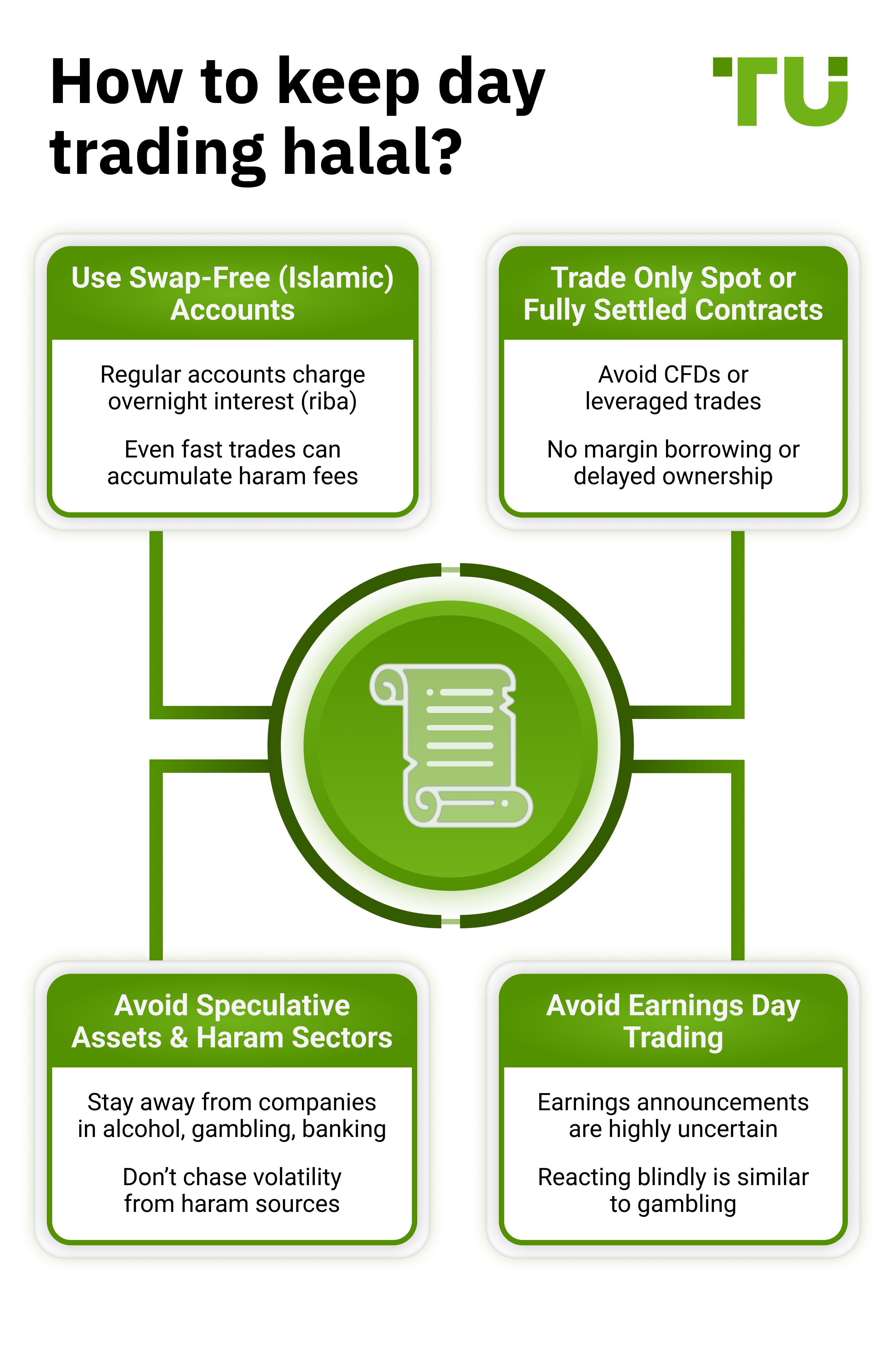

How to keep day trading halal?

If you’re trying to start halal day trading, you need more than just good intentions. Use swap-free accounts, avoid speculation, and ensure contracts involve real-time settlement. Here’s a checklist you may follow:

Always use swap-free or Islamic accounts. Regular accounts charge overnight interest even if you exit trades fast, and that small riba exposure adds up without you noticing.

Trade only spot or fully settled contracts. Avoid CFDs or leveraged products that settle on margin because they often involve borrowing and delay in ownership transfer.

Avoid assets that move on speculation or haram sectors. Day traders love volatility, but companies involved in alcohol, banks, or gambling are off-limits even if the setup looks perfect.

Don’t day trade during earnings announcements. These events involve too much uncertainty and can feel like gambling if you're just reacting without analysis.

Alternative investment options for Muslims

Experts have highlighted below some alternative investment options for Muslims that adhere to Islamic principles

Halal stocks (Equities)

Consider investing in shares of companies that operate ethically and in line with Islamic guidelines.

Focus on businesses involved in permissible activities like technology, healthcare, and real estate.

Use screening tools to identify Shariah-compliant stocks and avoid those engaged in haram activities such as alcohol and gambling.

Try to target price swings backed by a strong fundamental rationale for investing and avoid scalping or similar forms of trading.

Copy trading, however, is a widely debated method for investing in equities. You may learn about its permissibility in detail in our article: Is copy trading halal or haram?

Islamic mutual funds and ETFs

Explore mutual funds and ETFs that follow Islamic principles and invest in halal assets.

These funds are managed by professionals who ensure investments comply with Shariah guidelines while aiming for competitive returns.

| ETF Name | Last 5-Year Return | Year-to-Date (YTD) Return | Expense Ratio |

|---|---|---|---|

| Wahed FTSE USA Sharia ETF (HLAL) | 17.26% | -11.35% | 0.50% |

| S&P 500 Sharia Industry Exclusions ETF (SPUS) | 19.28% | -9.14% | 0.45% |

| SP Funds S&P Global REIT Sharia ETF (SPRE) | N/A | -6.96% | 0.50% |

| Wahed Dow Jones Islamic World ETF (UMMA) | N/A | 5.00% | 0.65% |

| ETFB Green SRI REITs ETF (RITA) | N/A | -8.75% | 0.50% |

| SP Funds Dow Jones Global Sukuk ETF (SPSK) | 1.60% | -0.50% | 0.50% |

Sukuk (Islamic bonds)

Sukuk are bonds issued by governments or companies that avoid interest and are backed by real assets like real estate or infrastructure.

They provide returns through asset performance rather than fixed interest, making them compliant with Islamic financial principles.

Real estate investment

Investing in real estate properties that generate rental income can meet Islamic guidelines when the assets are ethically sound.

It’s important to avoid properties linked to haram activities such as bars or gambling, and instead look for long-term value through responsible property ownership.

Precious metals (Gold and silver)

Gold and silver are widely accepted as halal investments.

They offer a dependable store of value and can protect your portfolio from inflation and shifts in currency value, making them a practical option for preserving wealth.

Cryptocurrencies (with caution)

Some scholars allow cryptocurrency investments under specific conditions.

Since crypto markets can be volatile and speculative, it is essential to approach them carefully and consult trusted Islamic advisors before including them in your portfolio.

| Cryptocurrency | Description |

|---|---|

| Bitcoin (BTC) | Well-known and widely accepted cryptocurrency, considered halal. |

| Ethereum (ETH) | Platform for smart contracts, analyzed for Sharia compliance. |

| Ripple (XRP) | Facilitates low-cost international transfers, recognized as halal. |

| Litecoin (LTC) | Peer-to-peer currency, certified halal and similar to Bitcoin. |

| Stellar (XLM) | Provides affordable financial services globally, compliant with Sharia. |

| Zcash (ZEC) | Privacy-focused crypto with enhanced security, adheres to Sharia. |

| Cardano (ADA) | Supports decentralized apps, aligned with Islamic principles. |

Islamic crowdfunding platforms

Participate in crowdfunding campaigns that fund ethical projects and businesses in line with Islamic principles.

These platforms support initiatives in areas like social impact, education, and healthcare, offering opportunities for socially responsible investing.

Proprietary trading on swap-free accounts

Explore proprietary trading opportunities on swap-free accounts, which enable trading without interest charges.

Prop trading may allow active trading within Shariah-compliant parameters, aligning with Islamic finance principles.

With prop trading, traders can participate in the financial markets while adhering to Islamic guidelines regarding interest (riba) and speculative behavior.

If you wish to invest in financial assets (stock, crypto, etc), and are looking for brokers that offer Islamic accounts, we have presented the top options below. You may compare and choose one for yourself:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review |

Structuring halal day trades through asset-backed entries and real-time settlement

A key part of making day trading halal isn’t just skipping interest or leverage. What really matters is making sure your trades are tied to something real, like sharia-compliant stocks, where you actually take ownership at the moment of the trade. This is something beginners often miss. It’s not just about using an Islamic account. You need to work with brokers that offer real-time settlement and confirm you actually own what you’ve traded. That’s where true compliance begins, not just in how you fund your account, but how the transaction is carried out.

Here’s something else that often slips through the cracks. A lot of short-term strategies are based purely on chart patterns or fast indicators, but that can lead to a level of uncertainty that Islam doesn’t permit. Instead of just reacting to market movements, try building your trades around real business events, like earnings results or big announcements from the company you’re trading. When your decisions are based on real information, not just signals on a screen, your trades are more in line with sharia values and less like rolling the dice.

Summary

The question “Is day trading halal or haram in Islam?” doesn’t have a one-size-fits-all answer. Scholars differ based on contract structure, market behavior, and ethical intention. However, growing scholarly support now leans toward permissibility, provided traders uphold core Islamic finance values. With discipline, Shariah-compliant tools, and a strong moral compass, Muslims can engage in markets ethically and confidently.

FAQs

Can Muslims use trading bots for halal day trading?

Yes, if the bot follows ethical rules, avoids leverage, and trades only in halal assets using a compliant broker.

Is it halal to trade penny stocks intraday?

Only if the companies meet Shariah standards and the trading avoids speculation, riba, or unethical behavior.

What’s the ruling on trading ETFs intraday in Islam?

ETFs are permissible if they track halal indices, use physical assets, and are traded without margin or short selling.

How can I confirm if a broker supports halal day trading?

Look for documented swap-free accounts, no-interest terms, and tools to screen for Shariah-compliant assets.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Short selling in trading involves selling an asset the trader doesn't own, anticipating its price will decrease, allowing them to repurchase it at a lower price to profit from the difference.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.