Mt. Gox Crypto Portfolio: An Overview

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

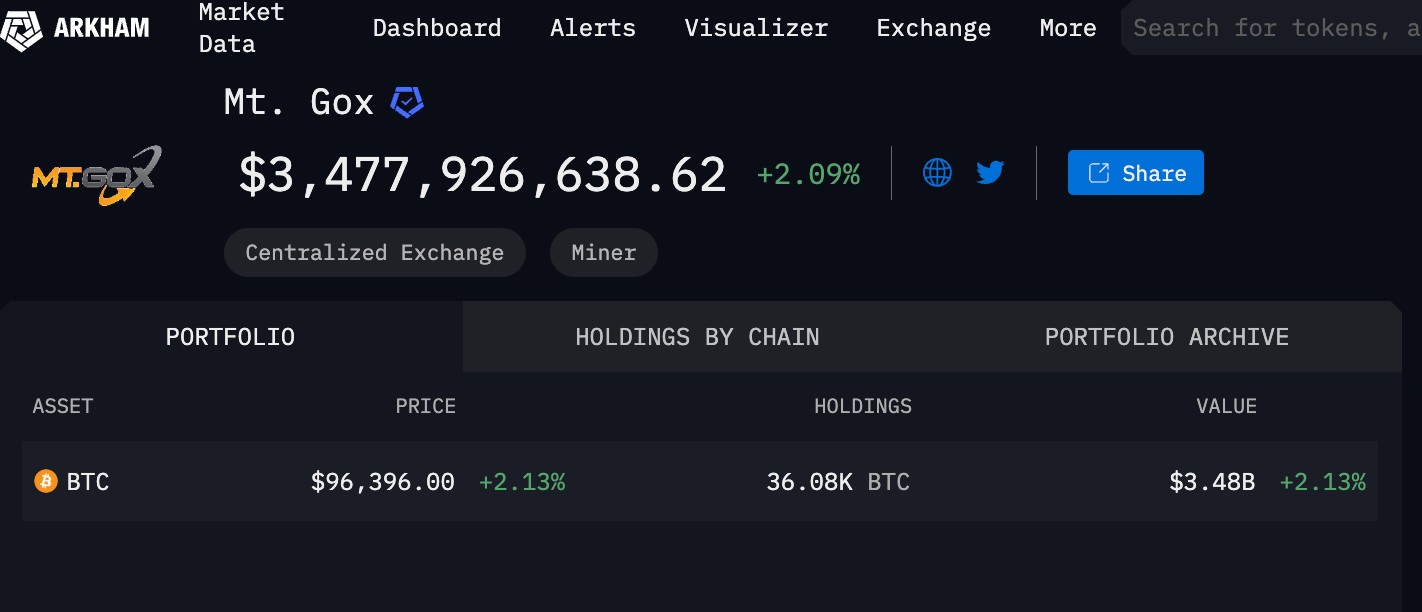

The Mt. Gox controls about 36.08 BTC (worth roughly $3.48 billion) and 142,846 BCH (valued at approximately $44.3 million), along with an estimated $510 million in cash reserves from previous asset liquidations.

Mt. Gox was once the biggest Bitcoin exchange, processing over 70% of Bitcoin trades at its height. But in 2014, it crumbled after a massive hack, wiping out around 850,000 BTC. After a long legal battle, what's left of its crypto holdings is finally set to be distributed to creditors. This long-overdue payout has reignited interest in Mt. Gox’s remaining assets, with creditors hoping to recover some of their lost funds.

Breakdown of Mt. Gox’s cryptocurrency holdings

The Mt. Gox trustee currently controls a significant amount of Bitcoin (BTC) and Bitcoin Cash (BCH), which will be used to repay creditors. As of recent reports:

BTC holdings: approximately 36,08 BTC remain under the control of the trustee, valued at around $3.48 billion based on recent market prices.

BCH holdings: around 142,846 BCH, worth approximately $44.3 million, are also in possession of the trustee.

Cash reserves: an estimated $510 million in fiat from previous asset liquidations is set aside for fiat-based repayments.

Mt. Gox Bitcoin repayments and market reactions

The ongoing repayments from the Mt. Gox bankruptcy has introduced unique dynamics to the cryptocurrency market. Here's what you should know:

Repayments are spread out. Instead of releasing all 142,000 bitcoins at once, the trustee is distributing about 75,000 bitcoins over several days in July 2024. This approach aims to minimize sudden market impacts.

Big creditors' choices matter. Groups like Bitcoinica and MtGox Investment Funds, which have large claims, chose early lump-sum repayments. Notably, MtGox Investment Funds has said it doesn't plan to sell its bitcoins right away, which might ease immediate market concerns.

Bitcoin's market can handle it. With an average of 32,000 bitcoins moving through exchanges daily, the staggered release from Mt. Gox is a small portion of typical trading volumes, suggesting the market can absorb these distributions without major issues.

Investor feelings play a role. The memory of the 2014 Mt. Gox hack might cause some worry among investors, possibly leading to more volatility as repayments happen. However, the market has matured since then, which could help keep reactions steady.

Bitcoin Cash might see more ups and downs. While Bitcoin's market can likely handle the influx, Bitcoin Cash (BCH) could experience more volatility due to its smaller market size and liquidity, making it more prone to price swings from the repayments.

Ethical considerations and regulatory scrutiny

The downfall of Mt. Gox, once the biggest Bitcoin exchange, has sparked deep ethical and regulatory debates. Here's what stands out:

Transparency was lacking. Mt. Gox hid bitcoin thefts going back to 2011, which led to financial troubles well before its 2014 bankruptcy.

Legal ambiguities emerged. The Mt. Gox bankruptcy brought up new questions about property and financial laws, showing the need for clear rules in the crypto world.

Jurisdictional challenges arose. Lawsuits against Mt. Gox's CEO highlighted how tough it is to apply traditional laws to global online financial platforms.

Regulatory gaps were exposed. The Mt. Gox scandal showed that more oversight is needed to keep cryptocurrency exchanges safe and reliable.

Reputational damage occurred. After Mt. Gox's collapse and its CEO's arrest, trust in crypto exchanges took a hit, leading to calls for stricter rules.

Mt. Gox Bitcoin repayment strategy

Understanding the intricacies of the Mt. Gox Bitcoin repayment strategy can offer unique insights for those new to the crypto space.

Repayments are phased. The distribution of Bitcoin to creditors is occurring in multiple stages, with the first phase between July and October 2024, involving 71,403 BTC.

Direct exchange deposits are used. Creditors receive their Bitcoin directly into their exchange accounts, meaning the funds first enter hot wallets, mixing with other user funds and making individual tracking challenging.

Market impact may be less than feared. Despite concerns, the structured and phased nature of the repayments suggests that the market can absorb the influx without significant disruption.

Bitcoin Cash faces higher sell pressure. Analysts predict that the repayment event will exert four times more selling pressure on Bitcoin Cash compared to Bitcoin, due to its weaker investor base.

Repayment deadlines have been extended. The final repayment deadline has been pushed to October 31, 2025, allowing more time for creditors to complete necessary procedures.

Future outlook: What’s next for Mt. Gox creditors?

As the Mt. Gox repayment process progresses, creditors should be aware of several key developments that could impact their claims and the broader cryptocurrency market.

Repayment timeline extended. The deadline for repayments has been pushed to October 31, 2025, allowing more time for creditors to complete necessary procedures.

Partial repayments initiated. In July 2024, the trustee began distributing Bitcoin and Bitcoin Cash to some creditors, with further payments contingent on account verifications and agreements with cryptocurrency exchanges.

Market impact considerations. The release of significant Bitcoin holdings could influence market dynamics; however, the extended repayment schedule may help mitigate sudden market fluctuations.

Ongoing legal proceedings. Some claims remain disputed, potentially affecting the total amount available for distribution and the timeline for final repayments.

Importance of timely action. Creditors are encouraged to complete required procedures promptly to ensure they receive their due repayments within the established timeframe.

Risks and warnings

Market volatility. The release of over 140,000 BTC into circulation could trigger high volatility in Bitcoin’s price, especially if a large portion is sold within a short timeframe. Historical trends show that major sell-offs by institutional or corporate entities often result in sharp price fluctuations.

Creditor sell-off. Many creditors have waited nearly a decade to recover their funds, and some may choose to liquidate their holdings immediately upon receipt. This could result in increased selling pressure, temporarily driving Bitcoin’s price downward before the market stabilizes.

Regulatory delays. Global regulatory frameworks surrounding large-scale Bitcoin transfers remain inconsistent. The repayment process must comply with various international financial regulations, and unexpected legal obstacles could lead to further delays, frustrating creditors and impacting investor sentiment.

Market manipulation risks. With a known release of Bitcoin into the market, institutional investors and whales may attempt to manipulate prices by shorting BTC in anticipation of sell-offs. This could cause additional uncertainty and further price instability.

Liquidity concerns. If Bitcoin's liquidity is insufficient at the time of repayment distribution, the sudden influx of sell orders could create temporary liquidity issues on exchanges, leading to increased slippage and potential flash crashes.

Mt. Gox creditor repayments have rippling effects

Looking into Mt. Gox’s crypto portfolio, most people are watching for repayment dates — but what really matters is how that money moves once it hits creditor wallets. These payouts don’t just cause price drops; they create quick bursts of volatility, especially when big holders start dumping at odd hours. The trick isn’t to panic-sell or rush in blindly. Instead, set lowball buy orders about 1-3% under the market price right when major payouts happen. You’ll often find that BTC and BCH prices dip momentarily before bouncing back. A key thing to watch is when creditors move funds to exchanges like Kraken or Bitbank — these transfers usually signal when selling pressure is about to kick in. If you catch these moves early, you can position yourself ahead of the crowd.

Another angle that gets ignored? How this payout messes with Bitcoin miners. Many of them use their BTC as collateral for loans, and when price swings hit hard, some miners have to sell fast to avoid liquidations. This means you’re not just looking at Bitcoin’s price — you need to keep an eye on lending rates on platforms like Maple Finance. If borrowing costs spike right after a major repayment, it’s often a clue that things could get shaky. Smart traders use this to short high-risk mining stocks or adjust their leverage before the crowd catches on.

Conclusion

Mt. Gox’s crypto portfolio holds significant implications for the Bitcoin market. The impending repayments of over 140,000 BTC will likely cause price fluctuations, requiring traders to stay informed and strategic in their decision-making. While the phased distribution aims to prevent severe market shocks, short-term volatility is inevitable. Investors should closely track Mt. Gox-related transactions and be prepared for potential liquidity shifts in major exchanges. The impact of these repayments will also set a precedent for future large-scale crypto redistributions. Regulatory scrutiny remains a crucial factor, as compliance delays could further affect payout timelines. For long-term traders, maintaining a diversified portfolio and hedging against risks may be prudent. Ultimately, those who approach this market shift with careful planning and a disciplined strategy will be best positioned to manage the uncertainties ahead.

FAQs

What cryptocurrencies are in the Mt. Gox portfolio?

Mt. Gox holds Bitcoin (BTC) and Bitcoin Cash (BCH), along with some fiat reserves from liquidations.

How much is the Mt. Gox crypto portfolio worth?

The portfolio includes over 44,900 BTC, valued at approximately $4.25 billion, and 142,846 BCH, worth around $28 million.

Will Mt. Gox repayments affect Bitcoin prices?

Yes, a large distribution of BTC could temporarily impact market prices, depending on how creditors handle their holdings.

When will Mt. Gox creditors receive their Bitcoin?

Repayments are expected to be completed by the end of 2025, with a phased release to mitigate market disruptions.

Should investors be concerned about Mt. Gox’s Bitcoin movements?

Investors should monitor these transactions closely, as they could influence short-term price volatility.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Ray Dalio is the founder of Bridgewater Associates, one of the world's largest and most successful hedge fund firms. His investment principles, outlined in his book "Principles: Life and Work," have been influential in guiding his investment strategy and the culture of his firm. Dalio is also known for his economic research and predictions, which have garnered significant attention in the financial industry.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.