How to Withdraw Money From BNB Airdrop

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How to withdraw money from BNB Airdrop:

Check airdrop eligibility and details.

Claim your airdrop.

Transfer airdrop to wallet.

Confirm withdrawal.

Receive funds.

A BNB Airdrop gives Binance Coin (BNB) to users who hold certain cryptocurrencies, often as a bonus or special reward. Binance, a top crypto exchange, regularly runs these airdrops to attract users, introduce new projects, or show appreciation to its community. Users get free BNB tokens if they meet certain conditions, like holding a specific cryptocurrency or performing tasks on the platform. These airdrops offer users the chance to earn extra tokens without needing to buy them directly. In this article, we'll cover how to claim, transfer, and securely withdraw your BNB from an airdrop.

How to withdraw money: step-by-step guide

Withdrawing funds from a BNB airdrop involves several steps, ensuring you have received the airdrop, and then transferring the funds to your preferred wallet or exchange.

Check airdrop eligibility and details

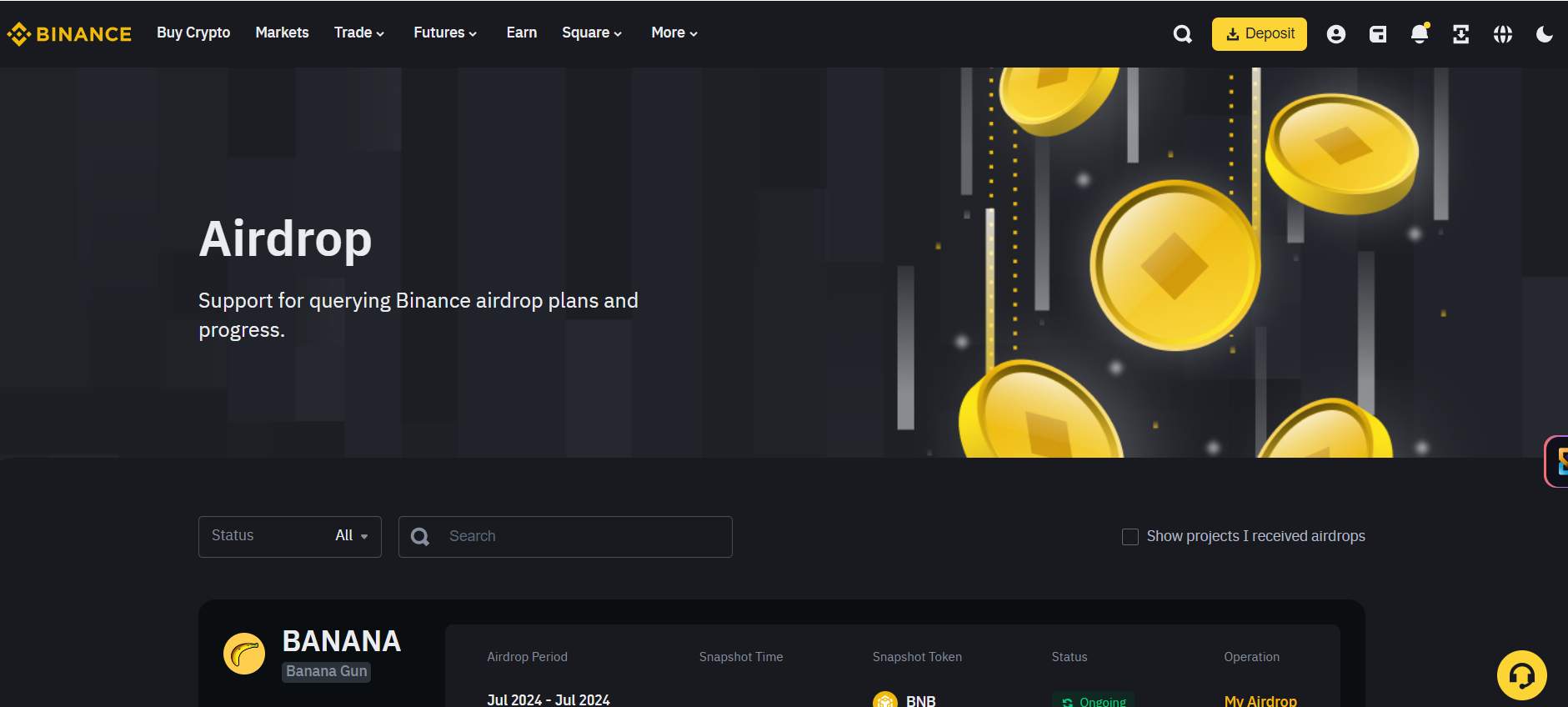

Log in to your Binance account and visit the Binance Airdrop Portal.

Filter airdrops by status or check for received airdrops.

View details of the airdrop, including snapshot time, eligibility, and amount received.

Check airdrop eligibility and details

In an exchange account: Once you log in, check the balance section under your wallet or assets tab. Ensure the airdrop was correctly credited to your account.

In a private wallet: Open your wallet and ensure that the BNB tokens have been deposited. For most wallets like MetaMask or Trust Wallet, BNB tokens will appear on the Binance Smart Chain (BSC) network. You can switch to the Binance Smart Chain network if necessary.

Check airdrop eligibility and details

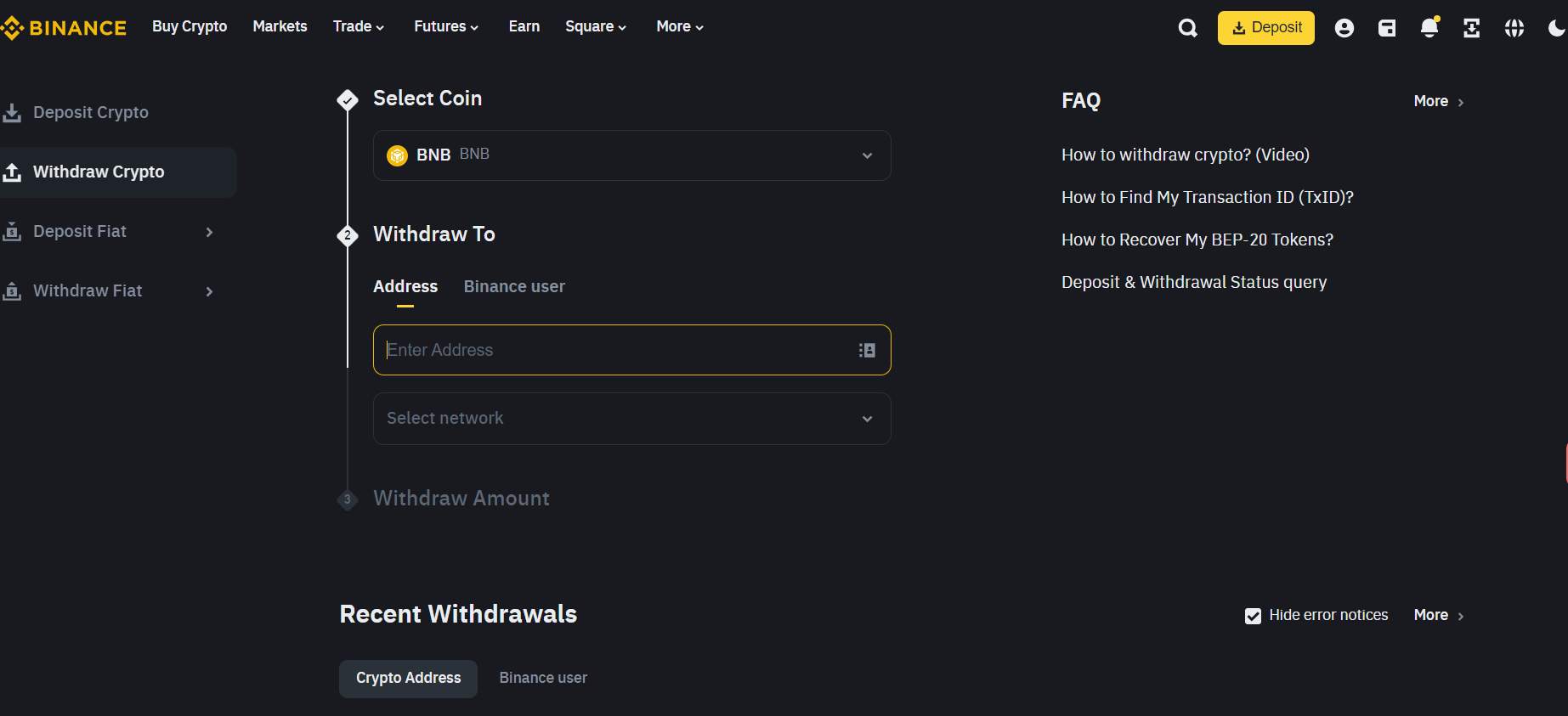

Go to “Wallet” - “Overview” on Binance.

Click “Withdraw” and select the cryptocurrency you received (e.g., BNB).

Enter the recipient address (your external wallet address) and choose the correct network (BEP-20 for BNB).

Check airdrop eligibility and details

Enter the withdrawal amount and review the transaction details, including network fees.

Confirm the transaction and complete any security verifications (e.g., 2FA).

Check airdrop eligibility and details

Once the transaction is processed, the funds should appear in your external wallet.

Risks of BNB Airdrop

Participating in airdrops and withdrawing funds comes with several risks:

Scam airdrops. Many fraudulent platforms promote fake BNB airdrops to trick users into providing personal information or private keys. These scams can result in the loss of funds and access to wallets. It's important to verify the source offering the airdrop.

Phishing attacks. Users participating in airdrops might receive phishing emails or links asking for private keys or wallet credentials. Falling for these schemes can lead to unauthorized access to funds.

Smart contract issues. Some BNB airdrop platforms use smart contracts for distribution, which could be flawed or compromised. Issues in these contracts might cause users to lose tokens or face potential security threats.

Token value fluctuations. The value of tokens received in airdrops can change rapidly. If the market for these tokens is illiquid or speculative, participants may have difficulty trading or selling their airdropped BNB tokens at a good price.

Regulatory challenges. Certain countries have strict regulations regarding cryptocurrency giveaways or airdrops. Participating in an airdrop without understanding local laws can lead to unintended legal consequences.

Network congestion. High traffic during major airdrops can cause delays or failed transactions on the Binance Smart Chain. Network congestion also raises gas fees, which may reduce the benefits of the airdrop.

Coins price and what it depends on

The price of BNB and other airdropped tokens depends on several factors:

Supply and demand dynamics. For BNB, the price is influenced by token burns, which reduce the overall supply. This scarcity tends to raise the value of the remaining tokens as demand increases.

Adoption and utility within the ecosystem. BNB price benefits from its use within the Binance ecosystem, including paying for transaction fees, participating in token sales, and integration into decentralized applications (DApps). The more BNB is used, the higher its demand and price.

Regulatory developments. Government regulations and the legal landscape play a role in shaping investor confidence and market activity. Positive regulations and clearer legal frameworks increase BNB’s value, while stricter regulations may lower the price.

Market sentiment and investor confidence. News events, partnerships, and developments in the cryptocurrency sector can drive price fluctuations. Positive sentiment, driven by innovation or high-profile endorsements, typically leads to an increase in price.

Trading volume and liquidity. The amount of BNB being traded affects its liquidity and volatility. Higher trading volumes generally stabilize prices, while lower volumes can lead to significant fluctuations.

How to efficiently withdraw funds from BNB Airdrop

When withdrawing funds from a BNB airdrop, make sure your wallet is set up for Binance Smart Chain (BSC). A lot of newcomers use wallets that only work with Ethereum, which can lead to failed transactions or missing funds. Choose something like Trust Wallet or MetaMask, which lets you switch networks easily. Double-check you're on the correct BSC network before you try to move your tokens. It’s also a good idea to avoid transferring directly from an exchange—use a wallet where you control the keys to keep your tokens safe.

Another trick that can save you money is watching gas fees closely before withdrawing. BSC uses BNB for fees, and they can jump a lot when the network is busy. Keep an eye on network traffic with tools like BscScan or Binance’s tracker, and wait until things slow down to pay less for your transaction. This move can really add up, especially when you're dealing with bigger amounts of tokens.

Summary

Withdrawing funds from a BNB airdrop is a straightforward process if you follow the correct steps. Ensure eligibility, claim your airdrop, transfer it to a compatible wallet, and stay updated with official announcements to minimize risks and maximize benefits.

FAQs

How do I know if I am eligible for a BNB airdrop?

Check the Binance Airdrop Portal for eligibility details, including snapshot times and token requirements.

What is the difference between BEP-2 and BEP-20 tokens?

BEP-2 tokens are on the Binance Chain, while BEP-20 tokens are on the Binance Smart Chain (BSC).

How long does it take to withdraw BNB to an external wallet?

The withdrawal process usually takes a few minutes but can vary depending on network traffic.

What should I do if my withdrawal is not processed?

Contact Binance customer support for assistance if your withdrawal is delayed or not processed.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.