The Role Of AI And Machine Learning In Prop Trading

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

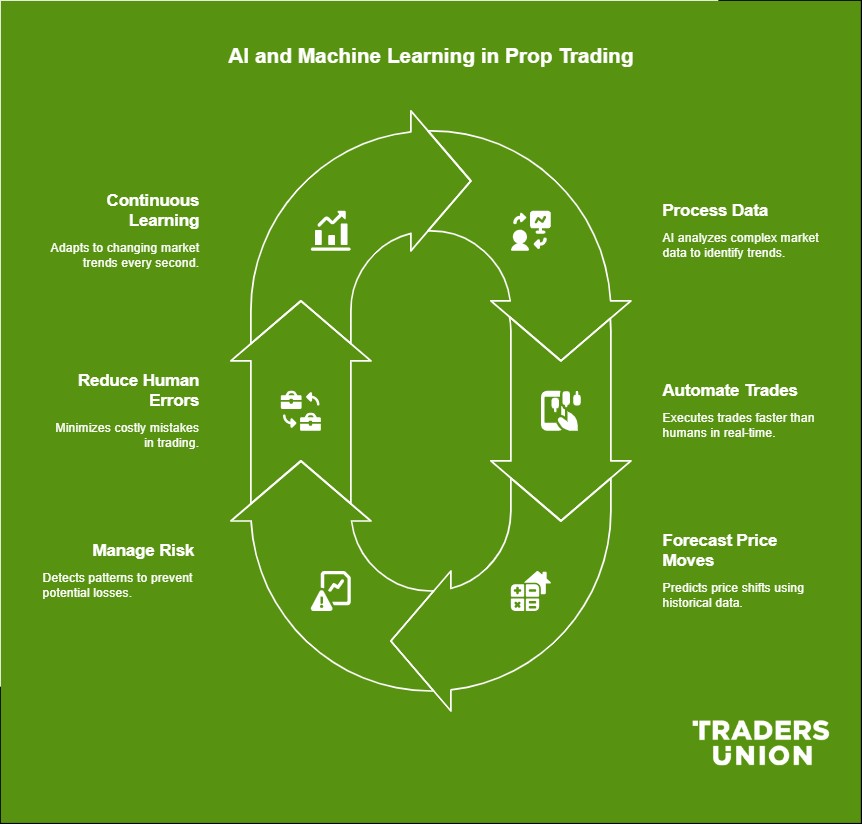

AI and machine learning help prop firms process data, automate trades, and manage risk. Key points:

Breaks down complex market data. AI spots trends in huge datasets.

Makes trades faster than humans. Automates execution in real time.

Forecasts price moves more accurately. Uses past data to predict shifts.

Helps traders manage risk smarter. Detects patterns before losses hit.

Cuts down costly human mistakes. AI ensures trades run smoothly.

Learns from markets every second. Adjusts to trends as they change.

AI and machine learning have changed how proprietary trading works by improving market analysis, trade execution, and risk management. These technologies help firms process huge amounts of live data fast, spot trading opportunities that humans might miss, and make trading strategies faster and more accurate. AI-powered algorithms drive high-frequency trading, optimize portfolios, and reduce risk in unpredictable markets.

As AI evolves, firms using AI-based trading models execute trades faster and smarter than traditional traders. The future of prop trading will be driven by AI, quantum computing, and new data sources, allowing firms to adapt quickly to changing financial markets and stay ahead of the competition.

Risk warning: Proprietary trading involves substantial financial risk. Using firm capital can lead to gains or losses, and failure to meet targets may result in account closure. Over 85% of prop traders do not achieve long-term profitability. Understand the risks and seek professional guidance.

AI & machine learning in proprietary trading: key impacts

Prop trading firms use their own money to buy and sell assets like stocks, Forex, and commodities. Unlike brokers, they don’t manage client funds or take commissions — they make money directly from market moves. Without client restrictions, they can take bigger risks to chase higher profits.

In the past, prop trading was all about skill, intuition, and deep market analysis. Now, AI and machine learning are changing the game, using data to remove human biases and improve accuracy.

We've carefully selected a list of the best proprietary trading firms suited for beginners, based on ease of entry, supportive tools, and beginner-friendly funding models.

| Max. Leverage | Funding Up To, $ | Profit split up to, % | Refundable Fee | Min Trade Days | Min Trade Days | Mandatory Stop Loss | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| 1:100 | 4 000 000 | 95 | Yes | 2 | 2 | No | 9.83 | Open an account Your capital is at risk.

|

|

| 1:30 | 200 000 | 90 | Yes | No time limits | No time limits | No | 9.79 | Open an account Your capital is at risk.

|

|

| 1:100 | 2 500 000 | 90 | No | 3 | 3 | No | 9.75 | Open an account Your capital is at risk.

|

|

| 1:100 | 2 000 000 | 95 | No | 3 | 3 | No | 9.71 | Open an account Your capital is at risk.

|

|

| 1:30 | 400 000 | 80 | No | 10 | 10 | Yes | 9.63 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial companies for over 14 years, evaluating them based on 70+ objective criteria. Our expert team of 50+ professionals regularly updates a Watch List of 60+ prop firms, assessing key factors such as funding programs, trading conditions, profit splits, and challenge requirements. We prioritize transparency, security, and realistic trading conditions to empower traders to make informed choices. Before selecting a prop firm, we encourage traders to review its challenge rules, funding terms, and risk management policies. Always conduct independent research and verify terms directly with the firm.

Learn more about our editorial policies.

AI and ML in market analysis and trade execution

Most traders overlook the real power of reinforcement learning in algorithmic trading. Unlike regular models that use past data to form expectations about upcoming price behavior, reinforcement agents actively adjust to current market conditions, fine-tuning their approach depending on how profitable each move turns out to be.

On a deeper level, some traders are now using multiple learning agents that mirror both bullish and bearish behaviors to stress-test trading ideas in a virtual market environment. This lets them challenge strategies under intense scenarios without putting actual money at risk.

Another fascinating technique gaining traction is the use of sophisticated tools that flag irregularities for spotting front-running or liquidity spoofing. These systems are built to catch slight shifts in buying/selling activity or order timing that even experienced traders might miss.

Automated trading and high-frequency trading (HFT)

AI and ML have played a key role in shaping automated trading systems, also known as algorithmic or algo-trading. These systems follow set rules to analyze market conditions and execute trades at optimal times, reducing the risk of manual mistakes while increasing efficiency.

High-frequency trading (HFT), a subset of algorithmic trading, gains significant advantages from AI. HFT algorithms operate at microsecond speeds, taking advantage of small price differences across multiple exchanges. Machine learning helps improve HFT approaches by adapting to changing market conditions in real-time, helping traders improve profit potential.

Risk management and portfolio optimization with AI

AI isn’t just about price prediction — it’s redefining how risk is managed on the fly. Some data-driven investment shops now use trial-and-error based AI tools that tweak what you hold as markets shift, especially during sudden changes like big price swings, global news, or money drying up.

These tools don’t wait for risk to show up — they move funds before the storm hits. In one 2023 example, a smart AI strategy that learns from market conditions cut drawdowns by 26% during chaotic months compared to old-school risk calculators. This kind of setup is rare but growing, and it's showing that AI can help manage risk before things go sideways.

Even crazier? Some models now watch for when assets stop moving together—something old optimizers totally miss — and cut positions as soon as patterns fall apart. In one case, an AI tool reduced exposure to regional banks weeks before the SVB crash just because it noticed the usual links between banks, treasuries, and tech stocks were fading. For beginners, this isn’t about flashy predictions. It’s about staying a step ahead when markets start acting weird—and no spreadsheet can do that like AI can.

Big data and alternative data sources in trading

Big Data is essential to the application of AI and ML in trading. Financial markets generate an enormous volume of data every second, and AI systems rely heavily on this data. Prop firms now use other kinds of data, like satellite images, online behavior, or economic signals, in their trading strategies.

For example, AI can study retail foot traffic using satellite images to estimate consumer spending or track how people are talking about a stock online. These observations offer traders a unique advantage that traditional methods couldn’t deliver.

Pros and cons of using AI and ML in prop trading

- Pros

- Cons

Speed and efficiency. Algorithms react to market changes faster than humans ever could.

Data utilization. AI can analyze and learn from data sets that are far too large and complex for manual analysis.

Scalability. Once developed, AI models can be deployed across multiple markets and asset classes with minimal adjustments.

Emotion-free trading. Removing human emotion leads to more disciplined and consistent trading outcomes.

Data quality. Poor or incomplete data can lead to inaccurate predictions.

Overfitting. ML models might perform well on historical data but fail in live markets.

Regulatory concerns. As AI-driven trading grows, so does the scrutiny from regulators.

Operational risks. Bugs in code or system errors can lead to substantial financial losses.

The future of AI in prop trading

AI and ML are becoming indispensable tools in the arsenal of modern prop trading firms. As technologies advance, we can expect even more sophisticated models that:

Integrate alternative data sources (e.g. satellite imagery, social sentiment, credit card data).

Adapt quickly to black swan events and market anomalies.

Operate with minimal human intervention through automated feedback loops.

In the near future, we’re likely to see:

Increased use of reinforcement learning for real-time, adaptive trading decisions.

More personalized trading algorithms tailored to specific risk profiles and investment goals.

Deeper integration with emerging technologies like quantum computing and edge analytics.

Tighter collaboration between data scientists and traders, combining machine intelligence with human intuition.

AI will also expand its role in regulatory compliance through RegTech solutions, helping firms monitor algorithmic behavior in real-time, detect and prevent market abuse or malfunction, stay aligned with evolving global regulatory frameworks.

Machine learning adapts to real-time trader behavior in prop desks

One of the least talked about applications of AI in prop trading is its use in monitoring trader psychology — not to punish mistakes, but to build in live support systems. Top-tier firms are now training machine learning models on each trader’s behavior patterns, such as reaction time after losses, execution timing after wins, or even skipped trades during market uncertainty.

The idea is to catch subtle performance drifts early. If a trader usually clicks within 2 seconds of a setup and suddenly hesitates for 5–6 seconds, the system can flag that as a confidence dip. This doesn't replace human mentoring — but it gives real-time cues before slumps become blowups.

Another underrated edge is the use of AI in recognizing "strategy fatigue". Many beginners don’t realize that some quant strategies have a shelf life, especially when too many desks start running similar logic. Machine learning systems trained on execution decay can spot when your strategy is no longer performing because the edge has been arbitraged away.

Instead of just stopping after a big loss, these tools recognize gradual deterioration — like spread compression or volume thinning — and prompt traders to tweak or rotate out before losses hit. This kind of insight isn't obvious to beginners — but it's exactly how top desks stay ahead.

Conclusion

The integration of AI and machine learning in prop trading is not just a trend — it is the future of the industry. By automating trade execution, optimizing strategies, and improving risk assessment, these technologies have given proprietary trading firms an edge that is impossible to ignore. As AI continues to evolve, traders who embrace these advancements will be well-positioned to navigate and profit from the ever-changing financial markets.

FAQs

How does AI improve proprietary trading strategies?

AI processes large datasets to detect trading patterns, optimize entry and exit points, and adapt strategies based on market conditions in real time.

Can AI completely replace human traders in prop trading?

While AI can execute trades and manage risks efficiently, human oversight is still necessary for strategic decision-making and adapting to unforeseen market events.

What are the risks of using AI in prop trading?

AI models can be vulnerable to unexpected market events, algorithmic biases, and overfitting past data, leading to potential losses if not properly managed.

Which machine learning techniques are most commonly used in prop trading?

Techniques such as deep learning, reinforcement learning, and natural language processing are widely used for predictive analytics, sentiment analysis, and strategy optimization.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Proprietary trading (prop trading) is a financial trading strategy where a financial firm or institution uses its own capital to trade in various financial markets, such as stocks, bonds, commodities, or derivatives, with the aim of generating profits for the company itself. Prop traders typically do not trade on behalf of clients but instead trade with the firm's money, taking on the associated risks and rewards.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.