An In-Depth Look At Bill Gross' Impact On The Financial World

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Bill Gross, often referred to as the "Bond King". His investment philosophy centers on active management and the exploitation of market inefficiencies. He believes in thorough research, disciplined risk management, and the importance of macroeconomic analysis in making investment decisions.

Bill Gross, the "Bond King"

Bill Gross, the "Bond King"Bill Gross was born on April 13, 1944, in Middletown, Ohio. He spent his formative years in San Francisco, California, where he developed a keen interest in the stock market from a young age. Gross obtained a degree in psychology from Duke University. He later pursued an MBA at UCLA Anderson School of Management, which laid the foundation for his illustrious career in finance.

Gross's career in finance began with a job as an investment analyst at Pacific Mutual Life in Los Angeles. His early experiences, including a brief stint in the Navy during the Vietnam War, shaped his disciplined approach to investing. In 1971, Gross co-founded Pacific Investment Management Company (PIMCO), which would become one of the most influential investment management firms in the world.

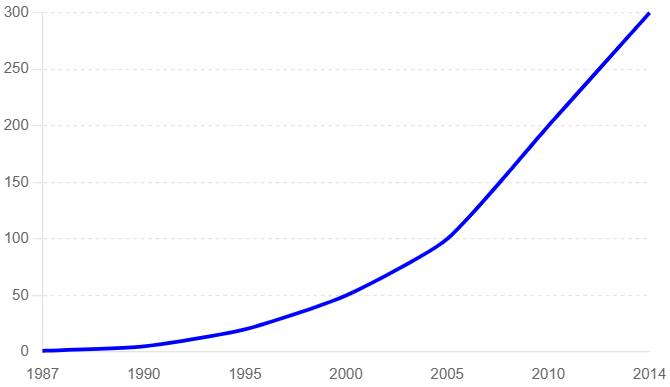

Success history of Bill Gross

PIMCO started with a focus on managing fixed-income assets, and Gross quickly made a name for himself through his innovative investment strategies. Under his leadership, PIMCO grew exponentially, with the Total Return Fund becoming the world’s largest bond fund. During his tenure at PIMCO, Gross was instrumental in growing the Total Return Fund to nearly $300 billion in assets. He pioneered the concept of active bond management and introduced innovative strategies that leveraged interest rate movements and credit risk management.

Growth of PIMCO's Total Return Fund

Growth of PIMCO's Total Return FundGross's strategies significantly impacted the bond market. He was known for his ability to foresee market trends and adjust portfolios accordingly, often ahead of his peers. His influence extended beyond PIMCO, affecting global bond market practices and policies.

Bill Gross's net worth is estimated to be over $1.6 billion, reflecting his successful career and prudent investment strategies. His wealth has grown through both his professional achievements and personal investments.

Gross's ability to predict market trends and his unconventional approach to bond trading earned him widespread recognition. Gross's achievements have been recognized with numerous awards, including Morningstar’s Fixed-Income Manager of the Decade in 2010. His contributions to finance have made him a legendary figure in the investment world.

Bill Gross writings and insights

Gross is renowned for his monthly investment outlooks, where he shares his market views and economic insights. Notable publications include:

“Neither a Lender Nor a Stockholder Be”

Main Themes: Critique of the low interest rate environment and its impact on savers and investors.

Market Predictions: Predictions on interest rates and market trends.

“Status Quo”

Analysis and Predictions: Analysis of market stability and future risks.

Strategic Advice: Recommendations for maintaining a balanced portfolio.

“Fundamentally Speaking”

Fundamental Analysis: Examination of economic indicators and their implications for investors.

Market Trends: Insights into long-term market trends and opportunities.

“Wall St. Playbill”

Innovative Insights: Creative analogies to explain market dynamics.

Future Market Projections: Predictions for various asset classes.

Screenshot of Bill Gross' quote

Screenshot of Bill Gross' quoteGross’s writings often emphasize the importance of adapting to changing market conditions, the risks of complacency, and the need for investors to stay informed and proactive.

Bill Gross's investment strategies and risk management approaches

Gross's investment philosophy centers on active management and the exploitation of market inefficiencies. He believes in thorough research, disciplined risk management, and the importance of macroeconomic analysis in making investment decisions.

Gross is known for several key strategies:

Unconstrained Bond Strategy: Investing without being tied to a benchmark, allowing for greater flexibility;

Duration Management: Adjusting the portfolio's sensitivity to interest rate changes;

Credit and Currency Risk Management: Utilizing various instruments to manage exposure to credit and currency risks.

Risk management is a cornerstone of Gross's strategy. He emphasizes diversification, stress testing, and scenario analysis to mitigate potential risks and protect investors' capital.

Gross has made several notable investment decisions, such as successfully navigating the 2008 financial crisis by positioning PIMCO’s portfolios to benefit from falling interest rates and widening credit spreads. His ability to anticipate market movements has led to significant gains for his funds.

Discipline as a basis for success

Bill Gross's career exemplifies the power of strategic foresight and disciplined investment. His ability to navigate complex market conditions and deliver consistent returns has made him a benchmark for bond investors globally. Gross's innovative approaches, such as the unconstrained bond strategy and duration management, have set new standards in the industry. Furthermore, his writings provide invaluable insights, helping both novice and experienced investors understand market dynamics and develop robust investment strategies.

Lessons from Bill Gross’s Success:

Strategic foresight: anticipating market trends and adjusting investment strategies accordingly can lead to sustained success;

Disciplined investment: maintaining a disciplined approach, even in volatile markets, is crucial for long-term gains;

Innovation: embracing innovative strategies, such as the unconstrained bond strategy and duration management, can set new industry standards;

Education and insight: continuously learning and sharing knowledge through writings and other means helps both novice and experienced investors develop robust strategies.

Summary

Bill Gross's legacy as the "Bond King" is a testament to his innovative strategies, keen market insights, and disciplined approach to investing. His contributions to the bond market and the broader financial world have left an indelible mark, influencing both peers and future generations of investors. From his early days at PIMCO, where he pioneered active bond management, to his time at Janus Capital Group, Gross's career is a model of adaptability and foresight. His writings have provided a wealth of knowledge to the investment community, emphasizing the importance of staying informed and proactive in an ever-changing market. Gross's substantial net worth and philanthropic efforts further underscore his success and commitment to giving back. Whether you are a beginner seeking inspiration or an advanced trader looking for deeper insights, Bill Gross's career offers valuable lessons and perspectives that continue to resonate in the world of finance.

FAQs

How did Bill Gross earn the title "Bond King"?

How did Bill Gross earn the title "Bond King"? Bill Gross earned the title "Bond King" through his role as co-founder and chief investment officer of PIMCO, where he managed one of the world's largest mutual funds. His exceptional ability to predict market trends and create innovative investment strategies has made a lasting impact on the financial industry.

What were Bill Gross's major achievements at PIMCO?

At PIMCO, Bill Gross grew the Total Return Fund to nearly $300 billion, making it the world's largest bond fund. He introduced innovative strategies and was named Morningstar’s Fixed-Income Manager of the Decade in 2010.

What is Bill Gross's investment philosophy?

Bill Gross's investment philosophy focuses on active management, exploiting market inefficiencies, and disciplined risk management. His key strategies include the unconstrained bond strategy, duration management, and managing credit and currency risks.

How did Bill Gross transition from PIMCO to Janus Capital Group?

n 2014, Bill Gross left PIMCO due to internal conflicts and joined Janus Capital Group. At Janus, he managed the Janus Global Unconstrained Bond Fund, continuing his innovative investment approach without the constraints of a larger firm.

What contributions has Bill Gross made outside of his professional career?

Bill Gross has donated millions to medical research, education, and humanitarian projects. His philanthropic efforts reflect his commitment to giving back to the community and making a significant impact.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.