What Are The Main Mistakes In Trading Using Signals?

Read our article to understand how you can reduce these 10 risks of signal trading:

-

Reliability of Signals: Accuracy is not guaranteed

-

Timing Issues: Can lead to missed opportunities

-

Over-reliance: May inhibit personal skill development

-

Costs: Benefits might not justify the expense

-

Market Risk: Inherent unpredictability remains

-

Scams: Potential exploitation by fraudulent providers

-

Psychological Effects: Can encourage emotional decision-making

-

Lack of Customization: Signals may not align with individual strategies

-

Execution Risk: Variability in trade execution can impact results

-

Regulatory Risk: Legal and compliance issues could arise

Trading signals have become a cornerstone in the modern trader's strategy, serving as pivotal cues for when to buy, sell, or hold assets across various markets. These signals, essentially recommendations or alerts generated through detailed market analysis, leverage both fundamental and technical data to guide trading decisions.

With their growing popularity, traders, from novices to professionals, are increasingly turning to signals to streamline their trading process and potentially enhance profitability. However, as with any tool in the financial markets, trading signals are not without their risks. Recognizing these risks and understanding how to mitigate them is crucial for traders looking to incorporate signals into their trading arsenal effectively.

-

What is a signal in trading?

A signal in trading is a recommendation or alert, often based on technical analysis or market trends, advising traders on potential buying or selling opportunities in financial markets.

-

Are trading signals legal?

Yes, trading signals are legal, but their provision and use are subject to regulatory standards in many jurisdictions, especially when they are offered as part of financial advice or investment services.

-

Do professional traders use signals?

Yes, professional traders can use additional trading signals - for example, in order to diversify their main trading strategies.

-

How accurate are trading signals?

The accuracy of trading signals can vary widely depending on the source, methodology, and market conditions, with no guarantee of profit due to the unpredictable nature of financial markets.

-

How does copying signals differ from trust management?

In case of trading on signals you (for free or for money) receive some information and make deals on your own. In this case, your capital does not pass under the control of the signal provider. In the situation of trust management (personal or via PAMM-account) trading decisions are made by the manager, and you do not control the risk of an open deal.

Understanding trading signals

Trading signals can vary widely in their source, application, and intended market.

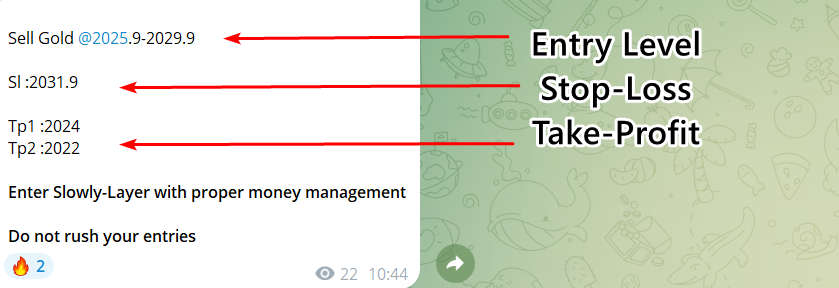

An example of a trading signal that is distributed in Telegram

Trading signals can be classified into several key types:

-

Paid vs. Free: Signals can either come at a cost or be offered for free. Paid signals typically (but not always!) promise more in-depth analysis and personalized service, while free signals might serve as a basic guide or teaser to more comprehensive services.

-

Manual vs. Automatic: Some signals are generated by human analysts who study market conditions and make recommendations. Others are created automatically by algorithms or trading bots based on preset criteria.

-

Distribution Methods: Signals can be distributed through various channels, including email, SMS, dedicated apps, or even social media platforms, ensuring timely and accessible alerts for traders.

-

Market Focus: While some signal providers specialize in a single market, such as Forex or cryptocurrencies, others may offer signals across a range of asset classes, including stocks or a mix of different markets.

-

Additional Features: Many signal services also include additional resources such as educational content, analysis tools, and real-time support to enhance the trading experience.

To give a practical example, imagine a trading signal for the Forex market indicating a strong buy opportunity for EUR/USD based on recent economic indicators and technical analysis. This signal might specify an entry point, target profit, and stop-loss levels, providing a clear instructions for traders to consider and potentially execute.

Best Forex Brokers in 2024

Is it good idea to trade with signals?

Trading with signals can offer several compelling advantages, making them an attractive option for traders looking to optimize their strategies and potentially enhance their market performance.

Benefits:

-

Time-saving. Signals provide ready-made analysis, allowing traders to make quick decisions without the need for extensive research. This is particularly beneficial for part-time traders or those balancing trading with other commitments.

-

Potential for profitability. Signals, especially those from reputable sources, are often the result of thorough market analysis and can highlight opportunities that traders might otherwise miss. This can lead to better-informed trading decisions and, consequently, higher potential returns.

-

Diversification. By following signals for different markets or assets, traders can spread their risk, reducing the impact of a poor performance in any single market on their overall portfolio. Furthermore, signals can introduce traders to new markets and trading strategies, broadening their trading experience and knowledge.

Lastly, signals can also offer an educational benefit, particularly for less experienced traders. By following signals and observing their outcomes, traders can learn more about market analysis, the decision-making process, and the timing of trades, thereby enhancing their own trading skills over time.

Risks of trading using signals

Despite their benefits, trading signals are not without risks, and it's crucial for traders to be aware of these potential disadvantages.

Market risks

Volatility Risks. Due to the fact that trading is associated with uncertainty of future prices, signals are not a way to make profits without having to lock in losses. The risk is that the amount of losses may exceed the amount of gains. Signals cannot eliminate the inherent risks of the market, which can be influenced by unforeseeable events and changes in market sentiment.

Reliability of Strategy: Not all signals are created equal, and the reliability can vary significantly between providers. Inaccurate signals based on flawed analysis can lead to poor trading decisions. Usually, signal users do not have full information about how signals are generated – in other words, you may be risking your capital without having enough reason to do so.

Operational Risks

Timing Issues: The effectiveness of a signal can be highly time-sensitive. Delays in receiving or acting on a signal can result in missed opportunities or entering a position too late.

Execution Risk: There can be a discrepancy between the recommended action in a signal and the actual execution, influenced by factors like timing, slippage, and brokerage fees. Execution risk can also be considered the timely and correct reaction of the trader, who uses the received signal to open a deal.

Costs: Quality signal services often come at a price. There's no guarantee that the cost of the service will be offset by the profits from trades based on those signals.

Psychological Risks

Over-reliance: Relying too heavily on signals can prevent traders from developing their own analysis skills and market understanding, making them dependent on the signal provider.

Psychological Effects: The use of signals can lead to emotional trading, particularly if a streak of losses leads to desperation and risk-taking or a series of wins results in overconfidence.

Additional Risks

Scams: The signal market is not immune to scams, with fraudulent providers offering misleading or false signals to exploit traders. It is not uncommon for signal providers to copy only profitable signals from the paid channel (hiding losses), creating the illusion that after buying access, a trader can get rich.

Lack of Customization: Many signal services offer one-size-fits-all advice that may not align with an individual trader's risk tolerance, financial goals, or investment size.

Regulatory Risk: The regulatory environment surrounding signal providers can be complex and varies by jurisdiction, potentially impacting the legality and safety of using certain signal services.

Understanding these risks is essential for traders considering incorporating signals into their trading strategy, as it allows for more informed decision-making and risk management.

A bit of criticism from a surviving beginner

When using trading signals, the trader's goal is obvious: to get the maximum result with a minimum of work - get a signal, fill in the order parameters, press one button and - profit in your pocket.

It is assumed that trading by signals:

...reduces the psychological pressure of making a trading decision. In real life: stress from a loss from someone else's signal is perceived more negatively than from an erroneous but own decision.

... is inexpensive. In real life: the price of trading signals varies from free to $100-500 and more, and not always the profit from the signal can compensate for these costs.

... teaches the trader how to trade on their own. In real life: this is true only for those who are ready to work on themselves and do not get used to such "easy" profits.

How to avoid scams in trading using signals

Navigating the realm of trading signals requires not only an understanding of their potential benefits but also a keen awareness of the risks involved, particularly the risk of scams. To safeguard against such pitfalls, traders can employ several strategies:

-

Conduct Thorough Research: Before subscribing to any signal service, it's imperative to research the provider's track record, reputation, and reviews from other traders. Legitimate providers are usually transparent about their trading history and methodology.

-

Seek Out Verifiable Results: Look for signal providers that offer verifiable trading results. Many reputable services will provide access to real-time or historical performance data. Be wary of providers that make bold claims without evidence to back them up

-

Analyze on your own: Keep in mind that any negative statistics that may scare away potential clients are simply not shown by unscrupulous traders. Therefore, look for a signal provider who is not afraid to show on an external monitoring, for example, https://www.myfxbook.com, a real (and up-to-date!) trading account, on which his signals and recommendations are used.

-

Use Free Trials: Many reputable signal providers offer a free trial period or a limited number of free signals. Use these opportunities to evaluate the quality and reliability of the signals before committing to a subscription.

-

Be Skeptical of Excessive Promises: Be cautious of signal providers that promise guaranteed returns or claim to have a secret formula for success. The financial markets are inherently unpredictable, and no service can guarantee profits.

By following these guidelines, traders can significantly reduce their risk of falling victim to scams and ensure that they are using trading signals in a way that is both safe and potentially beneficial.

For further insights, read our article on Best Day Trading Signals Providers and Indicators.

How do I start trading signals?

Starting with trading signals can be an exciting step towards more strategic trading, but it's important to approach this process with care and preparation:

-

Educate Yourself: Before diving into trading with signals, make sure you have a solid understanding of the markets you intend to trade in, as well as basic trading principles. This knowledge will help you make more informed decisions when interpreting signals.

-

Choose the Right Provider: Select a signal provider that matches your trading style, preferred markets, and risk tolerance. Consider providers that align with your educational needs and offer support and resources for beginners.

-

Start Small: When you begin trading with signals, start with smaller amounts to limit your risk. This approach allows you to get a feel for the signal provider's performance without exposing yourself to unnecessary risk.

-

Monitor and Evaluate: Regularly review the performance of the signals you are trading with. Keep track of your trades and assess whether the signals are meeting your expectations and investment goals. Be prepared to adjust your strategy or change providers if necessary.

If you do decide to trade on signals, form a package of signals from several providers at the same time, working on different strategies, periods, assets, and risk level. Due to such a variety, you can significantly reduce the probability of errors and trading account downtime. Of course, each of the signals should be tested separately beforehand.

Read our article on 12 Best Forex Signals Providers for 2024 to learn which signal providers have a reputation for being successful.

Conclusion

Trading signals offer a compelling blend of benefits, including time efficiency, potential profitability, and educational value, but they also come with inherent risks such as scams, market unpredictability, and reliance issues. By conducting thorough research, starting with caution, and continuously educating oneself, traders can navigate these waters more safely.

Remember, the key to successfully incorporating trading signals into your trading strategy lies in a balanced approach that combines due diligence with a commitment to ongoing learning and adaptation. With the right mindset and precautions, trading signals can be a valuable tool in your trading arsenal.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.