Silver Trading On Forex | Top Strategies To Trade XAG/USD

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Top strategies for trading silver (XAG/USD) on Forex:

Puria method : Uses MACD and Moving Averages on the H1 timeframe.

SMA strategy : Tracks trend reversals with three moving averages.

Volume Spread Analysis : Analyzes trade volumes to confirm trends.

Silver (XAG/USD) is a unique asset on the Forex market, valued for its role as both a precious and industrial metal. Its price is influenced by global demand, production rates, and seasonal trends, offering traders opportunities for significant profits.

This article outlines key strategies, essential indicators, and factors to help you trade silver successfully.

Best silver trading strategies

Silver trading strategies on Forex have significant differences from strategies that are used for currency pairs. Let’s take some examples of top strategies successfully used by experienced traders.

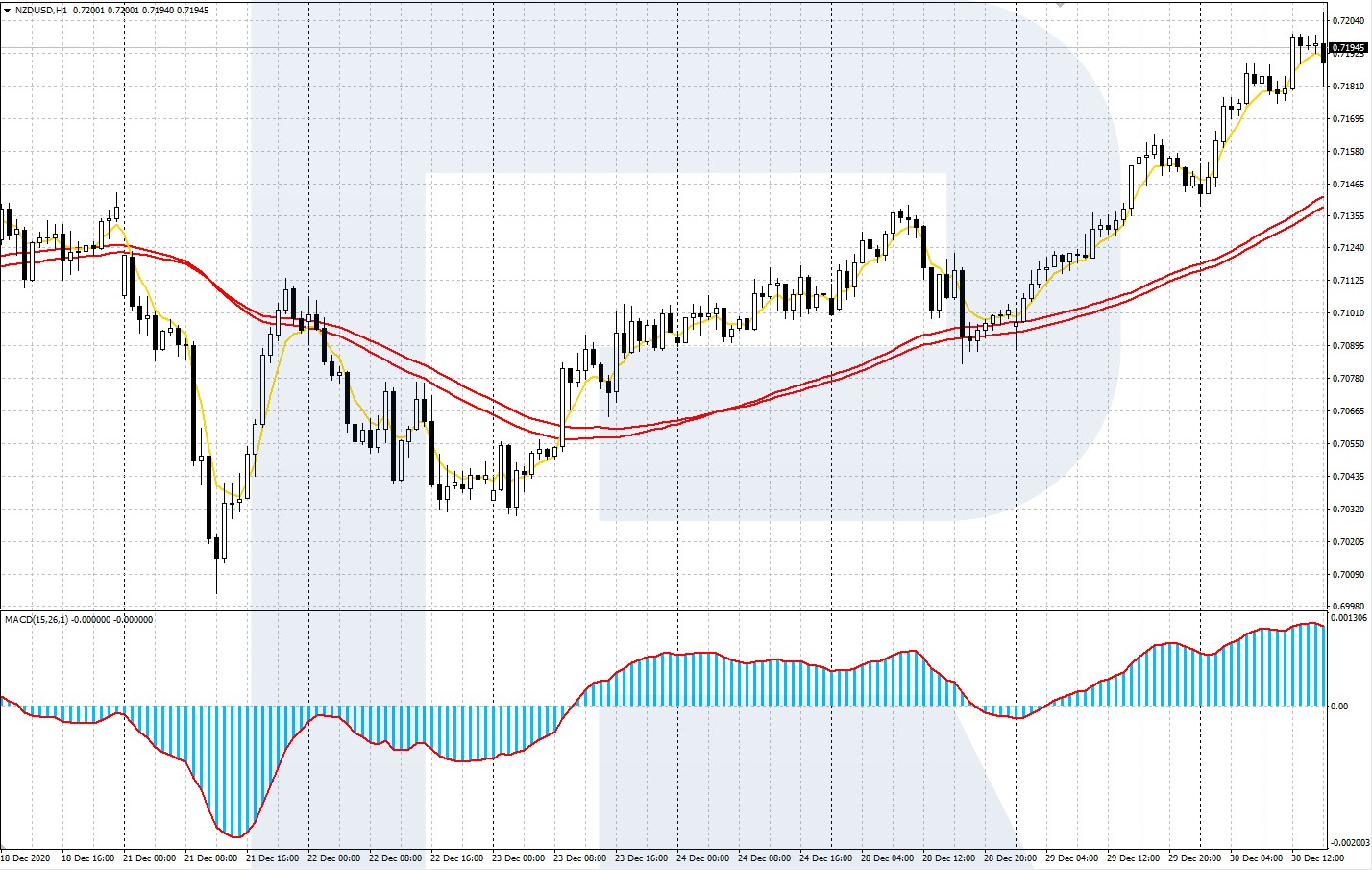

Silver trading using the Puria method

The Puria method is a beginner-friendly strategy relying on two indicators: MACD and Moving Averages (MA). Most platforms like MT4 come preloaded with these tools, simplifying analysis. It tracks three moving averages: two red lines (periods 75 and 85) based on low prices and one orange line (period 8) based on close prices.

A buy signal occurs when the orange line crosses the red lines from below, confirmed by a MACD bar above zero. A sell signal appears when the orange line crosses downward, with the MACD showing a bar below zero. Trades usually occur on the H1 timeframe, offering stable opportunities for profit, though careful risk assessment remains essential.

Silver trading using the SMA indicator

The SMA strategy uses three moving averages for close prices: green (period 5), blue (period 3), and orange (period 8). A buy signal happens when the orange line crosses the green and blue lines upward, and a sell signal occurs when it crosses downward. Positions close when the orange line reverses direction. This method works well alone but can also be paired with the Puria strategy for faster results and better deposit management.

Volume Spread Analysis (VSA)

Volume Spread Analysis (VSA) is another effective approach, helping traders monitor trade volume and market activity. VSA pairs well with Price Action (PA), which identifies trends through chart patterns. Downtrends are marked by lower highs and lows, while uptrends show higher highs and lows. Key levels where price peaks or troughs consistently update are prime areas for trade entry. Traders open positions when a trend reversal is confirmed and close them as soon as the pattern shifts.

In trading, patterns reflect predictable price movements. Whether using Puria, SMA, or combining VSA with Price Action, the key is spotting these movements early, timing trades carefully, and reacting as patterns evolve.

Historical overview of silver trading

To understand silver trading, let’s start with the basics. Silver, known as Argentum in Latin, has been valued as a precious metal since the 4th millennium BC. Unlike other metals, it’s often found in its natural form, requiring no smelting.

Historically, silver was primarily used for coinage, jewellery, and utensils. With technological advances, its role expanded to mirrors, electroplating, and electrical appliances. This dual status — as both a precious and industrial metal — explains its stable price on the Forex market and its reputation as a defensive asset.

While silver is the third most traded raw material after oil and gold, its liquidity lags far behind gold. Still, trading volume remains sufficient to apply strategies across various timeframes.

In recent decades, silver experienced a strong uptrend, peaking in 2011 before falling sharply to $14–15 by 2013. Unlike gold, which stabilized faster, silver entered a flat, sideways trend before regaining balance.

Current trends

Overall, silver has been rising steadily in recent years, and there is no reason to think that this long-term trend will change.

Nevertheless, the potential of explosive movement in this metal is low, it is several times inferior to the potential of gold.

There is a certain correlation between gold and silver, these metals are usually subject to the same trends.

It means that if gold goes down shortly, the "little brother" is sure to repeat this downfall.

General information regarding silver trading on the Forex market

The XAG designation is how silver is labeled on the Forex and its most popular pairing is XAG/USD. The asset is traded in the soi-disant troy ounces, where one troy ounce is equal to 31.1034768 grams. The futures contracts in most cases contain 100 units of the trading instrument. So, for example, if the price of an ounce of silver on Forex is $14, then a futures contract would be worth $1400.

Since it’s comfortable to trade on Forex in split lots, the trader can buy/sell just one troy ounce. And here it is important to note that currency pairs in Forex do not have tickers (abbreviations), instead, international codes are used (EUR, USD, etc). Precious metals have tickers, but silver can be written not only by the code XAG. Another designation of silver on Forex is SILV. This ticker is commonly used by many brokers in their trading terminals.

Because the "moon metal" experiences constantly high volatility, it often allows traders to employ aggressive strategies to achieve large profits via moderate costs. And given silver’s constant dependence on gold and the general trends in the commodity market, the movement of quotations is predicted quite successfully.

Factors affecting silver quotes

Industrial demand spikes. Silver is used a lot in tech gadgets, solar panels, and medical tools. Tech breakthroughs or green energy projects can raise demand, making prices climb fast.

Supply chain disruptions. Most silver comes from a few countries like Mexico and Peru. Issues like strikes or new environmental laws there can limit supply and make prices jump quickly.

Global economic sentiment. Silver acts both as a tech metal and a safe investment. When the economy looks shaky, people buy silver to protect their wealth, driving prices up.

Currency strength shifts. Since silver is priced in U.S. dollars, a weaker dollar makes it cheaper for international buyers, increasing demand. A stronger dollar can pull prices down.

Emerging technologies. Future tech like electric car batteries and 5G networks could boost demand for silver due to its excellent electrical conductivity, driving prices higher in the long run.

Main producers of raw materials

Germany

Spain

Peru

Chile

Mexico

China

Canada

USA

Australia

Poland

Russia

Kazakhstan

The silver market is largely consolidated, with a few major companies controlling production. Price movements often align due to shared output capacities and overlapping industries, such as electrical engineering, where both silver and gold are widely used.

Seasonal trends also play a unique role in silver trading. For instance, the Indian wedding season, which runs from December to March, sees a surge in demand for jewellery. This increases the price of precious metals, with silver acting as a cheaper alternative to gold. As gold prices rise during this period, silver’s market value often accelerates in response.

Beyond seasonal factors, silver prices are influenced by broader economic and political events. Developments like advancements in mining technology, breakthroughs in inorganic chemistry, new players entering the market, or bankruptcies of major mining companies can significantly impact silver’s value. While such factors are irrelevant for currency pair traders, they are vital for those trading precious metals.

Peculiarities of silver trading in Forex | Basic indicators and forecasting

Trading the silver/dollar pair on Forex often involves pending stop orders and corrections. This asset typically sees risk control breaches before rebounding 2-3% within a day. Silver isn’t ideal for beginners; oil and gold are better for honing skills in commodities trading.

In a stable sideways market, the RSI (Relative Strength Index), developed by W. Wilder in 1978, remains one of the most reliable indicators for silver. Additionally, the MACD (Moving Average Convergence/Divergence) and SMA (Simple Moving Average) offer valuable insights for traders.

For counter-trend strategies, the Price Channel (PC), a key Envelope indicator, is often applied to silver. While liquidity issues can arise in the 15-minute timeframe, the hour timeframe provides smoother trading conditions.

Silver can be traded on the Forex, futures, and options markets. In Forex, it is typically available via CFDs provided by brokers. To avoid getting caught in market noise — known as the 'saw' effect — it’s important to use wide stop orders.

A striking example of silver trading in Forex

The easiest way to trade silver and gold is through binary options. Virtually any broker provides the appropriate functionality in their trading platform. You need to choose the precious metal you are interested in, enter the amount of investment, see the forecast and compare it to your analysis.

An option is a futures market instrument, so it is open for a certain period. Therefore, it is necessary to set the time when the option will stop working. By that time, the price per ounce of silver on the Forex will change, our task is to predict how exactly it will change, whether it will rise or fall compared to its current value.

| Silver | Demo | Min. deposit, $ | Deposit fee, % | Withdrawal fee, % | Regulation level | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | 100 | No | No | Tier-1 | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | No | No | No | Tier-1 | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | No | No | No | Tier-1 | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | 100 | No | No | Tier-1 | 6.95 | Study review | |

| Yes | Yes | No | No | Yes | Tier-1 | 6.9 | Open an account Your capital is at risk. |

What else to bear in mind when trading silver

Silver quotes on Forex can fluctuate 60-70% annually, compared to 20% for most national currencies, even during global crises. Unlike short-term movements, commodity assets like silver often follow long 10-15-year trends, making them viable for short-, medium-, and long-term strategies.

Currently, over 50% of mined silver is used in industry — a trend that continues to grow. Increased demand in medicine and meteorology has pushed countries, especially China, to modernize production, surpassing Australia, Canada, and the U.S.

During crises, reduced industrial consumption can drive silver prices lower, similar to oil's collapse due to falling demand and rising shale production. Though silver is considered a second-tier instrument after oil and gold, traders often use it for diversification within broader strategies, offering a practical edge without being the primary focus.

Time silver trades around U.S. events and track institutional buying for success

Trading silver (XAG/USD) on Forex isn’t just about charts — it’s about timing trades when important U.S. economic news hits. Since silver is linked to the U.S. dollar, watch reports like Non-Farm Payrolls, inflation updates, and Federal Reserve rate decisions. These events can make prices jump fast. Set orders ahead of time, about 15-20 pips from the current price, to catch profitable moves when big news drops.

Another smart move is to mix chart tools with trader behavior insights. Use the Relative Strength Index (RSI) with the Commitment of Traders (COT) report, which shows if big players are buying or selling silver contracts. If institutional buyers are going long and RSI shows silver is oversold, it’s likely a strong buy signal. This cuts down on fake signals and helps you trade better.

Conclusion

Silver trading on Forex, particularly XAG/USD, offers unique opportunities for traders due to its volatility and status as a safe-haven asset. By applying top strategies like trend-following, breakout trading, and fundamental analysis, traders can effectively capitalize on market movements. Success in silver trading requires a solid understanding of the market, disciplined risk management, and staying updated on economic indicators that influence silver prices. With the right approach and tools, XAG/USD can be a valuable addition to a diversified trading portfolio.

FAQs

When should one start trading silver on Forex?

We recommend that beginners start with currency pairs. Even experienced traders rarely use silver as their main asset. However, it can be a source of additional profit and is often used for diversifying the risks of the main deals.

What influences silver quotations?

Mainly it is the amount of production of raw materials, as well as the number of producers. Demand can change seasonally (for example, during the wedding season in India) or in response to a crisis — when investors tend to invest in protective assets (which are often raw materials).

What are the peculiarities of silver trading?

The "moon metal" is quite volatile. Quotes can change significantly (up to 70% per year). In addition to tracking the major political and economic news, it is necessary to follow the market of raw materials and news from the world of chemistry and jewellery.

What are the strategies for trading silver?

Traditional strategies used for currency pairs are not suitable for precious metals. However, a trader still uses RSI, SMA, MACD, and other asset indicators. It is possible to trade based on these indicators, the Puria method, combine them and develop your strategies.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

A futures contract is a standardized financial agreement between two parties to buy or sell an underlying asset, such as a commodity, currency, or financial instrument, at a predetermined price on a specified future date. Futures contracts are commonly used in financial markets to hedge against price fluctuations, speculate on future price movements, or gain exposure to various assets.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.