What Is A Dividend Adjustment | Full Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

A dividend adjustment in trading refers to the modification of the value of certain financial instruments, such as stock options, futures, or indices, to account for the payment of dividends by the underlying stock. This adjustment ensures that the payout of dividends does not unfairly benefit or disadvantage the holders of these instruments.

Dividend adjustments are crucial to maintaining market integrity and ensuring that the prices of derivative instruments accurately reflect the economic realities of the underlying assets. In this article you will learn what dividend adjustment is, how it works and why dividend adjustments are important.

Dividend adjustment = Size of dividend payments / Number of shares per lot * Size of the position in shares

All about dividend adjustments

A dividend adjustment occurs when the price of a stock or other trading instrument is adjusted to reflect the payout of a dividend. This is necessary to ensure that traders do not experience an artificial gain or loss simply because a dividend was paid. For example, if a stock you hold pays a dividend, the stock's price typically drops by the amount of the dividend paid out. Dividend adjustments calculated based on the size of dividend payments, the number of shares per lot, and the size of the position in shares.

Calculating dividend adjustments involves a few straightforward steps to ensure your trading positions accurately reflect the impact of dividend payouts. Here's a clear and understandable guide:

Identify dividend dates:

Be aware of the key dates related to dividends for the stocks you are trading:

Ex-dividend date: The date after which new buyers of the stock are not entitled to the declared dividend;

Record date: The date on which the company determines which shareholders are eligible to receive the dividend;

Payment date: The date when the dividend is actually paid out to shareholders.

Calculate the adjustment:

Determine the dividend per share and adjust your position accordingly.

Example: If you hold 100 shares of a stock that pays a $1 dividend, your position will be adjusted as follows:

Dividend per share = $1

Number of shares = 100

Total dividend adjustment = 100 shares * $1 = $100

Your position will be adjusted by $100, reflecting the dividend payout.

Adjust your orders:

Update any stop-loss or take-profit orders to reflect the new, adjusted stock price;

Example: If your stock was trading at $50 before the ex-dividend date, and the dividend is $1 per share, the stock price will typically drop to $49 after the ex-dividend date. Adjust your orders to account for this new price.

Monitor your account:

Ensure that the dividend adjustment is correctly applied by your broker and reflected in your account balance;

Check your account to confirm that the $100 adjustment (from the example above) is accurately reflected.

Why are dividend adjustments important?

Dividend adjustments are crucial for maintaining fairness and accuracy in trading. They ensure that:

Both long and short position holders are treated equitably. Long position holders receive a dividend credit, while short position holders are debited the dividend amount.

Trading accounts accurately reflect the true value of positions after dividends are paid, avoiding discrepancies in profit and loss calculations.

Adjustments help maintain the integrity of the market by preventing exploitation of dividend payouts for artificial gains.

| Stock | Dividend Yield | Dividend Payment Dates 2024 |

|---|---|---|

Altria Group (MO) | 8.4% | 10/03/24, 10/06/24, 10/09/24, 10/12/24 |

First of Long Island Corp. (FLIC) | 8.6% | 16/01/24, 16/04/24, 16/07/24, 16/10/24 |

MPLX LP (MPLX) | 9.23% | 14/02/24, 14/05/24, 14/08/24, 14/11/24 |

AT&T (T) | 6.29% | 01/02/24, 01/05/24, 01/08/24, 01/11/24 |

Pfizer (PFE) | 4.00% | 01/03/24, 01/06/24, 01/09/24, 01/12/24 |

Bristol-Myers Squibb (BMY) | 4.25% | 01/02/24, 01/05/24, 01/08/24, 01/11/24 |

Pioneer Natural Resources (PXD) | 4.49% | 10/02/24, 10/05/24, 10/08/24, 10/11/24 |

Duke Energy (DUK) | 4.29% | 15/02/24, 15/05/24, 15/08/24, 15/11/24 |

Medtronic (MDT) | 3.21% | 19/01/24, 19/04/24, 19/07/24, 19/10/24 |

Gilead Sciences (GILD) | 4.00% | 30/03/24, 30/06/24, 30/09/24, 30/12/24 |

International Business Machines (IBM) | 4.06% | 09/03/24, 10/06/24, 10/09/24, 10/12/24 |

Cisco Systems (CSCO) | 3.1% | 25/01/24, 25/04/24, 25/07/24, 25/10/24 |

Broadcom (AVGO) | 2.92% | 31/03/24, 30/06/24, 30/09/24, 30/12/24 |

When a company declares a dividend, the following steps typically occur:

Dividend declaration. The company announces the dividend amount and the key dates, including the ex-dividend date, record date, and payment date;

Ex-dividend date. On this date, new buyers of the stock are not entitled to the declared dividend. The stock price usually drops by the amount of the dividend to reflect this payout;

Record date. This is the date on which the company determines which shareholders are eligible to receive the dividend;

Payment date. The date on which the dividend is actually paid out to shareholders.

Dividend adjustments affect various trading instruments differently. For instance, in CFDs(Contracts for difference), the adjustment is typically credited or debited to your account based on whether you hold a long or short position. For indices, the dividend adjustment can impact the overall index value, which in turn affects all positions tied to that index.

Tips for beginners

For beginner traders, it’s essential to understand that dividend adjustments ensure fairness in trading. For instance, buying a stock just before the ex-dividend date to receive the dividend and selling it immediately after could artificially inflate profits. Dividend adjustments prevent this by recalculating the position to reflect the dividend payout.

Ignoring ex-dividend dates and not adjusting trading strategies accordingly;

Failing to update stop-loss or take-profit orders after dividend adjustments;

Misunderstanding the impact of dividends on short positions, which typically incur a debit.

Tips for experienced traders

Experienced traders need to perform detailed calculations to accurately adjust their positions. This includes understanding how dividend yields, payment frequencies, and different market conditions affect adjustments. For example, a high dividend yield stock might require more frequent adjustments and careful monitoring of market trends to ensure positions are correctly managed.

Incorporating dividend adjustments into trading strategies can enhance performance. For instance, traders can use dividend information to anticipate price movements and adjust their strategies accordingly.

Risks and warnings

Misjudging the adjustment can lead to unexpected losses, especially in volatile markets where prices fluctuate significantly around ex-dividend dates. Pay attention to:

Market volatility can exacerbate the risks associated with dividend adjustments. For example, a sudden market downturn around the ex-dividend date can amplify losses if adjustments are not correctly applied. Traders must remain vigilant and adapt their strategies to changing market conditionsж

Tax considerations are crucial when dealing with dividend adjustments. Dividends are typically subject to withholding taxes, which vary by jurisdiction. Understanding these tax implications can help traders optimize their strategies and minimize tax liabilities.

Recommendations on handling dividend adjustments

As an expert in trading and risk management, I think a disciplined approach to handling dividend adjustments is crucial. To manage these adjustments effectively, it is important to integrate a few key practices into your routine.

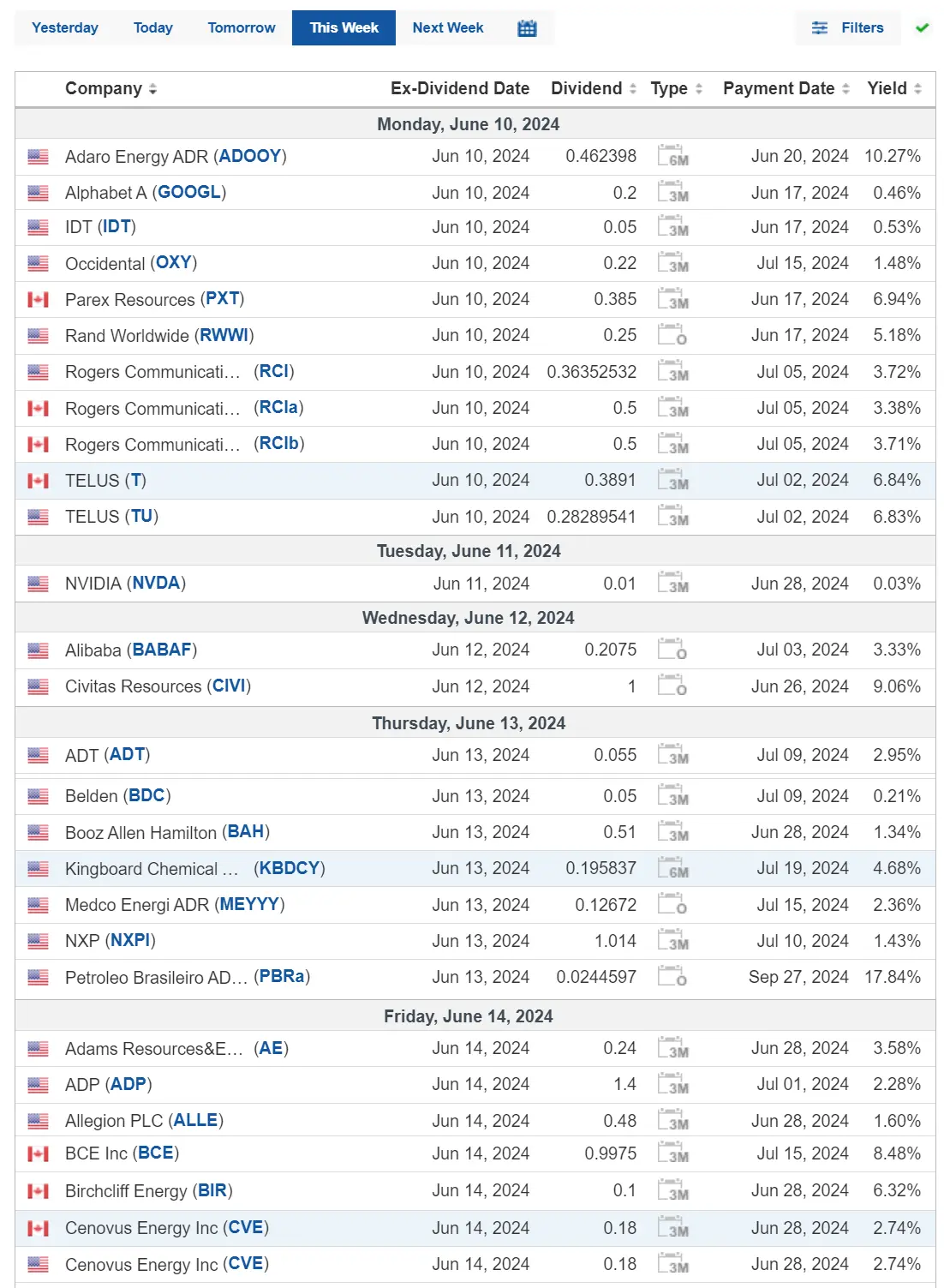

First, make it a habit to regularly review dividend calendars. These calendars provide essential information about upcoming dividend dates, including the ex-dividend date, record date, and payment date. By staying informed, you can anticipate changes and prepare your trading strategy accordingly.

Next, ensure that you promptly update your positions when a dividend is declared. Failing to do so can lead to inaccuracies in your trading account and negatively affect your overall strategy. As soon as a dividend is announced, adjust your trading positions. This involves modifying stop-loss and take-profit orders to reflect the new stock prices after the dividend adjustment.

Using advanced trading tools can significantly enhance your efficiency. Many brokerage platforms, such as Interactive Brokers and E*TRADE, offer automated dividend adjustment features. Additionally, it is beneficial to stay informed through reliable financial news services like Bloomberg, Reuters, and MarketWatch.

Furthermore, develop a comprehensive trading plan that includes strategies for handling dividend adjustments. Your plan should outline when and how you will adjust your positions, considering dividend declarations and market conditions. This structured approach ensures you are always prepared and helps you avoid making hasty decisions based on incomplete information.

Conclusion

Understanding dividend adjustments is vital for effective trading. These adjustments ensure fairness and accuracy in trading positions, preventing artificial gains or losses due to dividend payouts. By incorporating dividend adjustments into strategies, you can optimize their performance and manage risks more effectively.

FAQs

How does a dividend adjustment affect long positions?

For long positions, a dividend adjustment results in a credit to the account, reflecting the dividend received.

How does a dividend adjustment affect short positions?

For short positions, a dividend adjustment results in a debit from the account, as the trader owes the dividend amount to the lender of the shares.

What tools can help manage dividend adjustments?

Tools that can help manage dividend adjustments include brokerage platforms with automated adjustment features, dividend calendars, and financial news services like Bloomberg and Reuters.

How should I integrate dividend adjustments into my trading strategy?

Integrate dividend adjustments into your trading strategy by developing a comprehensive trading plan, regularly reviewing dividend calendars, updating positions promptly, and using advanced trading tools.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

The dividend adjustment in CFD trading is an analogue of the dividend amount, which is accrued for a long position on a CFD on shares and deducted for a short position. Depends on the position volume and the number of contracts in the lot.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Take-Profit order is a type of trading order that instructs a broker to close a position once the market reaches a specified profit level.