MiCA Regulation: A Comprehensive Guide In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

MiCA regulation is the EU’s way of regulating crypto-assets and related services. Here’s what it means for crypto traders:

Covers all crypto assets. Includes stablecoins, utility tokens, and more.

Requires licensing for providers. Companies need approval to operate.

Enhances consumer protection. Adds safety measures to avoid fraud.

Creates a unified market. Standardizes rules across EU countries.

Supports financial stability. Increases transparency to prevent crises.

The cryptocurrency industry is entering a new era with the introduction of the Markets in Crypto-Assets Regulation (MiCA). As one of the most ambitious regulatory frameworks, MiCA seeks to establish order in the chaotic crypto landscape by harmonizing rules across the European Union (EU). Let’s understand how it affects you as a trader based out of Europe.

What is MiCA regulation?

The Markets in Crypto-Assets Regulation (MiCA), formally adopted by the EU in 2023, introduces a comprehensive regulatory framework for crypto-assets, their issuers, and service providers. MiCA aims to:

Covers stablecoins with reserve rules. MiCA makes sure stablecoins are backed by reserves to avoid collapses like in past failures.

Includes NFT - related clauses. MiCA also considers some tokenized assets based on how they’re used in the market.

Requires proof of sustainability. Platforms need to share their energy usage so users know their environmental impact.

Introduces an EU passport system. Approved platforms can offer services in all EU countries without separate licenses.

Exempts decentralized protocols for now. Platforms without intermediaries aren’t covered under MiCA — at least for now.

Focuses on large issuers. Big stablecoin issuers with many users face stricter rules and monitoring.

Why MiCA matters?

MiCA isn’t just about rules for crypto — it’s a game-changer for how the industry works across Europe. One big feature is passporting, which means crypto platforms only need approval in one EU country to offer services across the entire region. For beginners, this removes the headache of dealing with different rules in different countries. It also makes it easier to access safe, regulated platforms with fewer fees. MiCA’s approach helps crypto businesses grow while giving users a more consistent experience, no matter where they are in Europe.

Another important point is how MiCA handles stablecoins. It makes sure stablecoins are fully backed by reserves, which stops the value from crashing if there’s a sudden demand for withdrawals. This is especially important because stablecoins are often the first step for people getting into crypto. By making the rules clear and transparent, MiCA builds trust in the system and makes the crypto space safer for new investors.

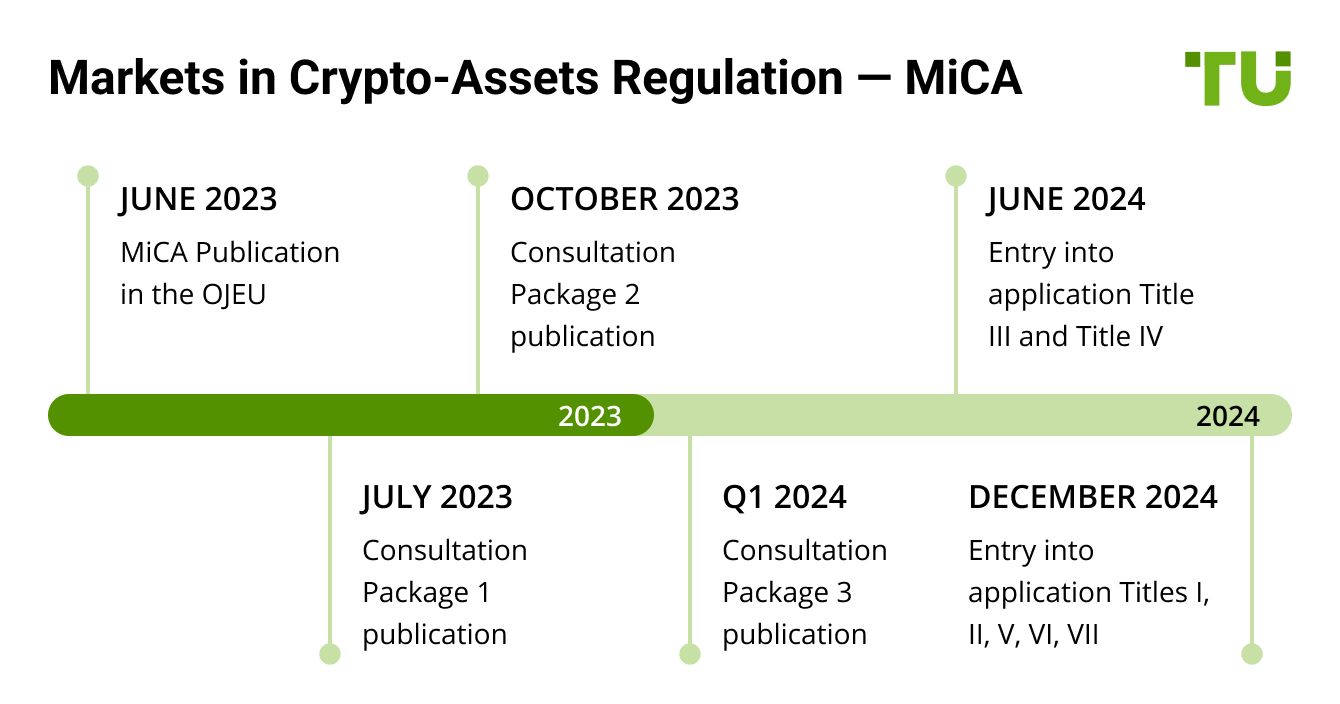

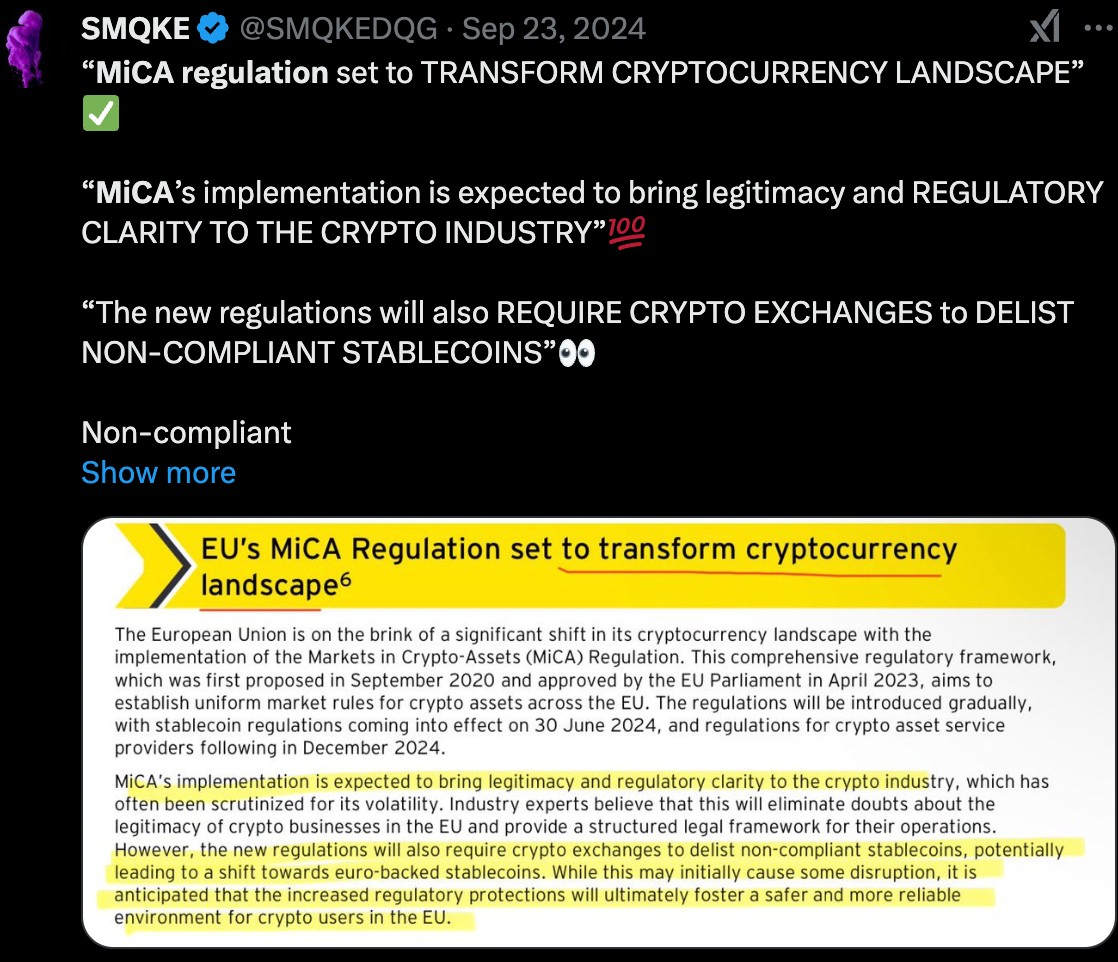

Many experts and leading media outlets believe that MiCA regulation will change the crypto landscape and make it more orderly.

MiCA regulation explained: a step-by-step guide for traders

Understand the scope

MiCA applies to:

Utility tokens. Tokens granting access to specific services or goods.

Asset-referenced tokens. Stablecoins pegged to assets like fiat currencies or commodities.

E-Money Tokens. Digital representations of money issued and redeemed at par value (e.g., USDT, USDC).

However, it excludes:

Decentralized Finance (DeFi). Protocols without centralized governance.

Central Bank Digital Currencies (CBDCs). Managed by central banks.

Check compliance

To ensure compliance with MiCA:

Verify whether the trading platform is registered and regulated under MiCA.

Confirm that the platform issues white papers for all tokens, detailing their purpose, risks, and backing.

Choose MiCA-compliant platforms

Platforms adhering to MiCA standards offer:

Safeguards against fraud.

Transparent fees and operational guidelines.

Protection against insolvency or technical failures.

Secure your crypto

Store your funds in wallets provided by regulated platforms. Use multi-factor authentication and avoid storing large amounts on exchanges.

Stay updated

MiCA will be rolled out in phases through 2025. Subscribe to official updates from the European Securities and Markets Authority (ESMA) and trusted financial sources.

Key provisions of MiCA regulation

MiCA introduces clear classifications:

Utility tokens. For accessing decentralized services.

Asset-referenced tokens. Bridging crypto and traditional finance.

E-Money tokens. Digital substitutes for traditional currency.

Regulatory requirements

White paper publication. Issuers must disclose all relevant details, including token use, risks, and governance.

Operational standards. Platforms must maintain capital reserves to mitigate risks.

Consumer protection. MiCA mandates compensation for users in case of breaches.

Supervision and enforcement

National Competent Authorities (NCAs). Each member state enforces MiCA locally.

European Securities and Markets Authority (ESMA). Oversees cross-border compliance and disputes.

Considerations for beginners

For beginners, MiCA reduces the risk of scams and simplifies trading by establishing standardized rules. Key considerations include:

Understand the licensing requirement. Small crypto companies now need approval — check how this affects the platforms you use.

Focus on stablecoin limits. MiCA limits how much you can move with stablecoins — adjust your strategy if you use them often.

Check for custody rules. Exchanges must follow stricter rules for holding crypto — make sure your platform has solid security features.

Review whitepaper details. Token issuers must share detailed info — avoid projects that don’t explain their goals clearly.

Prepare for tax transparency. You may need to report your transactions — keep your records updated for tax purposes.

Watch for new cross-border fees. MiCA simplifies EU-wide trading, but some exchanges may add fees — include this in your plans.

Beginners must also avoid common mistakes such as:

Trading on non-regulated platforms.

Ignoring white paper details before investing.

Considerations for advanced traders

Check compliance for cross-border trades. Make sure your trades follow rules in different EU countries since taxes vary even with unified regulations.

Monitor stablecoin usage limits. MiCA has limits on how much some stablecoins can circulate — this can affect your liquidity strategy.

Understand when to report large trades. If you’re making big trades, be aware that you might need to report them.

Watch for changes in custody rules. Stricter rules for asset storage may change where you keep your holdings.

Review rules on market activity. Large orders or sudden trades could fall under new anti-manipulation checks.

Know licensing deadlines for providers. Make sure your exchange or broker meets licensing deadlines to avoid service disruptions.

Challenges

Increased scrutiny. High-frequency and leveraged trading will face stricter oversight, requiring traders to adapt strategies to comply with new limits and disclosures.

Tax obligations. MiCA introduces standardized tax reporting across the EU, simplifying compliance but adding administrative responsibilities. Traders must stay informed to optimize net profits while meeting new tax requirements.

Risks and warnings

Some rules will take time. Not all MiCA regulations kick in right away, which could confuse early users.

Approval delays could pile up. Too many licensing applications may slow down approvals for new projects.

Hybrid tokens face stricter checks. Tokens that act like stablecoins and securities may go through tougher reviews.

Regulation might vary slightly. EU rules are unified, but some countries may enforce them differently.

Compliance can get expensive. Small crypto startups might struggle to cover the costs of meeting all legal requirements.

Future rules could change. MiCA may later include stricter rules for DeFi platforms not covered initially.

How to mitigate risks

Understand how tokens are classified. Check whether your coins are utility tokens, stablecoins, or e-money to know what rules apply.

Stay updated on new rules. Regulations can change, so check for updates to avoid missing key changes.

Watch for cross-border limits. Make sure you’re following rules when trading with platforms outside the EU.

Check if your platform is licensed. Ensure exchanges and wallets you use have the right approvals to protect your funds.

Use different types of wallets. Split your funds between custodial and non-custodial wallets to stay flexible.

Keep your tax reporting accurate. MiCA regulations align with financial reporting rules, so double-check your crypto tax filings.

Pros and cons of MiCA regulation

- Pros

- Cons

Market stability. Reduces fraud and speculation.

Consumer trust. Enhances safety and transparency.

Innovation opportunities. Encourages sustainable projects.

Increased fees. Higher compliance costs for platforms.

Regulation complexity. Traders must adapt to new rules.

Understanding MiCA regulation isn’t just about following rules

Understanding MiCA regulation isn’t just about following rules — it can actually help you plan smarter. For beginners, it’s useful to see how MiCA categorizes crypto-assets like stablecoins and utility tokens. These categories can change how your investments are taxed or even limit your use in bigger trades. Some countries might set limits on how much you can use stablecoins in a single transaction. Knowing this ahead of time helps you plan large trades without issues.

Another important tip is to avoid depending on just one platform. Since MiCA requires crypto service providers to get licensed, some smaller platforms might struggle to stay compliant. Instead, spread your trades across a few licensed exchanges. That way, if one service gets shut down or loses its license, you can still access your portfolio without a problem.

Conclusion

The Markets in Crypto-Assets Regulation is more than a set of rules — it’s a transformative framework shaping the future of cryptocurrency trading. By prioritizing security, transparency, and innovation, MiCA sets a global benchmark for crypto regulation.

Whether you’re a beginner looking to trade safely or an advanced trader seeking to optimize strategies, adapting to MiCA regulations is essential. Stay informed, choose compliant platforms, and seize the opportunities presented by this evolving market.

FAQs

What is MiCA, and why is it important?

MiCA, or the Markets in Crypto-Assets Regulation, is an EU framework to standardize crypto regulations, ensuring consumer protection, market stability, and innovation. It’s crucial for traders as it creates safer, transparent trading conditions.

Does MiCA apply to all cryptocurrencies?

MiCA covers utility tokens, asset-referenced tokens, and e-money tokens. It excludes decentralized finance (DeFi), non-fungible tokens (NFTs), and central bank digital currencies (CBDCs).

How do I ensure a platform is MiCA-compliant?

Check if the platform is registered with a National Competent Authority (NCA) or ESMA. Look for transparency in fees, operational standards, and white papers for all listed tokens.

Can beginners benefit from MiCA?

Absolutely. MiCA simplifies trading by enforcing transparency and consumer protection, reducing the risk of fraud and market manipulation.

Related Articles

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.