Are Bonds Halal Or Haram In Islam? A Guide For Investors

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Most conventional bonds are viewed as haram in Islam because they involve riba (interest), which is clearly forbidden in Islamic teachings. Bonds typically guarantee fixed interest payments, ignore the concept of risk-sharing, and may include speculative elements, which go against the core principles of Shariah. In contrast, Sukuk provide halal investment opportunities through asset-backed structures and shared profit models that follow Islamic financial values.

Is investing in bonds halal? This is one of the most common questions faced by Muslims trying to make ethical financial choices. While bonds may appear to offer a steady and low-risk source of income, they conflict with Islamic finance due to their reliance on interest, which the Qur’an strictly forbids.

This guide takes a closer look at whether bonds meet Islamic standards, introduces Sukuk as a compliant alternative, and helps you make decisions that reflect both financial goals and religious beliefs.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Are bonds halal or haram in Islam?

In Islamic investing, a frequently raised concern is whether bonds align with Shariah principles. For Muslims who aim to remain compliant with Islamic law while building a stable and diversified portfolio, clarity around bond permissibility becomes especially important. The discussion largely centers on the issue of riba (interest), which is a key factor in evaluating traditional financial instruments.

Conventional bonds are defined as debt-based assets where investors lend money to governments or companies in exchange for a fixed interest return. This guaranteed interest is the main reason these instruments often clash with Islamic teachings.

Since Islamic finance prohibits earning fixed income through lending, standard bonds are typically viewed as non-compliant. However, this doesn't mean all fixed-income tools are automatically forbidden. A deeper look into why are bonds haram reveals the reasons that distinguish impermissible instruments from acceptable ones under Islamic law. To build a stronger understanding of ethical investing in Islam, you may also want to explore: Key Islamic Investing Rules and Limitations.

Halal bonds vs conventional bonds

For Muslim investors, choosing between halal and conventional financial instruments isn’t just about yield — it’s about ethical alignment. While both halal bonds and conventional bonds are designed to generate steady income, their underlying structures, risk-sharing mechanisms, and religious permissibility are fundamentally different.

Fundamental difference

Conventional bonds are structured as debt instruments. The investor lends money to the issuer and receives fixed interest payments in return. This model inherently involves riba (interest), which is strictly prohibited under Islamic law.

In contrast, halal bonds are structured around ownership or profit-sharing. When you invest in halal bonds, you become a partial owner of a real asset or project, and you earn income through rent, operational profits, or other lawful means. Since halal bonds are backed by tangible assets and avoid interest-based returns, they are considered compliant with Shariah principles.

Advantages and limitations

Halal bonds are fully Shariah-compliant and provide transparency through asset-backing. They appeal to ethical investors seeking religiously sound options. However, they may offer lower yields compared to conventional bonds, and their market availability is more limited.

Conventional bonds are easier to access and typically more liquid. They are also widely used by institutional investors. Yet from an Islamic perspective, their reliance on interest payments makes them impermissible, regardless of their performance or issuer profile.

| Criteria | Conventional bonds | Halal bonds |

|---|---|---|

| Legal structure | Interest-based debt | Ownership-based or profit-sharing |

| Shariah compliance | Not compliant (involves riba) | Fully compliant |

| Income source | Fixed interest | Rental income, profits, or sales revenue |

| Asset backing | Often unsecured | Always backed by tangible assets |

| Risk profile | Generally low | Varies based on asset type and contract |

| Liquidity | High | Moderate to low |

| Accessibility | Widely available in global markets | Limited to Islamic financial institutions |

| Examples | US Treasuries, corporate bonds | Malaysian government bonds, ijara-based bonds |

Practical implications for investors

Choosing between halal bonds and conventional bonds depends on more than just return expectations. Halal bonds offer a way to earn income while remaining aligned with Islamic ethics. They are especially relevant for long-term investors who prioritize religious compliance over aggressive yield seeking.

For Muslims, conventional bonds — no matter how safe or profitable — remain problematic due to their structure. Halal bonds, on the other hand, offer a balanced solution by combining stable income with Shariah integrity.

If you're new to Islamic finance, it's important to understand not just that bonds are prohibited, but exactly why scholars take such a strong stance.

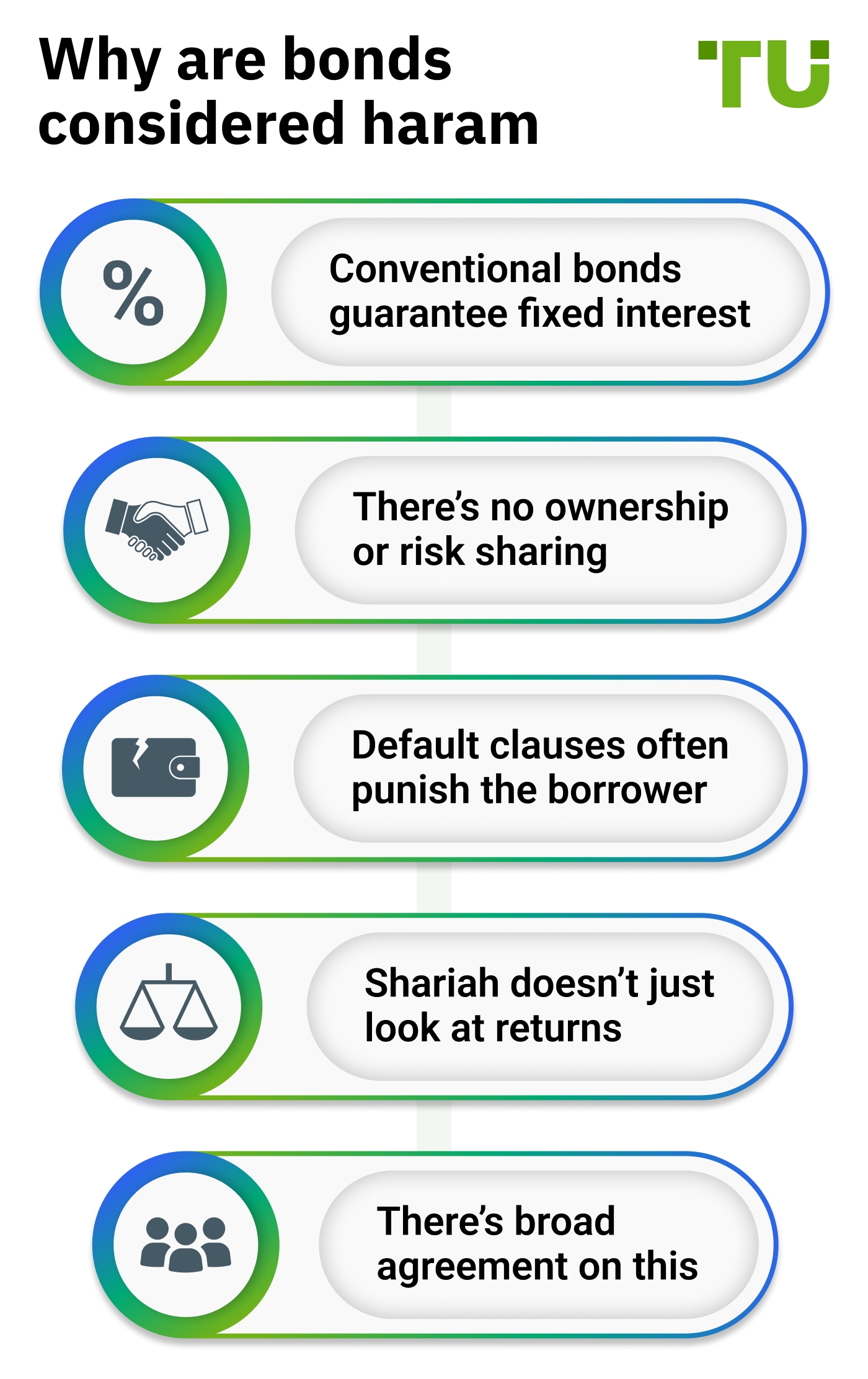

Conventional bonds guarantee fixed interest. Islam doesn’t allow earning guaranteed money without real risk, and this is the heart of why bonds are usually not allowed.

There’s no ownership or risk sharing. Buying a bond means you’re not part of a real business, you’re just lending money and getting more back, no matter what happens.

Default clauses often punish the borrower. Many bonds increase interest if payments are late, which feels unfair to one side and clearly breaks Islamic rules.

Shariah doesn’t just look at returns. Even if bonds seem safe, they don’t treat both parties equally, which is why scholars say they’re off-limits.

There’s broad agreement on this. Across Islamic finance, the recurring concern is investing in bonds halal, especially when the structure depends entirely on earning interest without engaging in real economic activity.

Is buying bonds halal?

No, buying or investing in conventional bonds is usually not seen as halal. The way these bonds are structured goes against Islamic financial principles because they depend on fixed interest payments.

Still, a few rare exceptions or blended models do exist, such as:

Bonds that don’t pay interest but instead offer returns based on profit-sharing (though these are uncommon in regular markets).

Sukuk bonds, which are Shariah-compliant and built to avoid interest completely.

For anyone exploring fixed-income options, especially those wondering is investing in bonds halal, it's important to look closely at the following:

Whether riba (interest) is involved.

If the returns are shared through real business risk.

And whether the bond is backed by actual assets or tied to productive economic activity.

Are any types of bonds halal?

While traditional bonds are haram, Islamic finance has developed halal bond alternatives to serve Muslim investors. These include:

Sukuk bonds. Structured as asset-backed certificates, Sukuk avoid riba and promote risk-sharing.

Green Sukuk. Used to fund environmentally sustainable projects within Shariah guidelines.

Premium bonds. Typically haram due to speculative prize-based returns, but opinions vary.

Prize bonds. Often classified as gambling (maysir), and thus impermissible.

Government bonds. Usually haram unless issued as sovereign sukuk.

Each bond category must be analyzed individually, considering the structure and source of returns.

Religious and expert opinions on bonds in Islam

Quranic references

Surah Al-Baqarah (2:275). "Those who consume interest cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan..."

Surah Al-Imran (3:130). "O you who have believed, do not consume usury, doubled and multiplied, but fear Allah that you may be successful."

Fatwas and institutions

AAOIFI has clearly stated that bonds involving interest are not permissible under Islamic law.

Mufti Taqi Usmani, a respected scholar and Shariah advisor to various Islamic financial institutions, maintains that any fixed-income product based on riba is forbidden. His view reflects the broader reasoning behind why bonds are haram in Islamic finance.

Shariah-compliant investors

Today, many Muslims who follow halal investing principles use platforms like Zoya, Islamicly, or Wahed Invest. These tools help them avoid conventional bonds and focus instead on equities and Sukuk, which comply with Islamic values.

Halal alternatives to bonds

If you’re trying to stay away from interest-based gains, there are smart halal options most people miss that still help you earn and grow responsibly.

Explore sukuk over fixed-income bonds. Sukuk are backed by real assets and use rental or sharing models, so you make money in a clean way, not through interest.

Use mudarabah contracts for profit-sharing. You provide funding to a business and get a share of the profit, but you're also exposed to loss if things go south.

Consider Shariah-compliant peer lending. Try platforms that offer interest-free funding for real causes, using models that share risk instead of charging interest.

Invest in rental-generating property funds. Some halal REITs avoid haram leases and focus on ethical, stable tenants that match Islamic finance rules.

Look into the best halal ETFs and index funds with dividend purification. These funds are designed to track Shariah-compliant companies while also helping you stay clean on the income side.

Hold physical assets that generate halal income. Gold and farmland, when held or leased properly, are simple but powerful ways to earn without compromising your beliefs.

If you wish to invest in financial assets (stock, crypto, etc), we suggest you do so through brokers that offer Islamic accounts. We have presented the top options below. You may compare and choose one for yourself:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review |

Embedded debt structures reveal if bonds are halal or haram in Islam

When you're new to Islamic investing, don't stop at asking whether a bond charges interest, go further and look at how the bond earns money. Even Sukuk, which are supposed to be halal, can cross the line if they’re backed by businesses that earn revenue from activities not allowed in Islam, like alcohol sales or conventional lending. Just because it’s labeled Islamic doesn’t mean it’s clean. It helps to go beyond app-based filters and actually check the bond's prospectus to see what’s really driving the returns.

There’s another detail many people miss, the rules that kick in when the bond defaults. Some bonds might not charge interest, but they still include late fees or use courts that settle disputes in a way that conflicts with Islamic principles. This can quietly bring riba back into the equation. One thing to look for is whether the contract includes Shariah-based arbitration instead of regular court enforcement. That one clause, often hidden in the fine print, decides whether a bond is truly halal or just trying to look that way.

Conclusion

Are bonds halal or haram? In most cases, traditional bonds are haram due to their interest-based nature. However, modern Islamic finance offers halal alternatives like Sukuk that provide income while respecting religious guidelines. Whether you’re an ethical investor or a devout Muslim seeking Shariah compliance, understanding the structure and spirit behind each investment is critical.

By avoiding riba, minimizing gharar, and investing in real economic activity, Muslims can grow wealth ethically. For further clarity, always consult a Shariah advisor or use trusted screening tools.

FAQs

Can I invest in halal bonds through a conventional brokerage account?

Not directly. Most standard brokerage platforms offer conventional bonds that include interest (riba), which is prohibited in Islam. However, if you're looking to invest in Sukuk or Shariah-compliant bond alternatives, you’ll need to use specialized Islamic investing platforms or consult with brokers that offer access to Sukuk markets and Islamic mutual funds.

Do halal bond alternatives like Sukuk offer competitive returns?

Yes, many Sukuk offer competitive and stable returns, particularly those tied to infrastructure, energy, or real estate assets. While they may not always match the high yields of speculative bonds, Sukuk emphasize ethical risk-sharing and asset backing — offering both spiritual peace of mind and long-term financial value.

Can non-Muslims invest in Sukuk or halal bonds?

Absolutely. Sukuk are open to all investors regardless of faith. In fact, many non-Muslim institutions invest in Sukuk to diversify portfolios with low-leverage, ethical assets. The emphasis on transparency, real economic activity, and social responsibility appeals to a broad range of values-based investors.

Is buying government bonds haram in Islam?

Most government bonds are haram due to their interest-bearing nature. However, some countries issue sovereign Sukuk — Shariah-compliant versions of government debt. Always verify the structure: if it's based on fixed interest, it’s haram; if it's based on asset ownership and profit-sharing, it may be halal.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.