Are Mutual Funds Halal Or Haram In Islam?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Mutual funds can be halal if they follow specific Shariah-based conditions. This means they must invest in only permissible businesses, stay away from interest-linked instruments, and align with broader ethical values. Shariah-compliant mutual funds are carefully screened to avoid sectors considered haram, such as alcohol, gambling, or conventional financial services.

Many Muslim investors often wonder: is it halal or haram to invest in mutual funds? With the growing presence of mutual funds in the investment world, they offer an accessible way to build a diversified portfolio. Still, Muslim investors must closely examine a fund’s structure, investment choices, and income practices to ensure full Shariah compliance. This guide helps clarify whether a mutual fund fits within Islamic investing principles and offers hands-on advice for identifying options that align with faith-based financial goals.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What makes a mutual fund halal or haram?

A mutual fund is viewed as halal in Islam when it aligns with ethical values and financial principles defined by Islamic teachings. It must focus on the halal stocks available across the stock market. Here are the key aspects of halal mutual funds:

1. Investment screening

The fund must avoid investing in businesses connected to haram sectors such as:

Alcohol;

Gambling;

Pork-based items;

Traditional banking and insurance;

Weapons and adult content.

2. Financial ratios

Scholars set specific financial filters to ensure compliance:

Debt should not exceed 33% of assets.

Any income from haram sources, such as interest, should remain below 5% of total earnings.

At least 30% of the fund’s assets must be in tangible, non-cash holdings.

3. Purification process

Profits traced to prohibited sources must be given to charity. This act helps maintain the integrity of the investment and supports its acceptance in Shariah. It also helps cleanse the portfolio from indirect exposure to activities involving gharar (excessive uncertainty) or maysir (speculation or gambling). These are core elements of halal mutual funds, helping Muslims invest while staying true to their faith.

Are mutual funds allowed in Islam?

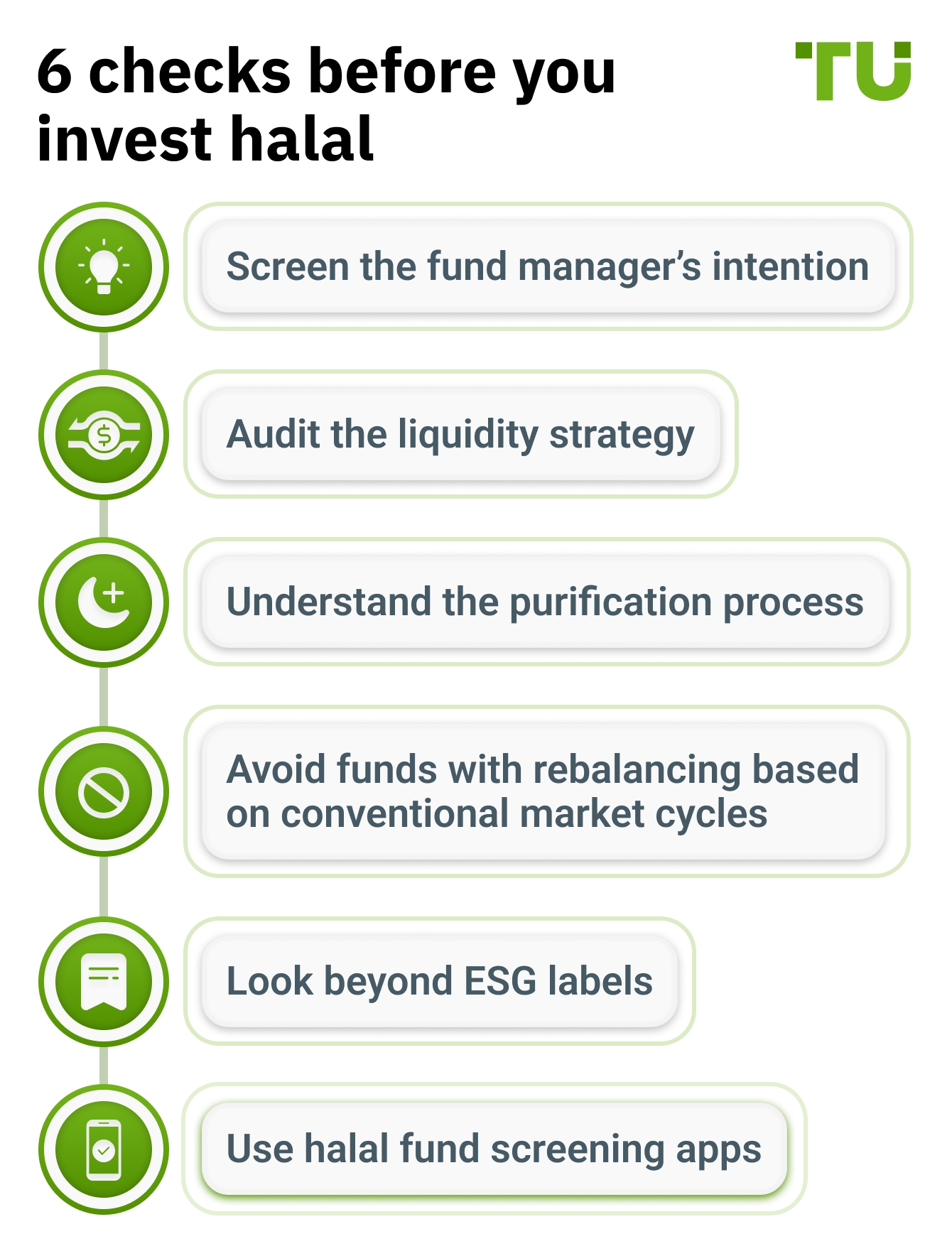

If you’ve ever wondered whether mutual funds are allowed in Islam, here’s what you need to check before finalizing your investment decision:

Screen the fund manager’s intention. Even if a fund’s holdings are Shariah-compliant, the niyyah (intention) of the manager matters. Some Islamic scholars stress that ethical alignment begins from the top, not just with the portfolio.

Audit the liquidity strategy. Many halal funds park idle money in interest-bearing instruments to maintain short-term liquidity. True Shariah-compliance should include Islamic money market tools or sukuk-based alternatives. Also, stock lending must be avoided.

Understand the purification process. If a small portion of earnings come from impermissible sources, Shariah-compliant funds often "purify" them by donating to charity. Learn how often and transparently this is done before investing.

Avoid funds with rebalancing based on conventional market cycles. Some funds follow quarterly rebalancing strategies tied to interest rate shifts or debt cycles, which can unintentionally compromise Shariah goals.

Look beyond ESG labels. While ethical investing and ESG funds may sound similar to halal investing, they are not substitutes. Many ESG funds still invest in banks, insurance, or alcohol-linked businesses.

Use halal fund screening apps. Tools like Zoya or Islamicly give real-time fatwa-based screening for mutual funds. This is especially helpful for beginners unsure how to dissect complex fund documents.

Types of mutual funds in Islam

Not all mutual funds are automatically halal — their permissibility depends on what they invest in, how they generate income, and whether their operations align with Islamic financial principles. Here's a quick overview of the most common types of mutual funds and how they are viewed from a Shariah perspective:

| Type | Halal Status | Notes |

|---|---|---|

| Equity mutual funds | Potentially halal | Must be screened for compliance |

| Fixed-Income funds | Haram | Based on riba (interest) |

| Balanced funds | Usually haram | Contain bonds and interest-heavy assets |

| Commodity funds | Halal if Shariah-compliant | E.g. gold ETFs screened for purity |

Equity mutual funds. These invest in stocks and can be Shariah-compliant, but you need to screen them carefully. Make sure the companies in the fund don’t deal in interest, alcohol, gambling, or other prohibited sectors. If penny stocks are part of the portfolio, they must be halal in nature.

Fixed-income funds. These are not allowed in Islamic finance because they earn returns through interest (riba), which is explicitly forbidden under Shariah law.

Balanced funds. These combine stocks and bonds. Since they typically include interest-generating assets like bonds, they’re generally considered non-compliant.

Commodity funds. These can be halal if they invest in physical, permissible assets, like gold or other approved commodities, and follow Islamic rules around trade and storage.

What are Shariah-compliant mutual funds?

Shariah-compliant mutual funds are vetted by Islamic scholars to ensure they meet all halal investment standards. They:

Understand purification of returns. In a Shariah-compliant mutual fund, even trace amounts of income from non-compliant sources are identified and purified, usually by donating that portion to charity. Beginners often overlook this, but it's one of the most powerful signs of ethical transparency.

Look beyond just the stocks. Many assume Shariah compliance ends with stock screening, but true funds also screen management practices, leverage ratios, and how surplus cash is handled; all must meet Islamic principles.

Don’t skip the fund manager’s track record in Islamic ethics. You might check performance, but you also need to see if the fund manager has experience navigating ethical challenges unique to Islamic investing. Not all high-performing managers understand the nuances of Islamic finance.

Watch for fund-level leverage. Even if underlying companies are Shariah-compliant, if the mutual fund itself borrows or uses derivatives in a non-compliant way, it breaks the rules. Many overlook this structural detail.

Ask about the Shariah board's independence. The scholars guiding the fund shouldn’t be handpicked to rubber-stamp decisions. An independent, well-respected board is essential for legitimacy.

Review how zakat is handled. Some funds assist investors with zakat calculations based on their share of holdings. This is a small but critical benefit for Muslim investors planning ahead.

Not all 'Islamic' labels are equal. Just because a fund is marketed as Islamic doesn’t mean it meets standards. Always verify whether it’s truly a Shariah compliant mutual fund and whether it follows AAOIFI or similar regulatory frameworks.

Examples:

Some of the best halal mutual funds out there include:

Amana Growth Fund (AMAGX). Screens U.S. equities based on Shariah rules.

Wahed FTSE USA Shariah ETF. A halal ETF tracking U.S. halal stocks.

Takaful Mutual Funds. Offered in Islamic finance institutions across the Gulf and Southeast Asia.

How to know if a mutual fund is halal?

Let’s explore how to figure out if a fund really meets Shariah standards without falling for surface-level checks.

Study sector allocation deeply. Avoid funds that simply claim to exclude alcohol or gambling; take a close look at how much is tied to sectors like insurance, conventional finance, or entertainment, even if the share is small.

Scrutinize purification methodology. Some funds allow small amounts of non-permissible income and expect you to donate it. Learn how they calculate this and how much you’ll actually need to purify.

Check fund rebalancing frequency. Halal compliance needs regular updates. Funds that only rebalance once a year or not at all might slip into non-compliant zones between checks.

Demand Shariah board transparency. Good funds clearly list their Shariah advisors and how often they review holdings. If that info is hidden, be cautious.

Look into the debt screening ratio. Most scholars agree a company should not have debt beyond 33% of its assets. If your fund includes stocks that cross this, it could be non-compliant.

Verify compliance with AAOIFI standards. Funds that follow guidelines from this global Islamic finance body generally have a better chance of staying truly halal.

Cross-check against global Shariah indexes. Index funds aligned with benchmarks like the Dow Jones Islamic Market Index or the S&P 500 Shariah Index tend to keep their holdings cleaner.

Watch how dividends are handled. Some funds include minor non-halal income in payouts. Make sure they purify dividends before passing them on.

Many of these tips go far beyond the usual screening process people use when asking is investing in mutual funds halal or haram.

To make the entire process of halal investing easier, use platforms like:

Can Muslims invest in mutual funds?

Yes, Muslims can invest in mutual funds, provided that they:

Understand fund rebalancing. Many funds that market themselves as Shariah-compliant still rebalance quarterly using screening ratios that allow some haram revenue. Learn how and when they do this to stay in control.

Track purification thresholds. Every halal fund handles impure income differently, and depending on how much you’ve put in, you may need to donate a portion of your earnings.

Don’t ignore the debt-to-equity screening. A fund might include companies with short-term high debt that still pass filters. Debt levels can change quickly, and you need to know when that happens.

Avoid auto-investment plans without filters. SIPs might invest your money when the fund is holding non-compliant stocks. Check the fund’s updated stock list every three months.

Review the scholars behind the certification. Not all Shariah boards follow the same standards. Look into how trustworthy the scholars or boards really are.

Use ethical benchmarks, not just financial ones. Combine halal screening with ESG filters to make sure your money supports what you believe in.

Understand that global markets require deeper screening. Many halal funds invest across borders, but some markets might follow different rules than what you expect. Don’t take compliance for granted.

As an alternative to mutual funds, you may also invest in index funds or ETFs. These instruments are similar to mutual funds in terms of diversification through pooled funds. We have presented the top brokers offering Islamic accounts that offer investments in these assets. You may compare and choose one for yourself:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review |

Hidden compliance filters most Muslims miss when choosing mutual fund

For Muslims stepping into the world of investments, the concern isn’t just which stocks are halal. One thing many don’t realize is how the fund manages your money in the background. Some mutual funds, even with a halal label, may keep leftover cash in accounts that earn interest. That might seem like a small technicality, but in Islam, even that interest exposure matters. So before choosing a fund, it’s worth asking: where does the idle money go? If it’s parked in places that don’t align with Islamic values, the label means little.

There’s also something rarely talked about is your voting rights. If your investment lets you vote on big corporate moves, and one of those votes supports something against Islamic ethics, like approving deals based on debt, you’re indirectly involved. That’s why some of the more reliable halal funds go beyond the basic filters. They bring in scholars who keep a close eye on how the fund behaves, not just what it invests in. For someone trying to stay true to their faith while investing, this kind of deep clarity really matters.

Conclusion

So, is investing in mutual funds halal or haram? The answer depends entirely on the fund’s structure and adherence to Shariah guidelines. Mutual fund investment is allowed in Islam when it avoids interest, speculation, and unethical sectors, and provides purification for any haram income. By carefully screening options and using tools like Islamicly and Zoya, Muslim investors can grow their wealth without compromising on faith.

FAQs

What role does niyyah (intention) play in halal investing?

In Islam, intention matters as much as action. Even if a fund meets Shariah rules, a Muslim’s personal intention when investing should be ethical, like long-term wealth building or supporting good causes, not just chasing profit. That internal niyyah can elevate your financial decisions into acts of faith.

Can zakat be calculated on mutual fund investments?

Yes, and some Shariah-compliant funds actually assist with this. They help calculate zakat based on your share of the fund’s assets, so you can fulfill your religious duties more easily. Always check if the fund offers zakat assistance or disclosures.

Is margin trading within mutual funds always haram?

Generally, yes. Margin trading involves borrowing money with interest — clearly forbidden in Islam. If a mutual fund uses leverage or borrows to boost returns, it likely violates Shariah. This detail is often hidden, so it’s worth checking the fund’s prospectus carefully.

Can halal mutual funds include cryptocurrencies?

Some funds are starting to explore this, but it’s controversial. Cryptos like Bitcoin are considered halal by many scholars, but others view them as speculative. If a mutual fund includes crypto, make sure it’s backed by strong Shariah opinions and avoids gambling-like behavior.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.