Is Investment Banking Haram? A 2025 Islamic Finance Analysis

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Yes, investment banking is widely viewed as haram in Islam because it involves interest-based earnings (riba), excessive uncertainty (gharar), and associations with non-permissible industries. As of 2025, the global Islamic finance sector presents practical alternatives, offering over $3.69 trillion in Shariah-compliant assets and a sukuk market worth between $190 and $200 billion. These avenues allow professionals to build careers in ethical finance without violating Islamic principles.

Investment banking remains one of the most prominent and high-earning roles in the global financial system. However, for Muslims seeking a career path that aligns with religious values, a fundamental concern persists: is investment banking halal or haram in Islam? This article addresses that issue through the lens of Islamic finance, drawing on respected fatwas, updated financial benchmarks, and emerging ethical career paths.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What is investment banking?

In simple terms, investment banking is the part of finance that builds complex deals worth billions for companies, governments, and wealthy clients. These banks don’t just help close big deals, they reshape businesses, restructure debt, and create financial tools like credit swaps or bundled assets that can influence how markets move. What sets them apart is their ability to control how much something’s worth and when it hits the market, all through made-to-fit financial plans. Because they regularly deal with interest-based tools and risky bets, many Muslims today are asking: is investment banking haram?

Key functions of investment banking

Most beginners think investment banking is just about helping companies go public, but the real work runs way deeper than just IPOs. Here are some clarifications:

M&A advisory is about power, not paperwork. When investment bankers guide mergers, they’re not just crunching numbers. They’re deciding who gets to lead the industry.

Debt structuring can quietly redirect economies. These banks help clients borrow in ways that can impact entire economies, including interest rates and currency value.

Syndicated lending means choosing who gets the money. Investment bankers team up with other banks to control who gets big loans and at what cost.

Derivatives are tools to tilt outcomes. Beyond just protecting against risk, derivatives are used to tilt the odds in their clients' favor across global markets.

They reshape balance sheets for appearances. Investment banks help companies adjust how their finances look without changing much underneath. This can influence investor decisions without adding real value.

No surprise, this kind of influence makes people seriously question the ethics of the job, especially when asking “is working in investment banking halal or haram in Islam?”.

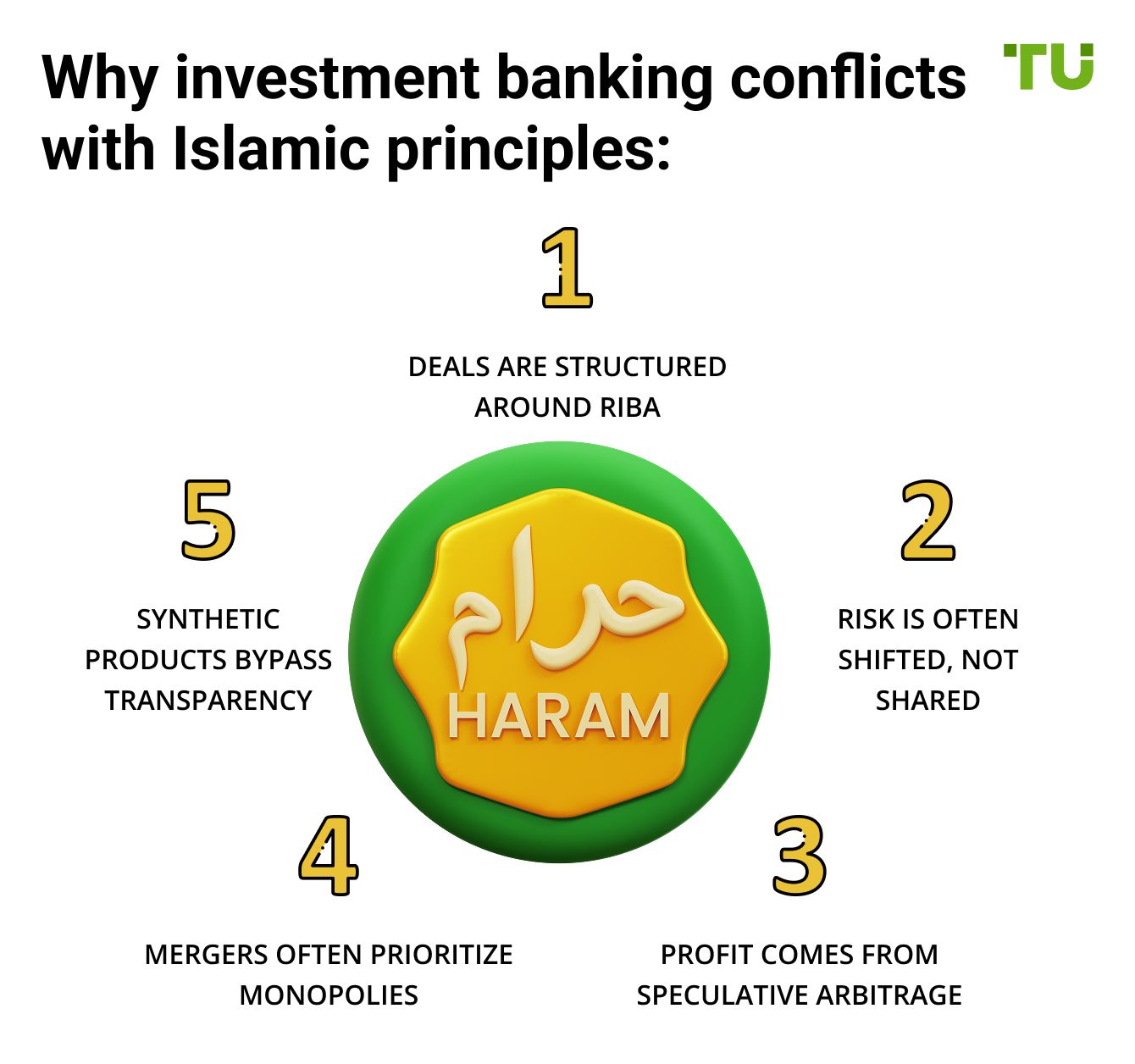

Why investment banking conflicts with Islamic principles

If you’re wondering why many scholars strongly oppose investment banking, it’s not just about interest. It’s about how the entire banking system operates beneath the surface.

Deals are structured around riba. Most investment banking services like bonds, margin financing, and structured debt rely on interest-based earnings, which clearly go against Shariah.

Risk is often shifted, not shared. Tools like derivatives and hedging are built to protect the wealthy while pushing losses onto others, breaking Islam’s principle of fairness in risk-sharing.

Profit comes from speculative arbitrage. Much of the income comes from fast, speculative trades instead of value creation, closely resembling gambling and uncertainty.

Mergers often prioritize monopolies. Many banks push for deals that crush competition and create industry giants, which violates Islamic values around economic balance and justice.

Synthetic products bypass transparency. Instruments like credit default swaps and CDOs are deliberately complex, making it hard for ordinary investors to understand what they’re buying.

This is why investment banking is considered haram by many scholars. The demand for ethical models like Islamic investment banking is rising because it prioritizes real assets, transparency, and justice, principles at the heart of Shariah-compliant finance.

Why is investment banking haram?

Riba (Interest)

Riba, or interest, is strictly forbidden in Islam. Investment banks usually earn profits by underwriting interest-based products like corporate loans and bonds, which directly conflict with Islamic teachings.

The Islamic Financial Services Board (IFSB) states that global Islamic banking institutions avoid interest-driven structures by using alternatives such as sukuk and profit-sharing contracts. This core reliance on riba raises the question: is investment banking haram under Islamic law?

Gharar (Uncertainty and speculation)

Islamic finance rejects gharar, meaning excessive uncertainty or speculative risk. Many investment banking activities, especially those tied to derivatives trading or short selling, rely on unpredictable market behavior. These forms of speculation often undermine fairness in transactions and violate the principles of Islamic contract ethics.

Investment in prohibited industries

Investment banks often fund or partner with businesses in sectors like alcohol, gambling, or pork production. Even if an individual’s role does not directly touch these industries, contributing to their financial growth remains ethically concerning from an Islamic perspective.

What do scholars say?

Multiple fatwa councils and Islamic scholars have addressed the issue:

IslamWeb and IslamOnline explain that any position linked directly or indirectly to interest-based dealings is not permissible.

AskImam, following the Hanafi school, views most jobs at investment banks as haram when they involve supporting riba-related transactions.

AAOIFI's Shariah Standard No. 21 clearly states that employment at institutions whose core business violates Shariah cannot be considered acceptable.

There is strong agreement among scholars that working in investment banking can be considered halal or haram in Islam depending entirely on the job’s nature. Unless the role is completely detached from non-compliant practices, a condition that is rarely met in conventional banks, it remains impermissible.

Global Islamic finance market

Despite limitations in conventional banking, the Islamic finance sector is growing rapidly. Key statistics include:

| Metric | Value (2025) |

|---|---|

| Global Islamic Finance Market | $3.69 trillion (Straits Research, 2025) |

| Islamic Banking Assets | $5.0 trillion (Economy Middle East, Apr 2025) |

| Sukuk Market (Islamic Bonds) | $190–200 billion issuance forecast (S&P Global, Jan 2025) |

| UAE Islamic Asset Target by 2031 | AED 2.56 trillion (≈ $697 billion) |

| Meezan Bank (Pakistan) | 88% YoY profit growth in 2024 to $305 million (FT, 2024) |

Islamic finance is no longer a niche; it is a well-regulated and globally recognized sector offering viable alternatives to conventional finance.

Is working in investment banking halal or haram?

Whether the bank job is halal or haram often depends on the nature of your role within the bank.

Roles typically considered haram include:

Underwriting interest-based bonds.

Structuring instruments like credit default swaps or interest rate swaps.

Managing mergers or acquisitions that involve companies dealing in prohibited sectors.

Working on proprietary trading desks or short-selling operations.

Roles that may be conditionally permissible include:

Providing IT support in a department that operates independently from interest-based functions.

Working in internal audit, especially if the focus is on compliance or ethical oversight.

Creating graphic design or communication content that doesn’t promote prohibited financial products.

So, is working in investment banking halal or haram in Islam? Most scholars maintain that the majority of roles are not permissible, as they involve direct or indirect engagement with activities prohibited in Islamic finance. A growing number of professionals are seeking out careers in Islamic investment banking, which align more closely with ethical and Shariah-compliant practices.

Halal or Islamic investment banking options

When it comes to halal investment banking, people often think it’s just regular banking without interest. In reality, it’s designed from the ground up to follow Islamic values like fairness and real value.

Equity replaces debt. Islamic banks use contracts like mudarabah and musharakah, where both the bank and investor take real financial ups and downs together.

Transactions are tied to real assets. Investments are always linked to tangible things like buildings, commodities, or halal stocks so money isn’t made out of thin air.

Fee-based services replace interest earnings. Instead of charging interest, banks earn through honest fees for services like asset management or advising.

Structured sukuk instead of bonds. Sukuk gives you a stake in something physical, like a building or infrastructure, instead of loaning money and collecting interest.

Shariah boards oversee product design. A Shariah board checks each deal and has the power to reject or redesign it if it doesn’t meet Islamic rules.

This model is growing because more people are beginning to understand why is investment banking haram and want a system that’s built on fairness, transparency, and real economic contribution.

Common misconceptions

Misunderstandings about the permissibility of investment banking in Islam are common, especially among professionals entering the finance sector. Below are some of the most frequent misconceptions, along with clear, factual clarifications based on Islamic jurisprudence and market realities as of 2025.

| Misconception | Reality and Explanation |

|---|---|

| “If I’m not directly involved in interest, my job is halal.” | In Islam, even indirect assistance in haram activities is forbidden. This includes roles in IT, compliance, or HR that support riba-based products or services. Qur'an 5:2 warns against cooperating in sin and transgression. |

| “Donating part of my income to charity purifies my haram earnings.” | While charity is encouraged, it does not make impermissible earnings halal. According to the majority of scholars, income from haram sources cannot be cleansed through sadaqah or zakat. Repentance and seeking lawful alternatives are the prescribed actions. |

| “Islamic finance isn’t practical or globally recognized.” | As of 2025, the Islamic finance industry is valued at $3.69 trillion globally. Islamic banking assets are projected to hit $5 trillion, and sukuk issuance is expected to reach $200 billion this year. Islamic finance operates in over 80 countries and is regulated by global bodies like AAOIFI and IFSB. |

| “My role only involves advising, not executing transactions.” | Advisory roles that help structure riba-based deals or manage unethical portfolios are also not permissible. If your advice facilitates haram outcomes, it remains impermissible—even if you don't sign the final contract. |

| “It’s only temporary until I find a better job.” | While necessity (darurah) may be invoked in extreme hardship, it does not justify knowingly working in haram sectors long-term. Scholars advise immediate efforts to transition into permissible employment and reliance on tawakkul (trust in Allah) during the process. |

Understanding the broader context of Islamic finance and its application beyond investment banking

Understanding Islamic finance requires analyzing financial instruments from both investment and loan perspectives. For Muslim investors, the challenge is finding halal alternatives to conventional savings and investment tools. Certificates of Deposit (CDs) are generally haram because they offer fixed interest returns, violating the prohibition of riba. Similarly, conventional savings accounts, which generate interest, are also problematic. However, Islamic savings accounts that operate on profit-sharing models are considered halal. ISAs can be permissible if they avoid interest-bearing or haram investments, while 401(k) plans are acceptable when they invest in Shariah-compliant assets.

Loans and debt instruments present a different challenge, as they often involve riba. Credit cards are usually haram due to interest on unpaid balances, though some Islamic cards use fee-based models. Student loans are typically haram unless they are interest-free. Mortgages involving interest are also problematic, but Islamic mortgages like Murabaha (cost-plus) and Ijara (lease-to-own) offer riba-free alternatives. Shared ownership provides another solution by allowing co-ownership and gradual buyout without interest, emphasizing partnership rather than debt.

Another critical aspect is ensuring that your investment approach itself follows Islamic principles. The best way to do this is by choosing an Islamic trading account specifically designed to meet Shariah requirements. These accounts help you invest ethically across major markets such as stocks, Forex, and cryptocurrency. We have reviewed and compiled the essential features of the most reliable brokers that offer these accounts, which you can explore below.

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review |

Practical tips for muslims

Starting out in big companies or finance roles as a Muslim can be overwhelming, but practical steps grounded in your values can make all the difference.

Don’t just avoid haram, actively seek halal alternatives. Instead of just rejecting interest-based roles, look into less obvious but rewarding paths like Islamic investment banking, value-based startups, or ESG firms that fit with your beliefs.

Check where your salary and bonuses are really coming from. Even if the job feels fine, your stock options or incentives could be tied to haram sectors like conventional banks or alcohol companies.

Use your contract to stay ahead. When joining, ask for clauses that let you sit out projects involving unethical industries, it’s easier than backtracking later.

Secure a halal retirement plan early. Most company pensions invest in standard mutual funds. If they offer a self-directed plan, choose one with Islamic or ethical options.

Speak their language but stay grounded. Learn how to discuss finance or corporate goals confidently while staying true to your faith, that balance earns long-term respect.

Your support role in investment banking may still be haram

A lot of Muslims who wonder about investment banking only think about interest. But the truth is, the risk goes beyond just riba. If you’re working on a merger deal where a beer company buys another brand, you’re not just watching from the sidelines — you’re helping it happen. That deal spreads something clearly haram, and your work is tied to that result. Even if your role looks harmless on paper, if it helps launch IPOs for gambling firms or promotes companies selling alcohol, it becomes a part of something bigger. Titles like “compliance analyst” or “research associate” don’t mean you’re safe if the output fuels unethical growth.

There’s another layer most people ignore. Some scholars explain that even if you're not touching the interest directly, working in a bank that survives on it can still be wrong. Why? Because your effort supports the whole system. Whether you're fixing a server or making a marketing pitch, your work helps that machine run. Islam encourages us to step back from anything that strengthens something harmful. This doesn’t mean quitting finance altogether. It means choosing roles where your skills build something ethical and don’t quietly enable what you’d never defend openly.

Conclusion

The structure of conventional investment banking — based on interest-bearing instruments, speculative products, and support for non-halal industries, renders it haram under most Islamic rulings. The good news: With a global Islamic finance sector worth nearly $4 trillion, professionals now have meaningful, ethical alternatives. For Muslims serious about both career growth and religious integrity, halal investment banking offers a future built on fairness, equity, and faith.

FAQs

Can I study finance or investment banking as a Muslim?

Yes, studying finance is permissible as long as your intention is to seek beneficial knowledge and apply it within halal frameworks.

Is it permissible to intern at a conventional investment bank?

It depends on the role. If the internship involves direct participation in haram transactions (like interest-bearing instruments), it should be avoided.

Are robo-advisors and trading apps considered halal?

Not all are halal by default. Many robo-advisors and trading apps recommend or automatically invest in interest-bearing bonds, ETFs, or companies in haram sectors.

What careers in finance are clearly halal?

Careers in Islamic banking, takaful (Islamic insurance), Shariah auditing, fintech, and ethical fund management are considered halal. These roles avoid interest and speculation, promote transparency, and align with Islamic commercial ethics.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

A Robo-Advisor is a digital platform using automated algorithms to provide investment advice and manage portfolios on behalf of clients, often with lower fees than traditional advisors.