Understanding The Salam Contract In Islamic Finance

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

In Islamic finance, “what is a Salam contract?” is a common question, especially in sectors like agriculture where access to non-interest-based funding is critical. A Salam contract refers to a Shariah-compliant forward sale agreement in which the buyer pays the full amount in advance for goods that will be delivered later. This model helps farmers and small businesses secure working capital without relying on conventional loans. Institutional versions like a Parallel Salam contract have made it easier to scale this model across larger markets.

The Salam contract in Islamic banking is formally recognized as a forward sale method tailored to meet the needs of producers and suppliers. It enables buyers to support manufacturers, farmers, and traders by providing early payment for goods to be delivered at a future date. This advance funding solution has become particularly valuable in regions where Islamic banking is gaining ground. Over the years, adoption has accelerated across Islamic banks and fintech platforms in Southeast Asia, the Gulf Cooperation Council (GCC) countries, and North Africa. The continued expansion of Salam-based models demonstrates how Islamic finance adapts classical contracts to meet modern economic challenges while adhering to faith-based principles.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What is a salam contract?

A Salam contract is a forward agreement in Islamic finance where full payment is made upfront for goods delivered at a later date. The Salam contract's meaning lies in more than just timing, it’s a tool that gives sellers immediate liquidity and buyers price certainty, all within Shariah rules. Unlike speculative contracts, it requires clear terms on quality, quantity, and delivery. That’s why it’s ideal for industries like halal medicine or made-to-order goods where ethical funding is essential.

To understand how Salam works today, consider this unique Salam contract example. In Indonesia, farmers and fishermen receive financing through mobile-based Salam platforms. Buyers lock in future deliveries at fixed prices, while producers get the money they need without loans or interest. It also cuts out unnecessary middlemen. From honey and rice to small-scale agriculture, Salam is reshaping trade through simple digital tools and trust-based systems.

Salam contracts also act as a protective strategy in volatile markets. When currencies are unstable or inflation is high, Salam gives both sides stability. Sellers get early payment, and buyers avoid sudden price hikes, all without stepping into interest-based traps. A structure called Parallel Salam even allows third parties, like Islamic banks, to handle delivery without violating ethical principles.

Conditions of Salam contract

To align with Islamic legal principles, several essential rules must be observed when entering into a Salam contract:

Full upfront payment. The buyer is required to pay the full purchase price at the time of agreement, which ensures there is no uncertainty or deferred obligation regarding payment.

Standardized goods. The goods must be interchangeable and clearly described in terms of quality and quantity, items like wheat, oil, or metals, e.g. gold, are commonly used to meet these standards.

Definite delivery date and location. Both parties must agree on an exact delivery date and place in advance, eliminating ambiguity and setting clear expectations for fulfillment.

Eligible commodities. Only non-perishable, widely available goods are permitted; for example, grain, oil, and metal qualify, while custom or perishable items do not meet the conditions of Salam contract.

Avoidance of gharar (uncertainty). All contract terms must be clearly stated to prevent vagueness or dispute.

No involvement of maysir (gambling). The contract must avoid speculation or elements of chance that could result in one-sided gain or loss.

Exclusion of riba (interest). Profits should not be generated through interest or lending.

Each of these guidelines reflects the ethical and transparent framework that defines how Salam contracts function within Islamic finance.

Key features of Salam contracts

Advance capital to the seller

One of the most practical features of a contract of Salam is its ability to provide early-stage liquidity to producers in sectors where credit access is limited. This is especially vital in regions where formal financing is scarce. For example, the World Bank (2023) notes that around 70% of smallholder farmers do not have access to conventional banking services.

In Pakistan’s Punjab region, more than 60% of wheat farmers reportedly rely on Salam-based funding during the sowing season, benefiting from upfront cash for essential inputs.

By securing funds early, producers can avoid interest-based debt while covering the costs of seeds, fertilizers, labor, and fieldwork, well before harvesting begins.

Clearly defined obligations

Specificity is key in every transaction. A valid Salam contract in Islamic finance must include:

Quantity (e.g., 50 tons of grain).

Quality (e.g., moisture content not exceeding 12%).

Delivery date and place (e.g., August 1 at XYZ Storage Facility, Riyadh).

According to AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions), lack of detailed terms renders the contract invalid under Islamic financial law. Proper documentation ensures the agreement is enforceable, transparent, and aligned with Shariah principles, making it an essential risk control mechanism.

Restricted to tangible, fungible goods

Salam is restricted to goods that are measurable, standardized, and interchangeable across units.

Permitted items include:

Agricultural products like grains, sugar, or cotton.

Raw materials such as copper or aluminum.

Industrial inputs like cement or steel rods.

Based on data from the Islamic Development Bank, nearly 85% of Salam deals in the last five years have focused on these sectors, particularly in cross-border trade. A widely used example of Salam contract is when international buyers provide upfront funding to farmers or commodity producers, in exchange for assured delivery during the harvest period.

Legal and regulatory recognition

Several jurisdictions with mature Islamic finance ecosystems have formally integrated Salam into their financial systems. Countries like Malaysia, Saudi Arabia, Indonesia, and the UAE recognize Salam under both Shariah-compliant frameworks and national civil law.

As of 2024, Malaysia’s IFSA (Islamic Financial Services Act) lists Salam among approved Islamic financial instruments.

Bahrain’s Central Bank has also included Salam in its Fintech Regulatory Sandbox to support innovation in digital forward contracts.

This legal backing not only improves investor confidence but also increases institutional uptake of Salam contracts in regulated markets and Shariah-compliant funds.

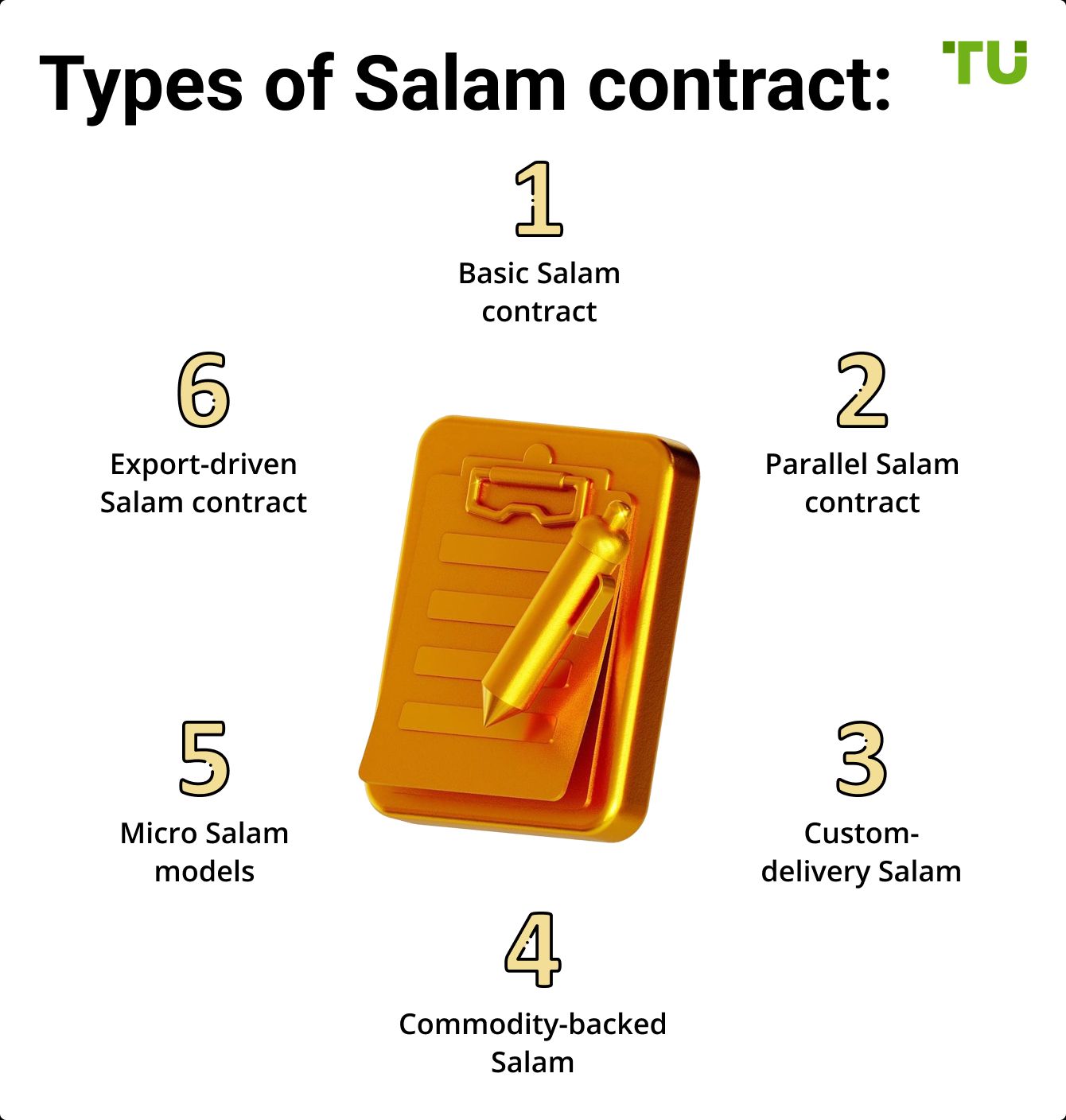

Types of Salam contract

Salam contracts come in more than one form, and understanding the different types can unlock serious advantages for traders and Islamic finance institutions alike.

Basic Salam contract. This is the original form where full payment is made in advance for goods to be delivered later, typically used in agriculture or manufacturing.

Parallel Salam contract. This involves two separate Salam contracts where the buyer in the first contract becomes the seller in the second, allowing for a chain of production without breaching Shariah rules.

Custom-delivery Salam. In this lesser-known setup, the delivery schedule is staggered over multiple dates. It's useful for perishable goods or projects with phased outputs.

Commodity-backed Salam. This type links the deal to a commodity index, allowing institutions to hedge price movements while still honoring the fixed-price structure.

Micro Salam models. Used in rural finance, this version allows pooling small orders from multiple farmers into a larger Salam contract, minimizing risk and improving access to markets.

Export-driven Salam contract. These are structured to support small-scale producers with international buyers. They help manage foreign exchange risks while securing upfront capital for raw materials.

Salam contract example

A commodity trader enters into a Salam contract with a wheat farmer during the planting season. Under the agreement:

Product. 50 metric tons of Grade A wheat.

Price. $400 per metric ton (total $20,000).

Payment. Paid in full on contract date: March 1, 2025.

Delivery. August 1, 2025, at a specified warehouse in Jeddah.

Specifications. Wheat must meet moisture and quality criteria as defined in the contract.

The trader, by paying upfront, secures wheat at a fixed price. The farmer gains early capital to buy seeds, fertilizer, and labor without resorting to interest-based loans. Upon delivery, the trader can either sell the wheat at market price or fulfill a resale agreement made through a Parallel Salam contract with a local food processor.

Why it works for traders:

Helps businesses secure stable pricing for goods, especially during periods of global commodity price increases.

Minimizes counterparty risk by setting clear terms for delivery and product inspection upfront.

Aligns with Shariah principles, making it appealing to institutions and investors seeking faith-based compliance.

This setup highlights the practical value of a Salam contract in Islamic finance, not as a tool for speculation, but as a responsible and ethical way to pre-finance genuine trade and production.

Salam in Islamic banking and finance

While the Salam contract in Islamic banking is often introduced as a simple advance payment agreement for future delivery, its real power lies in how it redefines liquidity and farmer-credit relationships in Islamic finance. Unlike conventional forward contracts, Salam is legally binding only when full payment is made upfront, which shifts the risk structure significantly. Banks using Salam don’t just provide capital, they lock in production with strict inspection criteria and delivery terms, creating a hybrid between financing and ethical procurement.

What’s rarely discussed is how Salam was historically used not just in agriculture, but in cross-border trade between merchants in Medina and the Levant. It enabled commodity financing before the goods were even produced, without violating Shariah restrictions on speculation. Today, institutions like the Islamic Development Bank have adapted this model to finance wheat, oilseeds, and even renewable energy components in developing nations.

Another important aspect is that Salam contracts can be paired with a Parallel Salam, allowing the bank to sell the goods to another buyer at a profit without tying the two contracts together legally. This opens up hedging opportunities while maintaining Shariah compliance. The trick lies in structuring delivery timelines and quality clauses so that the second sale doesn’t breach Islamic principles of gharar (excessive uncertainty). It's not just halal finance, it's precision-crafted risk management wrapped in religious ethics.

Benefits of Salam contract

Salam contracts offer more than just early payments, they give traders and producers real tools to handle uncertainty and build ethical supply chains.

Locks in costs during price spikes. Salam lets you fix the price early, which is a major win in markets like grains or metals where prices jump overnight.

Boosts small-scale producers' cash flow. Farmers or manufacturers can receive payment in advance, helping them buy raw materials without loans or interest.

Supports real economy transactions. One of the biggest benefits of Salam contract is that it ties finance directly to production, avoiding speculative trades completely.

Builds trust in long-term partnerships. Because both parties agree on clear terms from the start, it’s easier to build repeat relationships with fewer disputes.

Ideal for crisis-hit or inflationary regions. In places with unstable currencies or broken lending systems, Salam becomes a tool for stability and survival.

Challenges and considerations

Using Salam contracts can unlock early capital, but they come with technical traps that traders must spot early on.

Delivery location must be fixed. One of the most overlooked risks is vague or shifting delivery points which can void the contract under Shariah rules.

Quality has to be clearly defined. If you're vague about grade or specifications, especially in commodities like grain or metals, disputes are almost guaranteed.

Advance payment isn't just symbolic. You must pay in full at contract signing. Any delays or part payments turn it into a deferred sale, which isn’t allowed.

Timeframe affects market exposure. If delivery is set too far out, your risk rises in case of supplier defaults or major price swings in volatile sectors.

How Salam contracts link to other Islamic finance models

To truly grasp how the Salam contract fits within Islamic finance, it helps to explore its connection with other Shariah-compliant structures that serve distinct roles across various sectors. For instance, while Salam facilitates pre-paid purchases of goods, Istisna is typically used for commissioned manufacturing or construction, allowing staged payments over time.

On the investment side, Mudarabah offers a profit-sharing model ideal for venture financing, whereas Musharakah enables joint ownership, often in long-term projects. For asset financing, Murabaha is used when goods are bought and resold at a profit margin, while Ijarah operates like leasing.

Each of these frameworks — be it Wakalah for agency-based contracts or Musharakah for equity partnerships — serves a specific purpose in faith-compliant finance. Together, they form the building blocks of a versatile and ethically grounded financial system, with Salam standing out as a tool for liquidity and price stability in commodity trade.

If you're also exploring shariah compliant investments outside traditional banking, whether in stocks, crypto, or the Forex market, it’s a good idea to consider using an Islamic trading account. This helps ensure your investments stay aligned with your religious values. Below, you'll find a curated list of brokers that offer Shariah-compliant accounts. Take a moment to compare their features and find the one that suits your needs best.

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review | |

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review |

Boost pre-delivery profits through hybrid Salam structures and micro-supplier pools

If you’re new to Salam contracts, don’t just focus on using them with a single supplier. A powerful but lesser-known tactic is pooling micro-suppliers under one Salam framework. Instead of locking a full advance with one producer, businesses are now distributing risk and production across smaller players while still complying with Shariah terms. This method creates agility and volume flexibility, especially in sectors like agri-tech or sustainable textiles, where delays or crop variances can ruin a one-supplier model.

Another game-changer is combining Salam with on-chain audits. Smart contracts now track delivery status, quality control checkpoints, and even environmental compliance in real time. New platforms allow these audits to be embedded into the Salam terms, so the buyer gets more than just a delivery, they get assurance. Beginners often skip this layer, but it can make or break your margins when dealing internationally. Think of it as Salam 2.0: ethical finance with blockchain accountability built in.

Conclusion

The Salam contract continues to offer a practical, ethical, and Shariah-compliant solution for forward sales. Especially in sectors with seasonal cycles like agriculture or manufacturing, it provides a fair mechanism to distribute risk and liquidity. With growing regulatory support and technology integration, Salam structures are expected to expand across both retail and institutional Islamic finance ecosystems.

FAQs

Can a Salam contract be used for services like consulting or digital work?

No, Salam contracts are restricted to tangible, measurable goods. Services, real estate, or perishable items cannot be traded using Salam structures.

How do Salam contracts help stabilize commodity prices?

By fixing the price at the time of payment, Salam contracts protect both parties from future market fluctuations, promoting stability in supply chains.

What happens if the seller fails to deliver in a Salam contract?

Failure to deliver leads to contract termination, refund obligations, or replacement goods, often overseen by a Shariah board or agreed mediator.

Are Salam contracts accepted by global financial regulators?

Yes, in countries with Islamic finance frameworks like Malaysia, Saudi Arabia, and Bahrain, Salam contracts are legally recognized and regulated.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.