Top No-Deposit Bonuses To Use

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

If you're too busy to read the entire article and want a quick answer, the best broker with no-deposit bonus is Plus500. Why? Here are its key advantages:

- Is legit in your country (Identified as United States

)

- Has a good user satisfaction score

- Potential to earn real profits

- Opportunity to gain experience on the platform risk-free

The best no-deposit bonuses in 2025 are:

- XM Group - Best Order Execution (99.35% of orders are executed nearly instantly)

- Bybit - A global cryptocurrency exchange offering Forex and CFD trading through the MetaTrader 5 platform, with leverage of up to 1:500.

- InstaForex - Biggest Forex bonuses (up to 100% per deposit)

- Tickmill - Best for EUR/USD trading (avg spread is 0.1 pips)

- WForex - Best for trading with a small capital (minimum deposit of $1)

- xChief - Cent accounts, 0 pips spreads, leverage up to 1:1000, and bonus offers

Tired of watching the Forex market from the sidelines? A no-deposit bonus could be your ticket to becoming an active trader - without having to commit a cent of your own money. Brokers tempt new traders with these free money offers. But not all bonuses are as generous as they first appear. Some come bundled with tight restrictions that make scoring real profits an uphill task.

This guide sorts the best from the rest. We've analyzed today's top no-deposit bonuses from leading Forex brokers. We lay out key details like amounts, terms and conditions so you can identify the opportunity that best fits your trading goals. For beginners, it's a no-brainer way to learn trading hands-on without exposure.

Best Forex no-deposit bonuses 2025

A Forex no-deposit bonus allows you to start trading live without depositing funds, making it a great way to explore the market risk-free. These bonuses, offered by brokers to attract new clients, vary in size, terms, and usability. However, they often come with restrictions, such as limited profit potential or withdrawal conditions. To maximize benefits, choose a reliable broker, carefully read the terms, and use the bonus to practice strategies or explore the platform. By understanding the rules and planning effectively, you can turn a no-deposit bonus into a valuable trading opportunity.

No-deposit bonuses are a popular tool Forex brokers use to attract and retain traders. These offers provide a risk-free way to start trading, perfect for testing strategies, building skills, or recovering from losses.

| Program name | Expiration date | Bonus Size ($, %) | No-deposit | Accessible to | TU Trust level | Open an account | |

|---|---|---|---|---|---|---|---|

| No Deposit Welcome Bonus $30 | Unlimited | $30 | Yes | Excluding clients under CySEC, ASIC, and DFSA jurisdictions | 4,4/5 | Open an account Your capital is at risk. |

|

| 20 USDT Welcome Gifts | Unlimited | 20 USDT | Yes | New clients | 4,9/5 | Open an account Your capital is at risk. |

|

| $1000 Startup No Deposit Bonus | Unlimited | $3,500 | Yes | New clients | 4,5/5 | Open an account Your capital is at risk. |

|

| $30 Welcome Account | Unlimited | $30 | Yes | Except European Union | 4,82/5 | Open an account Your capital is at risk. |

|

| Bonus $10 Free | Unlimited | $10 | Yes | New clients | 3,56/5 | Open an account Your capital is at risk. |

|

| $100 No-Deposit Bonus | Unlimited | $100 | Yes | New clients | 2,69/5 | Open an account Your capital is at risk. |

XM Group - No Deposit Welcome Bonus $30

XM offers a "Trading Bonus" promotion, giving new clients from Oman, Singapore, Malaysia, UAE, Kuwait, Bahrain, and Bruneia $50 bonus without requiring a deposit. In certain regions, new clients are eligible for a $30 No Deposit Bonus, This bonus is credited automatically upon account opening and can be used for trading. Profits made from the bonus can be withdrawn, though the bonus amount is deducted proportionally upon withdrawal. The bonus is valid for 30 days. This promotion is not available to clients under the jurisdictions of CySEC, ASIC, and DFSA.

- Register a new trading account

- Complete the account verification

- Claim the Bonus

- Complete the SMS verification

Bybit - 20 USDT Welcome Gifts

Bybit's 20 USDT Welcome Gifts promotion is designed to reward new users who join the platform. The offer celebrates Bybit reaching 15 million users, providing newcomers with a 20 USDT coupon upon registration. This incentive aims to familiarize new users with the platform's features and encourage their active participation in trading.

- Sign up.

- Receive a USDT coupon as a reward.

InstaForex - $1000 Startup No Deposit Bonus

The $1000 STARTUP bonus is a no-deposit bonus that allows new clients to start trading on Forex without any initial investment. Following registration, verification, and contacting customer service, the bonus amount is automatically credited to the client's account. The bonus can be used for trading purposes only and cannot be withdrawn. However, the profits made with the bonus can be withdrawn at any time. The bonus is available for all account types on the MetaTrader 4 and MetaTrader 5 platforms, and the bonus is valid for 7 days and can be canceled at any time.

- Register Live account

- Apply for the bonus

- No verification needed

Tickmill - $30 Welcome Account

The Welcome Account is a special offer that allows new clients to experience trading with Tickmill without any risk. The clients receive a $30 bonus, which can be used for trading on over 80 instruments. The bonus is valid for 60 days, and profits made from the bonus can be withdrawn after trading at least 5 lots. Profits not less than $30 and profits not more than $100 can be withdrawn from the welcome account to the client’s wallet. The bonus is available for trading for 60 days from the day of opening. Once 60 days have passed, trading will be disabled, but the account will still be accessible for an additional 14 days to claim the earned profit. The offer is limited to one account per client and is not available in certain countries.

- Complete the registration form

- Login into the account with credentials sent to you by email address

- Wait until the bonus is added

- * available for trading for 60 days from the day of opening

WForex - Bonus $10 Free

World Forex offers a $10 non-deposit welcome bonus for new clients. To participate, register on the site, complete the personal information form, verify your phone number and identity, open a trading account, and apply for the bonus. The bonus is available for W-PROFI, W-CENT, and W-OPTION account types. The $10 bonus can be used for trading, and profits earned can be withdrawn once a specified trading turnover is achieved. This promotion provides a risk-free opportunity for new clients to start trading and earning without any initial financial investment.

- Register and verify your account

- Open one of the trading accounts W-PROFI, W-CENT, W-OPTION

- Apply for a bonus

xChief - $100 No-Deposit Bonus

This is another promotion provided by ForexChief. It allows new clients to receive a $100 bonus without making a deposit. Once account verification is completed, the client will automatically receive the No-Deposit bonus via the xChief mobile application. The $100 No-Deposit bonus is only available for DirectFX and Classic+ accounts, and once credited to the client's account, it can be used to conduct trading tests on the platform. This bonus to available to a selected countries.

- Open DirectFX or Classic+ account

- Fulfill the verification process

- Download the mobile app to claim the bonus

- Choose the "No-Deposit Bonus" option

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Traders have varying views on no-deposit bonuses:

Some see them as an effective way to earn profits.

Others use them to fund a new interest in trading, potentially leading to long-term investments.

Many view them as motivation to engage actively in Forex, meeting specific broker conditions like completing transactions or trying new instruments.

These perspectives highlight the genuine appeal of no-deposit bonuses, especially as motivators for exploring the Forex market. For experienced traders, these bonuses offer a low-risk opportunity to test a new broker’s platform, tools, and trading conditions without risking personal funds.

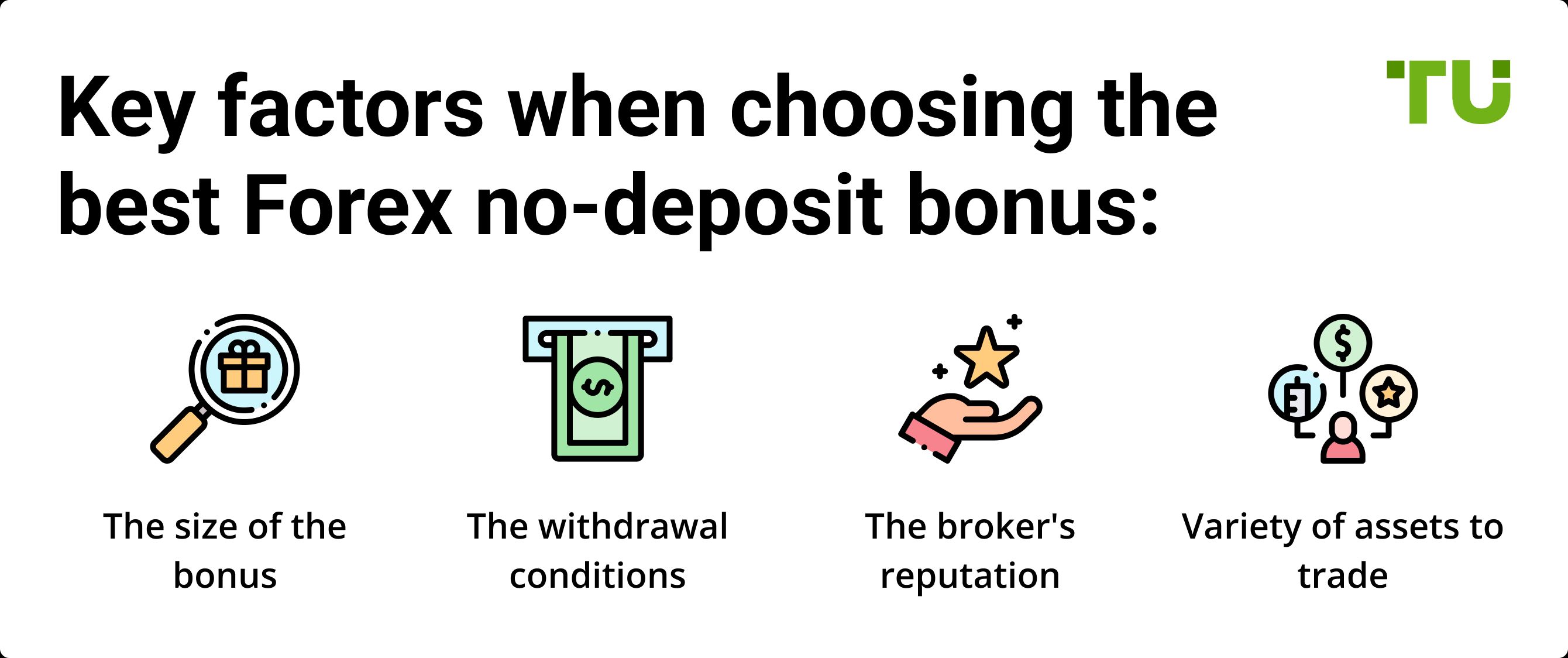

How to choose the best Forex no-deposit bonus

When looking for the best no-deposit bonus, you first need to consider whether the bonus suits your trading style. If you're a scalper or day trader, for example, then you'll need a broker that doesn't restrict your trading strategies. Some brokers offer bonuses that can only be used on certain types of trades, so make sure you read the fine print before signing up.

The size of the bonus

When it comes to choosing the best Forex no-deposit bonus, size does matter. The larger the bonus, the more trading capital you will have to work with. This can be a great advantage, giving you the opportunity to make bigger trades and potentially earn more profits.

However, it is important to remember that a larger bonus also comes with more risk. Be sure to carefully consider the size of the bonus in relation to your overall trading strategy before making a decision. Some brokers offer huge bonuses, but they may also require a correspondingly large deposit.

The withdrawal conditions

Some brokers will stipulate that you need to make a certain number of trades before you can withdraw your bonus or that you need to achieve a certain level of profitability. Others will place no restrictions on withdrawals, meaning that you can claim your bonus as soon as you've met the minimum deposit requirements. Obviously, the latter is the more favorable option, so be sure to check the small print before signing up for any bonus offers.

The broker's reputation

One way to do this is to check out online forums and see what other people are saying about the broker. If you see a lot of complaints or negative reviews, that's a red flag that you should avoid doing business with them.

It's also important to choose a broker that is regulated by a reputable organization, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US. You can also check out the broker's website to see if they provide any additional information about their regulation or other credentials.

Variety of assets to trade

When choosing the best no-deposit Forex bonus, it's important to consider the variety of assets that are available to trade. Some brokers offer a limited selection of assets, while others offer a wide range. The key is to find a broker that offers a good mix of assets that you're interested in trading.

For example, if you're primarily interested in currency pairs, you'll want to find a broker that offers a broad selection of currency pairs. On the other hand, if you're more interested in stocks and commodities, you'll want to find a broker that offers a good selection of those assets as well. In addition to the variety of assets, it's also important to consider the leverage that's available.

How to get the best Forex no-deposit bonus

How do you go about getting the best Forex no-deposit bonus? Here are a few tips:

Do your research

There are a lot of Forex brokers out there, and not all of them offer no-deposit bonuses. So, take some time to research your options and find a broker that fits your needs.

Read the fine print

Once you've found a broker that offers a no-deposit bonus, make sure you read the terms and conditions carefully. Some brokers require you to trade a certain amount before you can withdraw your bonus, so it's important to know what you're getting into before you deposit any money.

Make a plan

No-deposit bonuses are typically small - usually around $25 - so it's important to have a plan for how you're going to use it. If you're just starting out, you might want to use it to test out different trading strategies. Or, if you're more experienced, you could use it to supplement your income from other sources.

Read customer reviews

Customer reviews can give you an insight into the pros and cons of different Forex brokers and can help you to find the right broker for your needs. However, it's important to take customer reviews with a grain of salt, as they may not always represent the broader market.

In addition, some Forex brokers may offer incentives for customers to write positive reviews, so it's important to do your own research as well. With that said, customer reviews can be a valuable resource when choosing a Forex broker and should definitely be considered as part of your decision-making process.

Can I withdraw my Forex bonus

Many people are wondering if they can withdraw their Forex bonus. The answer is yes. In some cases, you can withdraw not only your winnings but also the bonus itself. However, there are certain conditions that must be met for you to be eligible for withdrawal.

For example, most brokers require that you trade a certain amount of money before you can withdraw your bonus. The typical range is from $4 to $20. So if you're thinking about withdrawing your Forex bonus, make sure to check with your broker first to see what the requirements are.

Risks and warnings

Strict conditions. Many brokers impose limitations on how bonuses can be used, such as requiring a set number of trades or restricting withdrawals until specific criteria are met.

Low profit potential. Some bonuses may cap the amount of profit you can withdraw, limiting their overall value.

Scam brokers. Not all brokers offering no-deposit bonuses are trustworthy. Always verify the broker's reputation and regulatory status before accepting any offers.

Overconfidence. Bonuses can encourage excessive risk-taking, which may lead to poor trading habits or unexpected losses.

Limited timeframes. Some bonuses expire quickly, leaving little time to meet the conditions and benefit fully from the offer.

How to maximize no-deposit Forex bonuses in 2025 and test trading strategies

When it comes to no-deposit offers, many beginners rush into them without reading the full details. Focus on the withdrawal terms and trading rules. While it might seem like free money, there are often hidden requirements like trading a certain volume before you can withdraw any profits. Make sure you fully understand the conditions — especially around time constraints and trading volume. Look for brokers that offer clear, transparent terms and a reasonable volume requirement to ensure you’re not caught off guard by restrictions later.

Another effective way to use no-deposit bonuses is to experiment with different trading strategies without risking your own funds. It’s a great chance to try techniques like scalping, swing trading, or using various technical indicators. But don’t get carried away — avoid overusing leverage just because it's not your own money. Treat the bonus as a learning opportunity, sticking to proper risk management principles. This is your chance to gain experience, adapt your strategies, and prepare for real trading without the pressure of losing your own capital.

Methodology for compiling our ratings of Forex brokers

Traders Union applies a rigorous methodology to evaluate brokers using over 100 quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

-

Regulation and safety. Brokers are evaluated based on the level/reputation of licenses and regulations they operate under.

-

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

-

Trading instruments. Brokers are evaluated on the range of assets offered, as well as the breadth and depth of available markets.

-

Fees and commissions. All trading fees and commissions are analyzed comprehensively to determine overall costs for clients.

-

Trading platforms. Brokers are assessed based on the variety, quality, and features of platforms offered to clients.

-

Other factors like brand popularity, client support, and educational resources are also evaluated.

Find out more about the unique broker assessment methodology developed by Traders Union specialists.

Conclusion

No-deposit bonuses offer a unique opportunity for both new and experienced traders to explore Forex trading without the need for an initial deposit. They are an excellent way to test brokers, practice strategies, or get acquainted with trading platforms. However, to maximize their potential, traders must carefully review the terms and conditions, as these bonuses often come with restrictions. By choosing reputable brokers and using the bonuses strategically, traders can enhance their trading journey while minimizing risks.

FAQs

How long do I have to use the bonus funds?

Time limits range from 1-3 months usually. Funds expire if not used or conditions met within the time frame.

Do I need to deposit my own money to claim a bonus?

No, bonuses are no-deposit by definition. However, some brokers require a minimum deposit to withdraw profits.

Can I claim multiple bonuses from one broker?

No, brokers often restrict traders to one bonus per account or IP address.

What are the requirements to get my profits?

Trading volume requirements typically range from 10 to 50 lots before earned profits can be withdrawn. Some brokers have additional deposit requirements too.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

The CFTC protects the public from fraud, manipulation, and abusive practices related to the sale of commodity and financial futures and options, and to fosters open, competitive, and financially sound futures and option markets.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.