How To Transfer Money From India To The USA

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The fastest and safest way to send money from India to the USA in 2025 depends on your priorities. For speed and low fees, Revolut and Wise are top picks, offering competitive exchange rates and secure transfers within 1–3 days. For large or high-compliance transfers, Indian banks using SWIFT remain reliable but slower. Crypto platforms like Binance P2P are quick and cheap but carry higher risks. Choose based on how fast, secure, and regulated you want the process to be.

When sending money to another country, the first concern is usually ensuring that the funds arrive safely with the intended recipient. Beyond that, people also focus on factors like timing, cost, and conversion value. In this guide, you’ll learn:

How to choose a reliable platform for international money transfers, especially from India to the USA.

Which channels are best for converting INR to USD and how the recipient's bank account in the United States receives the funds.

How to navigate the transfer process using different financial tools or intermediaries.

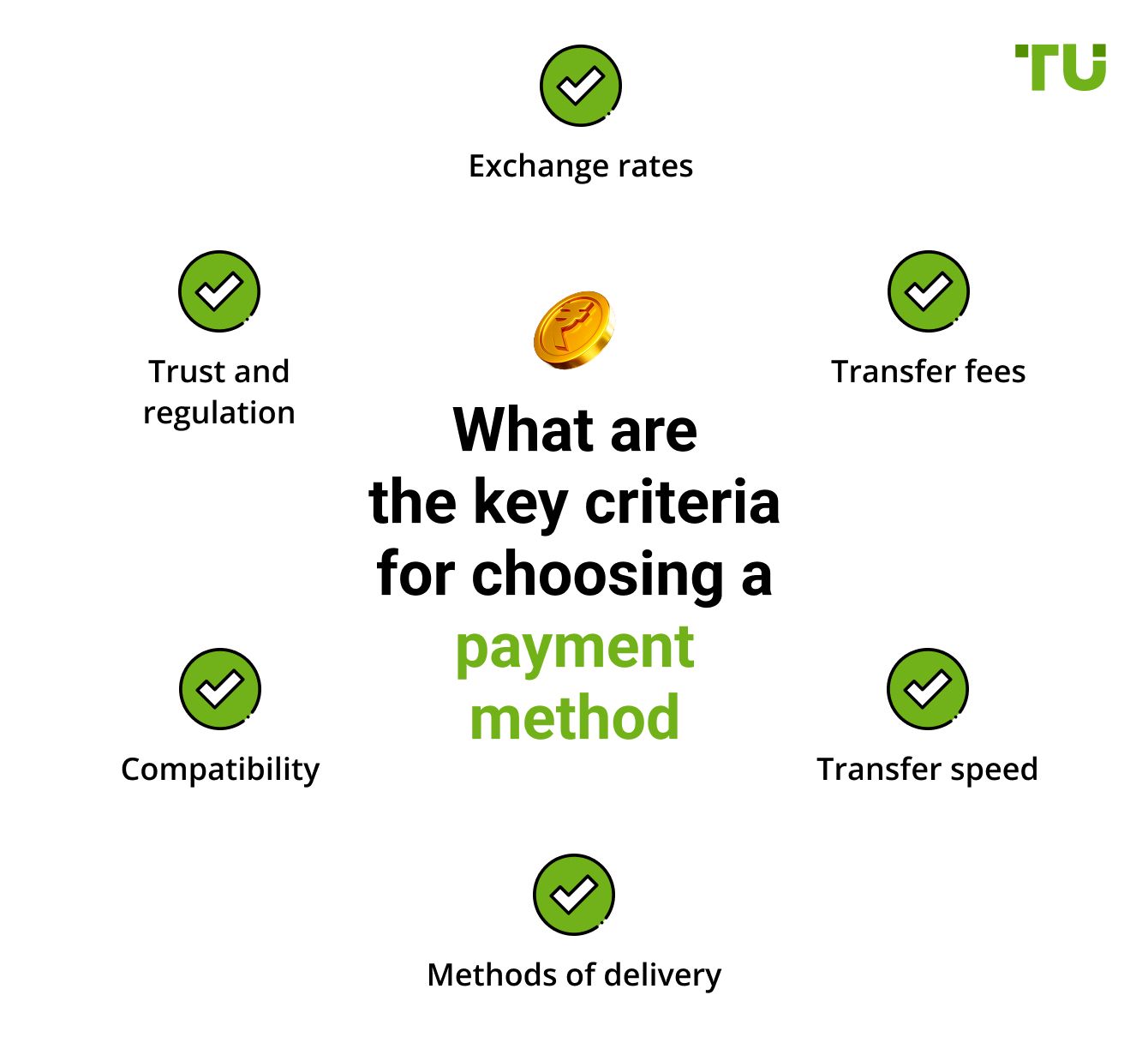

Criteria for choosing payment options for transferring money from India to the USA

When choosing how to transfer money internationally, it's important to evaluate several core elements:

Exchange rates. This will affect how much value the recipient ultimately receives in USD. Platforms that provide real-time, competitive currency conversion should be prioritized.

Transfer fees. Understand the cost structure. Some providers charge flat rates, while others use tiered or percentage-based models.

Transfer speed. Delivery time can range from a few minutes to several days. Factors like the provider’s network or number of intermediaries impact timing.

Methods of delivery. Some services allow direct bank transfers or enable transfers via a debit card deposit, while others rely on third-party wallets or agents. Make sure the method works for the recipient.

Compatibility. Ensure the recipient can access the funds through either a bank deposit or linked card at ATMs in the U.S.

Trust and regulation. Always use platforms backed by a regulated financial institution, preferably one licensed and monitored by the Reserve Bank. That ensures secure handling of your funds.

Rules and regulation

The total market capitalization of listed companies in India is approximately $4.8 trillion, ranking it among the top 5 globally.

Major stock exchanges

The National Stock Exchange (NSE), headquartered in Mumbai, is India’s premier marketplace for equities and derivatives. Known for its advanced electronic trading system, it plays a key role in capital movement that may precede international money transfers and transfer funds abroad.

The Bombay Stock Exchange (BSE), also located in Mumbai, holds the distinction of being Asia’s oldest stock exchange. As of 2021, it became the fastest globally, with a trading speed of 6 microseconds - drawing attention from global financial institutions and those investing with intent to later remit money or convert holdings into foreign currency.

Regular trading hours for both NSE and BSE are from 9:15 AM to 3:30 PM, Monday through Friday. These operational times guide many strategic financial decisions, including equity exits and subsequent bank transfers or sending money abroad via linked bank account setups.

Market overview

As of mid-2025, the NIFTY 50 tracks fifty influential companies across industries and represents more than 55% of the NSE’s total value. Market rallies or corrections often prompt domestic investors to transfer money from India to capitalize on global investment opportunities.

The BSE 30 (SENSEX) will see Bharat Electronics Ltd. and Trent Ltd. added by June 2025. These inclusions reflect the ongoing evolution of India’s financial landscape and its link to international money transfers made following stock movements.

On average, NSE and BSE see daily trades worth ₹1.30–1.65 lakh crore. These fluctuations often influence currency exchange decisions, especially when investors aim to hedge against volatility or liquidate holdings.

Prominent sectors such as Information Technology, FMCG, Banking, and Pharma maintain dominance in trading volumes. These industries are tightly connected to foreign remittance flows and profit conversions into U.S. dollars.

Companies like Reliance Industries, TCS, and HDFC Bank continue to bolster India’s economy and frequently prompt cross-border bank account funding by investors reinvesting their profits internationally.

India’s booming retail participation, now exceeding 110 million active equity accounts as of May 2025, is fueled by easy digital access and fintech apps. This shift also encourages more people to use digital tools for online money transfer, including remitting earnings or gains.

Regulations

Legal provisions and banking protocols to follow for sending money abroad: Overseen by the Reserve Bank with clear caps and permitted uses.

Regulated under the Income Tax Act, ensuring accountability for high-value or frequent money transfers.

Necessary documentation includes: recipient's account details (name, account number, routing number, SWIFT code), transfer intent and amount, proof of relationship or purpose (if for education expenses or medical treatment)

Participating entities: recognized Indian banks like ICICI Bank, trusted service providers offering wire transfers, bank deposits, or debit card deposit

Mandatory use of compliant digital platforms and accuracy in recipient details to avoid transaction failure or hold-ups.

Ultimately, successful international money transfers rely on using secure, compliant platforms, paying attention to transfer costs, and ensuring that recipient details are accurate to avoid errors or delays.

Best ways to send money from India to the USA

Regardless of the currency exchange involved, choosing the right intermediary is essential when you transfer money from India. This could be an international financial institution, a domestic bank, or a licensed service provider that facilitates cross-border transactions. Available options include SWIFT code transfers, wire transfers, Visa or Mastercard networks, e-wallets, and other online transfers.

The right method depends on your specific priorities, whether that's speed, ease of use, or minimizing transfer fees. Below are some of the most commonly used methods for sending money abroad to a recipient's account in the USA from India.

Payment systems

Digital payment platforms like PayPal, Payoneer, and others using debit card or credit card networks have become popular. These services allow users to remit money quickly, often supporting mobile phones and online access for convenience. They also accept bank details from both sender and recipient, ensuring seamless delivery.

Some platforms even support direct card-to-card transactions, regardless of the payment method used by either party. You simply need the recipient details, such as their card or account number, to proceed with the transfer.

Alternatively, you can open an account with the platform, link it to your bank account number or debit card, and transfer funds within its ecosystem. This internal setup enables faster transfers, especially when users are verified. It also helps avoid delays caused by time zones or system compatibility issues.

Banks

Conventional bank transfers are still widely used for their security and compliance. Most Indian banks, including ICICI Bank, support transfer of money internationally using the globally recognized SWIFT code system. This allows users to send money internationally to nearly any destination.

However, banks usually apply higher service charges and require extra documentation, particularly for large transfers. They also follow strict regulations laid out by the Reserve Bank and provisions of the Income Tax Act. In some cases, proof of current income or the purpose of the remittance, such as education expenses, must be submitted.

Despite the slower speed and additional steps, banks remain ideal for secure outward remittances, especially for high-value transfers or compliance-heavy purposes. Many banks now partner with digital providers to offer hybrid models, combining the assurance of a traditional bank with the speed of modern tech, for transferring money from India to destinations like the USA.

Cryptocurrency peer-to-peer transfers

Using cryptocurrency platforms such as Binance or HTX offers an alternative to traditional channels. These systems allow users to send money internationally with speed, often supporting multiple currencies and offering lower costs through peer-to-peer networks.

Both sender and recipient must complete identity verification on their chosen foreign currency exchange platform. Transactions are then matched with a counterparty who offers a favorable exchange rate and a good reputation. This arrangement helps reduce transfer fees through competitive bidding.

After selecting a counterparty, the sender deposits Indian rupees via bank deposit or debit card deposit. Once confirmed, the counterparty releases cryptocurrency (like USDT or another stablecoin) into the sender’s wallet. The sender can then forward this to the overseas recipient, who sells it locally for USD, sending it to their bank name, account, or digital wallet.

Though the process is fast, often under 10 minutes, it comes with risks, as these platforms usually fall outside the scope of Reserve Bank regulations. For financial year reporting, users must also track gains or losses and any tax collected to stay compliant.

Western Union

Western Union remains one of the most recognizable names for transfer money internationally, especially for those who prefer face-to-face service. Users can visit a physical branch in India to send money and provide the routing number or personal info of the recipient in the USA.

Funds can be picked up in cash at a U.S. Western Union location or deposited directly into the recipient’s bank account number. Some Indian banks also integrate Western Union into their digital platforms, supporting wire transfers and even debit card deposit services.

Do note, though, that Western Union charges a flat fee and caps the transfer amount at $5,000 for each transaction, in line with Reserve Bank limits. Documentation such as bank details, the purpose of the transfer, or tax credit eligibility may be required, especially for payments related to education expenses or family support abroad.

Best payment systems and transfer methods from India to the USA

Sending money abroad via digital platforms remains the most widely used option for international money transfers. These services are commonly used to transfer money for online purchases, pay for overseas services, support close relatives, business associates, or cover tourism-related expenses. Below is a review of several trusted service providers recognized for their strong reputations, competitive rates, and fast processing of funds to the recipient's account.

Wise

Wise is a payment system from the UK, licensed by the FCA, and one of the most reputable international regulators. To date, the system's services are used by more than 13 million people in more than 150 countries. Due to the large number of users, the system can offer the best exchange rates with relatively small fees.

Advantages of Wise payment system:

A multi-currency account that supports more than 50 currencies. Unlike many other systems, using Wise you can receive and send money in major currencies without the need for conversion.

There is a guaranteed exchange rate for most transfer options. This means that the exchange rate can be fixed for a short time interval, which protects against high volatility.

You can also use a service to notify you about changes in the exchange rate.

The transfer speed averages 1-3 days, and internal payments take place within a few hours.

Revolut

Revolut is a digital financial platform operating in more than 200 countries. The number of users is more than 20 million private clients and more than 950 legal entities. The platform supports the conversion and transfer of more than 30 currencies.

Advantages of Revolut payment system:

Transactions with cryptocurrency without commission.

No fees for most transactions.

A larger range of additional services for private clients: investing in metals and cryptocurrencies, personal accumulative virtual safes, and booking accommodation with cashback up to 10%.

The platform offers four rate plans, including the standard one, which is free. Paid accounts additionally offer various insurance services, a small deposit interest rate, accounts for children, one free SWIFT transfer per month, etc.

Curve

Curve is a multi-card wallet that allows you to add more than 100 payment cards to one app. This is how it works: you have analyzed the conditions of payment systems and decided that the "A" payment system is suitable for international settlements with customers or online stores because it offers the most favorable exchange rate. You prefer to use a "B" bank card for foreign trips due to good cash back and small withdrawal fees. Then, you add cards to the app, order a Curve universal card, and activate the desired card in the app.

Advantages of the aggregator:

Favorable conversion conditions.

Cashback is available when paying within partner networks.

Free cash withdrawal in the USA and Europe within the partner ATM network.

On the platform's website, you can find information about card maintenance fees and services that are included in a particular rate.

Best payment options compared

To identify the most effective way to transfer money from India to the USA, TU analyzed multiple digital platforms using their official cost calculators. A sample payment of 10,000 Indian rupees was sent across various systems at the same time to assess key factors such as transfer fees, exchange rates, and the total amount credited to the receiver’s bank account number.

| Amount received by the recipient (USD) | Fee (INR) | Transaction time | |

|---|---|---|---|

| Wise | 119.33 | 329.94 | 3 days |

| Revolut | 122.98 | 0 | 3 days |

| Skrill | 119.81 | 0 | 1 day |

| Instarem | 119.06 | 320 | 2-3 days |

| Western Union | 122.70 | 0 | 1 day |

How to convert INR to USD using a payment system

The process of sending money from India through online services generally includes a few structured steps:

Start by choosing a trusted service provider. It’s important to go beyond the obvious, such as delivery speed and fee transparency. You should also ensure that the platform supports your preferred payment methods like debit card, bank transfers, or account-based funding. Some platforms also minimize unnecessary conversion stages and reduce dependence on intermediaries between the sender and receiver’s bank account.

You’ll need to create and verify an account with the selected platform. Most providers ask you to link a debit card deposit method or connect an Indian bank account number registered in your name. Third-party cards or shared accounts are often rejected. This verification is required before you can transfer any funds, regardless of destination.

Once your account is active, add funds in Indian rupees. If your base currency is different, say USD, the platform will process the currency exchange using its applicable competitive rates. The money is then automatically converted before completing the transaction, ensuring clarity and minimizing loss during the conversion.

You can then send money directly to the receiver. Most systems allow you to transfer money internationally either to another platform user or straight to a bank deposit destination, such as the recipient’s card or bank name. You’ll typically need to enter the routing number, SWIFT code, and account number of the recipient for successful delivery.

What to do if the recipient didn't receive the money but the money was debited from your account?

In such cases, the financial institution or platform generally reverses the amount back to your account. If that doesn’t happen, both parties should immediately contact customer service. Each transaction carries a tracking ID that indicates if it's complete, on hold, or failed. You can also request a refund for any transfer fees incurred if the funds were not delivered.

Conclusion

There’s no universal solution for outward remittances. Each platform has its own benefits, limitations, and cost structures. The best choice will often vary depending on factors like transfer destination, purpose (such as medical treatment, current income, or other purposes), or whether you're sending to close relatives. Platforms may also apply rules based on your residency status, such as whether you are a resident individual or a resident Indian.

To ensure a smoother experience, always compare options before you send money from India. Verify how well the platform fits your needs, check if it complies with the Income Tax Act, and make sure the reserve bank guidelines are met. If you're expecting a tax credit, ensure the documentation supports that purpose. In some cases, using multiple providers helps lower cost and expands access to better low cost remittance channels.

FAQs

Which is the most effective payment system for sending money internationally?

There’s no one-size-fits-all. Each service provider offers different transfer fees, exchange rates, and speeds. Choose one that fits your needs and supports your preferred payment method and recipient's account.

What should I consider when choosing a payment system?

Focus on what matters most, speed, cost, or reliability. Many users check how much money the recipient actually receives, system trustworthiness, and available bank transfer or card deposit options.

Should I use banks, payment systems, or cryptocurrency for international transfers?

Banks offer high security but come with strict limits and high costs. Payment systems provide flexibility and lower fees. Cryptocurrency P2P platforms offer speed and great exchange rates, but come with higher risk and less regulation.

What extra features do payment systems offer?

Many include perks like cashback, low-cost insurance, interest on balance, investment tools, and discounts for using partner networks.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).