Is Forex Trading Halal Or Haram? Complete Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Forex trading is considered halal by certain Islamic scholars when specific conditions are met, such as conducting spot trades, avoiding any form of interest, and trading with a clear and purposeful approach. On the other hand, some believe it is haram because of its speculative aspects, the high level of risk involved, and the frequent use of leveraged positions.

More and more Muslim traders are exploring Forex, hoping to grow wealth while staying within faith boundaries, but people still have one key question that is whether Forex trading is halal or not. Some say currency trading is fine if done right, while others worry about interest charges, leverage traps, and trades that feel more like gambling than investing. This guide helps you figure out what’s clean and what’s not so you can trade in a way that fits with Islamic values without cutting corners.

Risk warning: Forex trading carries high risks, with potential losses including your entire deposit. Market fluctuations, economic instability, and geopolitical factors impact outcomes. Studies show that 70-80% of traders lose money. Consult a financial advisor before trading.

Is Forex halal or haram?

Forex trading can be both halal or haram, and the issue with it isn’t just about buying and selling currencies. It's about how it's done. Many brokers operate on models that involve interest-based overnight swaps, even if the trader never actively agrees to it. These seemingly small charges are rooted in riba, which is strictly forbidden in Islam. As the Qur'an states: "Allah has permitted trade and forbidden riba (usury)." (Qur'an, 2:275)

Even if you close trades within the day, platforms can apply hidden swap rules based on time zones or rollovers. This makes it critical for traders to verify if their broker truly offers a swap-free Islamic account or just markets it that way without real Shariah oversight.

Another layer often ignored is the concept of qabdh (possession) in Islamic finance. According to most scholars, for a currency trade to be valid, ownership must transfer immediately. In standard Forex platforms, this rarely happens in the physical sense. You're not receiving dollars or euros in your hand or account; you’re speculating on price differences without real delivery. The Qur'an advises clarity and transparency in transactions:

"O you who believe! Do not devour one another’s wealth unjustly but trade by mutual consent." (Qur'an, 4:29)

Some scholars argue this invalidates most margin-based Forex trades unless the contract structure includes genuine possession or risk-sharing. So it’s not just about avoiding interest, but also about how authentic the trade itself is from an Islamic legal perspective.

Lastly, the brokerage model matters more than most realize. Many retail Forex brokers are counterparty dealers, meaning when you lose, they win. This conflict of interest is considered unethical by some scholars because it resembles maysir (speculation or gambling), which is also prohibited. As mentioned in the Qur'an:

"They ask you about wine and gambling. Say, ‘In them is great sin and [some] benefit for people. But their sin is greater than their benefit.’" (Qur'an, 2:219)

A better alternative is trading through ECN or STP brokers, where trades are matched in open markets without the broker taking the opposite side. It’s a small structural change but can shift the entire ethical framing of your trading activity.

Is Forex trading halal: Hanafi scholars

In the Hanafi school of thought, Forex trading can be halal under specific conditions. The trade must involve immediate possession (qabdh) of the currencies exchanged, without any delay. Additionally, no element of riba (interest) should be involved, meaning swap charges must be avoided. If trading follows spot settlement rules with full transparency and no speculative contracts, it may be permissible. Otherwise, if transactions involve delayed settlement, margin loans, or hidden interest, Forex trading would be considered haram according to Hanafi jurisprudence.

Forex trading: Halal or haram according to Mufti Taqi Usmani

Mufti Taqi Usmani, a leading authority in Islamic finance, has clarified that most conventional Forex trading is haram due to the absence of immediate possession and the involvement of interest (riba) through margin trading structures. He states that to be halal, Forex transactions must be settled on the spot, without leverage involving loans, and without any deferred payments. Unless a platform ensures real delivery and complete Shariah compliance, Mufti Usmani considers traditional Forex contracts impermissible in Islam.

What is an Islamic account?

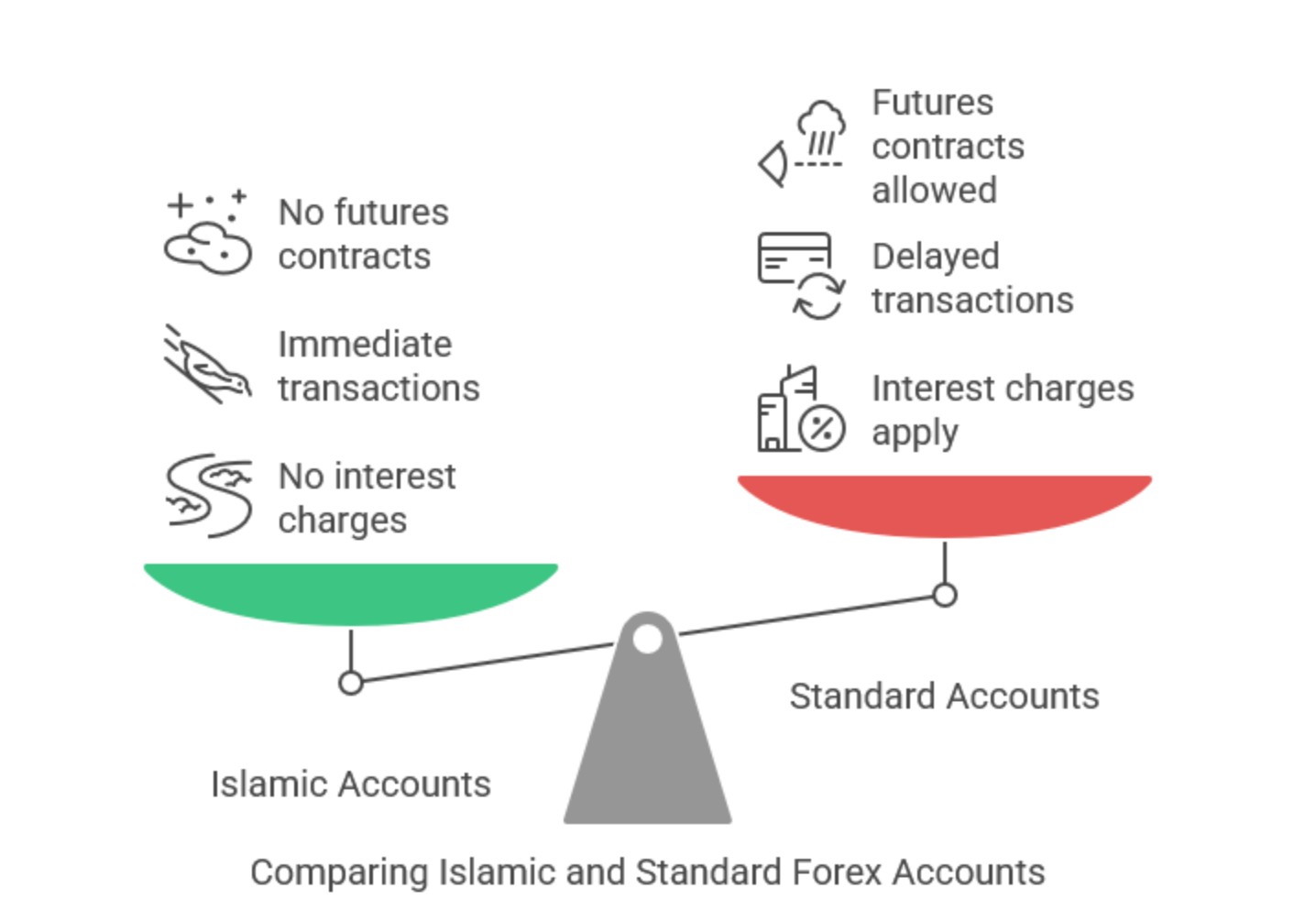

An Islamic trading account is a swap-free option designed to follow Islamic principles in Forex trading by removing any form of interest charges. The primary concern with Forex trading is the potential to earn money through swaps. For this reason, these accounts restrict the ability to profit from swap-based interest.

These accounts help ensure that trades are executed immediately without any delay in settlement. Additionally, currency exchanges take place at the same time and place as the agreement, avoiding the use of forward or future contracts. In Islam, the allowance for futures trading depends on fulfilling certain rules like staying away from Riba (interest), Gharar (excessive uncertainty), and Maysir (gambling).

If you wish to start your Forex trading journey or invest in other financial markets like stocks or cryptocurrencies, we suggest you do so through brokers that offer Islamic accounts. We have presented the top options below. You may compare and choose one for yourself:

| Plus500 | Pepperstone | OANDA | |

|---|---|---|---|

|

TU overall score |

No | No | No |

|

Max. Regulation Level |

Tier-1 | Tier-1 | Tier-1 |

|

ECN Spread EUR/USD |

No | 0,1 | 0,15 |

|

ECN Commission |

No | 3 | 3,5 |

|

Swap Free |

Yes | Yes | Yes |

|

Open an account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

How to create an Islamic trading account?

Research brokers. Look for reputable, regulated brokers that explicitly offer Islamic or swap-free trading accounts. Check reviews, licensing, and their track record with Muslim clients.

Check Shariah compliance. Make sure the broker’s Islamic account is certified or reviewed by a recognized Shariah advisory board. Confirm that it genuinely avoids riba (interest), gharar (uncertainty), and maysir (speculation).

Register an account. Go through the standard sign-up process on the broker’s platform. Provide accurate personal and contact information as required.

Request Islamic account status. After registration, specifically apply for an Islamic account. Some brokers require you to manually enable swap-free settings or submit a separate application.

Provide necessary documents. You may be asked to submit identity verification documents (e.g. passport, utility bill), and in some cases, a declaration or reason for requesting a swap-free account.

Verify account terms. Carefully read the broker’s Islamic account policy. Check for hidden fees or charges that might act as interest replacements, which may compromise Shariah compliance.

Start trading. Once approved, you can begin trading in accordance with Islamic principles. Stick to ethical instruments (no trading in alcohol, gambling, etc.) and monitor your positions regularly.

Halal investment guide for Forex trading

Is Forex trading halal or haram? For many Muslims, the answer depends on how it's done. While trading currencies is not automatically impermissible, the structure of most conventional accounts includes riba (interest), making them non-compliant with Islamic principles. That's why scholars such as Mufti Taqi Usmani and institutions like the Muslim Judicial Council recommend using a dedicated Islamic Forex account that avoids interest entirely. Specifically, here are the key principles to keep in mind:

Trade through an Islamic Forex account

The first step in avoiding haram elements is to open a swap-free Islamic account, which eliminates overnight interest charges. Many brokers offer these, and some even have a Forex trading halal certificate to confirm their Shariah compliance. This setup is considered halal by respected voices like Mufti Taqi Usmani Fatwa on Forex trading, the Muslim Judicial Council Forex fatwa, and the Fatwa from MUI tentang on trading Forex, as long as the trades are based on spot contracts, with currencies exchanged immediately.

So, if you’re wondering, is Forex trading halal as per Mufti Menk's view, or seeking a verdict from the Saudi fatwa on Forex trading, the consensus is that interest-free, instant-execution trading is the only acceptable model under Shariah.

Don’t turn trading into gambling

One of the key concerns in Islamic finance is gharar, or excessive uncertainty. This becomes a problem when traders engage in wild speculation or high-leverage positions without understanding the risks. It’s why some scholars say Forex trading is haram, especially when it feels more like gambling than investing.

The Muslim Judicial Council, the Saudi fatwa on Forex trading, and scholars like Mufti Menk have voiced caution about reckless behavior in the market. If you're still asking, is Forex trading haram Mufti Menk, the answer depends not just on your account, but your attitude. Responsible risk management and clear intention are essential. This is also why Forex day trading halal rulings depend heavily on the methods used and whether they avoid gambling-like characteristics.

Pay taxes and follow the Islamic rules

Compliance with both Islamic and local financial laws is essential for any halal investment, including Forex trading. As a Muslim trader, you are religiously and legally obligated to report your income and pay applicable taxes in your country of residence. Avoiding tax obligations may be considered unethical or even haram, as it involves deceit and harm to the public interest.

Additionally, ensure your trading activities align with core Islamic values:

Avoid trading during prayer times, especially Jumu'ah (Friday prayers).

Do not engage in excessive risk or emotionally driven speculation (maysir).

Maintain full transparency in your trading practices and interactions with others.

It's also important to refer to relevant Shariah rulings when evaluating the permissibility of trading. For instance, the Fatwa MUI tentang Forex (issued by the Indonesian Ulema Council) outlines specific conditions under which Forex trading is considered halal, such as real-time settlement and avoidance of riba-based transactions. Following such guidance ensures your investment remains compliant with Islamic ethics and jurisprudence.

Key questions related to halal trading

Now that you’ve understood how to do halal Forex trading, let’s take a look at other important aspects related to Shariah compliance:

Is trading gold in Forex halal?

Forex gold trading (using XAU/USD) can be halal or haram based on the rules followed. This is a common question among Muslim investors who ask, "Forex gold trading halal or haram?" The answer depends on strict adherence to Islamic principles. Gold must be exchanged in spot transactions with immediate settlement. Delayed delivery or trades based on speculation or interest (riba) would make it haram. Scholars agree that when done transparently and without delay, gold (or similar commodities) may be traded in a Shariah-compliant manner.

When choosing a broker for gold trading, Muslim investors should also ensure that the platform provides a Forex halal certificate or credible Shariah compliance verification. This certificate helps confirm that the broker’s trading conditions, including gold transactions, meet Islamic finance principles.

Is Forex day trading halal?

Forex day trading can be halal, but it depends on how it's done. If trades are based on spot contracts and avoid riba and gambling-like behavior, it's permissible. However, frequent, high-risk speculation without knowledge may lean toward haram due to gharar (uncertainty).

Is spread in Forex halal?

Yes, spread in Forex is halal as long as it's a fee transparently charged by the broker and not tied to interest. Since it's part of how brokers earn for facilitating trades, it's generally accepted in Shariah-compliant trading accounts.

Is leverage in Forex haram?

Leverage in Forex can be haram if it involves interest-bearing loans or excessive risk. Islamic scholars often advise against high leverage due to the possibility of riba and gharar. Some Shariah-compliant brokers offer interest-free leverage, which may be acceptable under certain conditions.

Is Forex spot trading halal?

Yes, unlike most futures trading, Forex spot trading is halal. It involves immediate exchange of currencies and is considered permissible in Islam, especially when no interest or delay is involved. This form of trading is the most widely accepted in Islamic finance.

Is swap in Forex halal?

Swap in Forex is not halal in most cases, because it typically involves paying or earning interest for holding positions overnight. That’s why Islamic accounts are swap-free and designed specifically to avoid riba and make trading halal.

Is Forex proprietary trading (prop trading) halal or haram?

Prop trading can be halal, but only if it follows Shariah principles. If a trader uses the firm's capital without interest-based loans or conditions involving riba or unethical instruments, it's generally permissible. However, many proprietary trading firms impose conditions that may include leverage, overnight swaps, or even gambling-like structures — so it depends heavily on the firm’s model.

Is Forex copy trading halal in Islam?

Copy trading is conditionally halal, but it can be halal if done with transparency, no interest, and clear terms. If the trader being copied follows halal strategies (no riba, no derivatives, no short selling), and the arrangement avoids guaranteed profits or commission structures that resemble gambling, it could be acceptable. But if you’re copying high-risk or speculative trades, it likely becomes haram.

Is swing trading Forex halal?

Yes, swing trading is halal, provided it avoids interest (like swaps on overnight positions), speculative behavior, and forbidden assets. As long as you’re holding positions in a responsible, informed way and using a swap-free Islamic account, swing trading can align with Islamic finance principles.

Is Forex options trading halal or haram?

Options trading is considered haram by most Islamic scholars. It involves contracts that are not backed by actual asset ownership and include elements of speculation, uncertainty (gharar), and often riba. Since the trade revolves around predicting price movement without real exchange, it closely resembles gambling.

Is Forex and binary options trading halal or haram?

Binary options are haram in Islam according to most scholars. It resembles gambling because you’re betting on the direction of price movement within a fixed time, with no actual ownership of the asset. There's also excessive uncertainty (gharar) and it usually involves elements of riba. Since the outcome is often win-or-lose like a bet, it's not considered a permissible form of investment in Shariah.

Is CFD Forex trading halal or haram?

CFD trading is generally haram, because you don’t own the underlying asset — you're only speculating on its price. This introduces high levels of gharar and usually includes swaps or interest-based leverage. Since it mimics betting on price movements, it’s not compliant with Shariah principles.

Is margin in Forex trading halal or haram?

Margin trading is haram in most cases because it relies on borrowing money with interest (riba), which is strictly prohibited in Islam. Even if the trades themselves are halal, the funding method makes the whole setup non-compliant.

Is Forex short selling halal or haram?

Short selling is widely considered haram because it involves selling what you don’t own, which violates the principle of asset possession in Islamic finance. It also carries elements of high risk and speculation that make it non-permissible.

Delayed settlement and margin contracts make Forex haram for most traders

Many new traders think opening an Islamic Forex account makes everything halal. But here's the catch — most trades aren’t settled instantly. In Islamic finance, the rule of Taqabud requires both currencies to be exchanged on the spot. So if the broker delays matching your order or settles the trade later, it might not meet Shariah standards. This issue is often discussed in rulings such as the fatwa MUI tentang trading Forex, which emphasize the importance of immediate settlement in currency exchange.

Swap-free accounts help avoid interest, yes, but timing and execution still matter. Unless your broker handles trades with real-time settlement and full transparency, your trades could quietly cross into haram territory. Those asking "Forex trading halal or haram fatwa" often overlook this critical technical aspect.

Margin trading is another area where things often go unnoticed. While it gives you extra leverage, it usually involves a loan from the broker or a third party. That brings in riba (interest) and gharar (uncertainty), even if the account is labeled Islamic. Leading scholars who issued Forex trading halal fatwa underline that leverage structures must avoid any interest-bearing components.

Moreover, popular Islamic scholars such as Mufti Menk have addressed the question "is Forex trading halal Mufti Menk," warning that many margin-based setups compromise Shariah principles. To stay on the safe side, use a full-cash account and ask your broker how trades are settled and who’s backing them. The fine print makes all the difference.

Conclusion

The question of whether Forex trading is halal or haram largely depends on the approach and adherence to Islamic principles. On one side, using Islamic accounts and strictly adhering to Sharia law may allow Muslim investors to engage in trading without violating religious norms. On the other side, trading based on high risks and speculation may be considered haram. Every trader faced with such a choice needs to carefully study the terms and principles offered by brokers, as well as risk management methods. With the right approach and adherence to Islamic financial principles, Forex trading can be not only profitable but also ethically acceptable.

FAQs

Why Forex is haram?

Forex can be considered haram when it involves elements prohibited in Islam, such as riba (interest), gharar (excessive uncertainty), and speculation without real asset ownership. This answers the common question "why is Forex haram" among Muslim investors. However, which Forex trading is halal depends on how the trades are structured — spot trading with immediate settlement, no interest charges, and transparent processes can make Forex trading permissible under Islamic law.

How to trade Forex in halal way?

To trade Forex in a halal way, use a swap-free Islamic account, ensure all trades are settled immediately (spot trading), avoid margin loans involving interest (riba), and choose an ECN or STP broker that does not act as a counterparty. Always verify the broker’s Shariah compliance.

What should I ask a broker before opening a halal Forex account?

Ask if they offer truly swap-free accounts, how trade settlements are handled (instant or delayed), and whether they act as counterparty to your trades. Also verify if they have any Shariah advisory board overseeing their Islamic account offerings.

Is demo account trading permissible in Islam?

Demo accounts are generally halal because they involve no real money or financial gain. They are useful for learning without risk, as long as they’re not used for gambling-like behavior or unrealistic high-risk testing that may build bad trading habits.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

The informal term "Forex Gods" refers to highly successful and renowned forex traders such as George Soros, Bruce Kovner, and Paul Tudor Jones, who have demonstrated exceptional skills and profitability in the forex markets.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Short selling in trading involves selling an asset the trader doesn't own, anticipating its price will decrease, allowing them to repurchase it at a lower price to profit from the difference.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.